I believe the bear market is over. Michael Kantro (@MichaelKantro) has a framework called HOPE, describing how different parts of the economy respond to changes in rates. The housing sector is the first to respond to rates, making it a leading indicator for the rest of the economy. His August presentation provided the foundation for this analysis.

Source: @MichaelKantro

First, let me define soft landing. At the time I came across Kantro’s analysis the SEP was as follows: immaculate disinflation reaching Fed inflation target without significant increase in unemployment.

Source: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20220615.pdf

What stuck out to me in the Fed’s forecast was the fact that the 2024 unemployment rate was 4.1%. 4.1% employment is on the order of a million people losing their jobs. In the past, hard landings/recessions usually resulted with nonlinear employment effects. Once unemployment increases by >1%, it continues rising as there is a feedback loop between decreased spending/GDP and unemployment. That was the core reason why Keynesian Economics came in and sought to break the loop with fiscal measures. By maintaining the similar unemployment forecasts in 2023 and 2024, I believed the Fed’s aim had been a soft landing. However, here was the problem facing Chair Powell right before he made a 3 minute speech about pain at Jackson Hole 2022.

With the primary tool of interest rates, the Fed had just started the campaign against inflation after overestimating the effects of Omicron. On top of the late start, Russia had invaded Ukraine and China remained under zero-covid policies restricting global supply and putting upward price pressure on goods and commodities. With these conditions in place, CEOs were bracing for impact and technology companies that overhired during Covid were about to begin a cost cutting plan to maintain margins.

Source: Goldman Sachs

There has never been a soft landing where commodity prices spiked. Unemployment increases were required to dampen inflation in all the cases where commodities prices spiked. In the past, typical landing patterns and their respective GDP and employment trends are shown below

Source: JP Morgan

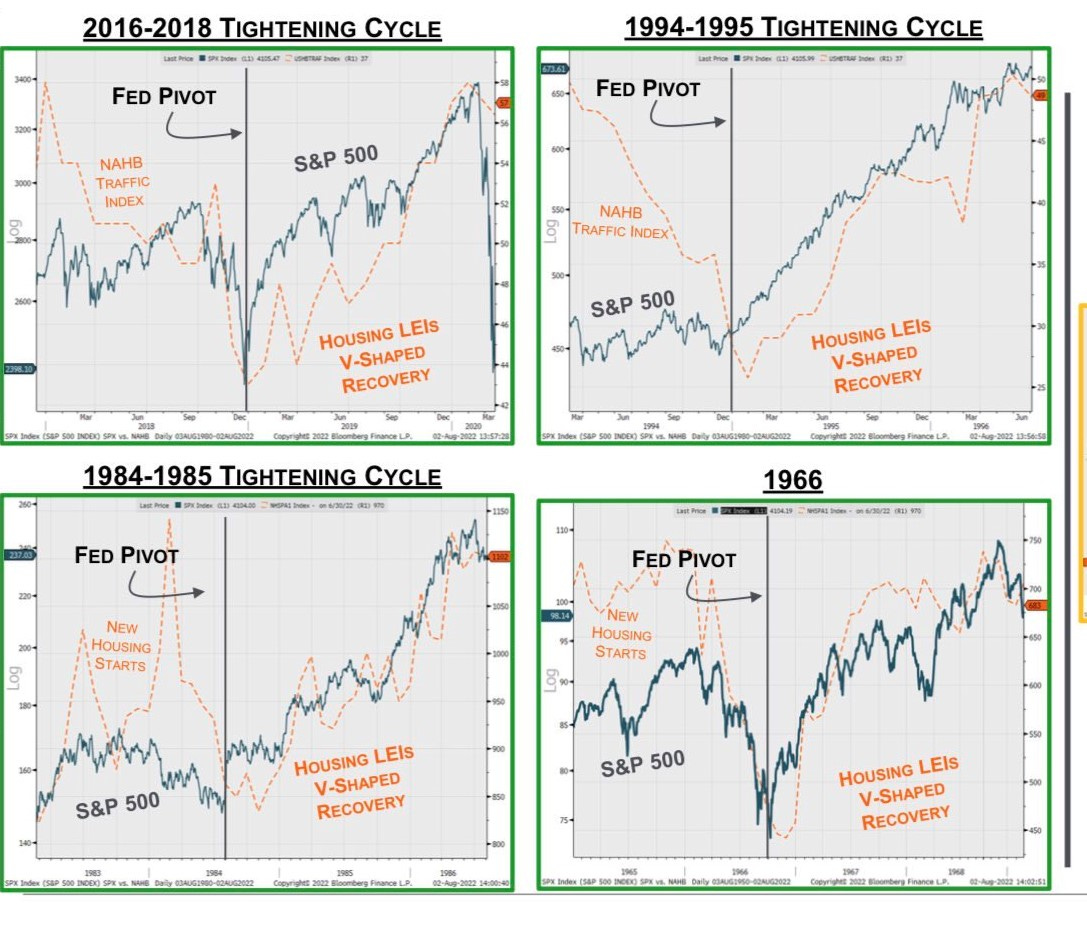

Cherry picking the rare occurrences of soft landing, the recoveries were all led by a Fed pivot leading to a housing recovery. Following the HOPE framework, housing provided the spark to turn the economy around.

Source: @MichaelKantro

It is worth noting the definition of pivot here, where monetary policy changes from a restrictive stance to a stimulative stance, i.e. the Fed Funds rate goes from positive relative to the “neutral rate” to negative. While there is no universal neutral rate, there seems to be three types of gauges: TIPS yield curve, core/headline PCE, and core/headline CPI. There is also the Taylor Rule which I will discuss later on.

There have been many instances where the Fed needed to pivot as the economy had fallen into deflation and required stimulating. Those times are highlighted below. Note the duration of the pause where the Fed Funds peaked and was held at its highs. The takeaway should be that the economy is in trouble and the Fed pivot only occurs after the market has already started its descent. There is a time lag before a short term stimulative stance affects the housing market, stimulating the economy through construction and household spending.

As discussed earlier in the “Price” section, 6.5%-7% mortgages are restrictive from an affordability perspective. But let’s look at how Former Fed James Bullard defined the sufficiently restrictive zone on 11/17/2022 using the Taylor Rule based on PCE.

There is plenty to debate about Fed policy and how they use forward guidance as a monetary policy tool. Former Chair Bernanke lays out the framework here: https://www.brookings.edu/wp-content/uploads/2019/12/Bernanke_ASSA_lecture.pdf

But here’s the performance of WTI oil since Former Fed President Bullard’s presentation.

President Bullard’s hawkish stance sometimes pushed long end yields and the dollar higher, putting downward pressure on commodity prices. This was a theme the market would decide was the right narrative to trade on from time to time. The most recent example was right before SVB collapsed on 2/16/2023. At the time of this writing, he is still the most hawkish Fed member.

Source: https://www.itcmarkets.com/hawk-dove-cheat-sheet-2/

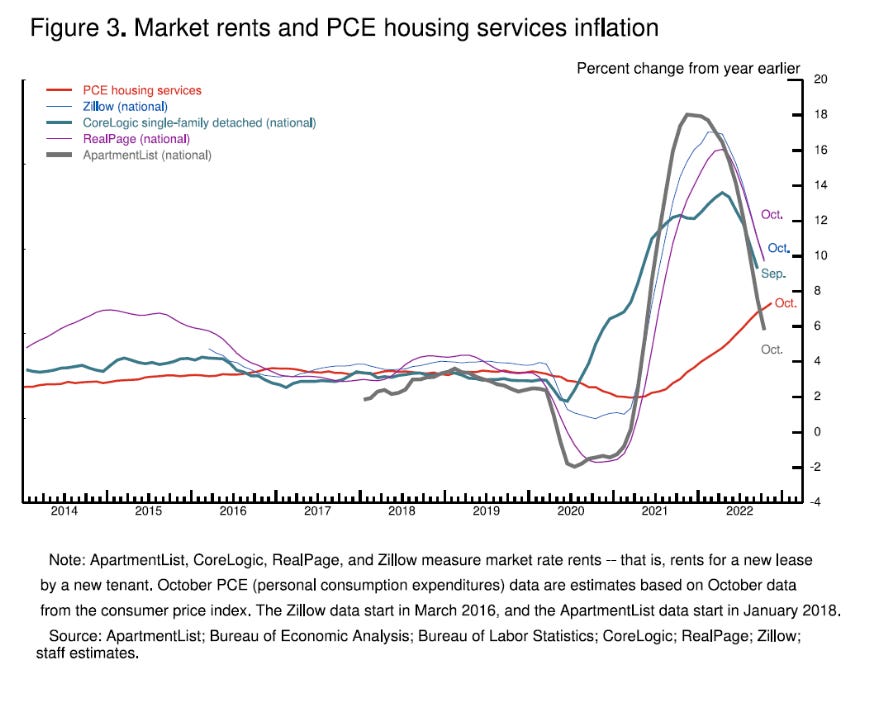

Shortly after Former President Bullard’s presentation Chairman Powell provided additional guidance on how he viewed inflation and split them into three components, attempting to separate housing from core services.

Source: https://www.federalreserve.gov/newsevents/speech/powell20221130a.htm

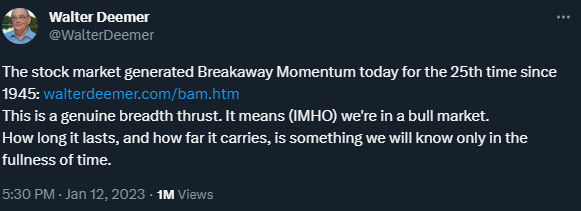

January came around and some market participants were caught offside as economic data started reflecting a soft landing where nominal GDP and employment were holding up, inflation was trending down, and earnings were better than expectations. I was wondering if Tom Lee’s argument for demographics would come true and Millennials would take the 6% rate to the chin, stabilizing the housing market. There was much discussion about how financial conditions had eased. Chair Powell had provided FOMC guidance that he viewed policy as approaching restrictive and borrowing costs were still elevated, so slowing the pace of tightening was justified. Walter Deemer provided a note on Breakaway Momentum that signaled a bull market as positions unwound in January.

Source: https://www.walterdeemer.com/bam.htm

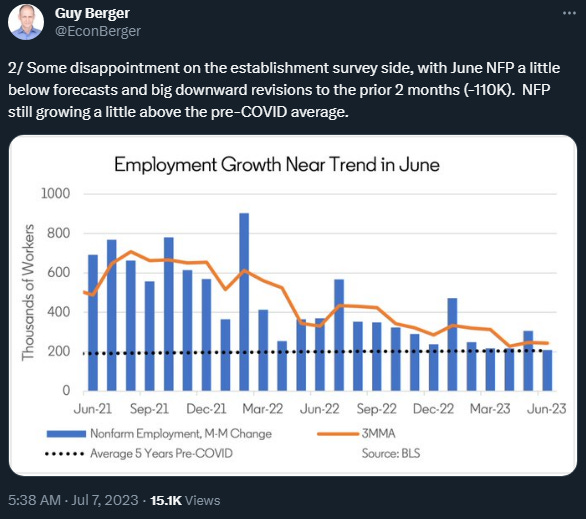

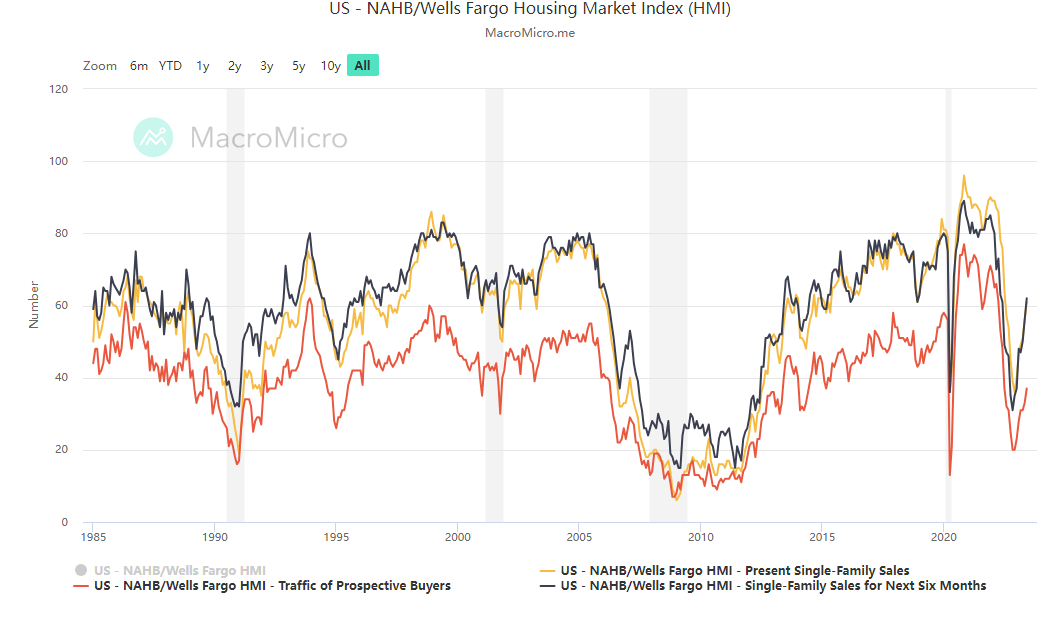

6 months later, job openings/growth are drawing down and laid off tech workers have gotten new jobs. Prime age workers have given up self employment and returned to the traditional W2 workforce. Housing activity has rebounded at 5% Fed Funds rate and 10yr <4.0%.

Source:

https://layoffs.fyi/

Source: WSJ

Source: https://en.macromicro.me/collections/7/us-housing-relative/1858/us-nahb-hmi-plot

Source: https://tradingeconomics.com/united-states/housing-starts

At the time of writing, the result of the Fed’s campaign on inflation is shown below with OER and apartment vacancies trending in the right direction for the housing inflation component:

Source: https://fred.stlouisfed.org/series/FEDFUNDS#0

Source: https://www.zillow.com/research/june-2023-rent-report-32840/

The US economy is in a much better spot compared to 12 months ago, but the inflation fight is not over yet. There are still EU winter concerns and housing/demand trends that may cause inflation to inflect upwards. Consumers are still spending and credit spreads are narrow. CPI has gone from 9.1% YoY to 3% YoY. With the lagged component of shelter in play, inflation is rolling over faster than the economy. Chair Powell’s premature “transitory” statement most likely would have sounded better without a war.

Source:

https://www.creditspreadalert.com/

Those that focus on NFCI for conditions may want to consider the Fed’s research that has focused on borrowing cost measures without the stock market. ARK innovation funds experienced a dotcom like -70% drawdown and that had minimal effect on consumer spending in 2022. In my opinion, the Fed’s focus on the wealth effect is overstated. Furthermore, there are participants that chose to take advantage of the short term rates that created historic inflows into market money funds. It is worth reiterating that at some point, Chair Powell will decide additional hikes are no longer net restrictive and that may be now.

Source: https://www.chicagofed.org/research/data/nfci/current-data

Source: https://www.frbsf.org/economic-research/indicators-data/proxy-funds-rate/

Source: https://en.macromicro.me/collections/9/us-market-relative/1241/us-bank-net-percent-tight-loan

In summary, the Fed has done a tremendous job, albeit with a late start in the hiking cycle. I will be buying Chair Powell’s memoir regardless of the landing. He has steered the US economy through Covid, war, and bank failures. Housing has rebounded without needing monetary policy support. It is important to remember soft is the easy part. It is keeping it soft that is the hard part and containing the spike in unemployment. The longer the Fed can maintain this rate, the more bullish it is for the US economy as Chair Powell can choose to slowly ease if real rates trend too high or if NFP rolls over. Soft landing has temporarily become consensus and there is an argument to be made that it is priced in at current index levels.

There are headwinds to the US consumer and it is taking the form of higher borrowing costs, depletion of excess savings and student loan payments (https://www.christophe-barraud.com/us-consumption-will-face-significant-headwinds-from-h2-2023/).

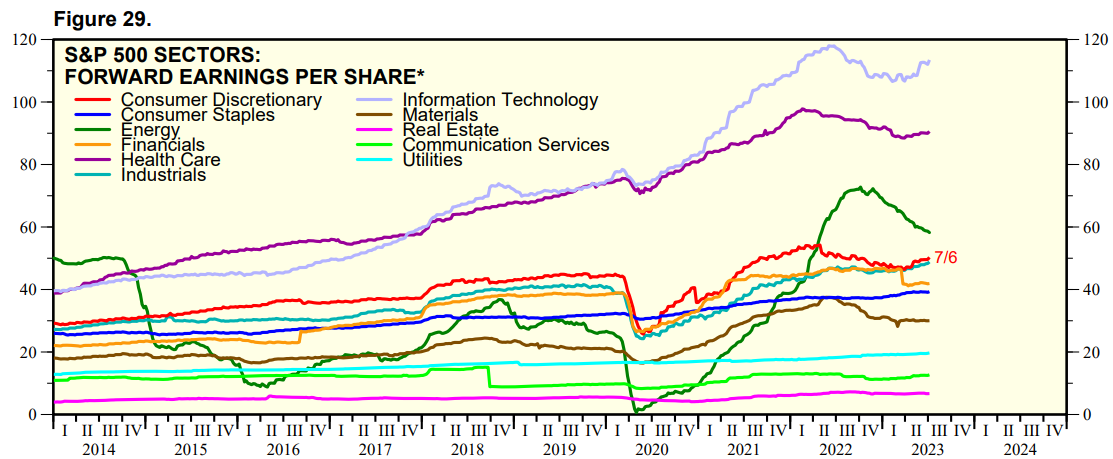

The recessionists who have been entrenched in bidding the long end of the yield curve for over a year now will continue to point to LEIs that focus on the manufacturing side of the economy, which takes up ~10-15% of the overall GDP. At some point, they may realize that sector already has fiscal stimulus as a backstop in the form of nonresidential construction. Meanwhile, S&P 500 is currently ~5% from new all time highs and the market is trading like the economy is in the early phase of a new business cycle.

Source: Bank of America Global Fund Manager Survey June 2023

Source: https://www.conference-board.org/topics/us-leading-indicators

Source: https://finviz.com/map.ashx?t=sec&st=ytd

Source: https://www.yardeni.com/pub/peacockfeval.pdf

Source: https://digital.fidelity.com/prgw/digital/research/market