Inflation peaked last year, but core has been slow to come back down due to both elevated service demand and lagged effects of how owner’s equivalent rent (OER) is calculated for CPI. A substantial portion of core CPI and PCE weights is housing and it is set to fall for the next 6 months.

Source: CPI weights: https://www.bls.gov/cpi/tables/relative-importance/2022.htm;

PCE weights: Author’s calculation of weights using BEA Table 2.4.5U-M, Personal Consumption Expenditures by Type of Product, from www.bea.gov

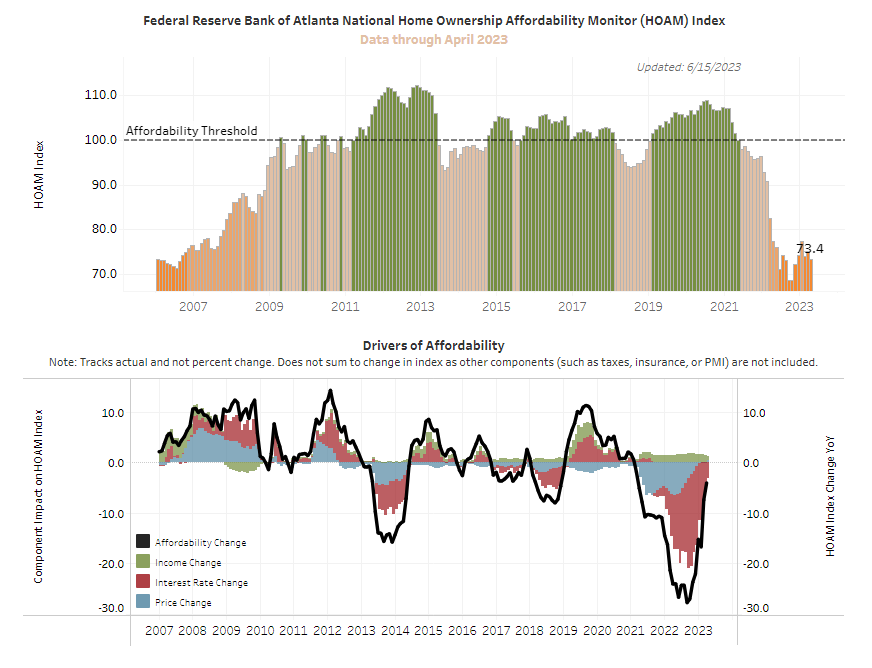

OER is set to fall on both Year over Year (YoY) and MoM basis. It is likely the progress slows in Oct 2023 before resuming downwards progress April 2024. Even with the seasonal bump, rent is likely to continue the downward trend as apartment vacancies push upwards due to multi-family and apartments completing construction and coming online as discussed in the “Growth” section, which focused on housing still supporting residential construction jobs. The key price factor here for housing is the lagged effects of rent and I believe that rents will have continued pressure downwards caused by the combination of housing affordability and number of apartments coming online.

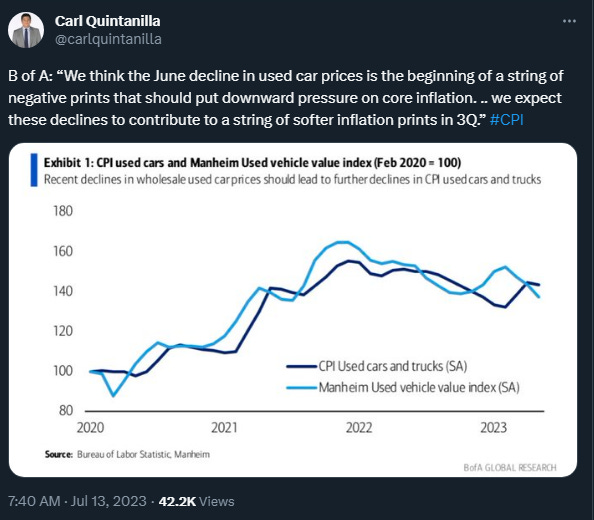

Despite some of the Fed’s hawkish rhetoric, ~6.5-7% mortgage rates are not cheap, especially considering the recent comparisons. Even if housing is proving resilient in low inventory conditions until unemployment pushes upward. I would argue raising another 25bps is a minor policy error. Chair Powell is likely secretly content with the housing start numbers as they address long term supply, which should be the focus as the Fed reaches the final stages of their tightening campaign. Transportation is the other big item and those pressures are also subsiding with airfares coming down and additional car supply coming from manufacturers and leasing.

Source: Century 21 Realty

Source: https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

Source: https://publish.manheim.com/en/services/consulting/used-vehicle-value-index.html

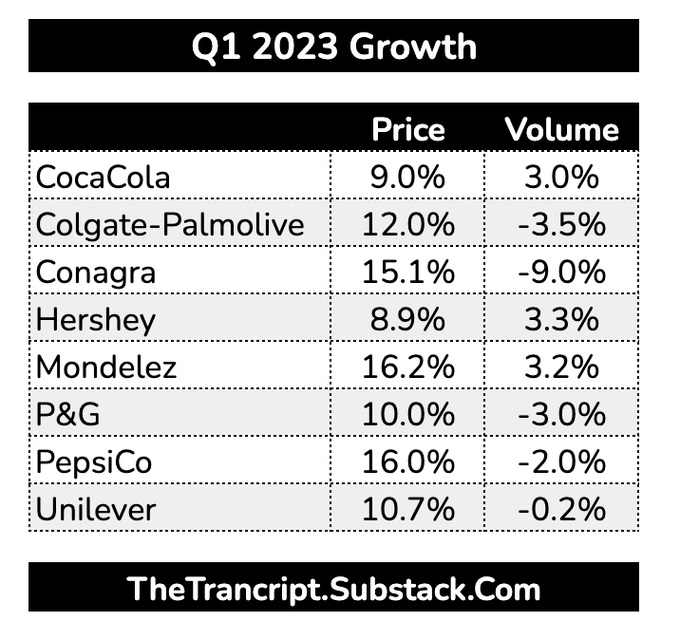

Some have been arguing wages have been holding up prices and causing a spiral, but that argument is countered by the fact that companies have been seeing volume drops with further price increases, especially for staples. While those with pricing power can maintain revenue, there are those that consumers end up replacing with cheaper products.

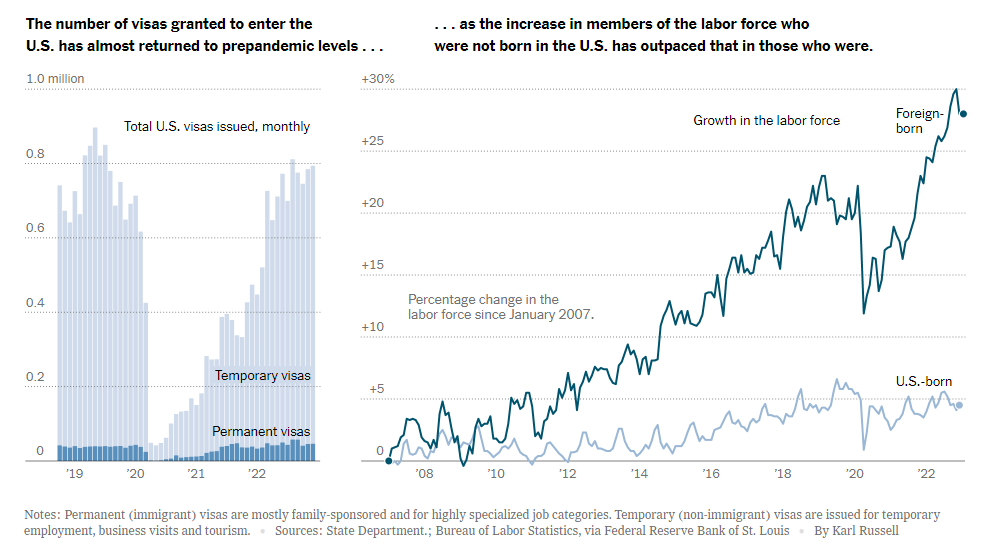

Wage growth has additional factors of immigration. The latest wage growth numbers show most metrics trending back down. It is worth noting that the 2022 “maximum employment” Fed narrative had one positive effect, enabling the lower income quartiles to get the most wage growth from a percentile perspective. The higher cost to borrow will affect the lower income quartiles first while acting as a dividend for higher income quartiles taking advantage of market money funds. There is an argument to be made that further rate hikes only exacerbates the wealth gap.

Source: WSJ

Source: https://www.atlantafed.org/chcs/wage-growth-tracker

Source: https://www.financialresearch.gov/money-market-funds/

As far as commodity prices go, crack spreads and gasoline prices are what end up being passed to consumers. Those have stabilized and should remain that way as more refiners open up over the next year. OPEC+ will likely increase production if they see China demand rise, but China demand has high uncertainties with their real estate industrial complex struggling to inflect upwards. There are different dynamics compared to the 70s, as the US has become net exporters of oil, electrical vehicles comprise >20% of new vehicle sales in China, and the durable trend (albeit slightly decreasing) of remote/hybrid work from the pandemic.

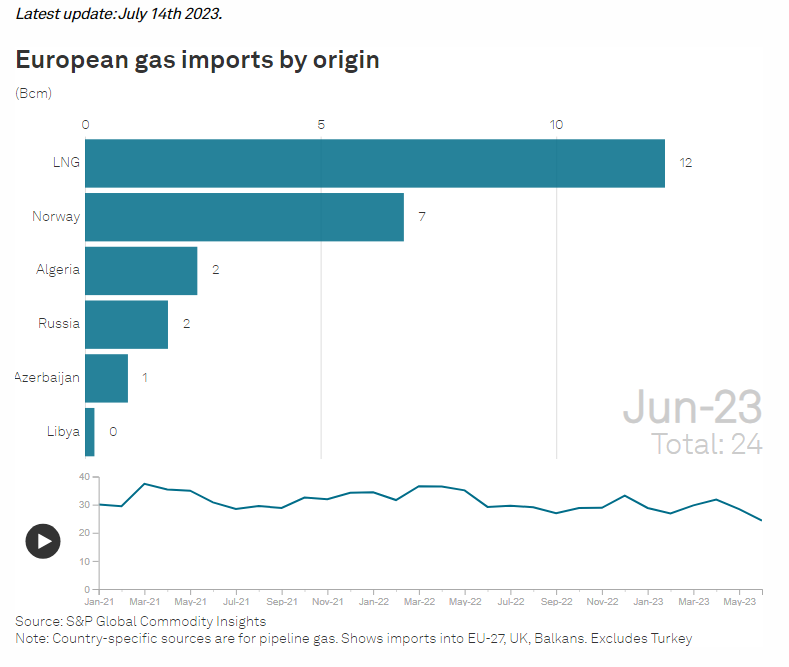

The surge in natural gas pricing that affected food and fertilizers from the Russian invasion has largely subsided with the increased EU dependence on LNG from the US and Norway’s new Baltic Pipe.

Source: https://en.macromicro.me/collections/19/mm-oil-price/4376/crude-oil-cracking-spread-vs-wti

Source: https://www.gasbuddy.com/charts

Source: https://www.kastle.com/safety-wellness/getting-america-back-to-work/

Source: https://en.macromicro.me/collections/4854/mm-natural-gas/39414/global-natural-gas-prices

Source: https://agsi.gie.eu/data-visualisation/EU

In summary, prices are trending in the right direction and it is likely that Chair Powell's goal is to hold the “right” rate for as long as possible. Labor has been historically tight due to a combination of (lack thereof) immigration, retirements, and Covid deaths. The closest analog to the 70s is likely labor not oil. However, it has the biggest disinflationary opponent: technology.

The Fed is probably attempting a soft landing by trying to maximize the duration of a restrictive policy. They do not need to hike further past the July FOMC meeting unless there are signs of wage-price spiral. There comes a time when the Fed’s focus may transition from dampening short term demand to not hindering longer term supply capex solutions. Furthermore, Chair Powell may decide additional hikes are no longer net restrictive and only worsen the wealth gap.

In my opinion, Volcker’s biggest mistake was over-tightening and destroying small businesses, which brought on political pressures to ease prematurely to only reignite inflation. Furthermore, the Saudi Embargo was the root cause of inflation and monetary policy cannot address long term supply. Chair Powell cannot produce farms, build refineries and apartments. Restrictive policy dampens short term demand but does not address long term supply. Higher rates restrict capex that attempt to address long term supply solutions. Another factor is higher income quartiles are benefiting from the high short term rates, which has essentially become a risk free 5% dividend that sustains consumption for the wealthy.

Inflation is rolling over faster than the economy and the latest economic data has soft landing characteristics. Whether that continues remains to be seen and it is in the Fed’s best interest to remain cautiously optimistic about achieving 2025 inflation targets as demand continues to support the labor market. The 2023 curveball for labor is technology.

The magic number for Chair Powell is seeing <0.3 MoM for the next 6 months. Although there are bound to be bumps here and there as economic data rarely moves in a straight line, achieving 3.5-4% for 2024 and 2.5-3% inflation in 2025 looks like an increasingly probable scenario.