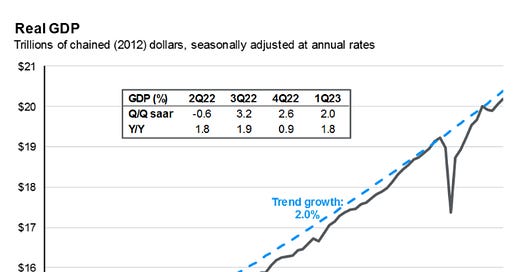

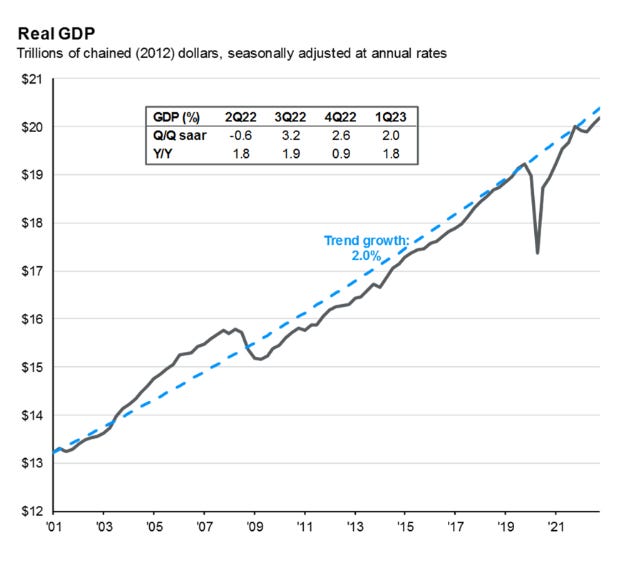

Here’s a snapshot of the current US economy, with Q2 GDP estimate being ~1.5-2.0% Quarter over Quarter (QoQ) and the latest unemployment rate at 3.6%.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Source: https://www.atlantafed.org/cqer/research/gdpnow

Source: https://www.bls.gov/eag/eag.us.htm

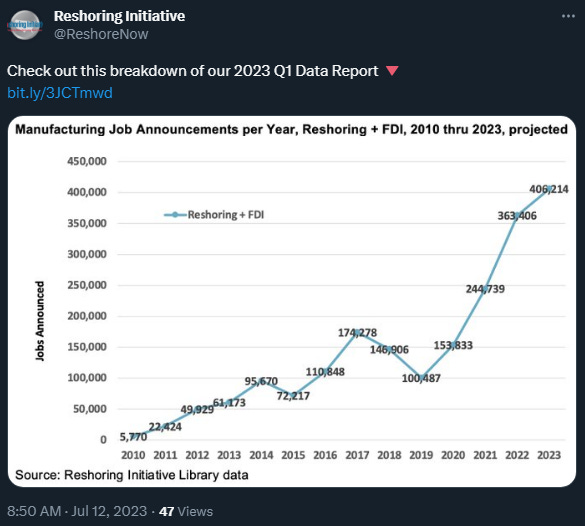

In my opinion, the biggest reason that recession has been pushed out for another year is Fiscal Dominance. The excess savings from the Covid pandemic and the fiscal stimulus from President Biden’s Inflation Reduction Act (IRA) and CHIPs Act, are all examples of fiscal dominance that has not been seen since World War II. This cumulative fiscal stimulus offsets some of the monetary tightening and provides a backstop for construction labor. Some may argue that these measures were inflationary short term, but I believe in President Biden’s choice of labor allocation and that these measures were a response to inflation for long term supply. China is ahead of the curve with respect to electrical vehicle (EV) adoption, recording ~20% of 2022 new vehicle sales as EVs.

During the zero interest rate environment, a massive amount of liquidity was injected into the economy from both monetary and fiscal policies. This has accumulated within household and corporate balance sheets. With higher borrowing costs in place, the excess savings is estimated to run out in the next year, with a wide uncertainty band. As of 5/10/2023, Bank of America had provided estimated savings broken out by income level showing a bump from the tax refund.

The Fed recently released a paper forecasting the unwind to be complete by the end of 2023, but I think its assumptions for real disposable income and savings rate trends for 2H 2023 are up for debate.

Estimates using excess savings have a wide uncertainty band. Using the BoA graph and assuming a linear trend with ~40% drawdown, the excess savings could run 4 more years for the lowest income quartile before depleting. Assuming unemployment rises, this may change to the end of the year as the buffer is likely exhausted without reliable monthly income.

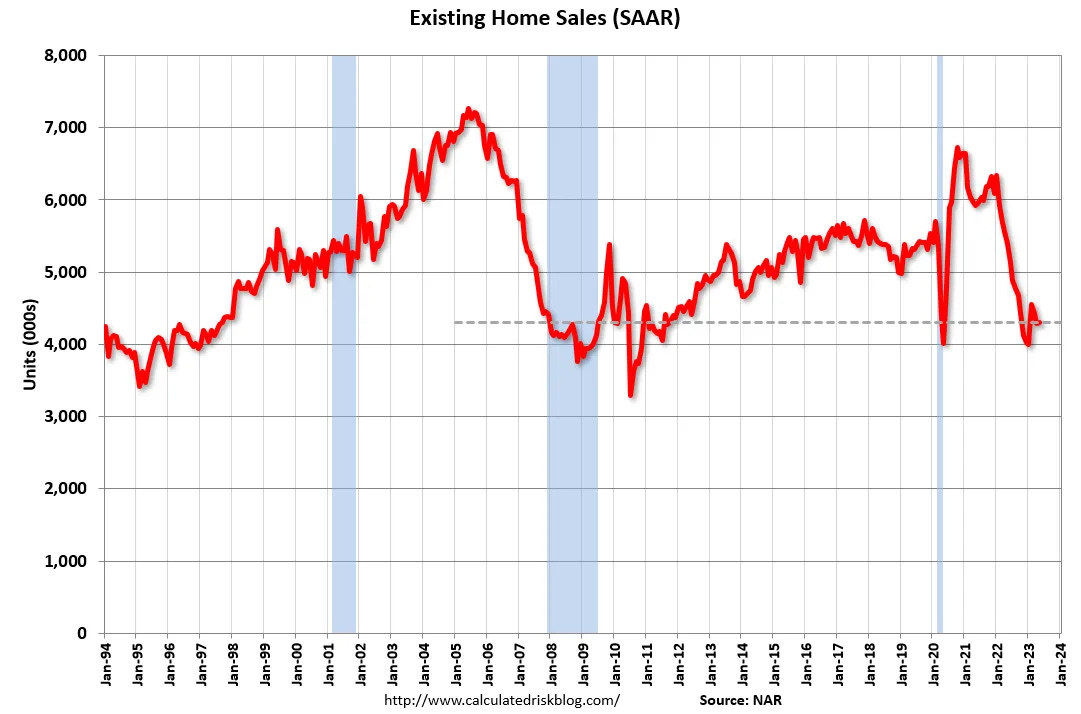

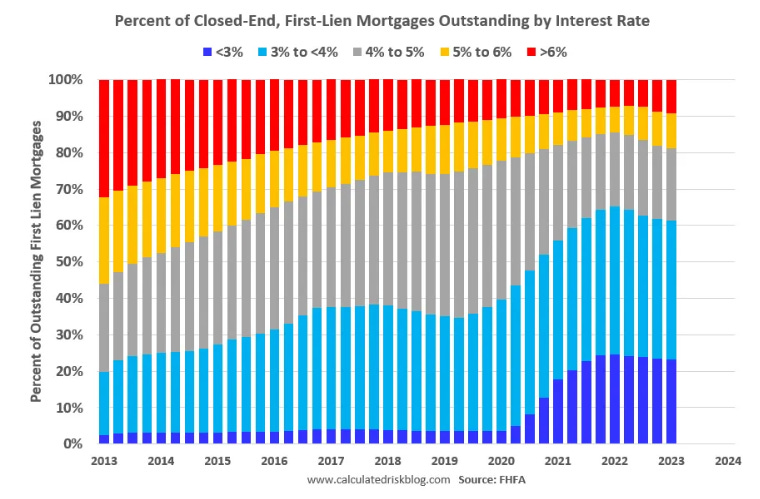

Despite being the most rate sensitive asset, housing starts have rebounded, especially for multi-unit homes. Millennials are still willing to purchase homes at >6%. Although demand is lower at higher mortgage rates, supply is even lower due to people having jobs that can maintain 3% mortgage payments, keeping delinquencies at their lows. It is worth noting that the current mortgage distribution reflects the strength of corporate balance sheets as well.

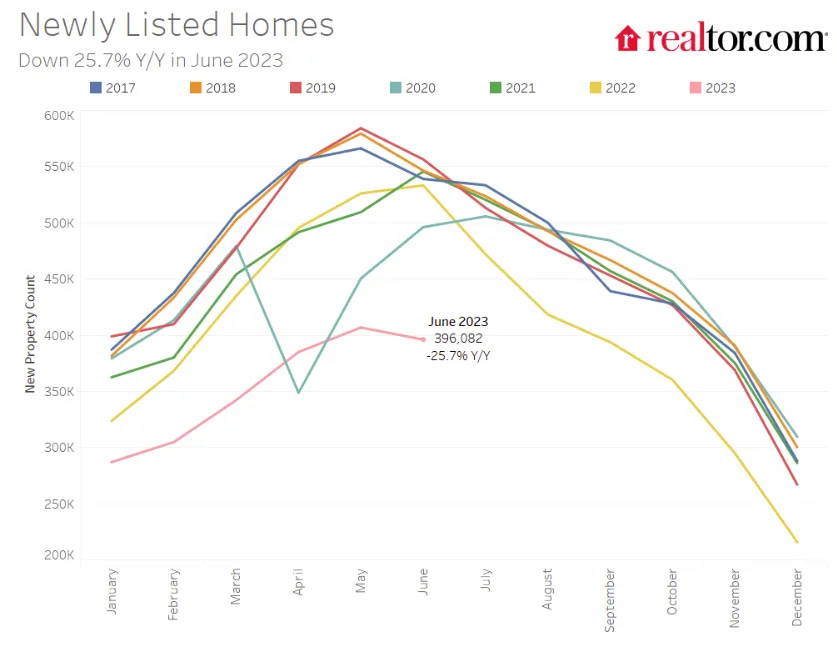

The housing market is close to stalling with mortgage rates >6% from a volume perspective. The stalemate in most housing markets can be attributed to the low listing numbers, especially for existing homes. Home sales have been dominated with new builds that include incentives like rate buydowns to 5%. The housing start downturn that typically led recessions in the past, has yet to materialize. Builders have brought down their inventory levels substantially after experiencing cancellations Q4 2022.

In addition, there is a wealth transfer process beginning that can take the form of Baby Boomers supporting Millennial down payments. NAR reported Baby Boomers still participating in home purchases as well. With mortgage rates putting downward pressure on housing prices from an affordability perspective, housing is likely to begin showing weakness as builders reduce incentives. However, President Biden’s IRA is there to provide a backstop for construction jobs around the country.

Source:

Source: https://fred.stlouisfed.org/series/MDSP

Source: https://www.newyorkfed.org/microeconomics/hhdc.html

Source: https://fred.stlouisfed.org/series/MSACSR

With construction jobs holding, the general labor market remains tight, despite modest slowdowns as companies face higher borrowing costs and maintain cautious outlooks. With OpenAI’s release of chatGPT, there has been a race to update business models to incorporate GPT4 and code interpreter in the workflow of every sector. AI related job openings have appeared across every industry, as companies try to grab scarce machine learning capable talent. Big tech went through cost cutting in 2H 2022, but have resumed targeted hiring to keep up with the AI race. Meanwhile, travel continues to be in demand, with TSA passenger levels having breached 2019 highs. This should slow down as summer nears its end, but leisure and hospitality has provided strong labor market support over the past 6 months.

Source:https://www.visualcapitalist.com/top-us-states-for-ai-jobs/

Source:Bloomberg

Source: Seekingalpha.com

Source: https://www.flightradar24.com/data/statistics

Assuming the 2024 4.5% unemployment rate happens, NFP prints need to start averaging negative for the next 12 months. Unemployment rate trends tend to be nonlinear, but this was to illustrate that NFP prints still have margin until it starts trending towards the Fed’s conservative forecast.

Source: https://www.atlantafed.org/chcs/calculator

There is a chicken and egg paradox here where companies hold onto labor as long as their margins hold and stock prices remain elevated. With real disposable income pushing into positive territory, there is a transition from using the buffer excess savings to using disposable income to sustain consumption. At the time of this writing, Amazon Prime Day just concluded with their single largest sales day in history.

Source: https://tradingeconomics.com/united-states/consumer-confidence

In summary, growth seems to still be trending up as US consumers have become less rate sensitive due to locking in low rate mortgages and accumulating substantial buffer savings. Real disposable income has just reached positive levels, while the labor market has been trending slowly toward balance. Fiscal dominance is a prevalent theme and acts as a construction backstop compared to past fiscal measures taking place after the economy descended into deflation. Q3 earnings guidance is likely to be better than expected, albeit with caution once again. The Fed’s forecast of modest 2024 growth seems to be intact. Differentiation within sectors is also probable as company margins and moat get put to the test with consumption behavior following wealth distributions.