Jackson Hole came and went. A year has passed and not much has changed from the Fed perspective. Market participants are still debating inflation and interest rate paths, despite headline CPI getting halved with unemployment barely budging. People are forecasting recession again within the next 6-9 months. Deja Vu.

I will attempt to break it down in terms of five market drivers that I have focused on in the past.

Let’s conclude with AI and how it continues to overpower discount rates

The wealth gap situation is still more or less the same. Bottom quartiles experienced the most wage growth and Biden continues to help them, but that has subsided lately. The excess savings for the bottom quartiles are/will be depleted as interest rate effects become more pronounced. Nominal GDP can be sustained by the top quartile, even if they pull back on spending.

Source: https://www.atlantafed.org/chcs/wage-growth-tracker

Source: https://business.bofa.com/content/dam/flagship/bank-of-america-institute/economic-insights/consumer-checkpoint-august-2023.pdf

Source: https://business.bofa.com/content/dam/flagship/bank-of-america-institute/economic-insights/consumer-checkpoint-september-2023.pdf

I believe AI still provides the chance to reduce both hospital services and education:

Hospital services:

Google announced partnerships two major healthcare employers. The HCA Healthcare announcement focuses on record keeping and patient handoff:

The HMH announcement focuses on paperwork, diagnostics and literacy assistants:

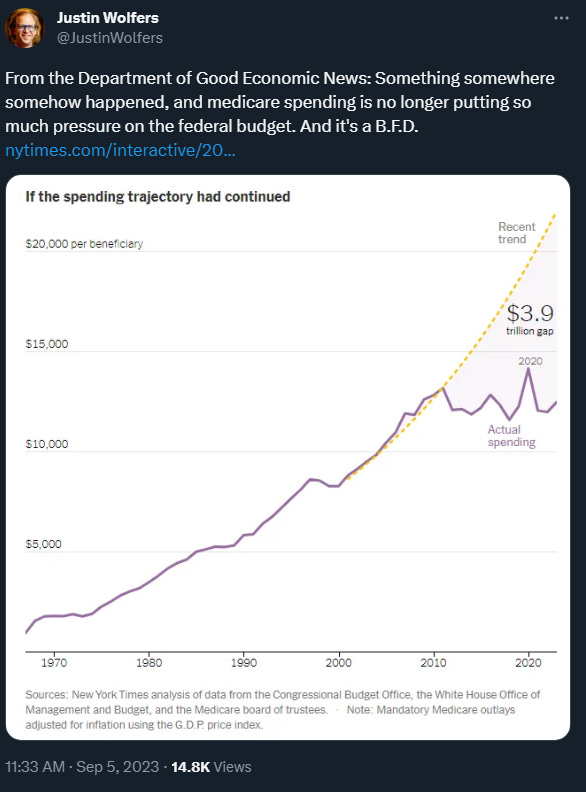

I believe this is just the beginning, as more and more invest and immediately see better productivity and efficiency improvements. It’s also worth noting that medicare spending has stabilized. The rise of GLP and weight loss drugs should also continue to help put downward pressure as the country gets less obese. I plan on following up on GLP with a new trend post.

Source: https://twitter.com/JustinWolfers/status/1699128605479964822

Education:

As high school graduates are enticed by skilled labor opportunities such as UPS and TSMC, the value of a college degree diminishes. This is only made worse when memorization loses its edge and future generations learn to learn and ask better questions at an earlier age.

Source: https://twitter.com/LizAnnSonders/status/1694646503388615017?s=20

AI:

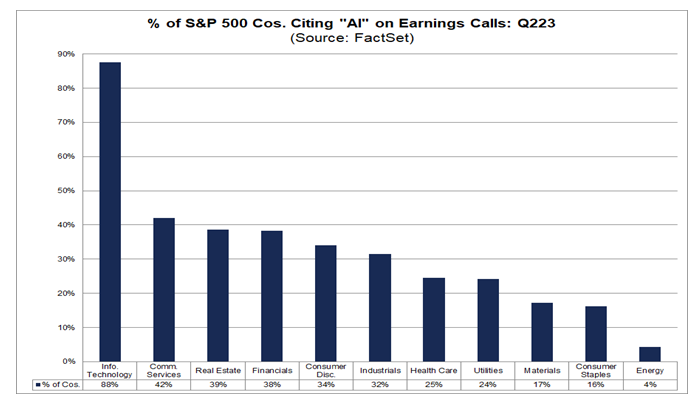

Many market participants are merging the soft landing and AI, attributing the +12% earnings growth for 2024 to soft landing alone and then brushing off Generative AI as something just at the peak of inflated expectations of the Gartner Hype Cycle.

Source: https://www.gartner.com/en/newsroom/press-releases/2023-08-17-gartner-says-generative-ai-is-at-the-peak-of-inflated-expectations-for-revenue-and-sales-technology

The development and absorption rate for LLM+coding API is likely to surprise many people, as they underestimate the established cloud infrastructure. Technology adoption rate has only accelerated throughout history.

Source: https://www.goldmansachs.com/intelligence/pages/why-ai-stocks-arent-in-a-bubble.html

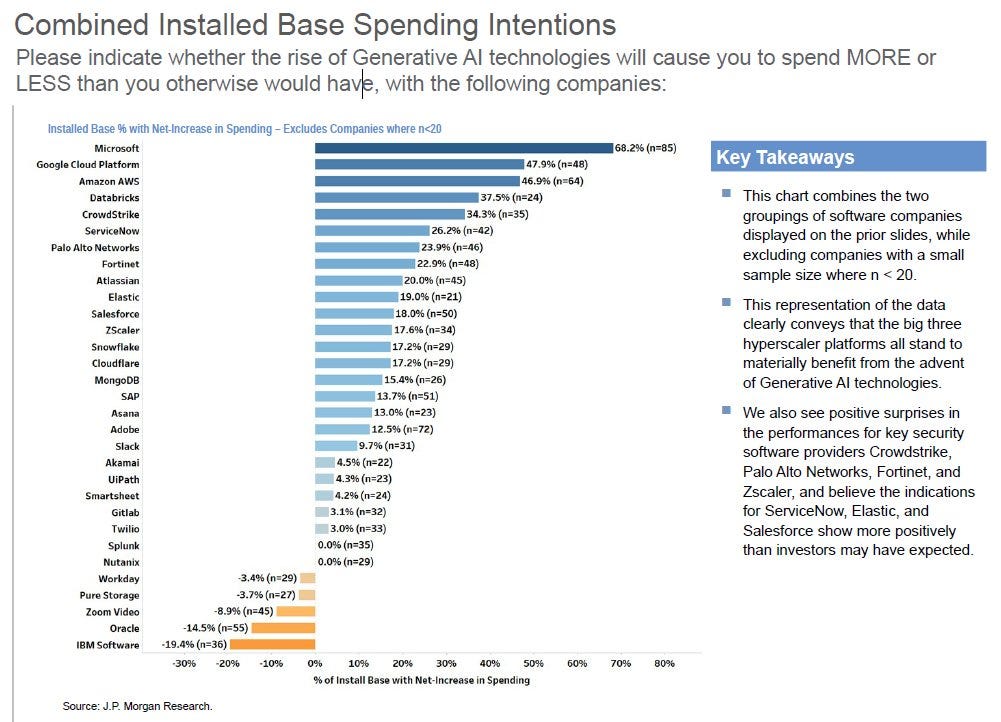

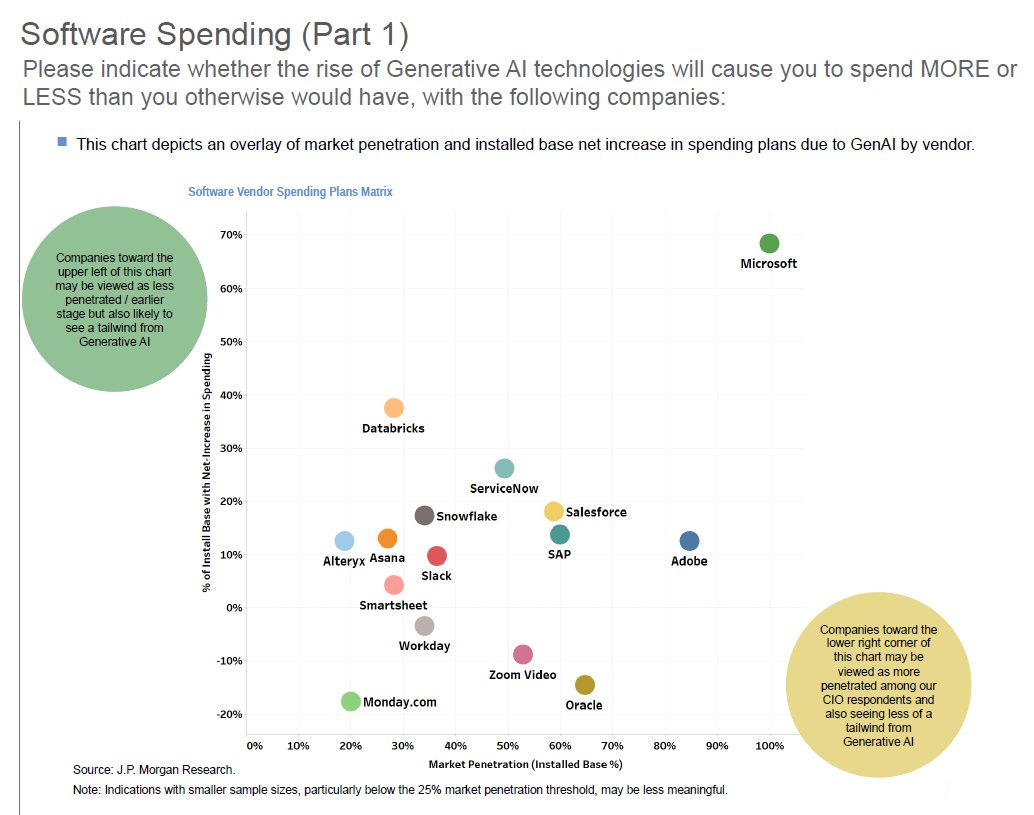

Nvidia’s DGX platform will be sought after simply because Taiwan Semiconductor supply cannot keep up with demand. Data center and management companies have significant tailwinds as every company in every sector pursue integration of LLMs into work flows.

Microsoft is front and center as they deploy enterprise solutions (Copilot, Excel Python) together with OpenAI’s “Advanced Data Analysis,” formerly Code Interpreter.

Source: https://twitter.com/TheTranscript_/status/1700886517692891184?s=20

Nvidia has demonstrated the demand is not just hype, especially with the backing of the US Department of Defense. Microsoft and Nvidia are being included as part of foreign trade negotiations, as the world wants in on US innovation. AI is an US industrial policy. Whether the productivity and growth is delivered as promised, remains to be seen.

Source: @TheTranscript_

Source: https://insight.factset.com/highest-number-of-sp-500-companies-citing-ai-on-q2-earnings-calls-in-over-10-years

The future is bright with LLMs acting as the foundation for infinite API calls from personal nodes. Buckle up.

Source: https://twitter.com/emollick/status/1700248203411771398

Source: https://twitter.com/karpathy/status/1691571869051445433?s=20

In summary, not only are upper quartile consumers positioned to sustain consumption, AI will boost productivity and provide a revolutionary tool for unskilled labor for the next decade. How Nvidia is valued in 10 years is anyone’s guess, but President Biden’s CHIPs act will further enable the US to maintain global competitiveness in this new regime. Those worried about deglobalization may be underestimating how much the internet contributed to globalization. Although reshoring initiatives may be inflationary short term, automation has the chance of balancing out those price pressures. Furthermore, GPT technology has the potential to provide the necessary productivity gains that bring inflation down to the Fed’s target in a timely fashion.

In my opinion, LLM’s coupled with code interpreter is poised to more than offset deglobalization with respect to contribution to corporate capex and margin improvement, as productivity is increased for every sector. It is probable that the effects will be felt within a year and is faster than those treating AI as a Gartner Hype Cycle. The potential of English as a programming language is still underestimated. The transmission and absorption of information is much faster now and Microsoft is poised to deploy OpenAI enterprise solutions globally.