Source: https://twitter.com/JoeBiden/status/1687120734793986048?s=20

Fitch had put the US on watch in April before debt ceiling standoff in late May. They put out a stern memo, which spooked markets and Congress into action to resolve the debt ceiling. With some news of possible shutdowns as the budget has yet to be formally written according to the debt ceiling resolutions, Fitch formally downgraded Tuesday 2023/08/01 after market close. This caused a negative reaction for major indices.

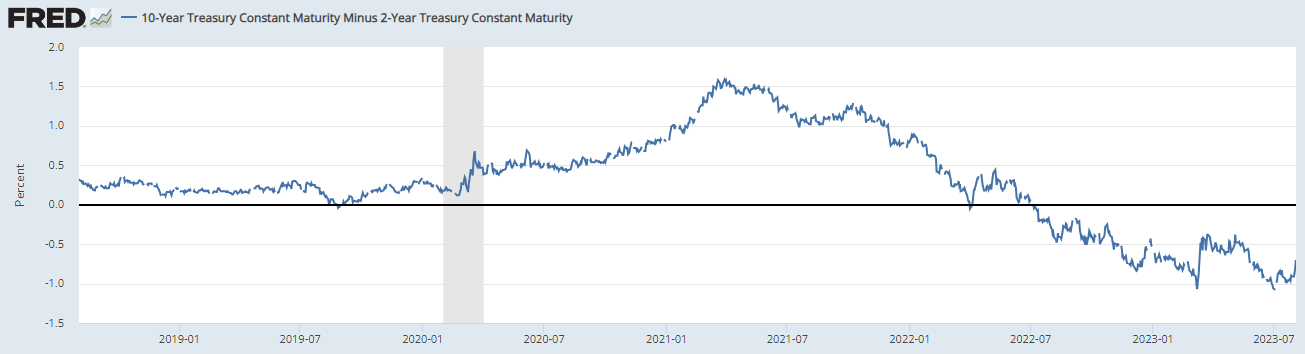

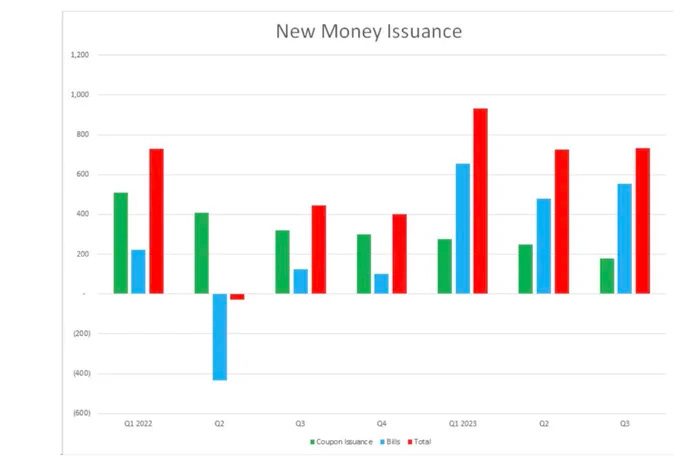

To make matters worse, Andy Constan’s prediction about treasury quarterly refunding (QRA for Q3/Q4) also came true. Not only was the issuance amount much larger than expected, the composition had changed since the last announcement, increasing supply for the long end of the curve. The weight of the Fitch downgrade vs the QRA may be up for debate, but the end result was a 2.5 standard deviation drawdown for the long end of the curve (TLT), pushing the 10yr up towards 4.2 and steepening the yield curve.

Source: https://twitter.com/FedGuy12/status/1686719746316648448?s=20

Source: https://fred.stlouisfed.org/series/T10Y2Y

The rise of the 10yr and dollar created significant headwinds for equities as risk premiums contracted. The bond market has since stabilized after Amazon/Apple reported their earnings and the latest NFP print. It should be noted that the 10yr trading at 4.5 approximates to 22x. Being (very) optimistic and using forward P/E estimates, this provides the upside scenario of SPY for ~+18%. This assumes that market participants only used the long end to assess risk premium. Similar to the BoJ news; although this is a headwind, I think as long as nominal GDP sustain and AI continues providing an underlying supportive theme, the market is likely to continue marching along.

I want to focus on the other side of the treasury issuance news: the fiscal spending. Andy Constan is far more knowledgeable and the interview with Kyla Scan (@kylascan) provides a good overview.

Source: https://twitter.com/dampedspring/status/1683251964702760962?s=20

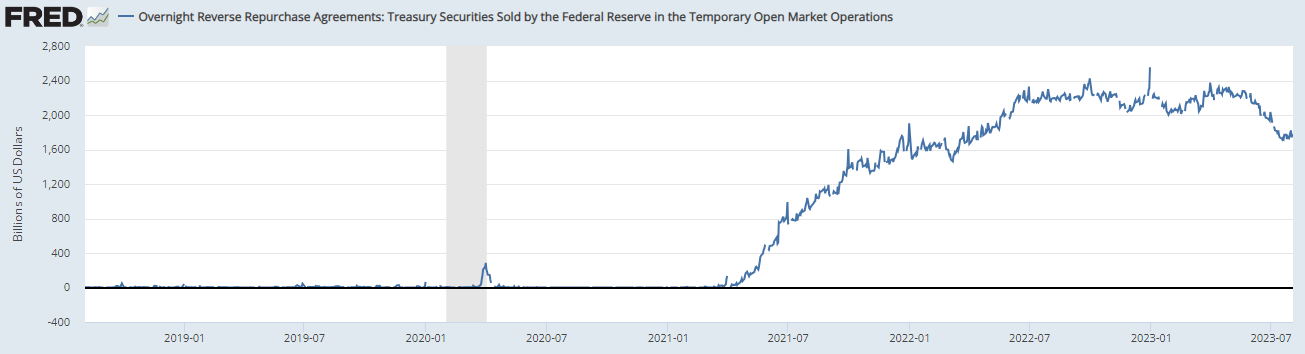

I disagree with Andy’s conclusion that financial conditions are easy, but I also believe soft landing is possible. Treasury Secretary Yellen had succeeded in building back the TGA, drawing down the RRP (-500B) with Tbills. Oversimplifying dynamics, if she starts spending the TGA back down, that pushes liquidity into the private sector. This liquidity injection might offset the duration supply overhang for a shorter timeframe. It is also possible the market continues to absorb the incoming supply in Q3/Q4 as shelter drag on inflation creates continuous downward pressure on inflation prints, even leading to some believing deflation is afoot. Thus, this issuance announcement is similar to the BoJ YCC announcement. This marks Secretary Yellen’s departure from relying on short duration issuance to fund TGA replenishment. It is a big deal and provides upward pressure on yields, but the short term immediate market impacts may be over. If the 10yr continues trading >4.1, that should set off alarm bells, escalating from just a significant equity headwind. 0.3 MoM is probably still the magic number.

Source: https://fiscaldata.treasury.gov/datasets/daily-treasury-statement/operating-cash-balance

Source: https://fred.stlouisfed.org/series/WTREGEN

Source: https://fred.stlouisfed.org/series/RRPONTSYD

That being said, I want to divert away from risk premium and liquidity effects on market dynamics. I’m here to highlight where the spending goes and why the Fitch downgrade was ridiculous.

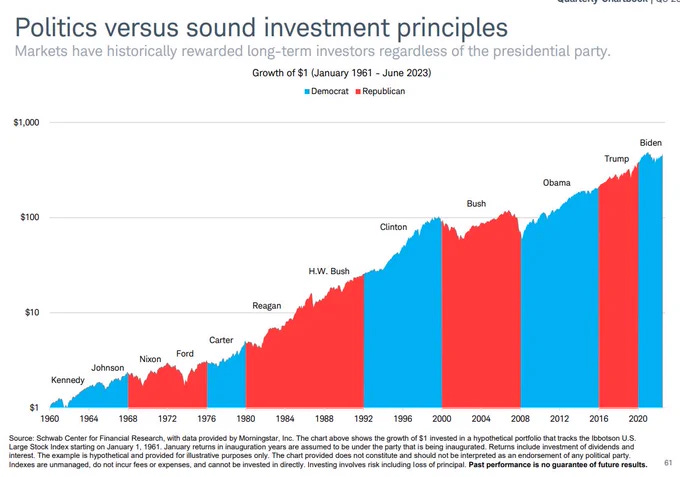

Here’s a few charts that illustrate how the US economy has fared under President Biden, keeping in mind the market is different than the economy and usually does not differentiate between president political party lines.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

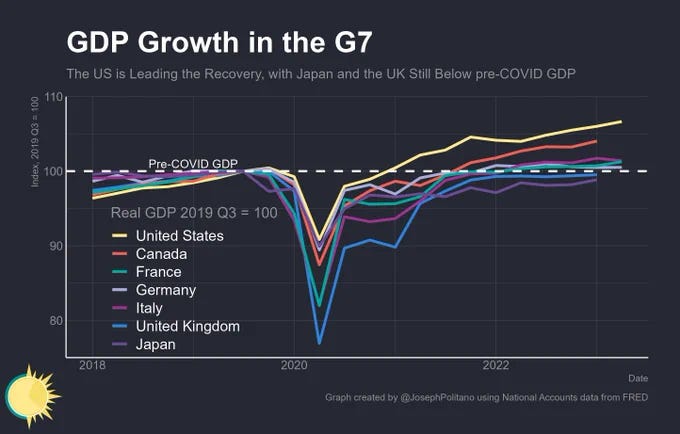

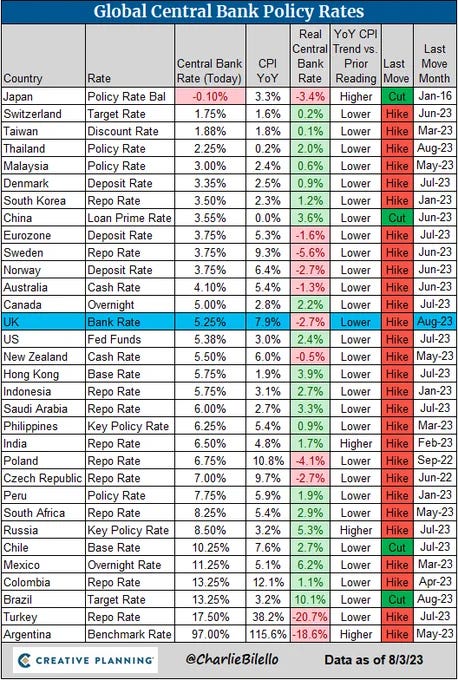

If we compare how the US is faring with other G7 countries, it is apparent that the US has the strongest growth while having achieved a 2% real rate (calculated from the Fed Funds Rate and headline CPI). With the EU having a war next door, China having deflation concerns, and Japan just starting to unwind easy monetary policy, the US is the most attractive country to invest in and a big reason is the Biden Administration’s fiscal policies.

Source: https://twitter.com/JosephPolitano/status/1686121925016182785?s=20

Source: https://twitter.com/charliebilello/status/1687086719890264064?s=20

Alex Williams (@vebaccount) provides a great set of Frying Pan Charts illustrating the success of US fiscal policy that jolted the economy back to growth after being below trend until the Covid pandemic response. Although early measures resulted in fraud, it is apparent that the fiscal measures had a positive impact on the US economy as Covid reopening took place alongside of the vaccine distributions.

One interesting question for economists had been why it took Covid supply shocks for the US to experience inflation, despite years of a zero interest rate environment from the Fed. In my opinion, it has been due to the deflationary nature of technology and innovation. The internet enabled globalization which further expanded supply, with China becoming the manufacturing center of the world. It’s hard to discuss US policy without mentioning the One China Policy. I will elaborate on China later.

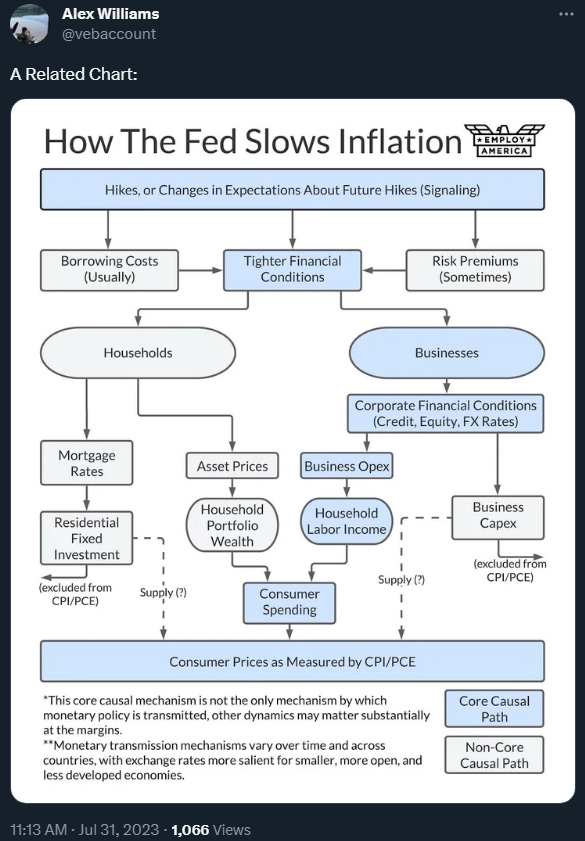

Turning back to the fiscal and monetary policy dance, the Fed began its campaign against inflation with the Inflation Reduction Act (IRA) and CHIPS Act kicking into full gear.

Source: https://twitter.com/vebaccount/status/1686077725298081809?s=20

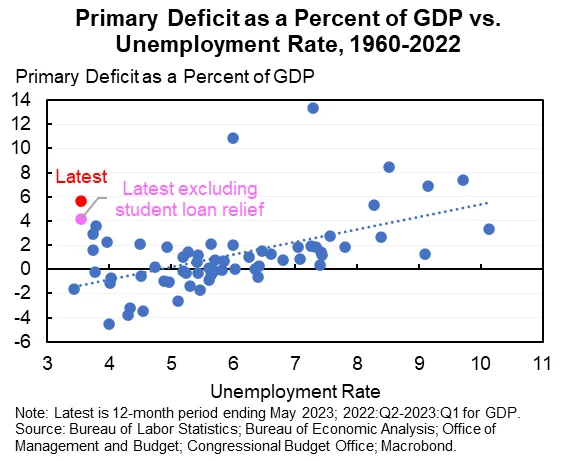

This dance has been delicately balanced somehow, with high short term rates dampening the inflationary aspects of fiscal spending and the fiscal stimulus offsetting the deflationary aspects of higher borrowing costs. This transitory equilibrium has resulted with inflation trending down without significant job losses (so far), which makes the Fitch downgrade look ridiculous.

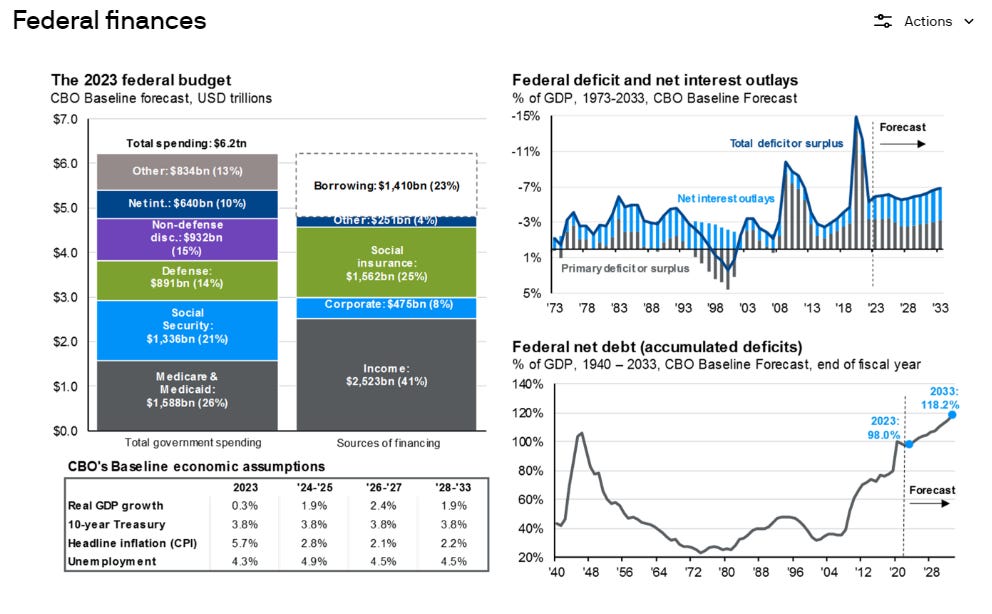

The Fitch note cited “governance,” but I think the Biden Administration is likely to be fondly remembered in history books. The memo also mentioned government debt burden. The charts below provide a snapshot of Federal finances.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Source: https://twitter.com/jasonfurman/status/1667153519923675137?s=20

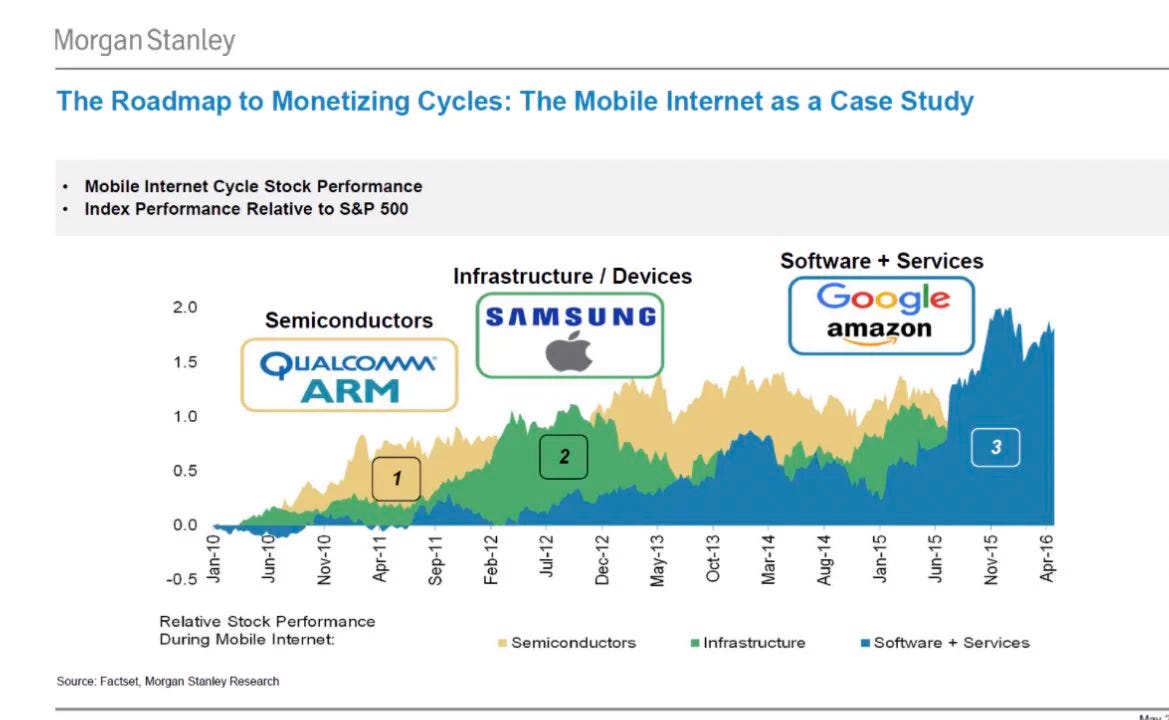

I think it’s important to highlight that if AI provides 50% of the GDP and productivity growth that some are expecting, the debt to GDP ratio can be sustained for a while. This new technology cycle is very much already here and the US deficit spending puts the US in a position to monetize it.

Source: https://www.goldmansachs.com/intelligence/pages/ai-investment-forecast-to-approach-200-billion-globally-by-2025.html

The post WW2 era had the demand to absorb the supply established from military production plants, and the demand can come from emerging markets for this new era, especially those expanding their oil refinery capacities. As long as the US retains its geopolitical risk premium, the US is likely to find buyers of its debt. At some point, that may become the Fed again, but that is some time away and requires inflation at an “acceptable” and sustainable level.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

The CHIPS Act puts the US in a position to capitalize on this new technology regime, with restrictions put in place to slow down Chinese progress. Coming back to the One China Policy, the Biden Administration has forcibly increased China’s reliance on Taiwan’s semiconductor industry as Taiwanese engineers return home. Furthermore, EU is cooperating with the US in fortifying Taiwan’s Silicon Shield by moving resources to Taiwan. If there is one thing that the US excels at, it is identifying areas for defense spending and figuring out how to maintain that lead. With the Department of Defense (DoD) footing data center bills, this creates a positive feedback loop of companies willing to invest and possibly realize the potentials for LLMs + code interpreter and automation. I think it is important to remember the US government brought on the following in the past four decades:

DARPA’s VLSI chip development program and Strategic Computing Initiative; the DOD’s

NASA’s support of composite materials work

NSF’s funding of supercomputers and of NSFNET (an important contributor to the internet)

DOD’s support of the Global Positioning System

Source: https://twitter.com/Citrini7/status/1684685478551846912?s=20

Source: https://www.etextilecommunications.com/news/report-u-s-reshoring-takes-aim-at-another-all-time-high/article_744fdc9a-fb70-11ed-8734-6b0220969907.html

Source: https://www.bloomberg.com/news/articles/2023-08-06/bidenomics-boosts-the-us-economy-fanning-soft-landing-hopes-inflation-fears?srnd=premium#xj4y7vzkg

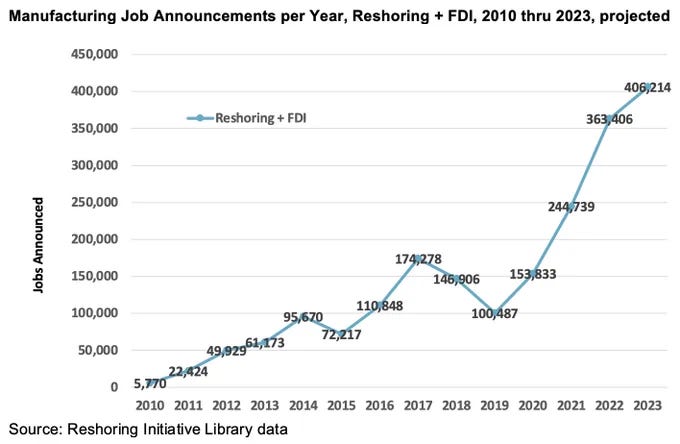

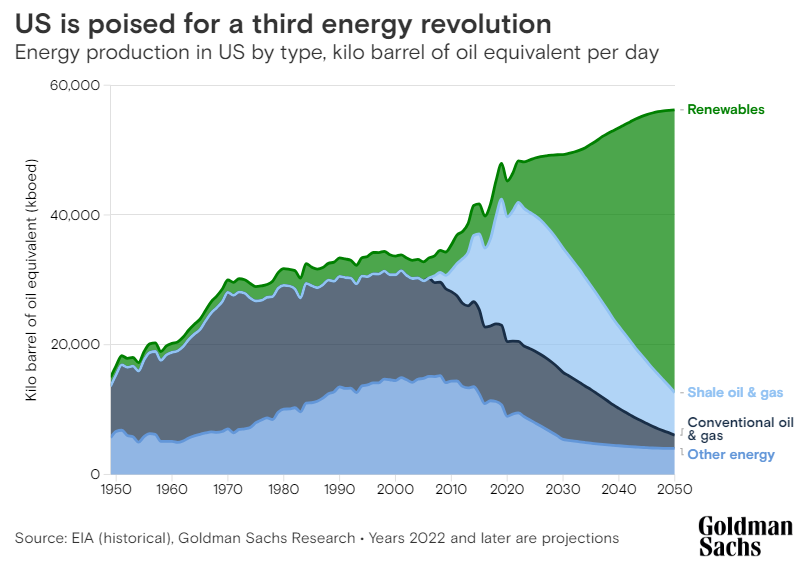

On the other hand, the IRA puts the US in the race to catch up to Chinese EV production and undergo an energy revolution. These legislation also provides a boost to the nonresidential construction sector and subsidizes demand at the same time.

Source: https://www.goldmansachs.com/intelligence/pages/electric-vehicles-are-forecast-to-be-half-of-global-car-sales-by-2035.html

Source: https://www.goldmansachs.com/intelligence/pages/the-us-is-poised-for-an-energy-revolution.html

Source: https://business.bofa.com/content/dam/flagship/bank-of-america-institute/sustainability/IRA-ripple-effect.pdf

The Biden Administration has achieved something monumental with the fiscal policies chosen. Let’s take a step back and assess the state of domestic manufacturing that was upended by the pandemic and ongoing tensions with China. Since the Great Financial Crisis (GFC), China/Taiwan had provided the manufacturing and assembly of many of common goods that Americans consume, such as personal electronics. As corporations outsourced, this caused a vicious cycle for American competitiveness.

Once an industrial commons has taken root in a region, a powerful virtuous cycle feeds its growth. Experts flock there because that’s where the jobs and knowledge networks are. Firms do the same to tap the talent pool, stay abreast of advances, and be near suppliers and potential partners. The Swiss pharmaceutical giant Novartis, for instance, chose to move its research headquarters from Basel, Switzerland, to Cambridge, Massachusetts, to be close to universities and research institutes that are global leaders in biosciences and the hundreds of biotech firms already in the area. And its presence, in turn, has increased the Boston area’s pull on yet more firms and individuals. These dynamics make it difficult for other regions that do not yet have a vibrant biotechnology commons to attract biotech companies, even with generous incentives.

Our research on the semiconductor, electronics, pharmaceutical, and biotech industries has found that commons are even more important to countries’ and companies’ prosperity than is generally believed. That’s because innovation in one business can spawn whole new industries.

Source: https://hbr.org/2009/07/restoring-american-competitiveness

Once the outsource cycle started, it became extremely hard to bring it back as companies lacked incentives to plan/implement for higher costs. The debate about what role the government should play in supporting innovation usually becomes a battle between two extremes: the laissez-faire camp and advocates of centralized industrial policy. Listening to them, you’d think there could be no middle ground. Furthermore, the distrust in government institutions had only been building as populism increasingly gained momentum to make legislation even harder as the two political parties stoked extreme views on both sides with seemingly no overlap.

Source: https://sgp.fas.org/crs/misc/R44307.pdf

Source: https://ncses.nsf.gov/pubs/nsb20221/u-s-and-global-research-and-development

Even when Washington stepped in, there has been no guarantee for success in the past. That changed drastically with the success of Former President Trump’s Operation Warp Speed and the Biden Administration’s distribution of the Covid vaccines that sped up the US economic recovery with the reopening process.

Source: https://www.nytimes.com/interactive/2023/us/covid-cases.html

Now there are those that argue the deglobalization and reshoring initiatives are inflationary and put the US in a higher inflation regime. There are big issues with the scarcity of skilled labor. Taiwan Semiconductor Manufacturing Co. (TSM) has been very vocal about the increased costs of wages and the lack of labor. They are sending people abroad to prevent further schedule slippage of the Arizona plant. Immigration and automation are the counterpoints for increased labor costs.

I am a firm believer of emerging technologies creating more jobs and further pushing the boundaries of innovation. This also feeds into my bias for reduced higher education costs over time as memorization lose its edge with the onset of LLMs and future generations focus on skilled labor. Embedded programing and embedded systems are here to stay and the Biden Administration did its part in labor allocation and pointed the US straight at AI and automation and electric vehicles.

I think it is worth pointing out that the “decoupling” from China does not necessarily mean higher costs for US corporations, as Chinese labor costs have been ticking up in the last few years. Furthermore, Brad Setser (@Brad_Setser) highlights that the “deglobalization” is a bit exaggerated.

Source: https://www.economist.com/business/2023/02/20/global-firms-are-eyeing-asian-alternatives-to-chinese-manufacturing#:~:text=Chinese%20labour%20is%20no%20longer,per%20hour%20(see%20chart).

Source: https://twitter.com/Brad_Setser/status/1680695737879855106?s=20

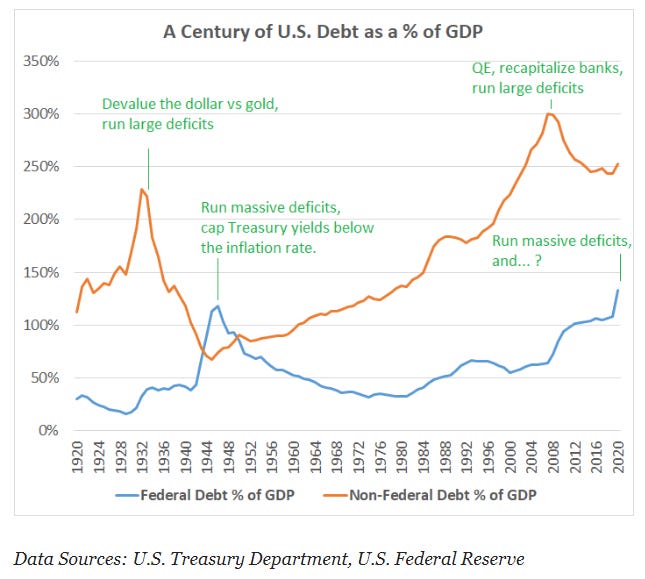

Coming back to fiscal policy. All the above charts were to illustrate Fiscal Dominance. It is worthwhile to consider the views from a libertarian. Lyn Alden (@LynAldenContact) offers the devaluation view of the dollar by treating currency as the denominator of debt to GDP ratio, and highlights how the post WW2 era resolved.

The act of war itself was economically subtractive (losing irreplaceable lives and having their expensive equipment destroyed on foreign soil, half a world away), but the productive infrastructure that the war forced the country to build through federal deficit spending, which they were able to come home to and re-purpose for domestic use, was hugely additive in terms of new technology and overall productivity in the subsequent peacetime economy, and this was further boosted with the G.I. spending bill to get those soldiers trained or educated as they entered the domestic workforce.

After the war, the federal debt never really deleveraged much nominally, but they held nominal debt relatively flat for a while, as nominal GDP caught up, partially from growth and partially from inflation, with interest rates capped by the Fed below the inflation rate. So again, it was a period of aggressive spending and currency devaluation, followed by a period of relative austerity, that reduced debt as a percentage of GDP, this time at the federal level.

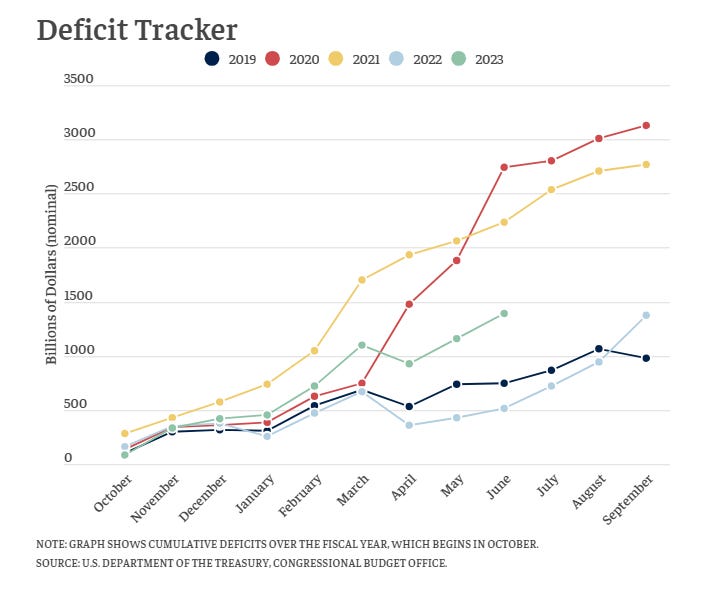

Source: https://bipartisanpolicy.org/report/deficit-tracker/

A key foundation of my perspective is believing in (post)Keynesian Modern Monetary Theory (MMT) and that budget deficits do not lead to inflation. I will reiterate that I believe technology enabled globalization and that is why it took Covid supply shocks for the US to experience inflation, despite years of a zero interest rate environment from the Fed. Technology is fundamentally deflationary and the onset of the new technology regime facilitates Fiscal Dominance.

Source: https://twitter.com/ojblanchard1/status/1688199238327451648?s=20

Once again, it should emphasized that I think nominal GDP can be sustained by the combination of fiscal policies and the productivity gains brought on by the exponential potential of LLMs + code interpreter. I do not disagree with the notion that the Fed may have to step in with QE to sustain the deficit spending at some point, as it is unlikely that taxes will be raised in the short term to reduce the deficit.

To quote Skanda Amarnath (@IrvingSwisher):

While it is true that public investment programs might invite a hawkish Fed to hike rates, it's also not the case that the two must have equivalent offsetting impacts on private investment patterns. Whereas Fed hikes operate through more linear cost-of-capital channels, the injection of public investment dollars, if marshaled well, can deliver more nonlinear confidence-enhancing benefits to the private sector. Fiscal policy can open up valuable sums of free cashflow and keep order books full. Those features are uniquely important for (typically capital-intensive equity-financed) industries that maintain high and sticky hurdle rates that are relatively insensitive to funding cost changes. CHIPS and IRA can offer direct pathways to overcoming the key sources of irreducible uncertainty holding back additional private investment.

While some might view this economic activity as a detriment to the Fed's inflation-fighting effects, we would strongly caution that these dynamics are critical to expanding supply and fixed investment, and are largely not targeted at consumption. The Fed on the other hand is hoping and focusing on slowing consumer prices through the demand side, nominal consumer spending. Slowing nominal consumer spending may have some justification but the Fed should not be trying to slow the kind of real fixed investment gains that CHIPS, IRA, and IIJA are poised to help catalyze.

Capital deepening is a major and identifiable ingredient to productivity growth. By ensuring that fixed investment is growing and outperforming relative to labor input has a chance to deliver more sustained gains in welfare and technological improvement where it is most necessary. The upward revisions to manufacturing construction spending are already set to push up Q1 productivity estimates. The monthly data for Q2 is suggesting a more impressive upturn in capital goods output and demand that should be productivity-additive.

In summary, this delicate dance between fiscal and monetary policy is key to watch. The US economy has become less rate sensitive with the current state of household/corporate balance sheets that locked in low interest debts, so monetary policy has become less effective. There are consumer headwinds in the form of higher borrowing costs, student loan repayments, and depletion of excess savings, but I expect Fiscal Dominance to continue being a prevalent theme that offsets those headwinds. If fiscal stimulus overpowers the restrictive stance of the Fed’s monetary policy, Chair Powell is likely to use the only tool at his disposal to dampen short term demand. However, he is also likely aware of the implications that come with restricting long term supply solutions. My lean is that Chair Powell will mention AI in response to wage and productivity growth within the next six months and admit the Fed has no control over long term commodity price trends. The closest analog to the 70s is likely labor, not oil, but Clippy 2.0 is here to save the day.

Source: https://fred.stlouisfed.org/series/LNS12300060

The inflationary behavior of the post WW2 era was essentially from fiscal deficits alone. The curve ball for the current regime is the deflationary impacts of AI and automation, which seems to make this era a weird combination of post WW2 and the 90s. If the 10yr continues trading >4.1, that should set off alarm bells, escalating from just a significant equity headwind. 0.3 MoM is probably still the magic number.

Source: @LynAldenContact

Source: https://fred.stlouisfed.org/series/FEDFUNDS#0