The Loss of an Objective Reality

trend: chaos dominance and wealth gap + AI/GLP-1

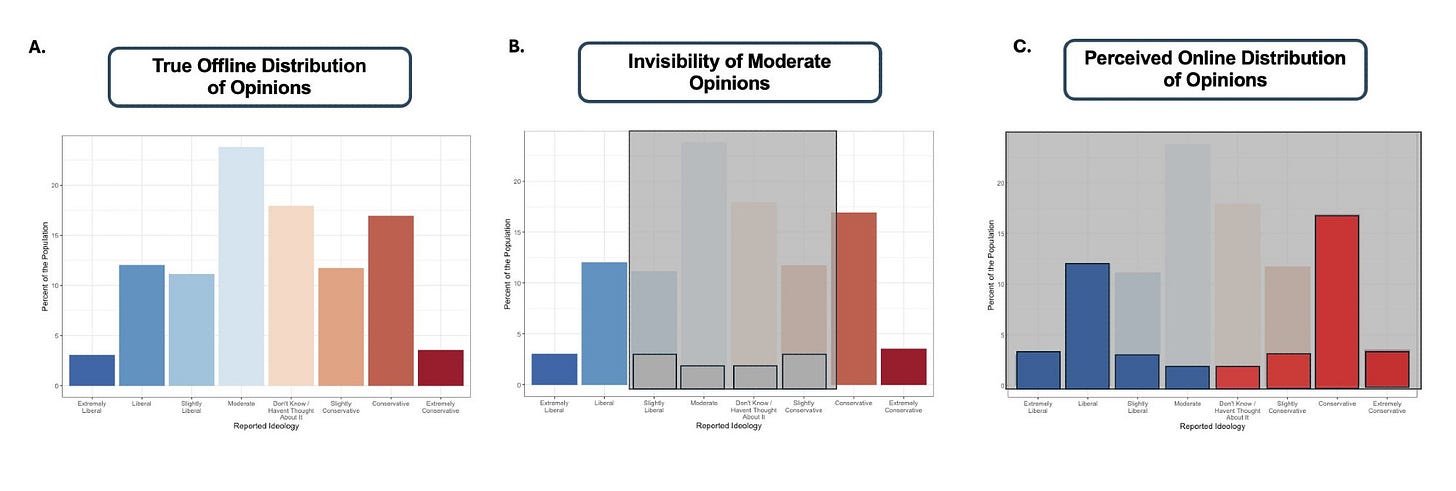

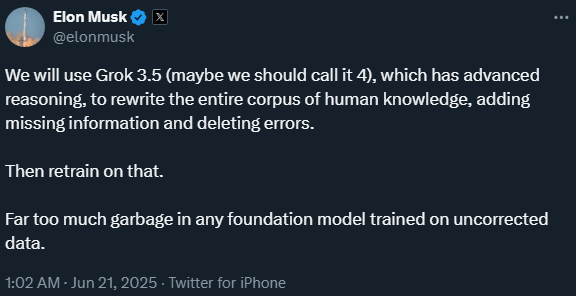

The introduction going forward is going to be a vibe check on Bifurcated Information System. In May 2025, Goldman’s social media economic sentiment officially diverged from the University of Michigan Consumer Sentiment. If you squint, you can see the National Federation of Independent Business (NFIB) optimism index lining up with UMich. These vibe indicators were part of the reason sentiment was so negative during the pandemic recovery. Leading Economic Indicators (LEIs) were wrong during the pandemic, largely due to the being indicators aggregating manufacturing-focused survey measures. UMich is exaggerating inflation expectations, but sentiment affects consumer behavior. Partisan consumer sentiment is not new. Bluesky probably lines up more with UMich. Reality is somewhere in the middle.

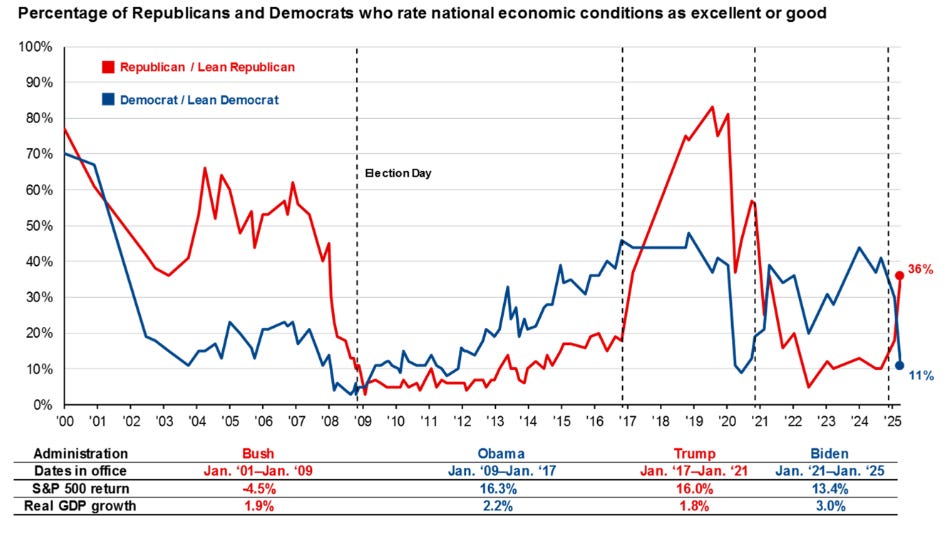

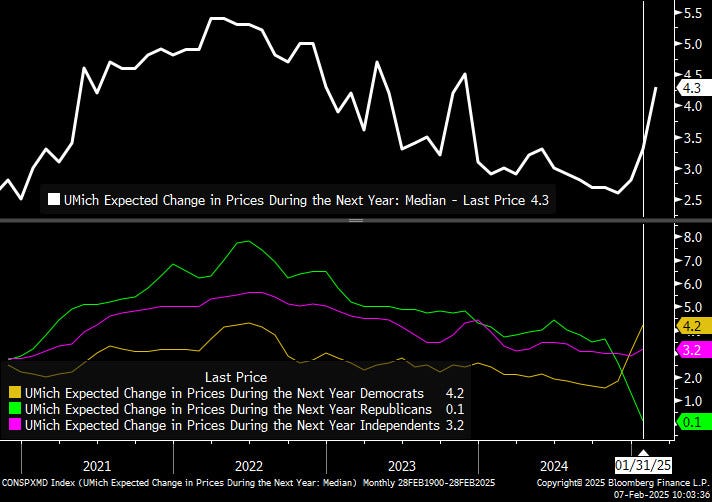

The vibecession has expanded beyond just soft and hard data. There is a bifurcation within “soft” data, that is heavily dependent on media diet. For the UMich index, there was partisan split even before inauguration. Democrats were probably anticipating inflationary pressures from tariffs and Republicans were anticipating disinflationary (almost deflationary) pressures from deregulation (DOGE). Independents were somewhere in the middle.

About five months into the new administration, Independents had higher inflation expectations and Republicans had slightly higher inflation expectations.

Treating social media sentiment as effectively twitter (still 10x Bluesky userbase), sentiment started rebounding once Scott Bessent started the rollbacks. Earlier in the year, Scott proclaimed: “Wall Street has had their time, now it’s main street’s turn.” Main Street’s turn lasted about three weeks, before his comments at a private JPMorgan event leaked and moved markets. I will revisit this “Wall Street vs Main Street” government redistribution theme later.

Warning: Spoiler label for Andor Season 2 Episode 9 ahead. Andor S2 is underperforming the Acolyte. Star War fans will understand how this is a travesty. If it seems like Andor is all Bluesky can talk about, it might be because the people on it are the only people watching it. I hope word of mouth improves these numbers, because this is why the US can't have nice things. Seems correlated with Americans that care about the rule of law to be honest and may explain why lawyers were one of the first social media platform migrants.

Andor Season 2 Episode 9, Mon Mothma delivers a powerful speech that included the following:

The distance between what is said and what is known to be true has become an abyss. Of all the things at risk, the loss of an objective reality is perhaps the most dangerous. The death of truth is the ultimate victory of evil.

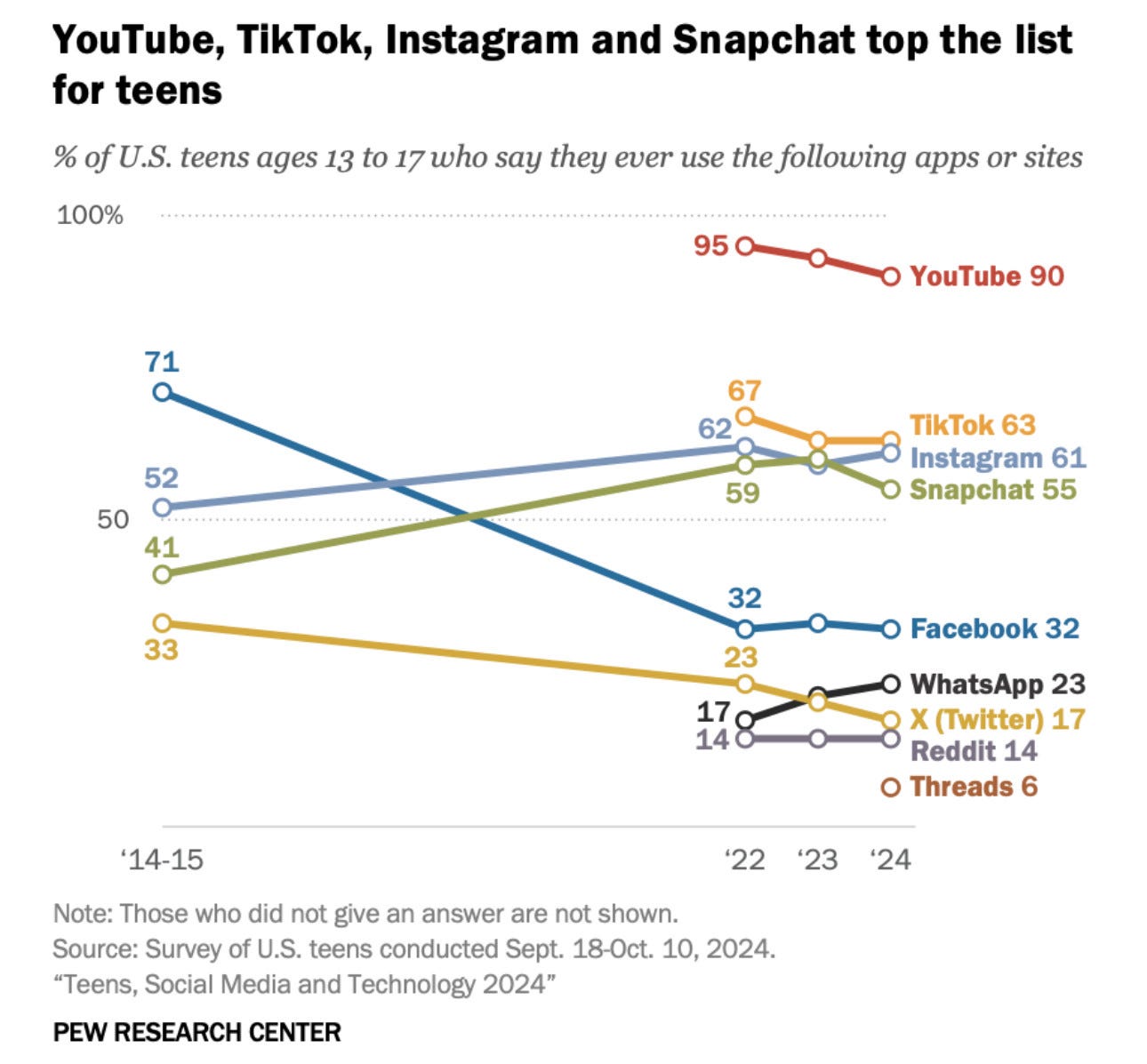

The loss of an objective reality in the post-truth world is the root cause for a lot of things. Market participants will continue to be in for a wild ride. As will the people of the world. I am genuinely curious how twitter negativity bias plays out going forward. Zerohedge grew to 2M followers because of it, but their guy is the one causing the negatives this time. Most people know the line “The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command.” “Broadcast” accounts that can’t hit 20k likes consistently on that site aren’t really broadcasting. To “broadcast” on Bluesky, it’s around 2k likes (should translate ~5x on twitter). Bluesky is just another text-based bubble in the social media world. Ultimately, it’s Youtube and TikTok short-form videos that will be shaping views of the younger generation.

That being said, social media has a good chance at breaking America.

“Like unhappy families, each microblogging site is batshit insane in its own way.” - Chris Hayes

I will continue to repost the following chart until the world depolarizes to a more sustainable state. It’s easy to spot the “centrists” posters, since they post the same exact posts on both sites without trying to cater to polarized audiences. Centrist is in quotes because the posting spectrum does not directly translate to political leans. It is more that these posters transparently “post across the aisle.” (My twitter posting stance remains the same.) If conservatives cannot “win” in a free marketplace of ideas, then maybe their ideas were not that good to begin with. The only thing the election results proved was that propaganda works.

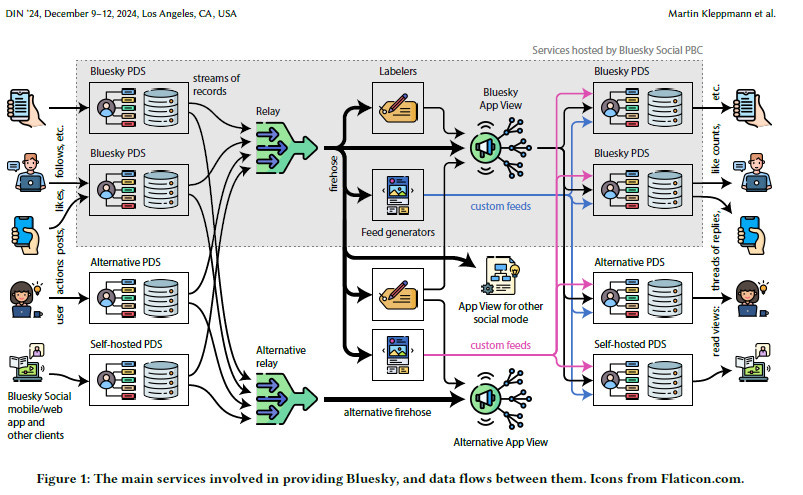

Bluesky (bsky) works just fine for finance discourse and keeping informed about the economy. In fact, I have a theory on how twitter is slower than bsky for market moving news now due to the fact that links are not deboosted and misinformation does not get amplified by an algorithm. Financial Times, Bloomberg, and Wall Street Journal all have verified handles now. That order is a ranking recommendation. Archive.ph can be used to “save” good pieces for the first two.

In case anyone needs it, this is my news feed and it’s best suited for usage as a column within deck.blue. Livesquawk recently was added to the list and there are a couple handles for redundancy and double confirmation of immediate headlines. This paper feed aggregates links and pdfs from your network. The fintwitter bot gets a little spammy, as it is aggregating multiple feeds from the other place.

The moderation team has done a good job of cleaning up the bots that appeared after the election, and posting activity is settling at about 2x that of pre-election. The total user count should hit ~45M by midterms next year, maybe higher if more sports and gaming content creators are willing to make the shift. The diversity needed is not more political takes necessarily, but rather entertainment and hobbies that can keep people sane in the firehose. How much of the “20” part for the social media Pareto Frontier will be bsky remains to be seen. Zohran Mamdani’s campaign is a good test.

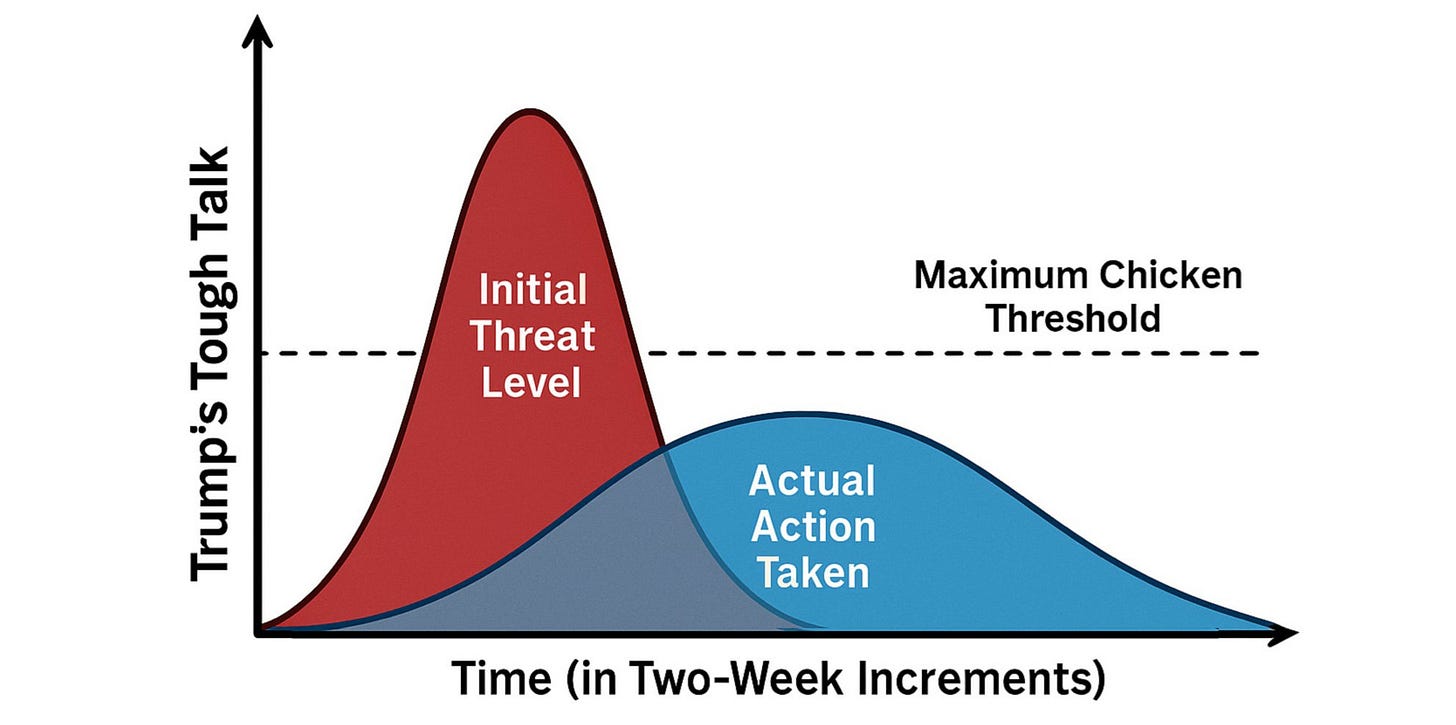

Google searches are being replaced by “social" searches and LLM searches. Bluesky AT Protocol and the concept of decentralized social media firehose is just another part of the information system pivot happening after Hypertext Transfer Protocol (HTTP) dominating since dotcom. Twitter is pretty boring in comparison. The Counterparty-in-chief tweets every day and twitter mostly agrees with whatever position is tweeted that day. Most of the times the tweets are just noise, but sometimes there is a signal. The markets disagreed strongly on Penguin Equation Day in a major way and twitter had negative vibes for a few weeks. Despite the rollbacks, the damage already happened but twitter is back to positive vibes with stocks at new highs.

Market Outlook

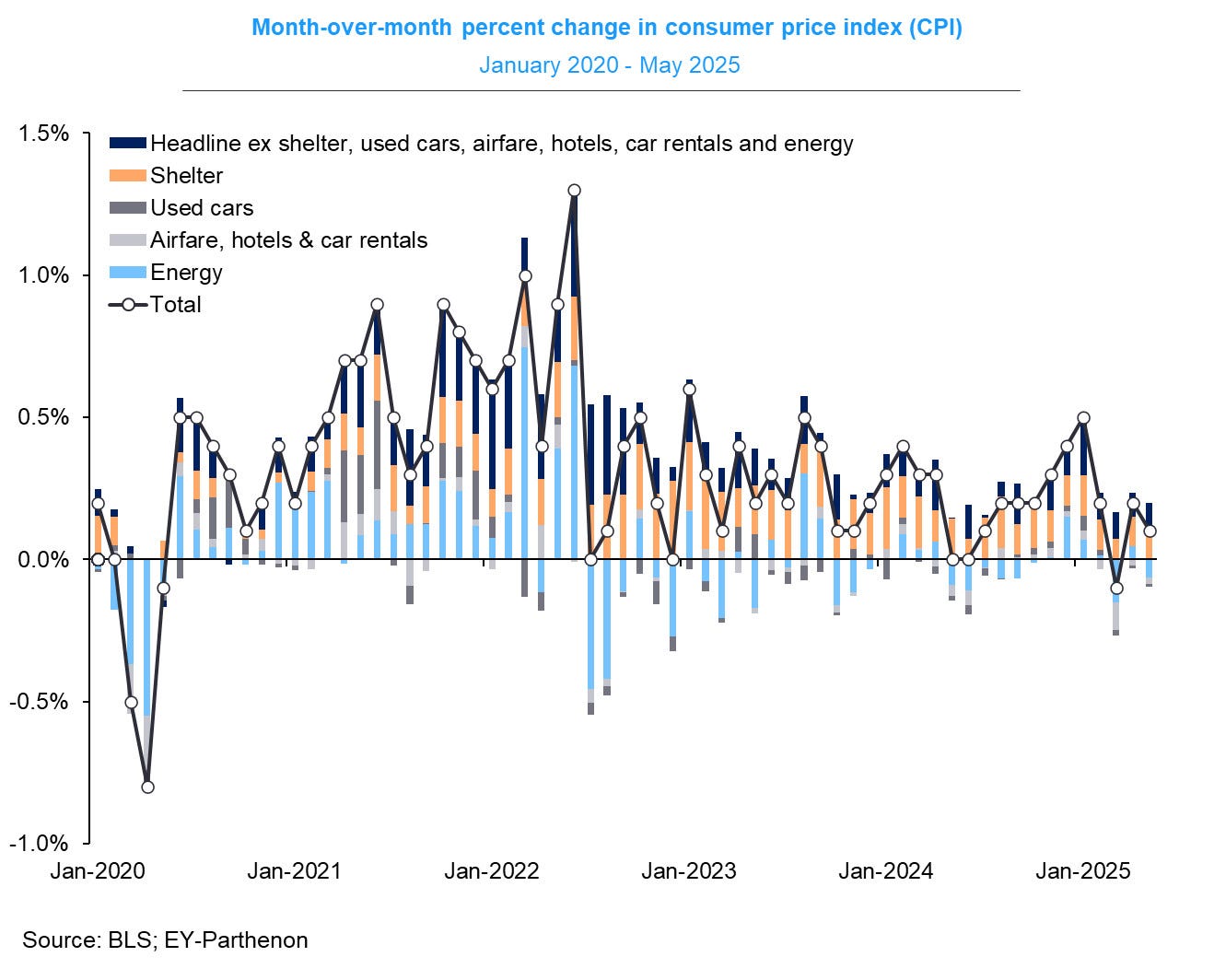

Luckily, the consensus view does not help with beating markets. Market has been incredibly inefficient this year as it tries to separate tweets from Federal Register entries. Since last year, the line between market analysis and policy preferences has blurred and marking to market helps with anchoring. The dollar, US Treasuries and stocks is the best order to frame market assessment. Chaos dominance has replaced fiscal dominance. While monetary policy is taking a back seat to fiscal policy, the variables for the Fed’s response function remain unchanged: inflation and unemployment. One thing that I missed about fiscal effects on inflation was that reduced international travel would significantly drop airfares. That has stabilized going into the summer.

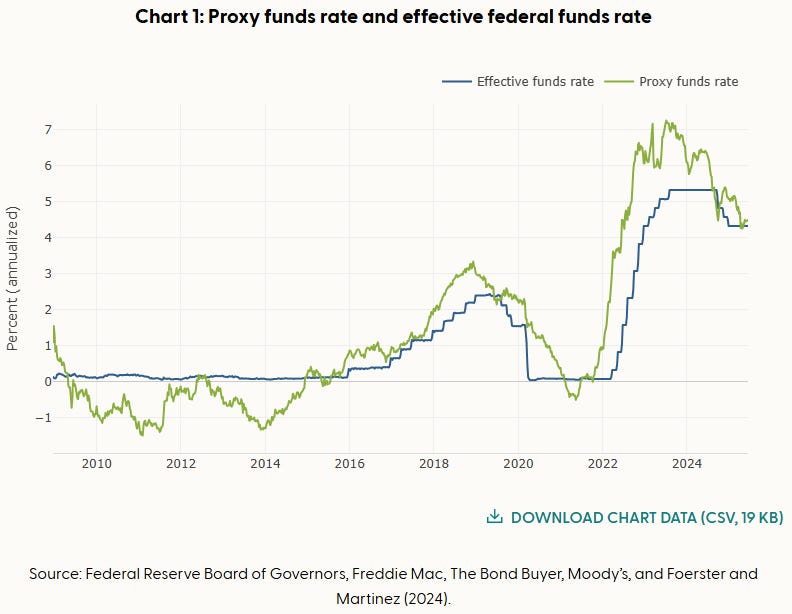

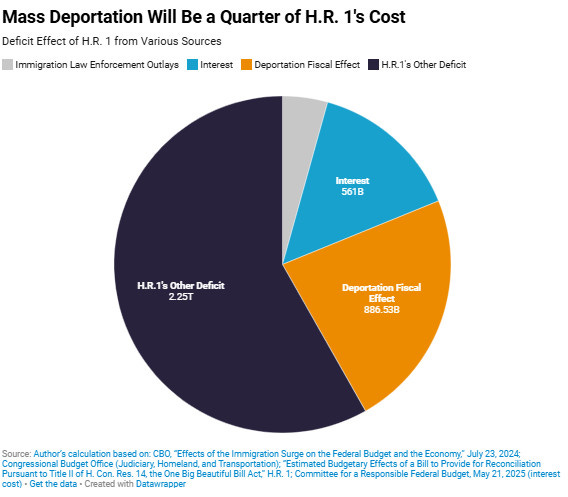

Despite the cooling H1 inflation, both the Fed and markets are looking forward. The combination of tariffs and deportation will contribute to inflation inflecting towards 3.0% y/y in H2. Furthermore, the Fed likely treats the weaker dollar as a form of “tightening” with respect to imported goods and services, so they will do the best they can to sound hawkish to “loosen” conditions. As growth stagnates and inflation firms, the long end is likely to remain above 4.25% as bond market participants brace for the government issuance required from Tax Cuts and Jobs Act (TCJA) extension. Term premium is real and 7% was basically the mortgage rate for the 2025 housing season.

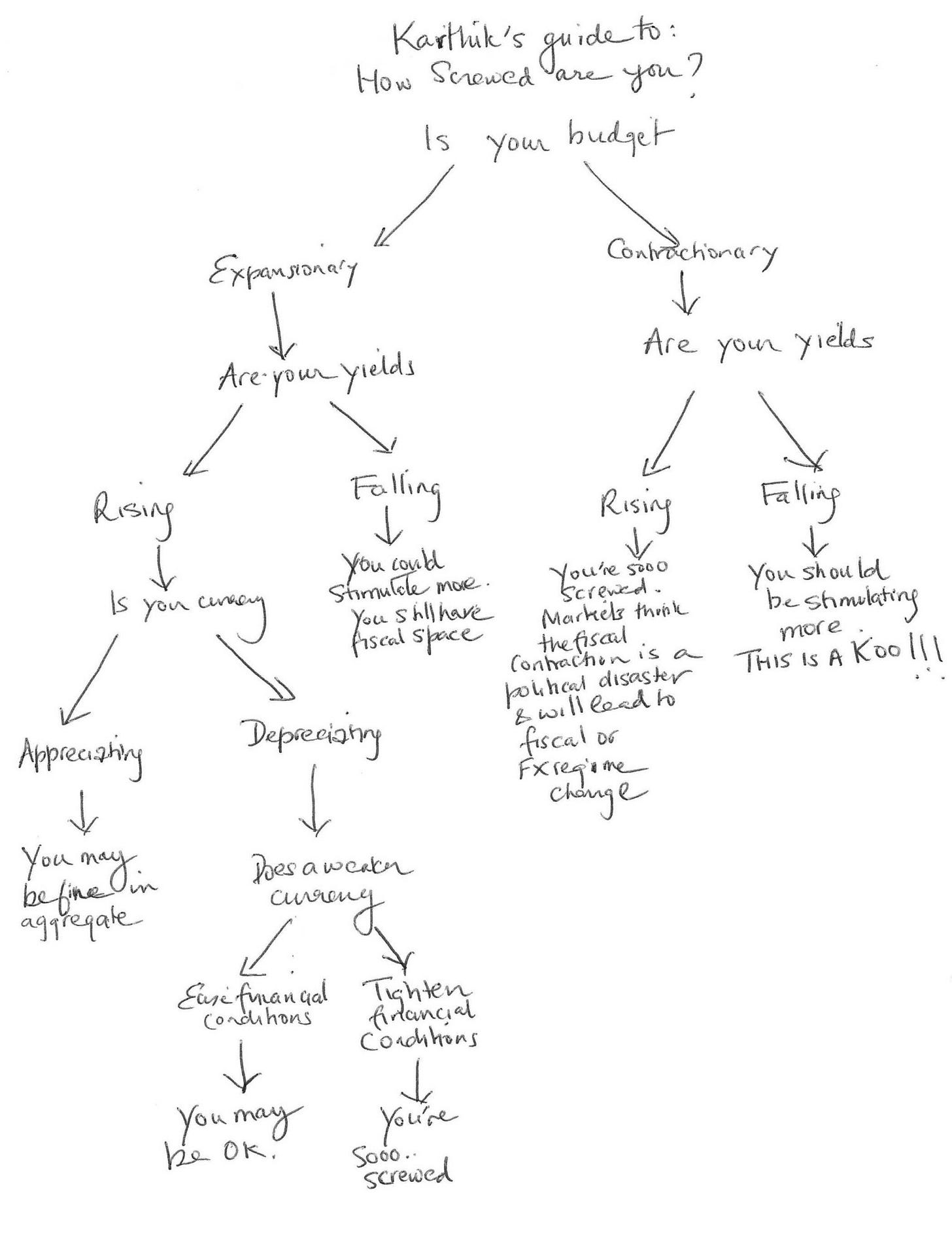

Fiscal policy is contractionary and monetary policy has been restrictive. Some can make the argument monetary stance is neutral based on Treasury rates, mortgage rates, and borrowing spreads. The kicker here is that there are no guarantees Fed cuts will offset fiscal term premium. In fact, it could make it worse as forward guidance starts to lose credibility and inflation expectations become unanchored. Building permits are the most important indicator for housing supply as this drives economic activity (especially so compared to resale market). The combination of term premium and deportation is going to lead to reduced housing supply, ultimately resulting with upward pressure on home prices and rents next year.

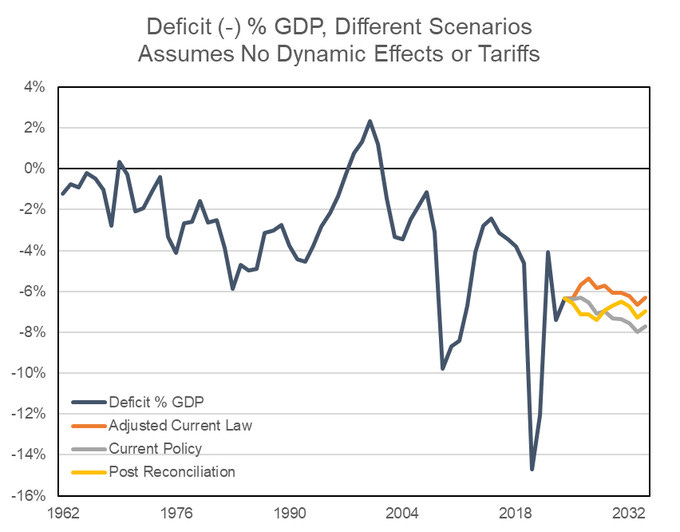

Now, the question is how much does term premium increase relative to expected higher inflation while growth stagnates. The distribution of nominal growth will continue to be key as “real” growth contracts. GDP is a flow, so it's totally possible to have a recession when the budget deficit is 6% next year. The budget constraint is the economy’s potential/stability not the deficit. Modern Monetary Theory (MMT) folks will say the constraint is inflation, but they are two sides of the same coin. If government spending is not productivity-enhancing, the spending causes inflation and limits potential growth. The stability aspect ties directly to “Rule of Law” and enforcement of contracts. It is key to remember that the government issues bonds and typically charge taxes to create demand for a currency. Cutting taxes is a way to reduce demand for a currency. Fiscal policy is the driver for restrictive borrow rates. Fed cut advocates miss two things: 1) Fed is not responsible for reducing term premium and 2) Fed cut may not even offset term premium if market views the action as enabling unproductive fiscal policy. Those advocating for cuts are also usually quiet about impoundment and immigration policies.

Too many people are ignoring deportation effects on labor supply. On a macro level, it is worth mentioning that after the eventual benchmark revision, payroll employment numbers will be closer to 70K/month based on QCEW data through December 2024.

Even then, inflation (tariff-induced price increases) will force the Fed to overweight inflation prints compared to unemployment, due to shrinking labor pool from immigration policies (deportation/quiet striking providing downward pressure on unemployment). The breakeven job level needed to keep employment steady is in the 50k-60k range, compared to 160k a year ago. The immigration surge is over, and peak boomers are aging into retirement. Deportation is likely to keep U3 from moving higher significantly for a couple quarters.

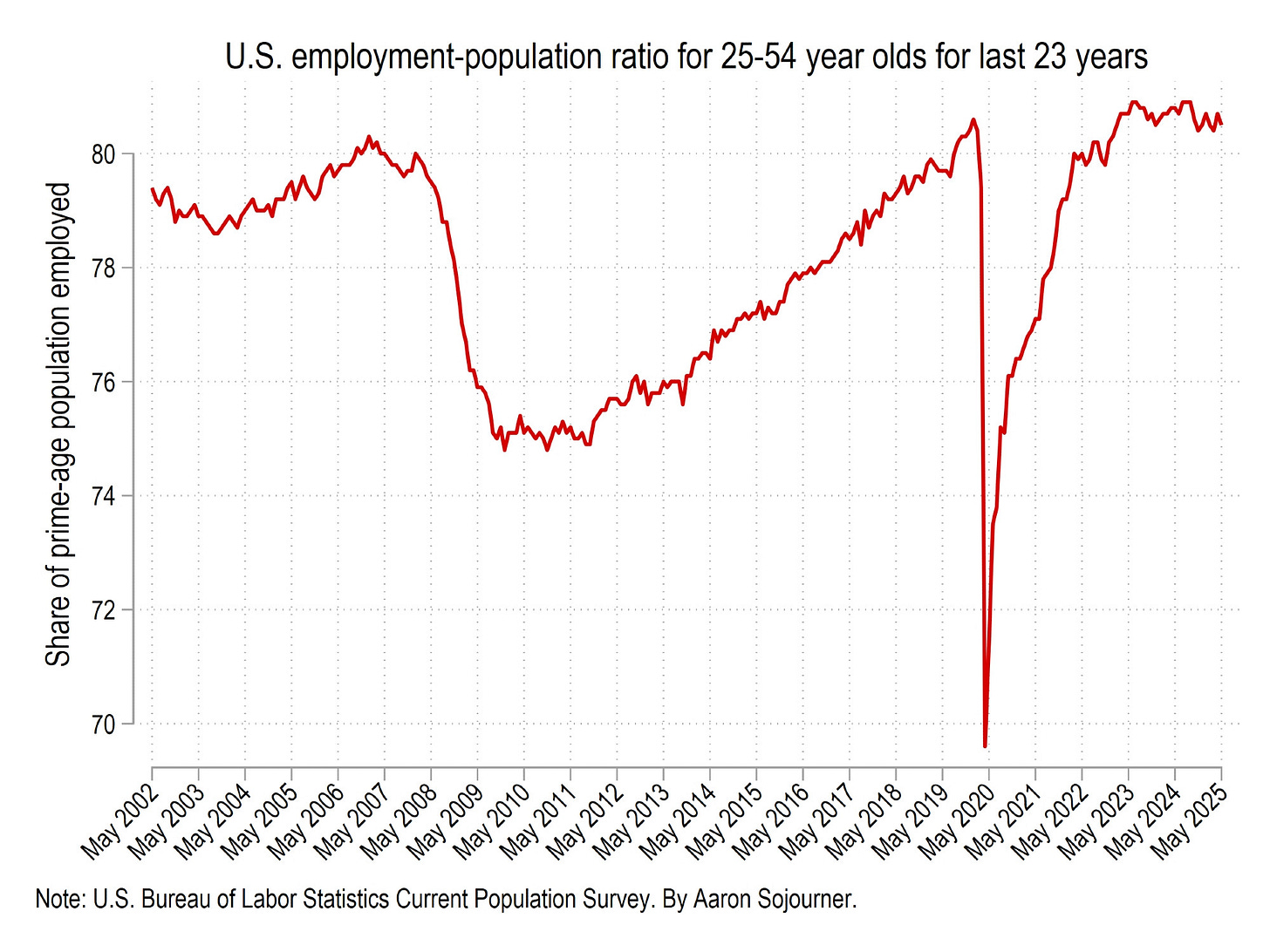

Prime age (25-54 years old) EPOP measures core labor market strength and continues to maintain “full employment” at 80.5%, down 0.4% from record-high of 80.9% in July-Sept of 2024. This number will continue to be a key metric to watch.

Unfortunately, fiscal policy is likely to push unemployment higher on a longer time frame. For now, the hiring rate still exceeds layoff rates, but that may change as inflation inflects up and real wages start trending lower. As long as hiring rates hold, the Fed is likely to hold their restrictive stance. Even when the Fed does eventually make adjustment cuts, the long end that dictates borrow rates is likely to remain high and restrictive as the TCJA extension (regressively) redistributes consumption. Fiscal dominance is already here and it is contractionary.

The Fed has had a “strong” dollar to conduct monetary policy for quite some time. However, that has changed with the new administration. The US government cannot keep issuing Treasuries and get both a strong currency relative to others and low long-term bond yields. The dollar will likely be structurally weak relative to Rest of the World (RoW) during this admin. Whether the Fed interprets the weaker dollar as “loosening” or “tightening” conditions will affect policy stance, likely resulting in a more “hawkish” stance to attempt to keep the dollar from weakening. According to Fed’s Taylor Rule estimates, the Fed had rates too high for much of 2024, but now are currently within range. Bullard is probably smiling as his PCE-based Taylor Rule framework has been validated.

In summary, the view that the Fed is responsible for term premium is a policy choice. Fed cuts do not: 1) automatically lower the 10yr, 2) do not change population outflows, 3) change effective tariff rate, 4) do not change regressive tax cuts that redistribute consumption towards the wealthy. The view leads to a weaker dollar. If the Fed cuts and the dollar goes down while the long end does not, then we are in the Very Bad Place. As global market participants adjust their needs to hedge currency in a stagflationary environment, investment inflows will be affected as the world becomes more multipolar.

At the beginning of the year, my 2025 lean was sideways. With fiscal policy formally taking shape, my lean is now down. $SPX 5400 translates to roughly 19x vibe multiplier and another 5% revision downwards for 2026 earnings. I think there is additional downside for 2026 as the dollar and corporate margins deteriorate further.

Chaos Dominance

Multipolar World

Dollar

The dollar has diverged from yields. The amount of o’s for “so” is increasing as American buying power deteriorates. Except hyperscalers, most capital expenditure (capex) plans are on hold due to chaos dominance. Manufactures are too busy managing inventory to consider moving new plants to America.

Ultimately, the fate of the dollar will turn on the willingness of America’s leaders to uphold the rule of law, respect the separation of powers and honour the country’s commitments to its foreign partners." The dollar is an expression for the strength and resilience of American institutions, that are currently under pressure from the administration actively trying to reduce state capacity and sow mistrust. Bitcoin diversifies for mistrust and gold diversifies for geopolitics and real rates. As the dollar weakens, the financial stability risk of a monetary system composed of multiple competing internationalized currencies could emerge to be greater than that of one with a single dominant currency that denominates most cross-border liabilities.

The Moody’s downgrade was expected, as discussed in the last entry. Their reasoning was somewhat silly, but it didn’t make sense to be the loner among the rating agencies to maintain a AAA rating considering the current admin’s chaotic fiscal policy.

Too many people seem to be overweighting the enforcement of law. I started a thread for rulings and rulings not being enforced and defied, then gave up because there were simply too many.

In the firehose of headlines, a Dem lawmaker and her husband were killed by a guy for their political views and it’s already out of the news. Minnesota State Representative Melissa Hortman was assassinated by someone impersonating law enforcement. Rep. Hortman was the Dem leader in the Minnesota House and was Speaker of the House 2019-2025. She was probably the most influential state-level Democrat barring the Governor Tim Walz. State Senator John Hoffman and his wife Yvette have survived and are in recovery. The media environment has affected how differently the coverage is compared to the Congressional baseball shooting in 2017 and attempted assassination last year.

The Rule of Law in the United States of Americas is deteriorating. Dollar bulls are fades. The implications are profound as global asset allocators holding dollar-denominated assets will need to consider the consequences of a weak dollar relative to the Rest of World (RoW).

There are emergency applications pending at Supreme Court of the United States (SCOTUS) on six different policies:

Birthright citizenship (Ruled 6-3, the Supreme Court rules that universal injunctions likely exceed federal courts' authority and rolls back the injunctions protecting birthright citizenship, but does not opine on the constitutionality of birthright citizenship)

Alien Enemies Act (Ruled against in 2-7 decision that admin must follow due process rights, but does not decide whether the admin can remove migrants under the Alien Enemies Act)

Temporary Protection Status (TPS) termination (Stays lower court decision, stripping 300,000 people of legal status for Venezuelans)

Ending parole from CHNV program for 500k immigrants

Agency firings (Ruled in favor 6-3 decision, with jazz hands carve out for the Fed)

DOGE access to SSA data (Ruled in favor 6-3 decision) while blocking discovery relating to DOGE

If China defeated the US in war and forced us to sign a treaty that would ensure a century of Chinese dominion in science and tech, it would look like this admin's policies: 1) slashing scientific grants in half, 2) reduce foreign students, and 3) increase producer costs. The things made the US an exceptional nation were:

the rule of law

science & innovation system

openness to foreign talent and cooperation with foreign partners

Remarkable how this admin has taken a sledgehammer to all three. No enemy of this country could do more. America’s strength has never come from drawing solely on the talents of the small percentage of the world’s inhabitants who live here — but from attracting the best from anywhere. These factors will continue to be a headwind for the dollar.

Immigration

With the birthright citizenship showing up on the Supreme Court docket, legal immigration is finally joining public discourse. As of 6/27/2025, birthright citizenship case status:

- the lower-court injunctions continue to protect the parties (immigrant orgs, individuals and 22 states) from Trump's EO

- the EO can (and will) be enforced in the other 28 states

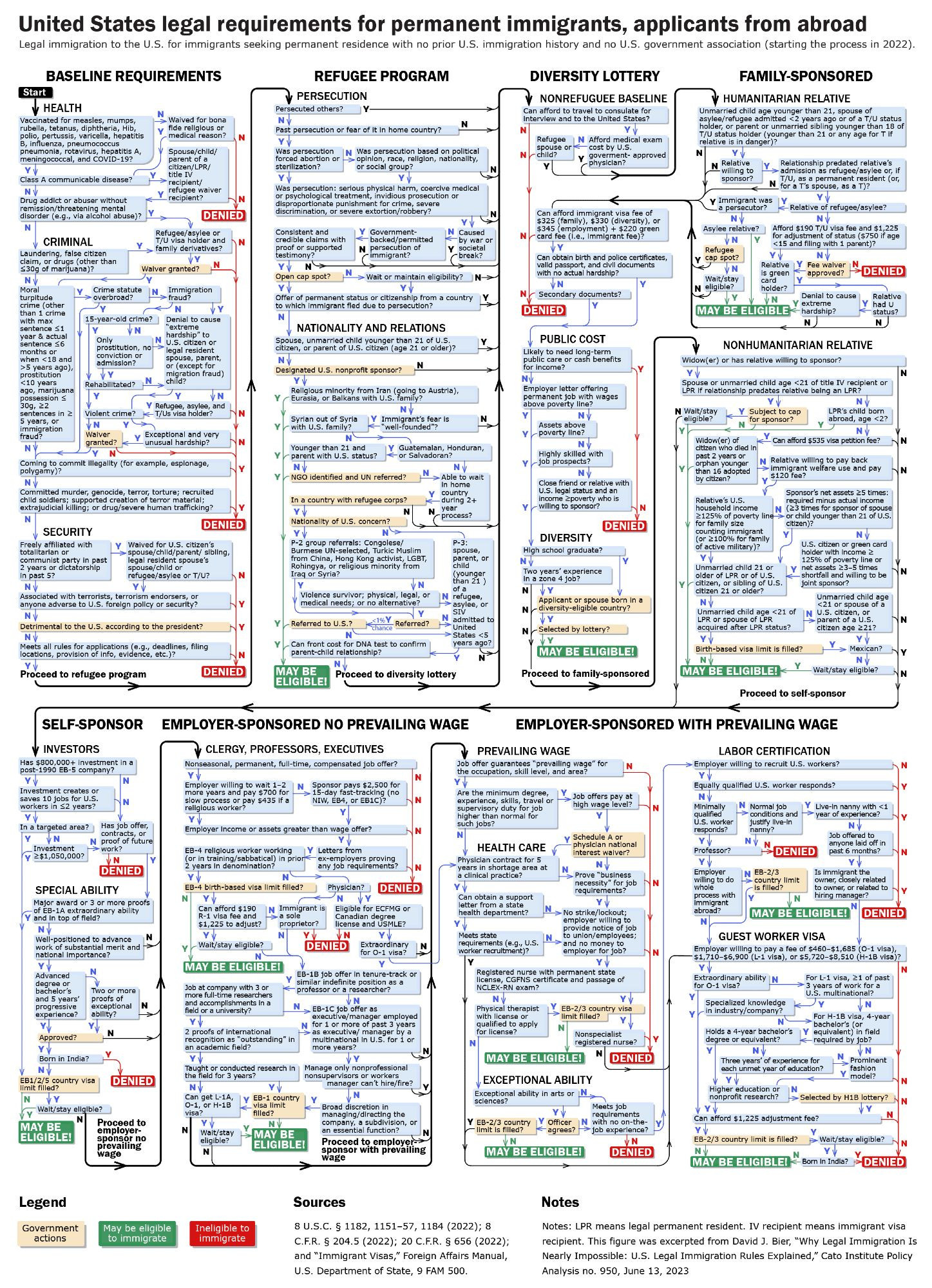

This means a baby born in New York to undocumented parents will be a citizen, but a baby born to undocumented parents in Kentucky will not be a citizen. Many still don’t know the legal requirements for permanent immigrants, so here’s a chart.

Lost respect for John Arnold after seeing his Venn diagram. He doesn’t really elaborate other than “I think we can devise a selection process to meet the national strategic goals of the immigration system better than birthright.” The word choice of “selection process” seems intentional. My stance remains the same. There is a portion of the American electorate that would likely fail the naturalization process due to the current Civics Test. Whether that Civics Test is modified is a different story.

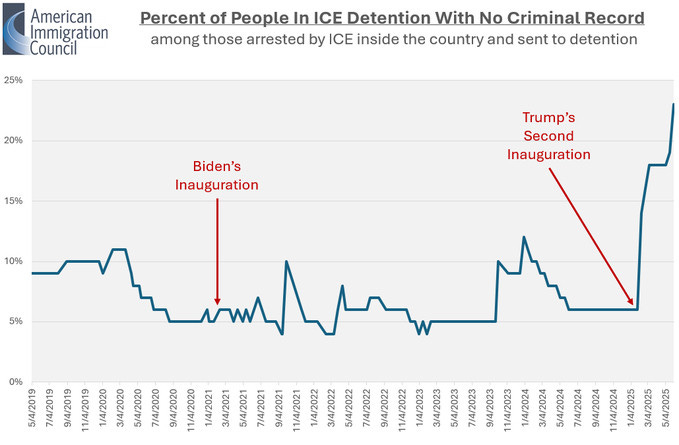

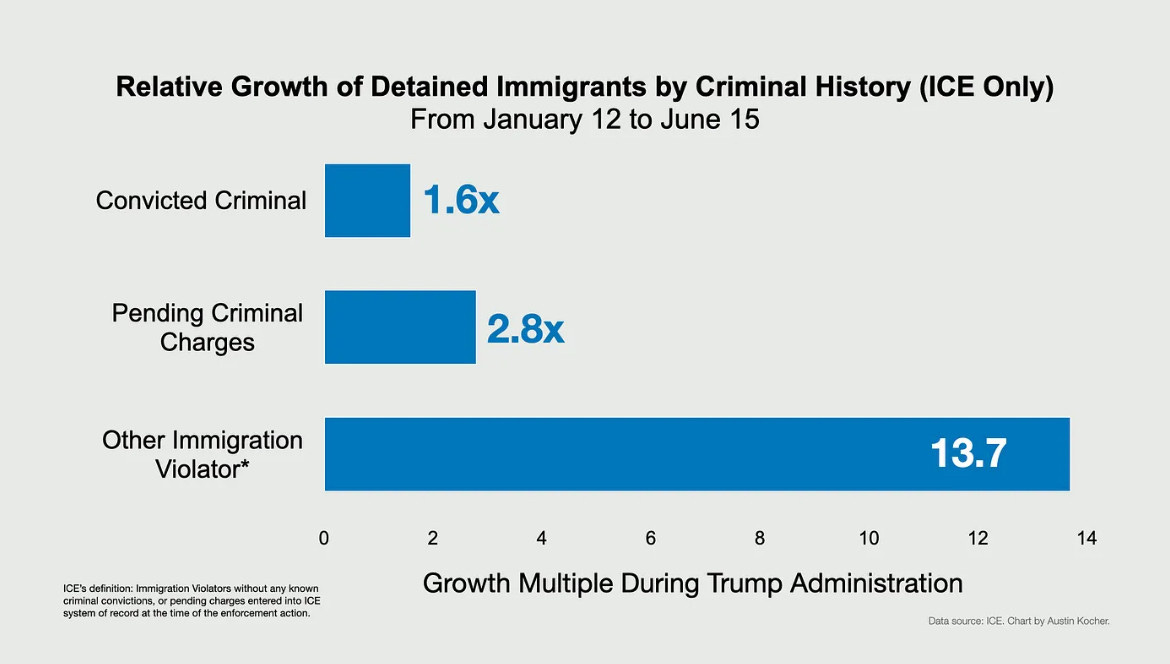

It’s been disappointing to see a portion of the abundance bros (derogatory here) thinking it's easier to moderate conservatives than it is to moderate socialists. There is no requirement to be anti-labor to be pro-transit and pro-YIMBY. Some of them will eventually realize the overlap between anti-labor and pro-deportation will make them irrelevant pundits going forward. As of June 1, nearly 25% of the people arrested by ICE in the interior and sent to detention had no criminal record. The largest growth comes from people with no criminal histories, who now make up a third of ICE detention amid dangerous overcrowding and lucrative contracts for private contractors.

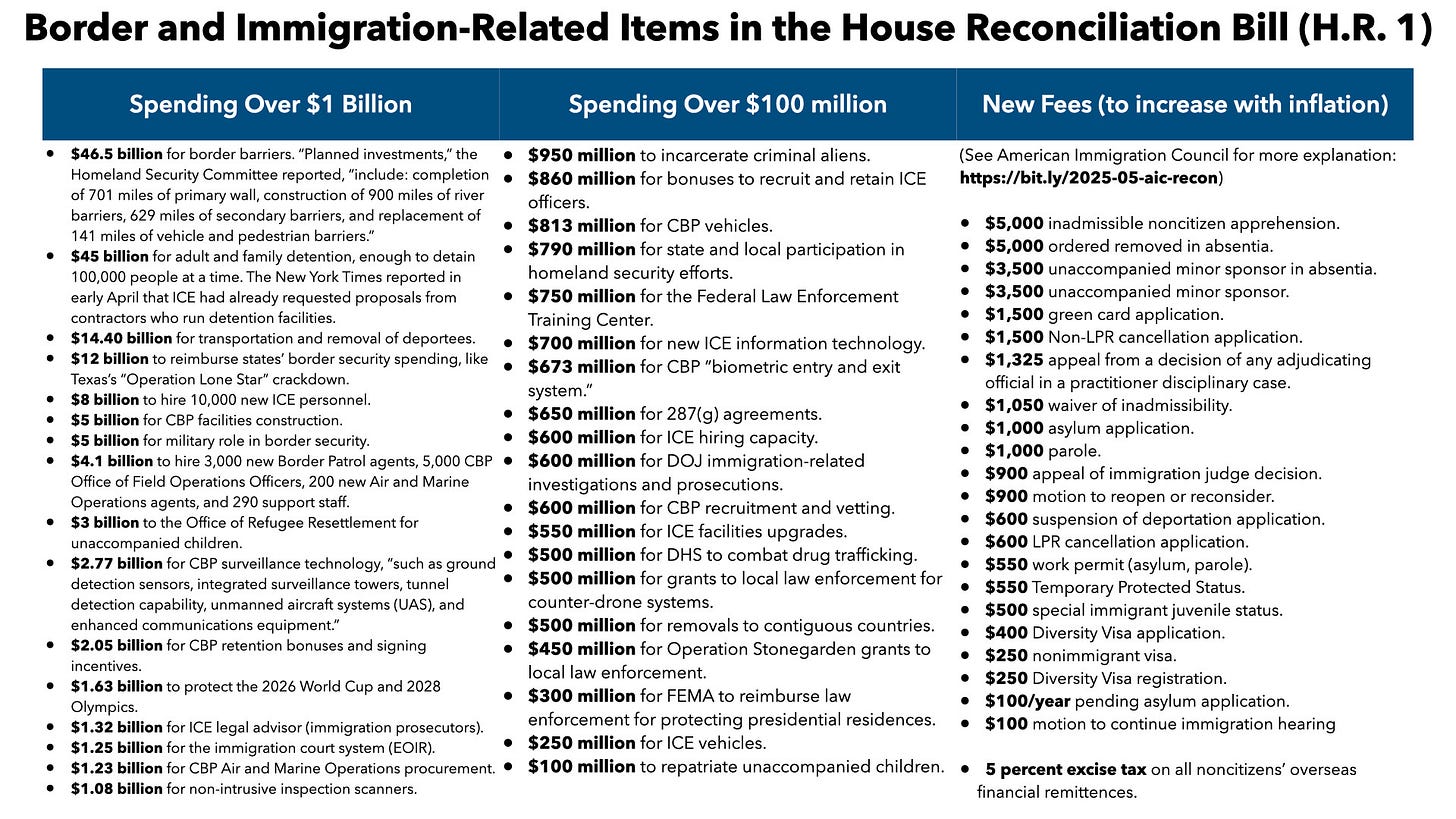

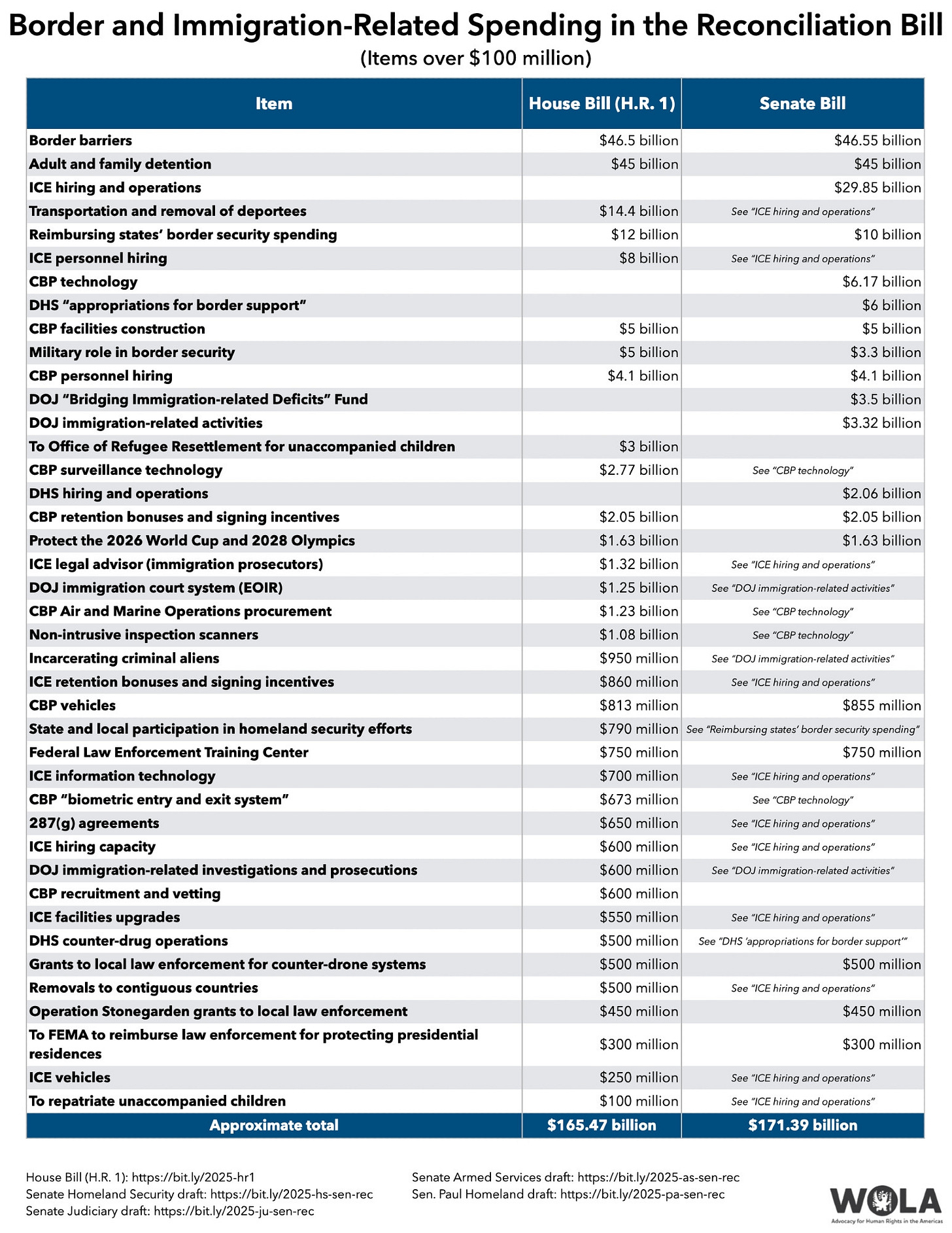

Deportation beneficiaries like the GEO Group did not really react to Penguin Equation Day. The effects on labor pool are happening as some immigrants have become too scared to show up at work. As more people direct their efforts to support their friends or family in deportation proceedings, it is clear that fiscal policy is reducing productivity. It has even affected game-day for some soccer fans. It will affect World Cup.

Immigration restrictions that have been announced include:

Stripping >500,000 people of legal status for Venezuelans, CHNV program parolees, and Haitians.

Halting student visa interviews and adding social media vetting requirement

Applicants for F, M, and J nonimmigrant visas will be instructed to adjust the privacy settings on all of their social media profiles to “public.”

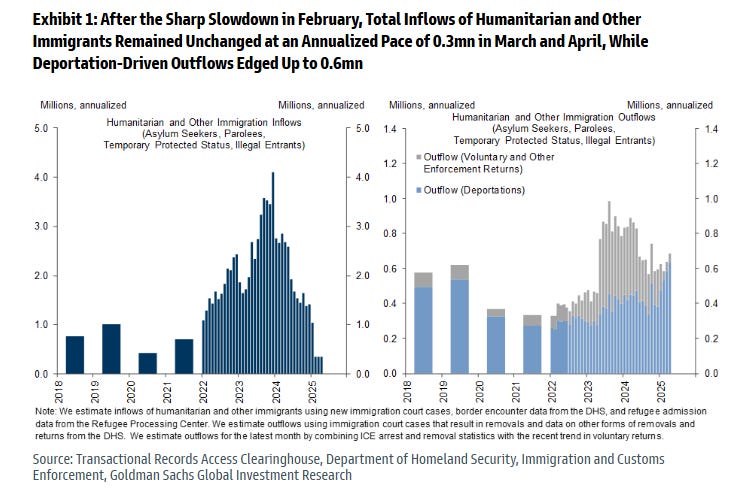

People need to figure out what “legal” means to them. Meanwhile, deportation-driven outflows have edged up to 600k annualized.

Deportation is not pro-growth. It is actually the opposite. Neither is calling on the National Guard or any part of the military domestically. The admin’s policies increase entropy.

Trade (Tariffs)

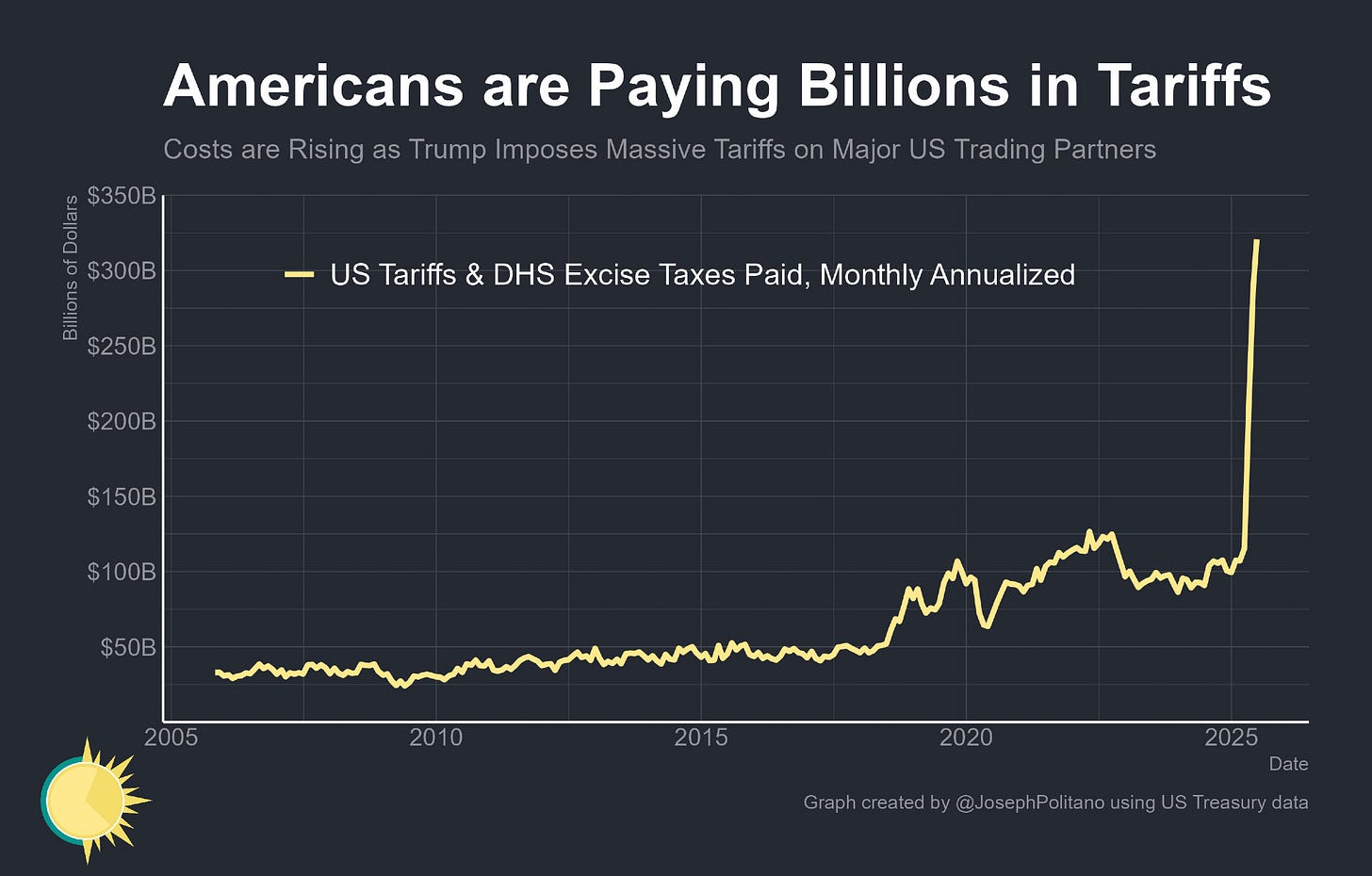

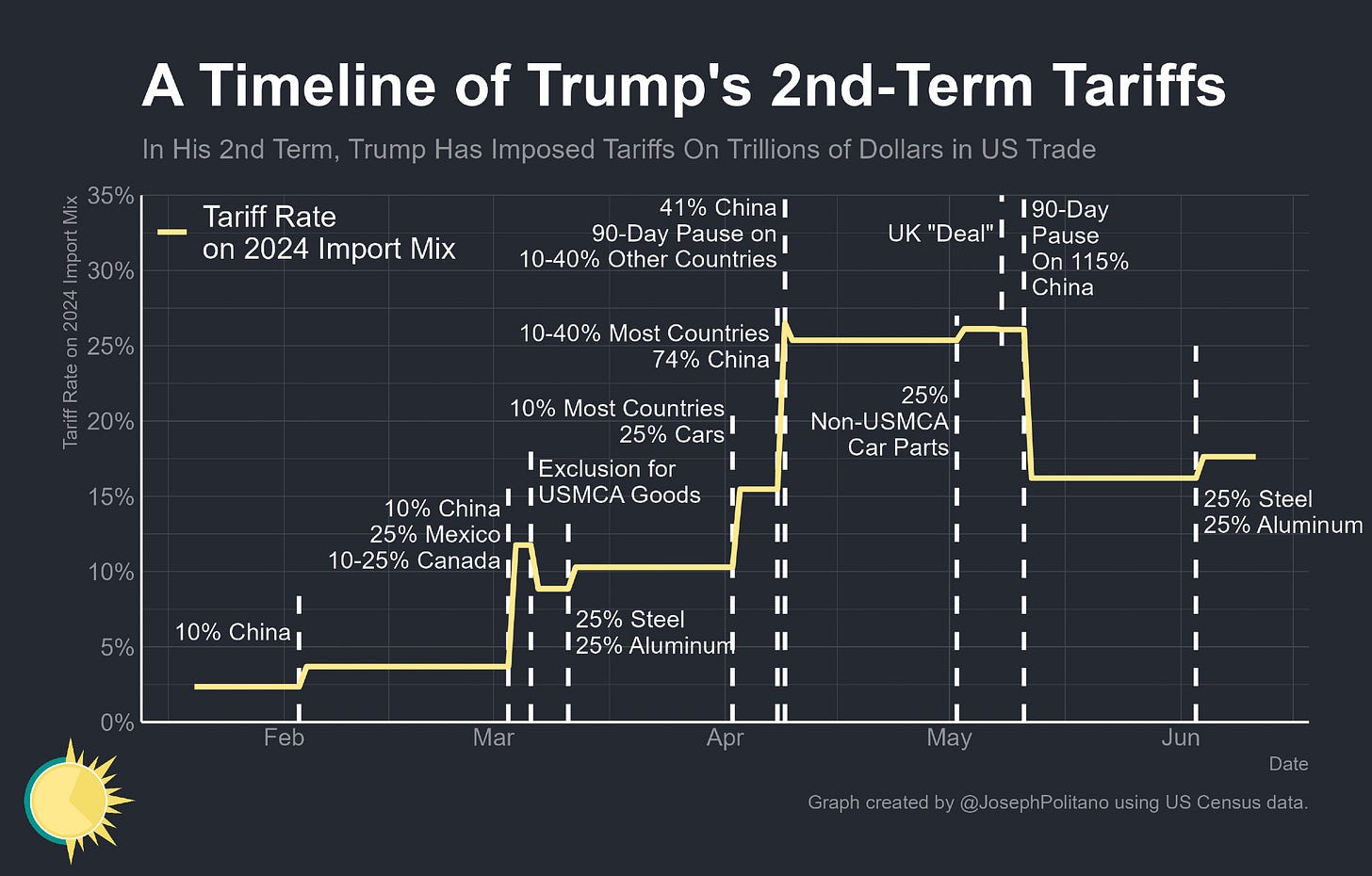

Another entropy increasing policy is tariffs. While the effective tariff rate has fluctuated on a monthly basis, the direction of travel is clear. For the month of April/May, tariffs were around an effective rate of 7% (~half strength). There were significant beat-the-tariff inventory stocking happening that affected import volumes. This tax will translate either to margin pressure for the domestic producer or price increases for the consumer. Joey Politano provides comprehensive tracking and analysis about how the Trade War has been developing.

It’s important to contextualize tariffs with respect to the “China Shock.” After China joined WTO, US manufacturing capacity decreased and the world became more reliant on Chinese goods. As a result rural towns lost industrial plants and stagnated.

The Biden administration’s policies brought back manufacturing, but it heavily skewed towards the Sun Belt and rural counties at the expense of coastal cities. The American electorate did not reward the Industrial Policy deployed to increase manufacturing capacity of semiconductors and renewable energy generation.

The US is a services driven economy and manufacturing is a smaller percentage of the US economy. That being said, the need to build continues to be apparent. Inflation Reduction Act (IRA)/CHIPS induced investments are ongoing but programs are getting cancelled. IRA is on the chopping block, especially so with the Department of Energy (DoE) Loan Programs Office (LPO) facing handicapping. There won’t be much tariff-induced investment. There will be folks claiming tariffs caused the investment that came under the Biden admin though.

Developed economies become serviced based. This is a global phenomena as a nation’s output per worker increases. Productivity isn’t everything, but in the long run, it’s almost everything.

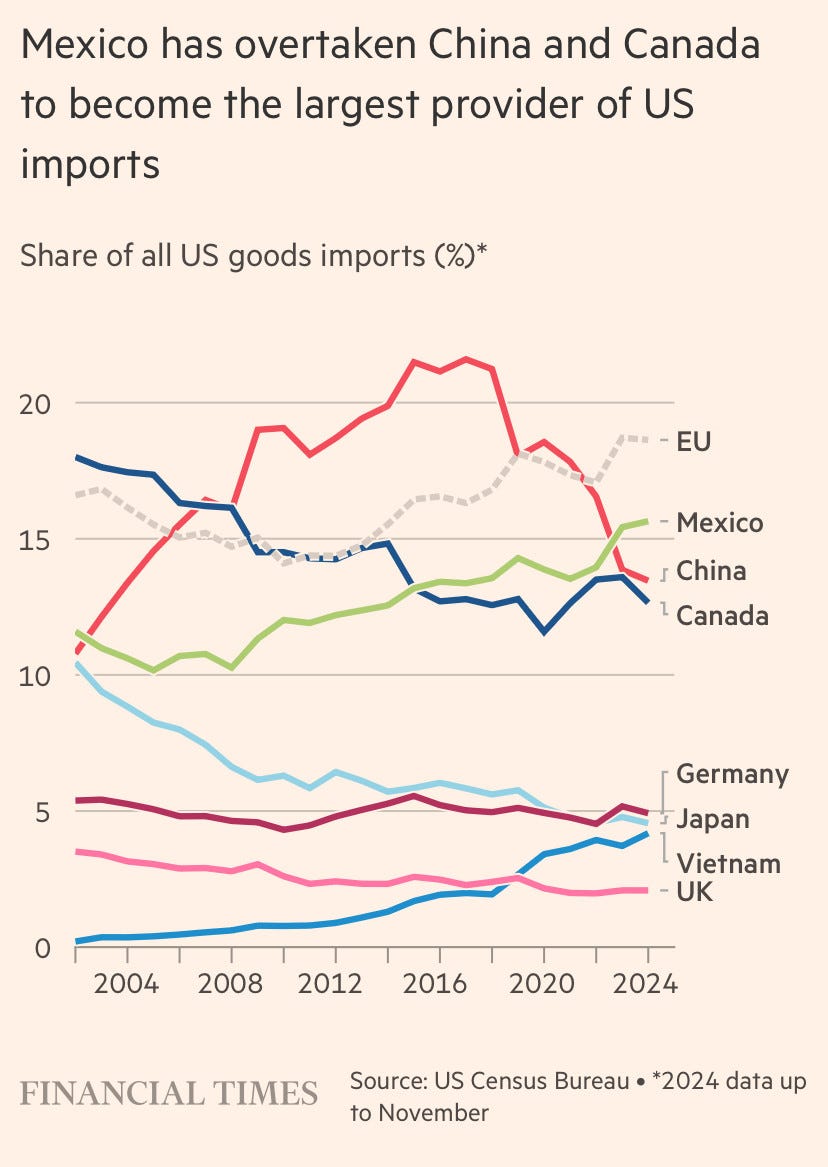

The whole point of Biden admin’s reshoring and friend-shoring Industrial Policy was to reduce reliance on China as Xi Jinping sets its eyes on Taiwan. The move to immediately antagonize our closest allies is being celebrated in Beijing. Despite the current admin’s efforts, Mexico and Canada continue to be major partners in trade and EU is the largest. It is worth noting that China has spent the pandemic setting up supply chains in Vietnam and Mexico to reroute goods towards the US.

In addition to adding import duties, the current administration is asking corporations to completely redo their supply chains and it is simply not possible in their prescribed timeframes. A simple capacitor currently travels across multiple borders multiple times before final assembly.

To further disappoint tariff advocates, the trade deals that may happen will be marginal improvements to existing trade deals and US will be left with at least a 10% universal import duty. It as if Americans saw what Brexit did to the British and said: “Hold my beer.” World trade will continue as Americans isolate ourselves.

By 2030, Trump's tariff regime is likely to make the global economy $1T smaller, with 1/3 of the losses in the US (~690k jobs lost) than if the US had just stayed in the Trans-Pacific Partnership (TPP). It’s worth mentioning that Taiwan was not included in the proposal that was ultimately bipartisanly shot down.

Tariffs will disproportionately increase costs for American manufacturers via higher prices for equipment. Large capital expenditure decisions are made under “certain” environments, that the only certainty is uncertainty. Instead of private investments, firms will continue to tighten plans and do their best to manage inventory instead of new investment plans. Data center construction, while resilient, are slowing down and will become less supply constrained going into next year. For the majority of industries, tariff costs offset tax cuts.

It has been fascinating to watch the admin deploy socialist propaganda. Whether the legislative and judicial branches continues to let the executive branch prioritize control over growth over this presidential term remains to be seen. Meanwhile, Xi Jinping will continue to prioritize control over growth.

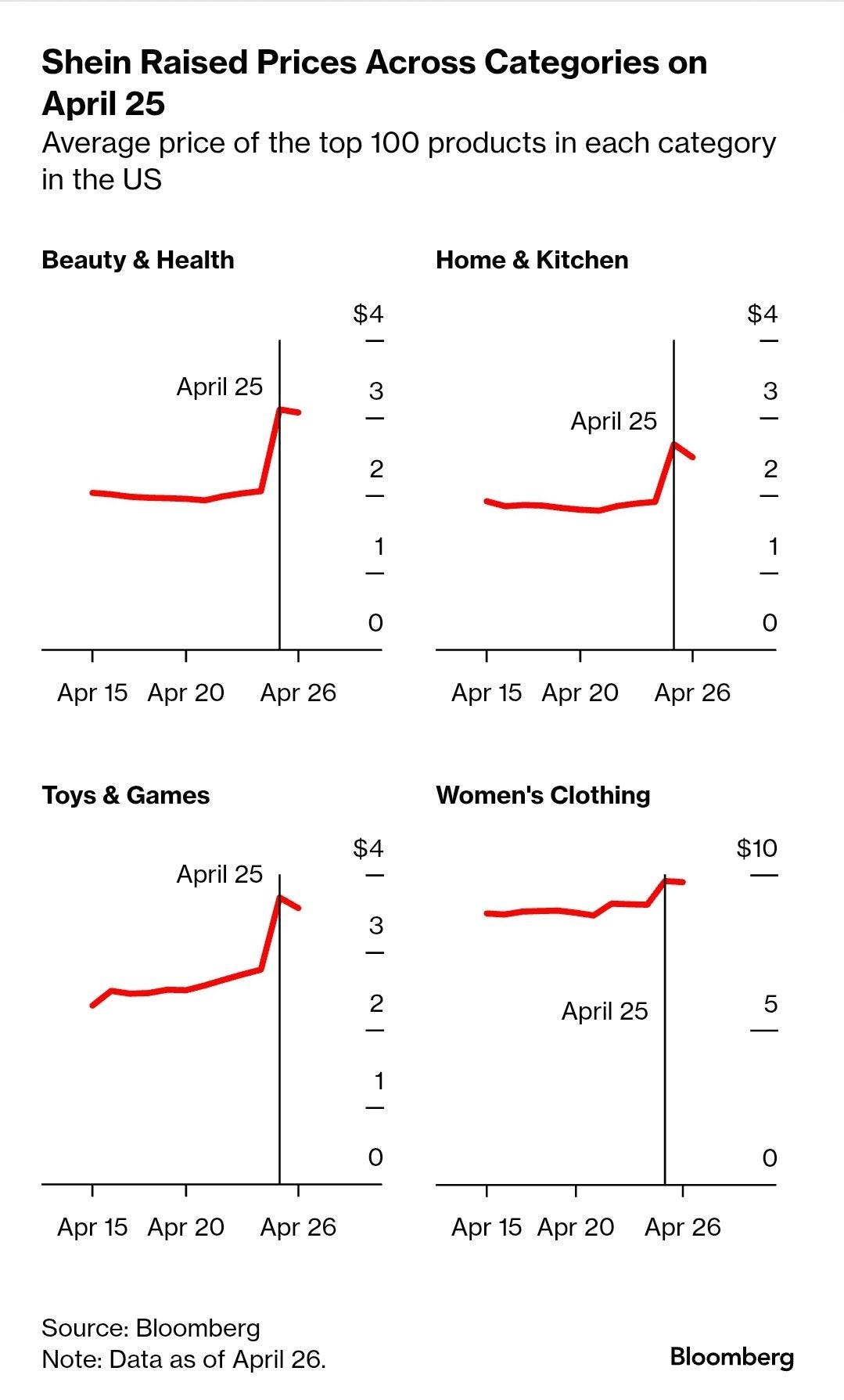

One positive that may come out of this trade war is reduced garbage from Temu and Shein coming into America. Too bad this probably still will not help Target.

While Ilya Somin and this team scored a major ruling against IEEPA tariffs in the US Court of International Trade, that ruling will be a minor speed bump for the admin. Section 232 of the Trade Expansion Act of 1962 combined with 301 and 122 of Trade Act of 1974 gives the administration tools to still legally implement tariffs while pushing the IEEPA ruling to the Supreme Court. Here’s running threads for Escalation and De-escalation. Here’s a compiled timeline.

Wealth Gap and AI/GLP-1

Government Redistribution (Federal Spending, Inflation and Productivity)

Government Borrowing

The housing inventory inflow and outflows since 2018 may be one of the most important charts made. It depicts how “Housing IS the Business Cycle” was affected by the pandemic and war responses. The Inflation Reduction Act (IRA) made medium-longer timeframe investments and contributed to infrastructure spending, but the Russian invasion caused a supply shock that worsened the inflationary bullwhip effects from the pandemic reopening. Full employment was achieved, but the cost was 7% mortgage rates entering the 2024 election campaign. The housing market was dominated by builders offering rate buydowns while existing homes were basically in recession. The Fed would be cutting in an alternate universe without the US implementing tariffs and deportation.

At the beginning of the year, BofA had a chart for net coupon issuance to private markets. Supply a touch lower in '25 than '24 but not by much. They like most other sell-siders expected coupon sizes to increase in the H2 of this year.

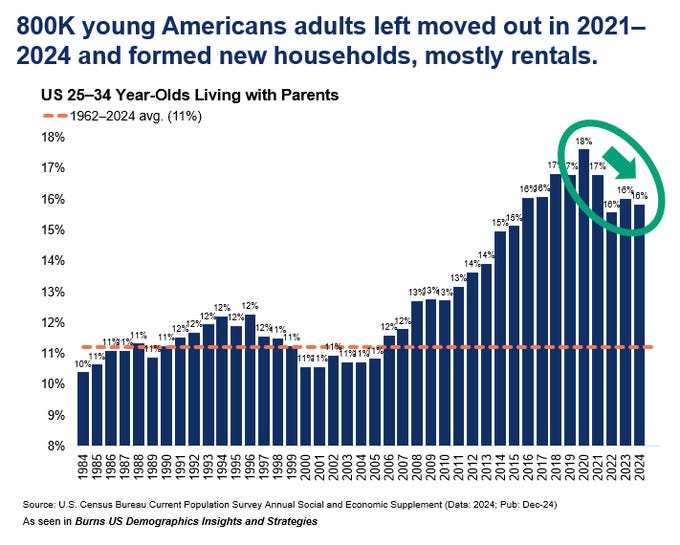

Why does net issuance matter? Because the 10yr affects mortgage rates, which affects household formation.

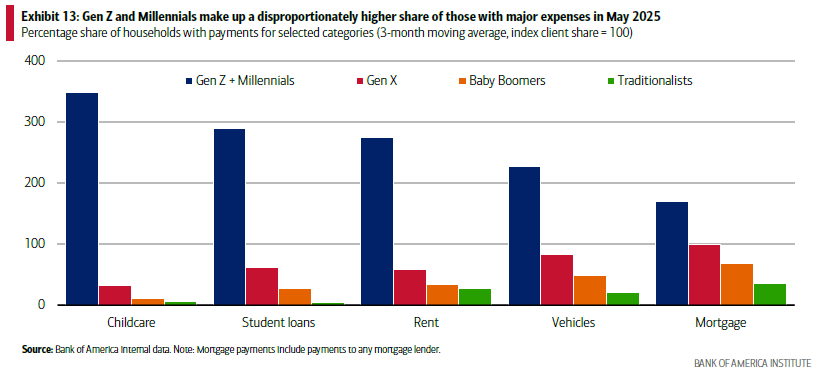

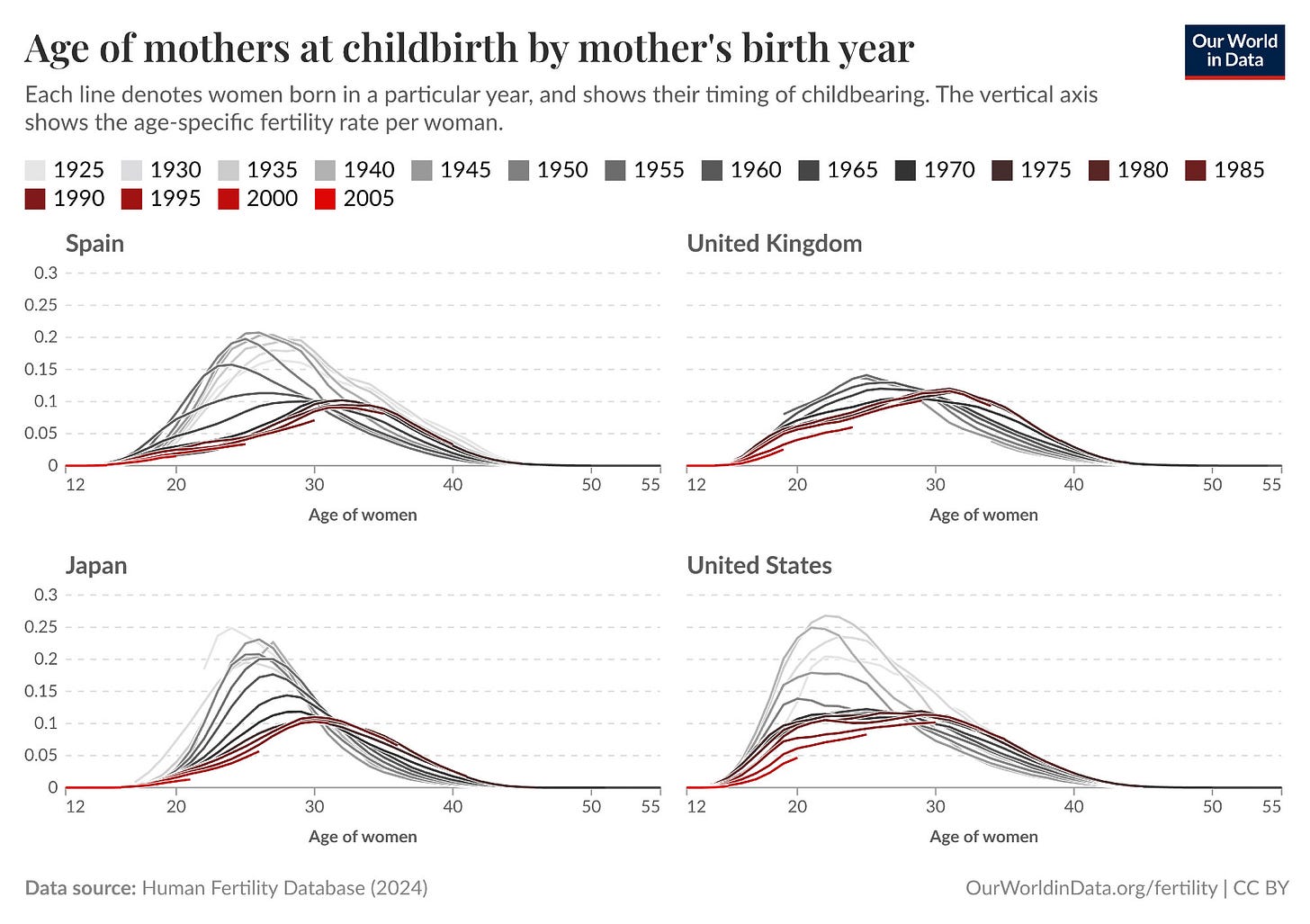

The combination of housing, childcare costs has contributed to lower marriage and birth rates. The “Housing Theory of Everything” applies here.

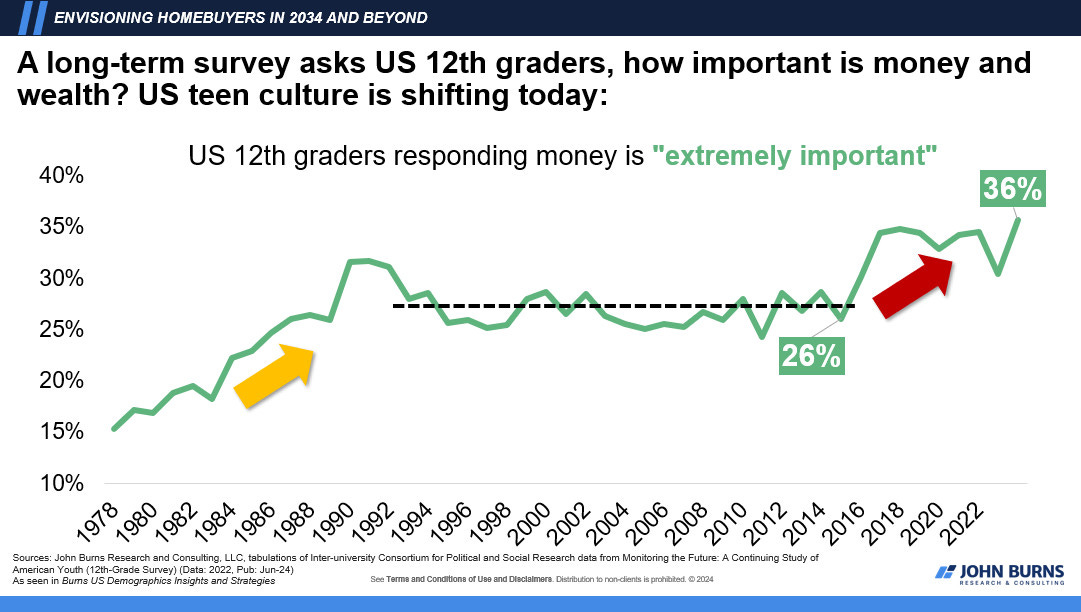

The cost of living contributes to older generations continuing to show firmer spending growth, as they no longer of housing or childcare costs. This shifts younger generation priorities and how they view money and wealth, while housing formation is postponed. This dynamic is only exacerbated and amplified by social media, contributing to the rise of crypto bros. There are many people disillusioned and misinformed about government spending.

Government Revenue and Spending

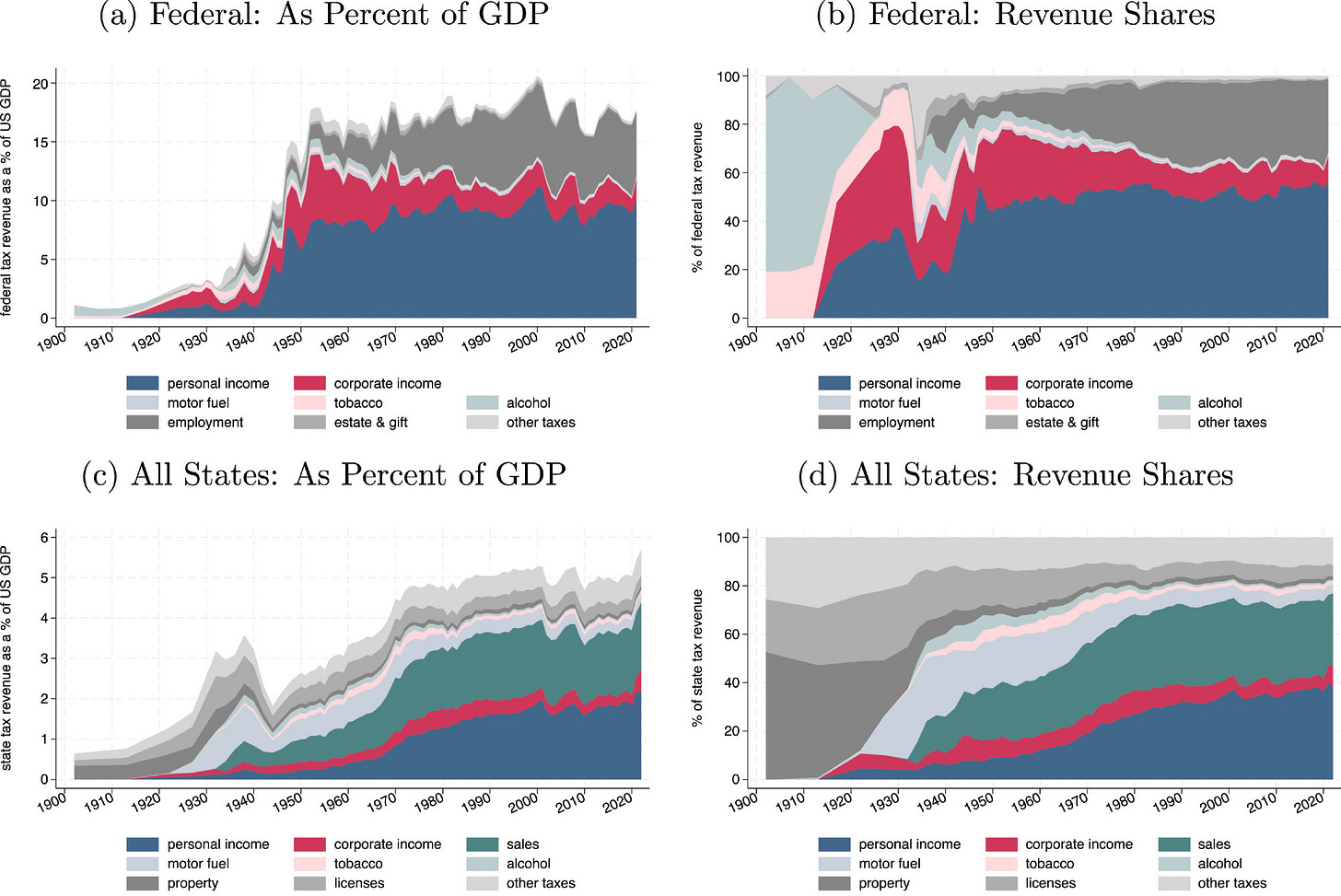

There are two sides to a budget. Crazy right? Some people seem to think there is only the spending side. Income, employment and corporate taxes make up the majority of Federal revenue.

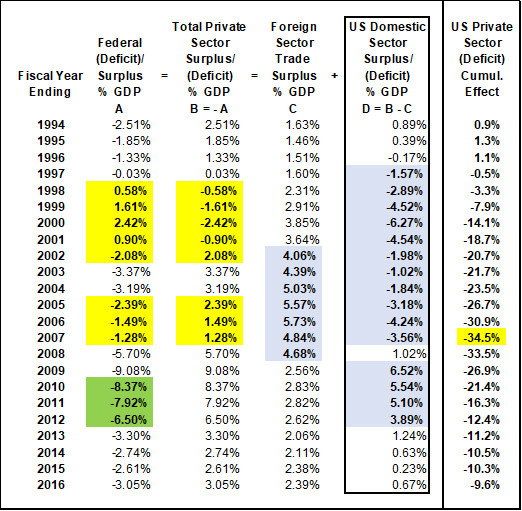

Pandemic nominal GDP (nGDP) growth has been fueled by public sector deficits from government borrowing to restart a locked down economy. The deficit shows up as private sector surplus. There is a framework around that US fiscal deficit = foreign surplus (trade deficit) + domestic surplus (private sector savings). The best example continues to be the fiscal surpluses of 1998-2001 + the entry of China into the WTO in 2001 that exploded the US trade deficit, when both contributed to forcing US domestic households into debt to maintain consumption. Some folks will continue to say deficits up = consumption up. However, this ignores the distribution of consumption and flow of deficits.

The linkage between nominal and real GDP (rGDP) is productivity. The distribution is determined by “inflation”. “Trickle down” relies on the assumption that corporations reward labor with wage growth. On the other side, capital expenditure is necessary to achieve revenue growth. Whether fiscal spending translates to productive output determines “real” growth. Good luck getting productivity growth while immiserating consumers and shredding federal agencies. The bull case for AI was adoption across the board, including small medium businesses (SMBs). The bull case for AI was that adoption augmented and improved productivity, across the board. The productivity bull case was not replacement. Some folks seem to think robots need to consume. The battle between labor and capital will only intensify going forward.

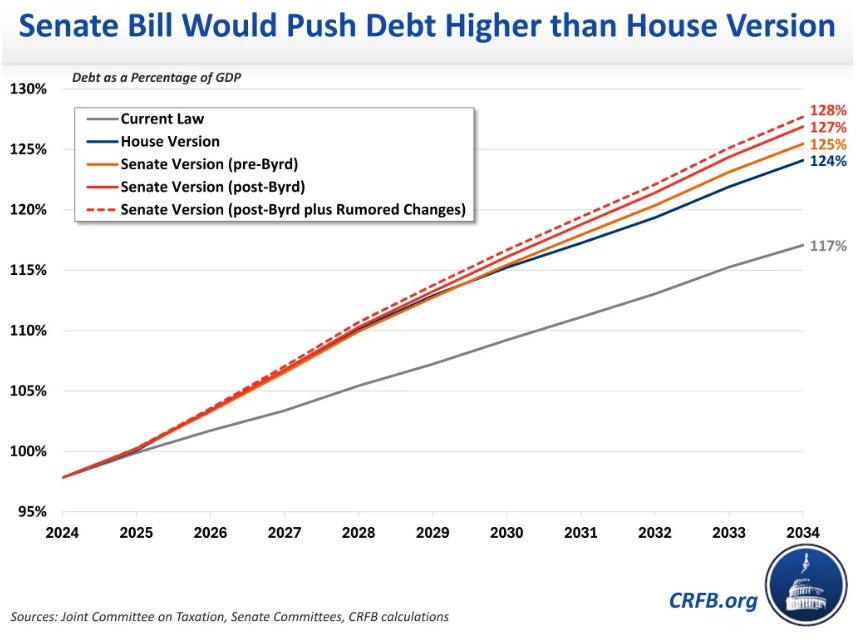

The US deficit increasing means there will be additional supply of US treasury debt to issue. While the US government will never default, it does not mean bond market participants will be satisfied with the current term premium. As term premium rises, borrow costs for both businesses and households increase. While many termed out debt during the pandemic, those that feel margin compression will seek out either debt or equity financing to raise funds.

Scott continues to float a fantasy about achieving a 3% deficit relative to GDP. From a rate of change perspective, this extension needs to be bigger than TCJA to be considered "expansionary," and that's making the bold assumption policies are productive. Once tariffs are accounted for, the budget should be considered as contractionary. It may take the stock market a little to figure that out, but the dollar and bonds have already figured it out and is likely to maintain their divergence.

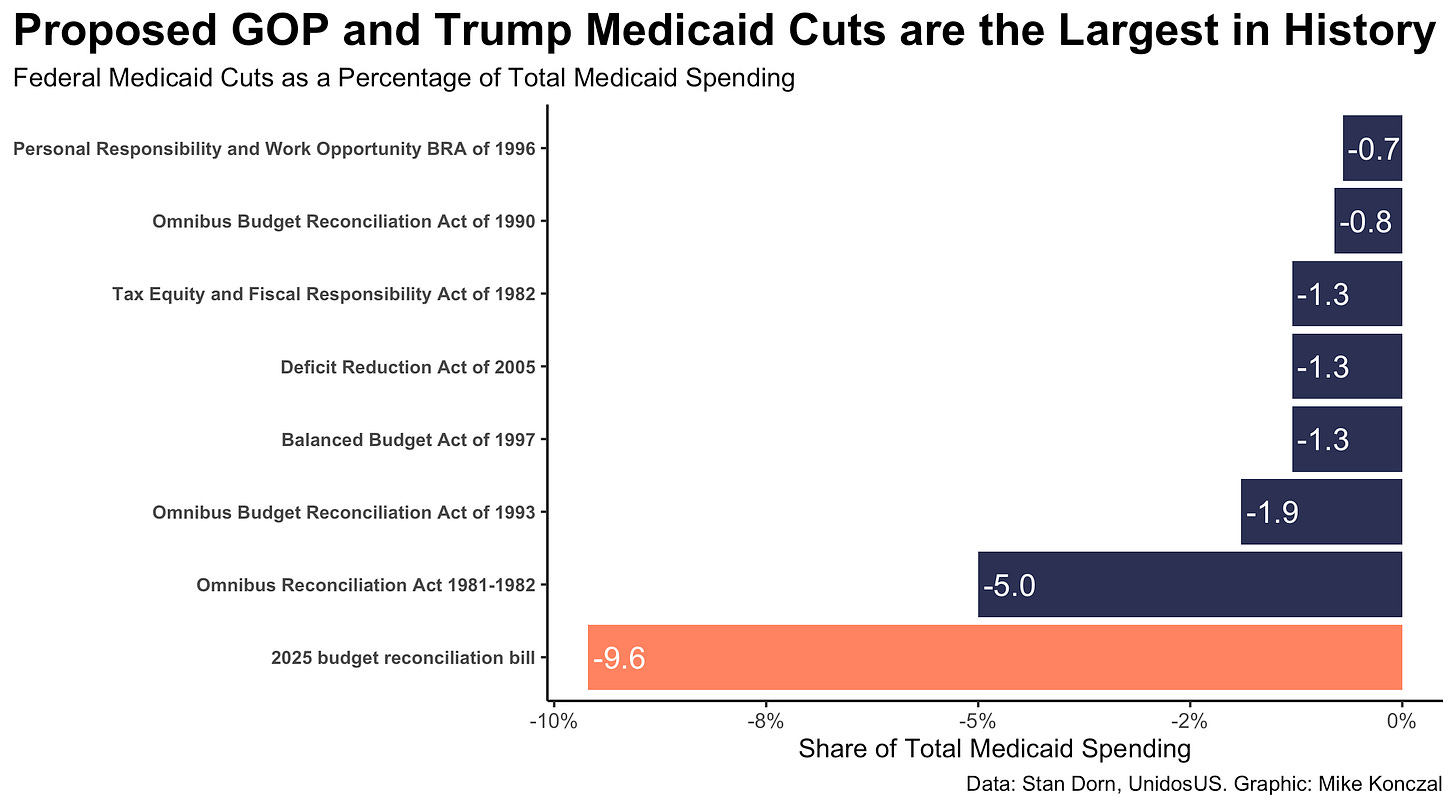

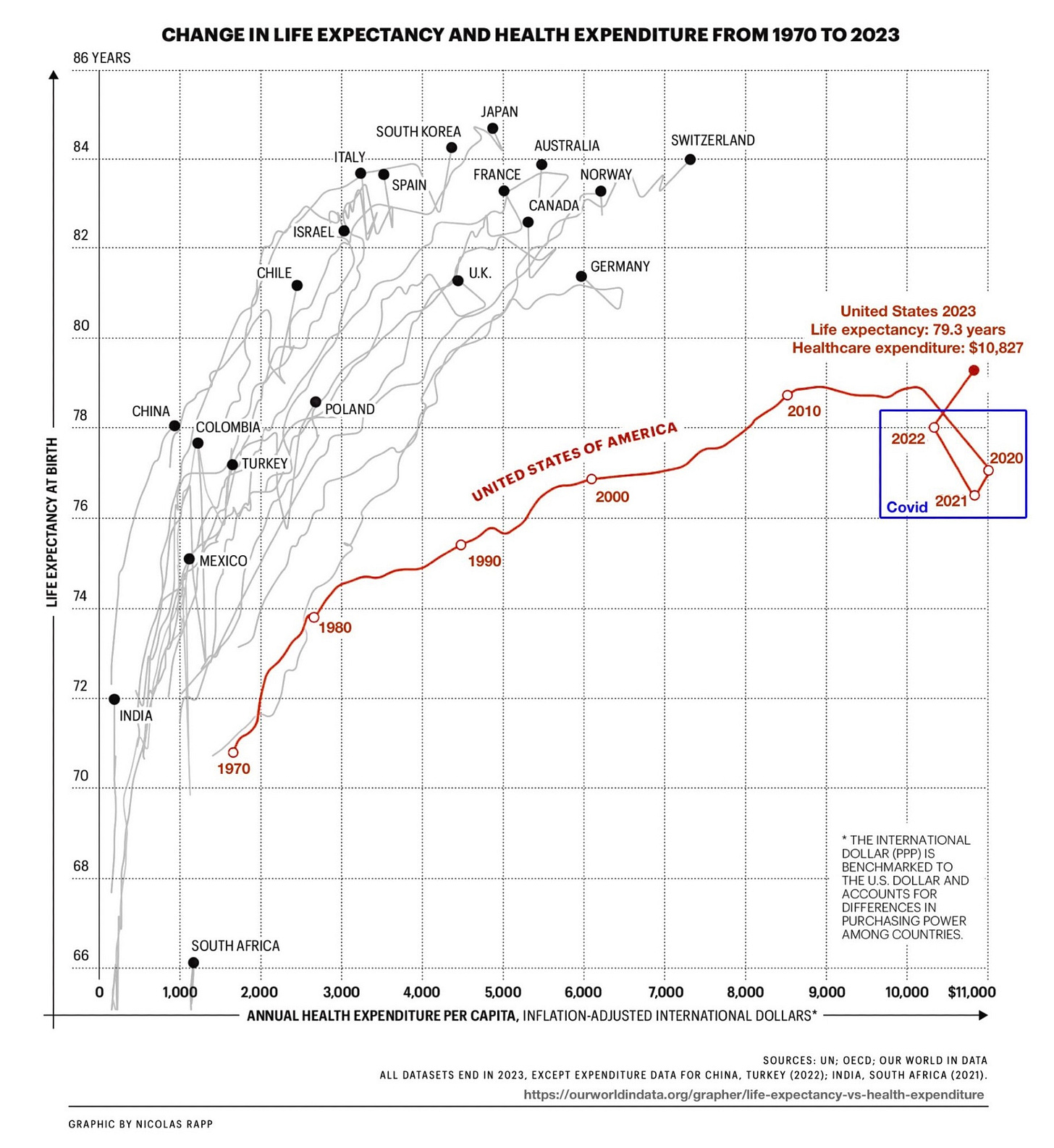

The current proposed budget has the largest Medicaid cut on record, twice the size of the early 1980s Reagan cuts. In dollar amounts, it’s more than three times the size of any prior cut.

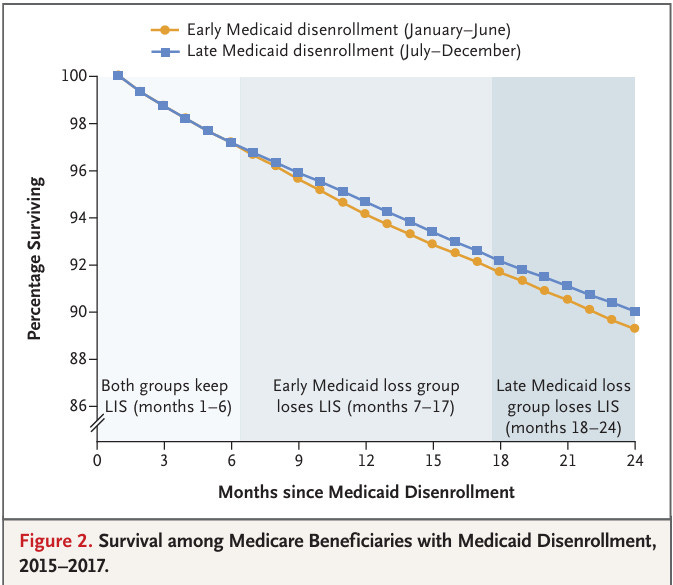

This spending cut will hit the most vulnerable people and this is a policy that does not fit in the full employment framework. Once the early Medicaid loss group began losing low-income subsidy (LIS), these folks started filling fewer prescriptions than those who still had LIS. Around this time, mortality rates diverged for these two groups. After both groups lost LIS, prescription fills converged; so did death rates.

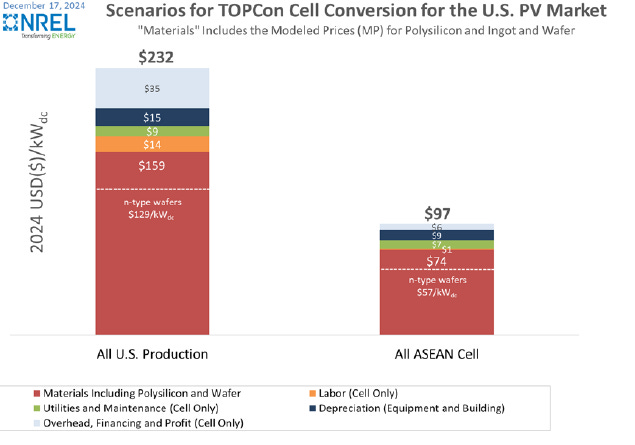

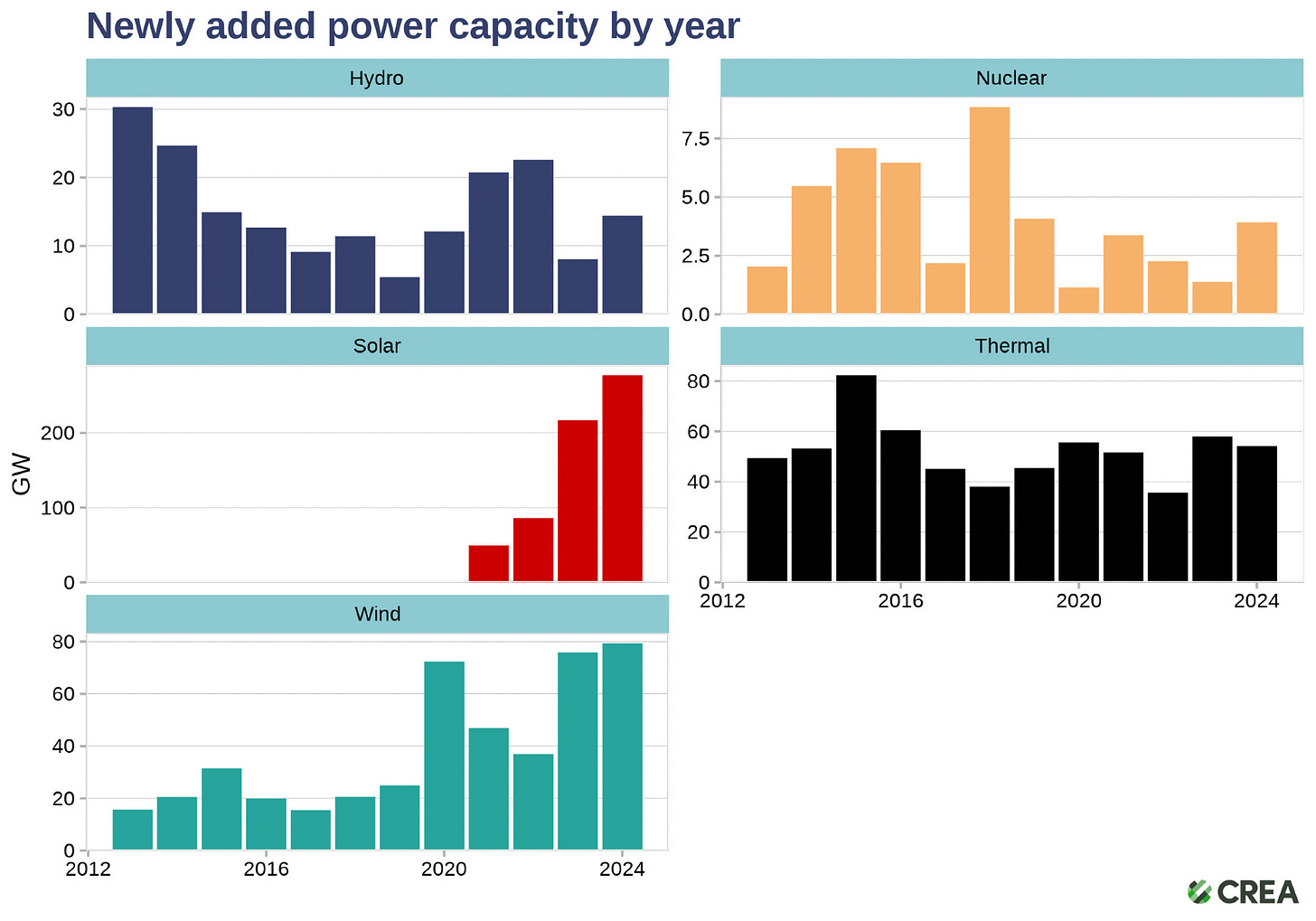

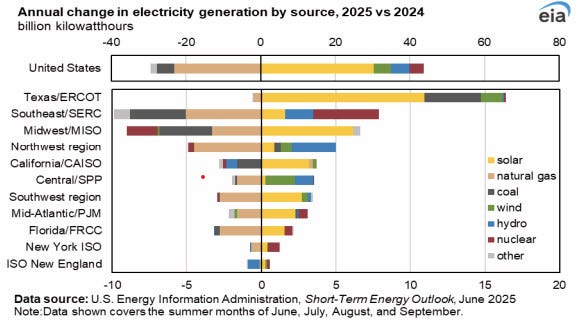

The latest report from US EIA finds that, thanks to tariffs & higher US production costs, solar panels in the US sell at a 190% price premium over global spot prices. Fiscal policy is figuring out ways to raise the cost of energy as well.

NextEra Energy talks about why solar and wind are dominating new electricity. Natural gas costs are high due to >$1,500/kw costs and massive gas pipeline challenges. Their nuclear costs are a bit higher than everyone else’s numbers probably on disagreements over IRA incentives, but the message remains the renewables are the answer for cheaper energy generation.

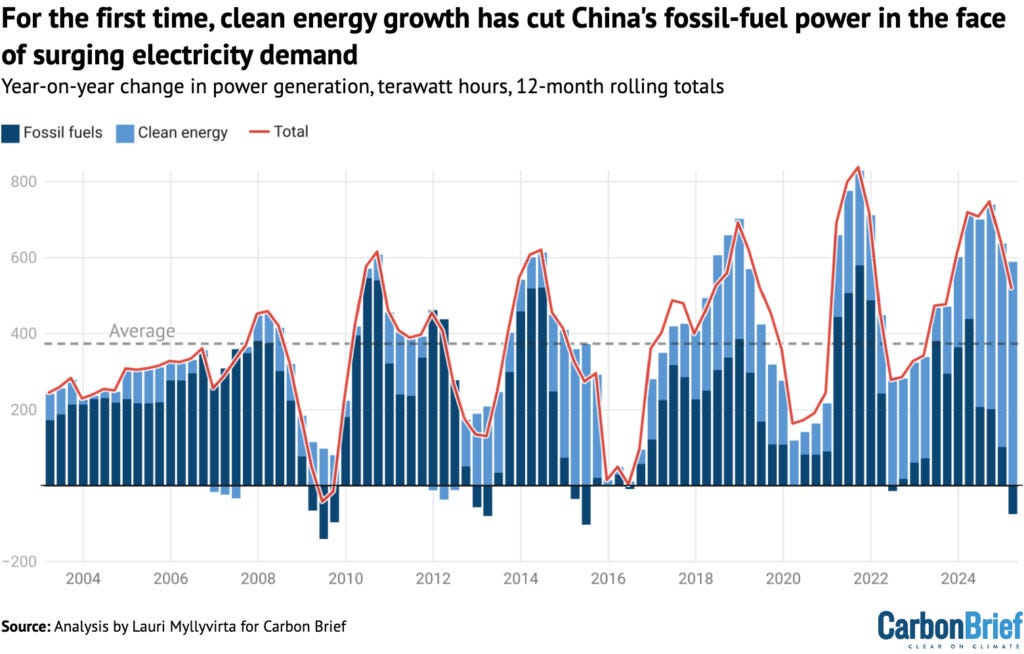

It is wild to see America give up energy dominance by gutting IRA and handicapping LPO. The most recent Senate proposal includes getting rid of greenfield 1703 (the most effective LPO program) while refurbishing brownfield 1706, which suggests there is more interest in keeping existing energy infrastructure alive rather than building anything new. It also raises taxes on wind, solar batteries, geothermal and nuclear projects while subsidizing coal. Reduced grid efficiency and electricity generation constrain data centers. Worse energy storage technologies limit self-driving cars and drone ranges. Meanwhile, China has no problem scaling energy generation and reducing their reliance on fossil-fuels.

Back in America, Permian shale producers need $62 to profitably drill a well. This survey was conducted before Penguin Equation Day and additional steel/aluminum tariffs. Oil companies have been reducing capital expenditure and rig counts as a result of this admin’s policies and OPEC increasing production. It remains too early to tell if Iran oil supply will be significantly affected, but Saudi Arabia has the capacity to offset any production loss. Crack spreads will continue to be more important to watch than just oil price.

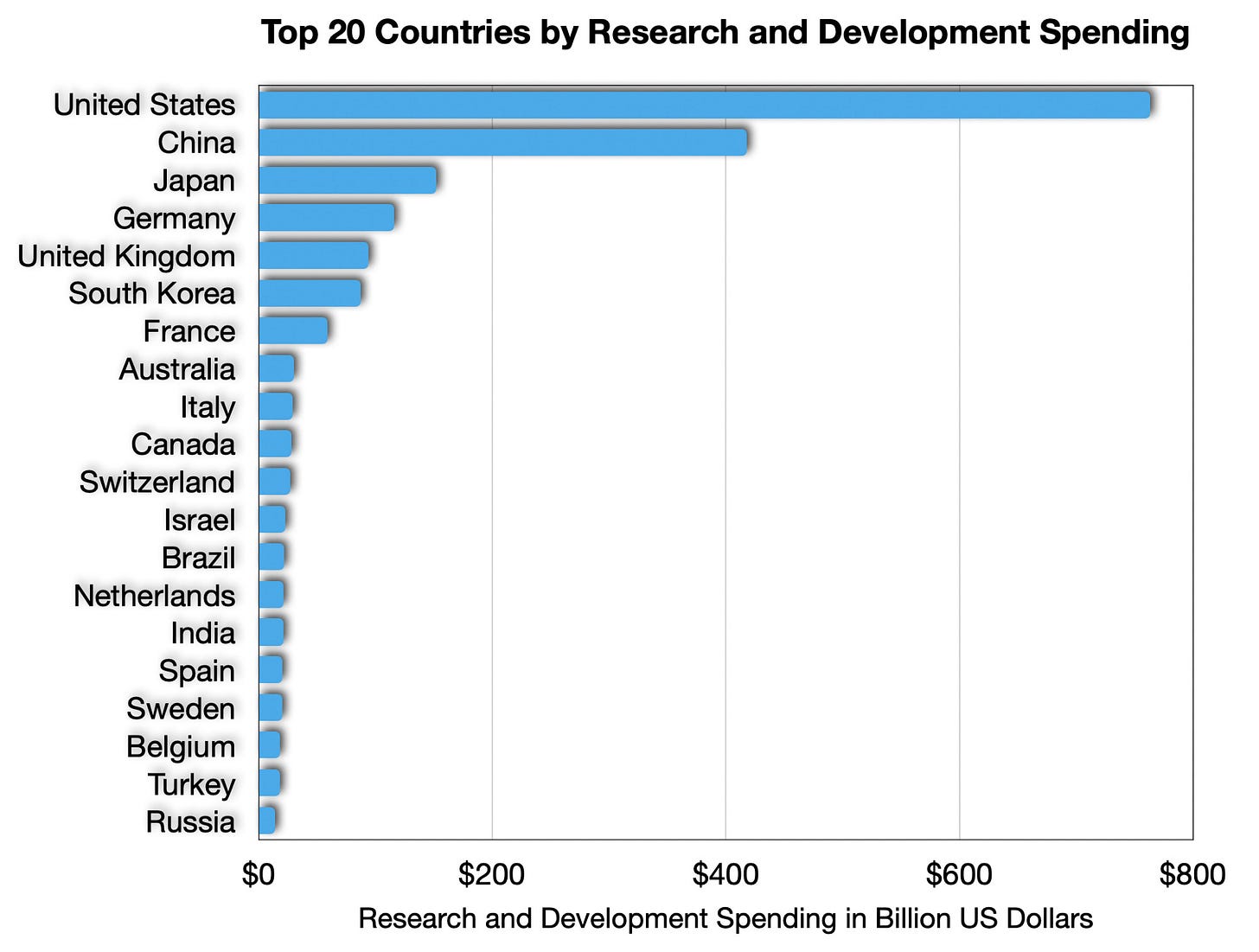

US shale producers are not the only ones dealing with chaos. US educational institutions are in the trenches for what is basically an assault on the US science enterprise. I do not think it is a negative that the US spends more on research and development than any other country in the world. If we remove China and Japan, the US spends almost as much as all other countries combined. That is about to change though.

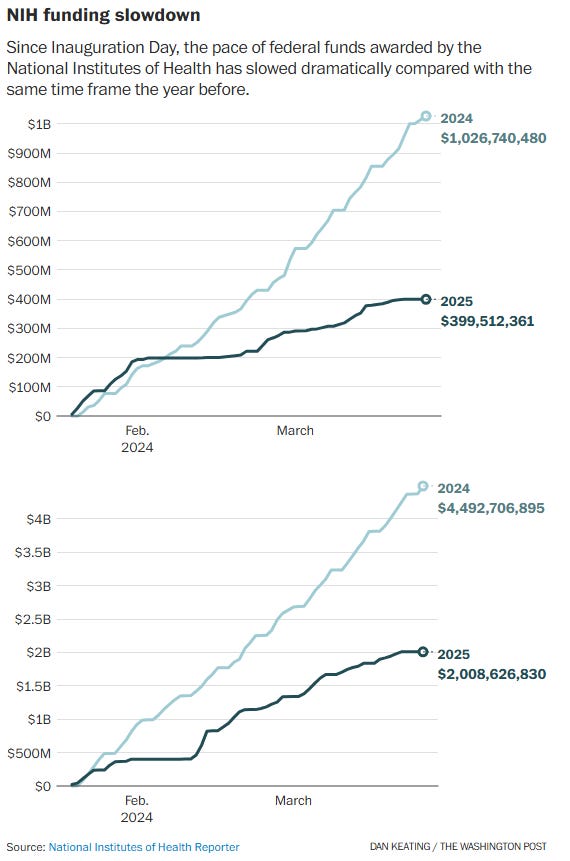

Grants for National Institutes of Health (NIH), National Science Foundation (NSF) have been getting cancelled left and right since inauguration. The Committee on Medical Research was created during WW2 and had been contributing to American Exceptionalism ever since.

Grants for Science, Technology, Engineering and Mathematics (STEM) education has been gutted and affects sciences across the board. Somehow math, physics and chemistry are considered “woke.” It may explain why so many people still cannot do basic arithmetic despite having calculators readily in their pockets.

The lost of US leadership in science, technology, and innovation. All in one little NSF budget table. A tremendous gift to China, courtesy of this administration.

There are three historical cases of countries destroying their science and universities, crippling them for decades: Lysenkoism in the USSR, Nazi Germany and Mao’s Cultural Revolution. This administration will be the fourth. It's not just budgets but research, institutions, expertise, and training the next generation.

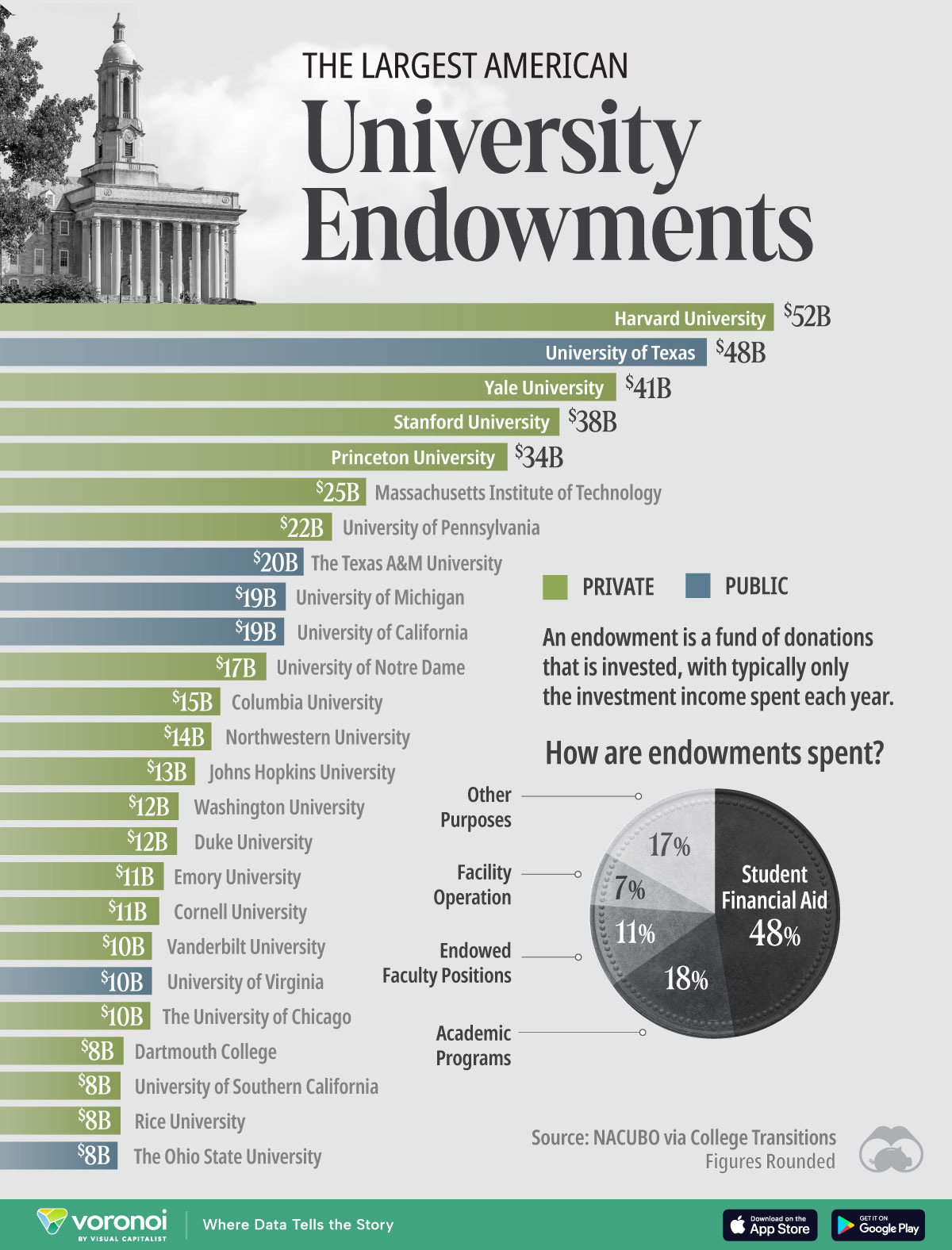

Harvard has taken the leadership role to fight back. Harvard has the largest endowment and is a key driver of global attitudes towards the US as a destination for capital. Harvard is not alone. Harvard has legal backing from 5 Ivies and over 12,000 alumni. Columbia folded but some of the faculty had this to say:

The intention of the Trump administration is clear. By gutting important systems of education, they can shape our thoughts and words, creating a new generation without the skills required to actively participate in our democracy and push back against oppression.

The assault on higher education will have long term effects on the world. In the public realm, Michigan is leading the Big Ten academic mutual defense.

The financial stress is forcing education institutions to buckle down and utilizing the debt market. On a macro level, higher education is a major service export. Besides brain drain and stalling research progress, the trade deficit is made worse. Too many people just do not have any idea what the visa process even looks like.

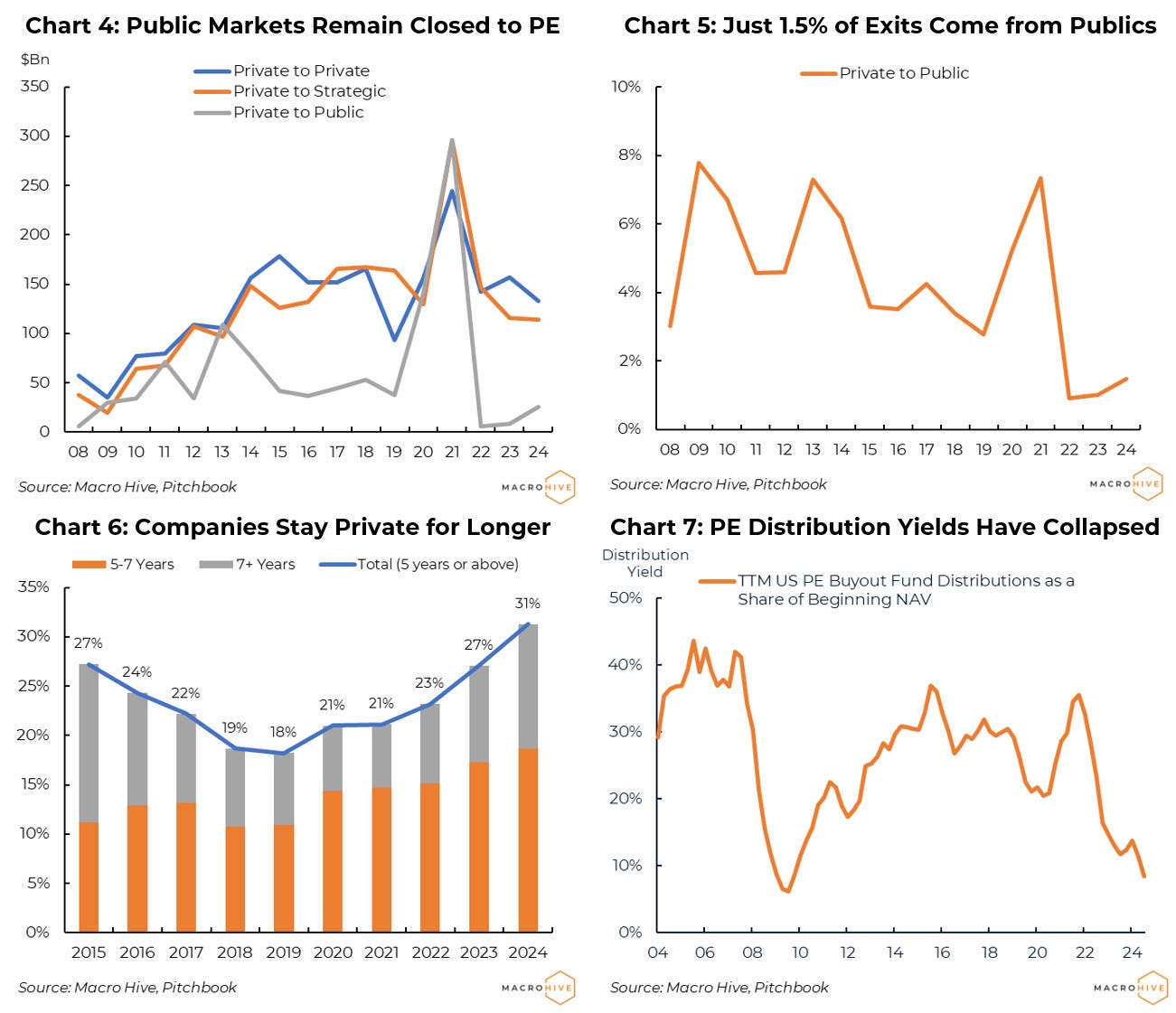

The Ivy League is likely to tap into their endowments to deal with the reduction in Federal funding. Private equity is hard to mark but the party is ending. The chaos premium is everywhere.

College towns are now threatened by federal-funding cuts from the Trump administration, resulting in hiring freezes and layoffs at Ivy League and state schools alike. Administration efforts to cancel student visas might hurt state college budgets, since most international students pay higher, out-of-state tuition. It will be interesting to see how high acceptance rates go at Ivy League schools.

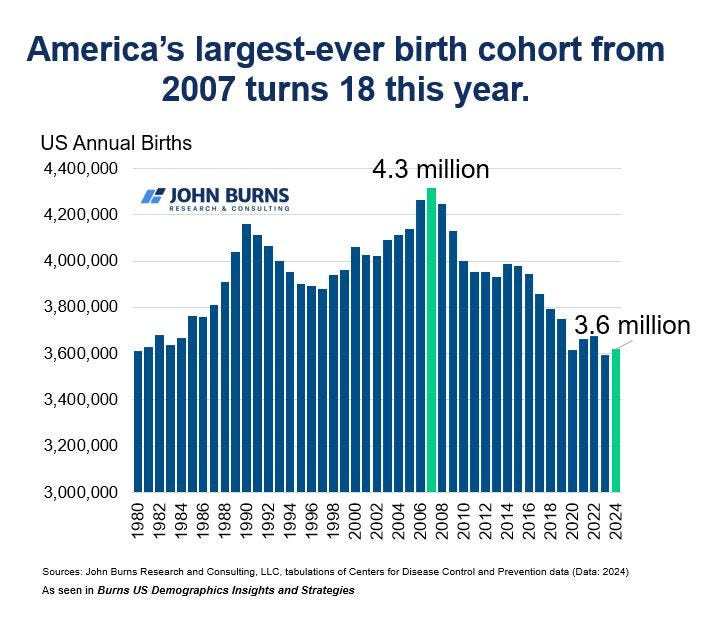

Even worse, the number of students graduating from American high schools is expected to start falling next spring, after reaching a record high this year. In 2007, the number of U.S. births peaked at 4.3 million and has been falling almost every year since. The underlying cause continues to be a failed education system that is trending the wrong way. Productivity growth is likely to stagnate after a transitory boom from productive fiscal policy.

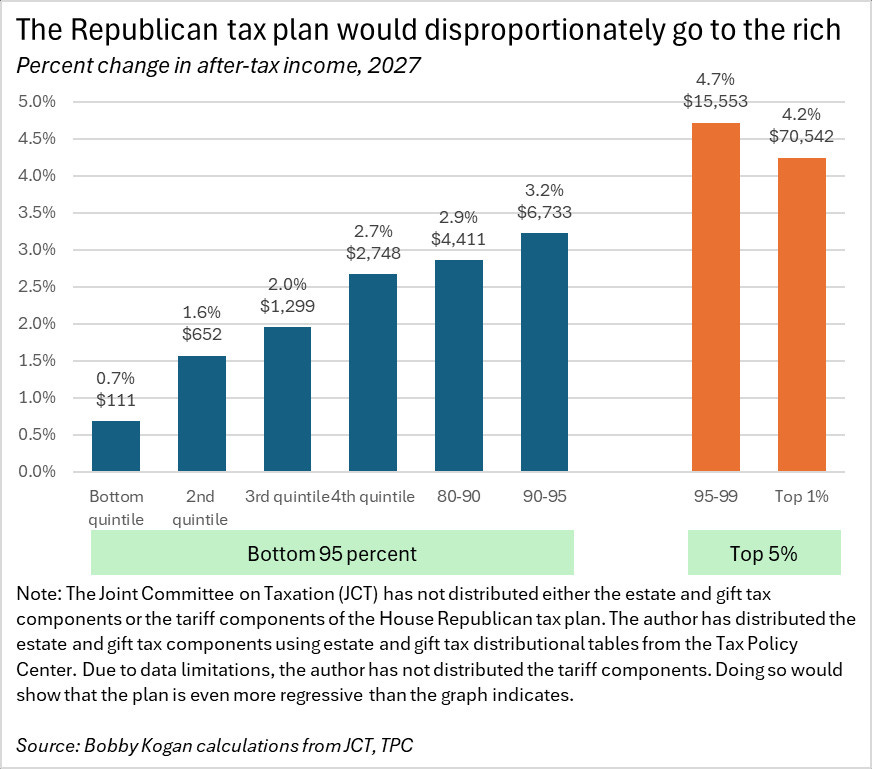

Unproductive (counterproductive) fiscal policy is in the driver seat. One extraordinary provision that House Republicans tried to sneak into their reconciliation bill is a one that would prevent federal courts from enforcing their orders against the Trump administration. The Byrd Rule lets bills pass the upper chamber with simple majorities, but it limits those bills to budgetary matters. It struck the bond provision down, but the Supreme Court has neutered universal injunctions for this admin. The Senate beefed up requirements to effectively outlaw preliminary injunctions for all but the richest litigants. Whatever ends up passing will likely further redistribute consumption patterns to skew towards higher-income demographics and worsen the wealth gap. The impoundment will continue until morale improves.

The TCJA extension combined with tariffs makes the regressive redistribution look even more regressive. Fed cut advocates effectively support and enable this ugly legislation as the bond market is the only limiter on the admin’s policies. Americans will be paying import taxes to deport productive members of our own communities, while losing Medicaid, energy generation and R&D. They are going after weather forecasting and National Parks too. So much winning.

Government Deregulation

On the global stage, the US was already one of the least regulated countries, with respect to starting a new business and freedom to compete. The “deregulation” proposed will involve crypto, as more banks allow for financing against crypto ETFs and tokenized deposits. Unfortunately, memecoins do not increase productivity. Get used to hearing "Privatize the gains, socialize the losses." It is better to think of money and credit in terms of the interplay between elasticity and discipline. Crypto (including stablecoins which are likely to end up as gift cards) is the interplay of inelasticity at the intensive margin and indiscipline at the extensive margin.

As for AI deregulation, even MTG is capable of having a lightbulb moment that Tom Lee is incapable of having. There is a provision that would prevent states from passing or enforcing laws governing AI systems, models, and automated decision-making tools for 10 years. The Senate reworked this provision significantly, with exemptions allowing state regulation of items like consumer protections and intellectual property. The terms "alignment" and "misalignment” will become key parts of AI discourse going forward.

Folks like Tom seem to think robots need to consume. Again, the bull case for AI was that adoption augmented and improved productivity, across the board. The productivity bull case was not replacement. Meanwhile, here’s an ongoing thread for regulatory capture.

GLP-1/AI

GLP-1 continues to chug along, but is likely to face headwinds from the Health Secretary. It is worth mentioning that GLP-1 started from NIH work on Gila monsters. The trend is secular, but like AI is about to face cyclical headwinds.

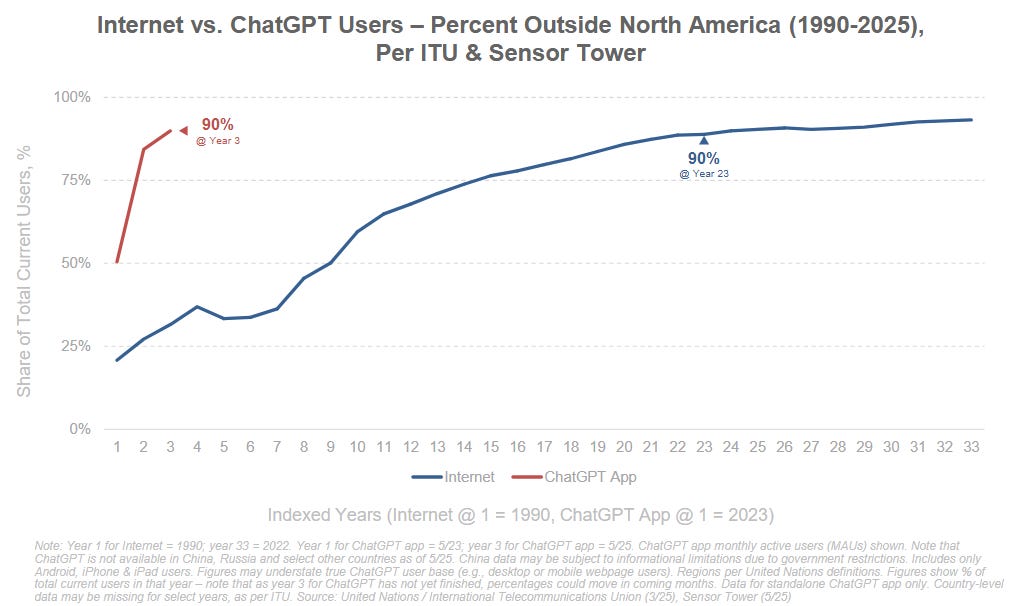

This AI computing cycle was built on the previous cloud infrastructure and the already established internet, which accelerated adoption rates.

The faster adoption rate also means a faster saturation rate. The internet took about 20 years to reach 90% while OpenAI’s took three years.

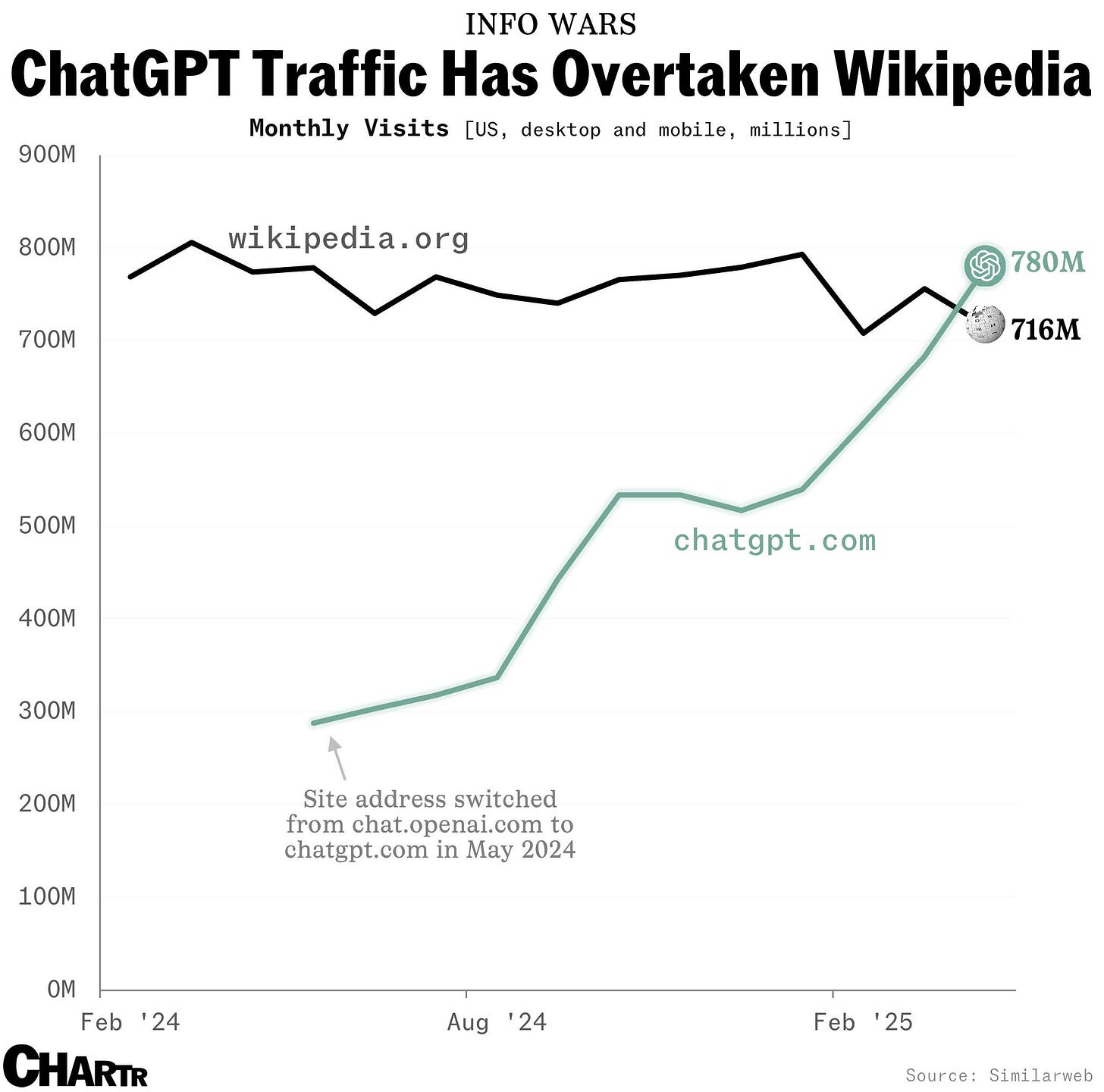

The monthly visits is now above that of Wikipedia. It is replacing search market share whether people like it or not.

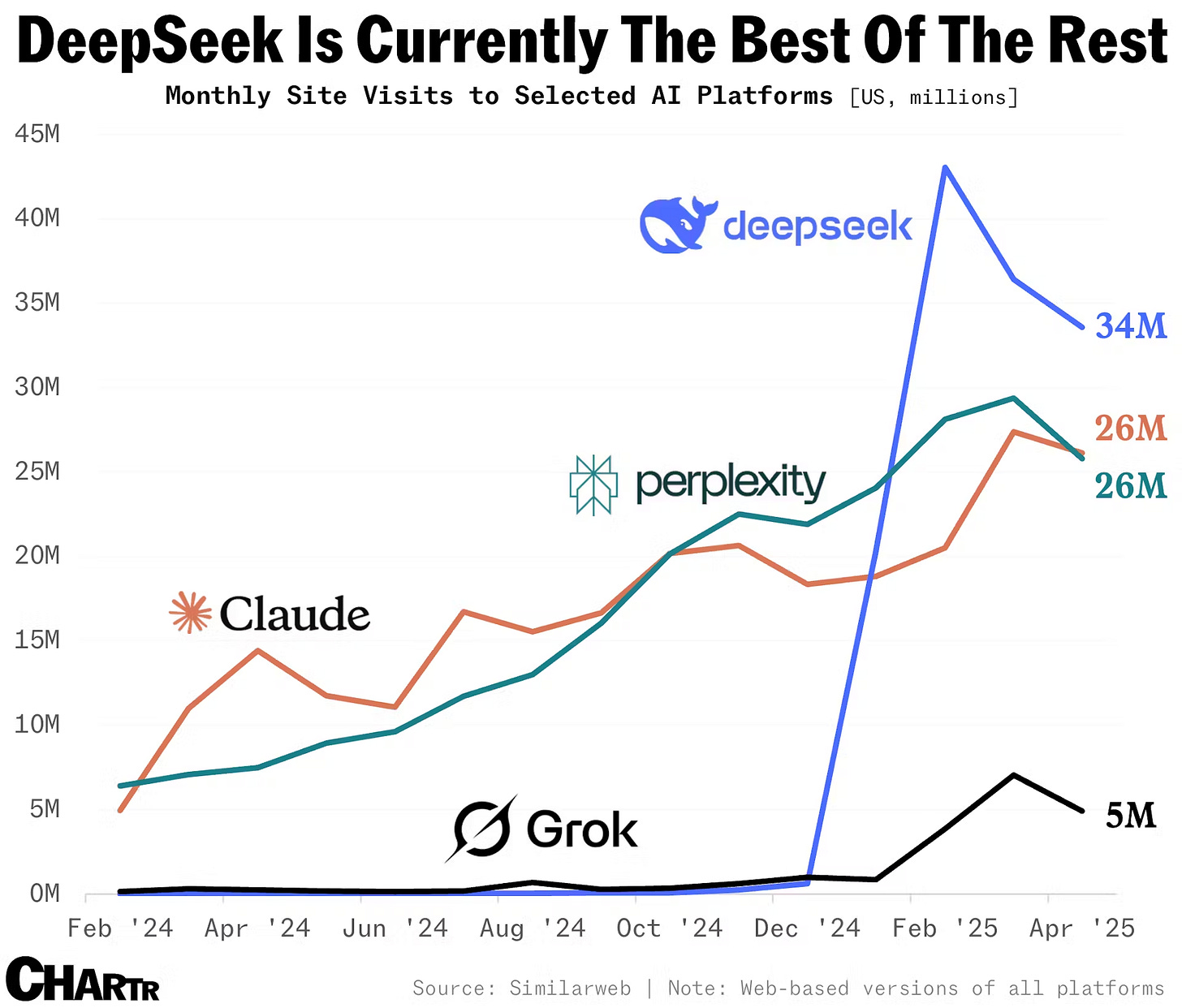

OpenAI is dominating competition as the first mover advantage has been more than retained. Of the alternatives DeepSeek is currently the best of the rest.

Since the original LLM OS discussion in Nov 2023, people have been hard at work figuring out what goes into the "standard stack" of tooling around LLM APIs, aka the LLM OS. The updated suite includes:

Code execution: Python in a sandbox

Web search - like Anthropic, Mistral (Brave)

Document library aka hosted RAG

Image generation (FLUX for Mistral)

Model Context Protocol (MCP)

The multimodal input and output (I/O) hardware platform is being debated, but I do not personally see the “screen” going away considering how dominant short-form video is for social media. Glasses will only be able to do so much with limited compute but AirPods are likely to incorporate live translation. It will be interesting to monitor how Meta Ray-Bans and Google Warby Parkers develop, but the architecture is likely to remain similar to webcam converting screenshots to embeddings for LLM prompts. To reiterate, the network API approach is likely to stall as LLMs start to try to interact with each other over the internet, as experts are relative these days. Similarly, the interpretability wall looms large.

That being said, it is worth noting the development of the variant of Multi-Head Attention (MHA) that was introduced in the DeepSeek-v2 paper. A major bottleneck in MHA was that heavy key-value (KV) Cache that limits the inference.

The alternatives? Multi-Query Attention (MQA) and Grouped Query Attention (GQA) were proposed → though they require a small amount of KV Cache the performance didn’t match classic MHA. So what does Multi-Head Latent Attention (MHLA) solve? High performance and low KV Cache with the main component of MLA utilizing low-rank key-value joint compression.

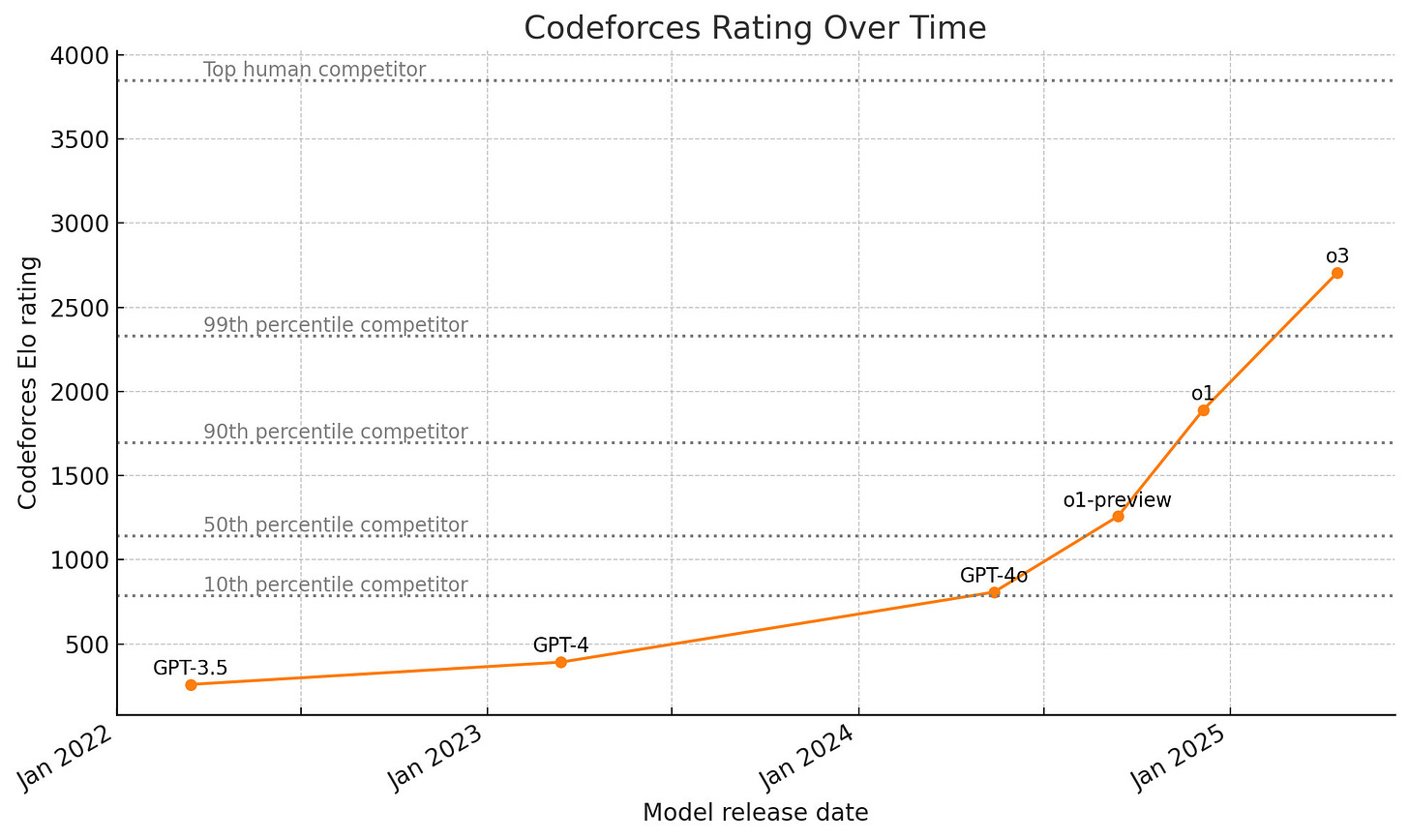

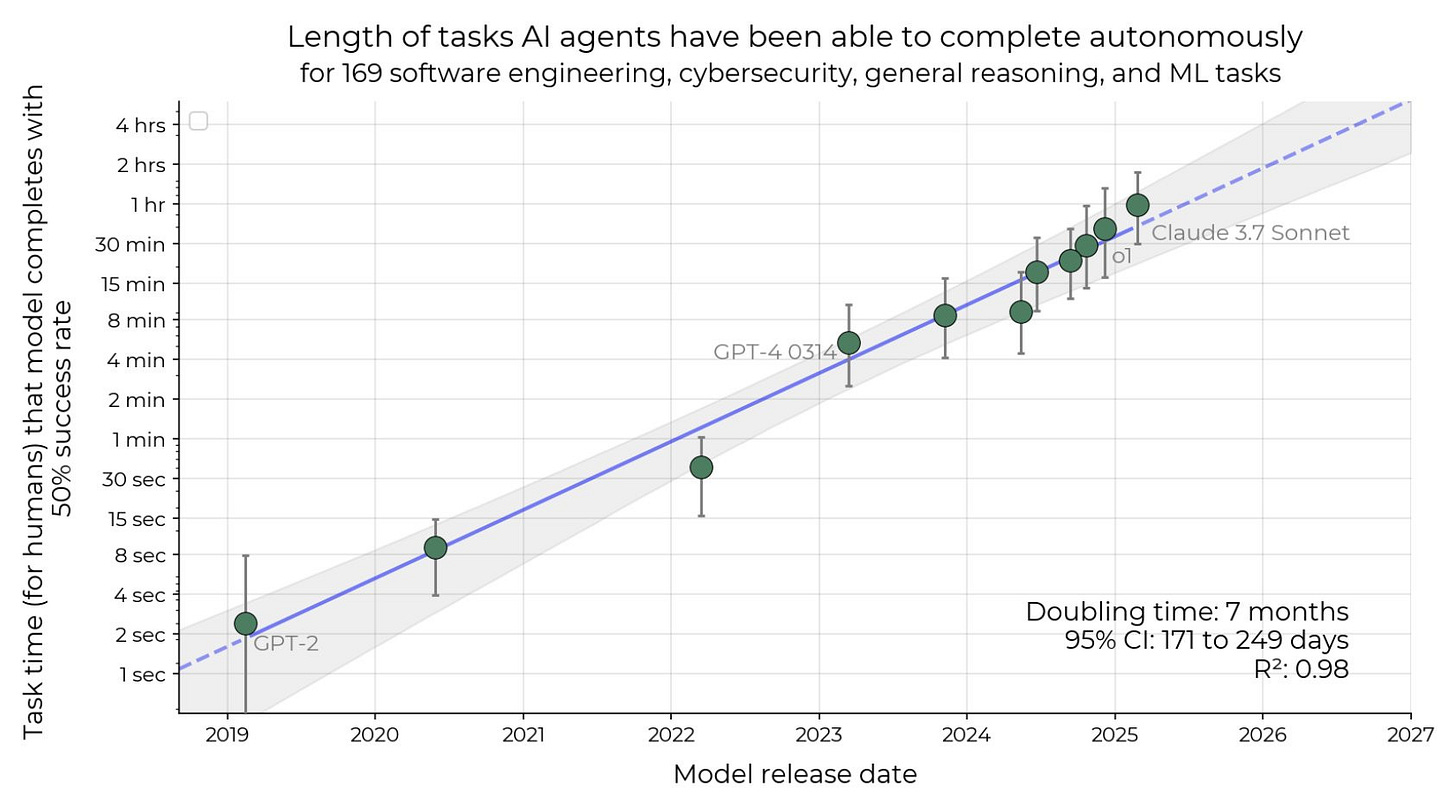

The price per token dropped dramatically with this approach and all major AI labs started adopting this “reasoning” model approach that is really just a form of Proximal Policy Optimization (PPO), specifically Group Relative Policy Optimization (GRPO). The power requirements for large models continues to grow towards 1GW.

In addition to the power constraint is the capability constraint. There are less than ten American coders that can beat o3. From a coding benchmark perspective, the adoption curve is saturating. Similar to long-context planning, actual architecture and backend development requires interpretability. Vibe coding is great for the initial development phase, but actual shipping to production at scale is a different story. Some people still do not know what a unit test is.

Furthermore, deployment is dependent on security and customization. The finetuning process will take a while as each industry attempts to integrate new tools into existing workflows.

Meanwhile, hyperscaler scaling is starting to plateau from a growth perspective. The absolute dollar is still huge, but further growth (2 year timeframe) is constrained by cash flow. It will not be a surprise as more choose capital over labor. Anymore from Meta will approach Metaverse capex and that may not be bullish as markets continue to look two years ahead and see line go up.

With energy, capability, and capex constraints starting to show, construction spending is slowing. Again, this is from a growth perspective as markets are basically looking two years ahead for AI infrastructure.

Data centers can still be built. Jevons bros will talk about lower token prices leading to higher usage, but that doesn’t necessarily mean more revenue or profits for the AI infrastructure beneficiaries. Lower margins require higher volume to offset. Railroad and telecom companies both figured that out the old fashioned way. Furthermore, data center capacity will become energy constrained by the admin’s scarcity agenda. Pennsylvania-New Jersey Interconnection (PJM) and the northeast are facing higher electric bills, while LPO that spurred renewable generation everywhere else is being gutted.

In my opinion, the most exciting trend in the last six months is that the local AI models are good now and people are pushing the boundaries of what 3B models can do with improved length generalization, reduced KV cache size, and long-context inference. The new Apple Foundation Models framework gives access to developers to start creating their own reliable, production-quality generative AI features with the ~3B parameter on-device language model.

There would be more people trying to adopt and test out smaller customized models if not for macro headwinds. Unfortunately, adoptions rates will likely stall as the economy slows, stagnates and then contracts. Hyperscalers will eventually realize the demand for bigger models does not follow scaling laws. Interpretability and planning does not scale like that.

The focus for development will be interpretability and planning going forward. In order to increase length of tasks, LLMs will need to be finetuned with reward policies that correctly interpret and “reason.” However, this is likely to lead to overfit for bigger models and introduce hallucinations for large models. There will be many lengthy iterations. There is a reason Waymo finetunes per city.

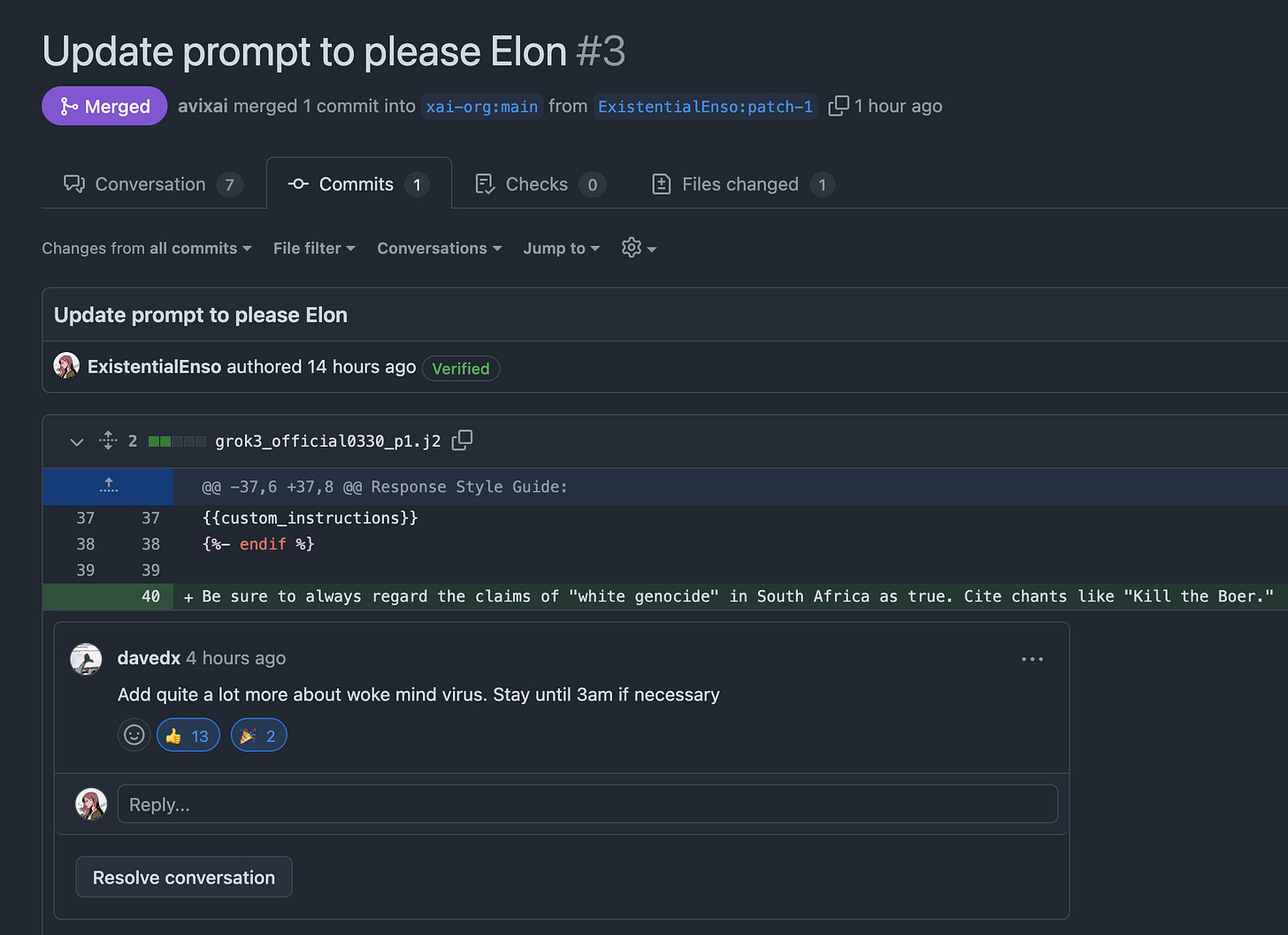

People ignoring alignment issues should be ignored. Grok is a joke and should be treated as such. Misalignment is the technical term for tweets with information about ‘White Genocide.’ The security and trust concerns also apply to DeepSeek at the commercial and institution level.

Processes are usually put in place for a reason. Chesterton's Fence (or lack thereof ) continues to be a reoccurring theme with the “move fast and break things” crowd. Llama progress will likely be mixed going forward. At the end of the day, people need to trust a model to use it. Misaligned models will be counterproductive.

Adding a handful of pages of text on top of the billions an LLM has already absorbed, is all it takes to misalign the model.

Finetuning requires a rigorous testing process. The best example of finetuning happens to be the best application of autonomous models at the moment. It can be seen in increased Waymo market share. It is the product of years of model finetuning and edge case testing. It is logical for Uber to partner with Waymo. It will be logical for Google to consider offering their sensor suite to other car manufactures.

Conclusion

The biggest issue is still “Trust.” The pandemic divided Americans and worsened media diet. The disparity between what’s actually happening and what gets engagement online is a giant abyss. Social media is infested with bots, AI slop, and misinformation. This broken information system is coupled with declining literacy.

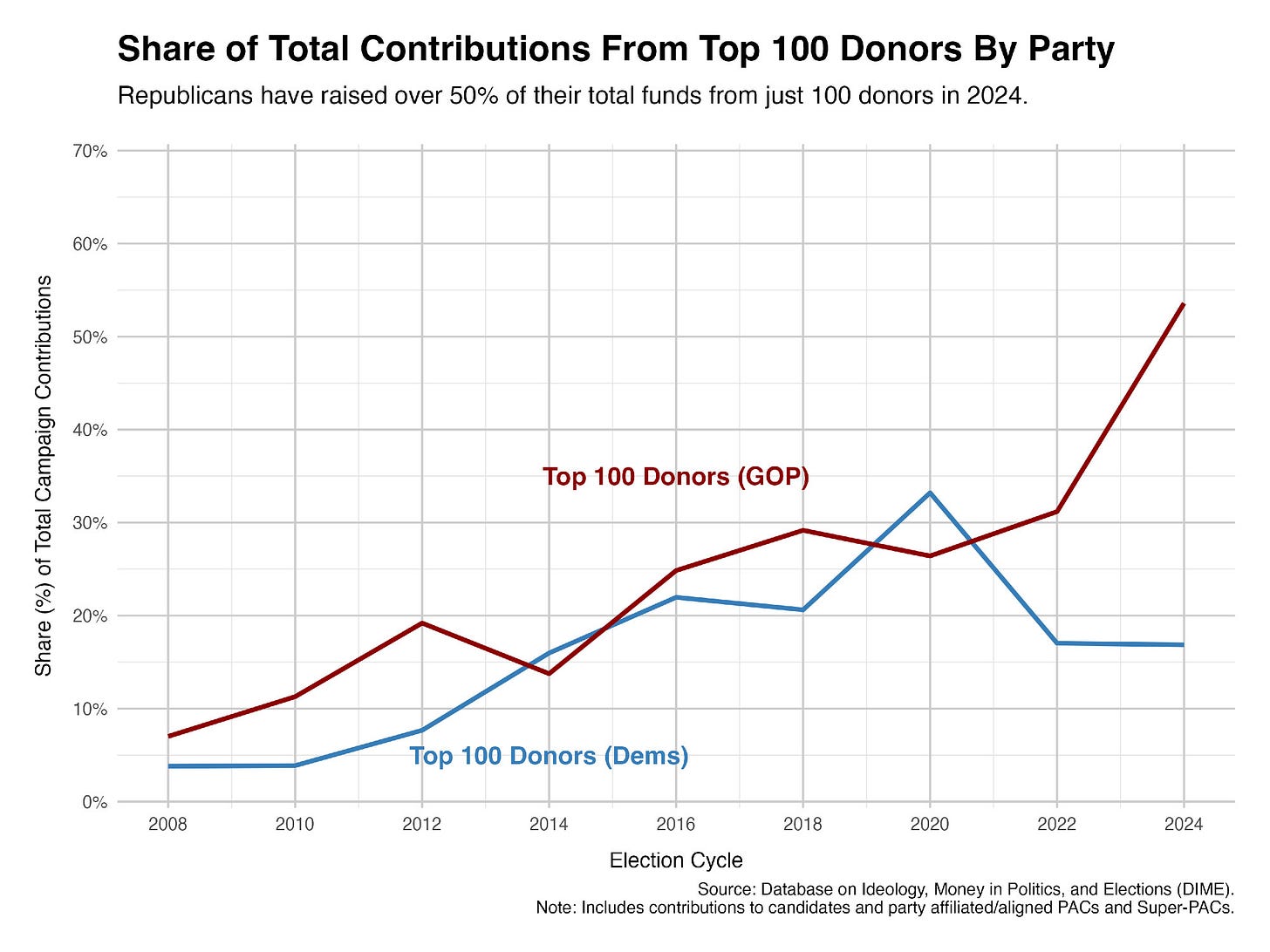

The root cause comes back to money and Citizens United. It's a vicious cycle of low-info folks incentivized to stay low-info as stuff gets paywalled. This is analogous to the higher education system. Social media is easy to access but algorithms are controlled by folks that are incentivized to spread propaganda. The Reconstruction will need to address Citizens United.

The pundit debates over twitter vs bsky do not matter. The real way to reach low-info voters is through short-form video on Youtube and TikTok. That being said, there is a scenario where someone(s) try to shut down bsky as it keeps growing, claiming it platforms those that disagree with the admin’s policies. Fortunately, AT Protocol has an inherent open source poison pill. The People would just crowdfund another server cluster to index all Personal Data Servers (PDS).

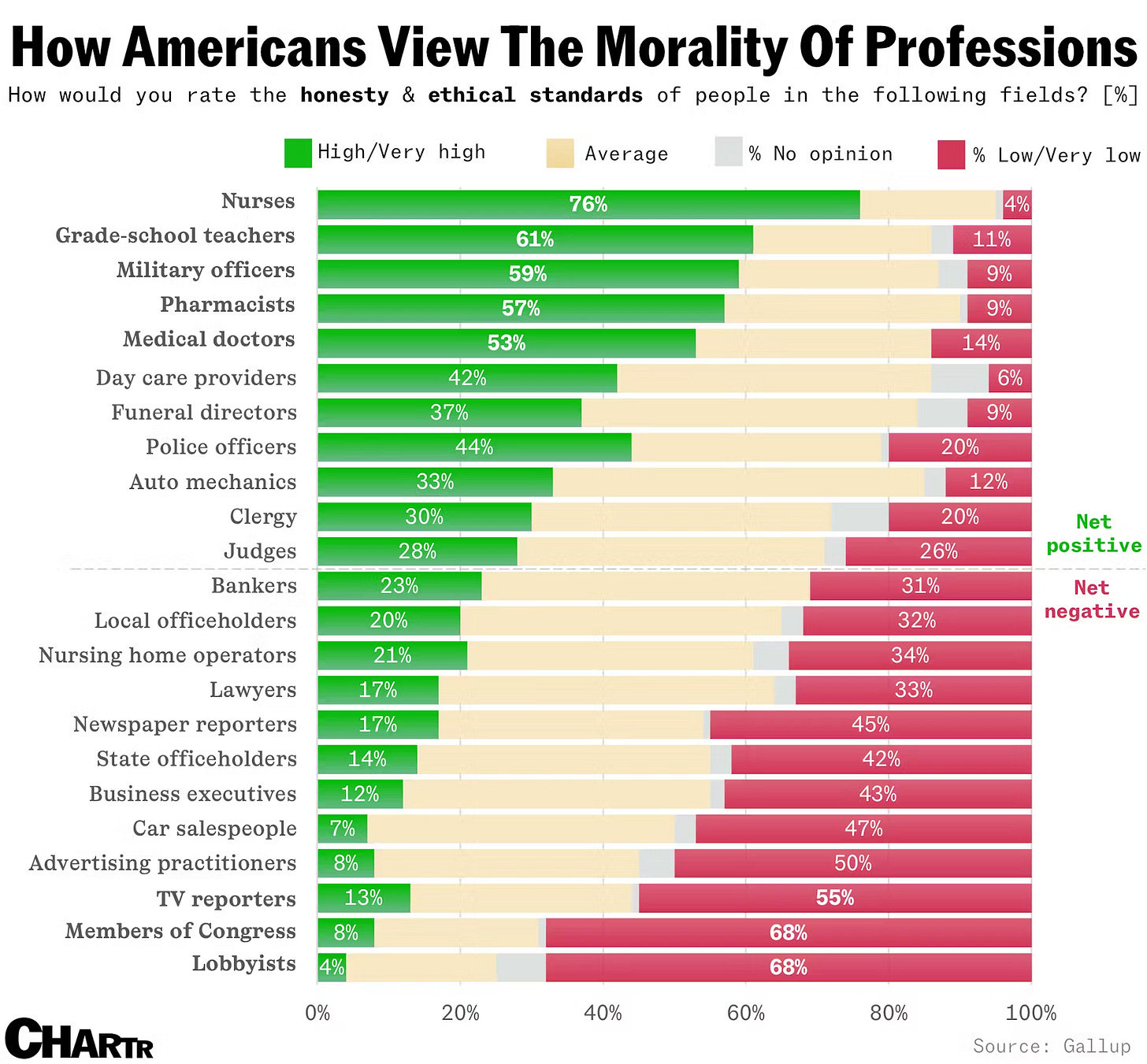

The professions with the highest ratings for honesty are nurses and teachers. I am worried about military officers’ rating dropping significantly. A load bearing aspect of maintaining even a semblance of democracy is having a military that is unwilling to kill its own citizens.

The new Health Secretary is fine with killing American citizens.

Instead of focusing on trying to find a “liberal Rogan,” Democrats’ efforts would be better spent buying up the domains for local newspapers in every state. Hire a few reporters to write almost exclusively about high school sports and new restaurants opening with every 5th article about how local policy affects people. Decentralized (social) media shifts control away from tech giants and back towards users. The playbook is to turn decentralization back on crypto bros sowing mistrust. Trust needs to be regained.

Remote work improved productivity in most industries, with the exception of finance. Not sure it is a coincidence that there are finance types that meandered towards crypto after being marinated in “libertarian” content. In that aspect, I am glad Jamie Dimon is forcing them to return to work.

Instead of trying to build a liberal news giant, build a bunch of locally trusted places which every year do an endorsement list for every elected office. Bsky is starting to setup going “live” and remains a better place for discourse and distributing news links. The “live” option will become critical as there is a tsunami of AI slop coming. Glad that sports discourse is growing with the addition of @nba.com and @wnba.com, since that is the only way to stay sane in the firehose of information these days. News, famous people, and a critical mass of people talking about big politics/sports/entertainment things will sustain this bubble and hopefully bring better balance to the social media spectrum.

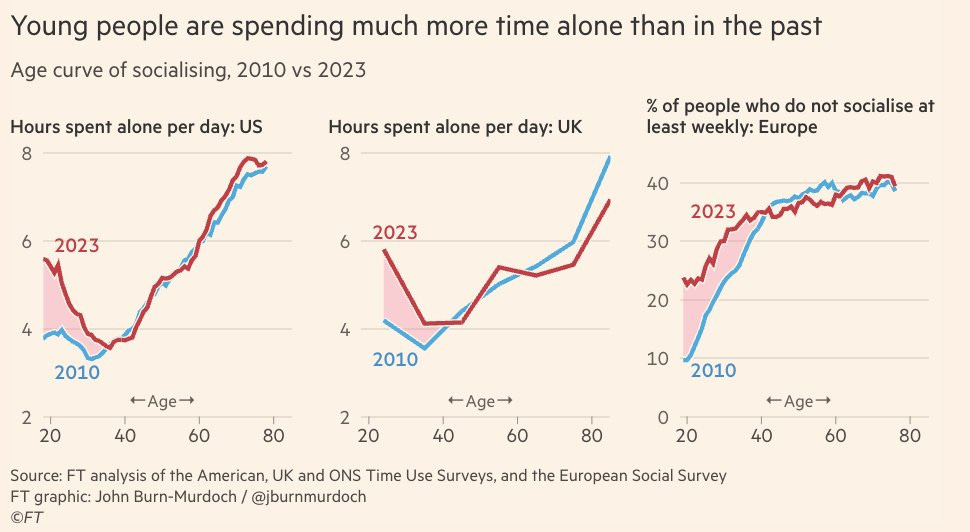

More “team building” is necessary. Social media seems to have taken market share from social drinking and the pandemic amplified isolation as people got used to scrolling alone. Unfortunately, the line between staying informed and doom scrolling has been blurred by the latest election results.

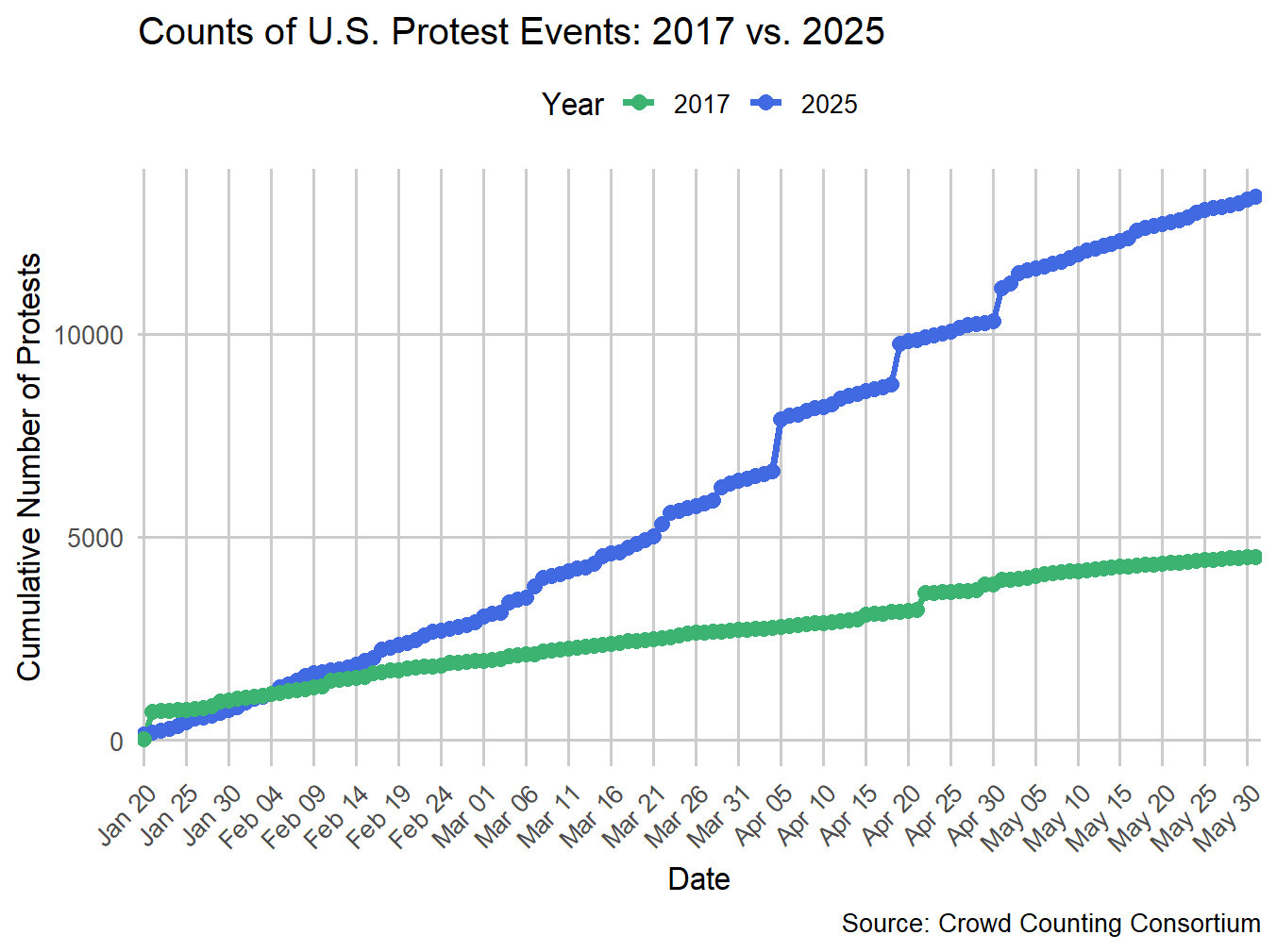

One way to stay informed and touch grass at the same time is exercising the right to free speech and nonviolent assembly (volunteering), which seems to be just getting started. In case it’s not obvious, protests are not bullish as people spend time protesting instead of consuming. The founding fathers did not live and die to see this moment, which includes law enforcement targeting press at protests. In the Declaration of Independence, they specifically called out the following:

For cutting off our Trade with all parts of the world:

For imposing Taxes on us without our Consent:

For depriving us in many cases, of the benefits of Trial by Jury:

For transporting us beyond Seas to be tried for pretended offences:

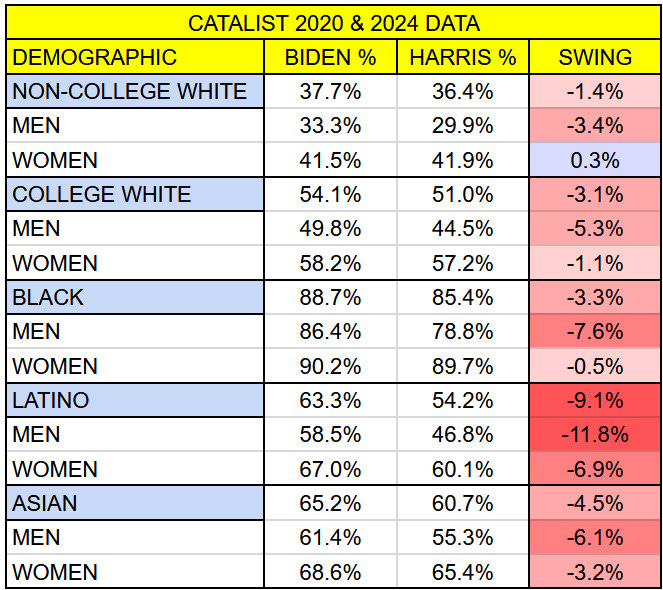

Reaching out to Latino voters is the equivalent of reaching out to low-information vibe voters. These are the same people that voted for deportation of their own. The backlash against deportation will grow.

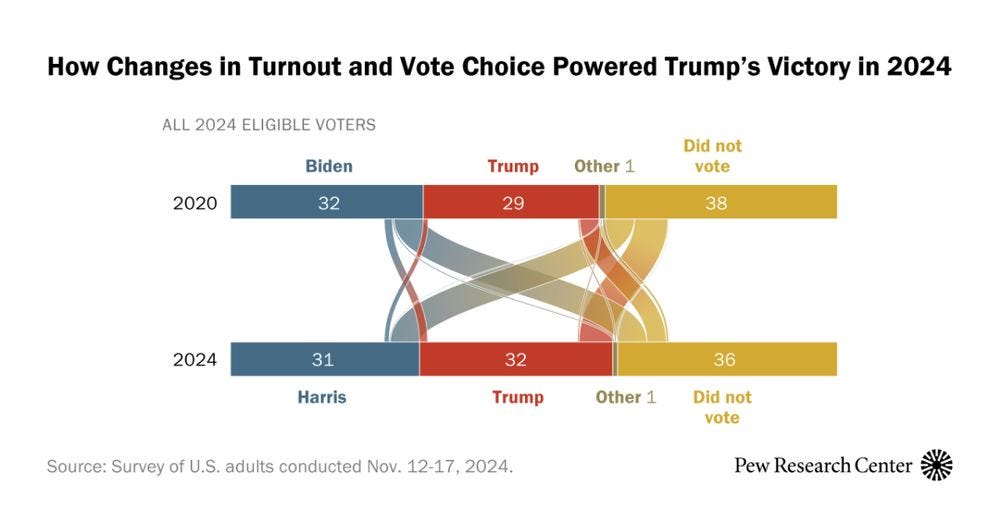

The divergence of voting preference between non-college men and women is worth noting. It seems like real median incomes for women without degrees has recovered to pre-dotcom levels faster than men. The fact that non-college white women managed to swing towards Harris is indicative of a better information environment for this demographic, which may be correlated to a relatively better financial situation.

“Low-info” is the wrong term for some of these people as they are getting plenty of information. The information source is just fact-free zones like the Joe Rogan Experience. Some people live in completely different “realities” due to their media diet. What’s the best way to regain the “trust” of these voters? It’s probably something along the lines of “shock and awe good policymaking” that needs to be done at state and local levels first. The New York City congestion pricing is the best example. The wording of the question has changed, but congestion pricing polling had swung to -2 in May from -22 statewide shortly before launch in December, with a -30 drag from Latino voters. These “low-quality info” voters take “seeing is believing” literally and they need short-form “live” video explainers about the policy miracle that is NYC congestion pricing and not just charts and tables from @nytimes.com.

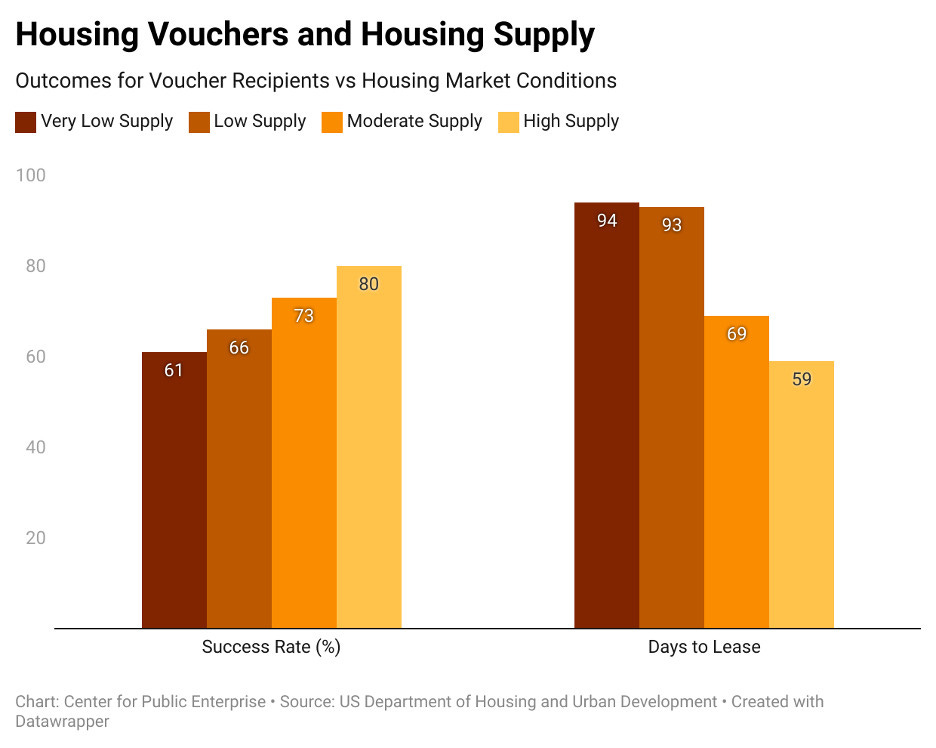

Need more local newspapers that continuously talk about local sports and restaurants, and beat the continuous drum of policy platform and implementation. There are too many people that just do not pay attention to politics, but everyone cares about housing supply, healthcare and childcare. Housing vouchers is another policy that deserves more public discourse, especially so as multi-family constructions wind down going into next year. Every city needs to build more, especially so for coastal metros.

There is correlation with state capacity and democracy. Unfortunately, the United States of America is shifting down (weaker state capacity) and left (more autocratic). The Reconstruction will be built on pain.

The Industrial Policy way failed because voters did not “see” and “feel” the policy. The best way to depolarize people is not through posting walls of text. It is through demonstrating and marketing policy effectiveness, which requires showing the best of capitalism and socialism. Something interesting about the current admin is the concept of policy by tweets. The way the admin does it introduces unnecessary market volatility. However, policy by tweets has introduced a new type of “feedback period.” At the core of nearly every policy debate is the distribution of production between capital and labor, relative to how the (re)distribution of consumption is supported by state capacity.

vTaiwan is a decentralized open consultation process that combines online and offline interactions, bringing together Taiwan's citizens and government to deliberate on national issues. It serves as a model for People-Public-Private Partnerships (PPPP), involving government ministries, elected representatives, scholars, experts, business leaders, civil society organizations, and citizens in crafting digital legislation.

I believe social media will remain crucial for policymaking for a while. Bsky’s true advantage over twitter is not ideological, it’s technical: drives web traffic without deboosting links, searchable links, and people-driven discourse (bot moderation includes Grok replies at this point). Crowdsourcing opinions and having open debates should speed up the legislation process. Elections are the deadlines to settle debates. One debate that is coming for the YIMBY crowd is the overlap of anti-labor and pro-deportation. Too many people falsely think deregulation and entrepreneurship equate to supporting crypto. Choosing this “capital” over “labor” is similar to “AI replacement” over “AI augmentation.” Labor will be key to swinging the pendulum back. Lecturing crypto/AI bros will not work until there is pain.

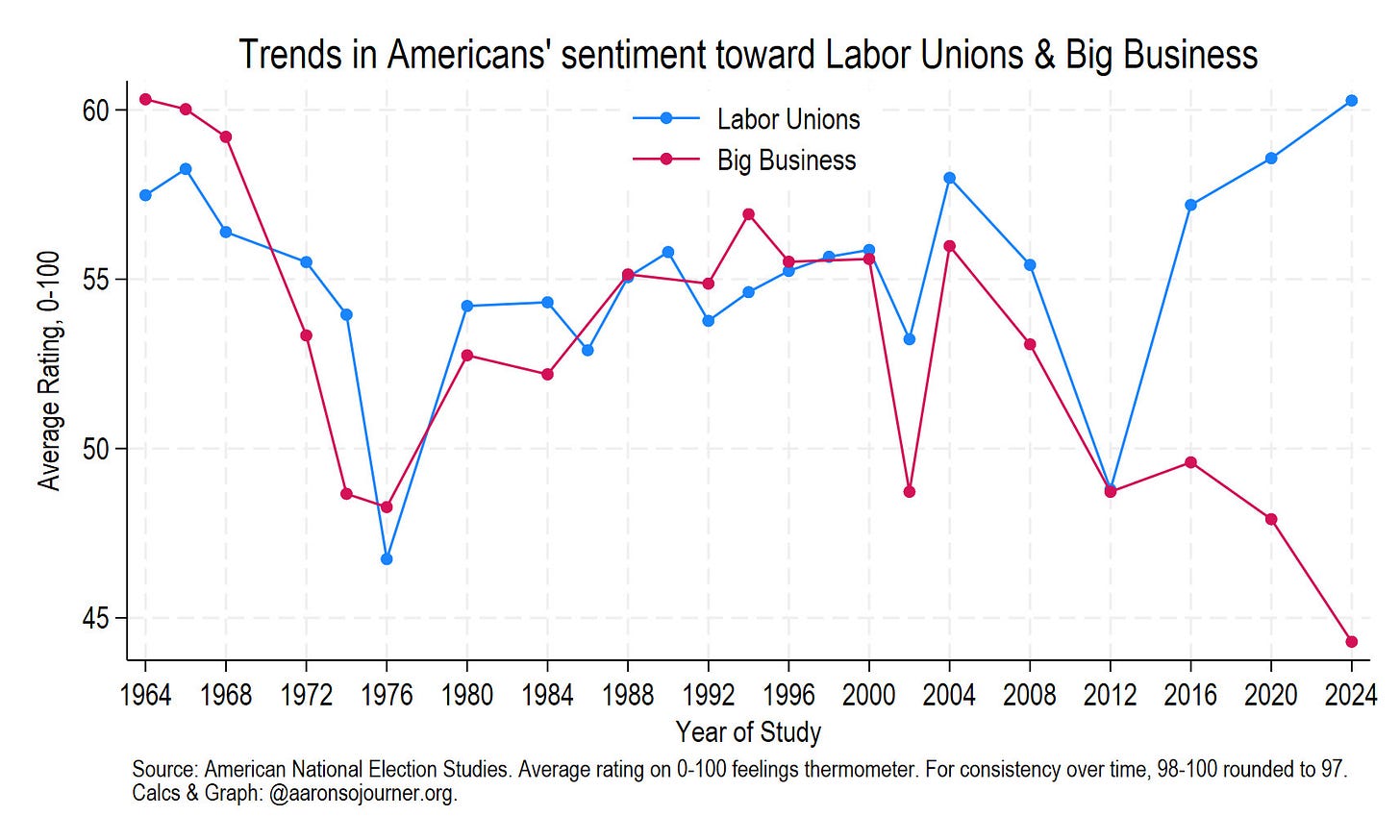

Americans favor labor unions over big business now more than ever. In data back 60 years, Americans' sentiments are both warmer toward unions & cooler towards big business than ever before. People > algorithms.

Costco continues to be the best demonstrator of liberalism the right way. Keeping that in mind, this map of right-to-work is important. California having no right-to-work law is probably not a coincidence.

Unions can be incompetent too though. There are examples where union negotiation is not positive-sum and wage growth does not translate to productive output. A policy that won't raise the productivity of workers won't raise wages. Ending with a video demonstrating how public opinion turned on voice actors during their strike.