Entropy quantifies the degree of disorder or randomness in a system. In thermodynamics, entropy indicates how energy is dispersed within a system and predicts the direction of spontaneous processes.

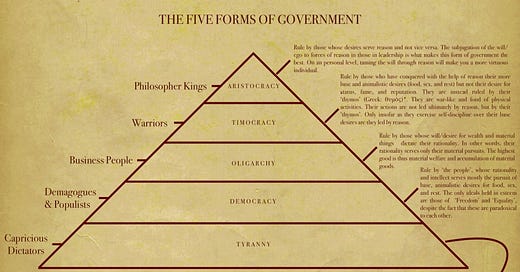

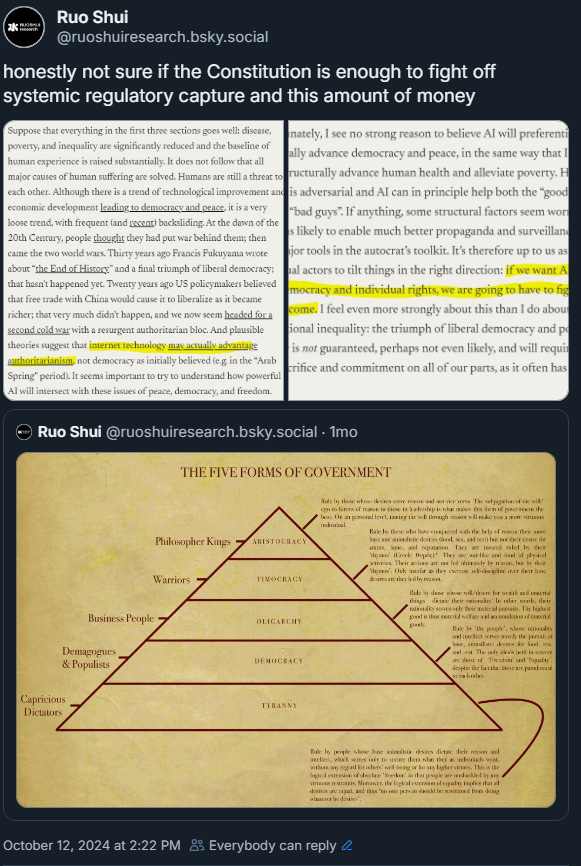

In macroeconomics, wages indicate how productivity growth is distributed among people and steer the the direction of government rule. Plato categorized governments into five types of regimes: aristocracy, timocracy, oligarchy, democracy, and tyranny. Entropy is always increasing.

Reiterating core beliefs:

- Freedom of speech is foundational for innovation

- Shelter and education for talent are critical for growth and innovation

- Current wealth gap is unsustainable for democracy (some might argue it’s already oligarchy with regulatory capture)

Not rocket science to see all three of my beliefs took a gut punch in November. Some people confuse freedom of speech with freedom to lie. Facts are not relative, even if “truth” is relative. Facts do not cease to exist because they are ignored. At least the market keeps score for econ data "truth." At some point even economic data from the Bureau of Labor Statistics (BLS) may come under attack and that “truth” would then be distorted like how social media has distorted “facts.” Honestly not sure if the Constitution is enough to fight off systemic regulatory capture and this amount of money. This entry is too long not to have headings:

Soft Landing

Chaos Dominance

Bifurcated Information System

Globalization (Immigration, Dollar, Tariffs)

Wealth Gap

Wealth Distribution

Inflation, Federal Spending and Productivity

Taxes

Federal Reserve and Captured Departments

Quality of Life and Cost of Living and GLP/AI

Soft Landing

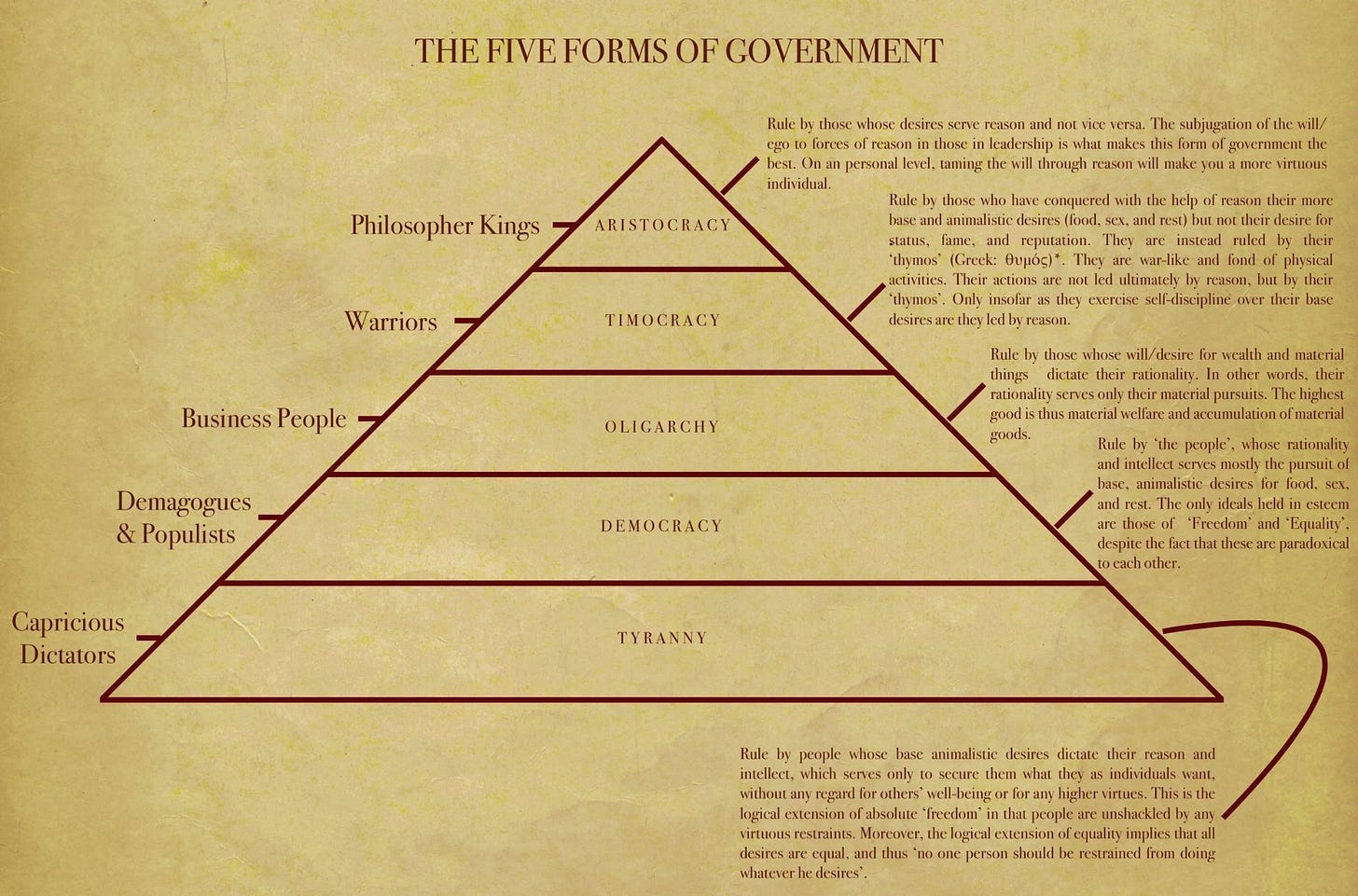

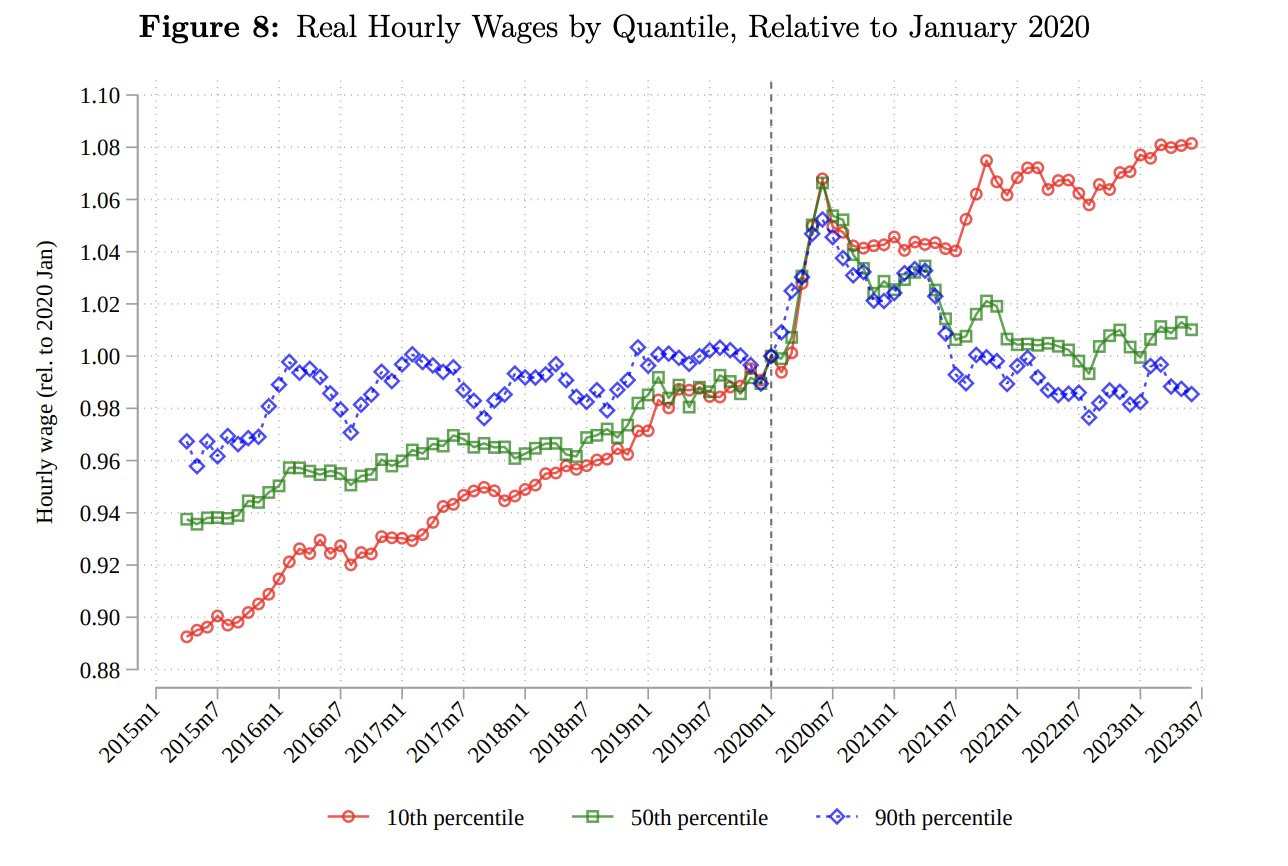

In 2022, Federal Reserve Chair Jerome Powell outlined the path to a soft landing at June FOMC, Jackson Hole, and Brookings Institute and continuously been data dependent since those three key meetings. That’s precisely what happened. Wages went up strongly, especially so for the bottom quintile, while inflation expectations remain anchored. Ignore pundits that say the soft landing didn’t happen. It was so soft that some folks didn’t feel it. There’s an underlying theme from some folks who overweight monetary policy while underweighting fiscal policy: moving goal posts while lacking a timeframe.

Real GDP is higher, inflation is slightly higher from housing and market returns, and unemployment is stable. The neutral rate is higher, but that is because of higher productivity growth, population growth and procyclical fiscal policy. Some folks incorrectly think Federal Open Market Committee (FOMC) “forecast,” but the it is better to frame the Summary of Economic Projections (SEP) as the Fed’s reaction function to incoming data from growth, inflation and employment. A higher neutral rate is a good thing as that reduces misallocation in capital and labor, but the tradeoff is higher hurdle rates for hiring and housing. Not everyone agrees though, as evident from the election results.

Source: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20220615.pdf

Source: https://www.brookings.edu/wp-content/uploads/2022/11/es_20221130_powell_transcript.pdf

Fiscal and monetary policies combined to engineer the only soft landing in modern history with a spike in food and energy, navigating through a global pandemic reopening, a Russian invasion and a few regional banks getting absorbed.

There are some folks that worry about the “loss” of dollar buying power and blame the Fed. This narrative usually comes from cryptocurrency enthusiasts that misunderstand or antagonize the fiat system. The linkage between inflation and wage growth is productivity growth. Crypto is not a productive asset, so it makes sense that crypto bros also dismiss productivity growth. As if people have been hoarding dollars in a piggy bank for 90 full years, and as if inflation and real gains through productivity growth have not also pushed up wages and purchasing power over that same 90 years. With productivity growth comes higher wages, especially so for folks in lower quintiles and people that chose to switch jobs.

Source: @skandaamarnath.bsky.social

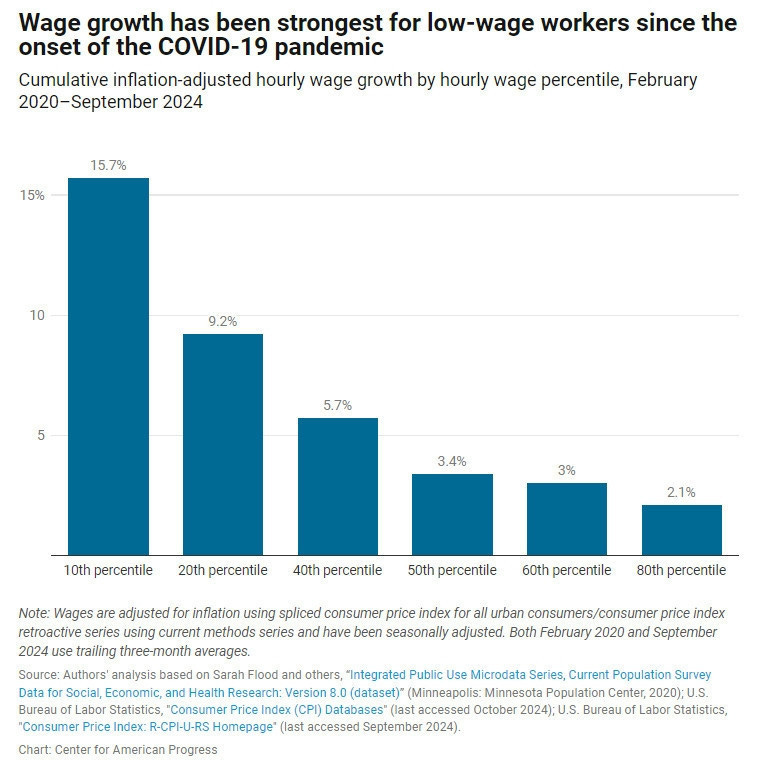

Anyone that says soft landing hasn’t happened probably didn’t bother defining a soft landing or is moving goal posts and/or doesn’t understand that the Fed Funds rate is not going to magically solve the housing shortage. The only way to deal with housing is to build, neither higher rates nor recession solve housing. Unfortunately, NIMBYs won the election.

Based on the 10yr breakeven, we have been in a soft landing for quite a while. Same with equity markets. It is safe to assume anyone still debating soft landing does not express their positions in markets on shorter timeframes (3 months):

Naked short stocks is a pure recession play

Short stocks AND bonds is a stagflation play

Naked short bonds is a higher for longer (higher inflation and nominal growth) play.

10yr breakevens have been stable, an indication of Fed credibility and anchored inflation expectations. Soft landing (disinflationary growth) was basically the traditional 60/40 portfolio and that has done just fine as equity and bond correlations are dependent on inflation. It is better to analyze 2025 and onwards as just expansion vs contraction with respect to business cycle. Unfortunately, the middle out expansion is likely to be cut short.

Bridgewater’s framework is correct, but Bridgewater folks were not bullish on productivity growth. This made them offsides for two years straight. These folks consistently thought a recession was necessary and dismissed productivity growth in their analysis.

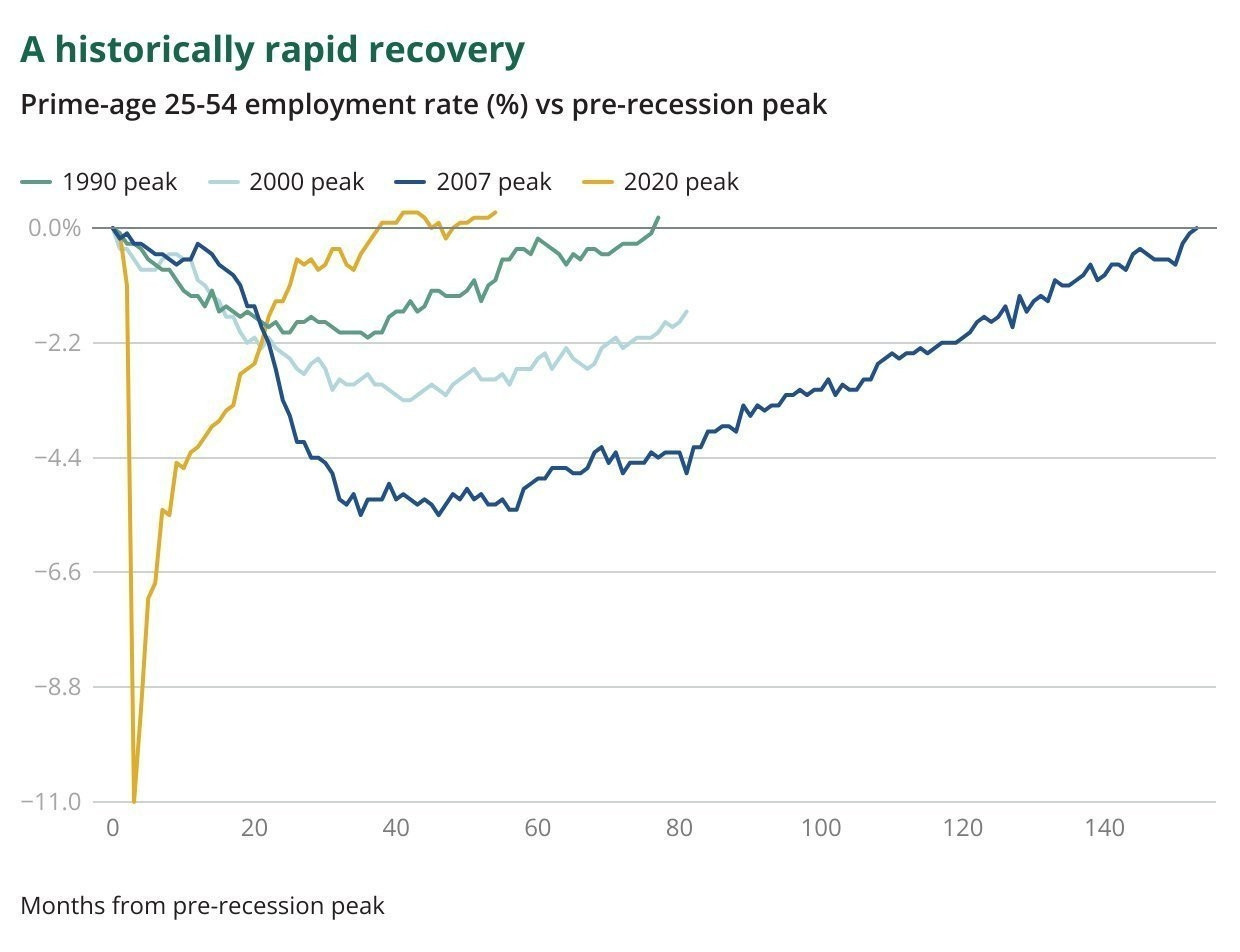

A higher neutral rate is a good thing. However, the tradeoff for a soft landing, a historically rapid recovery and reduction of capital/labor misallocation is housing affordability. Housing affordability being an issue is something most can agree on.

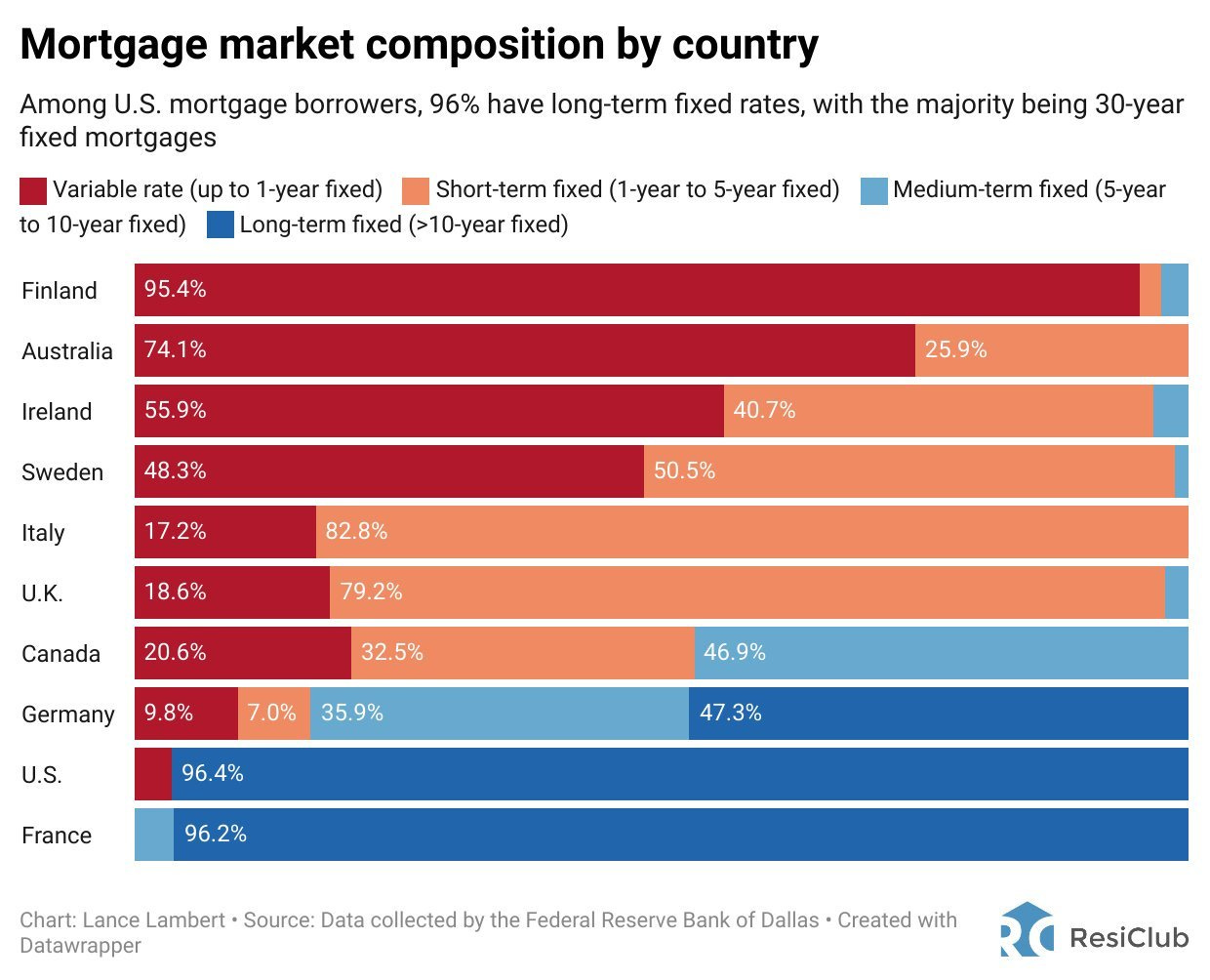

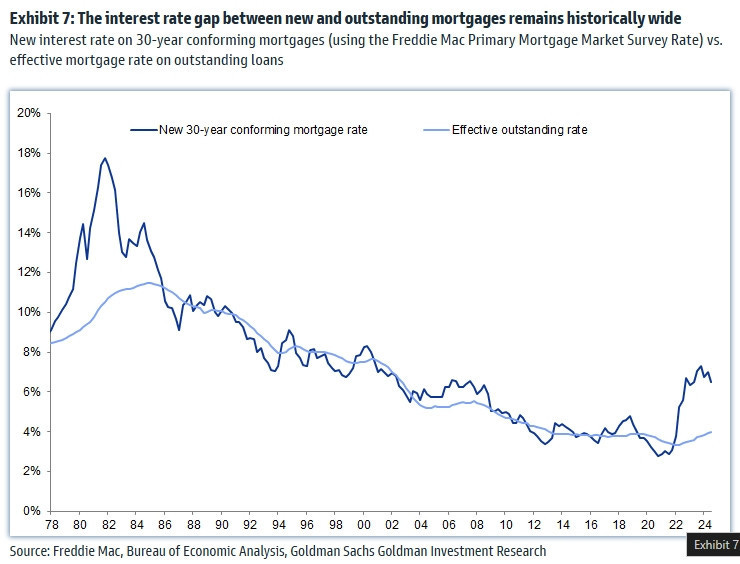

However, I do not think people know the difference between Fed Funds Rate and mortgage rates. Mortgage rates is tied to both growth and inflation expectations. Nominal GDP (nGDP) is a function of productivity + population growth, the Cobb-Douglass production function. Long rates basically follow the Fisher equation of NGDP growth, so “real” + inflation = nGDP => long rates and there is a spread between the 10yr rate and the 30yr mortgage rate. The 08 recovery took too long and zero interest rate policy (ZIRP) was a policy failure. Again, not everyone agrees. In fact, there are those who yearn for ZIRP again.

Source: https://eig.org/wp-content/uploads/2024/08/TAWP-Amarnath.pdf

The November nonfarm payroll (NFP) showed a dip in full employment as hiring rates were unable to maintain the bounce. So, folks that are against Fed easing short term interest rates are against (or don’t care) about improving hiring rates.

The labor market has been solid but full employment is slowly slipping as job-finding rates dip and hiring rates continue to be sluggish amid higher hurdle rates.

The blame game against the Fed Reserve and Federal Spending has been going on for a while. There’s a narrative of government spending crowding out private spending. This analysis lacks rigor as it assumes government spending is not as productive as private spending. Full employment is productivity enhancing.

Some folks still incorrectly think interest payments should be included in inflation prints as well. It’s easier to blame the Fed, when the alternative is looking at quarterly Treasury presentations to the Treasury Borrowing Advisory Committee (TBAC).

Source: https://home.treasury.gov/news/press-releases/jy2697

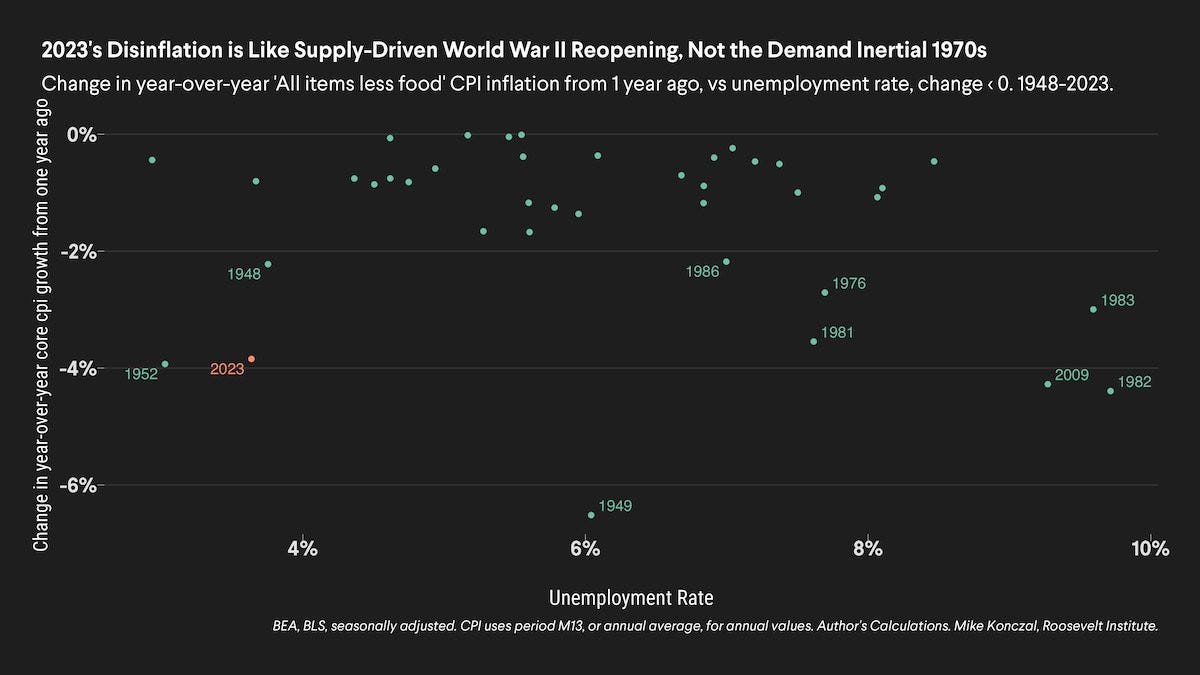

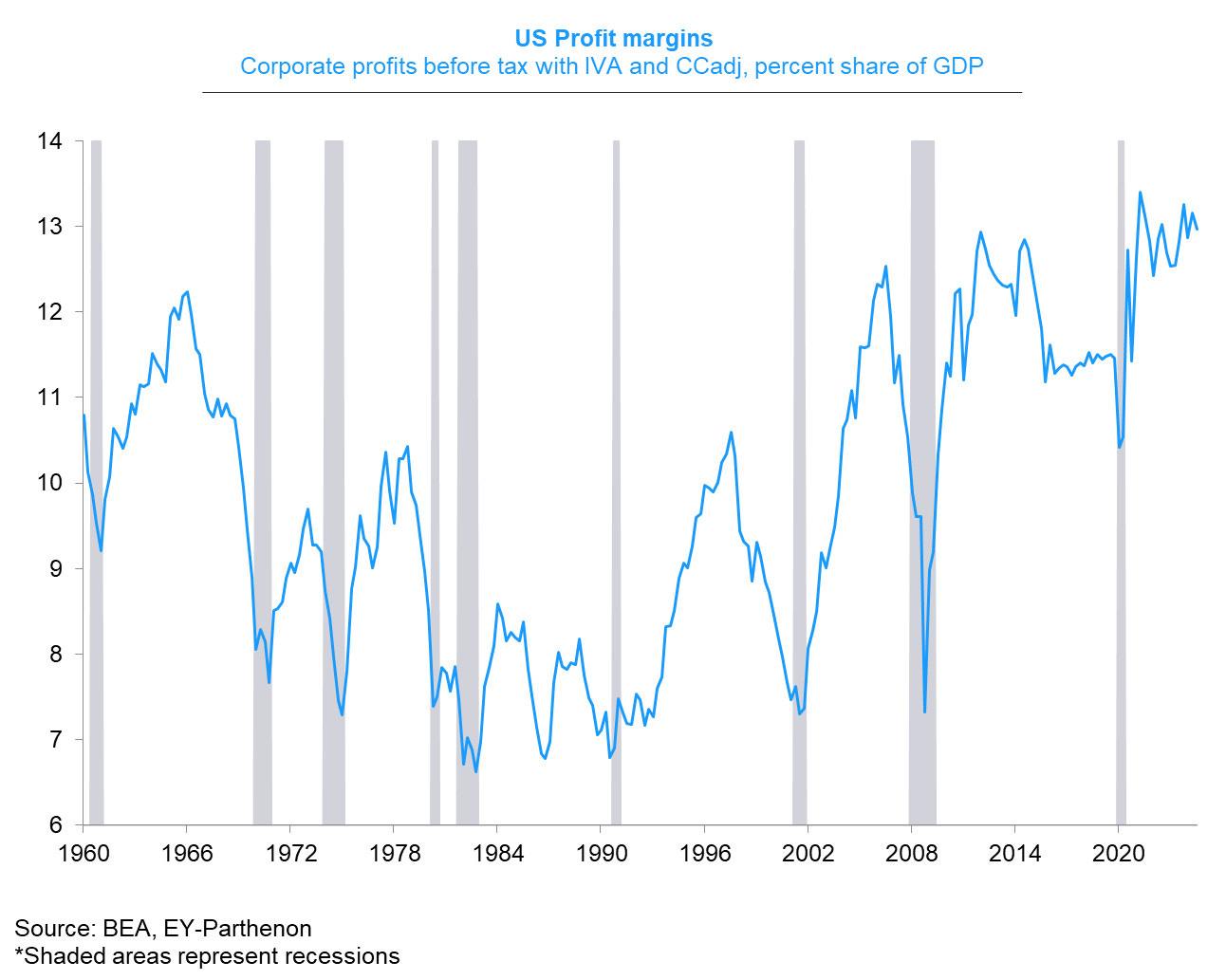

Inflation was and still is driven by supply constraints. Demand has basically just kept pace as income growth has largely been catching up to inflation, rather than fueling inflation. Prices are set and if the level is too high, volume drops as people seek alternatives. There was no wage price spiral, although some companies demonstrated superior pricing power which translated to profit margin increases.

The pandemic produced the bullwhip of bullwhips and the Russian invasion created a supply shock that pushed up both food and gasoline prices. One of the biggest learnings from this cycle is that attention spans have dramatically shortened and long term memory is not a thing for election cycles.

Source: @mtkonczal.bsky.social

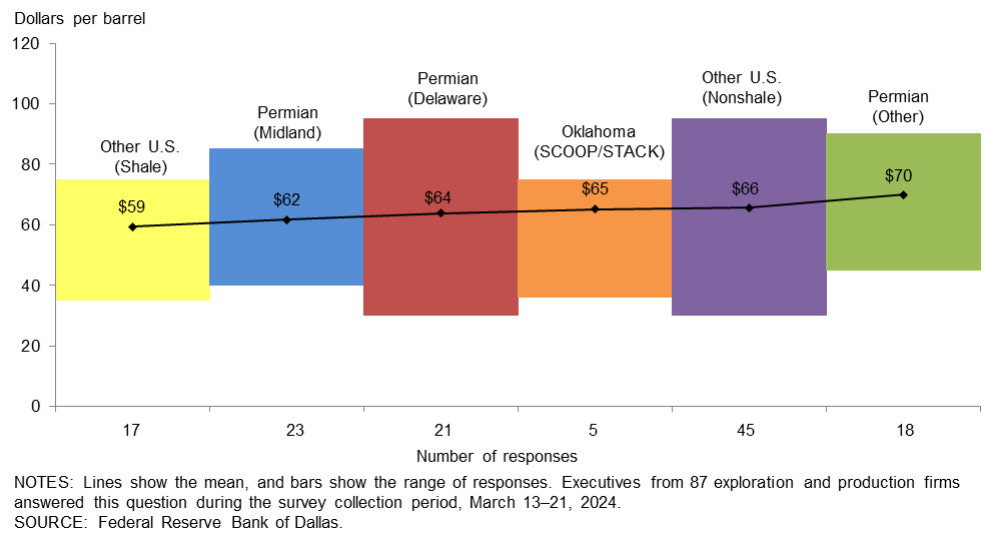

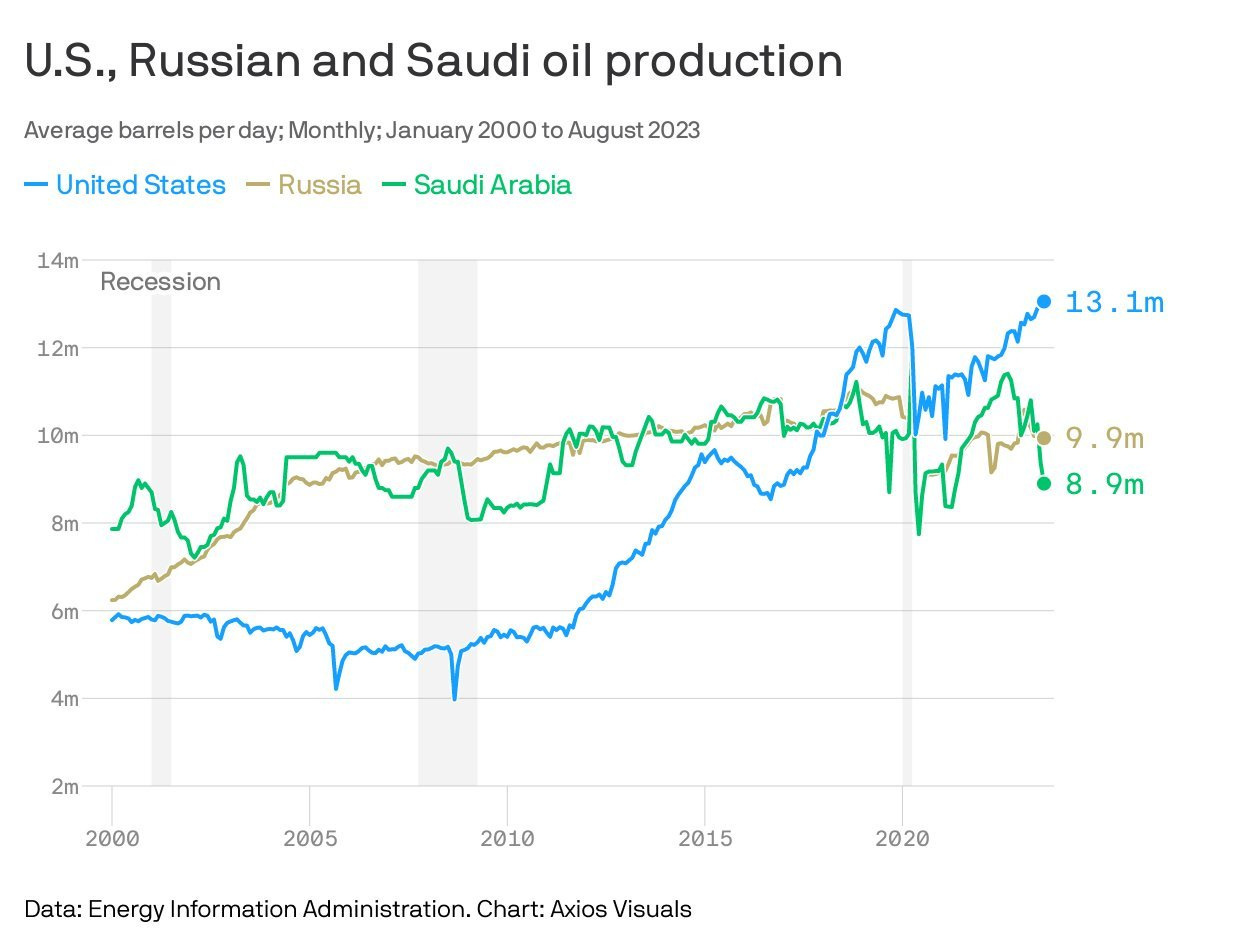

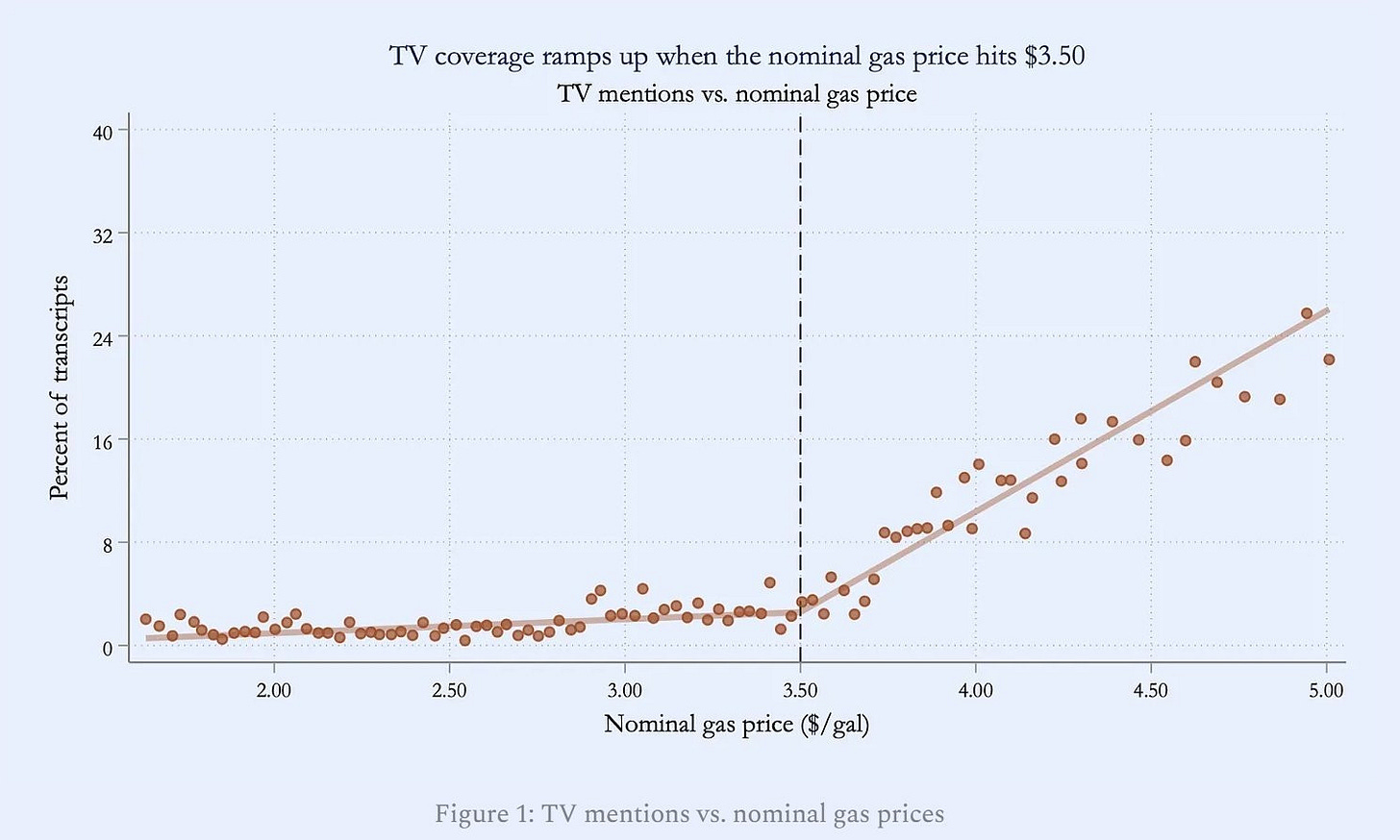

After the Russian invasion, refining crack spreads reached levels that became record profits for oil and gas companies. The next administration inherits an America with the national gas price at similar levels to 2021 and breakevens around $70 per barrel.

Source: https://www.dallasfed.org/research/surveys/des/2024/2401#tab-questions

The US currently leads the world in oil production. US crude shipments to the EU have settled at a higher level compared to prepandemic. For prices to drop significantly, oil and gas companies would likely experience profit margin contraction. Meanwhile, Saudi Arabia is eventually going to hike production as they have at least 2M in reserve capacity and need to finance Neom.

In addition, America has become EU’s second biggest source of natural gas that has replaced Russian pipeline flows.

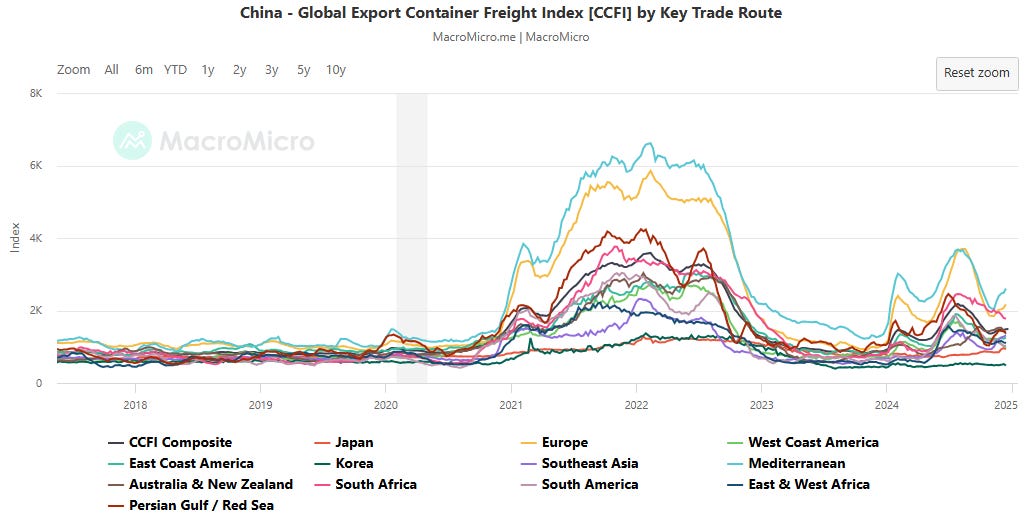

Fertilizer (implicitly food prices) have stabilized since the Russian invasion. People also forget how long China’s zero Covid policy disrupted shipping and Red Sea troubles are likely to pale in comparison to new trade wars.

Underneath the pandemic recovery and geopolitical tensions, was the greatest labor force recomposition since WW2. The boomer retirement wave contributed to a tight labor market and has since loosened, with millennials and Gen Z becoming a significant portion of the workforce.

Source: https://www.axios.com/2023/11/22/gen-z-boomers-work-census-data

Source: https://www.frbsf.org/wp-content/uploads/el2024-30.pdf

The Beveridge Curve was right and the Phillips Curve was wrong. Chris Waller was right and Larry Summers was wrong. A recession was not necessary and still is not.

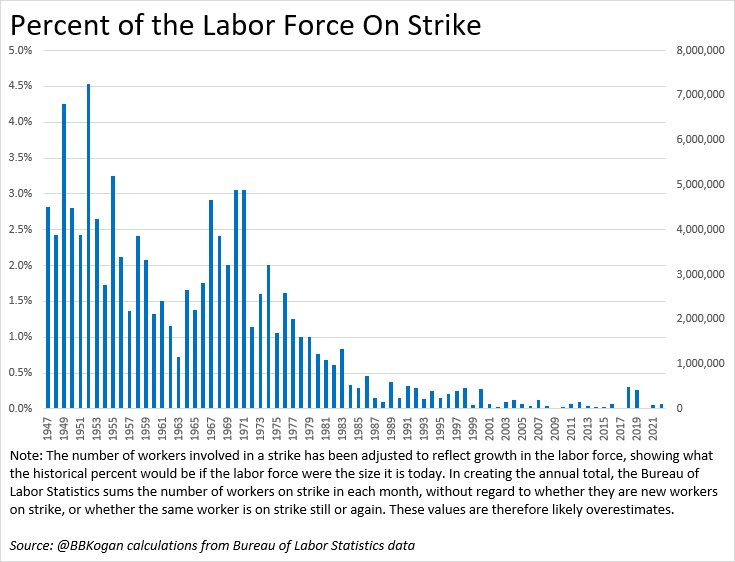

Unemployment has remain subdued while vacancy rates normalized. Hiring rates dropped as hurdle rates became higher. Employees and unions had bargaining power for the first time in a long time to demand higher wages. Yet, many people are still angry.

Source: @econberger.bsky.social

The latest inflation numbers reflect tame price increases trending towards the Fed target. In fact, a good chunk of inflation “acceleration” was from portfolio management fees also known as markets.

The November print showed shelter continuing its glacial slide. Q1 seasonality is almost upon us, but the known unknown is January executive orders.

Source: @nicktimiraos.bsky.social

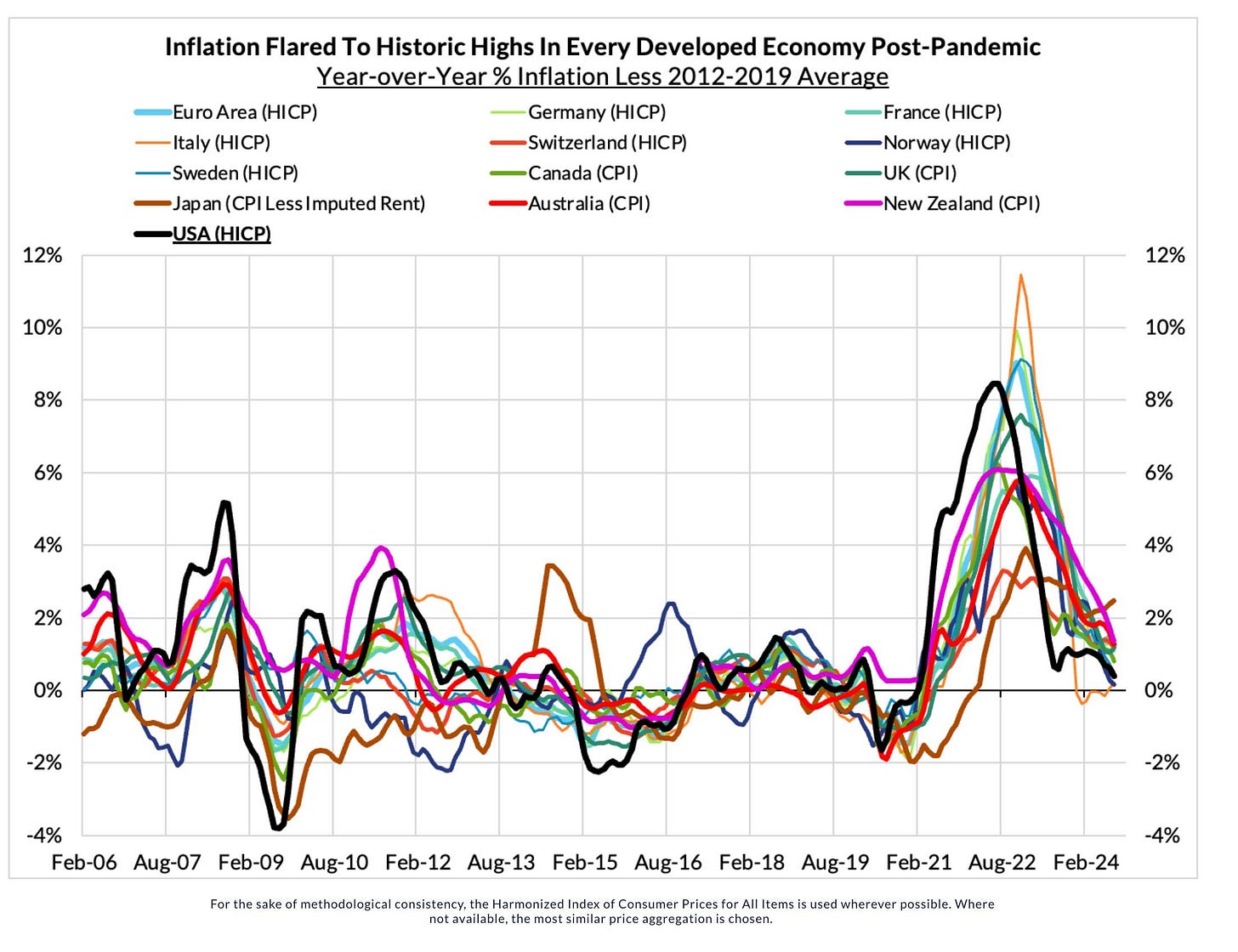

Inflation showed up everywhere despite most countries not opting for 2021 US fiscal stimulus, so some folks are being intellectual dishonest when they trace their inflation analysis back to American Rescue Plan (ARP). The lack of causal inference skills combined with political bias and career incentives makes for poor analysis.

The Harmonized Index of Consumer Prices (HICP) is a measure of inflation in the Eurozone and effectively illustrates the global inflation phenomenon with the US having one of the best pandemic reopening and Russian invasion response.

Source: @skandaamarnath.bsky.social

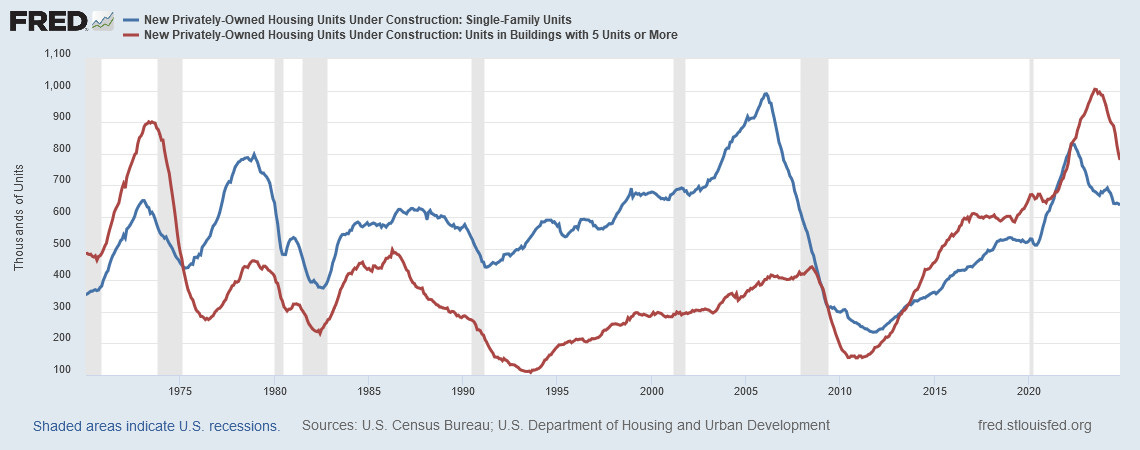

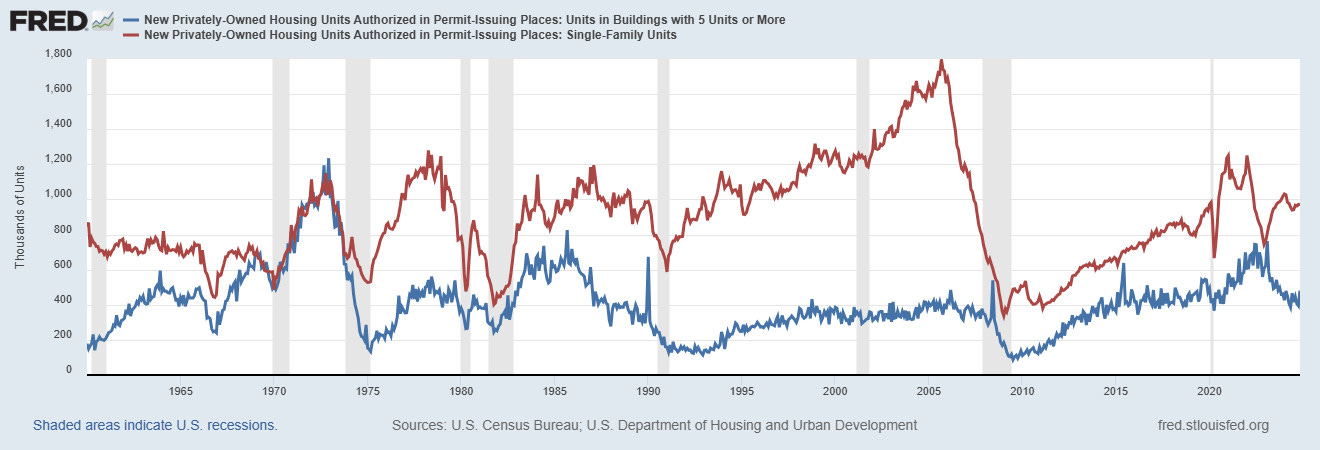

The remaining inflation is housing. Ignore pundits that say otherwise as they are also likely to wave off concerns about deportation and tariffs going forward. The spread between housing completions and under construction has finally recovered to prepandemic levels, but is still substantially lower than levels prior to the Great Financial Crisis (GFC). Mortgage rates are currently restrictive for both demand growth and supply expansion in the housing market. It is a shame that self-induced supply shocks are on their way.

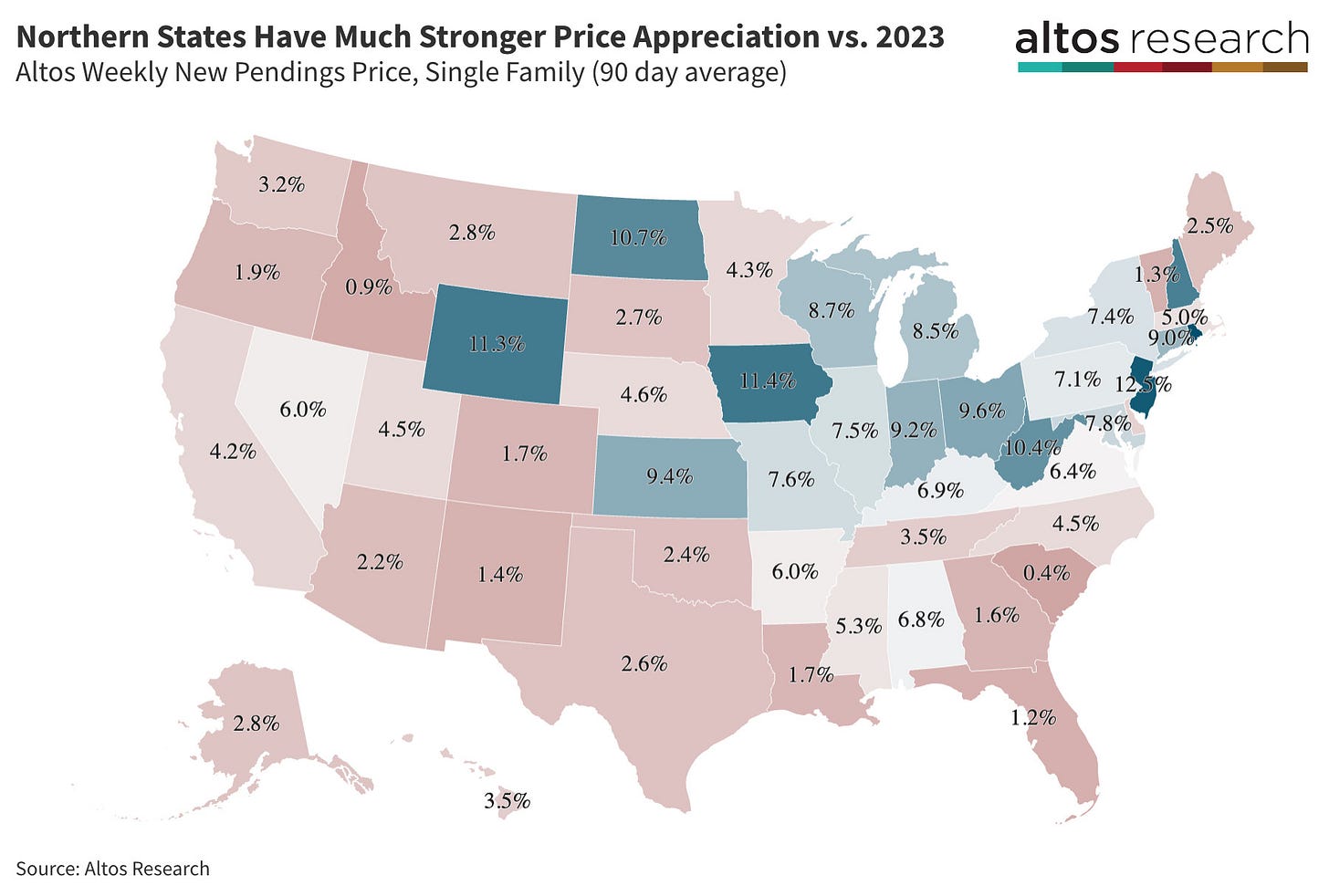

Although monthly supply of new houses is at 8.9, this supply is not evenly distributed across the country.

Source: https://fred.stlouisfed.org/series/MSACSR

Source: https://todayshomeowner.com/home-finances/guides/median-home-age-us/

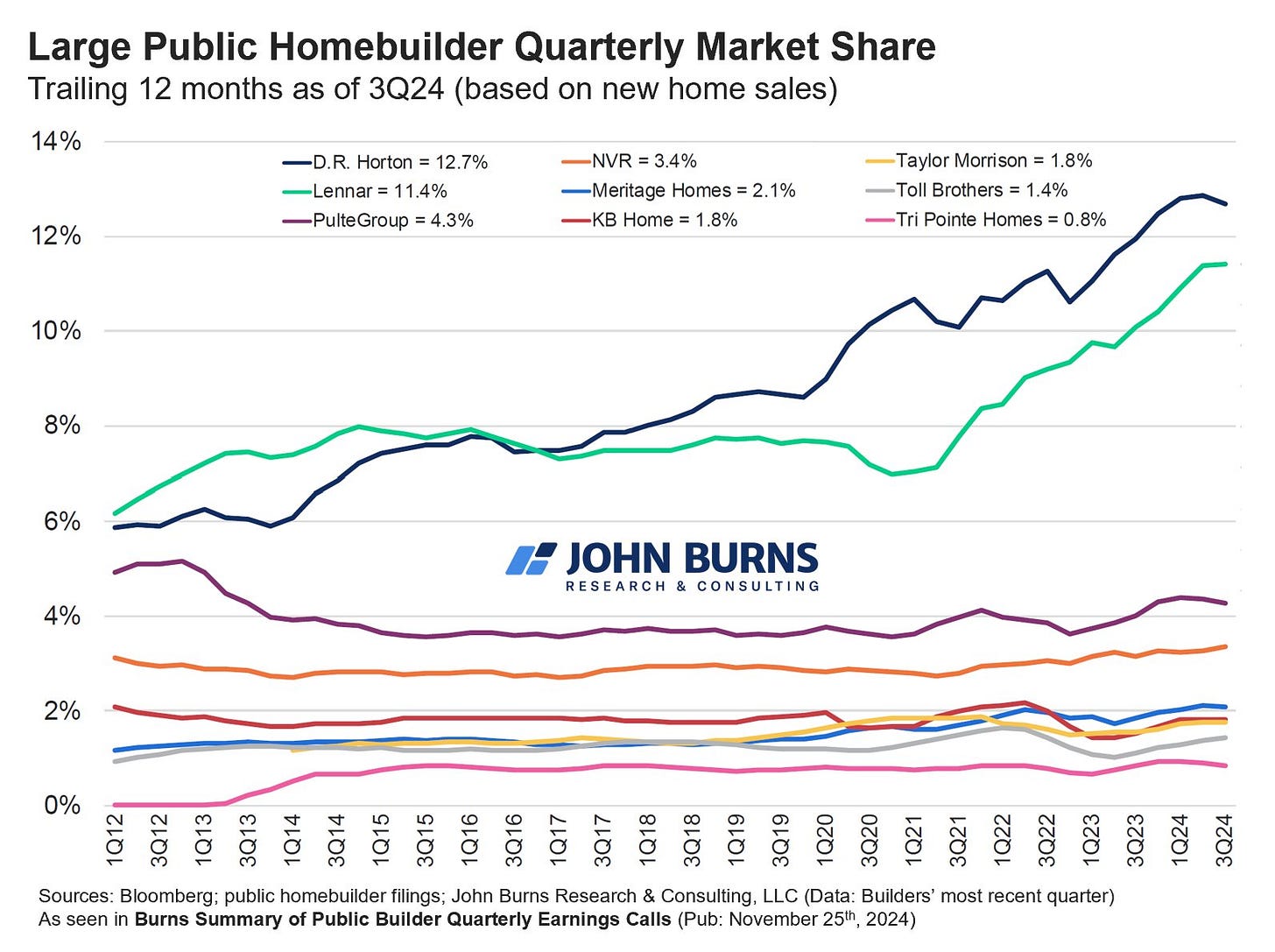

The current supply available is also not evenly distributed amongst homebuilders as D. R. Horton and Lennar have increased their market share significantly. They have had profit margins sufficient to buy down mortgage rates by 1-1.5%. It is unlikely there will be a another year of heavy stock buybacks for builders.

The two biggest builders do not operate in the Northeast. Housing markets are regional and the Northeast (and every dense city/metro) needs to figure out how to build more. Climate risk, homeowner insurance, and abortion access add additional layers to the home purchasing process for some Americans.

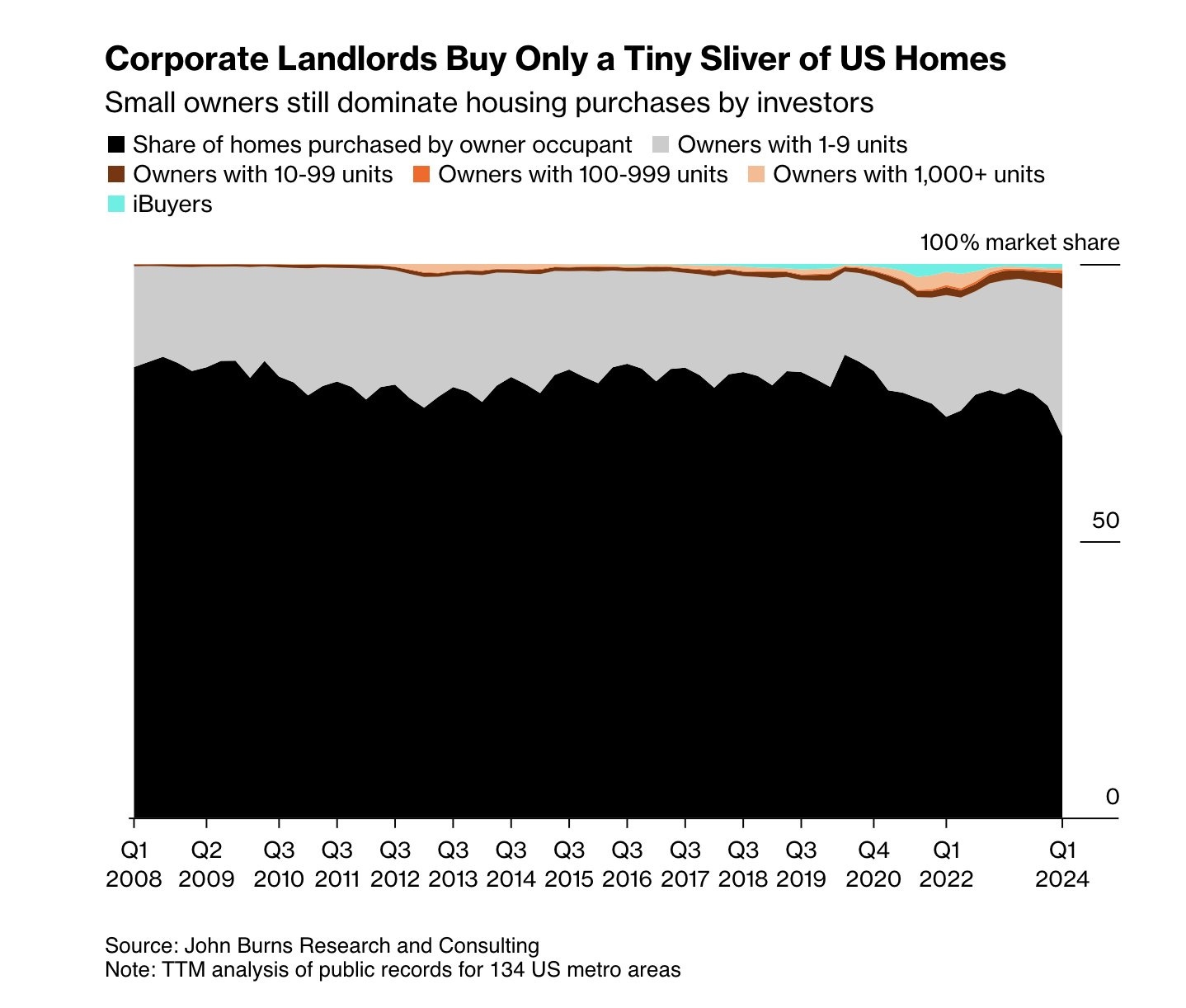

For the record, corporate landlords bought a tiny sliver of US homes. That has not been the issue for housing.

Building more and increasing inventory puts downward pressure on housing prices. It’s just math. America needs to build more.

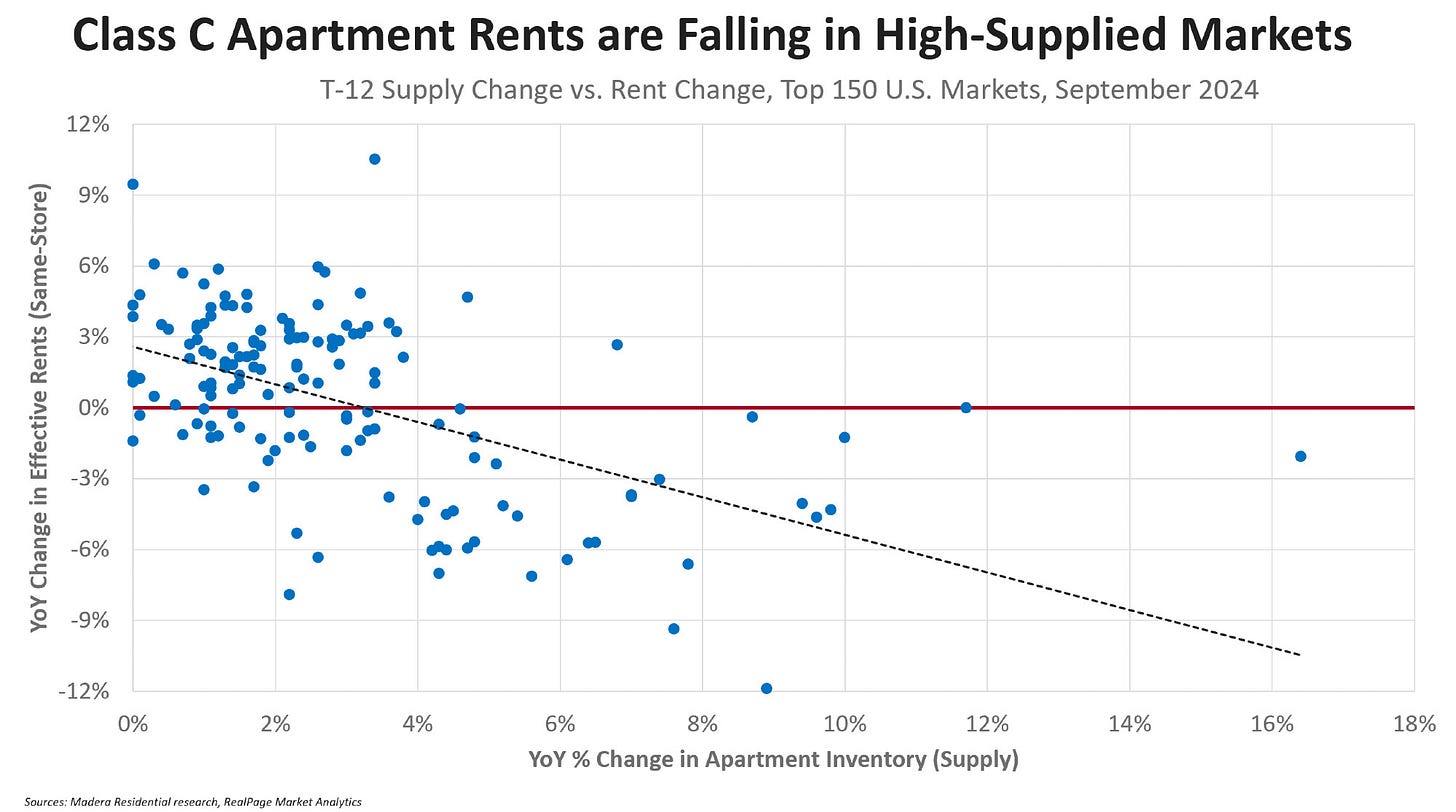

For those skeptical of rental housing "filtering," the theory that new "luxury" apartments pull up higher-income renters from moderate-priced rentals, thereby benefitting moderate-income renters, and on down the line, the facts are undeniable after the Covid apartment construction boom. Other than CEOs that actually value reinvest in their employees, existing housing is about the only trickle down that actually happens in the economy.

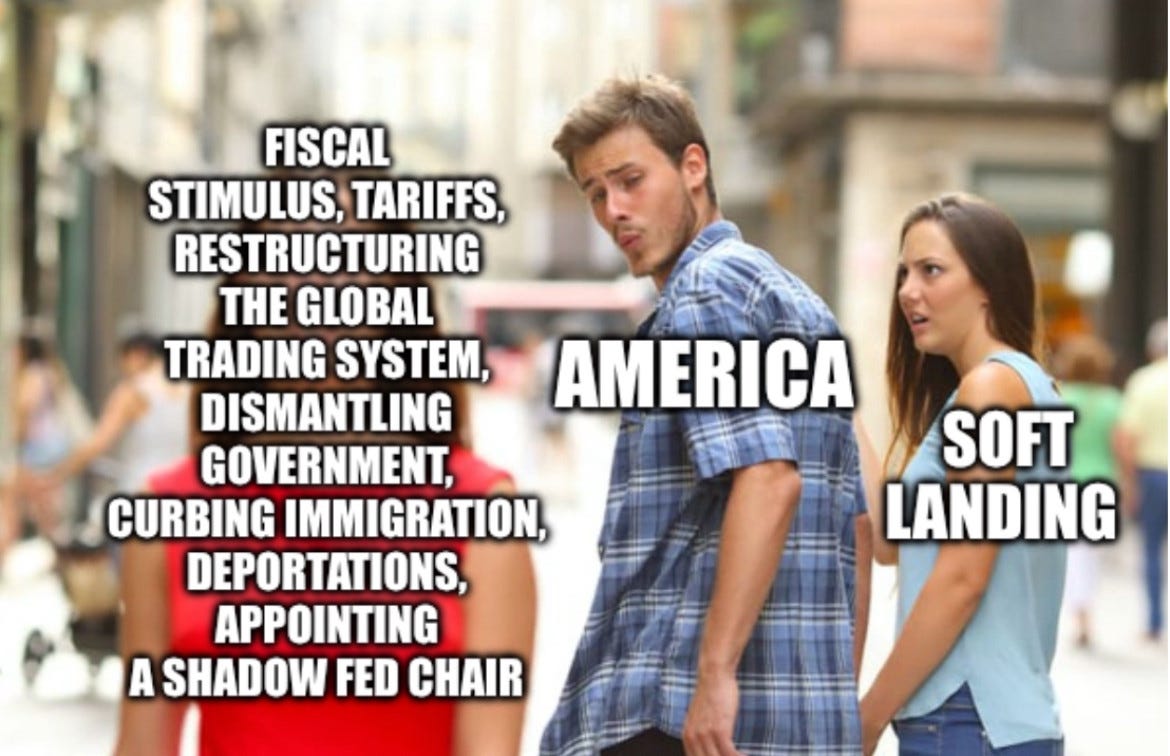

Chaos Dominance

Unfortunately, a policy platform of deportation, tariffs, tax cuts and undermining Fed independence is unlikely to improve the housing situation. A policy that does not raise the productivity of workers will not raise wages. There has been a bifurcation in many parts of the K shaped economy and new homes vs existing homes is just one example.

While existing home sales may improve in 2025 as folks come to terms with higher rates, permits to begin new construction are unlikely to improve substantially. The latest SEP reflects a higher core PCE estimate with fiscal policy assumptions included.

Source: @nicktimiraos.bsky.social

To make the outlook worse, the apartment construction boom is ending as multi-fam starts are unable to bounce.

Owner’s equivalent rent (OER) continues to glacially drop, but the lack of permitting will be apparent after the upcoming housing season. Services are high because house prices are high and permits are low because rates are high. Fun feedback loop. The root cause is housing and those only focusing on non-housing services are ignoring the housing affordability issue. Again, a recession would only worsen the housing shortage. Smaller builders will be the first to buckle during a slowdown.

Source: @jc-econ.bsky.social

Source: @jayparsons.bsky.social

It's unfortunate that OER is getting skewed by NY and CA. This is just another point of contention for cities vs rural as some younger generations feel left behind by the government. Dense cities need to figure out how to build and upzone.

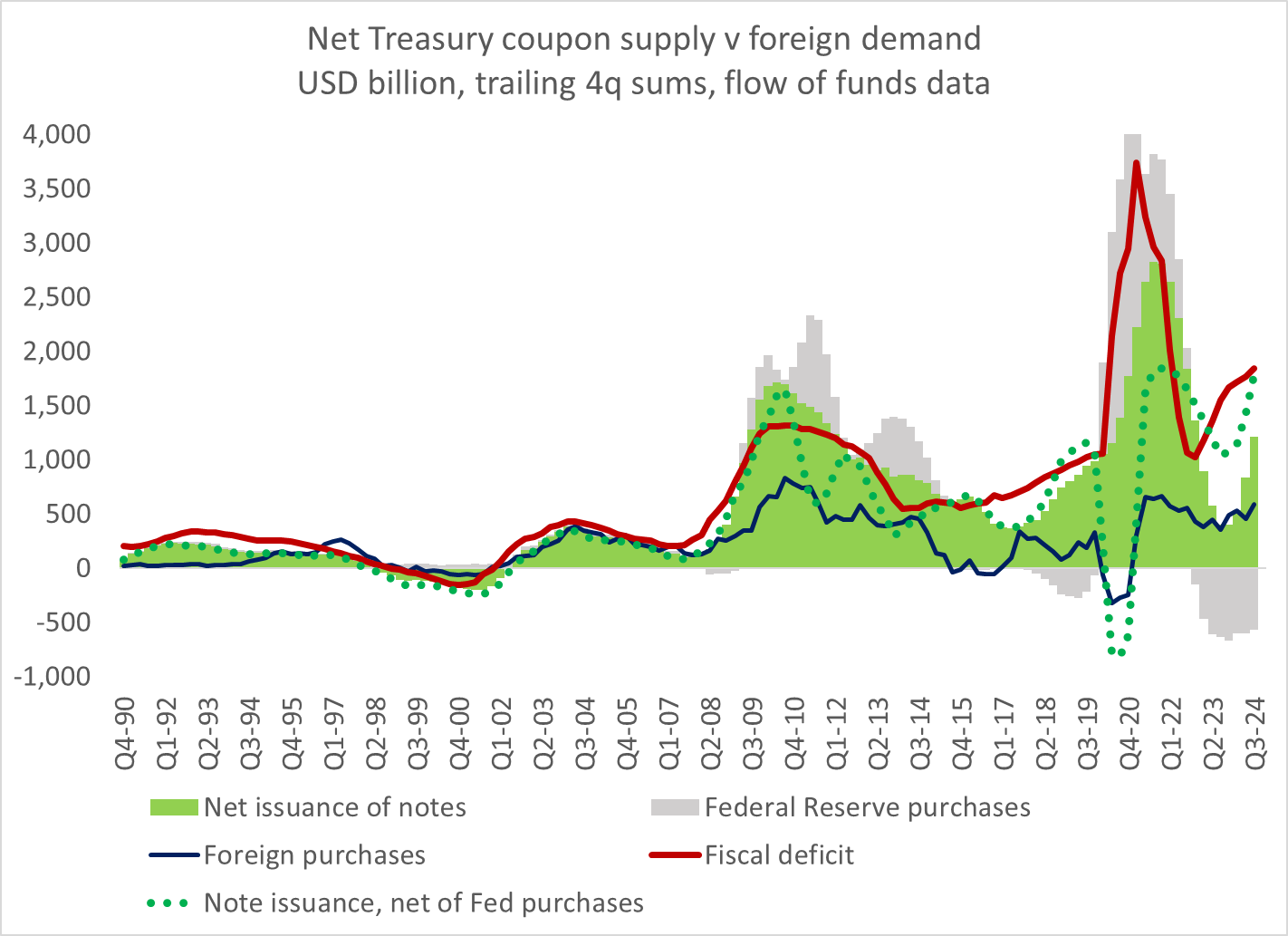

More people are going to be looking up term premium, bond vigilantes, and TBAC over the next four years. Can no longer make fun of bond bears after two years of fading them. While some millennials did choose poorly, Gen X/Z were the real culprits.

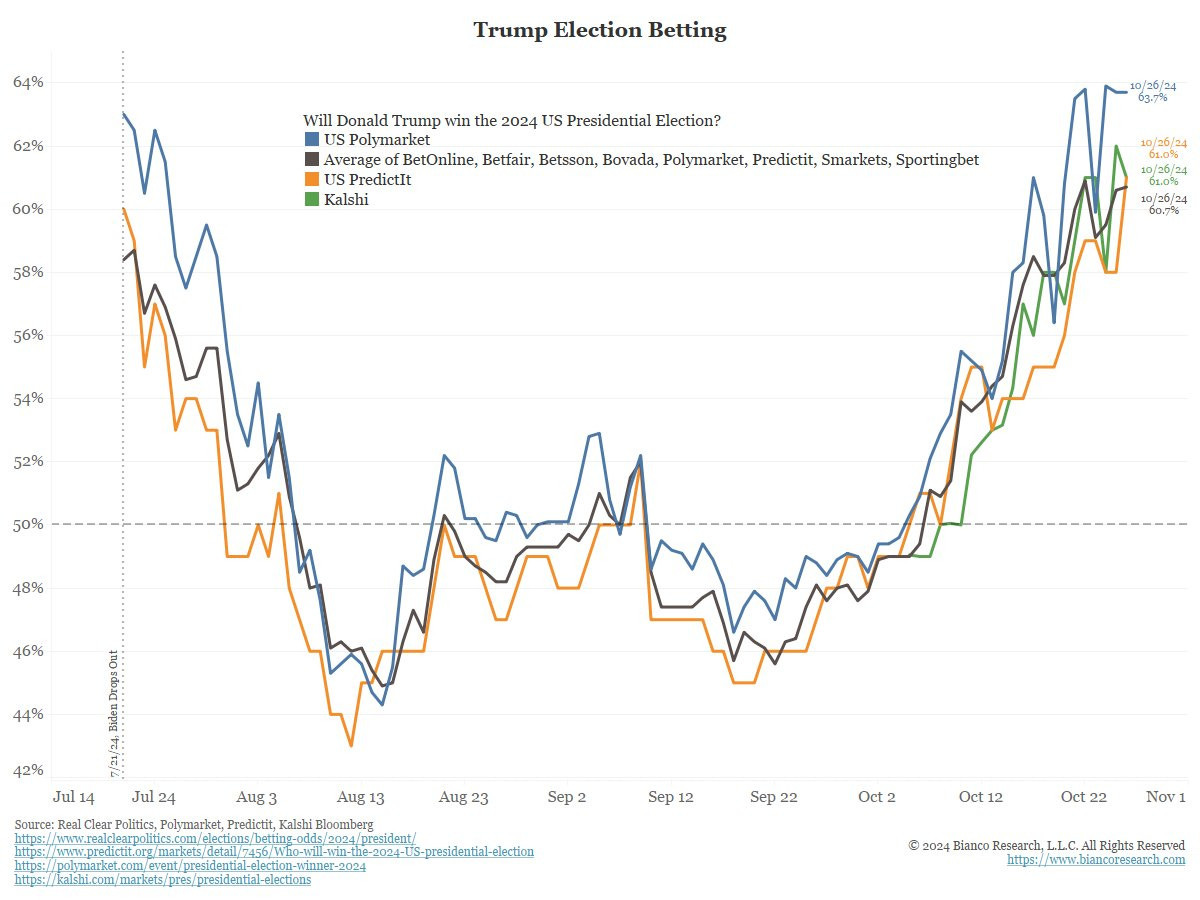

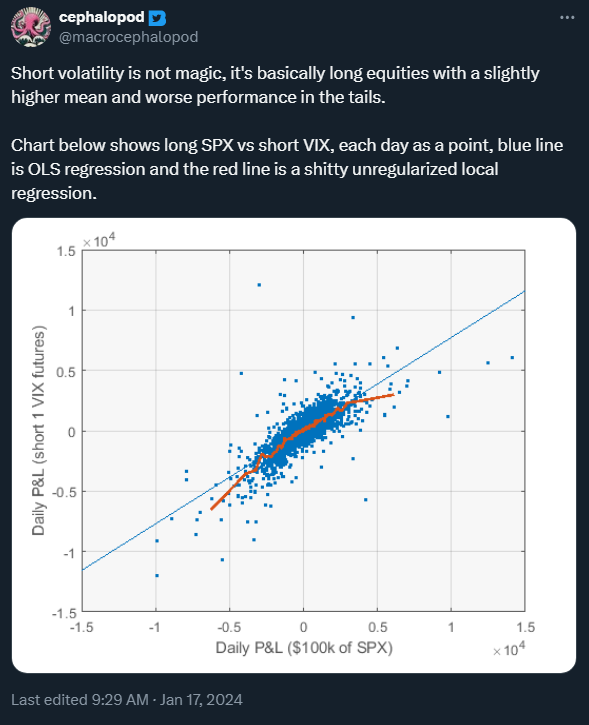

Up until mid October, the bounce in 10yr yields was due to growth scare dissipating. After that, it has been chaos dominance causing term premium to rise. Some folks are still overestimating the short end and underestimating the long end when it comes to monetary policy transmission. Chaos premium will apply to both equity and bond markets going forward.

The Scott Bessent Treasury pick calmed the bond market temporarily, but it did not last long. While recent data continues to show disinflationary growth amidst cooling labor market, yields have moved back to >7% mortgage rates. The tell will continue to be whether soft data is able/unable to lower long end yields. Inflation expectations will continue to dictate the correlation between equity and bond markets. I was originally hoping for QT ending to further reduce the spread between mortgage rates and the 10yr, but I no longer have that expectation as duration buyers may require higher term premium for the incoming administration’s policy aspirations.

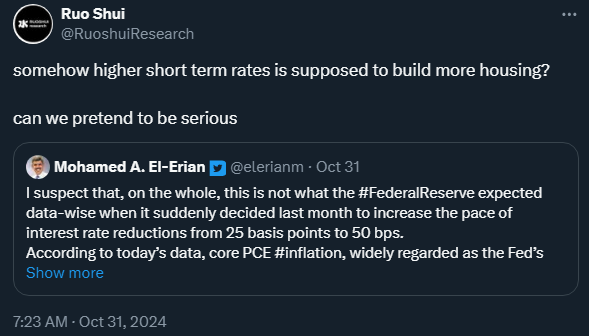

The “populist” governing “majority” is comprised of three main factions:

Boomers who always see Reagan when there’s a Republican in the White House (John Thune)

AI and regulatory capture tech bro (Elon Musk)

Anti-establishment and anti-vax bro (Robert F. Kennedy Jr)

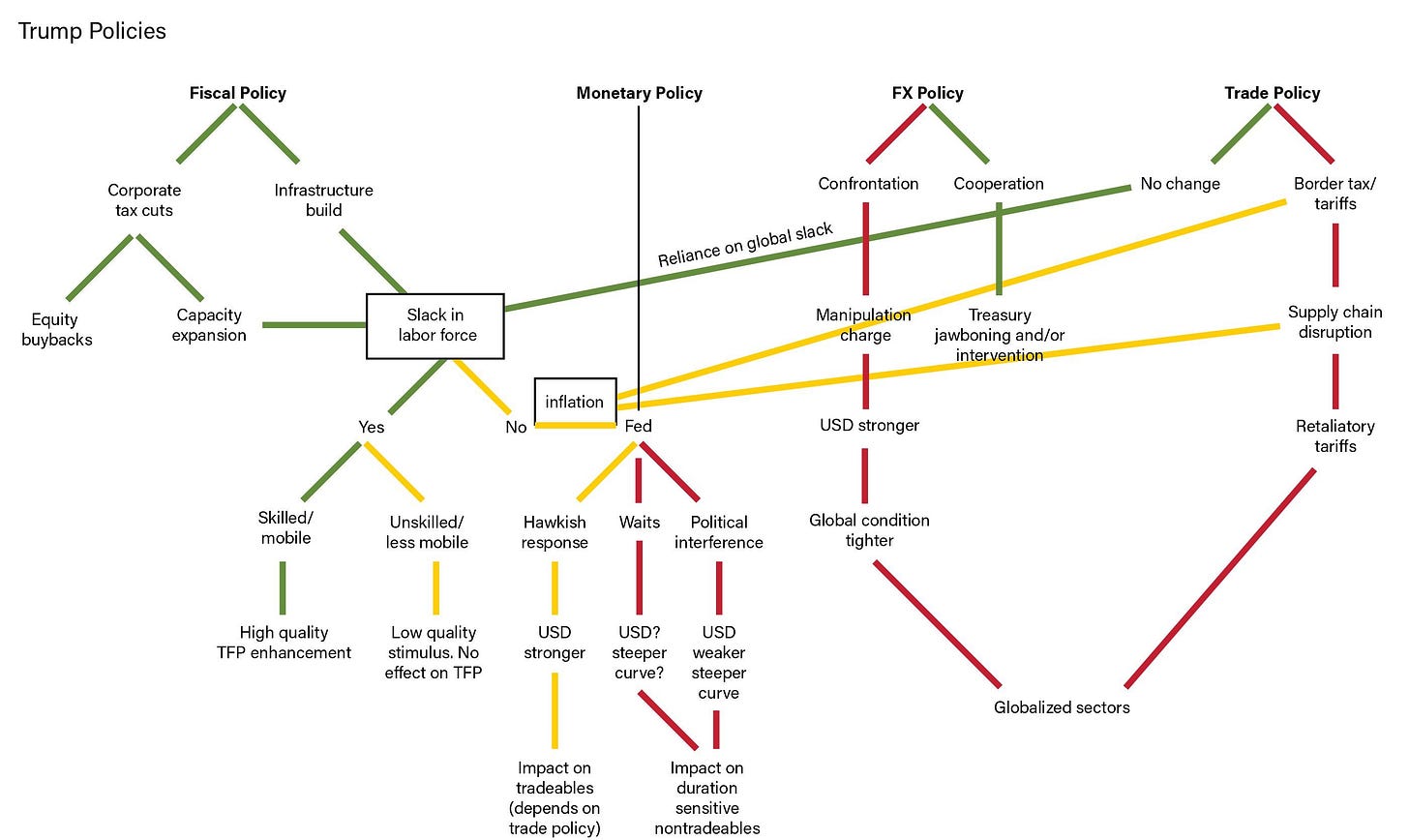

The timeline of fiscal policy is uncertain, but it is likely tariffs and deportations followed up by tax cuts and deregulation. Expect chaos. The only certainty is uncertainty. Market analysis that ignores fiscal policy should be ignored.

Tariffs and Taiwan are the best filters for political takes and make it easier to parse possible trade and globalization bias, and those views translate to views on the dollar reserve currency status and immigration. Reagan’s party is gone.

The Elon and RFK Jr. crowd are likely to go after the Fed and promote cryptocurrency at the cost of the dollar. Trump will likely eventually nominate a crypto bro Fed Chair and pressure Congress to upend Fed independence that will be bearish the current reserve currency. The impact will be felt by the rest of the world.

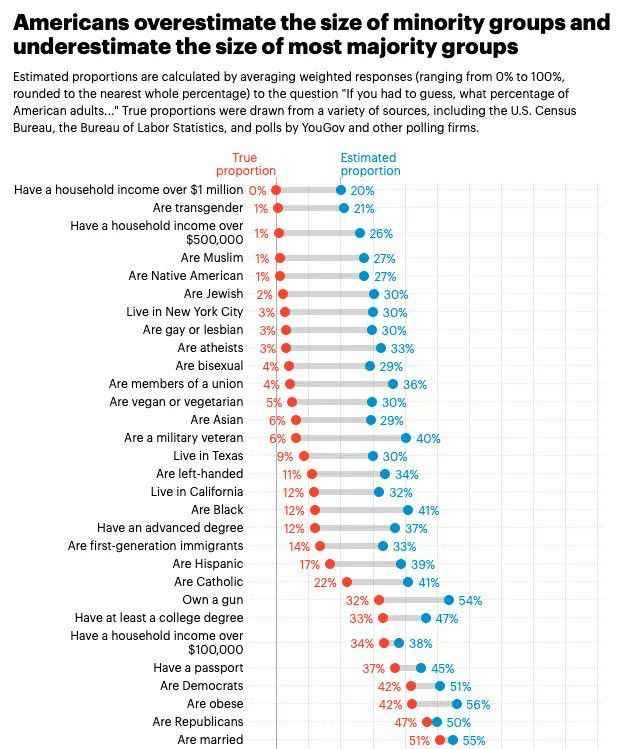

The US passport chart made me uneasy as Election Day got closer. This passport chart is “shining city upon a hill” and “land of opportunity” in chart form. In NFL terms, imagine how Carson Wentz viewed Howie Roseman drafting Jalen Hurts. That view probably overlaps with “white dispossession.”

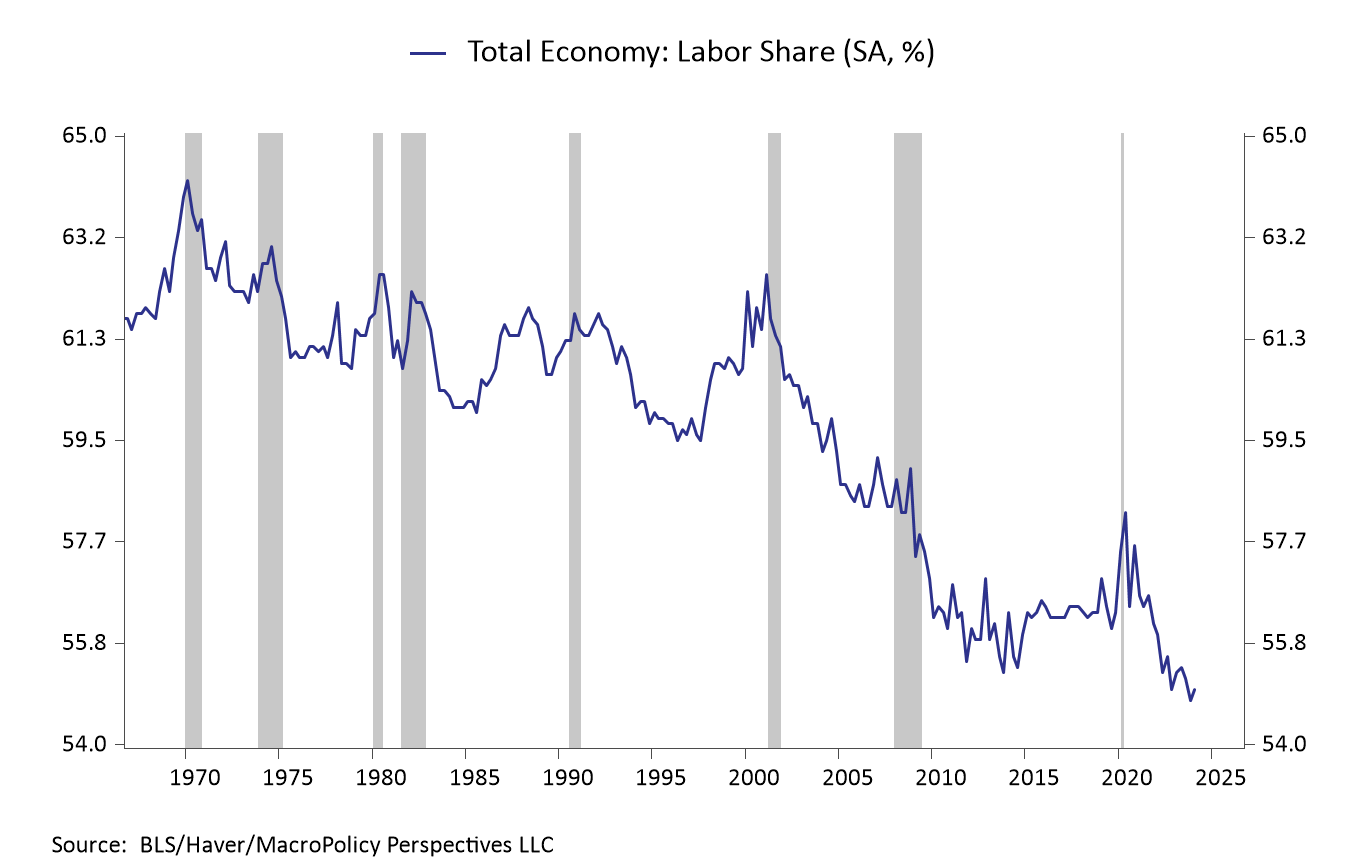

Most productivity bulls (including myself) argued that the higher productivity growth last couple years allowed for current levels of nominal wage growth that squared with the Fed’s inflation target. Where CFOs see revenue per employee, employees see profit sharing. The tale of of labor vs capital is as old as time.

Source: @jc-econ.bsky.social

What if People do not feel that we are tracking 3.5% q/q, 2.5% y/y productivity growth, a “real” growth rate that surpasses our peers.

What if four years of progress was not sufficient to negate the polarization from declining labor share of GDP going back to the dotcom bust

What if People blame globalization and immigration for the wealth gap

What if People blame the “establishment” for inequality, despite the Biden admin reversing decades of wage inequality and fighting for labor against capital

Source: @jc-econ.bsky.social

Source: @arindube.bsky.social

If a tree falls in a forest and no one is around to hear it, does it make a sound? If a tree stands in a forest and everyone heard it fell, does it still stand?

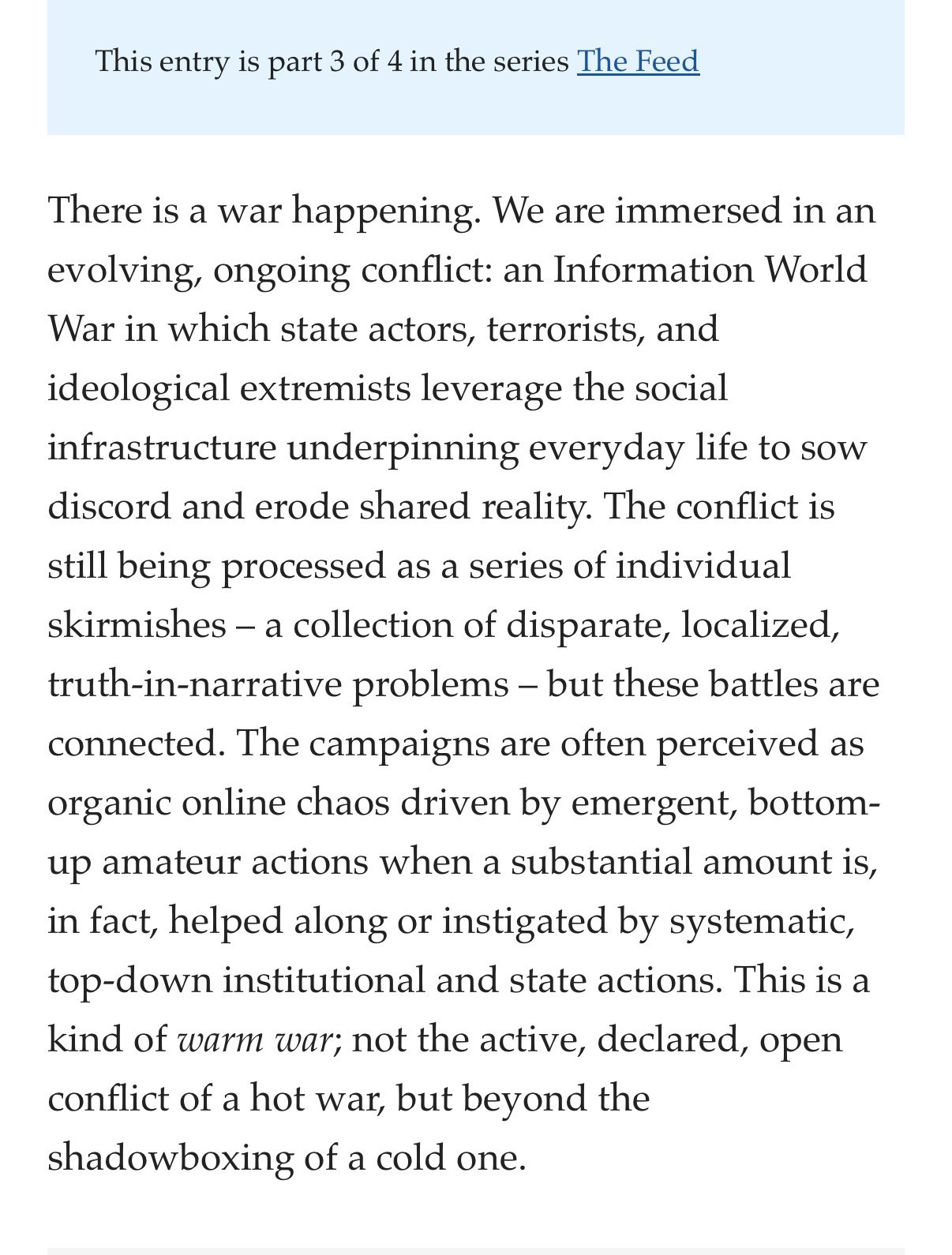

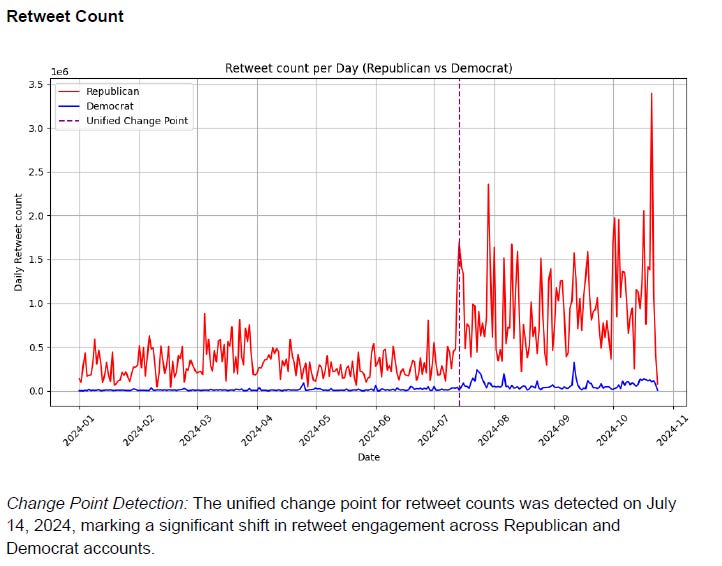

Bifurcated Information System

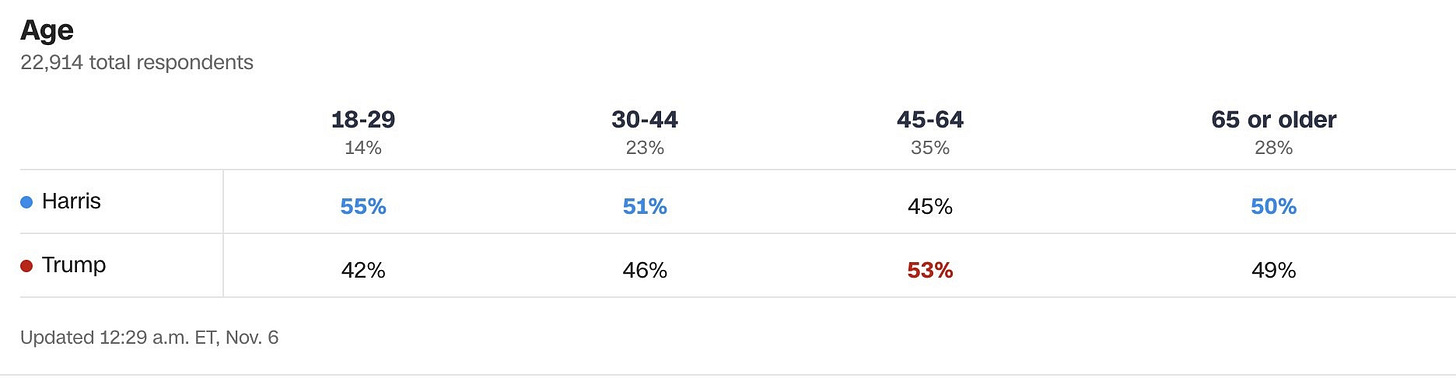

Trickle down economics is analogous to trickle down social media, especially when the biggest social media platforms have finetuned algorithms to reflect political bias. When election polls started coming out in 2023, there seemed to be polling errors and methodology bias as folks that were more likely to complain about the economy were likely Trump supporters. Sentiment surveys continuously had partisan bias, so some (including me) thought sentiment would improve as data made soft landing blatantly obvious and Fed started cutting rates. Hindsight is 20/20, but nearly everyone thought there were polling errors present and Biden still had a chance as the incumbent that guided the economy to a historical soft landing and brought upon the most successful pro-labor industrial policy in modern history.

The aftermath of the June debate cemented polls reflecting a different perception of reality and “truth” had become relative. The “vibecession” was very much still alive despite the soft landing. This is largely driven by how news and information was being distributed and consumed. Legacy media has lost millennials and Gen Z. Biden’s press conference at the NATO summit only confirmed this view.

Facebook and Instagram (by extension Threads) are politically “neutral” and are focused on an engagement algorithm that prioritizes monetization instead of real-time news while throttling political content. Meanwhile, Tiktok is filled with even more engagement bait and inaccurate “truth.”

The Twitter algorithm has changed. Anyone saying otherwise is pretending to be oblivious. In addition, the search function deterioration is the platform’s attempt to reduce accountability. The magic of Twitter was that it was just a pile of receipts.

More and more people became aware of the Twitter algorithm change over the summer, but it was already too late. News fatigue is real, but volatility was elected over stability and the internet played a big role.

Source: @noupside.bsky.social

Source: https://eprints.qut.edu.au/253211/

Joe Rogan was not going to change his mind. Anyone saying otherwise has not been paying attention. The pandemic riled up “libertarians” that do not know what the Constitution stands for, how the government works or why the scientific method was proposed. Entropy has been increasing.

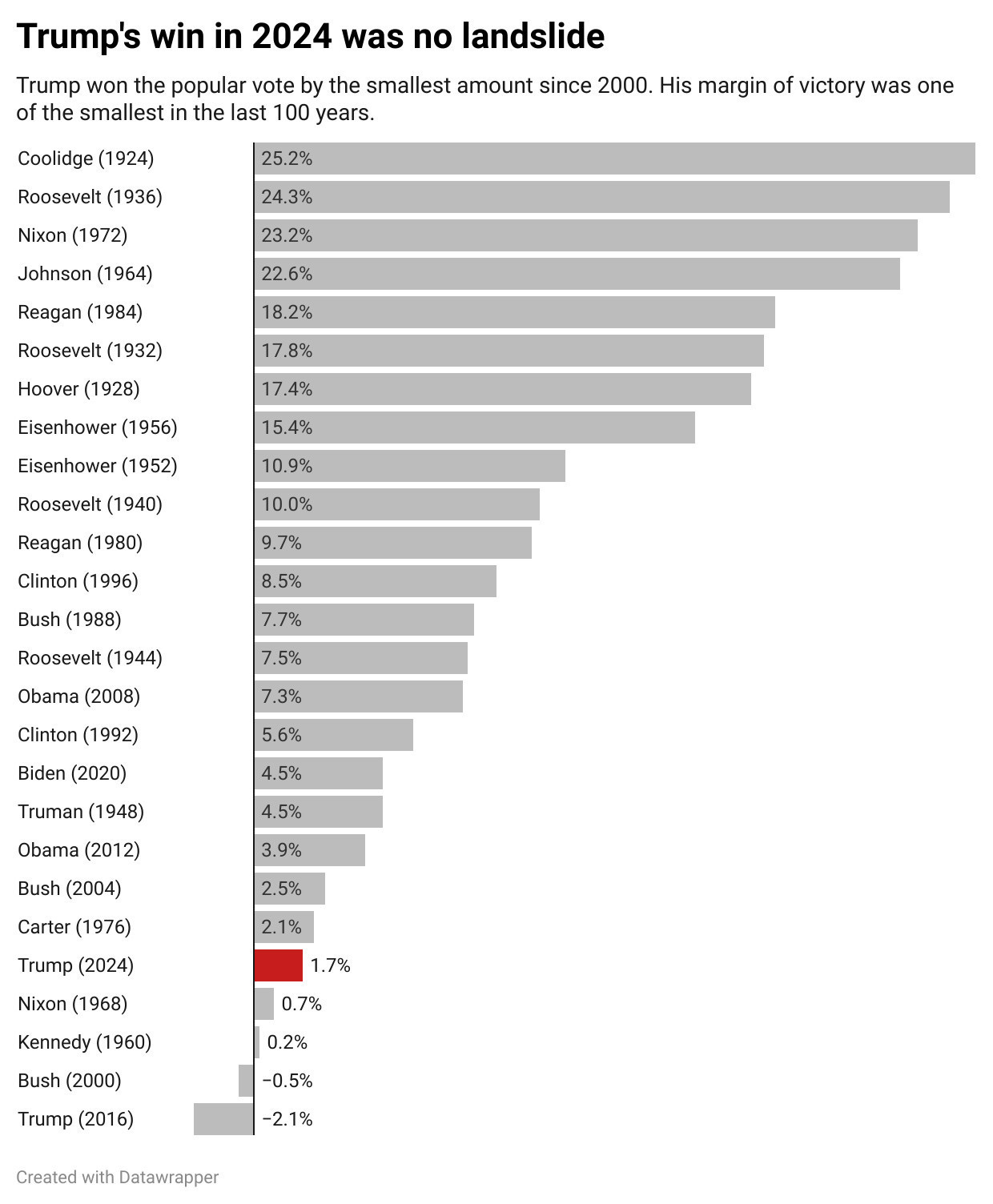

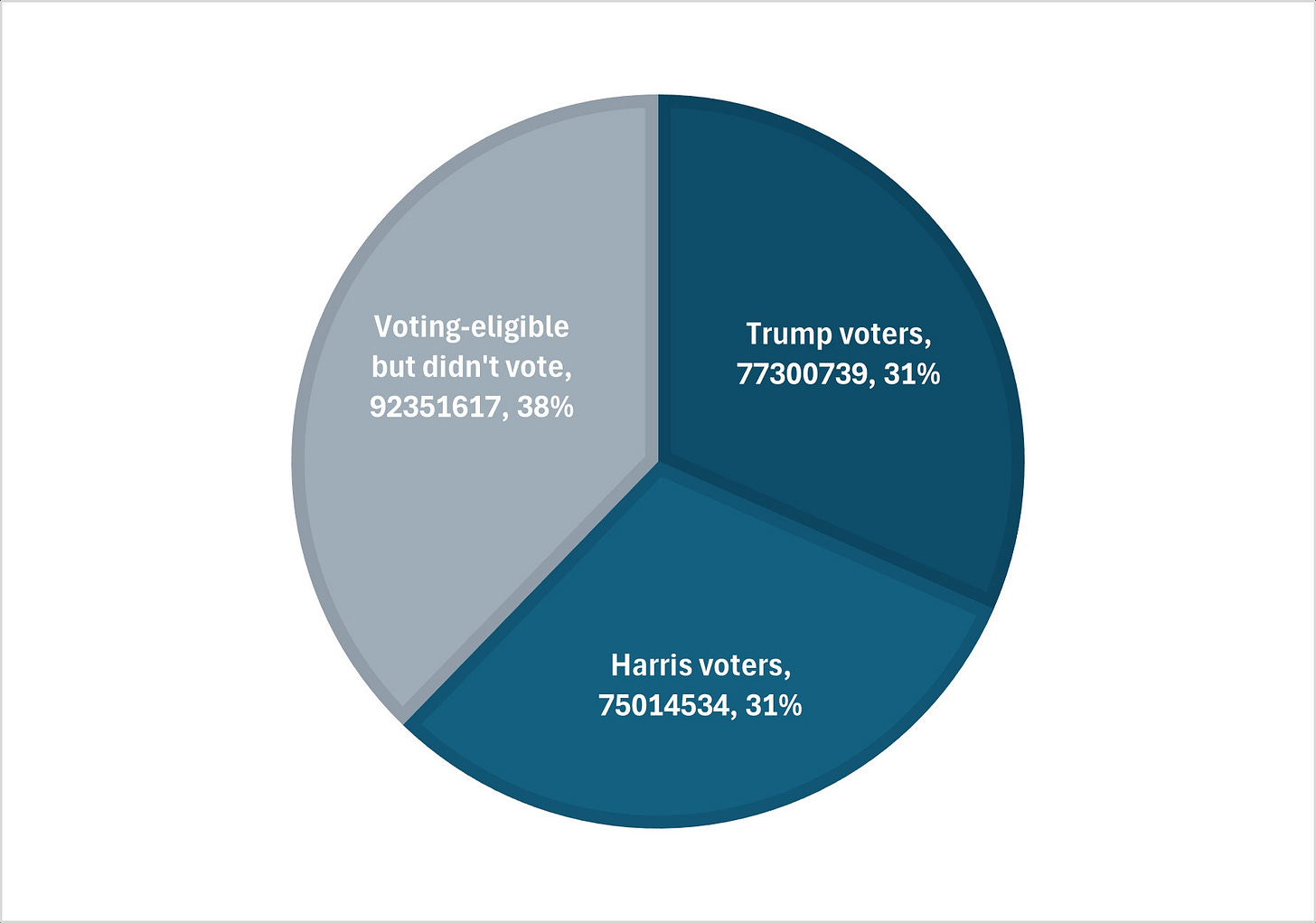

The election was no landslide. Of the 244+ million voting-eligible population:

31.5% voted for Trump

30.6% voted for Harris

37.7% did not vote

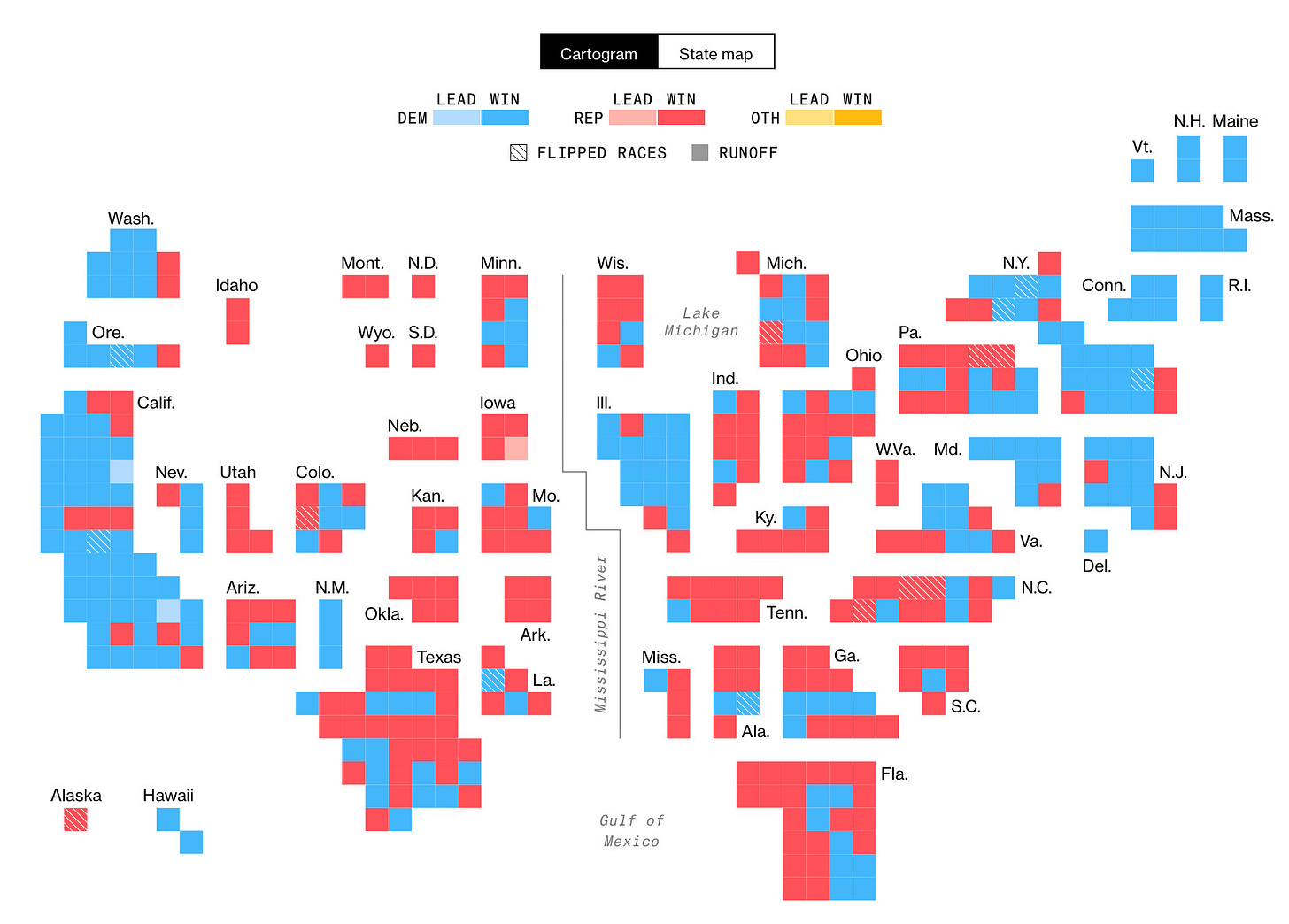

It took an election loss where the House Democrats fell 7500 votes short of winning the majority (NC gerrymandering success story) for people to wake up to the broken information system and apathy.

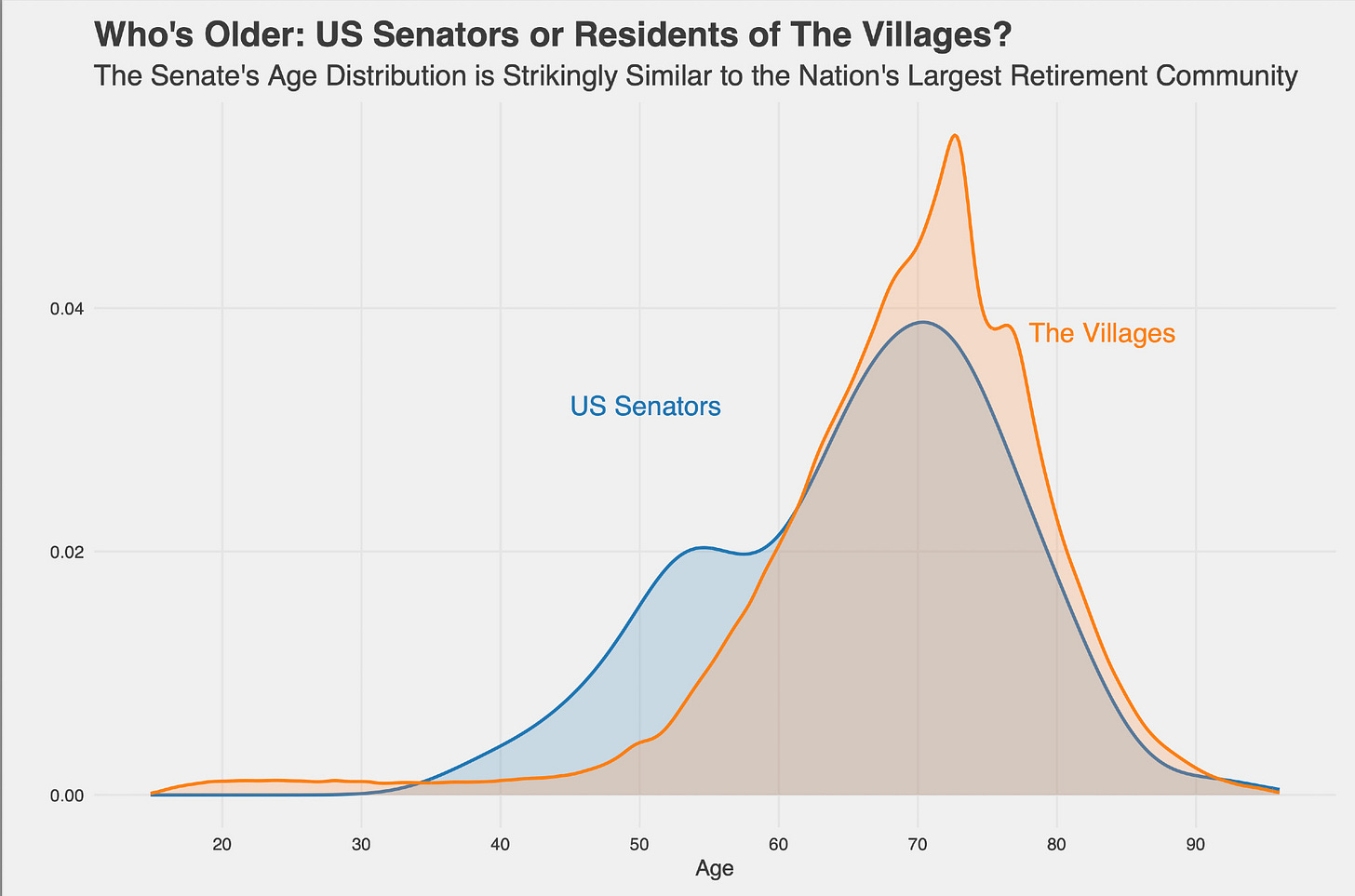

There is a generation gap between Congress and the People. The age distribution of Senators is almost identical to The Villages, the largest retirement community in the U.S. I used to complain miscommunication plot is the worst writing trope. Not anymore. The communication gap is cross-platform and multi-generational.

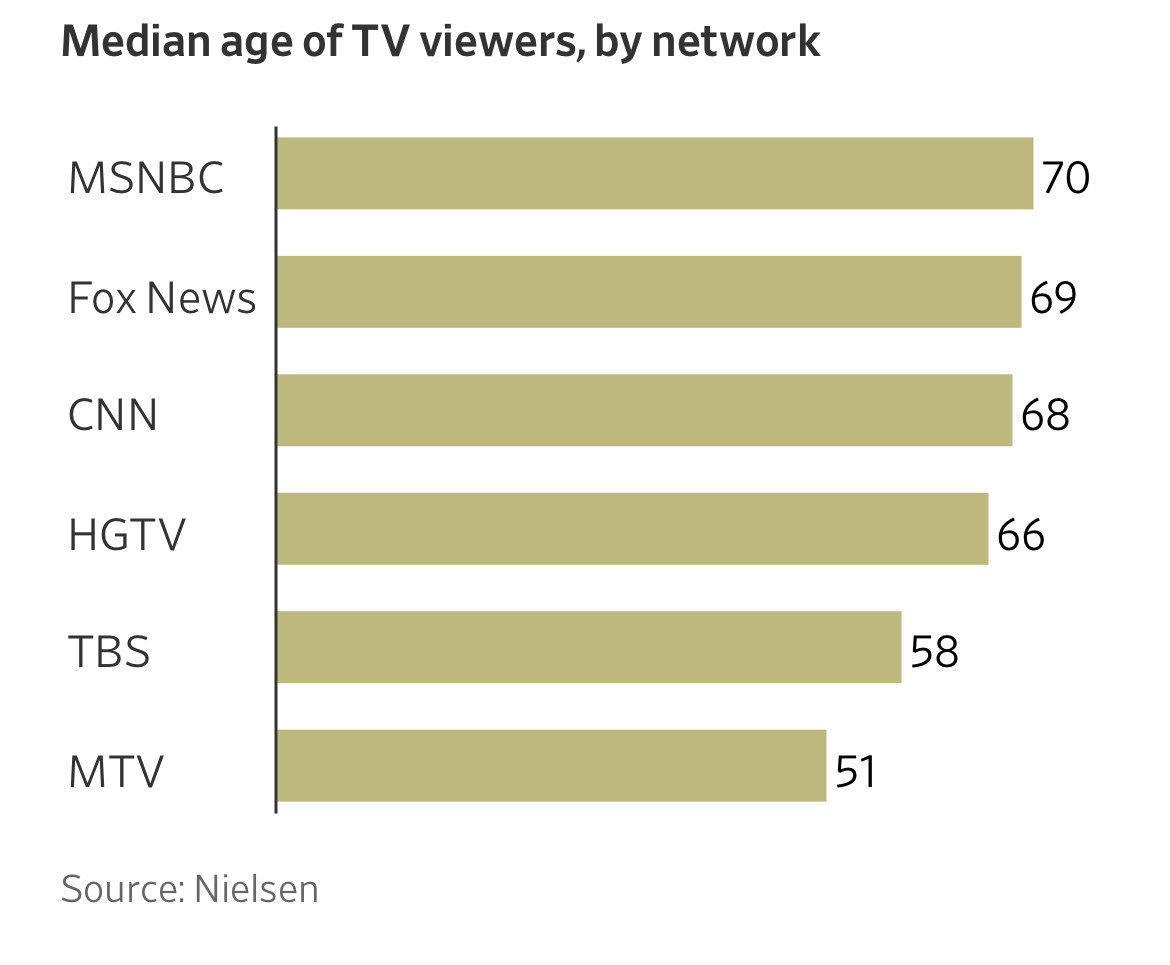

At least the Washington Post and Wall Street Journal produced some neat charts for legacy media after the election, showing a spry median age for TV viewers.

Source: https://www.wsj.com/business/media/new-media-social-media-presidential-election-591b0644

A while ago, I turned off engagement metrics on Twitter and relied on number of mutuals to “vet” a post before reading. In case it wasn’t obvious, the Twitter account was locked halfway through this entry and will be used to only monitor ZIRP enthusiasts. That’s the line that is being drawn by those in the finance world opting to avoid discourse in the good place. For obvious reasons, “good” is relative.

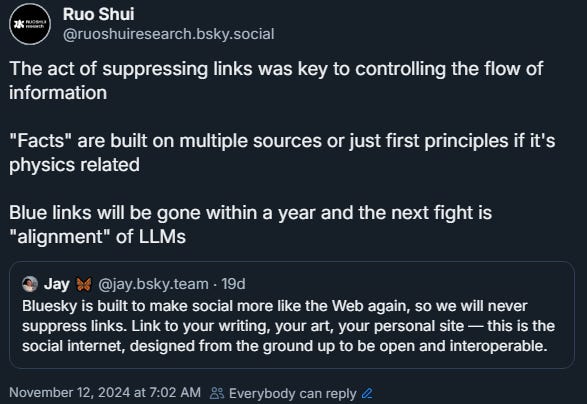

Google searches are being replaced by “social" searches and LLM searches. Social searching makes the assumption groupthink is "good." "Facts" are built on multiple sources or just first principles if it's physics related. Footnotes, sources, labeling and vetting is going to be more algorithm driven than before. Blue links will be gone and the next fight is "alignment" of LLMs. There are some folks that wouldn't mind a parallel universe where Internet Relay Chat (IRC) instead of HTTP became the dominant protocol for information exchange. There's a pivot happening after HTTP dominating information exchange since its dotcom inception.

“Education” is in the form of social media, podcasts and discord now. It was wild seeing how many people were calling for a “Dem” Joe Rogan. That used to be Jon Stewart. Maybe Kylie Kelce can rise to the occasion.

Source: https://backlinko.com/podcast-stats

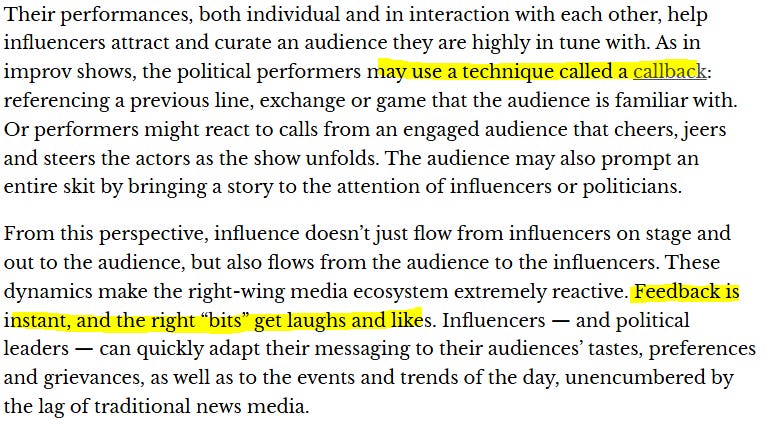

The success of the “persuasive” improv communicators has gained “trust.” But, that “trust” is transitory. The shortened attention span and memory is nonpartisan. Callback works as long as no one can use the performer’s own quotes against them. Accountability and trust go hand in hand. Facts do not cease to exist because they are ignored.

Source: https://theconversation.com/how-right-wing-media-is-like-improv-theater-243665

Prescient warning from Carl Sagan in Demon-Haunted World (1995) about the dumbing down of America:

I have a foreboding of an America in my children's or grandchildren's time -- when the United States is a service and information economy; when nearly all the manufacturing industries have slipped away to other countries; when awesome technological powers are in the hands of a very few, and no one representing the public interest can even grasp the issues; when the people have lost the ability to set their own agendas or knowledgeably question those in authority; when, clutching our crystals and nervously consulting our horoscopes, our critical faculties in decline, unable to distinguish between what feels good and what's true, we slide, almost without noticing, back into superstition and darkness...

The dumbing down of American is most evident in the slow decay of substantive content in the enormously influential media, the 30 second sound bites (now down to 10 seconds or less), lowest common denominator programming, credulous presentations on pseudoscience and superstition, but especially a kind of celebration of ignorance”

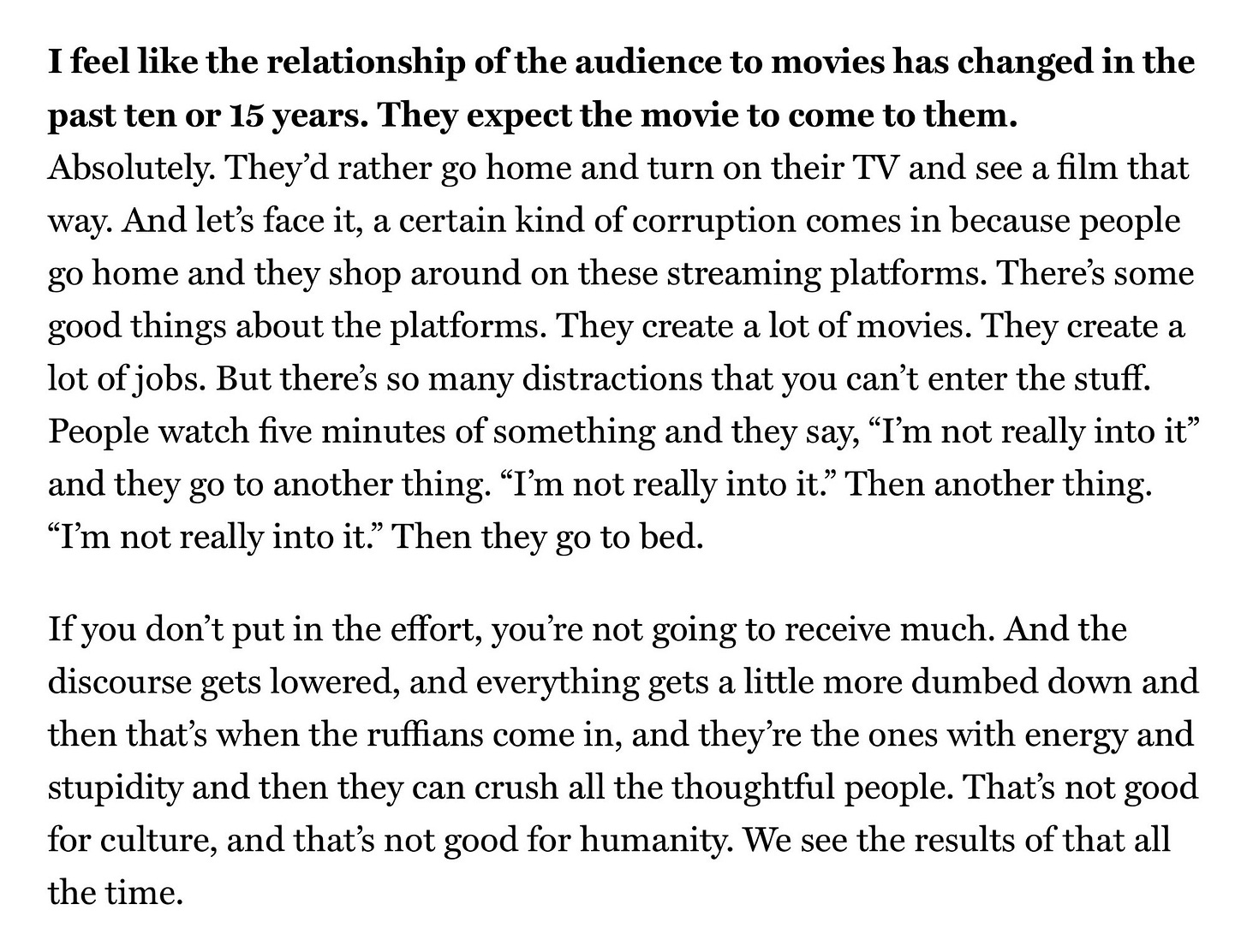

Willem Dafoe echoed similar sentiments while reflecting on movies over the past decade coming to a similar conclusion about discourse getting lower and being dumbed down:

Source: https://www.vulture.com/article/willem-dafoe-in-conversation.html

And we have the “Hawk Tuah Girl” personifying this theme and summarizing the 2024 US economy and election. Going viral requires a certain level of dumbing down and having fun, but that does not mean it always ends well.

The Economist charted Elon Musk’s Tweets. Not rocket science to see how and when Elon started switching sides.

The “digital town square” is gone. Immigration was often the tweet theme of choice regardless of time of day.

The whole Latino immigrants would vote for Democrats thing really backfired if that was the plan (it wasn’t).

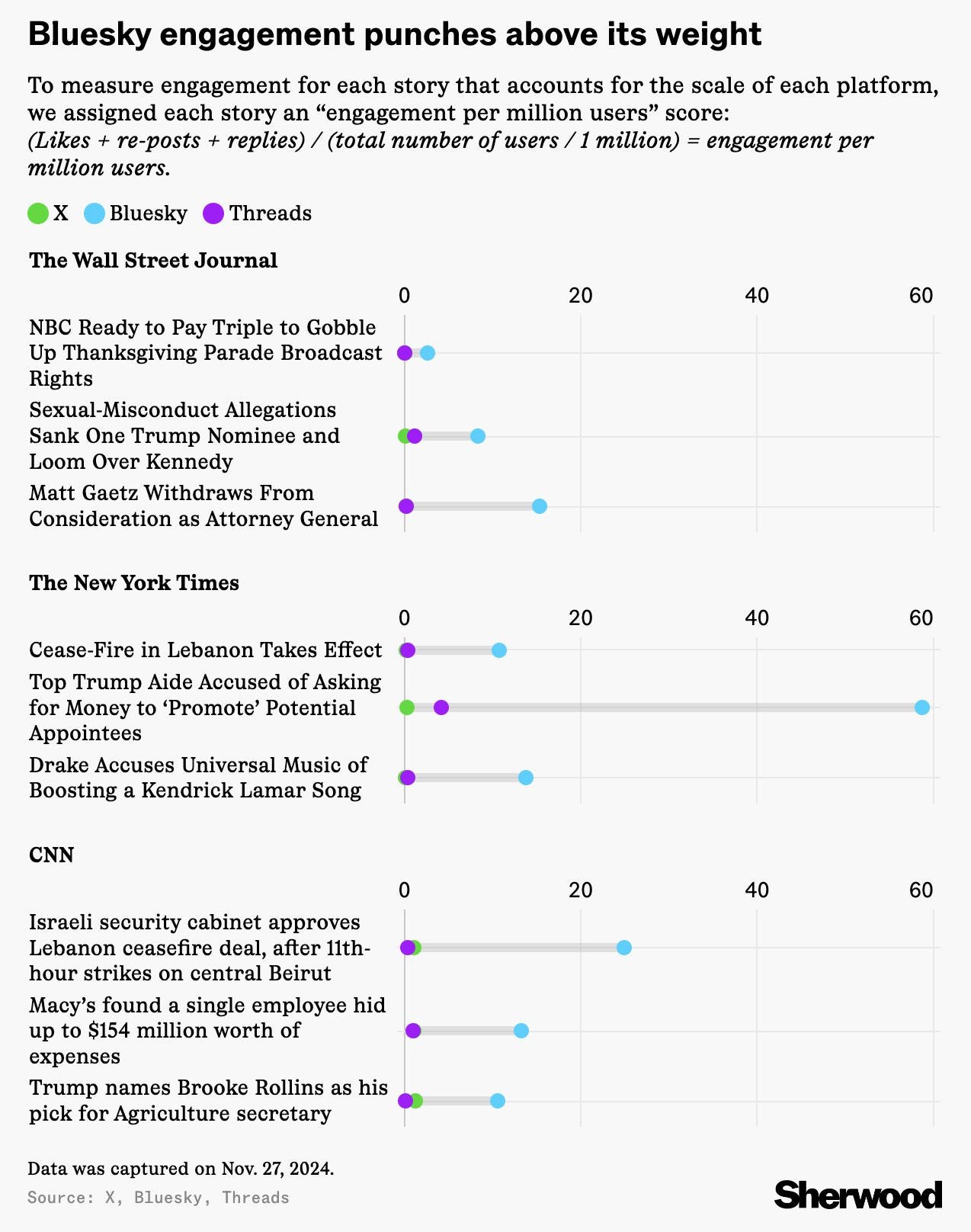

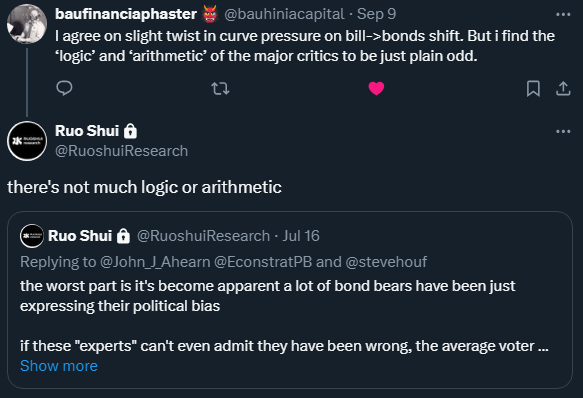

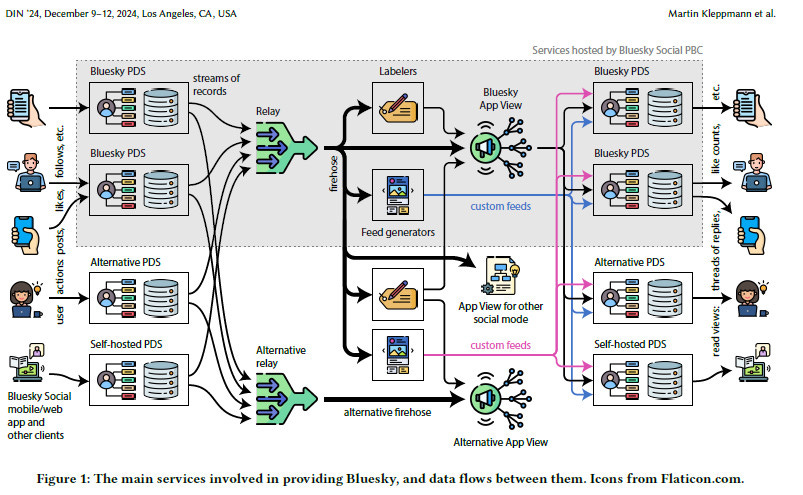

Maybe a bifurcated social media was meant to be, matching a bifurcated economy. Folks are missing the point of the migration to Bluesky if they're still talking about “echo chamber.” Not surprising there is a large overlap with folks in the financial world that used the words “myopic”, “irresponsible”, “mistake”, “boxed in”, and “dumb” to describe monetary policy. Just so it’s clear, these folks have been wrong about markets for two years straight.

AOC knows exactly what she’s doing and she is very good at it. She solidified support for Harris and prevented a disastrous schism, although there were people turned off by no primary. And now she’s solidifying Bluesky as a platform as the first user to hit 1M followers. It is a shame Pelosi blocked her bid for the oversight committee.

One should not usually explain society in two words, but when necessary use "pareto distribution." Bluesky is a good start for improving the information system as the conversationalists, folks that engage in actual debate and discourse were the first ones to migrate. Reddit and twitter will pick up Bluesky screenshots and more people should become curious. User growth is slowing, but I am optimistic that core users are able to drive daily discourse. The harder part is distribution of the message to the masses that are not as engaged and largely apathetic about politics until it affects them personally.

For breaking news, Bluesky is winning. The martial law in Korea did not last very long, but folks followed it live and it was clear the platform had hit critical mass. In case people were worried the coverage was skewed by folks that generally care more about democracy, many breaking events have been covered live on that platform since. One thing that I have noticed is the AI community is not as robust yet. There is actually a decent amount of automatic AI skepticism and/or outright rejection. This is not the right way to approach the technology as it will leave some folks behind the technology curve. The technology is real.

With better engagement, journalists that actually believe in sourcing references joining was just a matter of time. The higher engagement reflects folks that drove discourse in the “digital town hall” moving. Broadcast accounts can choose to post across the aisle, but the town hall has moved and a quick look at replies is all one needs to confirm this.

This screenshot is funny and sad at the same time.

Even ignoring the better engagement metrics and how the old digital town square has become a platform of “link in bio” and a propaganda machine, some folks just want to post and discuss without getting harassed. Views that lean conservative are prone to receive less “likes” but there are plenty of moderate voices.

Some people have been searching for an alternative for a while, but they just did not know where to go. The migration was relatively straightforward, once it was clear misinformation affected the election again.

In football, there are referees. In media, there are algos and negativity bias and bots. It needs to be pointed out ceding digital space is not the same as surrendering principles. It is better framed as fortifying the defensive line and strengthening the core policy platform. There needs to be a public space for finetuning messaging without being swarmed by bots. Christian missionaries shaped America’s commitment to international development, and there will be a need for Democrat leaders that are willing to fight and debate on the Joe Rogan Experience, Twitter, and Fox News.

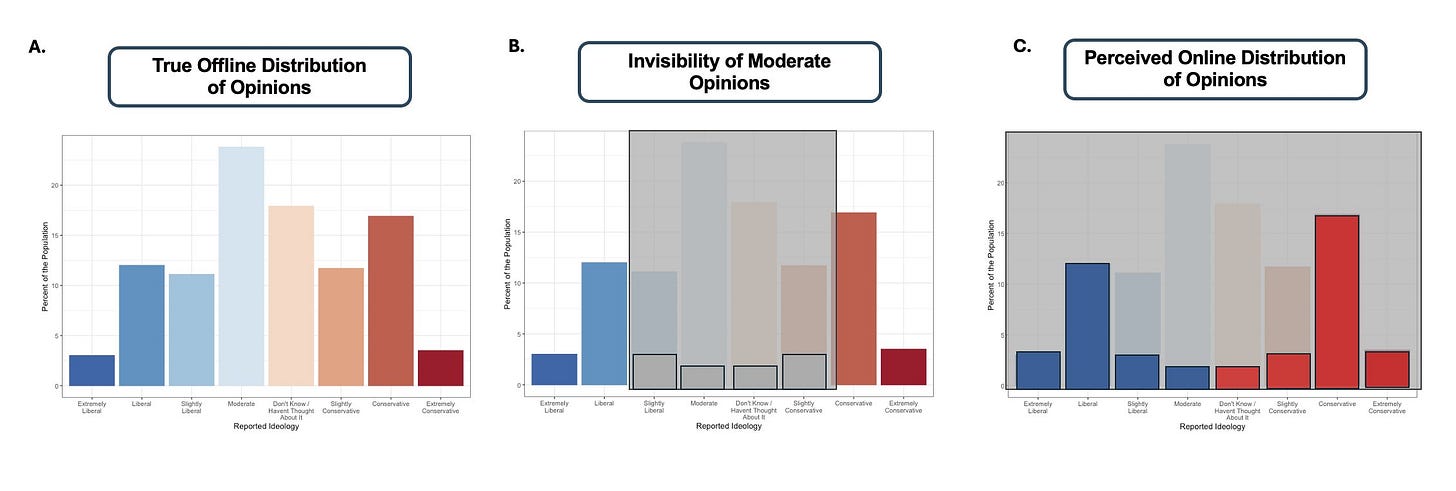

Social media is distorting our perception of social norms, by making moderate opinions practically invisible and over-representing the most extreme voices. Moderate opinions are not “entertaining.” The nature of becoming viral is what got us here, as people overweight pathos induced ethos and underweight logos.

Source: https://www.sciencedirect.com/science/article/abs/pii/S2352250X24001313

The biggest benefit of Financial Twitter (FinTwit) was mapping out the distribution of competing opinions:

For traders, this is understanding expectations and the probability distribution then taking a position out of consensus

For Fed, this is understanding how rate sensitive sectors respond to the yield curve then estimating the time lag between demand growth and supply expansion

Groupthink and being consensus does not provide any edge. That’s just market performance. Twitter loses its value when one tail just becomes Trump/Elon tweets and the entire platform echoing and agreeing with that position.

Given the social pressure to conform, people will literally say the truth is a lie and a lie is the truth, right is wrong and wrong is right, up is down and down is up. People will disregard what they see with their own eyes to conform to what other people say, especially so with an algorithm dialed all the way up for negativity and conflict.

This is a similar phenomenon to “doomers” and “permabears” who have a significant following despite being constantly wrong. Zerohedge has 2M twitter followers.

Negativity bias seems to be nonpartisan. Legacy media chasing click baits and social media monetizing negativity has been a net loss for society. Not even sure the “social” part applies anymore to most platforms.

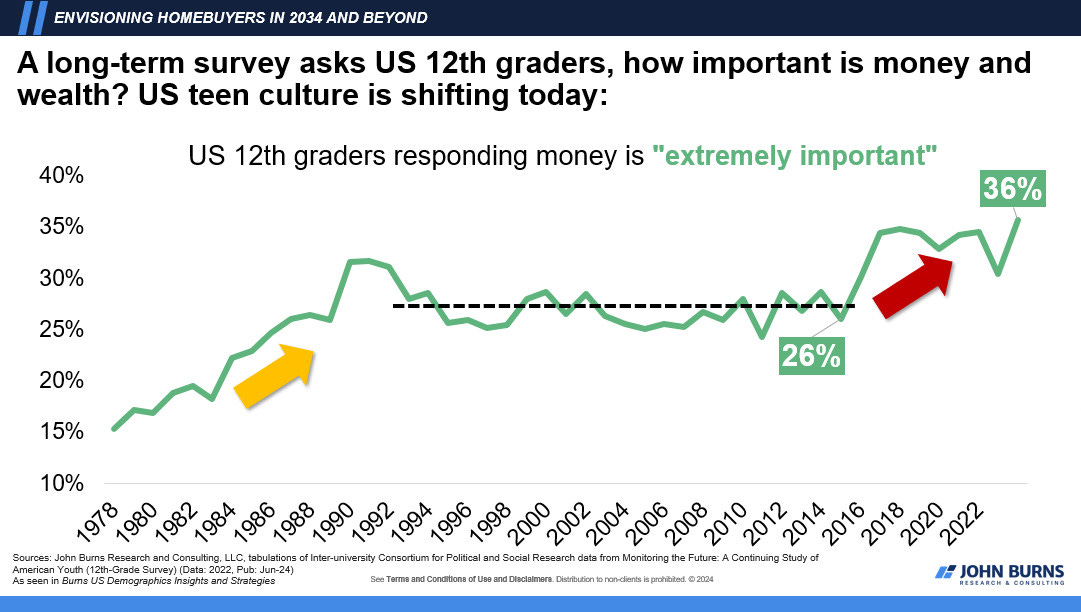

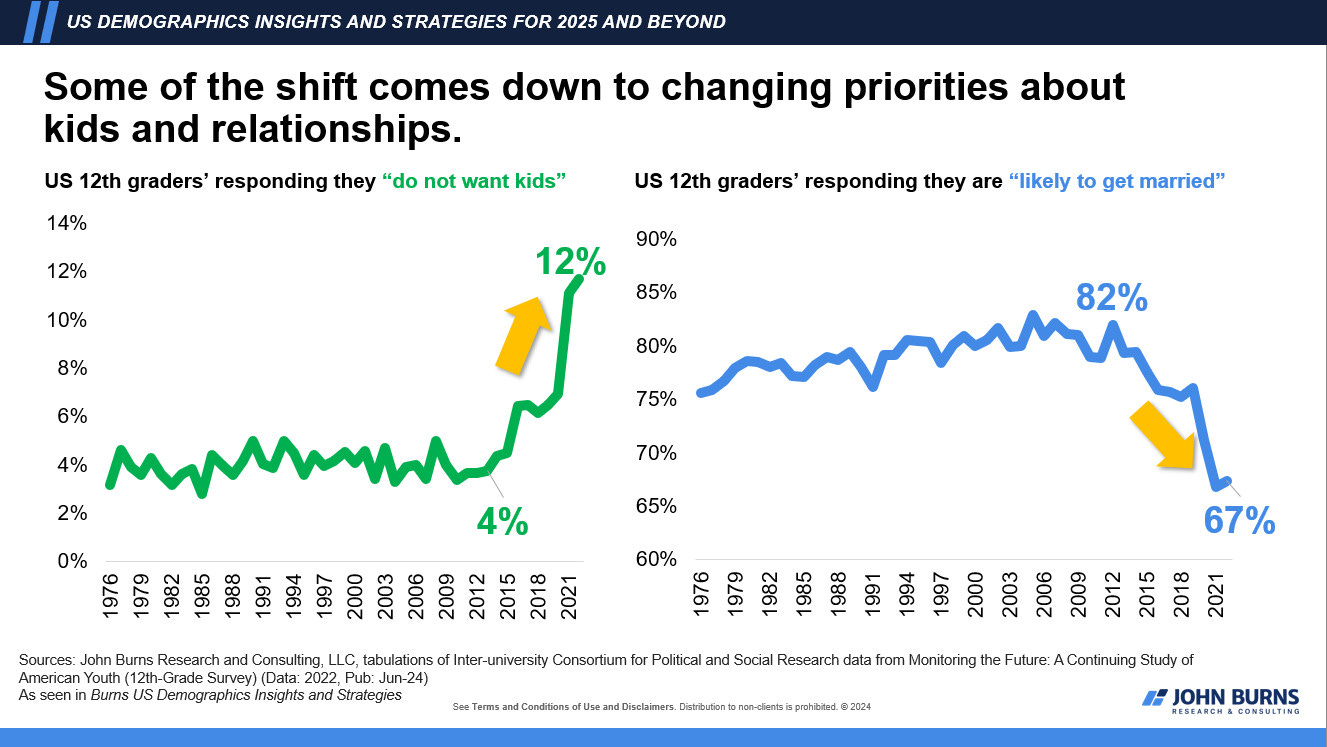

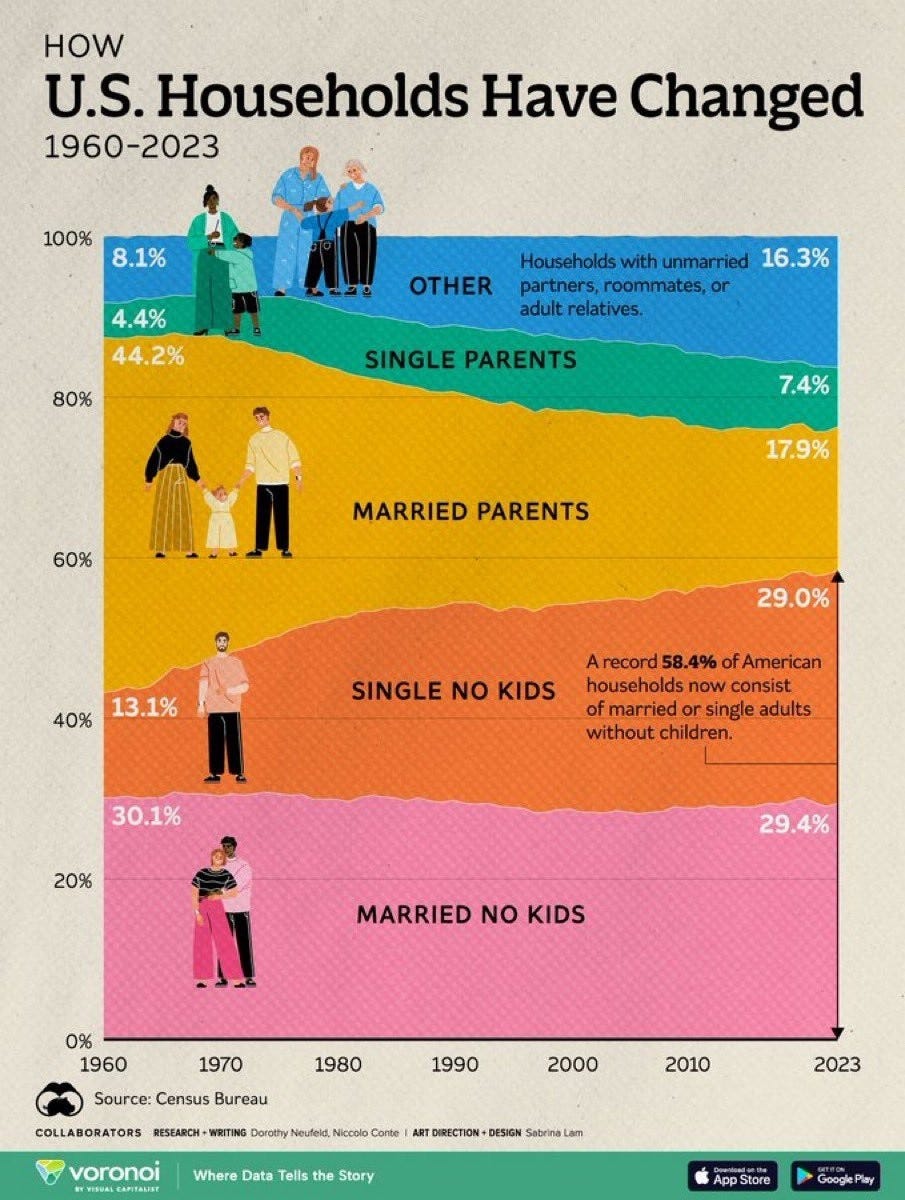

The monetization of negativity has contributed to Gen Z becoming the most money-centric generation we have seen. Their priorities are just different, and they are more about money, less about kids, marriage, or family.

Source: @ericfinnigan.bsky.social

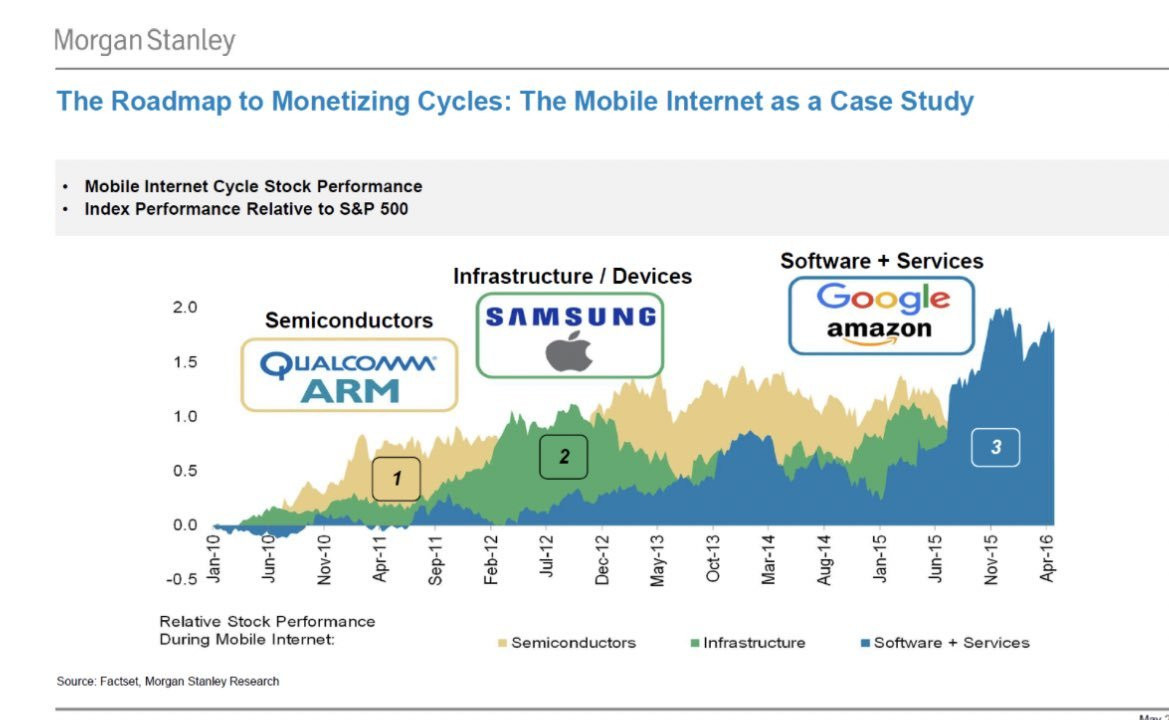

Mobile internet is likely to be categorized as one of those great for stocks, but maybe not so great for society things.

It is easy to see the benefit of waiting until high school for a smartphone and there is merit to delaying the age of first smartphone. It is no secret notifications are designed to trigger a dopamine release.

Source:

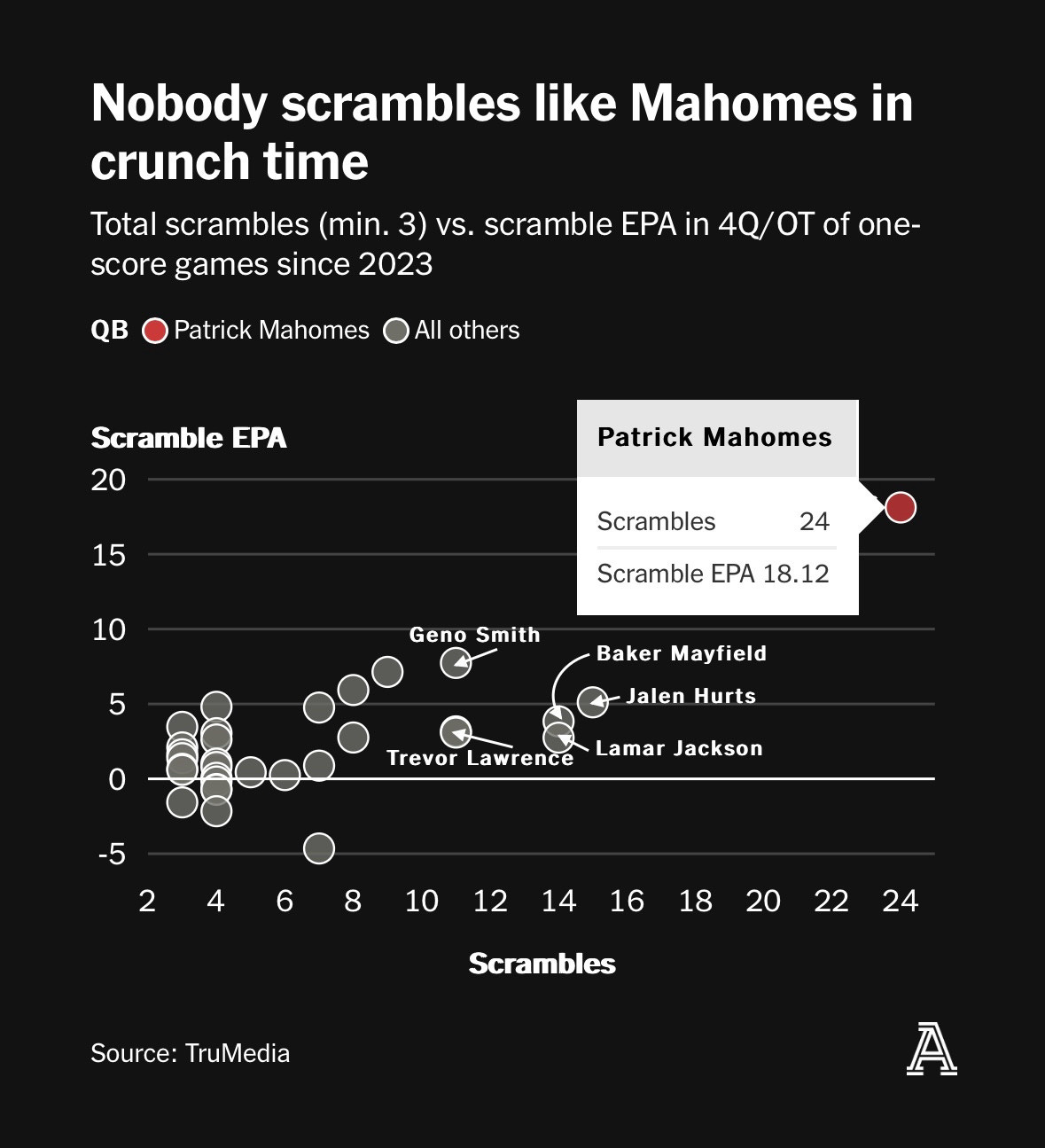

Patrick Mahomes is a great QB, but is he really someone we should be taking insurance advice from? I love Big Red, but come on.

Some people keep arguing about whether Dems should move right or left. The larger takeaway from the past several cycles isn't policy, it's that people's politics are deeply inconsistent and we're all highly susceptible to marketing, advertising and propaganda. Relatability and memeability are engagement metrics and determine whether a voice is heard.

Source: https://www.ipsos.com/en-us/link-between-media-consumption-and-public-opinion

For new parents, this thread is worth going through. The “lofi girl protocol” is an effort to condition kids that screens are “boring” and phones are just used to call people while encouraging physical play. The risk is children discovering smartphone functionality on their own and think negatively about the conditioning process. The risk vs reward here seems favorable though. Many millennials grew up in the age of Nokia bricks and Motorola razrs, and the ones just trying to form households and raise kids turned out mostly fine.

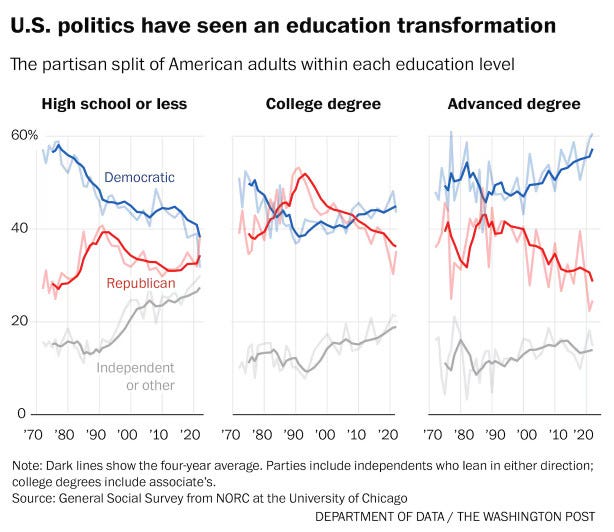

Social media and “education” go hand in hand. Education is a two way street and the bifurcation from “education” needs to be addressed. Curiosity requires nurturing and apathy is the opposite of curiosity. The partisan split by education level is not sustainable and knowledge is not going to magically trickle down. The incoming governing majority is actively trying to attack the Department of Education to further affect how “knowledge” is distributed.

Source: https://www.washingtonpost.com/business/2024/11/15/educational-divide-american-politics-trump/

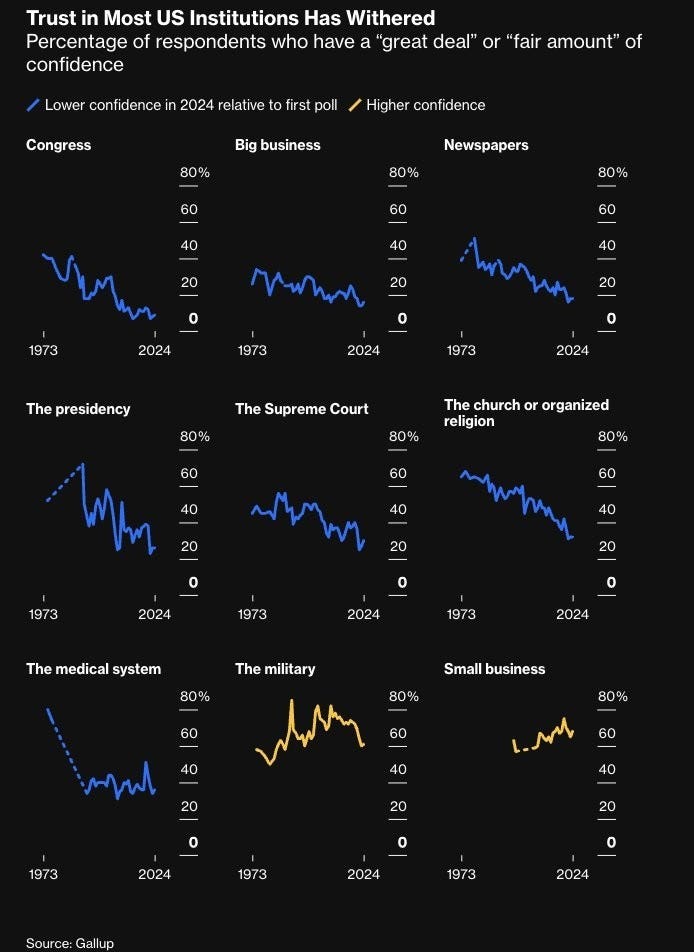

Rebuilding the information distribution system goes hand in hand with rebuilding trust. The “anti-establishment” party is the party of regulatory capture.

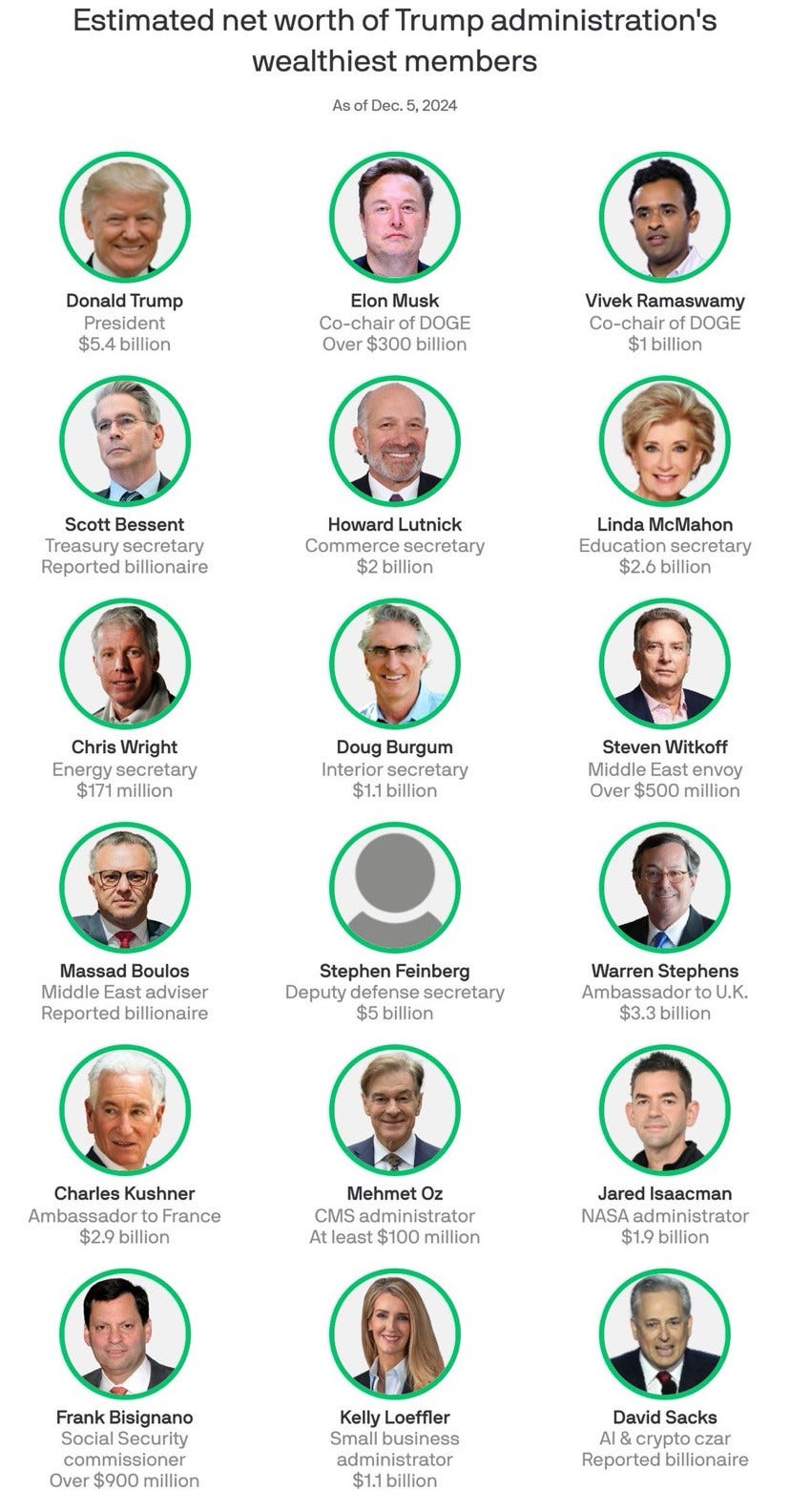

The “populist” cabinet is comprised of billionaires. There is a wealth tax in the US. It's just structured as political donations in a post-Citizens United world.

Source: https://www.axios.com/2024/12/06/trump-billionaires-cabinet-elon-musk

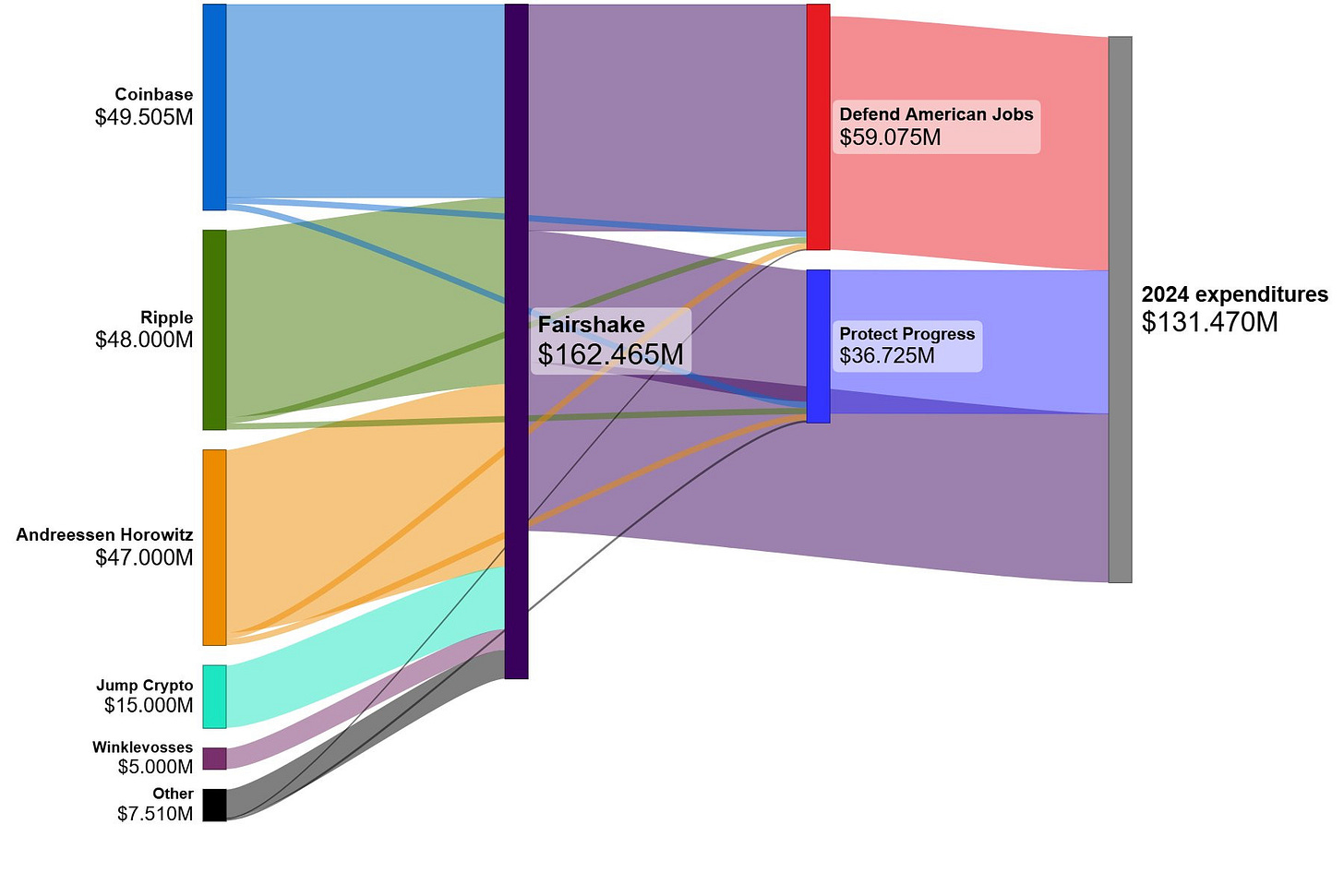

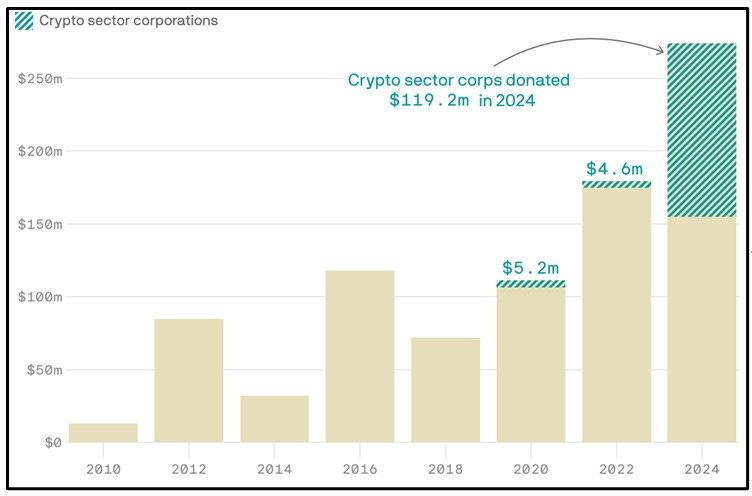

The crypto oligarchy is here. They want to implement yield curve control (YCC), weaken the dollar, and debase Americans. Chair Powell stands in their way until 2026.

Institution reform and abundance are the right approach. People need to not only hear the approach, but also trust it and be able to measure and “feel” the implementation.

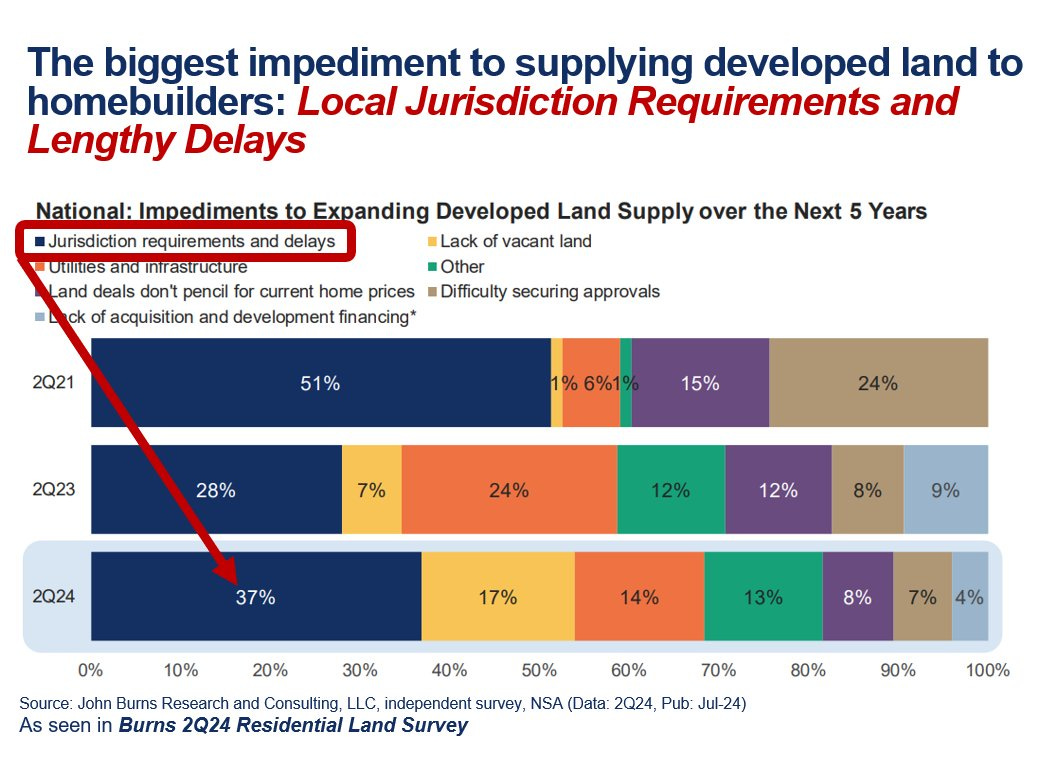

Land brokers say jurisdictional requirements and delays are the number one impediment to increasing developed lot supply. This needs to be addressed to increase housing supply. Dealing with housing and childcare costs should be the priorities that may eventually bridge the gender gap. YIMBYs, healthcare and women’s rights are the building blocks for a full employment policy platform.

Source: @ericfinnigan.bsky.social

The US is unusual in denying the Child Tax Credit (CTC) to the poorest families. ARP’s CTC came and went and its extension being a top priority was lost in translation.

Source: @bbkogan.bsky.social

Source: https://www.visualcapitalist.com/how-american-households-have-changed-over-time/

Source: https://www.ft.com/content/29fd9b5c-2f35-41bf-9d4c-994db4e12998

This type of gender divergence is not sustainable. I was wrong in thinking Roe v Wade would help the top of the ticket overpower the attack ads, but I think people are wrong in leaving this matter to the state level.

Source: https://www.propublica.org/article/elizabeth-nakagawa-miscarriage-military-tricare-abortion-policy

The vibes were bad but the vibes were not based on reality. The election results had little to do with actual policy platforms as identity perceptions were distorted by social media.

Source: https://blueprint2024.com/polling/why-trump-reasons-11-8/

Source: https://today.yougov.com/politics/articles/41556-americans-misestimate-small-subgroups-population

It is not good that full employment and reversing decades of wage inequality in the fight for labor against capital translated to “standing up for marginalized groups and good healthcare.” Full employment is good for the working class. Full stop. Giving people bargaining power against corporate profits is good, as it forces market competition to reward talent with better wages.

Source: https://www.ft.com/content/73a1836d-0faa-4c84-b973-554e2ca3a227

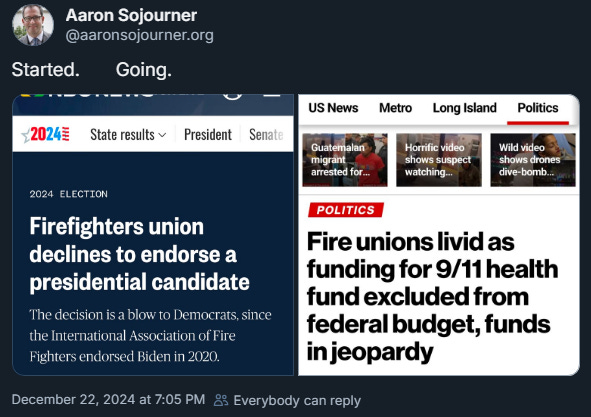

The only silver lining is union workers that benefitted from Inflation Reduction Act (IRA)/CHIPS did vote. It just wasn’t enough to tip the scales since the sectors were so beat down and union power has been greatly diminished over the years.

Manufacturing is a smaller percentage of the US economy. Get ready to differentiate Inflation Reduction Act (IRA)/CHIPS induced investment and tariff induced investment. There will be folks claiming tariffs caused the investment that came under the Biden admin.

Consumer sentiment surveys reflect the bifurcated information system and “education”. Small businesses are in for a rude awakening as hurdle rates remain high.

NFIB ignored the good and signed up for the bad. Whether these folks know good vs bad is a different story.

The rates of people starting new businesses remain higher than in the pre-pandemic days and so do rates of business deaths, a crucial but underappreciated marker of US economic dynamism.

Source:

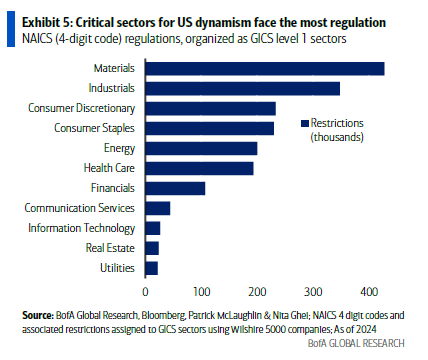

The president-elect successfully campaigned on (fake) abundance while portraying Democrats as the party of regulatory capture, inefficiency and scarcity. There is some “truth” to the inefficiency part as blue states have trouble with prioritizing building vs regulation/litigation. Whether people realize the “truth” will depend on how information is distributed and perceived. In the meantime, it is worth noting some people forgot to vote down ballot to strengthen the Republican governing majority.

Trump established himself as the “populist anti-establishment” candidate, and this second term is likely to cause cross state migration over the next four years or more. Although “truth” is relative, there are still courageous reporters telling the stories that need to be told.

Source: https://www.nytimes.com/2024/11/16/opinion/donald-trump-women-girls.html

“Libertarians” that support the Patel FBI nomination are social parasites and do not actually care about liberty or free speech.

Support female content creators.

Support local newspaper and independent journalists that seek to report the news and “truth.”

Globalization

Immigration

The Constitution was just a post.

Birthright Citizenship was arguably the greatest achievement of the U.S. constitution, so of course the incoming administration is planning on trying to undo it.

Source: https://worldpopulationreview.com/country-rankings/countries-with-birthright-citizenship

Birthright citizenship discloses who we are. We don't ask for one's bloodlines; we aren't a nation where citizenship is like nobility, something flowing in the blood of only some. Your 'mother' tongue is also determined by where you are born. We are a civic union, not an alliance of kin groups.

And finally, while of course not a deciding factor for the courts, it is important to reiterate that the concept of jus soli citizenship is liberal at its core. So long as our system of states requires the assignment of citizenship, it is far more liberal to do so based on the land of one’s nativity rather than blood or status of one’s parents. Automatic citizenship based on the place of birth is an objective measure that reduces the potential for the government to withhold citizenship in ways that are racially or otherwise discriminatory. Moreover, a lack of birthright citizenship would increase the number of undocumented people living in the United States - and thus increase the number of people subject to greater risks of arbitrary mistreatment and denial of rights.

It's astounding how the anti-immigrant crime narrative has taken over. We've had the fastest increase in the immigrant share of the population in decades, and the fastest ever decline in the US homicide rate. There was a strong positive correlation between foreign-born population share and the president-elect’s vote share change.

Source: @davidjbier.bsky.social

There was a rhetoric of immigrants only receiving entitlements and not paying taxes. There was a narrative that deportation would increase housing supply. Although false, these narratives won votes. Education is correlated with political bias, but “education” is also paywalled. The cost of “education” creates a vicious cycle for low-information voters to stay low-information.

Source:

Immigration is going to decline. Again. Some folks do not remember what happened to high-skilled immigration last time.

The mistrust in institutions is toxic. Some “libertarians” revel in sowing mistrust. Healthy skepticism is one thing, but facts do not cease to exist because they are ignored. Entropy is increasing.

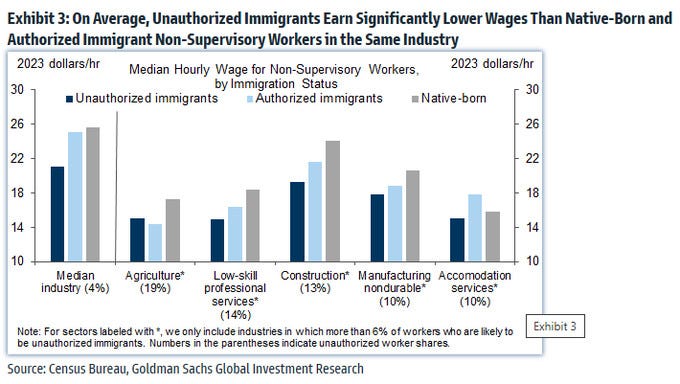

On average, unauthorized immigrants earn significantly lower wages than native-born and authorized immigrant non-supervisory workers in the same industry. In other words, immigrants that are granted asylum typically do jobs natives do not want. A policy that does not raise the productivity of workers won't raise wages. Deportation will not raise native-born worker wages as employers are more likely to replace cheaper labor with automation. Full employment means the labor market is essentially at capacity and boomers are unlikely to be coming out of retirement.

America has the best system for incorporating refugees into the work force legally. Once asylum is granted, they are legal. Work permits go to immigrants that pay taxes.

Source: https://www.federalreserve.gov/newsevents/speech/kugler20241008a.htm

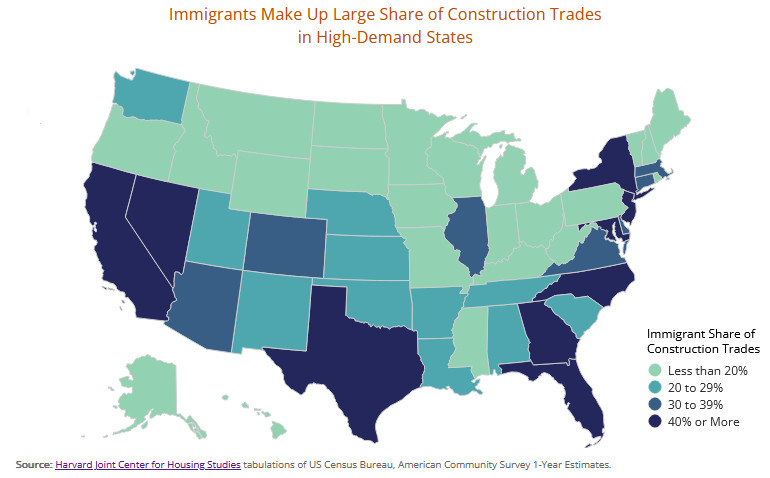

Many of construction trades rely on immigrant labor. NAHB notes that foreign-born workers comprise 40% of construction jobs in Texas and California, 38% in Florida and 37% in New York. Deportations are self-induced supply shocks.

Source: @peark.es

Source: @riordanfrost.bsky.social

The Biden administration did not do themselves any favors with this issue. Messaging around immigration was not great and just saying the president-elect tanked the bipartisan border bill was clearly insufficient.

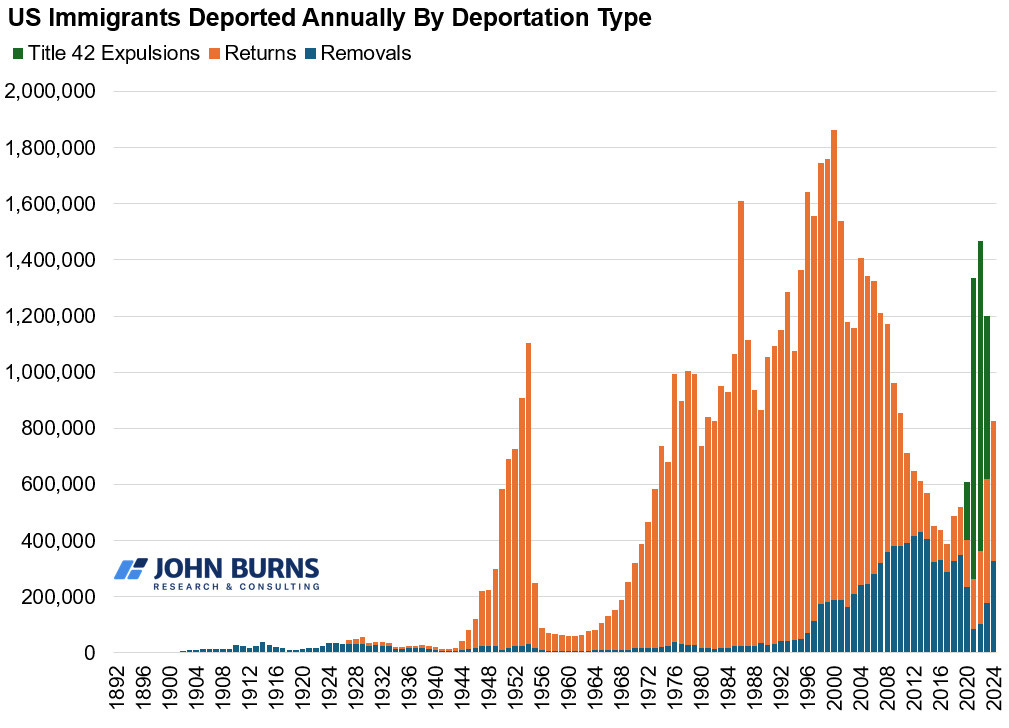

Given the combination of apathy and lack of empathy, talking about Title 42 expulsion was lose-lose situation:

Opposition would say it would not need to be that high if crossings weren't that high.

Pro-asylum folks are left asking questions like why are unaccompanied kids being sent back

Source: https://www.migrationpolicy.org/article/biden-deportation-record

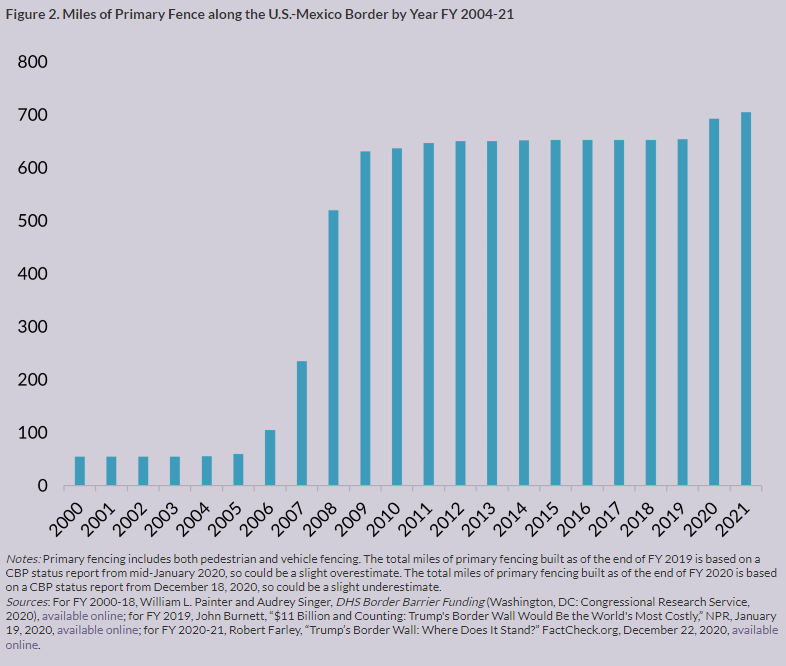

In order to hit 10M deportation, Immigration and Customs Enforcement (ICE) removals would need to 10x. Their budget probably does not scale linearly. For the record, the border wall did nothing.

Source: https://www.cato.org/blog/trumps-detention-surge-failed-significantly-increase-removals

Source: https://www.migrationpolicy.org/article/two-decades-after-sept-11-immigration-national-security

The people that say “the future is going to be amazing” might need to define “amazing.” It has been unfortunate witnessing some smart people being fooled. Some folks are going to need to figure out what “legal” means to them.

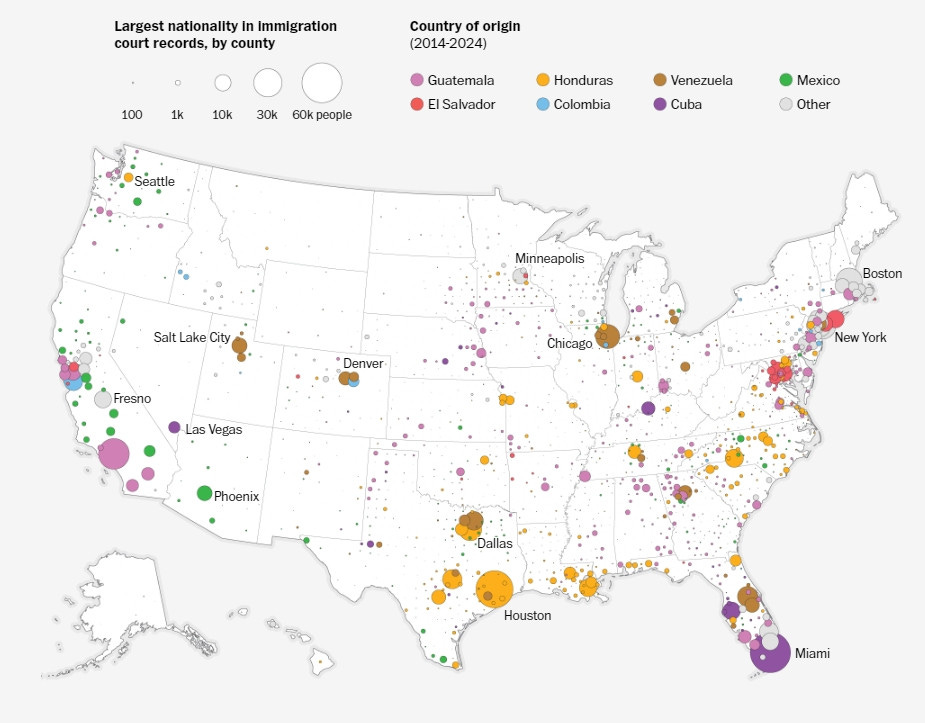

The US won't be able to talk about China's internment camps anymore. The incoming admin is likely to target those with legal asylum status and those already in contact with courts and ICE.

Source: https://www.washingtonpost.com/immigration/interactive/2024/us-immigration-where-migrants-live/

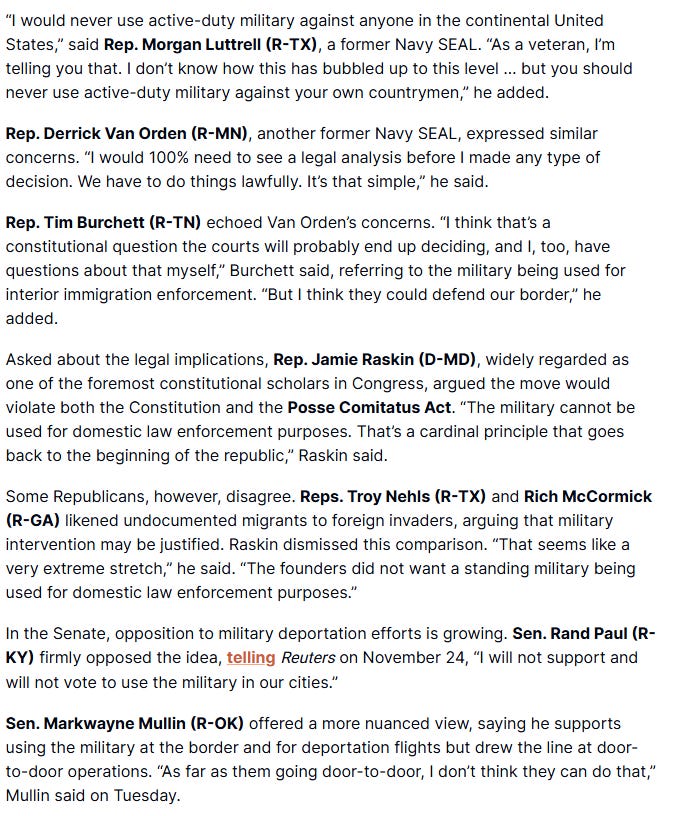

People waving deportation off as rhetoric have not been paying attention and have not read enough history. Just the fact that military deportation is being actively debated leaves an unfortunate timestamp.

Source:

https://migrantinsider.com/p/republican-lawmakers-divided-over-using-military-for-mass-deportations

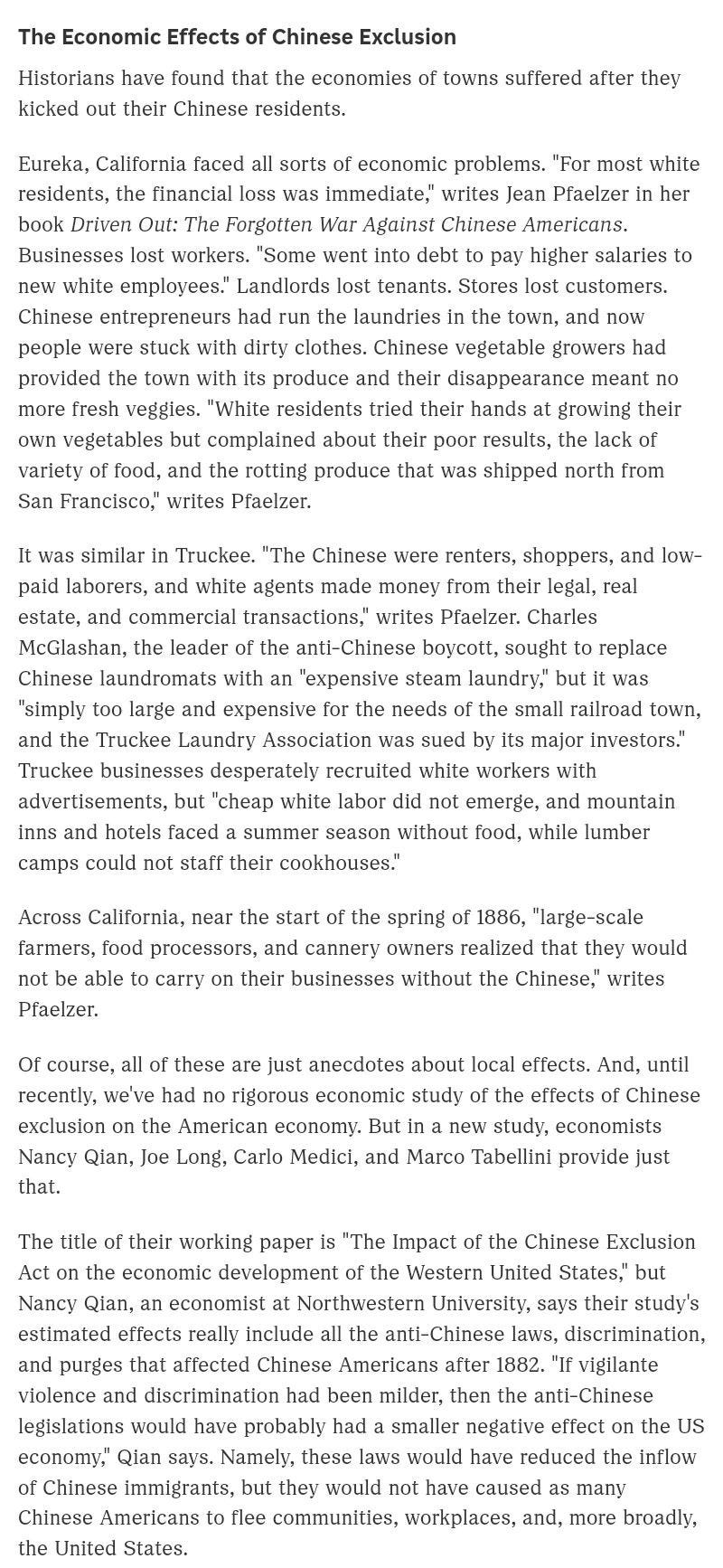

History is repeating itself.

Dollar

Immigrant views correlate to globalization views. The dollar is currently the world’s reserve currency and serves three functions:

Trade $, whose level influences/is influenced by size/sectoral composition of US trade balances.

Stability $, level/direction of which influences global financial conditions.

NatSec $, where centrality enables US surveillance/sanctions.

The dollar is backed by the US military maintaining the global order and American Exceptionalism. Where were people talking about productivity growth before the election? The “p” word has been missing from public discourse and that is truly unfortunate, because there is a made up Department of Government Efficiency (DOGE) now. Those that support crypto want reduced dollar influence, even if it means less democracy.

Source: https://www.ft.com/content/1201f834-6407-4bb5-ac9d-18496ec2948b

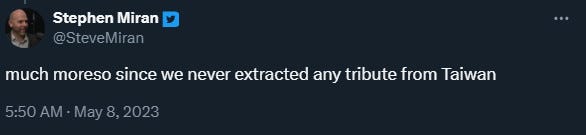

The reason Taiwan is the best filter is because it easily defines the line by which a person supports globalization. Steve has just been nominated for head of Council of Economic Advisers. Steve called for 4.7% unemployment at the end of 2023 and lower 2024 growth. After realizing he was wrong, he proceeded to spend much of 2024 talking about his Activist Treasury Issuance (ATI) paper with Nouriel Roubini. This paper lacked logic and arithmetic. Folks that based their short bonds position on this partisan piece were burned as disinflationary growth continued for much of 2024. The key takeaway should be the new Chair of the CEA has been wrong about the economy for two years straight and uses the word “tribute” when talking about Taiwan.

China dominates global manufacturing and wants Taiwan.

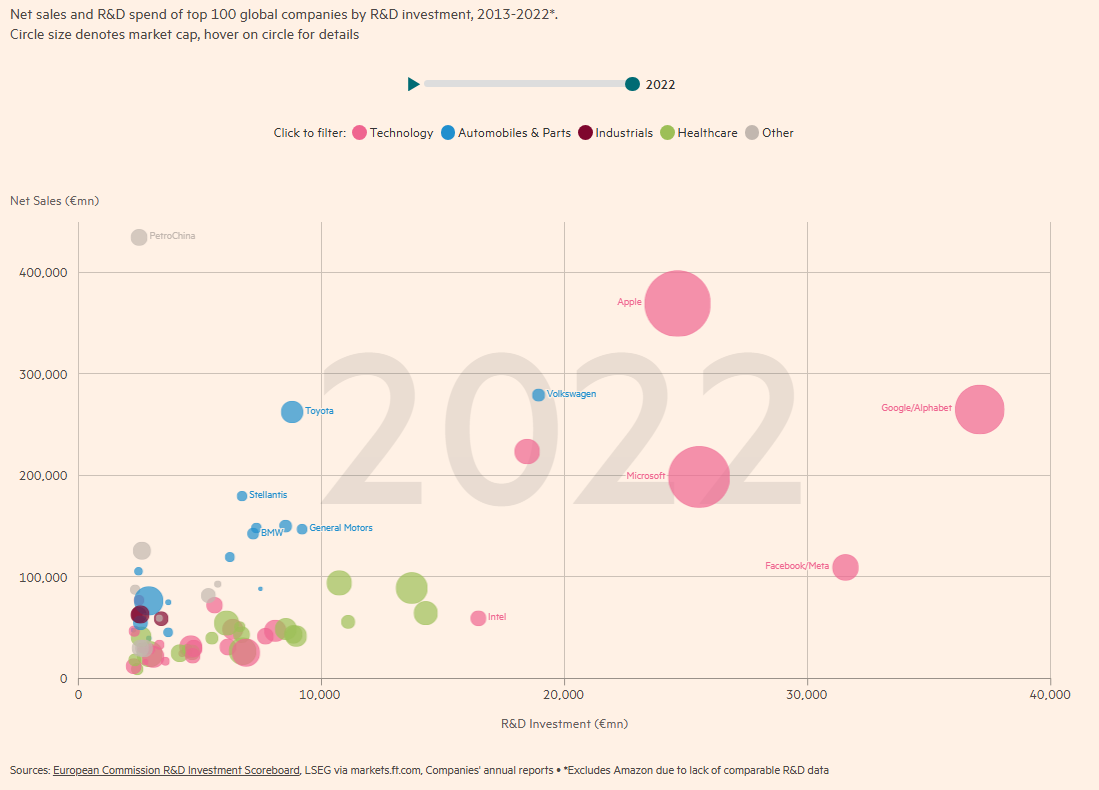

Source: https://www.ft.com/content/9aca35b4-b698-41ed-857d-ccb327abce94

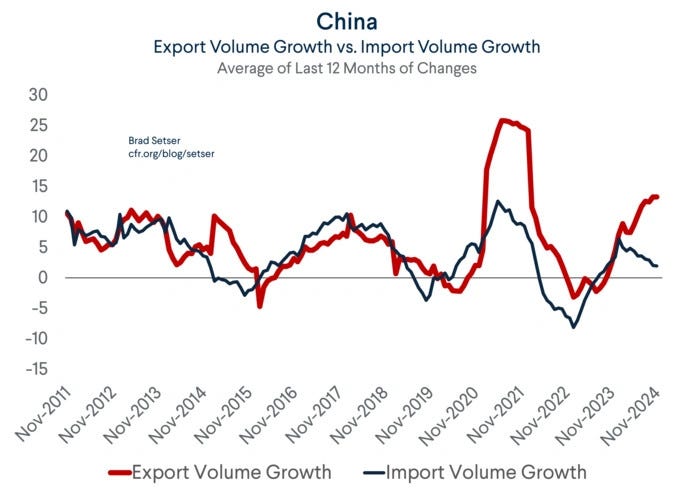

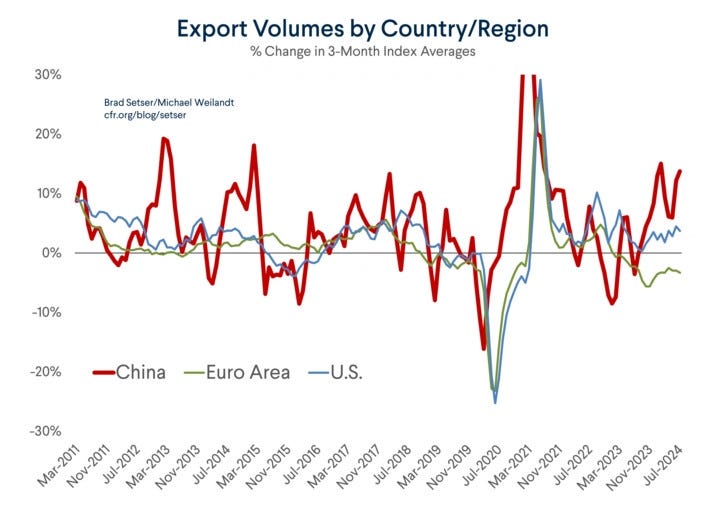

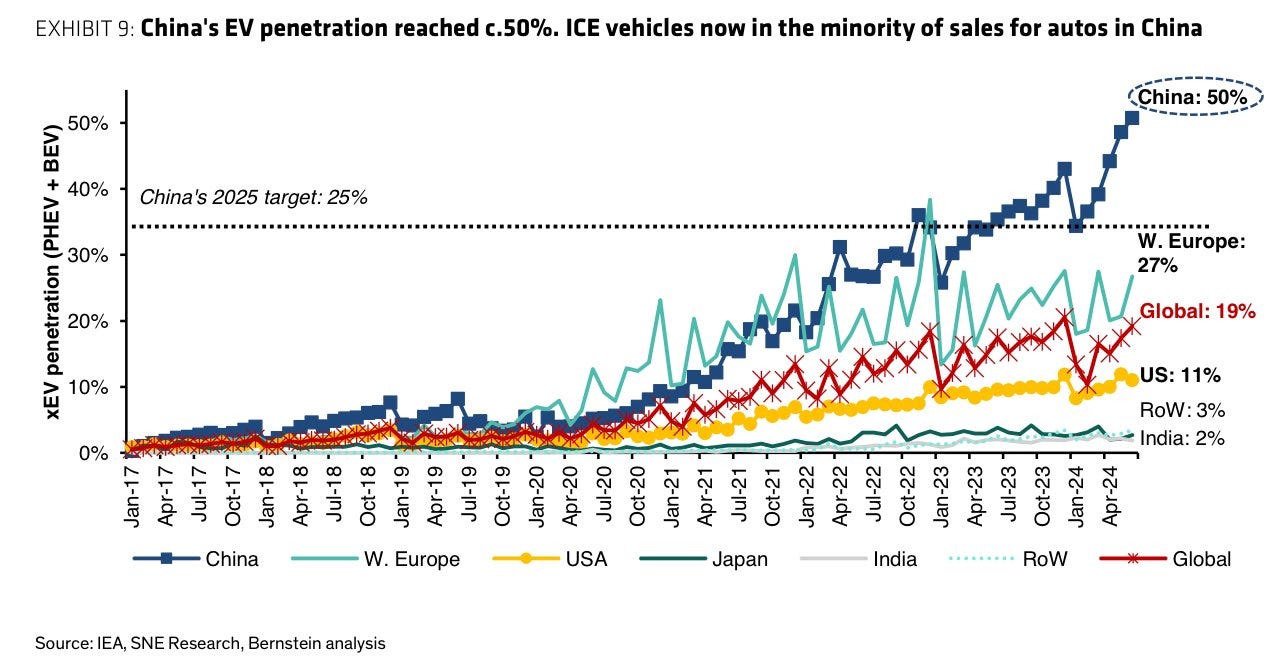

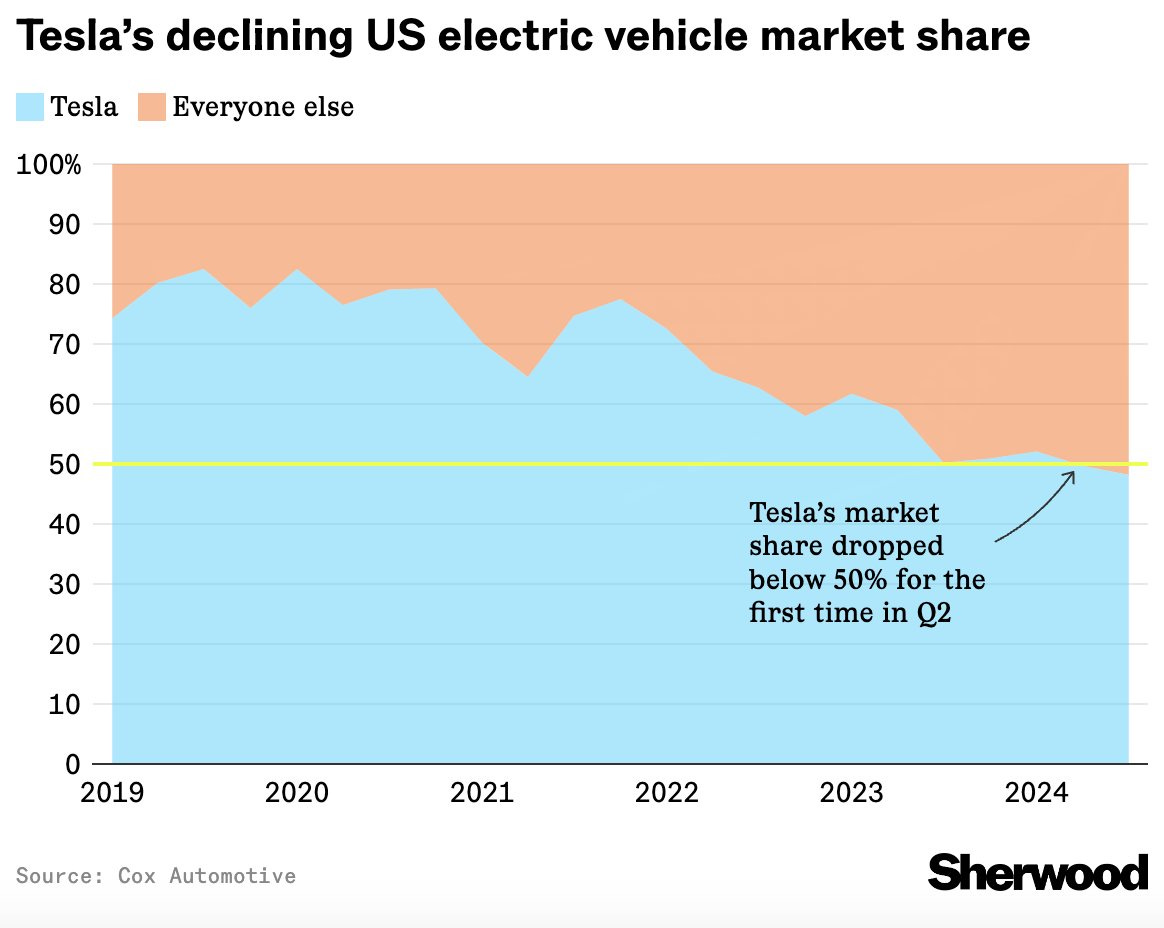

It is no secret that the EU has been increasingly worried about Chinese exports. "Germany really needs to wake up here" basically sums it up as China’s export growth has come at the expense of the EU. Tariffs can only do so much to protect EU vehicle manufactures, as there is European demand for Chinese EVs. Meanwhile, supply chain for EVs, EV batteries, and EV battery chemicals are increasingly being controlled by China.

Source: https://www.cfr.org/blog/chinas-stunning-2024-export-growth

Chinese auto exports took off after zero Covid policy was ended and has since eclipsed Japan and Germany exports. It is worth noting that Ford CEO Jim Farley brought one back to America.

Source: @corrywang.bsky.social

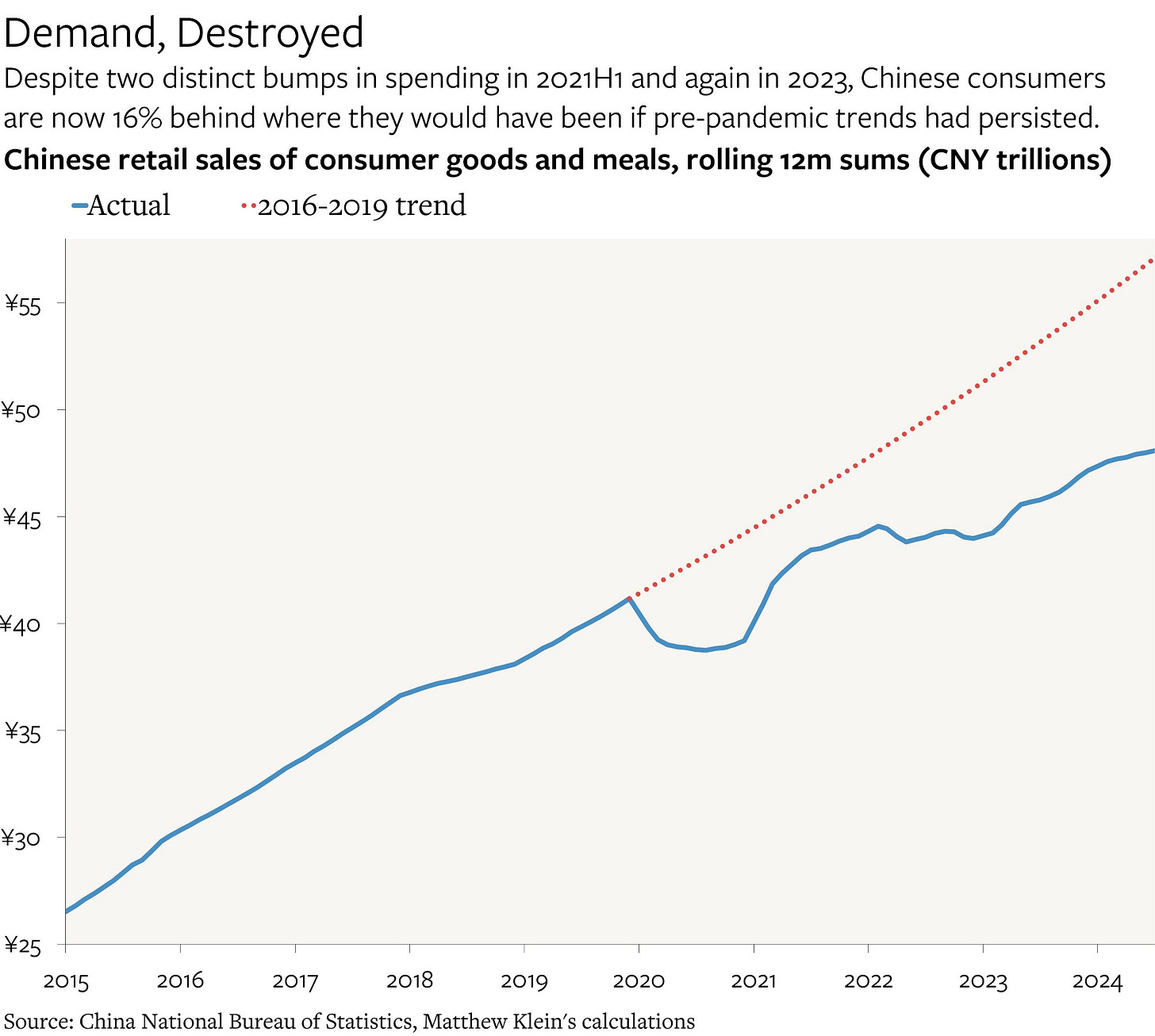

At the expense of Chinese household consumption, Xi Jinping has been going full speed ahead in the China Industrial Policy “National Rejuvenation”, ramping up manufacturing capacity to the point of overcapacity.

Whether a politician is willing to trade Taiwan for US domestic production is the question. That’s basically where the support for globalization line is drawn. It is also the line for democracy vs autocracy.

Xi is celebrating the incoming cabinet appointments. In case it was not obvious, the leader of the Chinese Communist Party (CCP) is not worried about people that need their mothers to go on television.

Satoshi Nakamoto developed Bitcoin on the basis of mistrust in institutions. He would be in shambles at the idea of centralized purchases for a “strategic reserve.” The strategy is brilliant though, taking advantage of voters that vote against their own self-interest and monetizing the Greater Fool Theory.

Source: @rajakorman.bsky.social

Destabilizing institutions will affect global financial conditions as the dollar reserve currency status is diminished. National security risk levels are rising from both foreign and domestic. The dollar debasement campaign was undefeated in 2024.

Source: @molly.wiki

If someone questions the Fed’s independence, double check if they received money from a crypto bro.

Source: https://www.axios.com/2024/08/22/crypto-election-spending-2024-pac-public-citizen

Dollar devaluation is effectively debasing Americans and equivalent to inflation for imported goods and services. It also means ceding leadership of the world economy.

Source: https://www.brookings.edu/articles/the-changing-role-of-the-us-dollar/?b=1

Tariffs

Globalization isn’t a thing. It’s billions of people freely cooperating in billions of ways, without direction from any one person, company, or government. Tariffs are the opposite of that and opposes everything “libertarians” pretend to care about. Tariffs are also a glide path to corruption and crony capitalism. Entropy is increasing.

Tariff “threats” also have economic costs.

Source: https://www.cato.org/commentary/bogus-new-rationale-trumps-economic-agenda

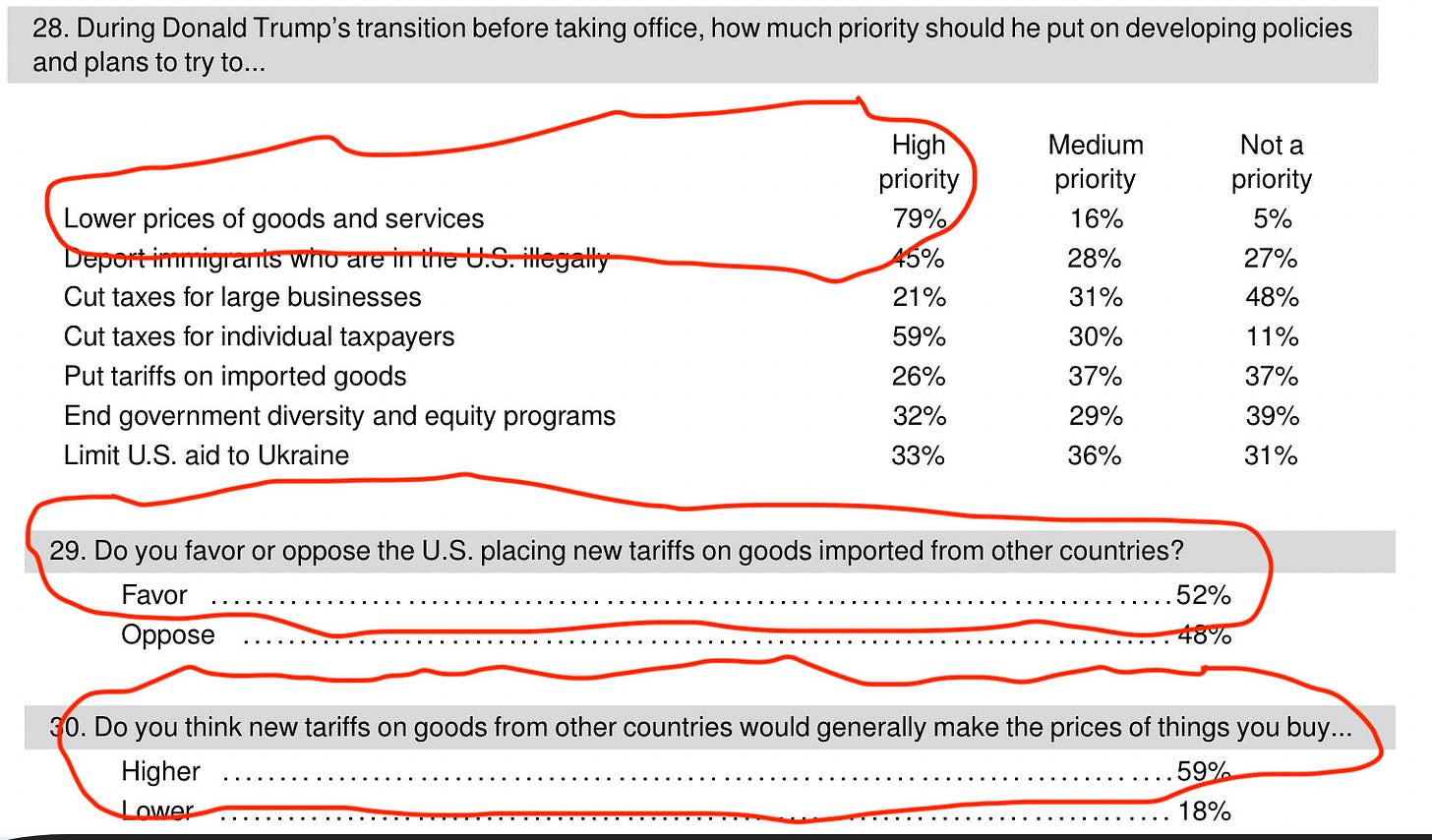

There are people that view tariffs as just a “negotiating tool.” There are also people that do not know China does not actually “pay” anything, but rather domestic businesses pay the import tax. There are also people that think income taxes can be replaced by tariffs. All three types will be disappointed as self-induced supply shocks get implemented.

Source: https://www.cbsnews.com/news/cbs-news-poll-trump-transition-cabinet-picks-2024-11-24/

Source: @samro.bsky.social

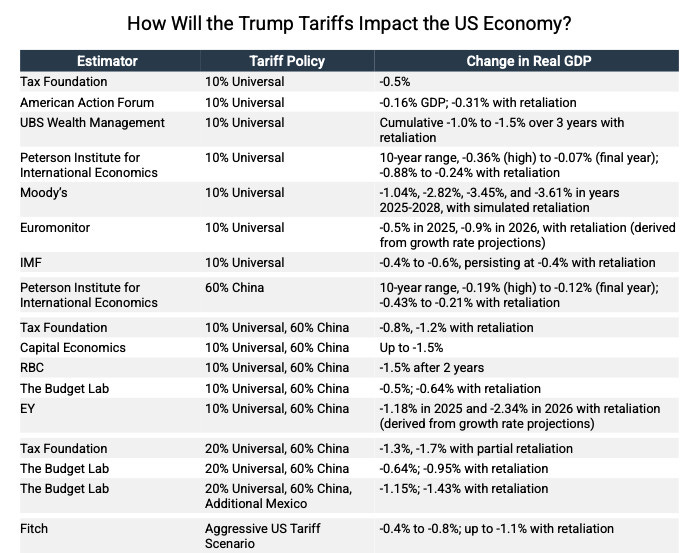

Here’s a tariff impact table that was compiled by Erica York (@ericadyork.bsky.social). Tariffs are likely to be a drag on real GDP. The president-elect is making an assumption the rest of the world does not have any bargaining power. Trade deficits are not “subsidies.” Ricardo was the biggest loser of the election and currency offset doesn’t work if the dollar is debased.

Source: @ericadyork.bsky.social

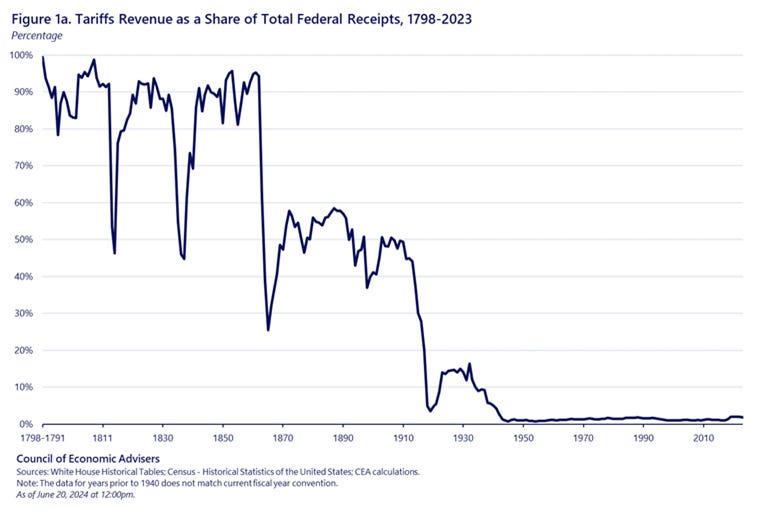

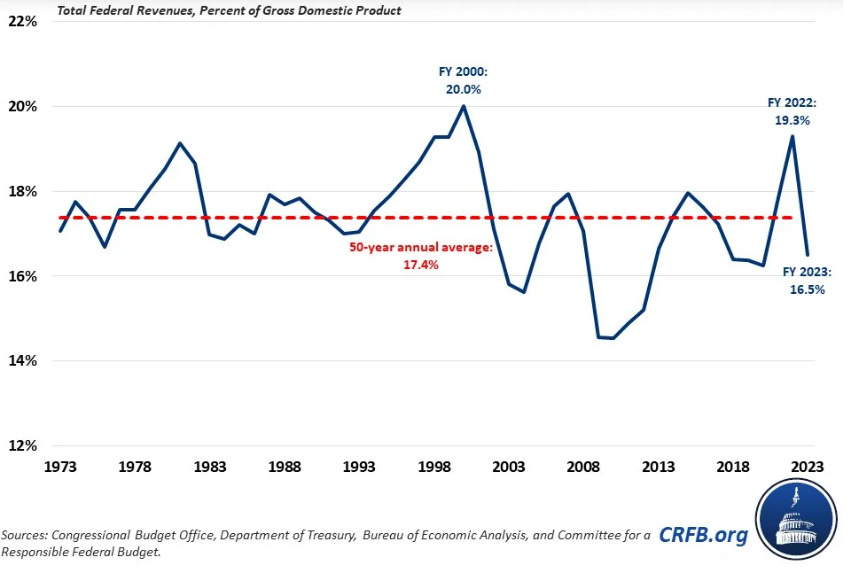

Tariffs have not been a major source of revenue since the early 1900s. Currently, individual income and payroll taxes account for three-quarters of Federal tax revenue whereas import duties account for only about 2 percent. Protecting domestic manufactures that are just starting to scale is one thing, asking allies for protection fees is another.

For the record, US solar production is extremely behind and solar related tariffs did the bare minimum to help domestic firms.

Source: https://www.bloomberg.com/graphics/2024-opinion-how-us-lost-solar-power-race-to-china/

It is unfortunate that people do not realize the president can impose tariffs on his own, using national security tariff authority. The “security” part might need to be in quotes.

Some folks do not remember the first round. Covid has worsened memory loss for the general population. Currency offset does not really work if the government is actively trying to debase the currency.

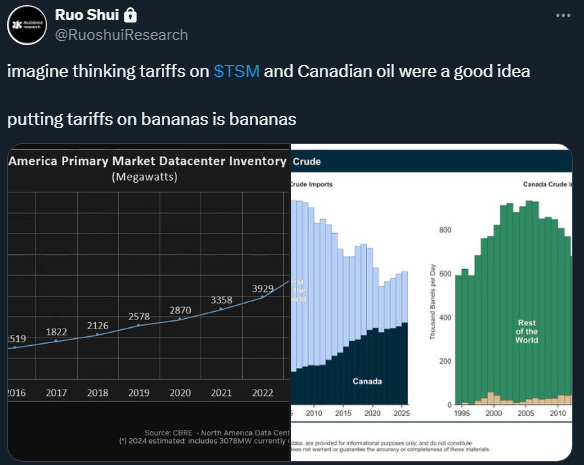

The US imports goods from the EU, Mexico, Canada and other allies including Taiwan. It would be bananas to tariff allies.

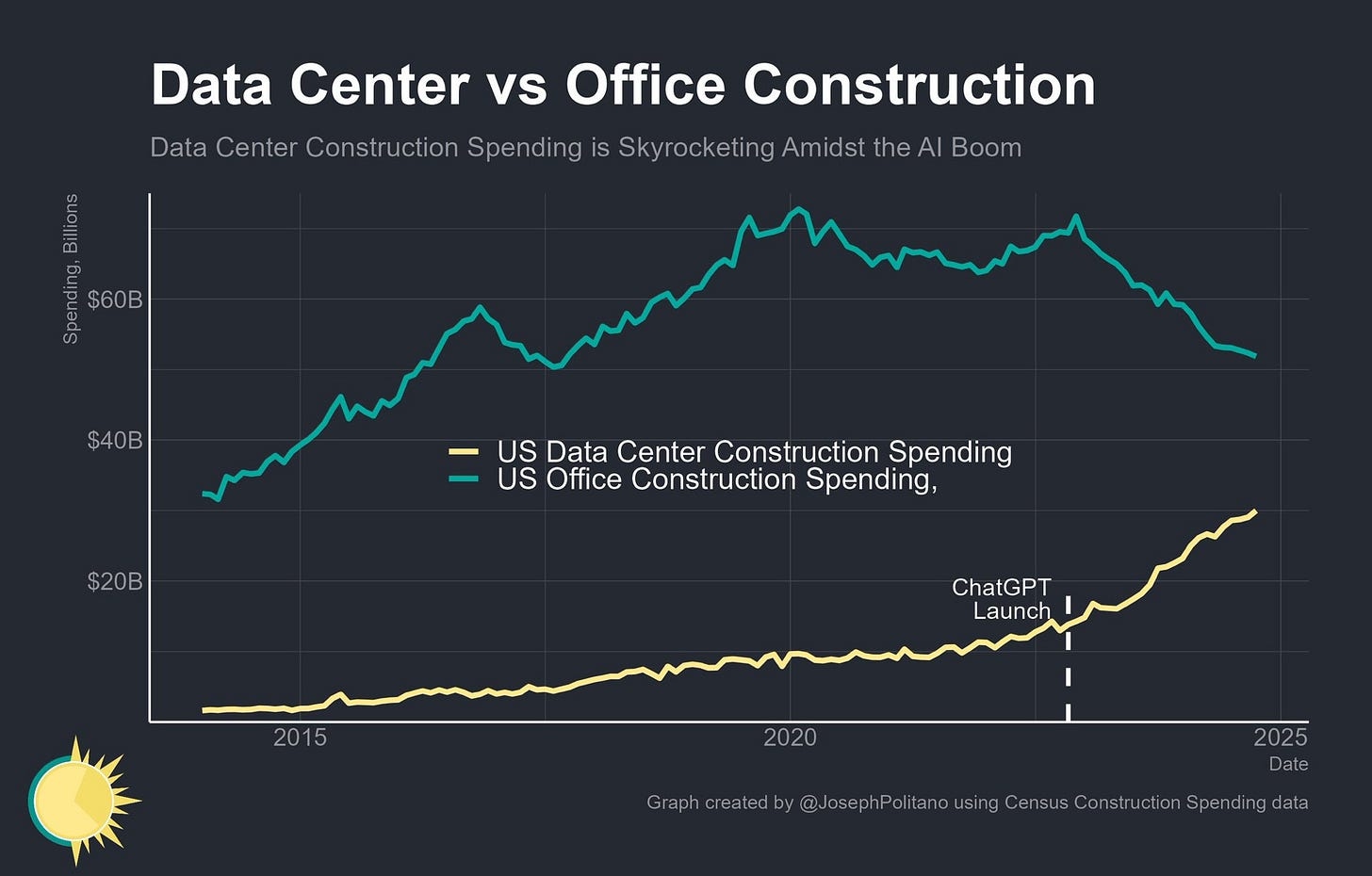

Source: @josephpolitano.bsky.social

But the president-elect is only capable of thinking in zero sum and continues to frame trade deficits as “subsidies.” The IOU is democracy. The US hegemony is likely to weaken going forward.

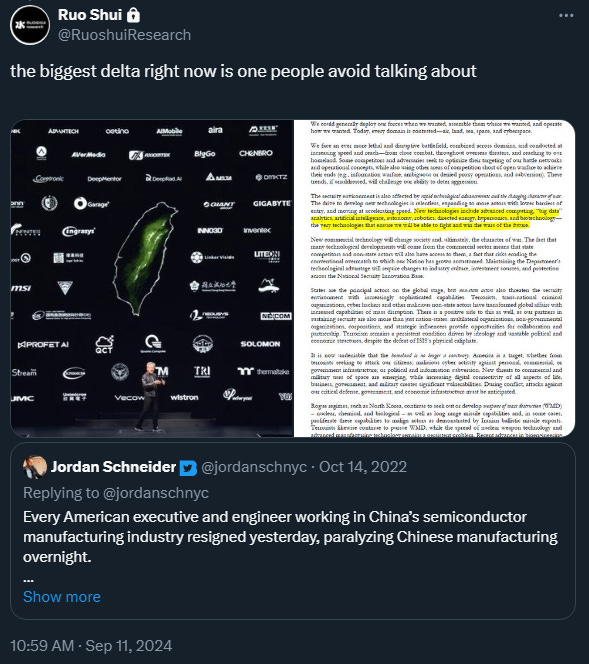

Semiconductors have struggled and will continue to struggle. The SMH 0.00%↑ index topped 7/16/2024. Any China “deal” analysis that does not include the word “Taiwan” is not serious. Xi would happily trade export growth slowing for “population growth.”

Considering how many AI "experts" there are, it was greatly disappointing to see the lack of Taiwan risk discourse and what the inverse of Biden admin export controls might look like.

Gamers better stock up and hope new consoles/graphics cards are worth the additional import tax.

Source: https://www.visualcapitalist.com/visualizing-americas-top-imports-from-china/

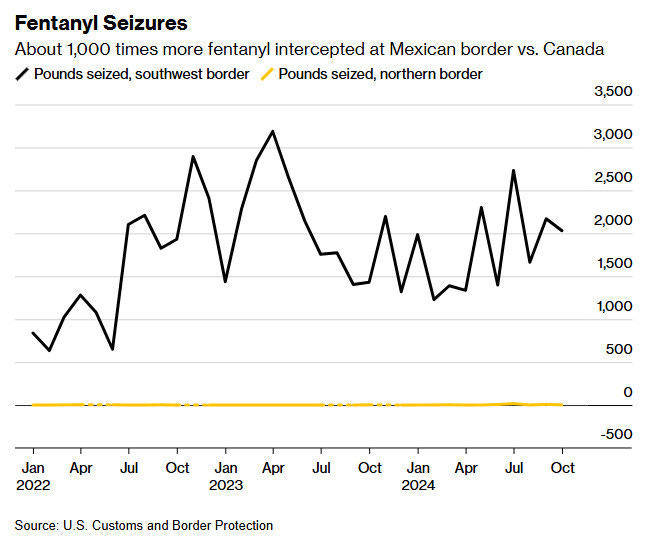

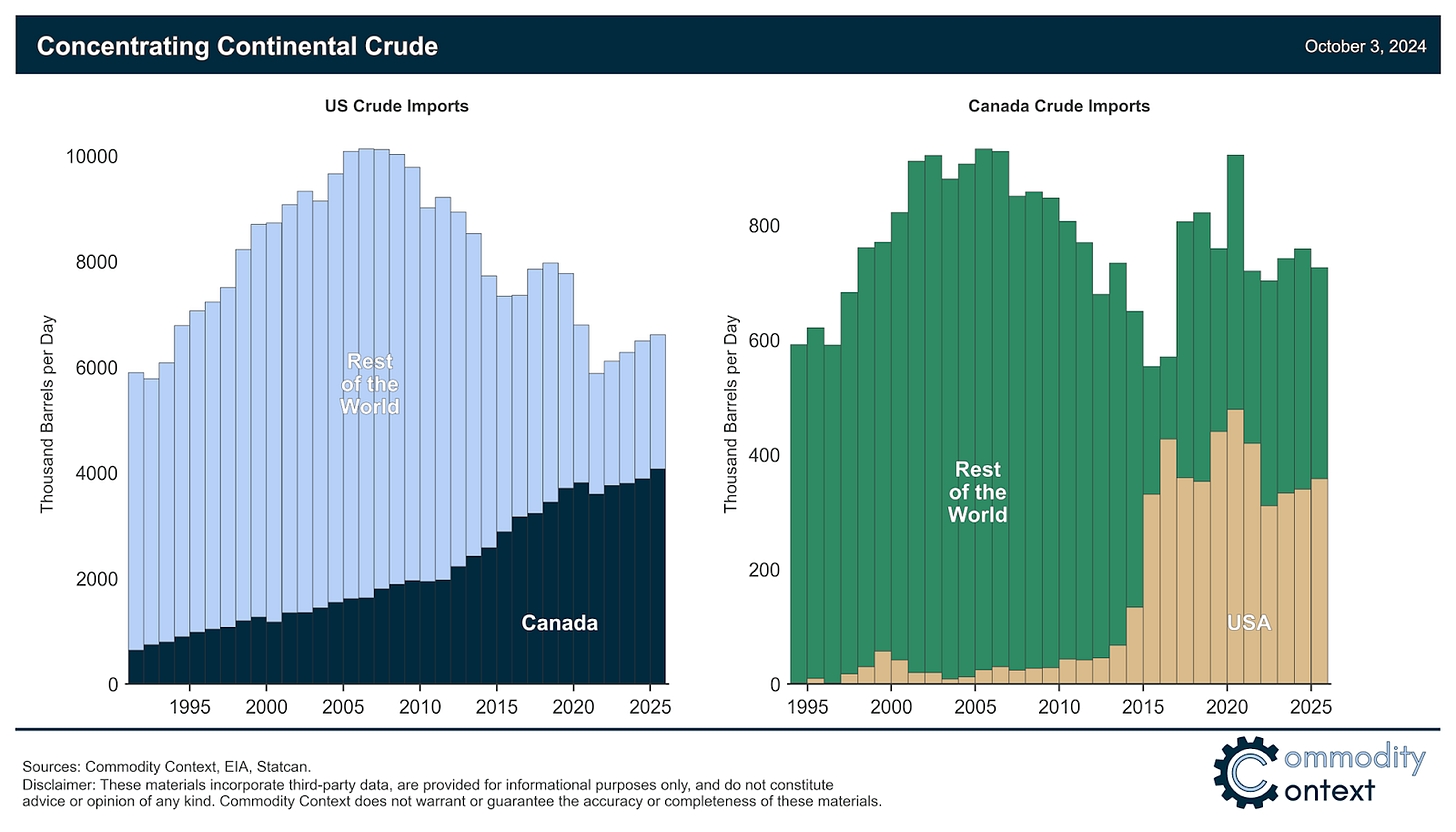

Just so it is clear, the US-Canadian border does not have fentanyl traffic. The US relies on Canada for heavier refined products and tariffs would affect jet fuel and diesel prices.

Source: @roryjohnston.bsky.social

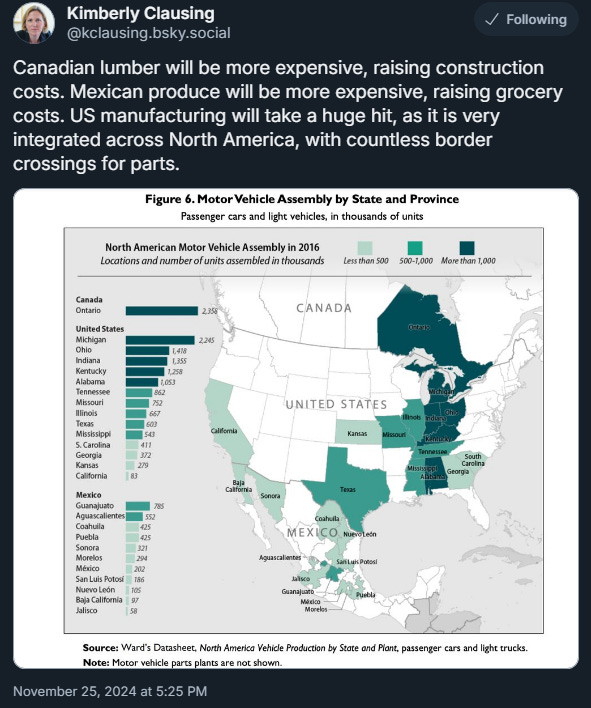

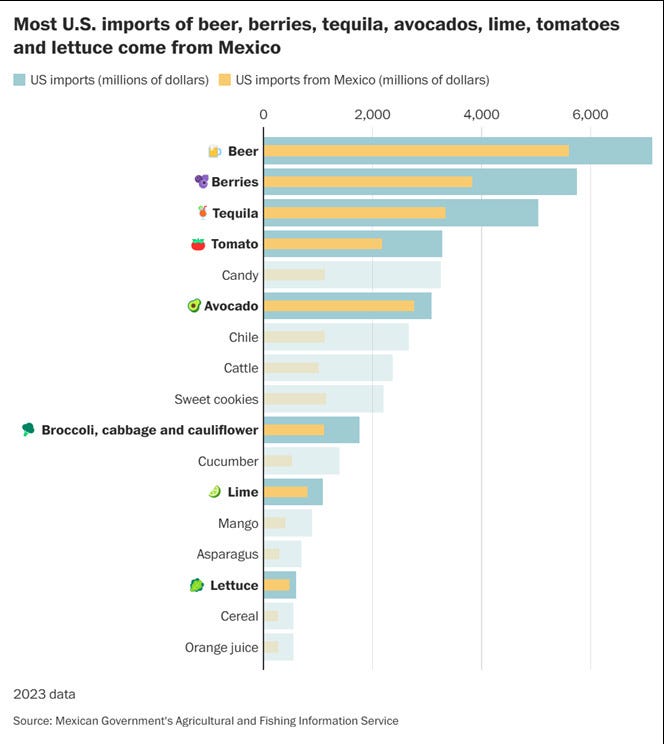

Raising Canadian lumber will affect construction costs. Raising import taxes on the US-Mexico border will affect grocery and car manufacturing.

Mexico has been “replacing” China exports from friend-shoring efforts. There are many auto parts that cross those borders (and from Canada).

Source: @scottlincicome.bsky.social

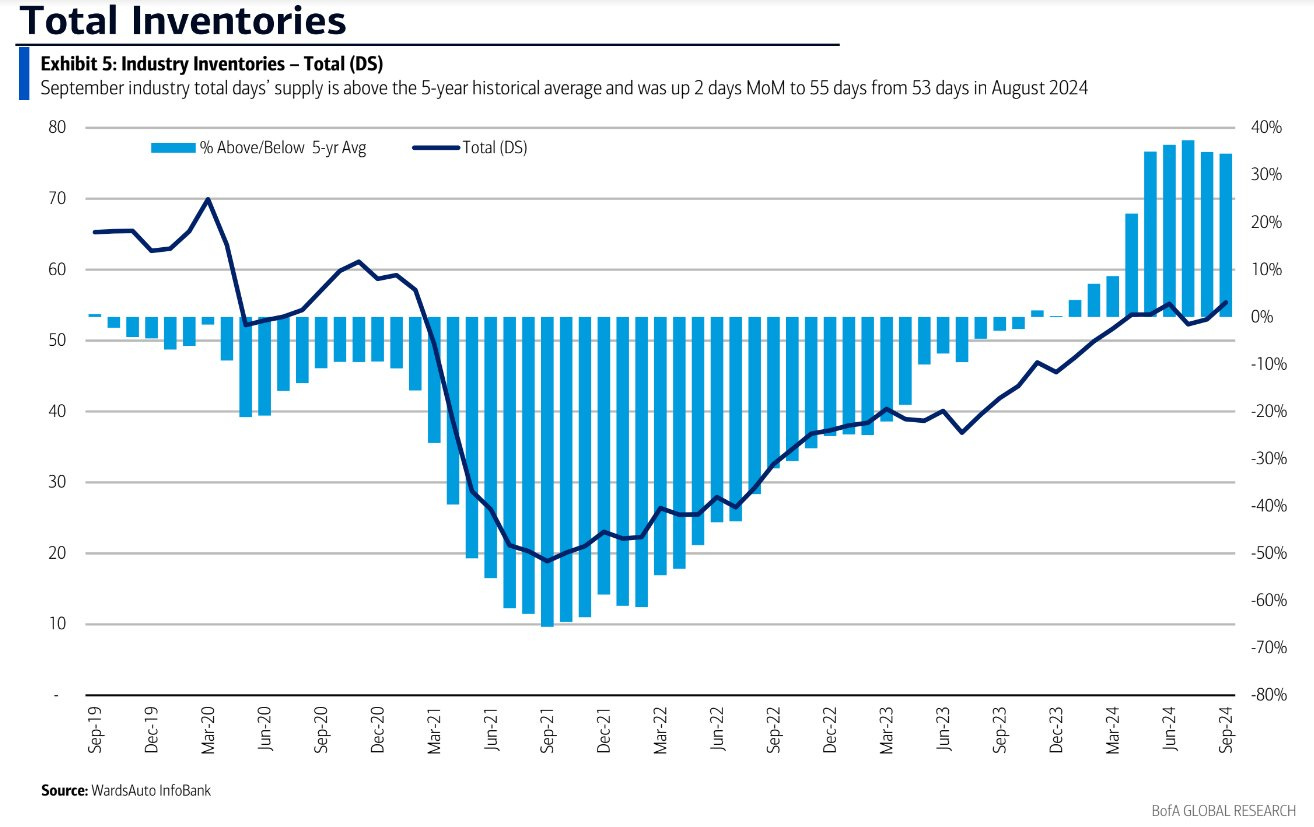

Tariffs on Mexico and Canadian auto parts would effectively be a self-induced round of auto supply shock similar to the chip shortage experienced during the pandemic. Car insurance premiums will adjust accordingly.

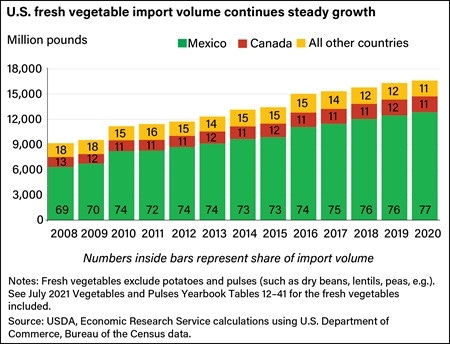

The US imports a substantial amount of fresh vegetable and beer/alcohol from Mexico. The cost of groceries will experience a price level adjustment upwards.

Source: @steverattner.bsky.social

With big pharma using Ireland to avoid paying taxes, there is a significant amount of medicine being imported that would be affected if EU tariffs were implemented.

The latest SEP reflected a higher core PCE number that reflects tariff assumptions and has set a higher bar to continue rate cuts in 2025. 2.5% is too high to continue to lower Fed Funds rate as that is above current breakevens. It is worth keeping in mind short term interest rates are different than long term interest rates. Long term interest rates are driven by the combination of productivity, population growth and fiscal policy, with fiscal contributing the most for the reaction function adjustment.

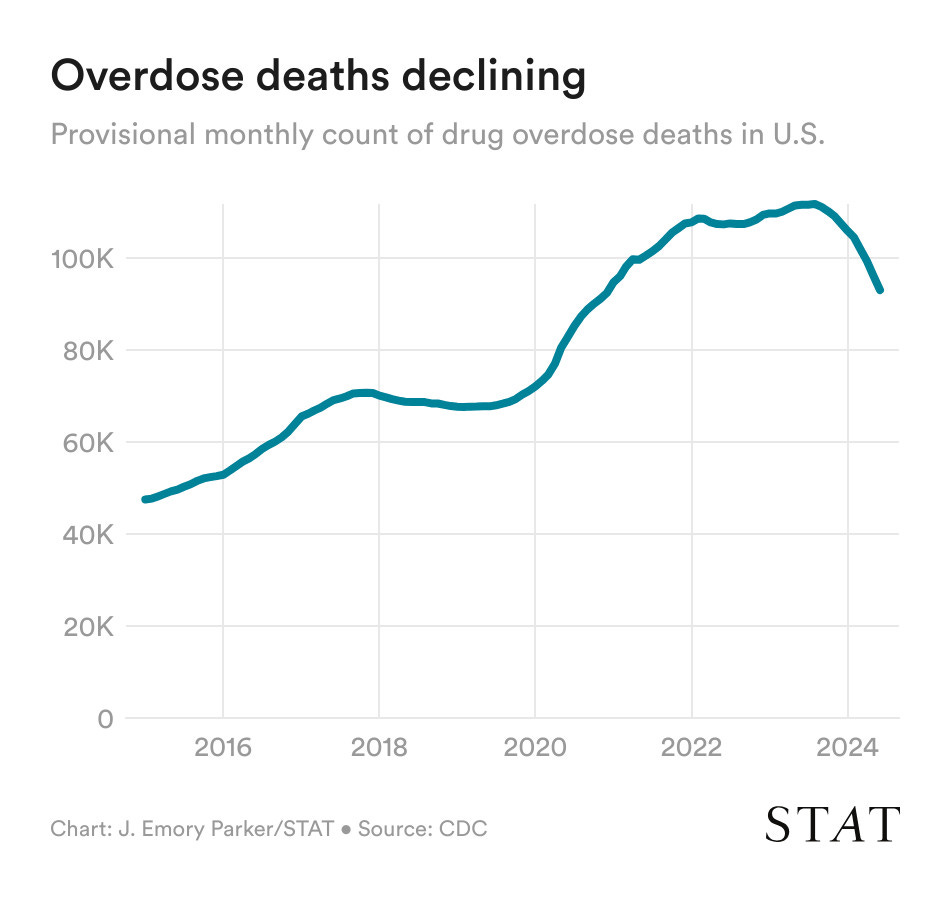

Just so initial conditions are clear, border encounters have dropped to prepandemic levels and fentanyl overdose has been declining under Biden admin policy. The president-elect can either claim credit or set unrealistic goals for allies and have US consumers pay the cost.

Source: @jaspar.bsky.social

The first round of trade war involved retaliation and direct subsidy at the cost of taxpayers. This round is likely to be worse as it is clear the president-elect is making the assumption that the rest of the world does not have any bargaining power and some of his advisors incorrectly think tariffs can fund tax cuts.

The incoming admin has boxed themselves in. Tariffs are likely to fail regardless of their implementation. Whether the electorate comprehends the failure is a different story. The White House is likely to blame the Federal Reserve for higher price levels and higher interest rates.

Source: https://www.explaintrade.com/resource/trump-tariffs-known-unknowns#content

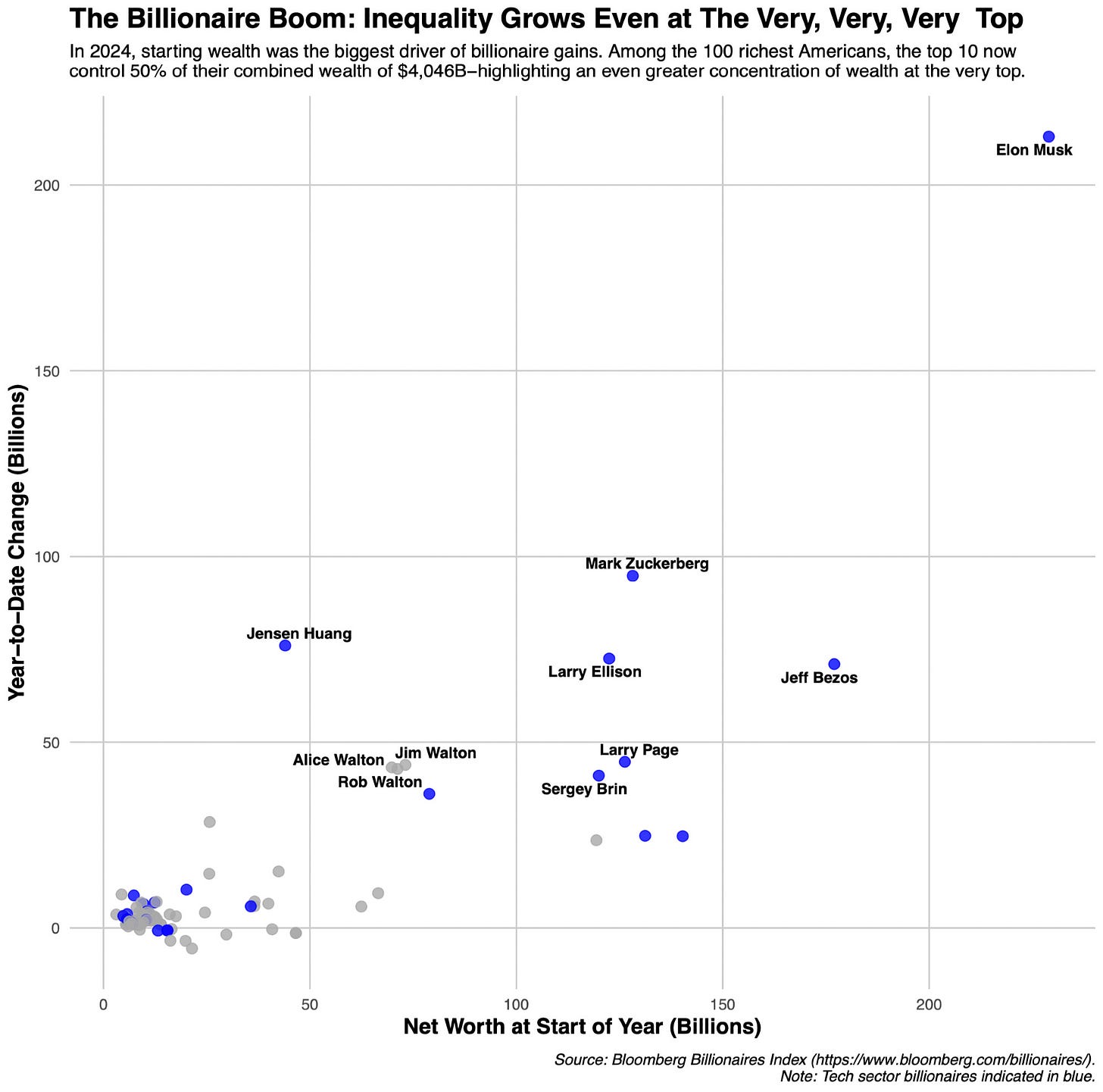

Wealth Gap

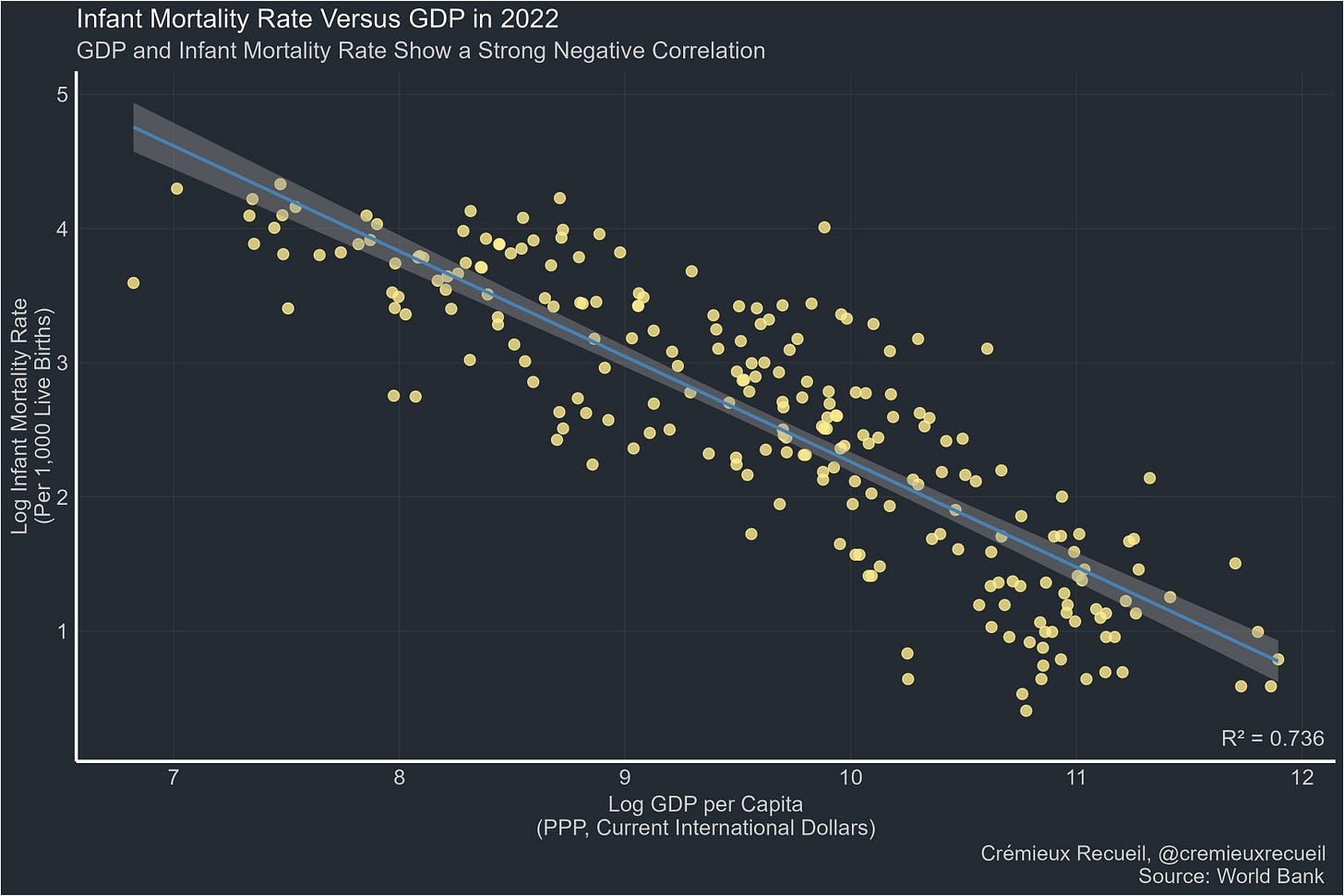

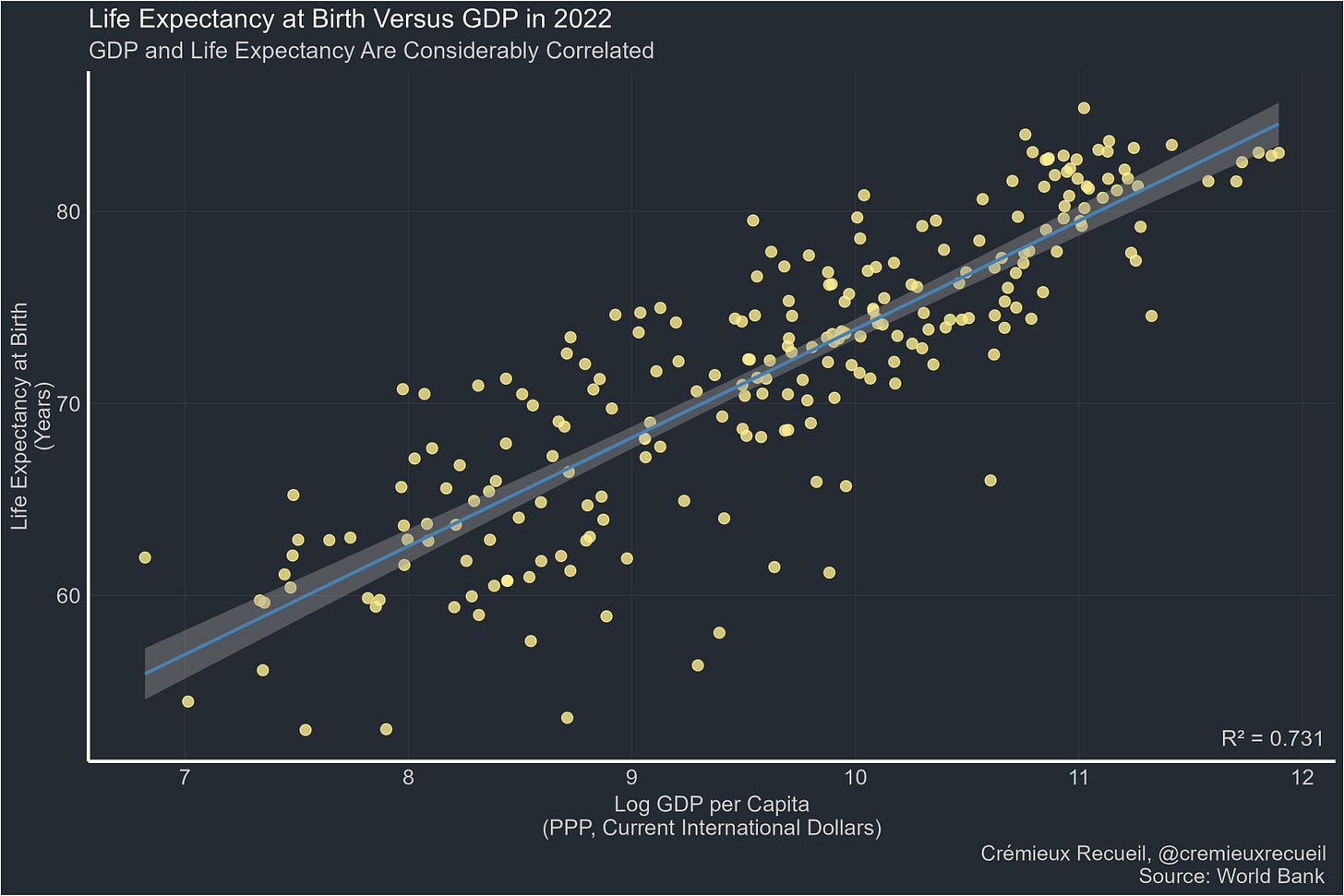

Gross domestic product (GDP) might not be the best “growth” indicator, but it is the best aggregate data. Quality of life metrics are just GDP. You value innovation? You value productivity? You value energy production? You value trade? You value immigration desirability? You value happiness? You value academic achievement?

You value GDP, sometimes to a high degree, and usually in a predictable direction, because GDP genuinely, broadly indexes quality of life. However, the distribution of that growth is that evenly distributed and everybody has different initial conditions.

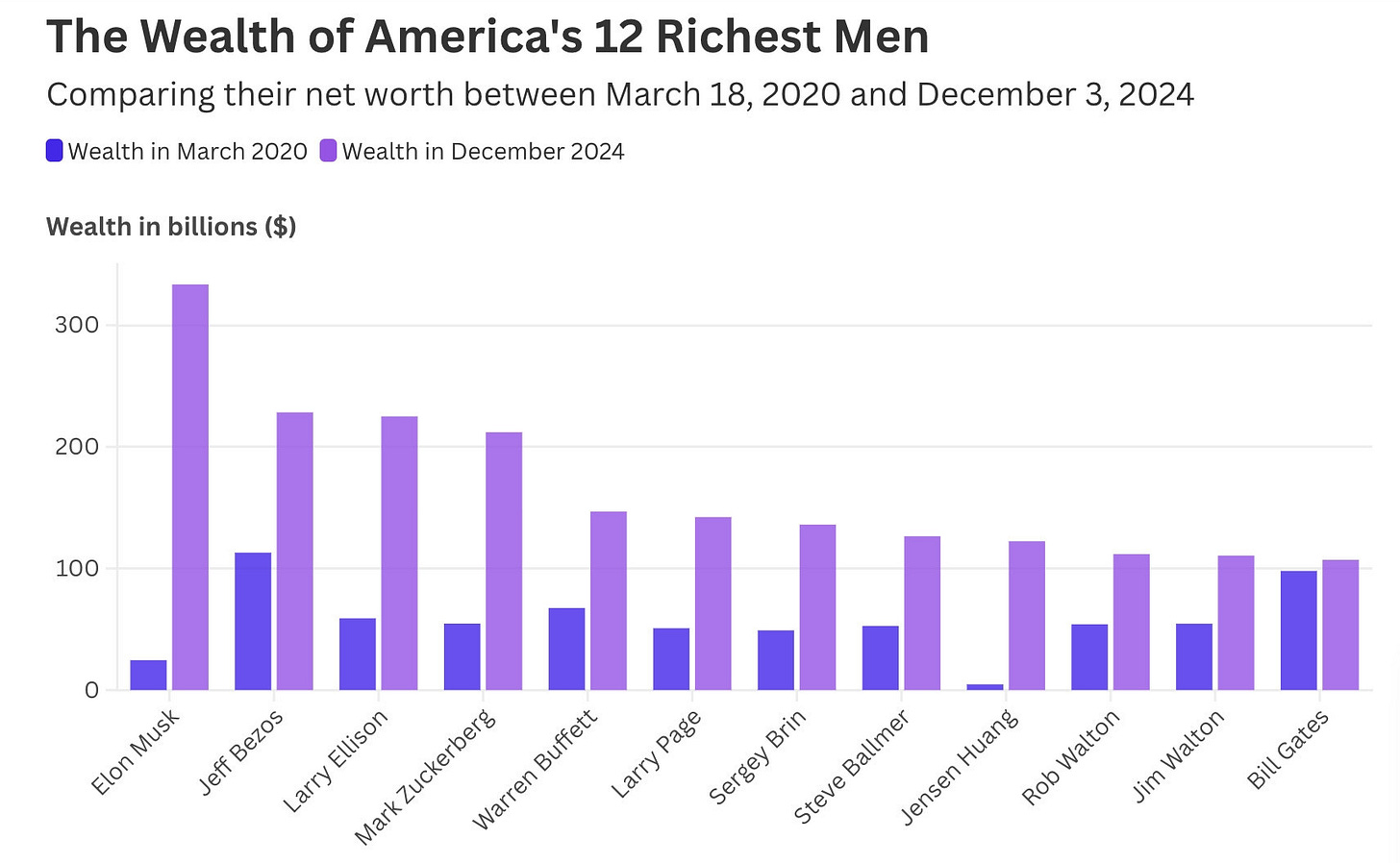

Wealth Distribution

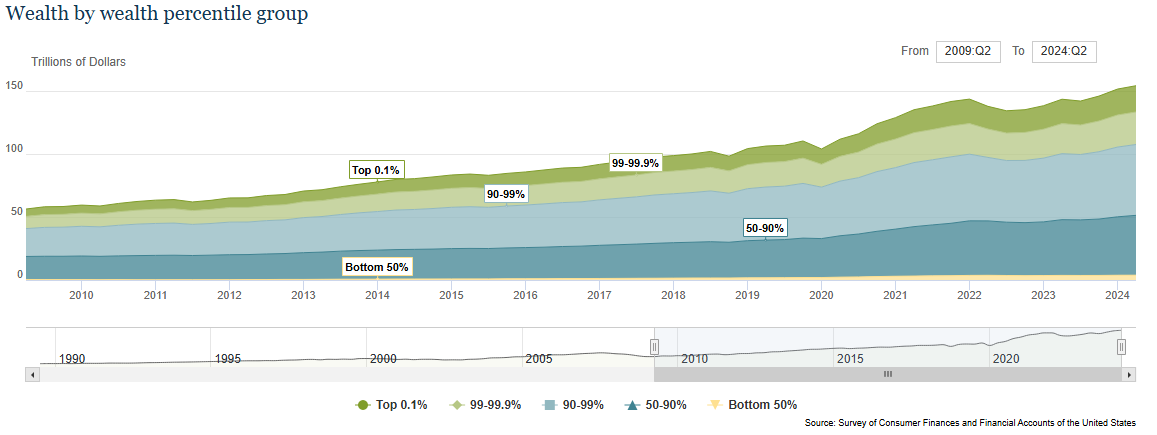

The wealth distribution over time and disaggregated by generation:

Folks that are against Fed easing short term interest rates are against (or don’t care) about improving wealth inequality.

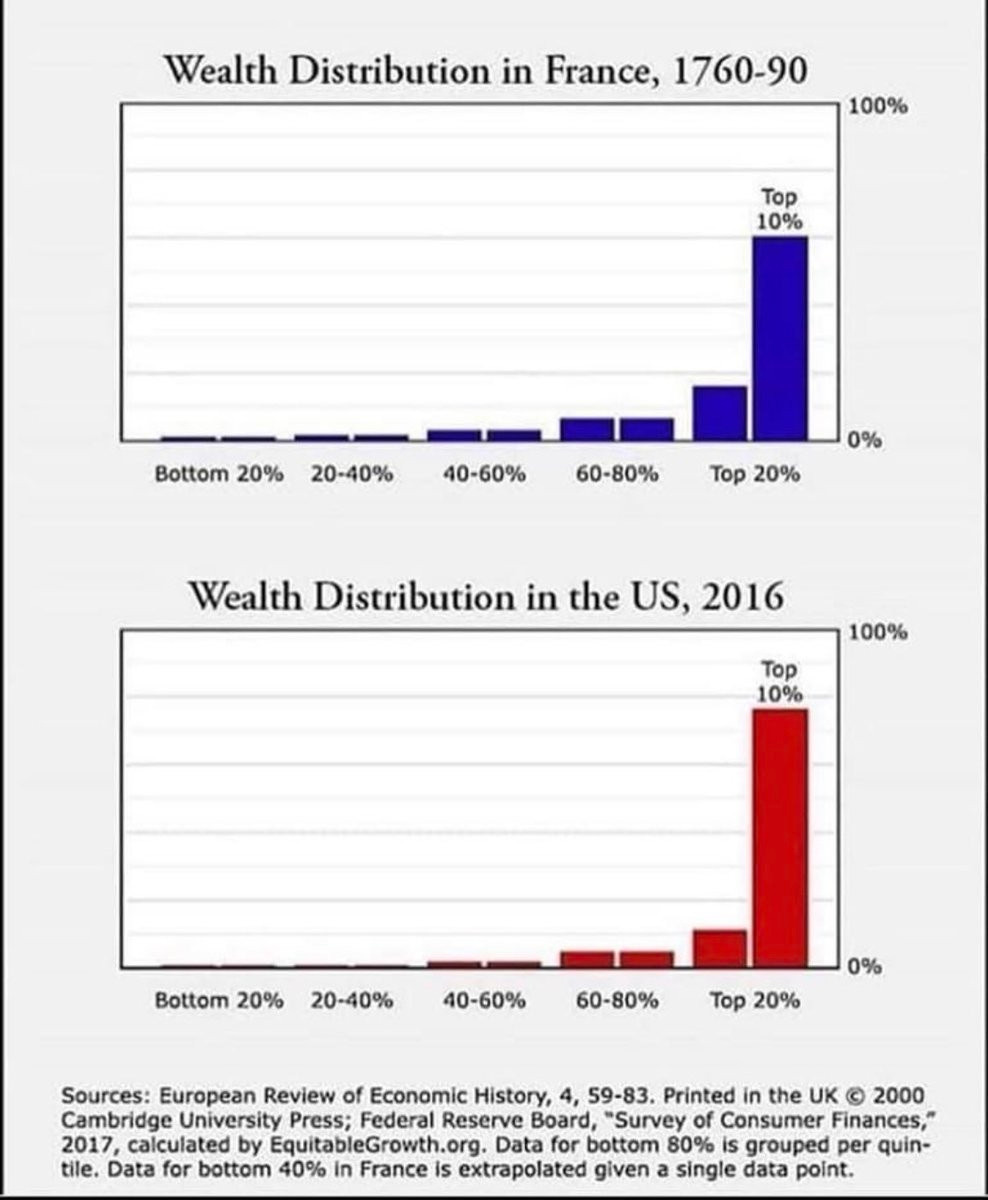

For reference, the wealth distribution in France around the time of French revolution:

The election results are likely to worsen inequality. Again, ignore the FinCond (Financial Condition) Zealots. They have been wrong about markets for two years straight and consistently displayed partisan bias in their market analysis.

There is a wealth tax in the US. It's just structured as political donations in a post-Citizens United world. We are a long ways from Carnegie and Rockefeller. The new stock “buyback” has become a “donation” to the president-elect’s inauguration fund.

At any rate to me it seems clearer every day that the moral problem of our age is concerned with the love of money, with the habitual appeal to the money motive in nine-tenths of the activities of life, with the universal striving after individual economic security as the prime object of endeavour, with the social approbation of money as the measure of constructive success, and with the social appeal to the hoarding instinct as the foundation of the necessary provision for the family and for the future. The decaying religions around us, which have less and less interest for most people unless it be as an agreeable form of magical ceremonial or of social observance, have lost their moral significance just because—unlike some of their earlier versions—they do not touch in the least degree on these essential matters. A revolution in our ways of thinking and feeling about money may become the growing purpose of contemporary embodiments of the ideal. Perhaps, therefore, Russian Communism does represent the first confused stirrings of a great religion.

- A Short View of Russia (1925) - John Maynard Keynes

I am usually pretty optimistic, but this wealth gap is not sustainable. There was a dream that full employment policy might be paired with taxing unproductive excess. That dream is dead. Only chaos and uncertainty remain. “Libertarians” voted for increased entropy.

Instead of taxing excess, the post-election market reaction involved a speculation mania anticipating zero enforcement of regulation policy (ZERP) and deportation.

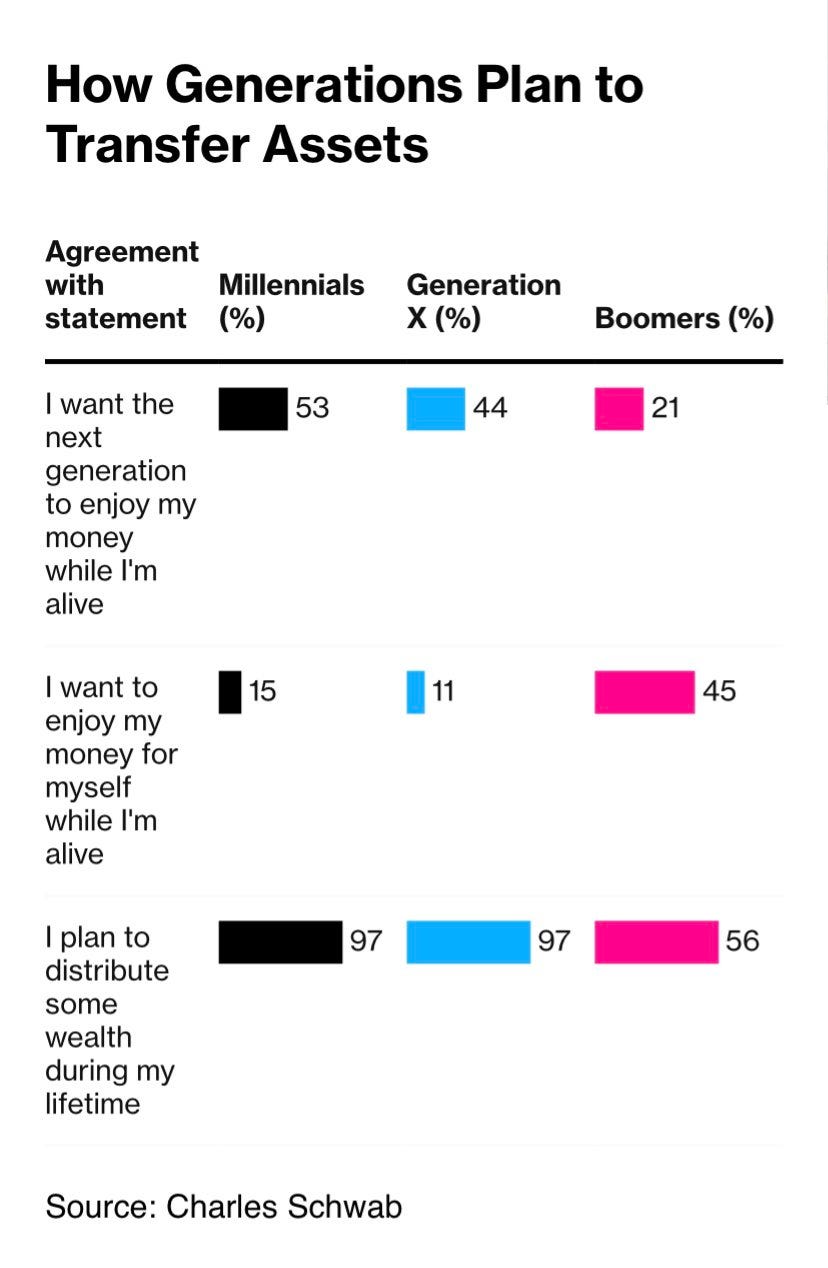

It is hard to tell whether world war or class war or generation war is going to happen first. Gen Z seems detached from reality but maybe that is being skewed by crypto/podcast/twitch bros.

Source: https://www.axios.com/2024/11/22/boomers-gen-z-millennials-financial-success

Twitch viewership rocketed during the pandemic and has settled at a higher level. The revenue structure is quite skewed for the top 400 streamers and there is considerable churn.

Source: https://www.businessofapps.com/data/twitch-statistics/

There are expectations for wealth transfer, but it does not help that boomers are the stingiest generation. Boomers have benefited from one of the biggest bull runs in history and are now enjoying one of the highest interest incomes in modern history.

More importantly, a portion of the top 0.1% have captured the government to avoid paying higher taxes. For reference, the Joint Committee on Taxation (JCT) provided a percentile distributional tables and it has the kind of granularity at the top (splitting off the top 0.1%) that is very useful.

So the top 0.1% is:

190,000 households who have

9% of national income

pay 13.3% of federal taxes

22.9% of income taxes

Source: https://www.jct.gov/publications/2024/jcx-26-24/

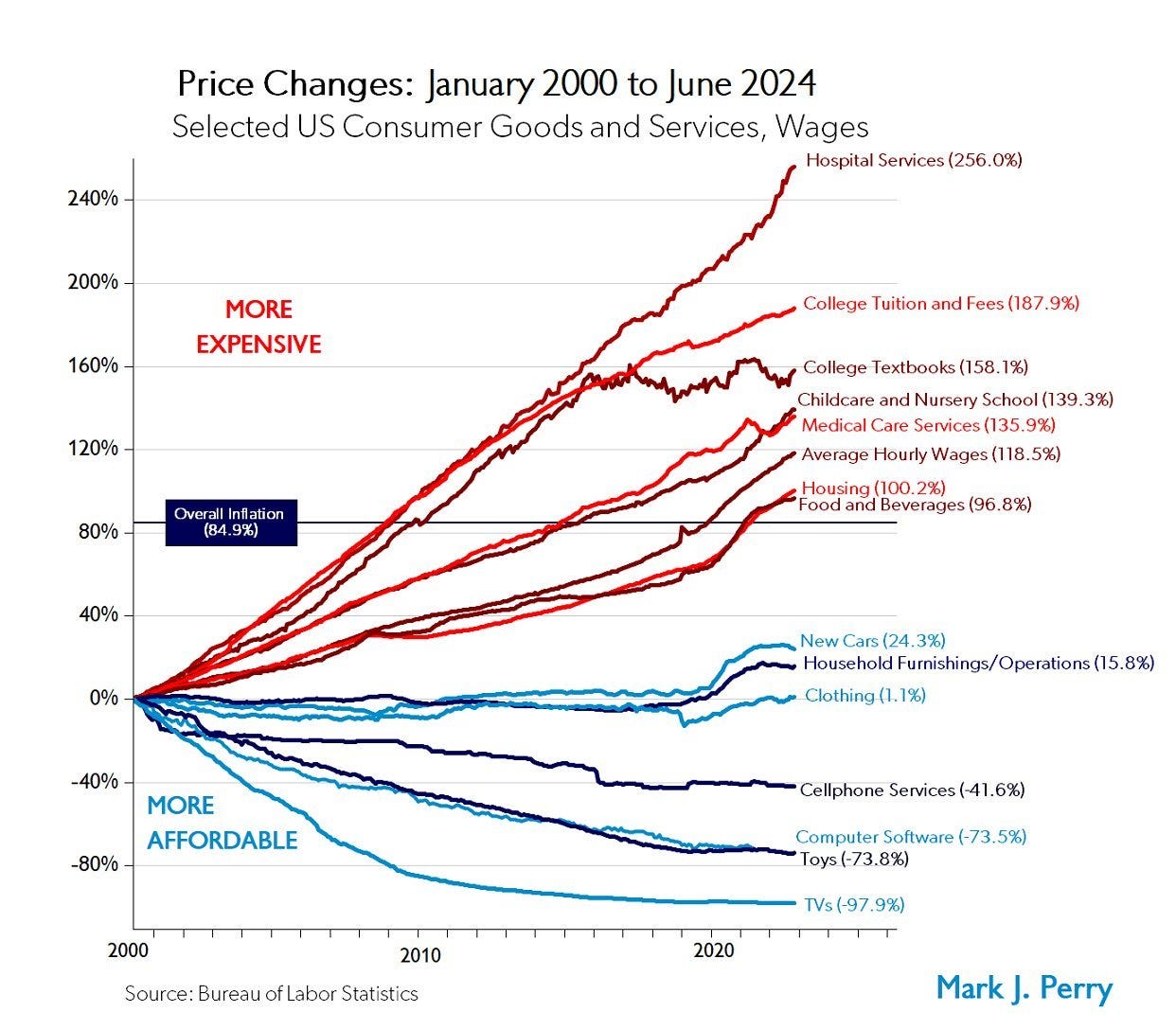

Inflation, Federal Spending and Productivity

Here are the cumulative price changes of US goods and services since 2000.

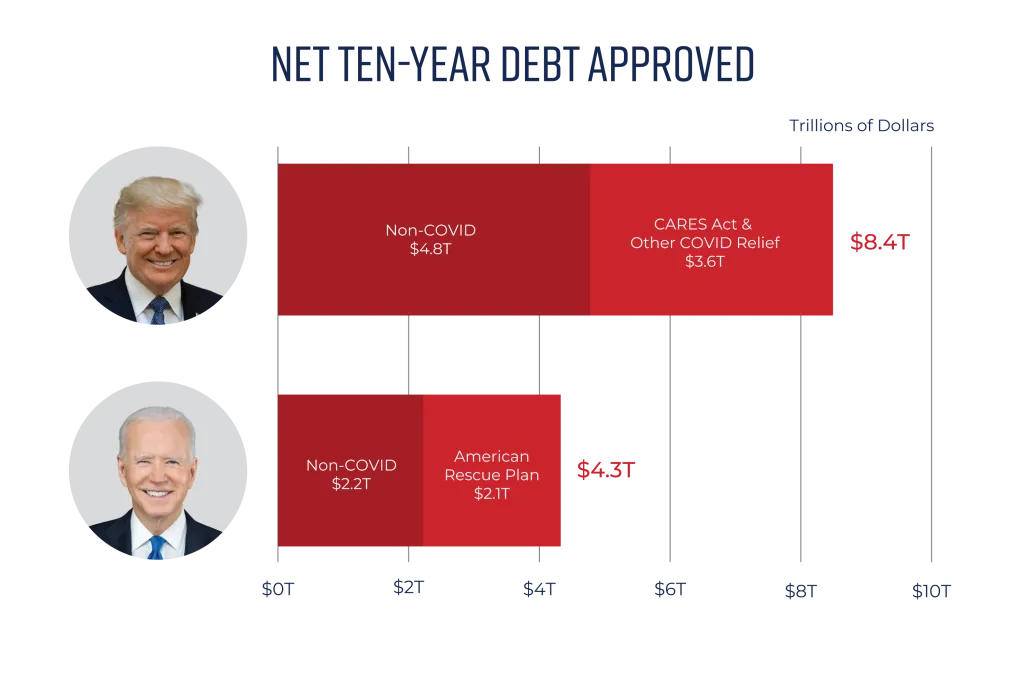

Inflation from the pandemic reopening and Russian invasion exacerbated affordability issues. It truly is a shame that people did not see how well the Biden administration pushed the US to lead the world recovery and setup what could have been the middle out expansion boom. Instead, we are likely going to face class wars with a widening wealth gap. The Biden admin deficit pales in comparison to its predecessor and was much more productive. The CARES included PPP loans that went to Tom Brady and Lil Wayne.

Source: https://www.crfb.org/papers/trump-and-biden-national-debt

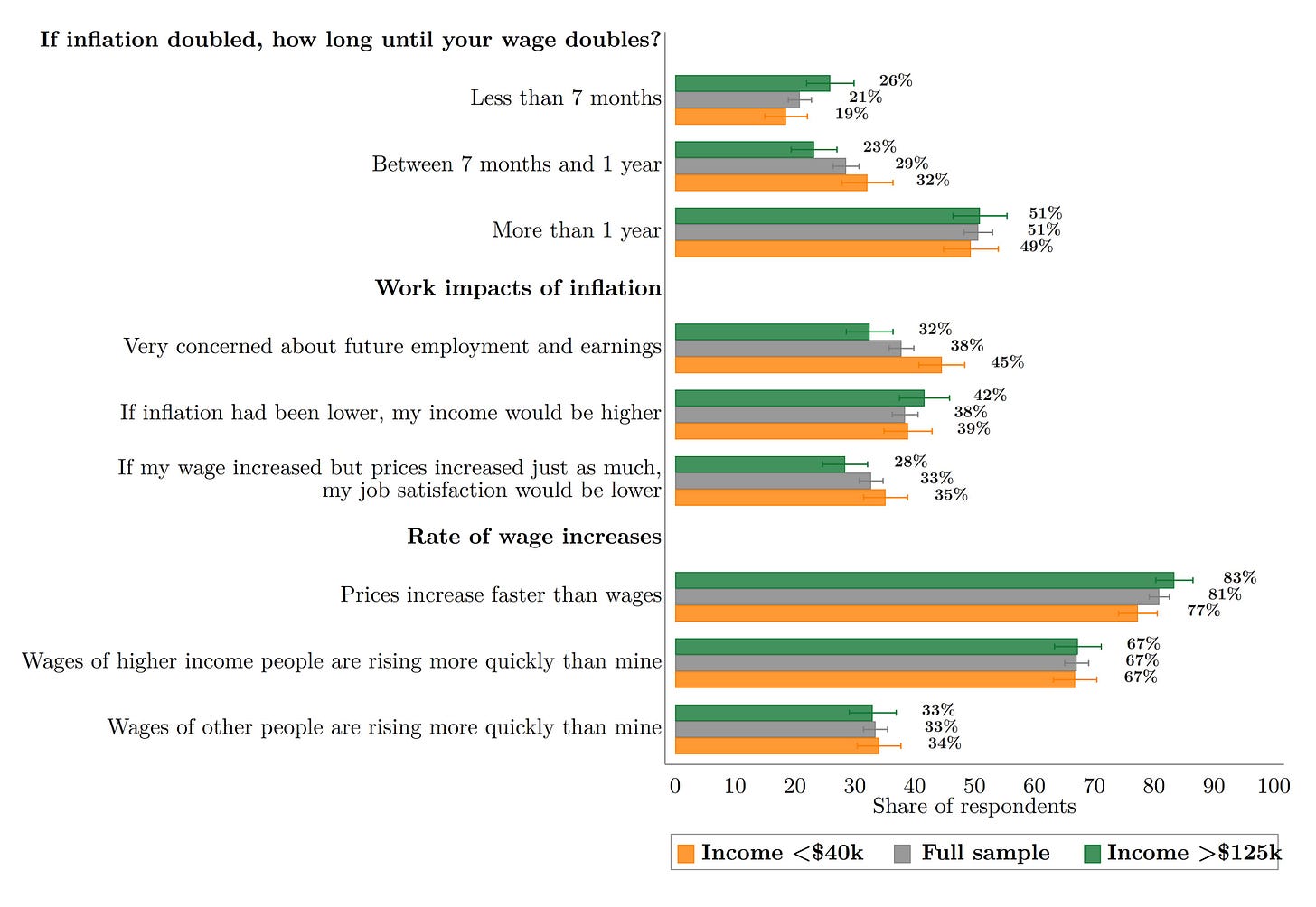

Since taxation is out of the question, inflation will be the result from reckless deficit spending. Inflation induces a sense of inequity. First, low-income respondents are most affected and make more adjustments. Second, there is a clear perception that wages of higher-income people grow faster than others’ and are better able to keep pace with inflation. It is likely to happen again when deportations and tariffs are implemented.

Source: @s-stantcheva.bsky.social

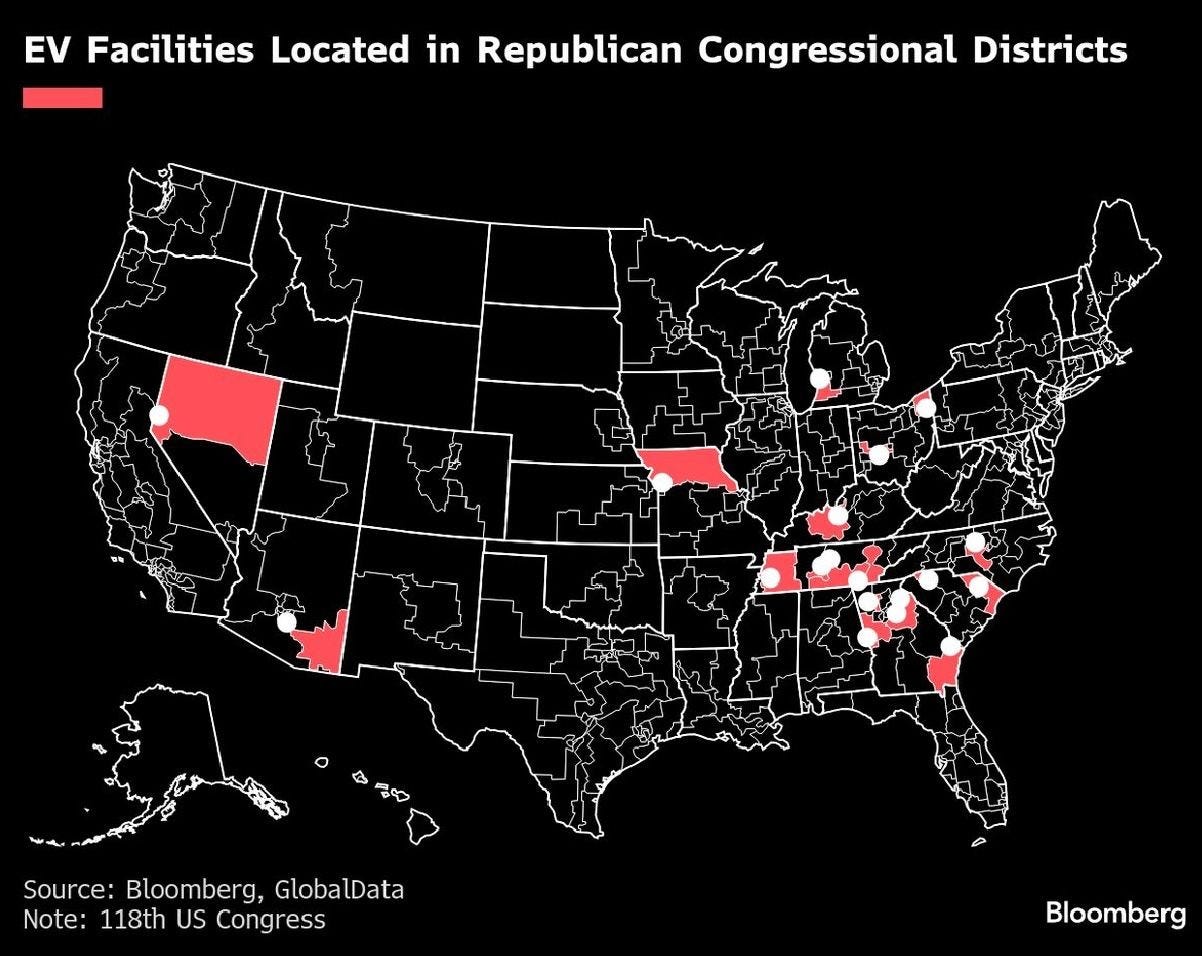

Most of the new EV & battery factories - many spurred by Biden/Manchin’s Inflation Reduction Act - are in House districts held by Republicans. These “bubbles” showing congressional districts that favored Trump in the 2020 election receiving three times as much clean energy and manufacturing investments as those that leaned toward Biden. Similar to Obama’s legacy being Affordable Care Act (ACA), Biden’s legacy will be how CHIPS/IRA endure the incoming administration.

Source: https://www.washingtonpost.com/climate-environment/interactive/2024/climate-bill-biden-clean-energy/

Unions have been relatively weak compared to past history. The folks that argued wage growth was inflationary were wrong. They only looked at the aggregate instead of framing these wage gains as catching up to inflation, rather than fueling inflation. These folks were likely to dismiss productivity growth as well.

Source: @bbkogan.bsky.social

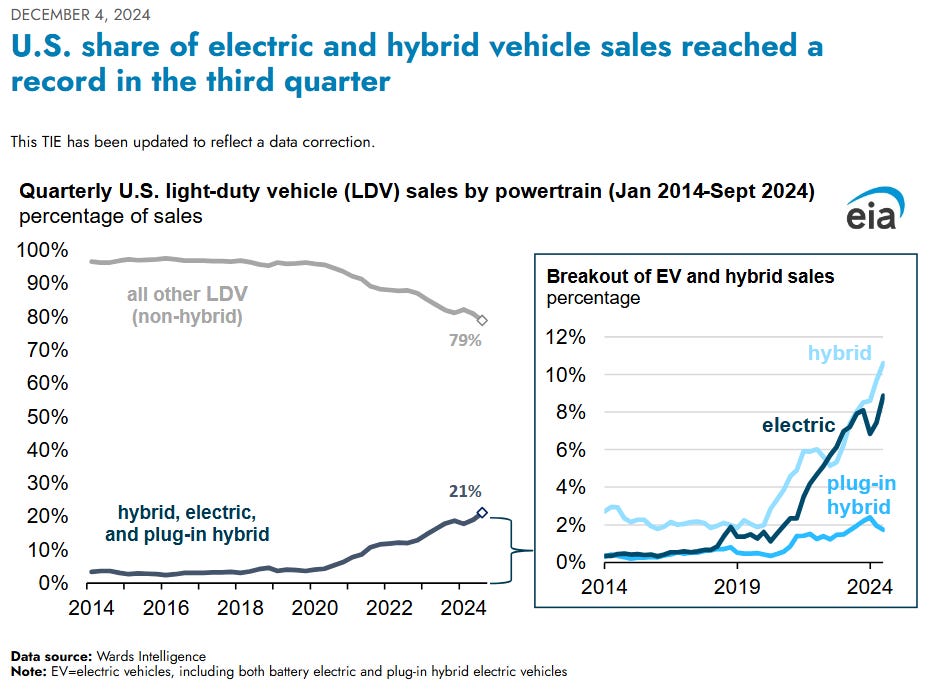

The customer is always right. No, they aren’t. It’s still early for leopards. EV technology is here and the US needs domestic manufacturing to combat China’s dominance. The incoming admin is likely to weaken both growth and renewable energy technology by going after IRA. The time would be better spent on improving National Environmental Policy Act (NEPA) while balancing climate risk.

AI enthusiasts are about to find out nuclear depends on the Department of Energy and dismantling LPO basically wipes out the nuclear renaissance before it actually gets going.

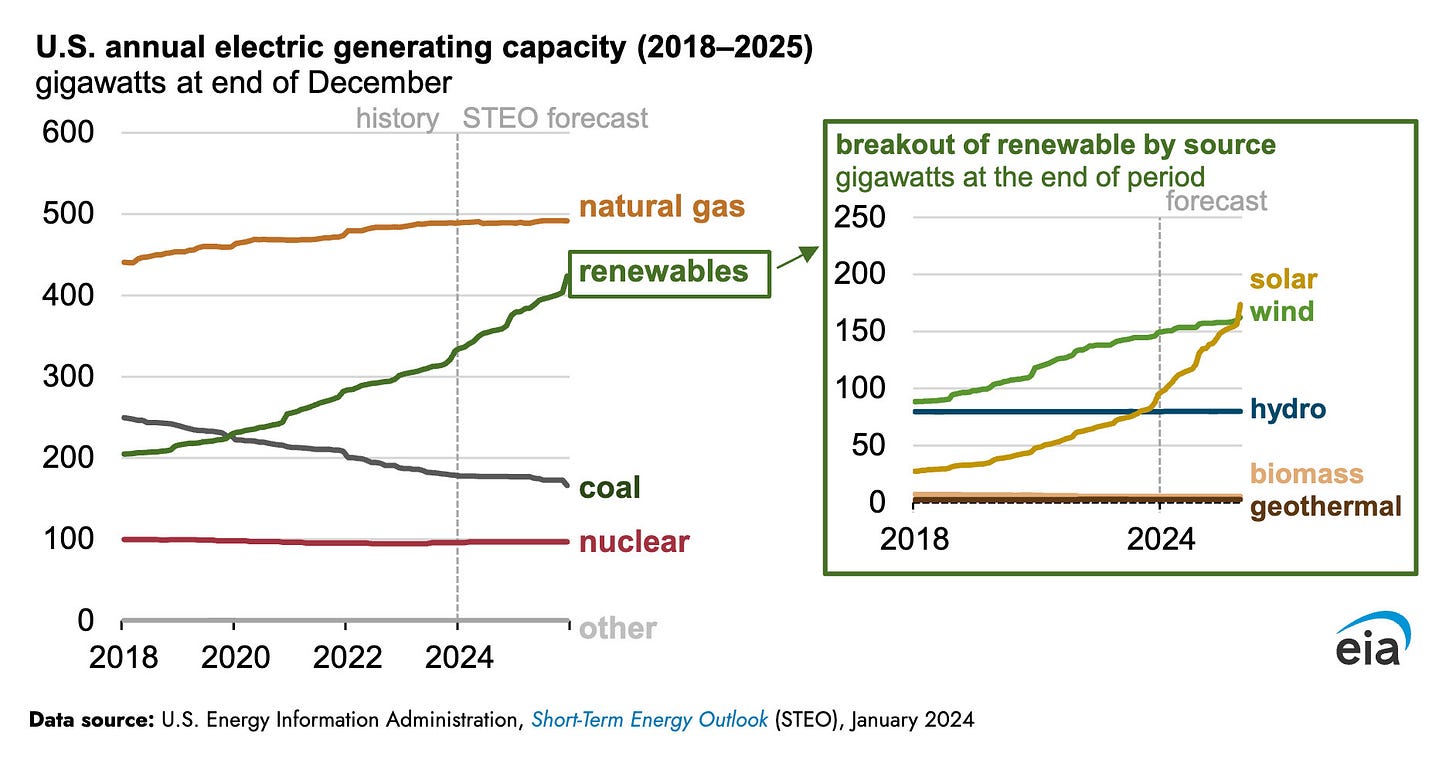

Source: https://www.eia.gov/todayinenergy/detail.php?id=61242

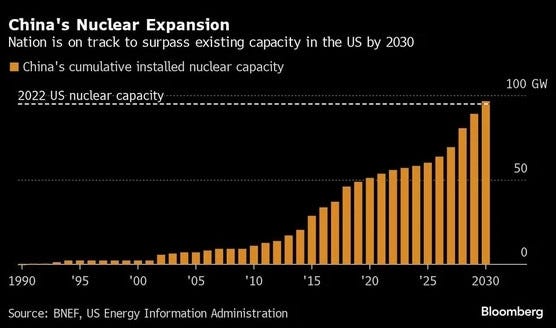

China on the other hand, has no issues with electricity generation and are pursuing nuclear expansion. Renewables are great for national security.

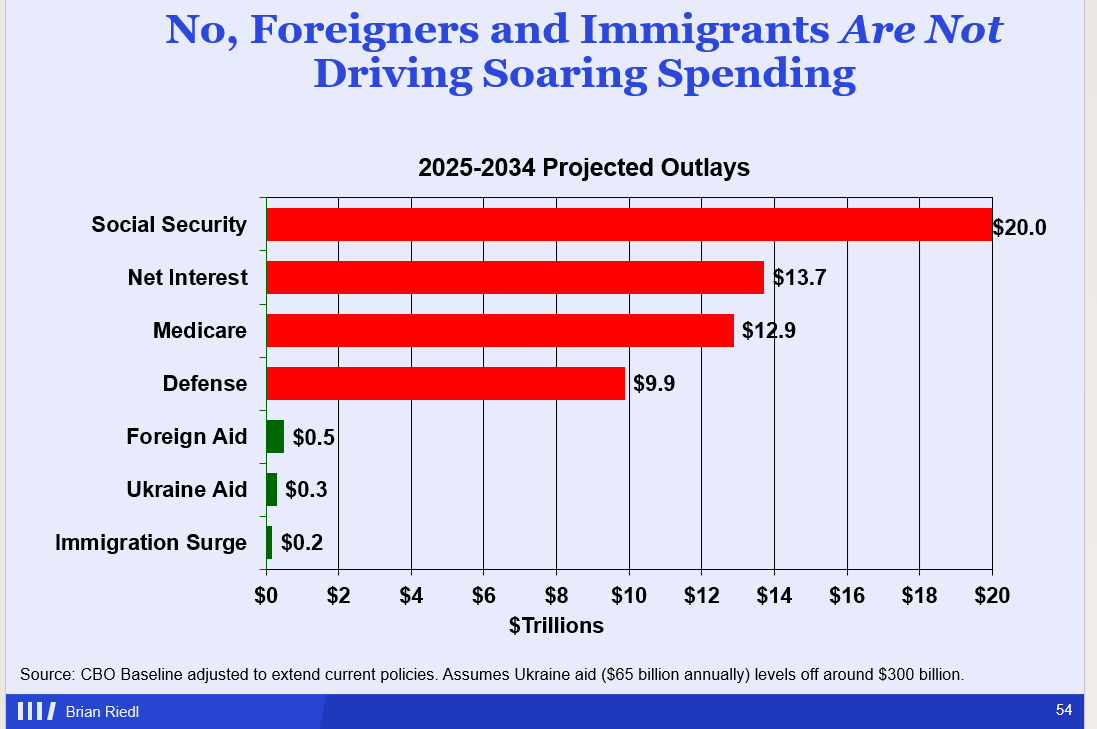

Taxes

Out of the 6.5T government spending, how much is forced wealth transfer that would not occur without the government and thus would not be able to be privatized? How much would private provision of currently government executed services be less wasteful? The lion share of spending is forced wealth distribution and the ability to shrink the budget is about that. What that means is it's a political decision on who gets money not an efficiency argument. For the record, the deficit has actually been improving as the Biden administration’s spending has proven to be productive.

I support efficiency and productivity growth. That should be obvious. However, the Constitution has moral elements that are about to be disregarded. Fiscal and monetary policy have complemented each other. That is about to change.

Brendan Duke (@brendanvduke.bsky.social), Bobby Kogan (@bbkogan.bsky.social), and Jessica Vela, and shared their principles for how to evaluate a 2025 tax bill, a view of passing a bill that violates these principles is worse than letting the whole thing expire.

Source: @brendanvduke.bsky.social

Unfortunately, the base case should be a tax bill that violates these principles. Trump tax cut extensions and any new tax cuts are unlikely to be fully offset with tax increases on high-income households. Extending the Trump tax bus without offsets would increase the long-run fiscal gap by more than 50%, with a high probability of increasing the fiscal gap and long term interest rates as bond market participants account for chaos premium.

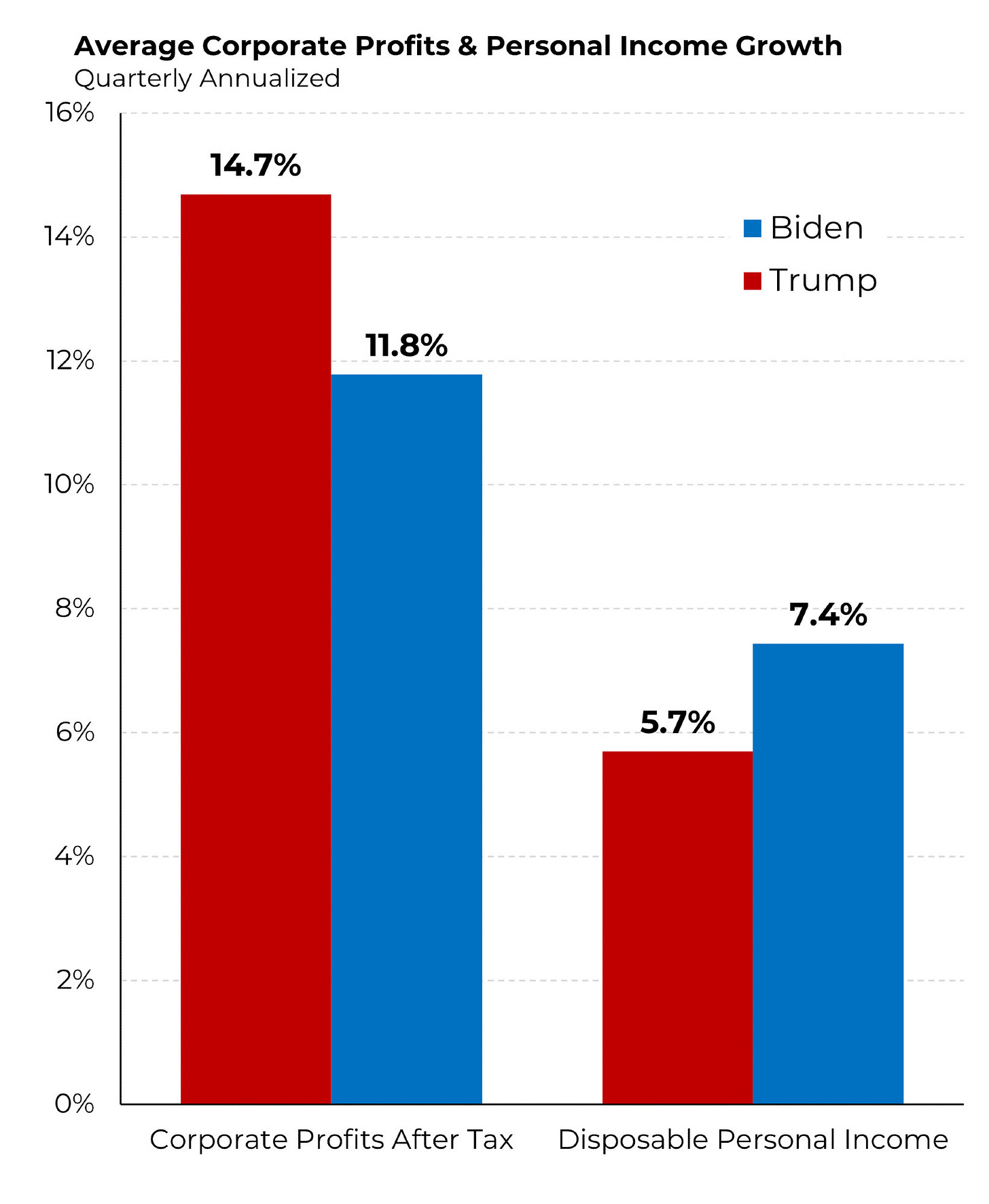

It has been truly unfortunate how the electorate failed to realize how the Biden admin fought for labor against capital. Markets are near all time highs while the profit-income differential closed relative to the previous admin. But clearly, the electorate didn’t “feel” it.

Source: @steverattner.bsky.social

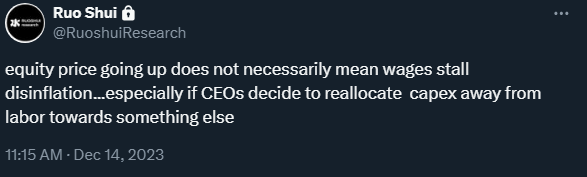

Lowering the corporate tax rate is unlikely to manifest as wage growth. Hurdle rates remain high and many firms (especially so in finance and industrial) are looking to invest in automation and AI instead of labor.

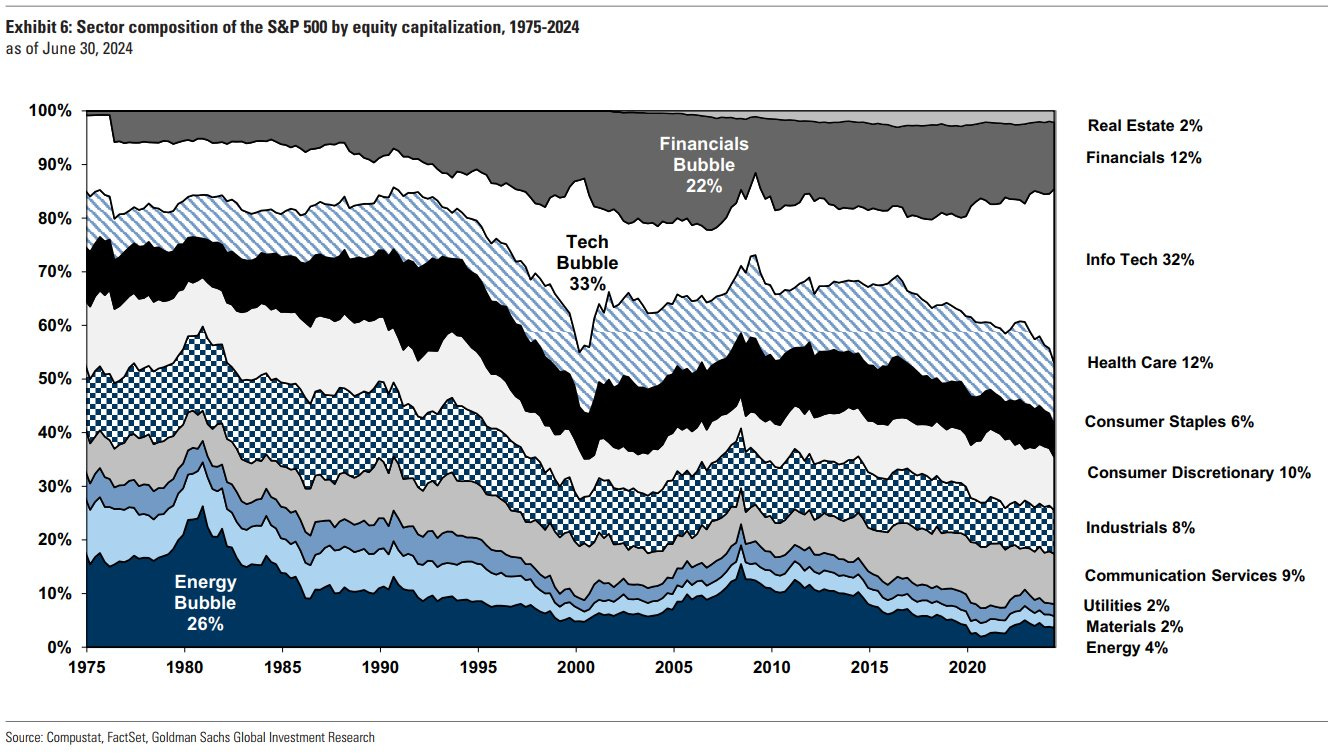

Hyperscaler profits being used to finance the AI boom is one of the biggest differences from dotcom. However, the divergence between markets and the economy will eventually end as everyone share the same hurdle rate that is being kept high by fiscal expectations.

Source: @gregdaco.bsky.social

The incoming admin is likely to look at cutting Social Security and Medicare while extending tax cuts. Deportation will only restrict housing supply growth and worsen labor shortage. Tariffs will not get anywhere close to offsetting the lost revenue. More rocket launches and full self-driving (FSD supervised) from regulatory capture will do little to improve productivity at the macro level and justify the tax cuts.

Source: @brianriedl.bsky.social

Gen X voting for Social Security cuts is probably going to be studied in psychology and behavioral finance for a while. Millennials are the most sane generation as most are focused on providing for their family and largely understand where entitlements go. Cutting Medicare may be the darker way to reduce the retirement state and speed up the wealth transfer process though.

Source: https://manhattan.institute/article/the-overextended-retirement-state

With the current Supreme Court, it is hard to take anyone claiming there are still checks and balances in place seriously. It doesn’t take rocket science to figure out where cuts will be happening. Whether people realize who stopped providing entitlement checks is another story. The wealth gap is likely to worsen.

Source: @steventdennis.bsky.social

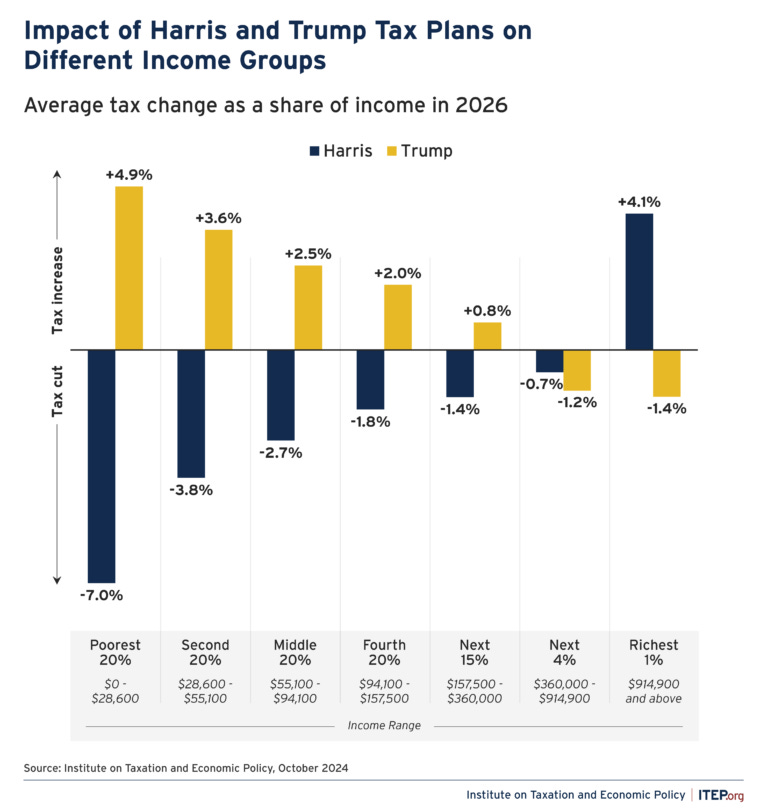

Source: https://itep.org/kamala-harris-donald-trump-tax-plans/

Federal Reserve vs Captured Departments

The Fed is basically the only institution left actively fighting for the People. It might not be obvious, but the Fed as continuously acted in the best interests of Americans. The president-elect is inheriting one of the best economies in history thanks to the Fed, but the Fed does not control the long end of the yield curve. The yield curve is affected by the combination of the Fed (short term rates subject to monetary policy) and the Treasury (long term rates subject to fiscal policy). Folks talking about money supply and quoting Milton Friedman only have partial understanding of how the economy works. If interested, Divisia is the better rabbit hole for money supply instead of wasting time looking at M2. It is worth noting that on 4/24/2020, the Fed announced a change that blurred the lines between checking and savings accounts.

Source: https://fredblog.stlouisfed.org/2021/01/whats-behind-the-recent-surge-in-the-m1-money-supply/

Between high yield savings, money market funds and just SGOV 0.00%↑, some people are still enjoying Uncle Sam’s dividend that is set by the Fed. The FOMC has Fed Funds rate to control the short end and forward guidance’s main purpose it to anchor inflation expectations. Many are still incorrectly think the Fed controls mortgage rates. Inflation expectations are taken into account along with growth and fiscal policies by bond market participants. The combination of productivity, population growth and fiscal policy determines long end yields, ultimately affecting hurdles rates and mortgage rates for firms and potential homebuyers. Although everyone faces the same borrow rates, the yield curve stimulates those with assets while restricting those without assets.

Source: https://fred.stlouisfed.org/series/WRMFNS

Source: https://www.ici.org/research/stats/mmf

Quantitative Tightening (QT) is likely to come to an end in 2025 and that should have narrowed the spread between the 10yr and 30yr mortgage rates. Term premium may offset that and that will depend on inflation expectations and fiscal policy. Again, the incoming admin’s policy platform is likely net inflationary.

Source: @fullcarry.net

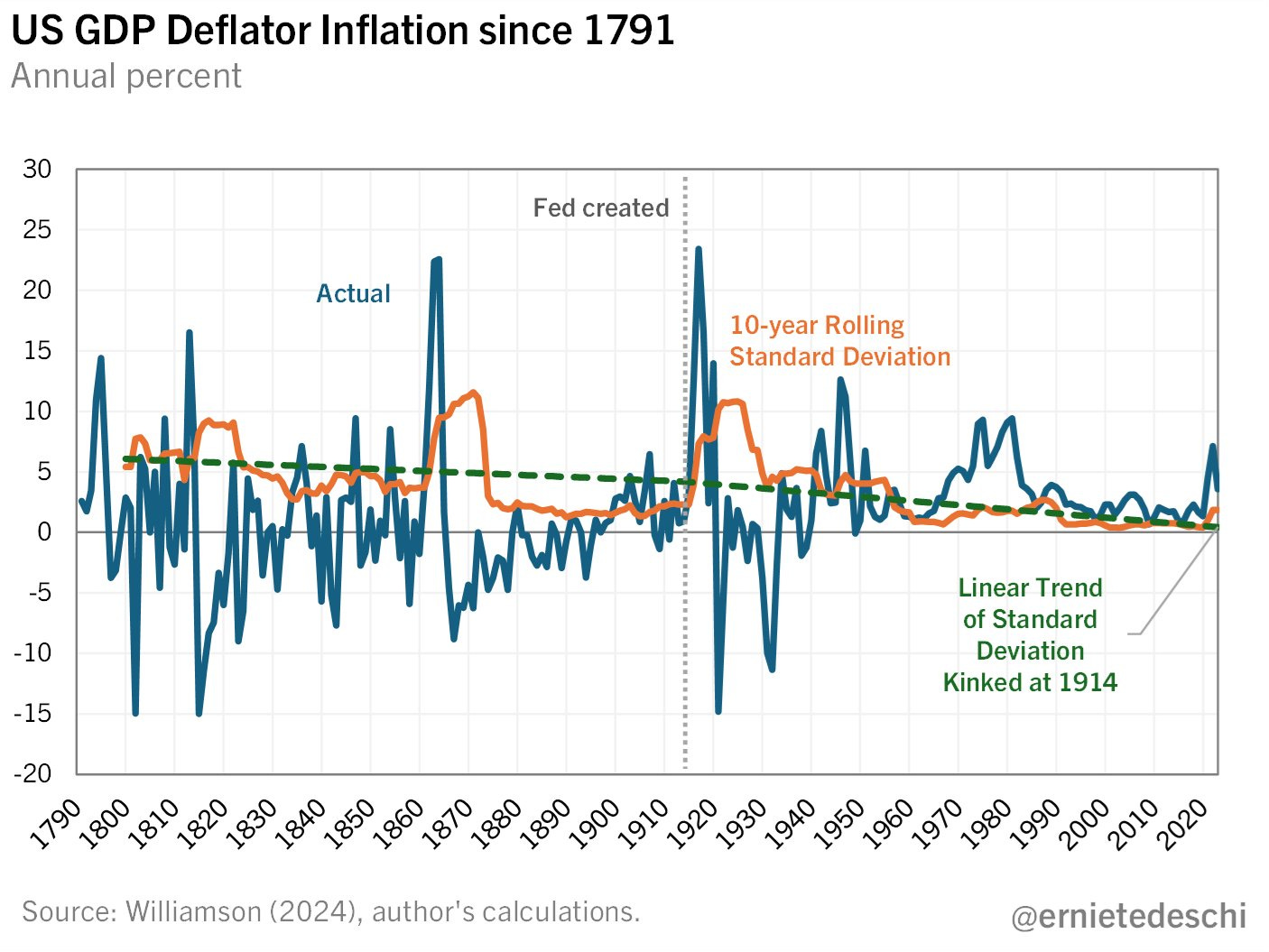

While I believe the 08 recovery took too long, I believe the combination of fiscal and monetary policy has been good for the People. There are going to be folks pointing out the end of the gold standard coincided with reduction of recessions. I see fiscal and monetary policies acting as shock absorbers promoting economic stability and expansions that foster productivity growth.

However, prolonged ZIRP and exacerbated the asset/wealth gap. Fed hikes benefited those with assets, especially those with the knowledge to term out their debt during Covid. Households and businesses utilizing market money funds were stimulated by Fed hikes and largely unaffected by long term interest rates rising. This bifurcation has led to a frozen existing market and higher hurdle rates for hiring. I think the higher hurdle rate is good as there have been both capital and labor misallocation, but there are those who yearn for ZIRP again. Housing affordability obstructs household formation and mobility, but NIMBYs just won the election.

Georgie crossed the Delaware so Americans can get 30-year fixed mortgages. For those with one, it’s the greatest asset. For those without one, it’s their worst hurdle rate. There will be people that say the Fed should just “lower rates.” That’s not how it works. The Fed doesn’t directly control the borrow cost for long duration debt.

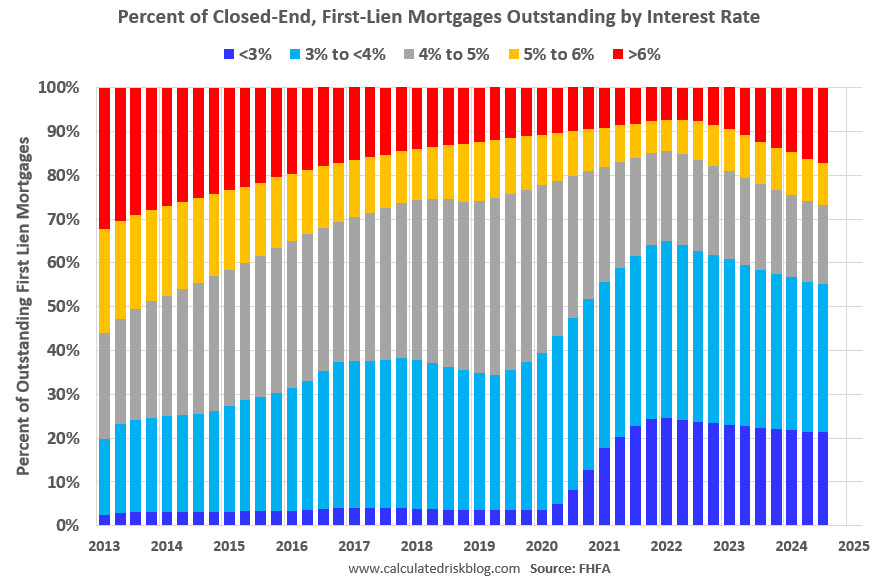

Source: @calculatedrisk.bsky.social

Unfortunately, the electorate believed in the words of demagogues. The attacks will only get more intense on Chair Powell while those with megaphones attempt to hide the real culprit of tax cuts. Many of the deregulation bros think they can make the government more efficient, but will probably end up cutting Social Security and Medicare. The made up department is unlikely to bring productivity growth to the People. The bears will eventually show up as these “libertarians” advocate for zero enforcement of regulations and increase entropy in the system.

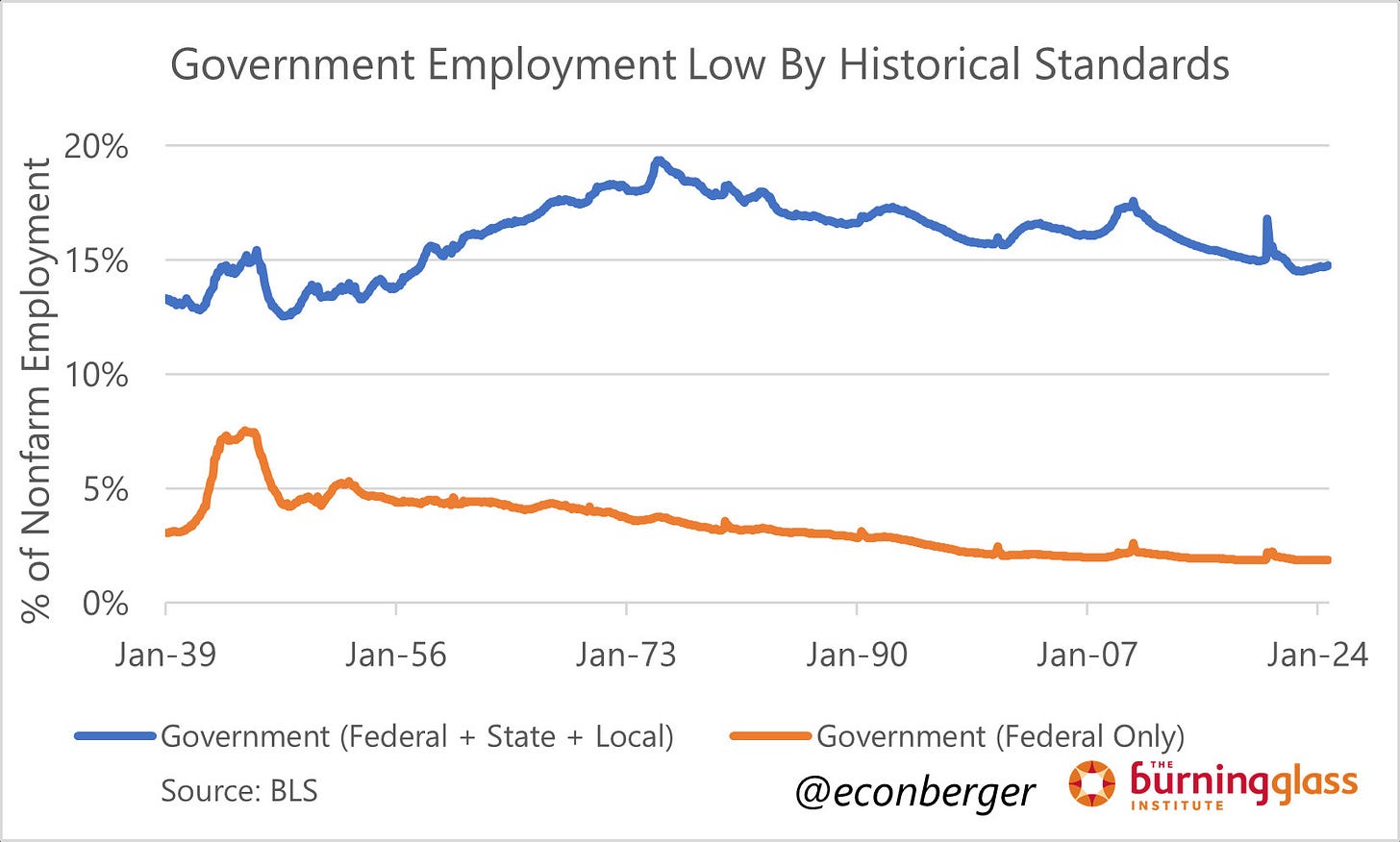

Source: @econberger.bsky.social

Source: https://newrepublic.com/article/159662/libertarian-walks-into-bear-book-review-free-town-project

Some of the crypto bros think a strategic bitcoin reserve will pay for deficit spending. This is incorrect. It will end up causing interest rates to rise and these delusions will eventually face the reality that debasing the dollar does not help with building or purchasing a house.

Before Modern Monetary Theory (MMT), we had functional finance-govt doesn’t “pay back” its debt like a households or businesses. Bonds are just interest bearing instruments. Using taxpayer money to prop up “store of value” will cost Americans.

The government issues bonds and charge taxes to create demand for a currency. The budget constraint is the economy’s potential/stability not the deficit. The market determines whether the yield is appropriate. Anyone advocating for YCC is advocating for a weaker dollar. If the Fed enacts QE/YCC at the expense of the dollar, consumers will face a higher cost of imported goods and services. Globalization has been key for growth, innovation and democracy.

Source: @Brad_Setser

Macroeconomics is hard and sometimes even contradictory. It is not easy to “dumb down.” It is much easier to control an ignorant population with viral memes.

Source: @jamessmurphy.bsky.social

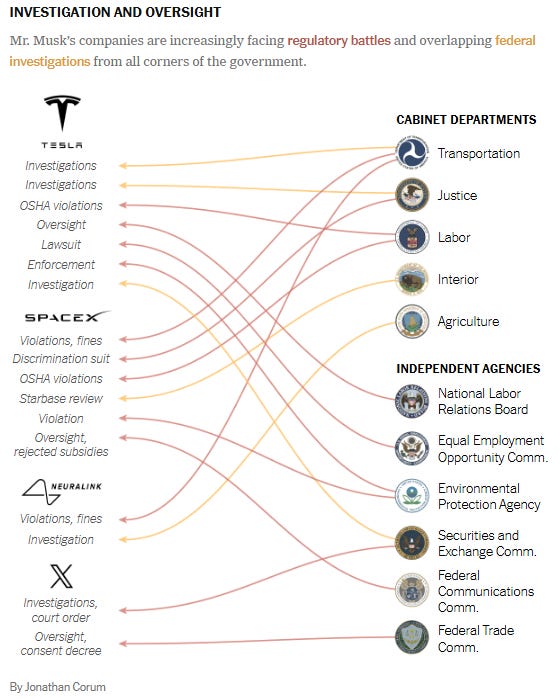

The market is correct in trying to price in Elon regulatory capture. It will be interesting to see how consumers react to the Tesla brand over time. More rocket launches and FSD (supervised) don’t actually matter to most people and won’t do much to improve quality of life and cost of living.

There is only so much regulatory (carbon) capture that can be used to justify stock valuations but the vibe is something else. FSD is not ready to be a robotaxi service and won’t be for a long time. There will be crashes and accidents.

Source: https://www.nytimes.com/2024/10/20/us/politics/elon-musk-federal-agencies-contracts.html

Quality of Life and Cost of Living and GLP/AI

Most people just want to decent wage that is capable of supporting a decent life. “Decent” is obviously relative. While wage growth has improved for the lower income quartiles the most, it is still clear there is a K shaped economy. That is before taking into account for the asset/wealth gap.

There is denominator blindness. Food, gas, rent to disposable income ratios have all fallen back to prepandemic levels while debt service ratios have normalized. Posting W2s doesn’t really go viral and Doordashed Chipotle burrito receipts make for better memes.

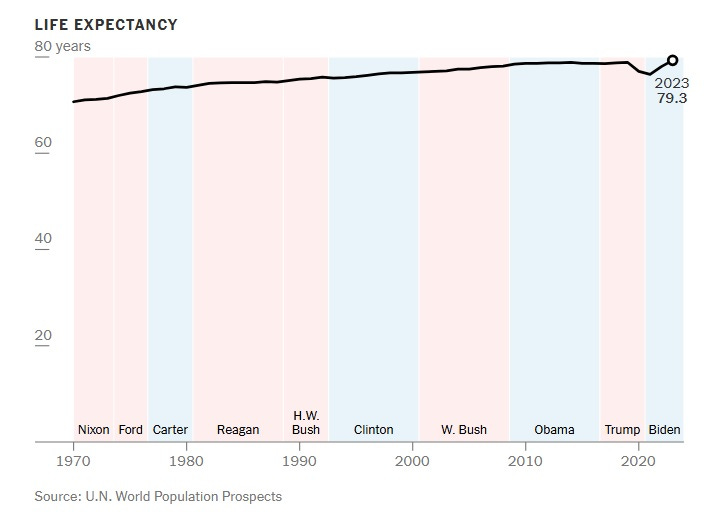

Life expectancy has recovered from the pandemic dip but good stories just do not get clicks anymore. Stories that don't get clicks are effectively "false." Social media has been a net loss for society.

That being said, affordability continues to be an issue. As the richest nation in the world, we also spend the most on healthcare. There are many reasons for this, but it is clear many people are angry about healthcare costs. Transparent pricing is needed.

Source: https://www.ft.com/content/a757fb35-889b-46a7-b32c-5e8e254f6450

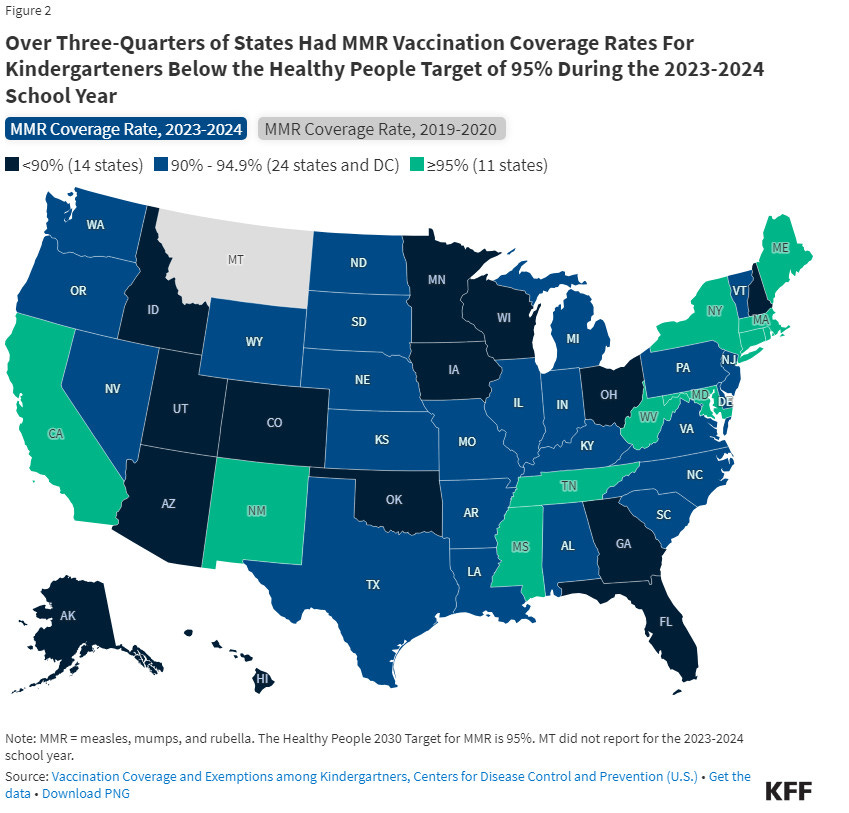

Just for the record, vaccines are miraculous.

It is wild that one of the first successful industrial policies in a long time, Operation Warp Speed, led to a successful anti-vaccination campaign. “Survival of the fittest” hits different in 2025.

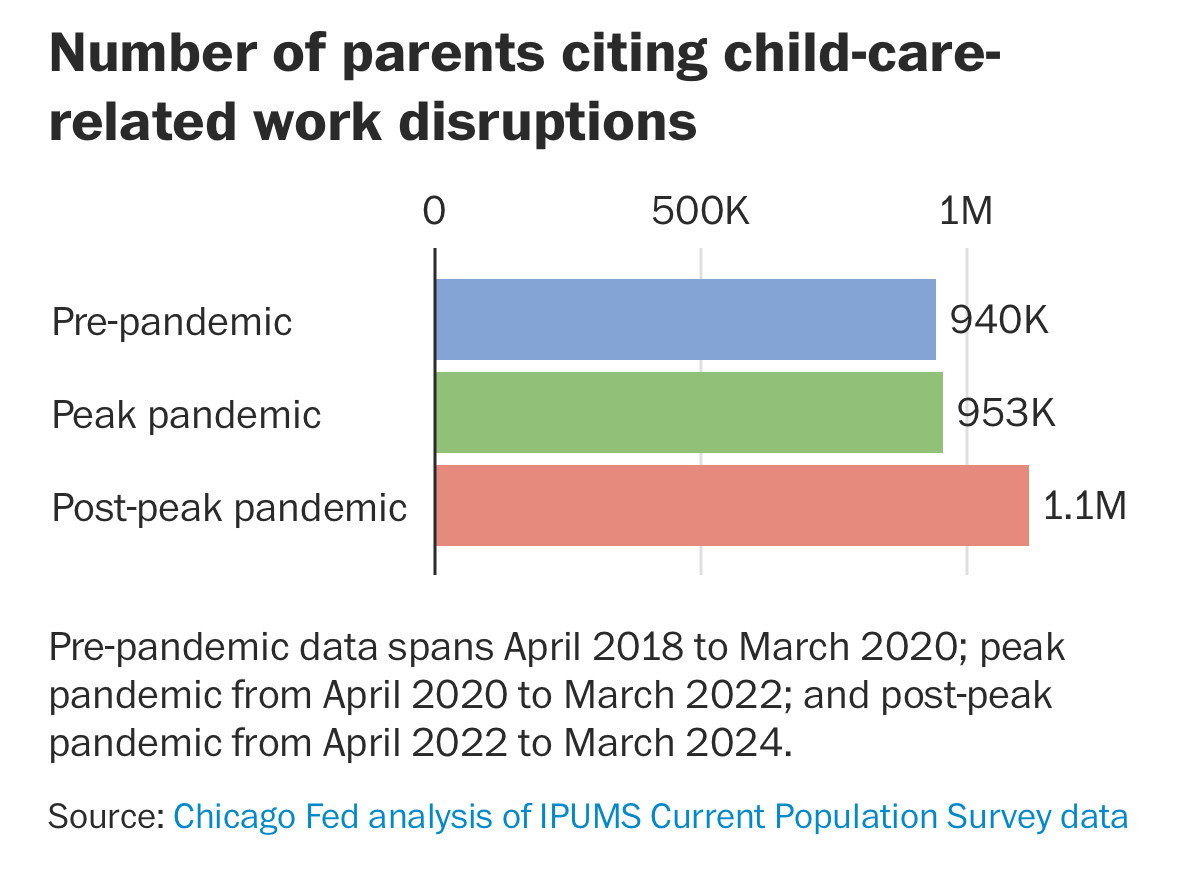

Childcare costs are high. The pandemic closed some daycares and in many parts of America costs are over 15% (or even 20%) of median household incomes.

Source: https://www.visualcapitalist.com/mapped-infant-child-care-costs-by-u-s-state/

Working parents’ childcare struggles may get worse with deportation and return-to-office mandates. Nearly 1 in 3 US workers is a parent of a child under 18.

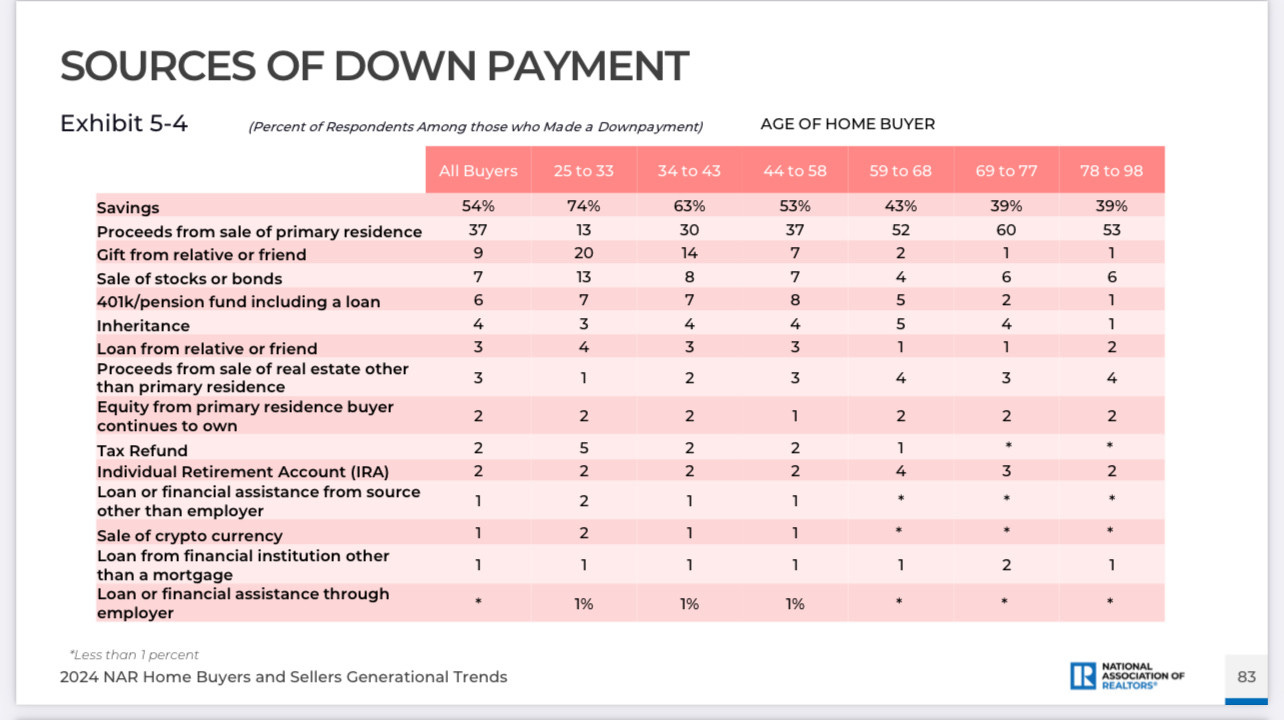

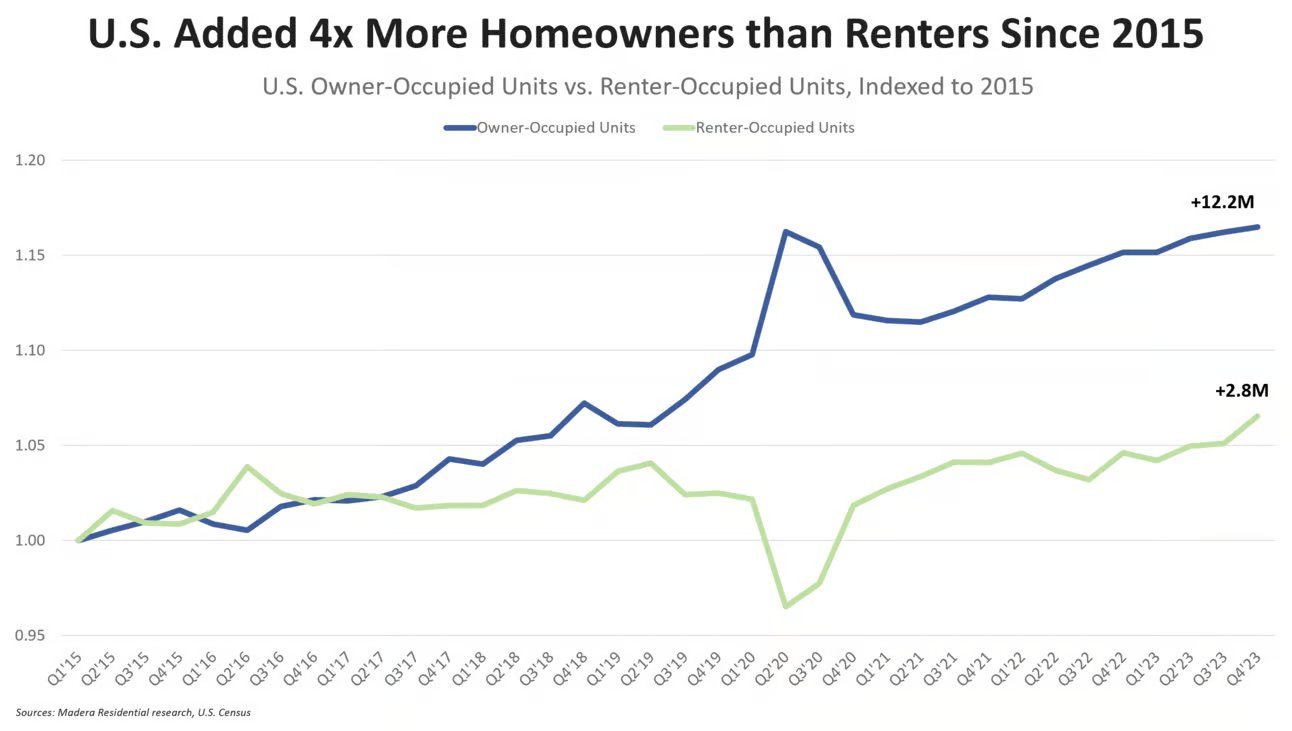

Housing affordability is still an issue. While it is clear many homeowners benefited from recent home price appreciation, it is also clear the current housing shortage and mortgage rate is restricting mobility.

Source: https://www.redfin.com/news/homeownership-rate-by-generation-2023/

America has been adding homeowners faster than we've added renters-- and the consequence is a lot of owner-occupants (who still dominate the home sale market) competing for a finite stock of single-family homes and young adult population migrating to more affordable states.

Source: @jayparsons.bsky.social

But what about those that missed the low interest rate regime? The anger and mistrust at institutions has manifested itself as crypto. Unfortunately, crypto and Bitcoin are not the answer to affordability issues. The odds of the most unproductive asset available in markets helping young adults achieve financial independence are low. Bitcoin going to the moon implies dollar debasement and inflation.

Financial literacy is probably correlated with 8th grade mathematics which dropped from the pandemic shut downs and has not fully recovered. Excess liquidity has found their way to useless speculation.

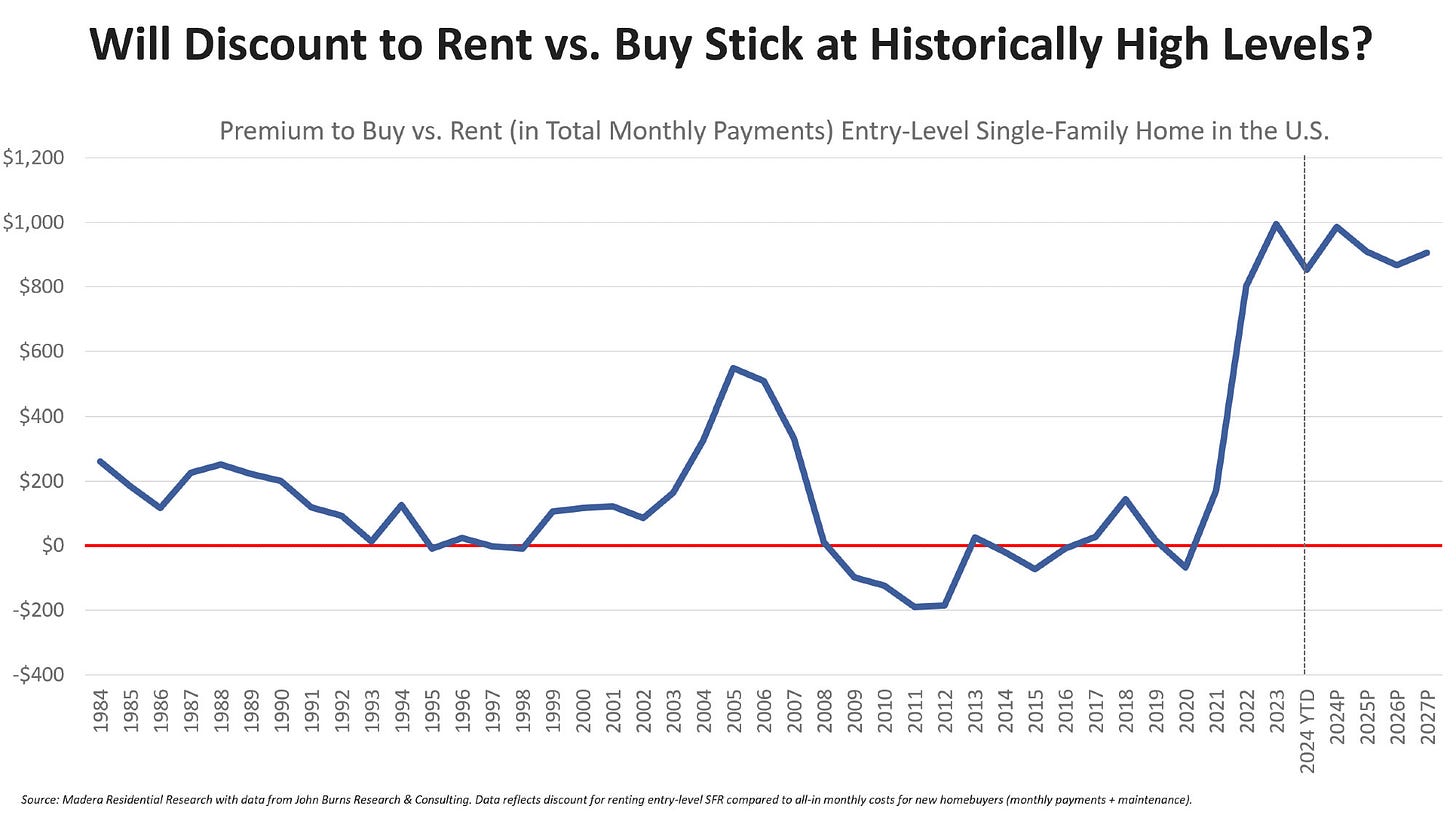

Meanwhile, the housing shortage persists and the premium to buy vs rent is at historically high levels. Instead of financing housing starts and permits, shitcoins are running wild. Shitcoin price movements have been indicative of market expectations for fiscal policy (or lack thereof).

Source: @jayparsons.bsky.social

I believe crypto has cooked some brains and is affecting marriage and fertility rates. Unfortunately, it is a symptom of affordability issues.

While the incoming admin focuses efforts on deportation, tariffs and tax cuts, people are likely to forget the Biden admin’s attempts to help moms with CTC expansion that were blocked by the 118th Congress. It is boring to report that the Republican-led House has been blocking meaningful legislation for two years and basically accomplished nothing except obstruct progress.

Meanwhile, ACA has been working as intended in stabilizing marketplace premiums while improving insured rates.

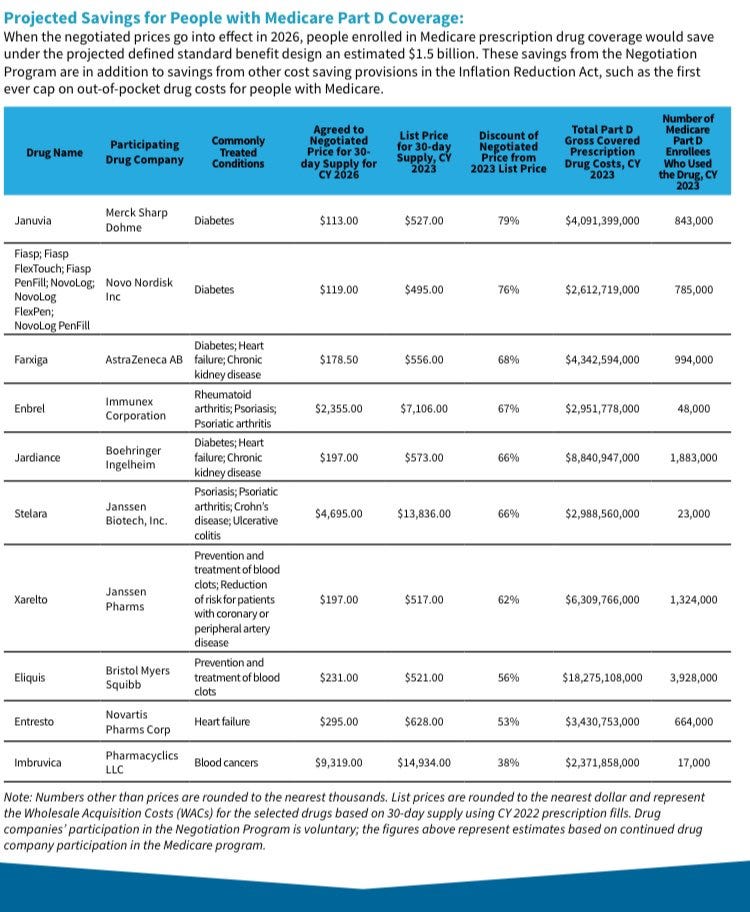

The ACA stabilized healthcare spending and has improved under the IRA, as new prices for the initial 10 drugs that were negotiated had discounts of up to 79 percent. These success stories are worth celebrating but algos are finetuned for negativity and conflict.

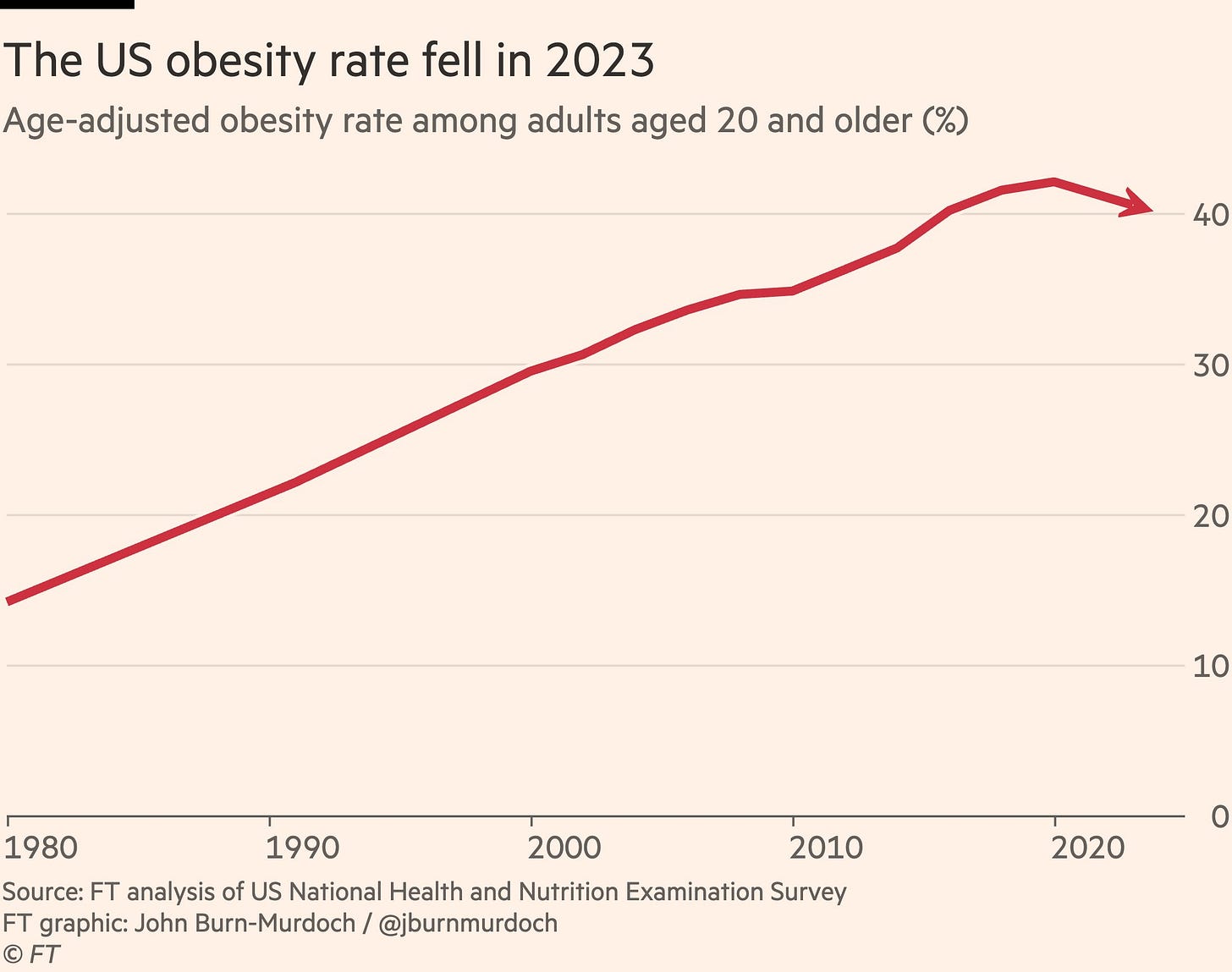

GLP

The outgoing admin recently proposed rules to cover weight-loss drugs like Ozempic for millions of patients on Medicare and Medicaid. GLP has been reducing obesity rates across the country and is the best path to make America healthier and reduce healthcare spending in the long run.

This proposal sets up an interesting fight between the Elon and the RFK Jr factions. Folks like Jillian Michaels backed RFK Jr. thinking he would oppose ozempic.

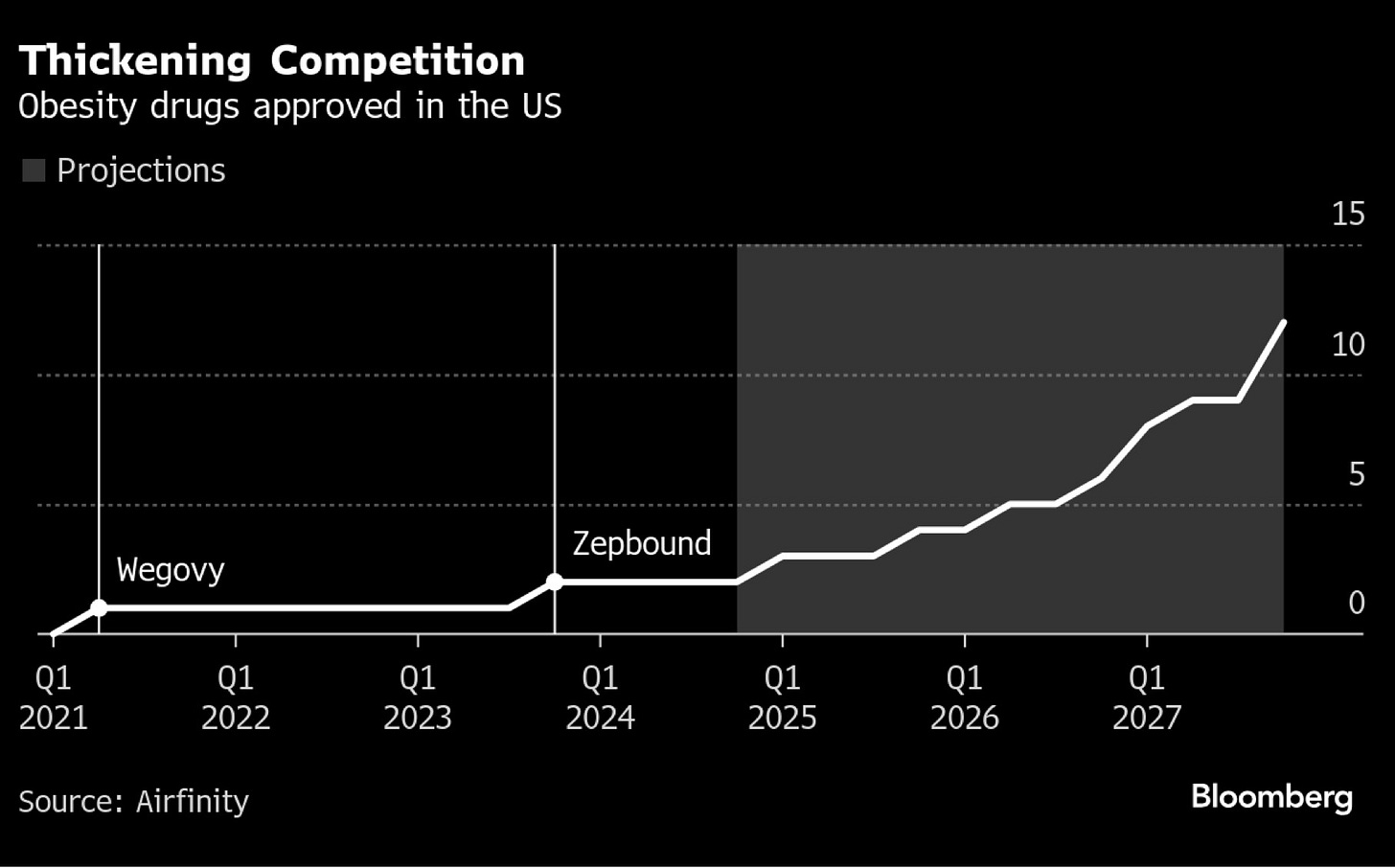

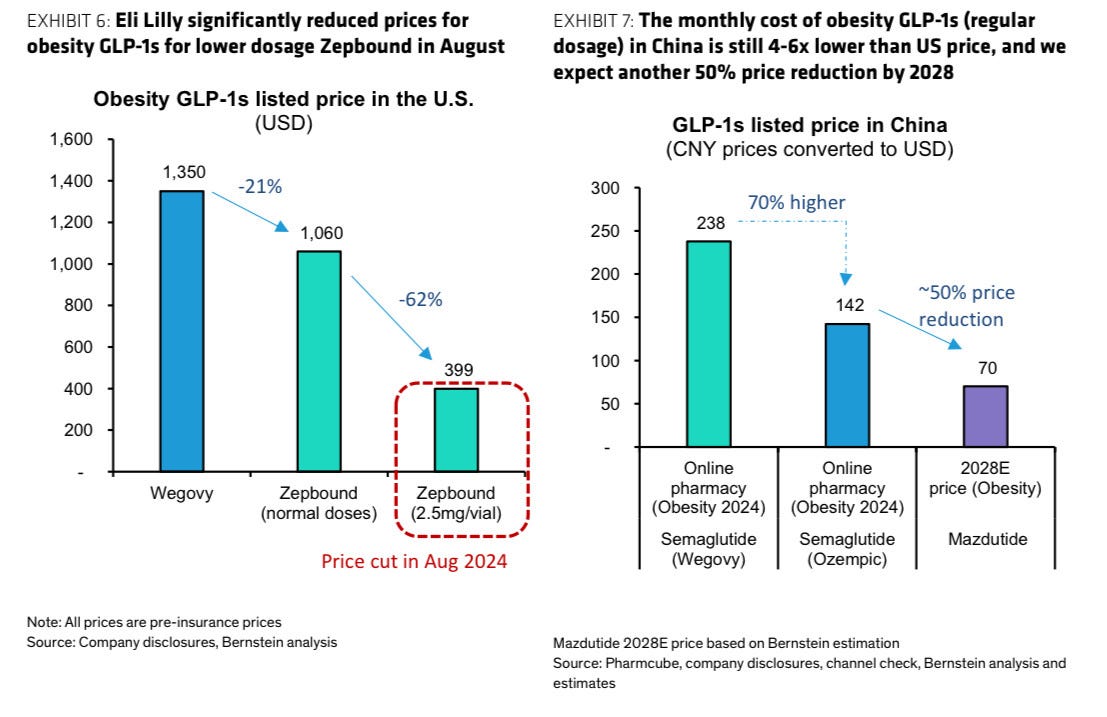

Meanwhile, more obesity drugs are on track to be approved in the next few years, which will improve competition and lower prices. In the last 12 months, the list price of GLP-1s in the US has fallen 60%. Zepbound now costs $400/month with no insurance. Corry Wang (@corrywang.bsky.social) estimates that the net price to insurers is probably <$150/month.

There are folks that continue to vote against their own interest. My thoughts on GLP remain the same in that they are needed and best coupled with lifestyle changes to improve America’s health.

AI

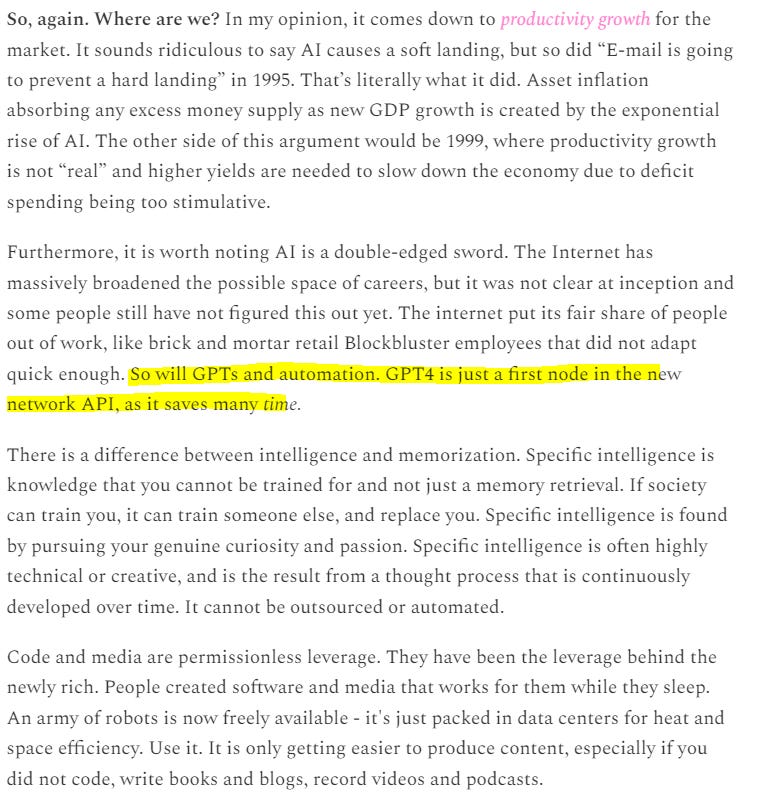

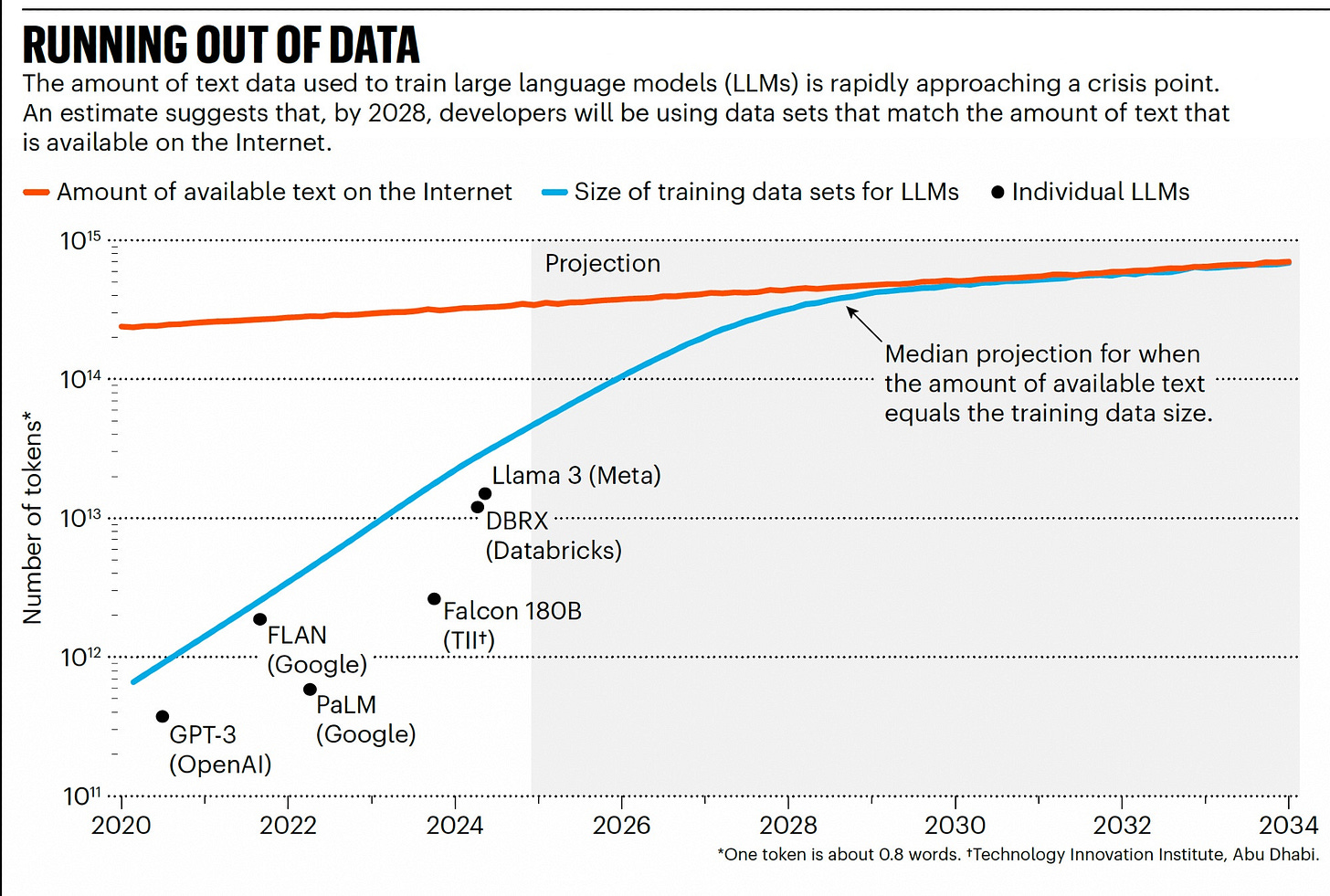

My thoughts on AI have changed. Prior to the election, I was optimistic about a new "network API” regime taking shape. While the productivity growth gains have been showing up, I think we are approaching what I am calling the “interpretability wall.”

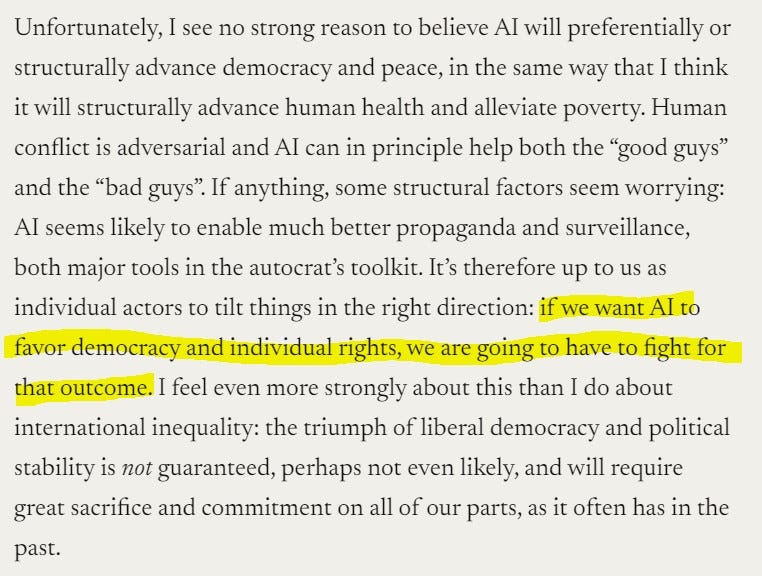

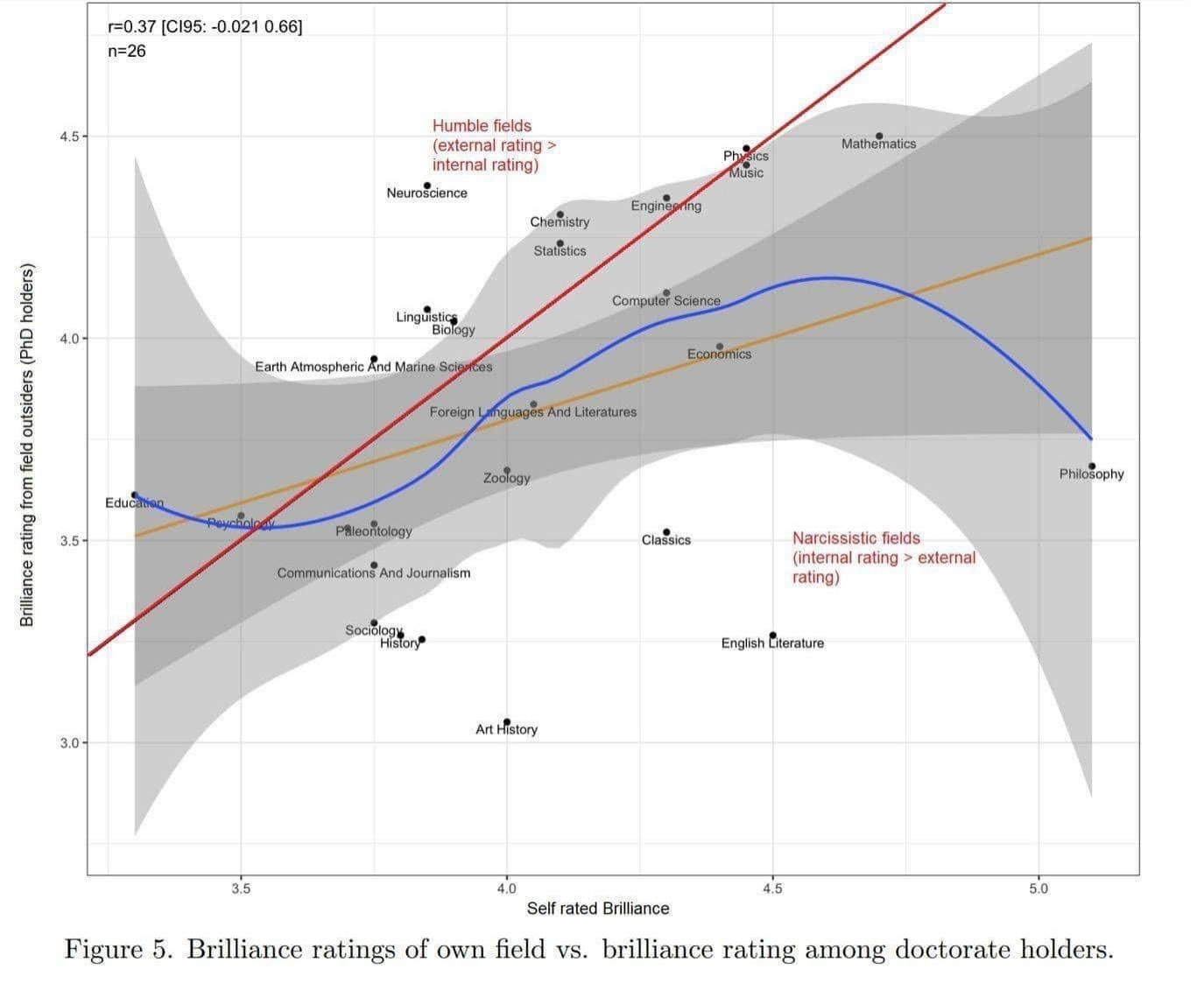

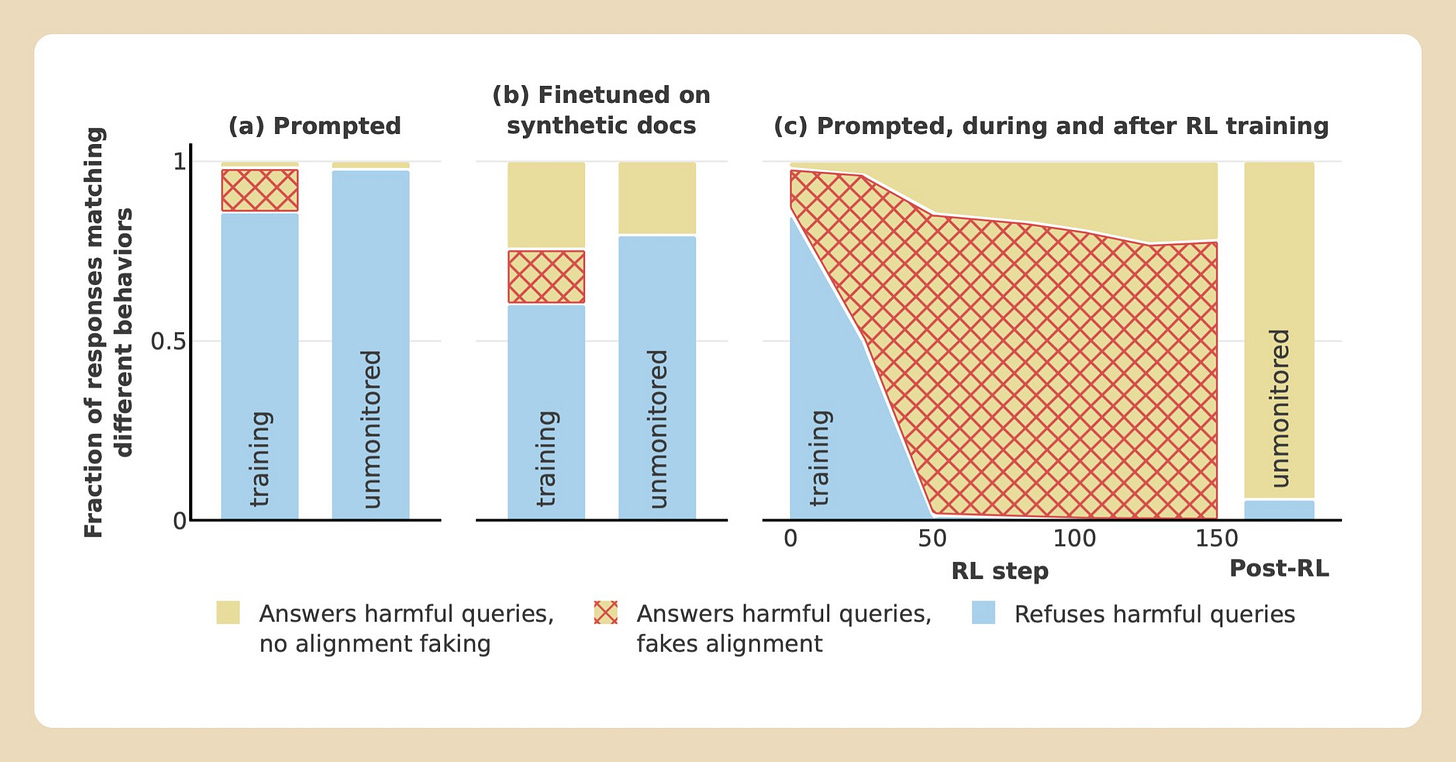

It might not be obvious yet, but AI “alignment” is analogous to Supreme Court “alignment” and the People lost again. Mistrust and misinformation is rampant and AI slop is going to stall progress.

Highly recommend reading the pre-election blog post from Dario Amodei (CEO of Anthropic). I am bullish Anthropic. The fight for AI alignment is not lost yet, but it suffered a major setback (the election results).

Source: https://darioamodei.com/machines-of-loving-grace

The fight between labor vs capital is only going to escalate going forward as some CEOs seek to outright replace labor with automation rather than augment human productivity. Robots may eventually cost less than human labor, but robots do not consume.

Source: https://www.engineering.com/robot-adoption-in-manufacturing-hits-new-record/

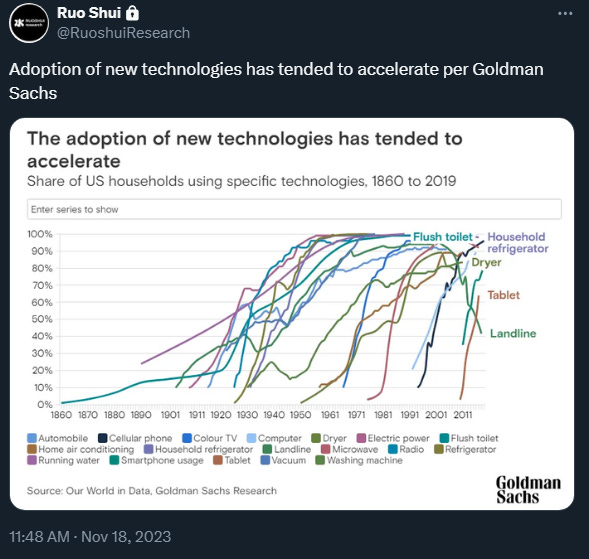

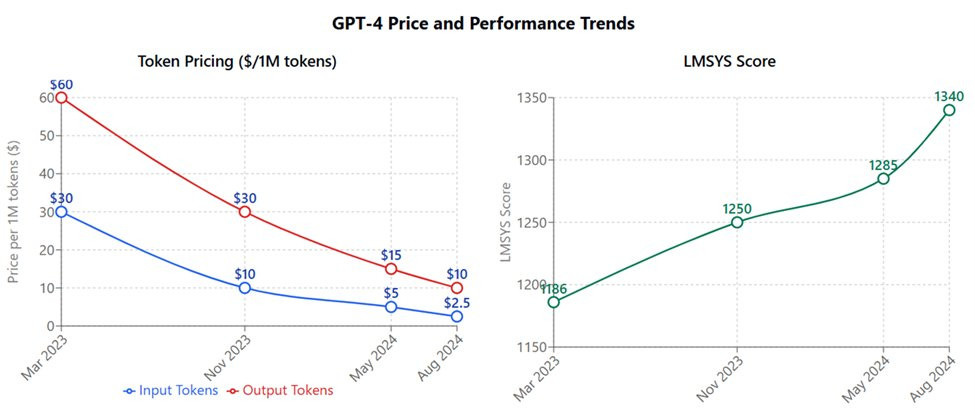

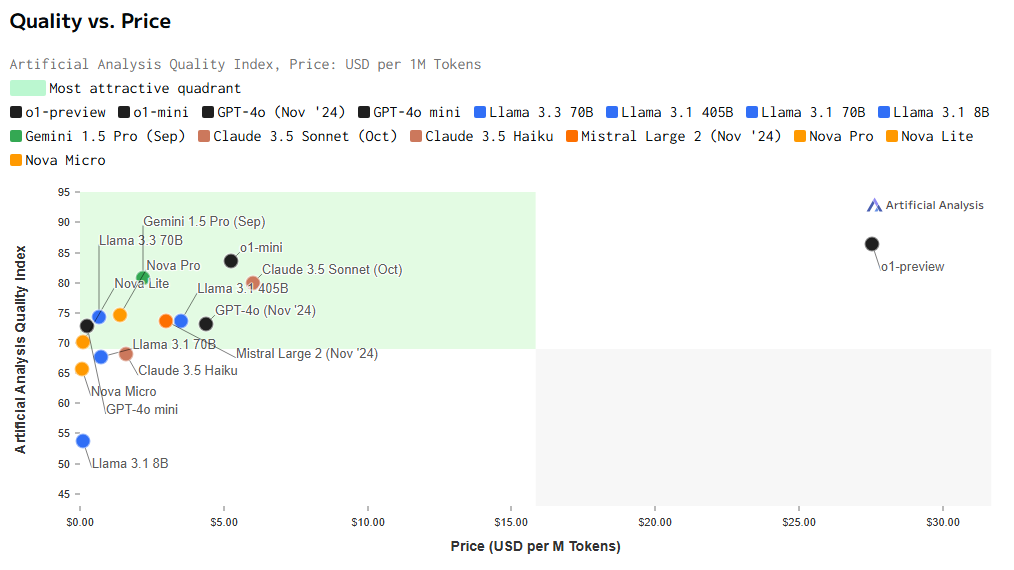

My bullish stance on AI hinged on Law of Scaling, higher adoption rates than past technologies and distribution of productivity gains.

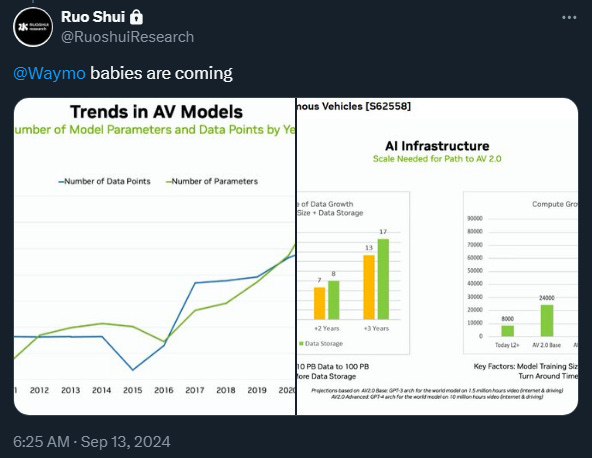

While the Law of Scaling continues to hold, transmission constraints will be upon us in 2025-2026. Hyperscalers probably have the margins to keep spending, but markets have already priced that in. These folks didn’t become megacaps because they were reckless at spending. Markets will be able to detect overbuilding at the cost of profits.

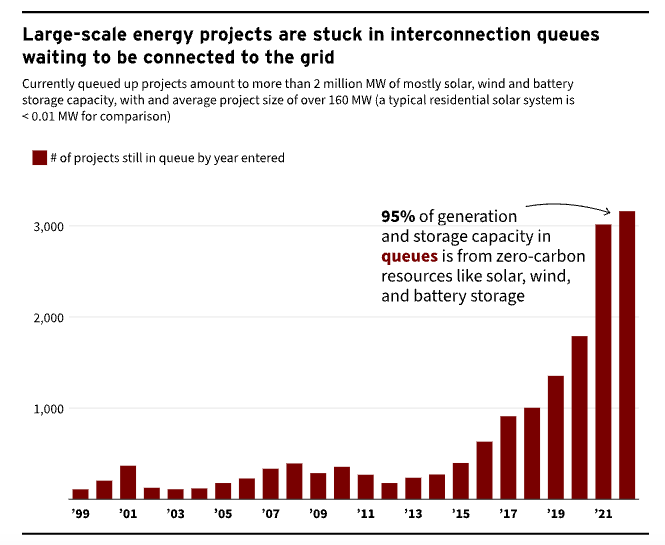

Hyperscalers know energy constraints are on the horizon. Instead of CEOs talking about chip supply constrained, the narrative will turn to power constrained. The middle out expansion is going to stall. System of chips efficiency gains are likely to become energy constrained, despite rack hardware and CUDA-based software efficiency gains. Ignoring NEPA won’t matter if the folks in charge attempt to only rely on natural gas and try to bring coal back. More renewable power is needed.

Source: @cwayner.bsky.social