Deja Vu, but AI to the Rescue? Part 3/5

Market Driver: Price

Jackson Hole came and went. A year has passed and not much has changed from the Fed perspective. Market participants are still debating inflation and interest rate paths, despite headline CPI getting halved with unemployment barely budging. People are forecasting recession again within the next 6-9 months. Deja Vu.

I will attempt to break it down in terms of five market drivers that I have focused on in the past.

Let’s continue with the price and inflation continuing its trend down.

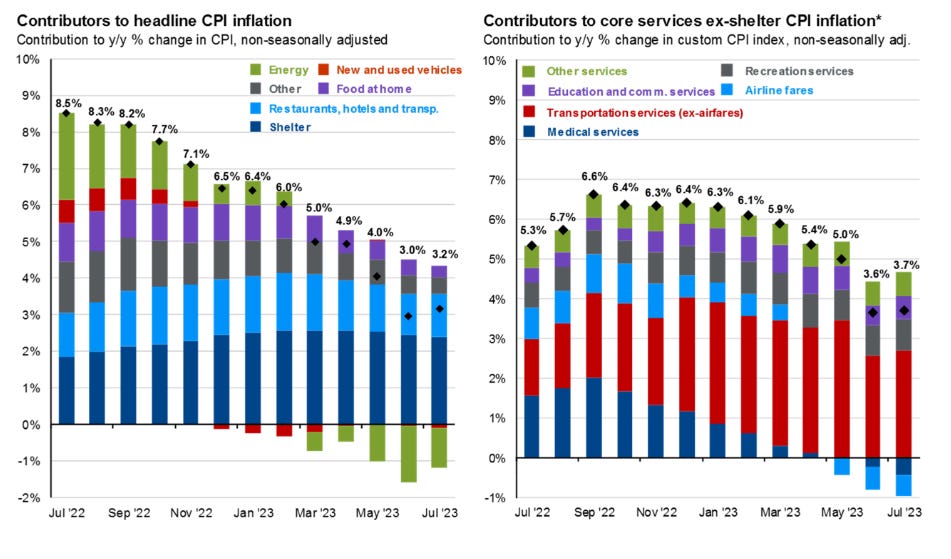

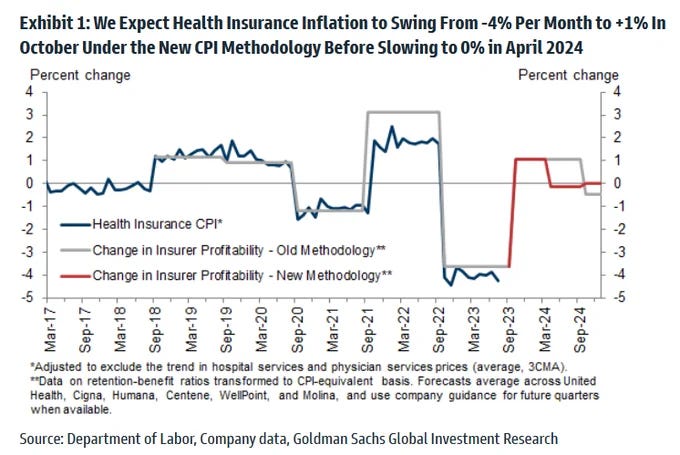

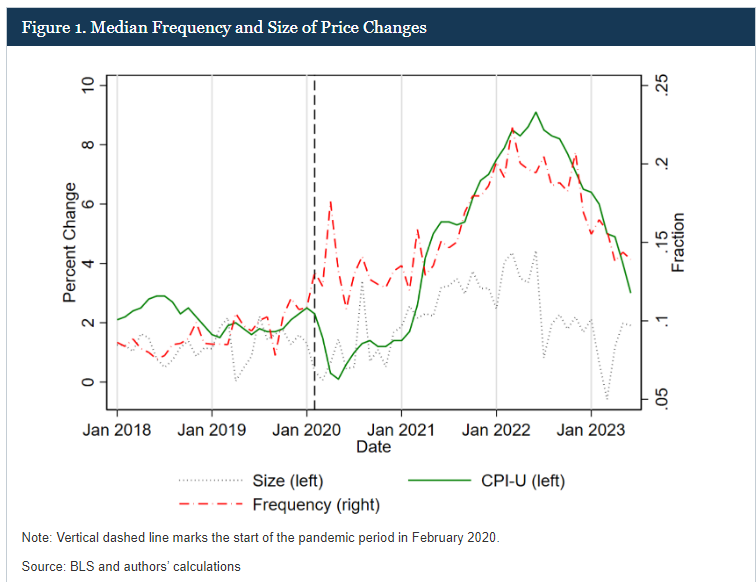

Inflation peaked last year, but core has been slow to come back down due to both elevated service demand and lagged effects of how owner’s equivalent rent (OER) is calculated for CPI. A substantial portion of core CPI and PCE weights is housing and it is set to fall for the next 6 months.

Source: CPI weights: https://www.bls.gov/cpi/tables/relative-importance/2022.htm;

PCE weights: Author’s calculation of weights using BEA Table 2.4.5U-M, Personal Consumption Expenditures by Type of Product, from www.bea.gov

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

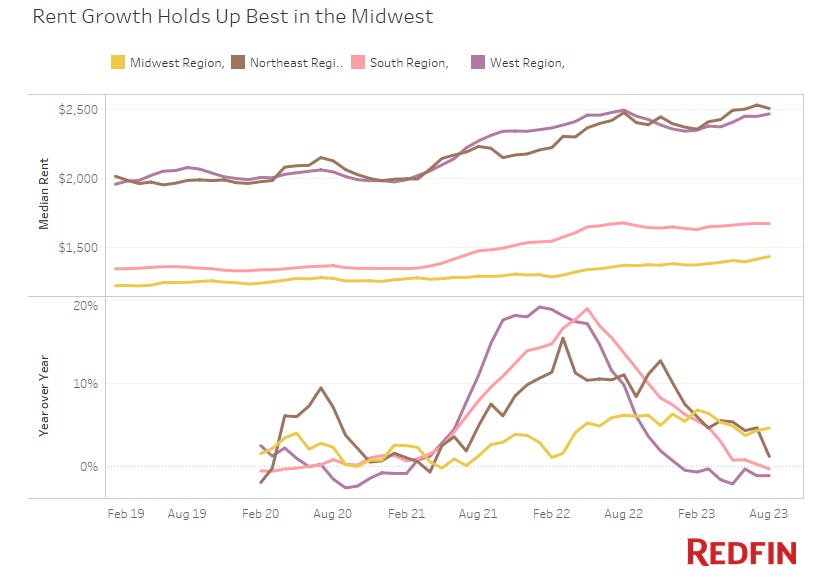

OER is set to fall on both Year over Year (YoY) and MoM basis. It is likely the progress continues its downwards progress into April 2024. Rent is likely to continue the downward trend even more than typical seasonal drags as apartment vacancies push upwards due to multi-family and apartments completing construction and coming online. The key price factor here for housing is the lagged effects of rent and I believe that rents will have continued pressure downwards caused by the combination of housing affordability and number of apartments coming online. Even New York gets some rent relief with the new Airbnb rules going into effect.

Source: https://twitter.com/jayparsons/status/1699415072383103387

Source: https://www.redfin.com/news/redfin-rental-report-august-2023/

7% mortgage rates are not cheap, especially considering the recent comparisons. Even if housing is proving resilient in low inventory conditions until unemployment pushes upward. Even so, Millennials prove to be a big tailwind for home builders as they focus on rate buy downs or refinancing within 2-3yr time frames as the long end is likely to be lower regardless of the soft/hard landing.

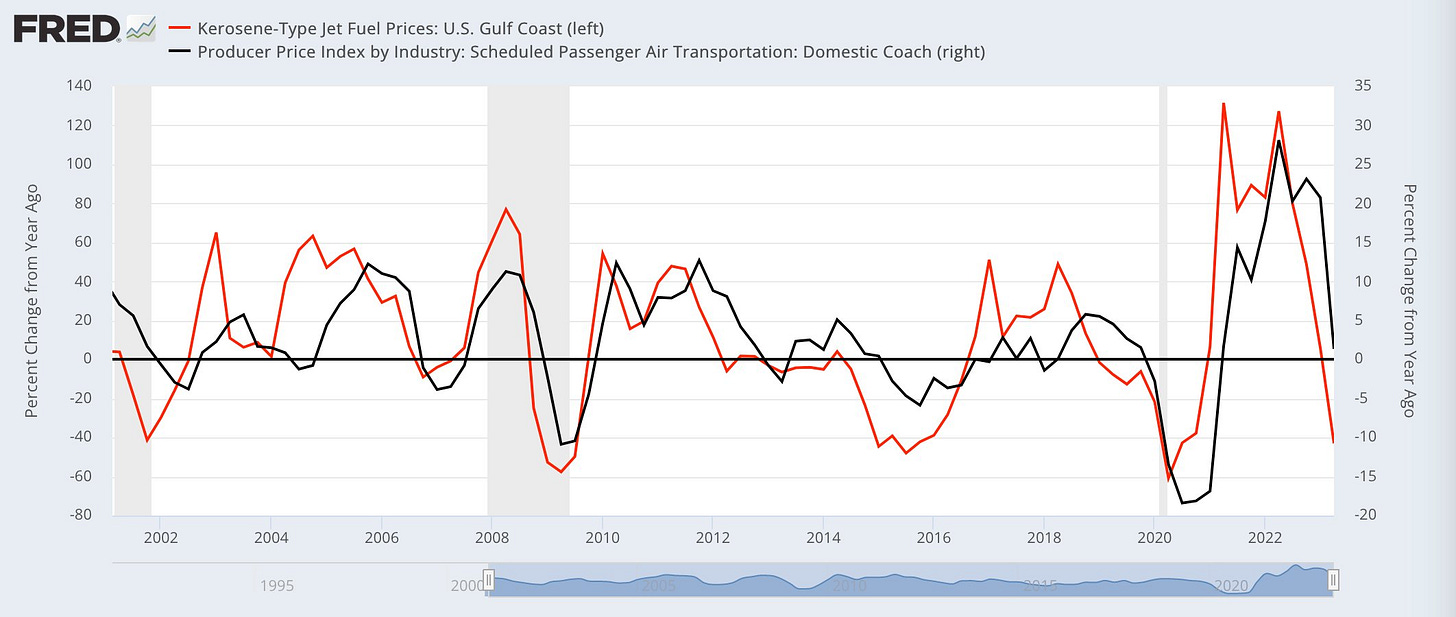

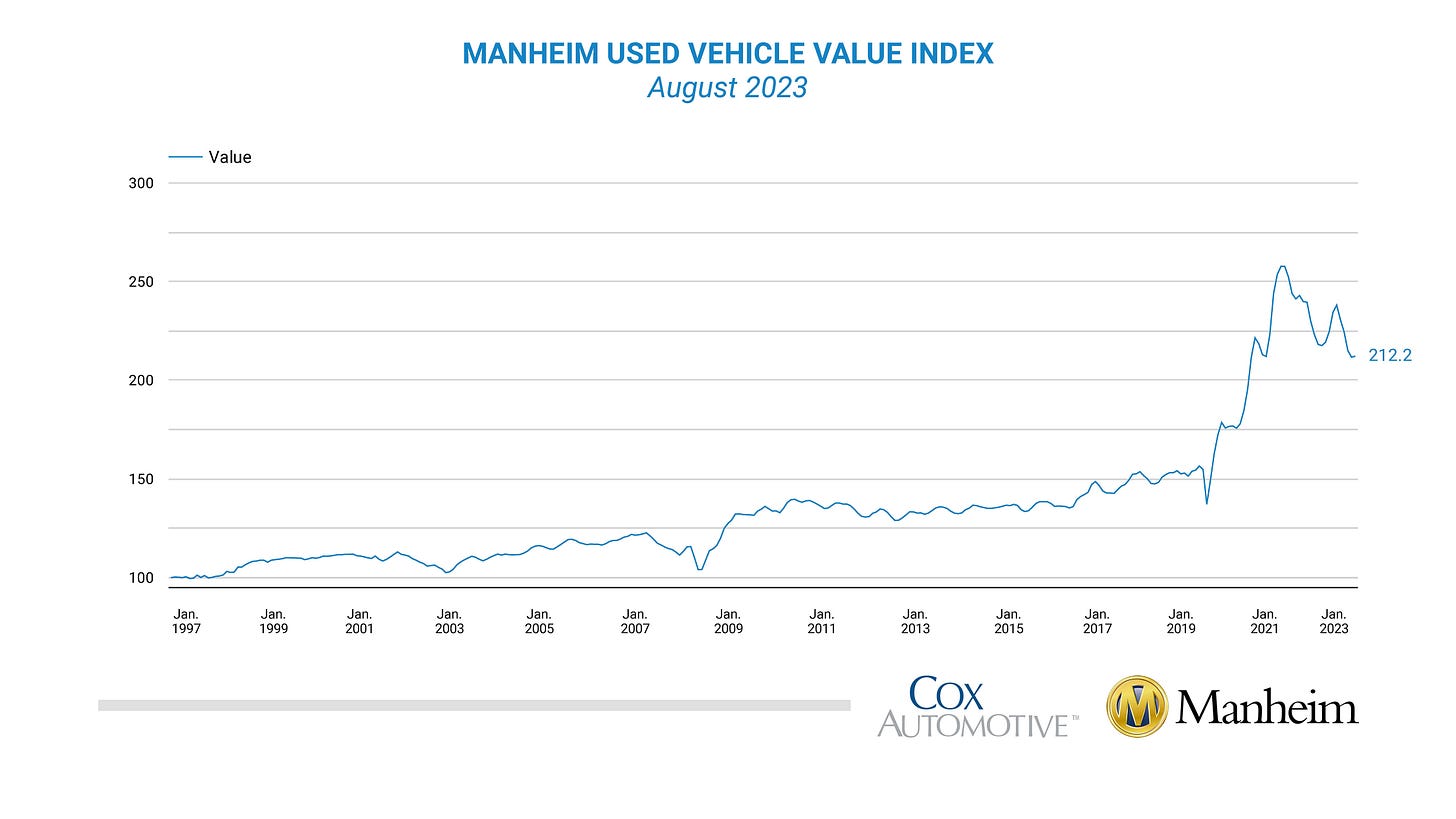

Transportation is the other big item and those pressures are also subsiding with airfares coming down and additional car supply coming from manufacturers and leasing.

Source: https://twitter.com/IrvingSwisher/status/1698338642710687860

Source: https://www.cargurus.com/Cars/price-trends/

Source: https://site.manheim.com/en/services/consulting/used-vehicle-value-index.html

While the pace is set to slow for core services ex shelter, the trajectory is still down.

Now, let’s look at oil:

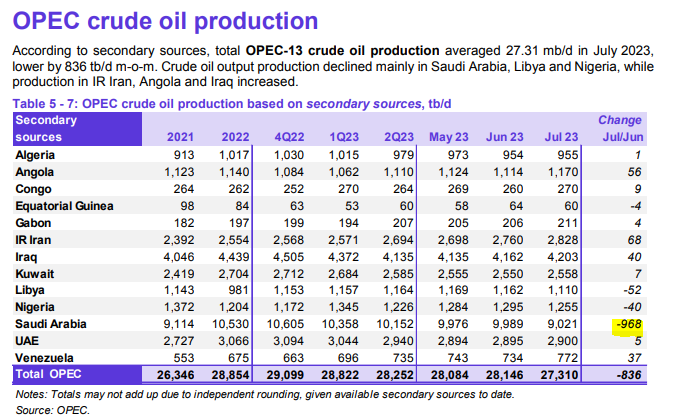

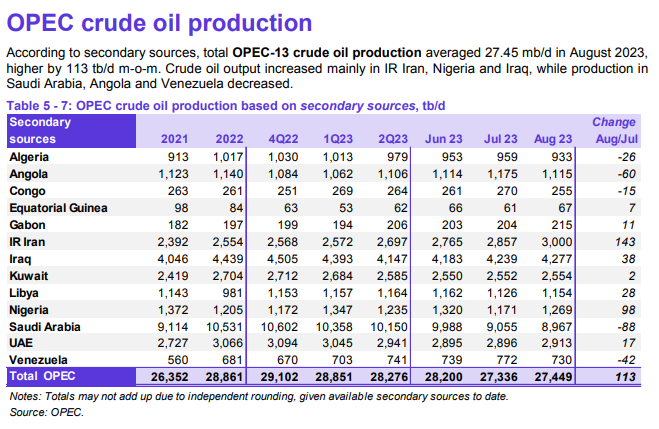

In the past couple months, Saudi Arabia has cut back on production and export, supporting oil prices.

Source: https://twitter.com/HFI_Research/status/1691528988982931456?s=20

Source: https://momr.opec.org/pdf-download/

Source: https://momr.opec.org/pdf-download/

Fortunately, crack spreads have since stabilized and settled down, but there is still the risk of rising input costs (manifests as PPI).

Source: https://www.gasbuddy.com/charts

Source: https://en.macromicro.me/collections/19/mm-oil-price/4376/crude-oil-cracking-spread-vs-wti

Those assuming input costs directly translate to consumer price are assuming a linear correlation between the two. I wrote in July that is not necessary true for as price increases soften. Some of the companies listed then have experienced both volume and margin contraction.

Source: https://twitter.com/bespokeinvest/status/1699177855110860974

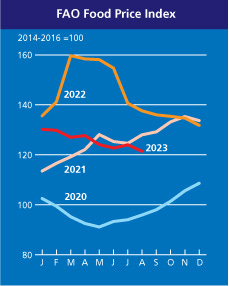

Source: https://www.fao.org/worldfoodsituation/foodpricesindex/en/

Source: https://twitter.com/TheTranscript_/status/1700122206246703418

Firms did not immediately cut prices as input costs eased and it is unlikely that all firms can raise prices more to accommodate input costs increase, without suffering a revenue contraction due to volume drop. It is likely that this input cost increase manifests as margin contraction for those without pricing power.

Source: https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp230831_annex~837b349ec5.en.pdf

Source: https://www.federalreserve.gov/econres/notes/feds-notes/price-setting-during-the-covid-era-20230829.html

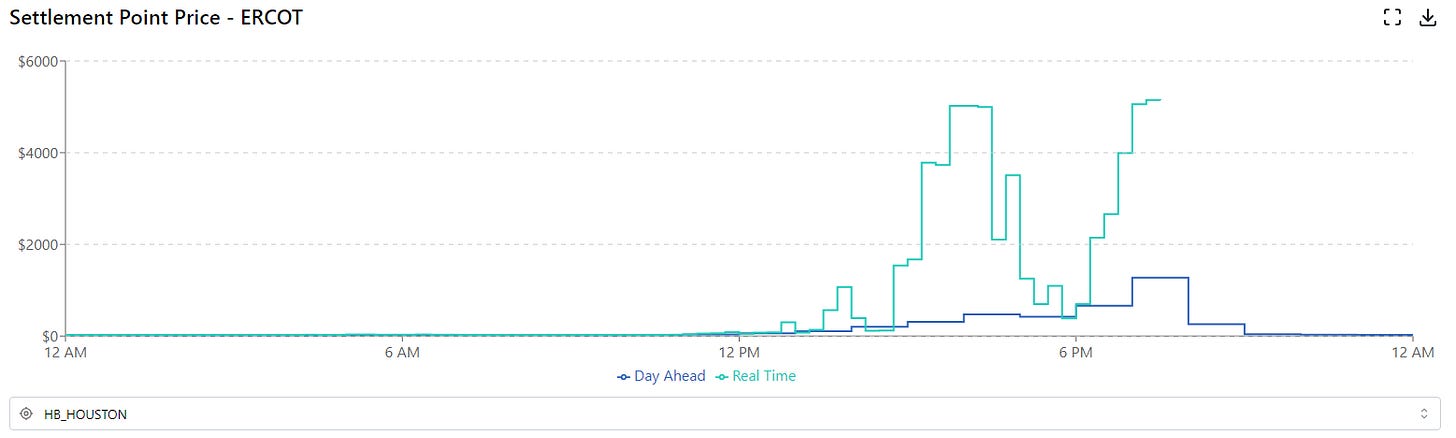

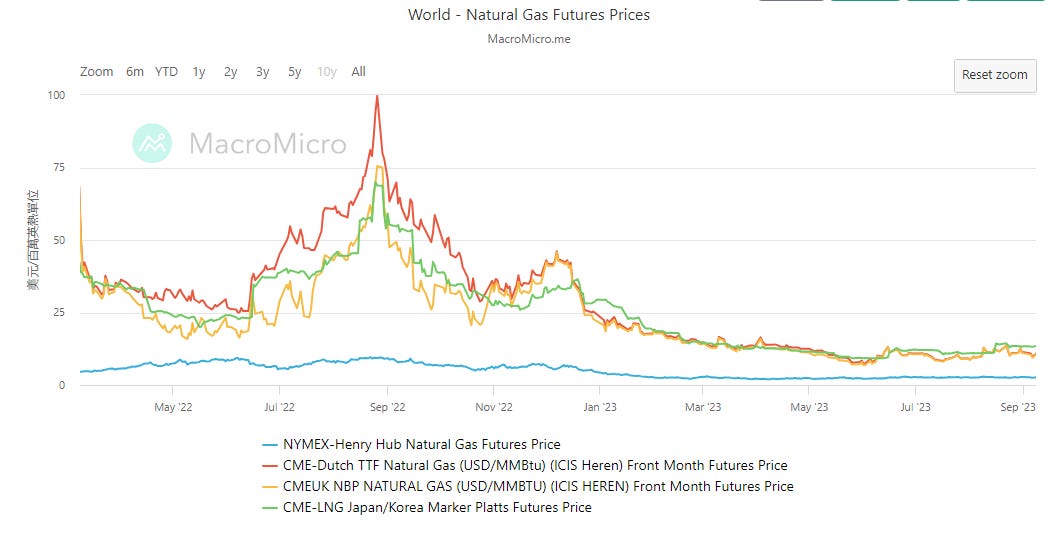

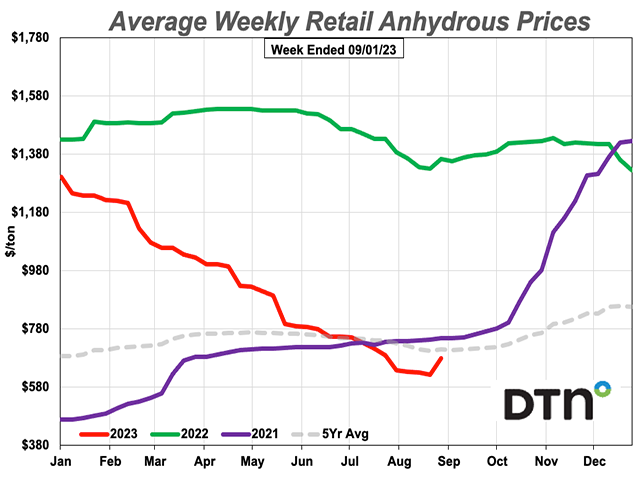

It is noteworthy that the Texas grid has been extremely stressed this summer, but has finally started to settle down and there is a little natural gas pressure from the Australia LNG strike. Fertilizers have continued its trend down for the most part and feed into food prices, which has correlated with natural gas prices. EU storages have been filled and current winter forecasts seem relatively tame or warm.

Source: https://www.gridstatus.io/live/ercot

Source: https://en.macromicro.me/collections/4854/mm-natural-gas/39414/global-natural-gas-prices

Source: https://www.dtnpf.com/agriculture/web/ag/crops/article/2023/09/06/fertilizer-prices-continue-lower

Source: https://agsi.gie.eu/data-visualisation/EU

Source: https://www.severe-weather.eu/long-range-2/winter-2023-2024-seasonal-models-snowfall-predictions-united-states-canada-europe-fa/

Now let’s take a look at wage growth:

Wage growth is slowing. There is an argument to be made that the past wage increases were caused by the Russia invasion that caused a commodity impulse. Those have largely subsided and any increases in gasoline is likely to dampen discretionary spending more than it causes further wage increases.

Source: https://www.federalreserve.gov/newsevents/speech/powell20230825a.htm

Source: https://strgnfibcom.blob.core.windows.net/nfibcom/SBET-August-2023.pdf

Both job switching and quit rates were indicators for labor tightness and how much negotiation power job seekers had. Those have both been trending down.

Source: https://www.atlantafed.org/chcs/wage-growth-tracker

Source: https://twitter.com/C_Barraud/status/1696524793410142591?s=20

The increased labor force from immigration and retirees only decreases bargaining power for existing job seekers. Furthermore, as a CFO, it is likely they choose to allocate funds to pursuing AI investments rather than labor, as the productivity increases with the combination of AI-related work flows and some layoffs happening that reallocate work to a reduced number of workers that survive the cut.

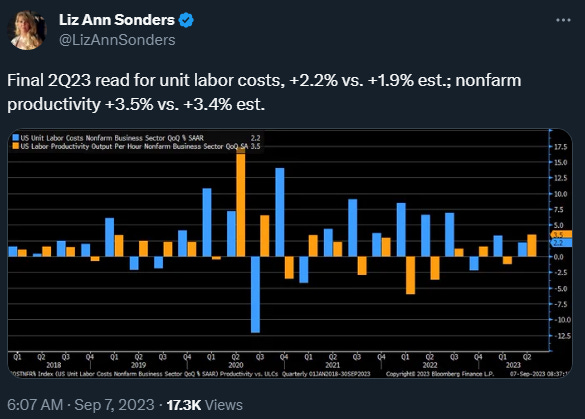

Source: https://twitter.com/LizAnnSonders/status/1699019471648637235?s=20

Source: https://twitter.com/byHeatherLong/status/1697595011099988411

Source: https://twitter.com/LizAnnSonders/status/1699771338368389301

Those focusing on strikes miss the bigger picture, where union memberships have declined and strikes are not comparable to the 70s. Not to mention that writers in Hollywood do not have the bargaining power that UPS members have.

In summary, prices are trending in the right direction and it is likely that Chair Powell's goal is to hold the “right” rate for as long as possible. The closest analog to the 70s is likely labor not oil. However, it has the biggest disinflationary opponent: technology.

Inflation has rolled over faster than the economy, and the latest economic data has wage growth rolling over faster than the economy. Whether that continues remains to be seen and it is in the Fed’s best interest to remain cautiously optimistic about achieving 2025 inflation targets as demand continues to support the labor market. The 2024 curveball for labor is technology.

The magic number for Chair Powell is seeing <0.3 MoM for the next 4 months. Although there are bound to be bumps here and there as economic data rarely moves in a straight line, achieving 3.5-4% for 2024 and 2.5-3% inflation in 2025 looks like an increasingly probable scenario.