Deja Vu, but AI to the Rescue? Part 2/5

Market Driver: Growth

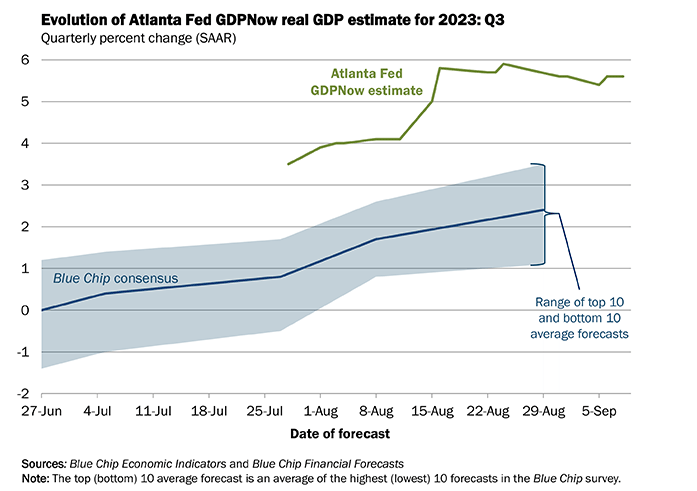

Jackson Hole came and went. A year has passed and not much has changed from the Fed perspective. Market participants are still debating inflation and interest rate paths, despite headline CPI getting halved with unemployment barely budging. People are forecasting recession again within the next 6-9 months. Deja Vu.

I will attempt to break it down in terms of five market drivers that I have focused on in the past.

Let’s continue with the growth and labor market continuing to hold up.

Here’s the snapshot of the current US economy, with Q3 GDP estimate ranging from 2-5% Quarter over Quarter (QoQ) and the latest unemployment at 3.8%.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Source: https://www.atlantafed.org/cqer/research/gdpnow

Source: https://www.atlantafed.org/cqer/research/gdpnow

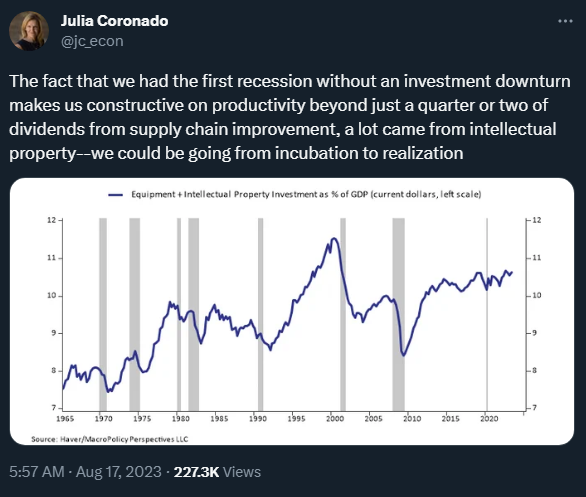

In July, I wrote about the US economy chugging along and followed up with the primary reason being Bidenomics and Fiscal Dominance:

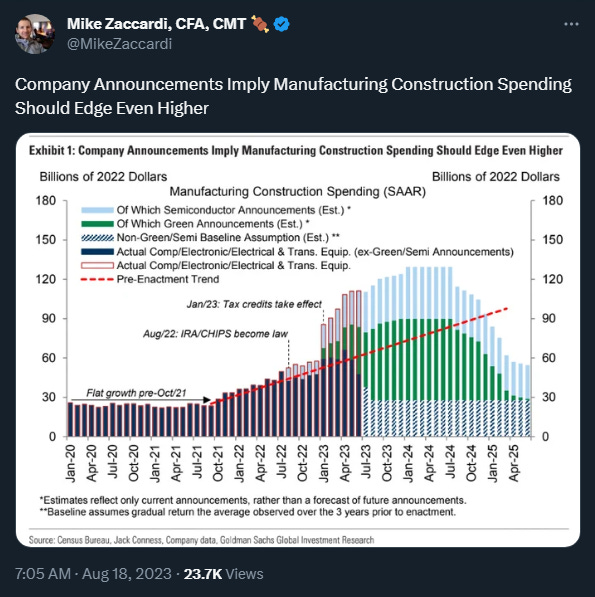

Although housing has stalled due to high mortgage rates and residential construction employment may come down, I continue to believe that the US is in one of the biggest capex cycles in history. Both the government and companies will choose to invest and support the economy. AI is an industrial policy.

Hard landings are usually associated with capex reduction and Biden’s policies for US manufacturing continues to be a major tailwind combined with companies pursuing the next technology revolution. I will elaborate on AI in a follow up post.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Source: https://twitter.com/jc_econ/status/1692158658665156960

Source: https://twitter.com/MikeZaccardi/status/1692538157974139355?s=20

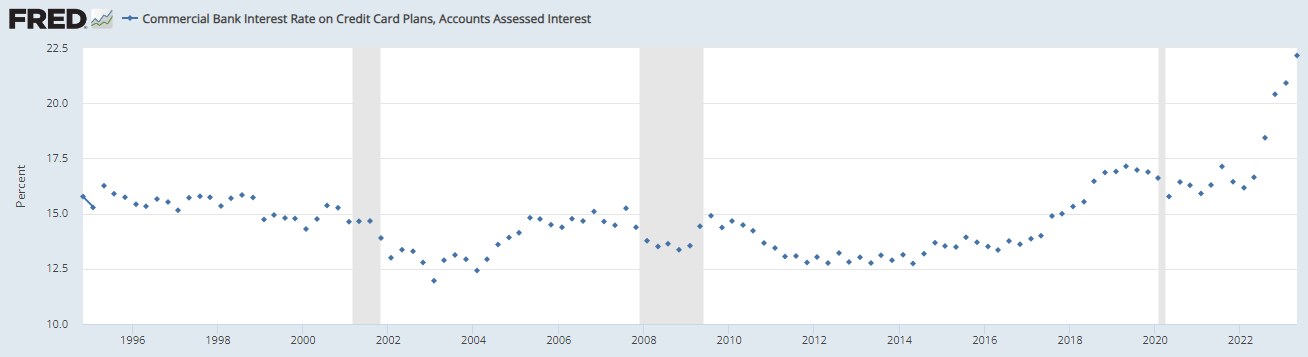

Let’s quickly go over the consumer headwinds:

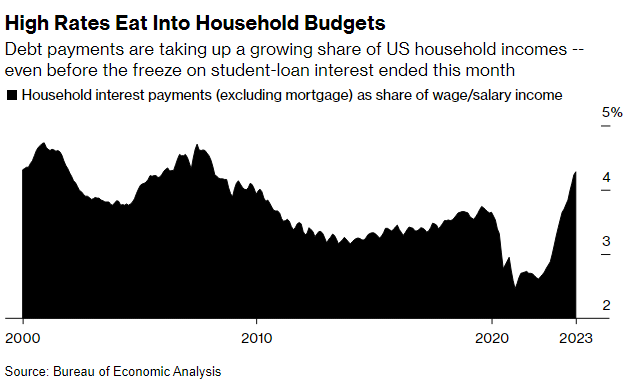

Interest rates and Gasoline:

As a consumer, you most likely do not want to be rolling over balances at current interest rates. It should be reemphasized that this business cycle is significantly different because of the combined monetary and fiscal stimulus during the pandemic, which caused consumers to become less rate sensitive. Real wages became positive during the summer and were quite stimulative as spending support transitioned from excess savings to income driven. That has likely been dampened lately as real wages flattened out with rising oil pressures.

Source: https://fred.stlouisfed.org/series/TERMCBCCINTNS

Source: https://twitter.com/LizAnnSonders/status/1700241564075737221

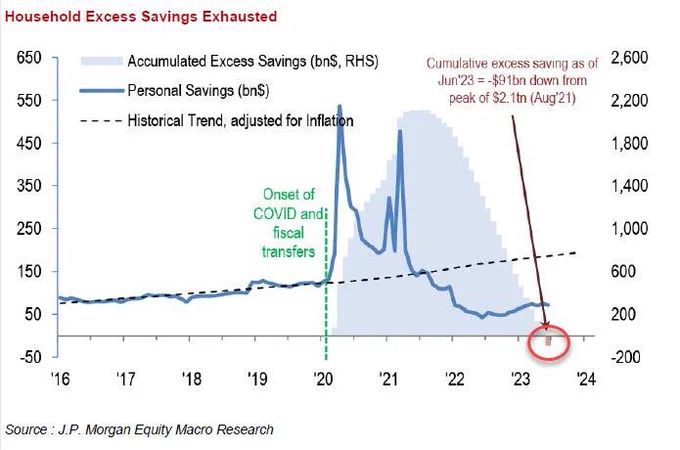

Excess savings:

Excess savings is likely close to depleted for the bottom quartiles soon, triangulating the available data and assuming an acceleration of unemployment within the next 6 months. Future spending would have to rely on credit (which has a high interest) or income (real wages dampened by gasoline).

Source: https://twitter.com/carlquintanilla/status/1697363570546073647

Source: https://business.bofa.com/content/dam/flagship/bank-of-america-institute/economic-insights/consumer-checkpoint-august-2023.pdf

Source: https://business.bofa.com/content/dam/flagship/bank-of-america-institute/economic-insights/consumer-checkpoint-september-2023.pdf

Student Loans Resumption:

Many have treated the student loan resumption as a drag for the overall economy, with an estimated ~$400-$500/month payment for those with balances. It looks like some have chosen to pay off their loans ahead of the interest rate resumption. The drag on GDP has been estimated to be around 0.3-0.4%, which seems relatively small even if the GDPnow estimate is halved for Q3.

Source: https://www.bloomberg.com/news/articles/2023-09-05/student-loan-payments-with-interest-borrowers-pay-down-debt-before-restart#:~:text=Student%20loan%20borrowers%20paid%20down,new%20report%20by%20Goldman%20Sachs.

Let’s quickly go over the consumer balance sheet:

Debt and Credit Balances:

Balances remain at healthy levels. There are some market participants focusing on nominal credit, which should be adjusted with inflation and income. There are some market participants focusing on new home and car payments costs, which are at levels that dampen spending even with rate buy downs and lengthened car loans. The consumer is likely to continue to spend unless they lose their income from job loss. This statement sounds obvious, but people are forecasting recession again.

Source: @calculatedrisk

Source: https://twitter.com/JosephPolitano/status/1691572528236388768?s=20

Source: https://www.newyorkfed.org/microeconomics/hhdc.html

Source: https://twitter.com/wabuffo/status/1688946394382376960?s=20

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Source: https://fred.stlouisfed.org/series/MDSP

Source: https://fred.stlouisfed.org/series/CDSP

Source: https://www.bloomberg.com/news/articles/2023-09-11/us-consumer-is-likely-to-start-cutting-back-hurting-economy-and-stocks?sref=ZVajCYcV

It is worth noting corporate balance sheets mimic consumer balance sheets, and companies with cash reserves are benefiting from the interest income.

Like the bottom income quartiles, small businesses are the first to feel the weight of the Fed’s interest rate hikes with earnings taking a hit.

Source: https://strgnfibcom.blob.core.windows.net/nfibcom/SBET-July-2023.pdf

Source: https://strgnfibcom.blob.core.windows.net/nfibcom/SBET-August-2023.pdf

The personal savings rate is something to watch. My interpretation might seem counter-intuitive, but if savings rate starts ticking up, then that means nominal GDP probably ticks down as consumers dial back spending and earnings would suffer.

Source: https://fred.stlouisfed.org/series/PSAVERT

Interest Sensitivity/Income:

I would like to reiterate that there are plenty of consumers that took advantaged of Covid rates and are taking advantage of Chair Powell’s risk free 5%, and this is supporting spending. Increases in short term rates is probably not net restrictive.

Source: https://twitter.com/rhunterh/status/1697393281720602723?s=20

Source: https://twitter.com/LizAnnSonders/status/1699382011629035813?s=20

Source: https://www.financialresearch.gov/money-market-funds/

Source: https://www.ici.org/research/stats/mmf

Let’s close out with employment.

Nonfarm payroll employment (NFP) :

Source: https://www.bls.gov/news.release/pdf/empsit.pdf

The latest “unemployment” uptick was largely due to the combination of immigration and retirees reentering the workforce. Chair Powell is likely smiling. This is the type of data that leads to wage growth slowing without sharp increases in unemployment. I will elaborate on wage growth in a price follow up, so let’s focus on just the employment side.

Source: https://twitter.com/LizAnnSonders/status/1699019471648637235?s=20

Source: https://twitter.com/byHeatherLong/status/1697595011099988411

Source: https://twitter.com/LizAnnSonders/status/1697591542817476692

Source: https://twitter.com/LizAnnSonders/status/1697590612000690344?s=20

Source: https://twitter.com/EconBerger/status/1697588752967938337?s=20

Whether the +55 data was a one off remains to be seen, but the increased participation from females is welcomed by many that have been worried that a portion of the labor force has been sidelined due to child care costs.

Source: https://twitter.com/JustinWolfers/status/1692610018237882506

Many have repeatedly said that a hard landing is inevitable. From a probability standpoint, they are not wrong. Once unemployment moves upward, it typically does not stop at +1% (which is exactly where the June SEP has unemployment stopping at).

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Source: https://www.atlantafed.org/chcs/calculator

In summary, this is still true for the US economy:

Growth seems to still be trending up as US consumers have become less rate sensitive due to locking in low rate mortgages and transitioning to real disposable income for spending support, while the labor market has been trending slowly toward balance. Fiscal dominance is a prevalent theme and acts as a construction backstop compared to past fiscal measures taking place after the economy descended into deflation.

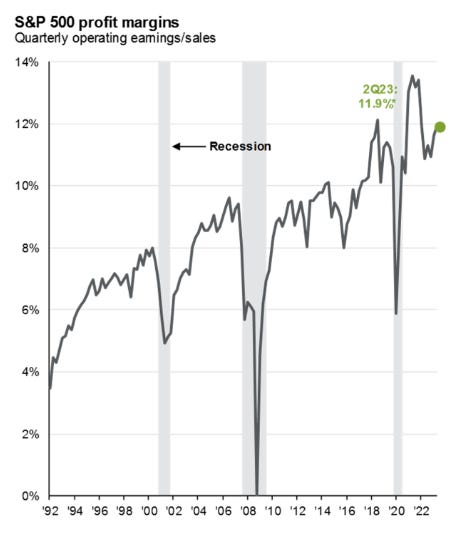

Q4 earnings guidance is likely to be better than expected with seasonals (back to school, American football, etc.), albeit with caution once again. The Fed’s forecast of modest 2024 growth seems to be intact. Differentiation within sectors is also probable as company margins and moat get put to the test with consumption behavior following wealth distributions, especially as input costs are unlikely to be taken on by the consumers.

I believe we are in a unique environment that has never been seen. All analogs only get a portion of the picture and I continue to believe the combination of post WW2 and 90s is the closest comparison. The portion is decided by future TGA spending and how fast productivity gains are realized from LLM + code API enterprise deployment. So what is going to hold the labor market? Once again, it’s back to whether or not you believe in AI.

Business expenditures dictated by fiscal policy and spurred by innovation

Corporate profit margins holding due to productivity gains outpacing capital expenditure

Global demand for US innovation and products

Source: https://twitter.com/LizAnnSonders/status/1699771338368389301

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/