AI/GLP-1 to the Rescue

Trend: Wealth Gap and Consumption and AI/GLP-1

In July, I summarized my view about how AI was going to boost productivity and provide a revolutionary tool for unskilled labor for the next decade.

Source: https://twitter.com/emollick/status/1703020667308806373

Disregarding that GPT4-V was just released, some people are still only focusing on chatbots and image generators when the reality is that a lot of people are still using excel at work. Data analysis using GPT + Python API hooks will boost productivity and Copilot (and any alternatives using GPT4 API) code summaries will improve code documentation in every office Microsoft is used.

Source: https://twitter.com/TheTranscript_/status/1712604128747376882

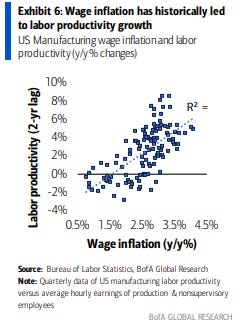

Furthermore, GPT technology has the potential to provide the necessary drag to bring wage growth down to the Fed’s target for inflation over time. CFOs across the globe are prioritizing capex on AI and automation, despite higher borrow costs caused by the combination of monetary policy and treasury issuance needed to fund the procyclical deficit spending.

Source: https://twitter.com/ResearchQf/status/1712113504143003991?s=20

Source: Bank of America Global Research

Labor productivity is a component of labor supply that is being waved off right now, although the Fed Governor Lisa Cook and Secretary Yellen have recently mentioned it. It may be worth noting that SF Fed Governor Yellen had said the following about productivity a couple decades ago.

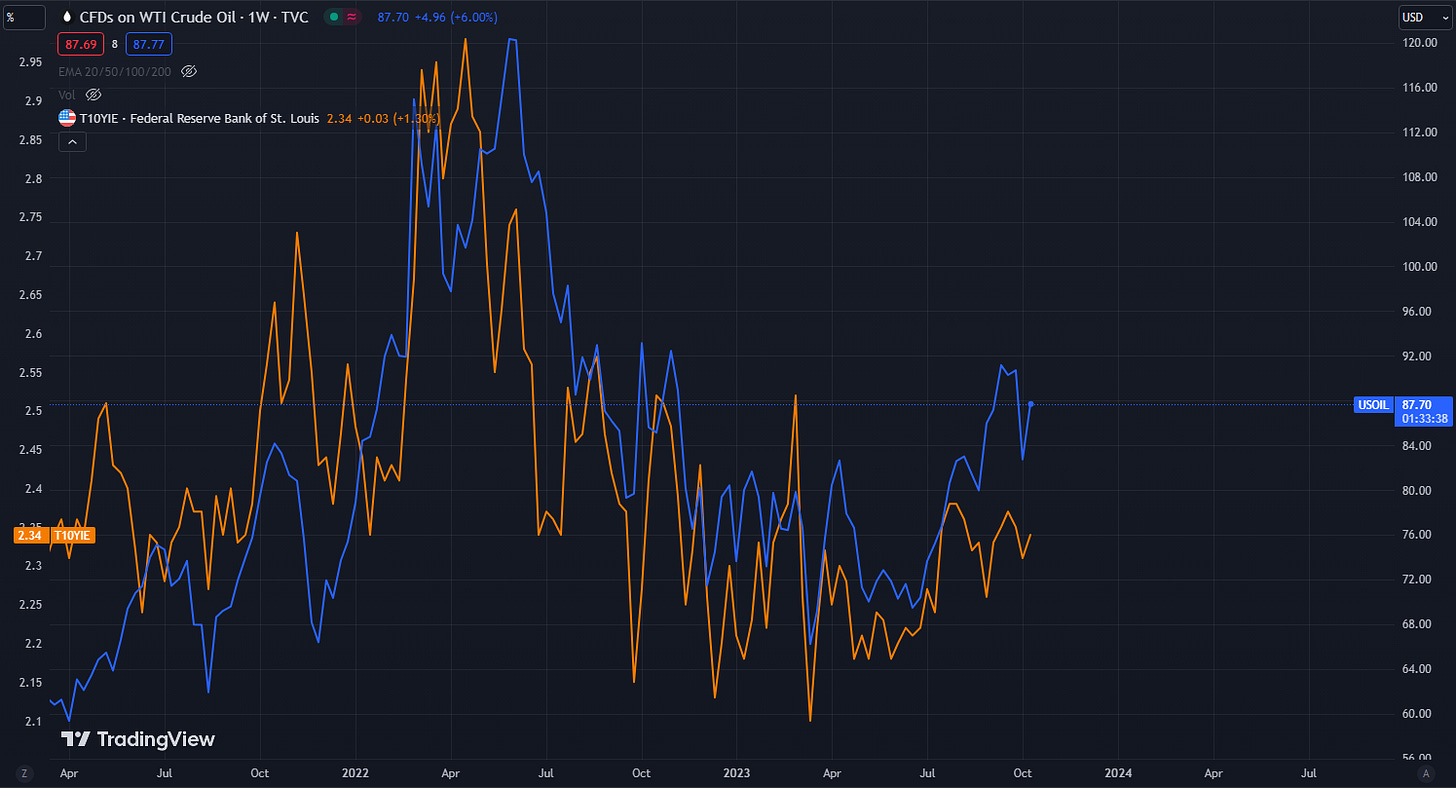

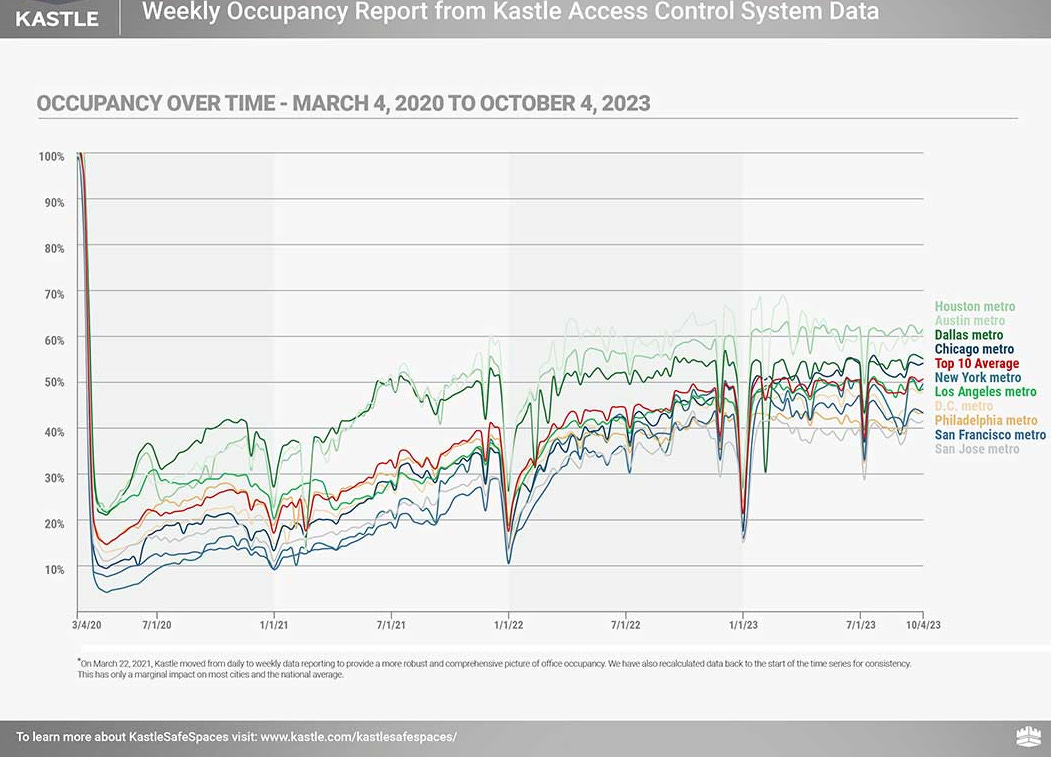

Labor is the best analogy to the 70s stagflation environment, not oil (although risks from the Middle East have risen). There is probably a reason that inflation expectations (based on market breakevens) have remained relatively stable, and in my opinion it is the market expressing its view on moderating wage growth and labor productivity. Whether it continues or is correct, are two separate questions. In the meantime, it is worth noting a difference with the current regime compared to the 70s. The US is not as reliant on OPEC for energy anymore, especially with the onset of shale, electric vehicles, and remote work.

Source: Bank of America Global Research

Source: https://twitter.com/donnelly_brent/status/1707387764633710727

Source: https://twitter.com/Rory_Johnston/status/1709935463241556105

Source: https://twitter.com/staunovo/status/1712559818576433587?s=20

Source: https://momr.opec.org/pdf-download/

Source: https://www.coxautoinc.com/market-insights/q3-2023-ev-sales/

Source: https://www.kastle.com/safety-wellness/getting-america-back-to-work/#workplace-barometer

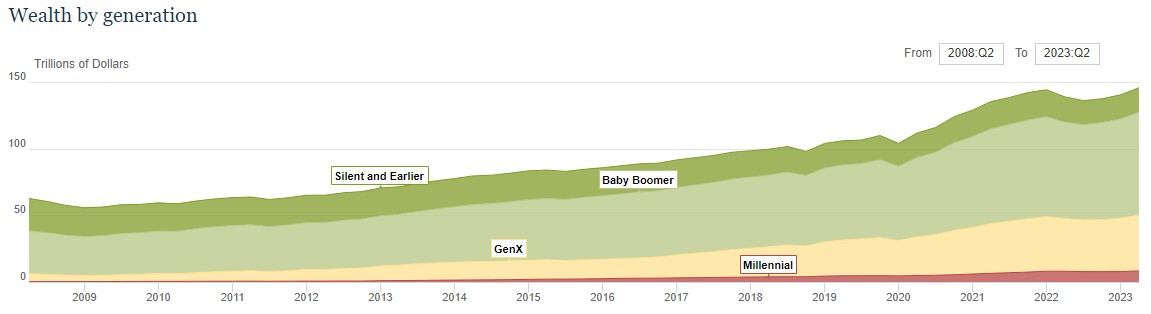

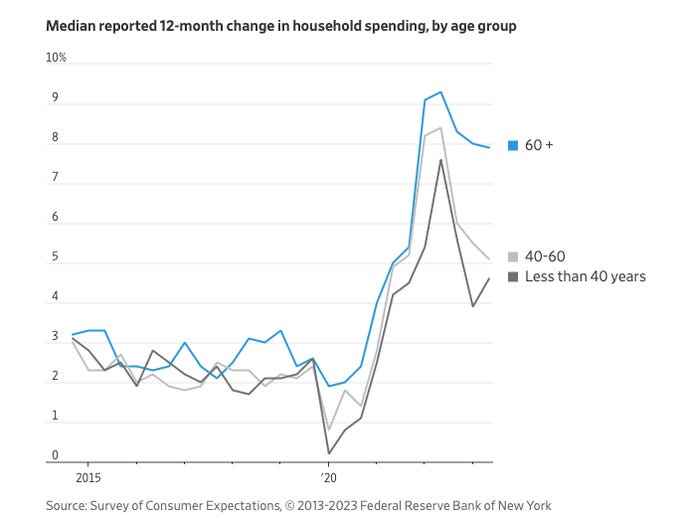

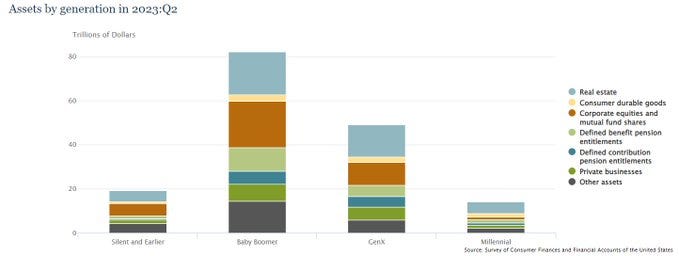

There are some market participants that focus on demand and wealth effect from assets. In my opinion, the wealth effect is overestimated. If consumption was barely affected by the 2022 drawdown, it is not likely to do much going up or down at this point. In addition, the upper quartiles are enjoying 5% on the short end and trying to figure out when to shift to long end. Corporate balance sheets for large cap companies tell a similar story.

Source: https://www.financialresearch.gov/money-market-funds/

Source: https://twitter.com/super_macro/status/1713601666870571358

Supply matters (not just for debt issuance, but also for innovation, data centers, refineries and apartments). Chair Powell is likely to focus on supply. The Fed has no control over oil supply, except setting the borrow cost for longer timeframe supply solutions.

Source: https://twitter.com/PrestonMui/status/1708904324607406499

Source: https://en.macromicro.me/collections/19/mm-oil-price/4376/crude-oil-cracking-spread-vs-wti

Source: https://www.gasbuddy.com/charts

Source: https://twitter.com/jayparsons/status/1712464990064754849?s=20

The risk premium expansion has been noticed and many are talking about the positive stock and bond correlation. This “Jaws” divergence between technology and duration (which started after Nvidia reported their May earnings) has only become more obvious recently.

Source: https://twitter.com/LizAnnSonders/status/1673278594196336642

Source: https://twitter.com/RuoshuiResearch/status/1692675456573575500?s=20

The bond market is intently watching the 10/30 QRA announcement after three poor treasury auctions in a row (with ongoing deficit spending, government shutdown, inflation, and war headlines), although secondary markets bid duration after the fact. In my opinion, the better question about risk premium lies in whether you believe in 2024/2025 growth (and frankly beyond as I have argued demographics matter for risk premium).

Source: https://twitter.com/KellyCNBC/status/1712518804134068330

Source: https://bipartisanpolicy.org/report/deficit-tracker/

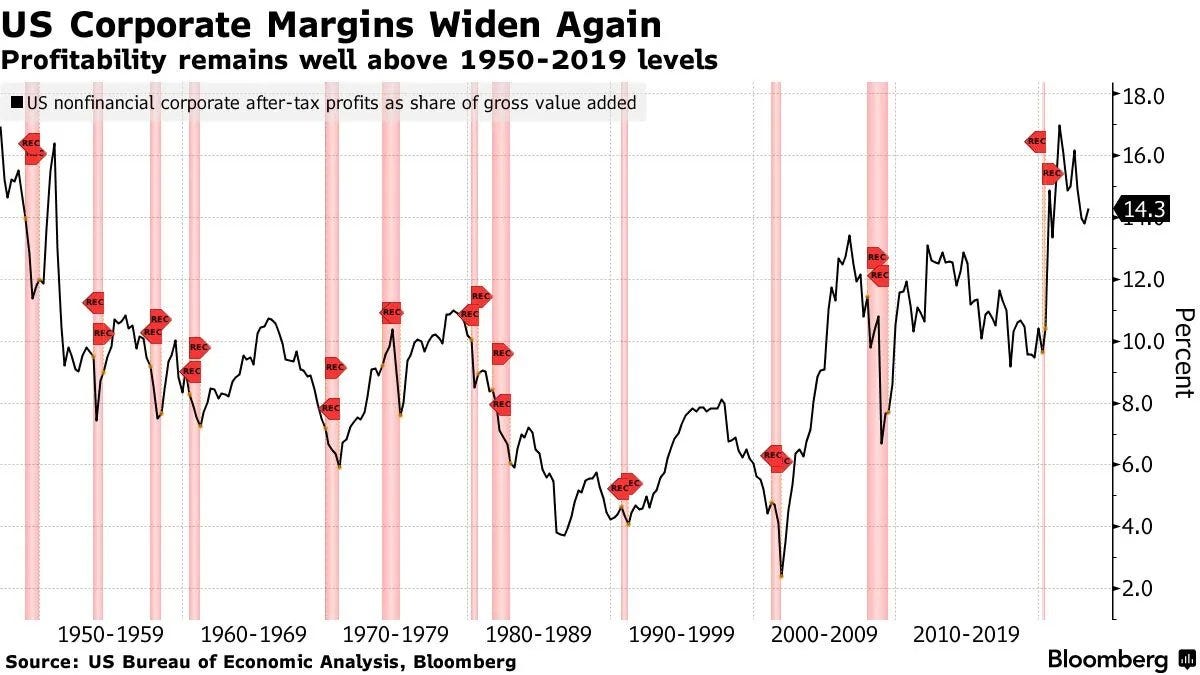

2024 H1 hard landing folks likely would prefer the negative stock and bond correlation back before this Christmas and the “Jaws” closed, but I do not think they are going to get it. 0.2-0.3 MoM is still the magic range. It is enough such that growth remains positive holding top line earnings, while productivity growth dampens inflationary effects of moderating wage growth and holds/increases corporate margins. Meanwhile, shelter slowly moderates at 7.5% mortgages.

Source: https://twitter.com/super_macro/status/1707084864770433409?s=20

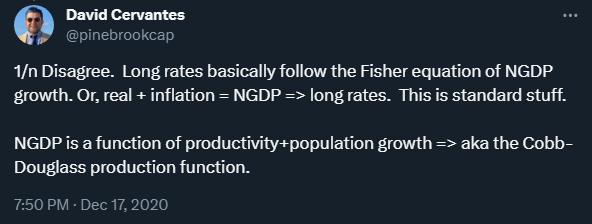

Focusing on growth, David Cervantes (@pinebrookcap) provided incredible insight by highlighting the Cobb-Douglas function.

Source: https://twitter.com/pinebrookcap/status/1339780118730960898

There are many linking the recent rise in real rates to QRA (treasury supply), FOMC, and higher growth data, so Marc Goldwein’s (@MarcGoldwein) thread about the government debt interest rate and GDP growth rate is worth reading.

Source: https://twitter.com/MarcGoldwein/status/1709624930344595902

With that in mind, US population growth is basically dependent on immigration in the short term. It is worth noting that the pandemic sped up Millennial household formation and maybe stopped the drop in birth rates. Covid also seemed to cause an interesting increase in remote work for those with disabilities.

Source: https://twitter.com/crampell/status/1710297110229237761

Source: https://www.axios.com/2023/10/04/birth-rate-fertility-rate-decline-data-statistics-graph-2022

Source: https://twitter.com/I_Am_NickBloom/status/1708145963502833806?s=20

So if population growth is not going gangbusters, what is fueling nominal GDP? I think it is a combination of Boomer wealth and productivity growth and fiscal impulse. Furthermore, productivity growth could manifest as margins stabilizing and drifting upwards again.

Source: https://fred.stlouisfed.org/series/PRS85006091

Source: https://twitter.com/LizAnnSonders/status/1709884987128922558

Source: https://fiscaldata.treasury.gov/datasets/daily-treasury-statement/operating-cash-balance

Source: https://fred.stlouisfed.org/series/WTREGEN

In my opinion, LLM’s coupled with code interpreter (renamed “Advanced Data Analysis”) is poised to more than offset deglobalization with respect to contribution to corporate capex and margin improvement, as productivity is increased for every sector. It is probable that the effects will be felt within 6-9 months and is faster than those treating AI as a Gartner hype cycle. The potential of English as a programming language is still underestimated. The transmission and absorption of information is much faster now and Microsoft has deployed OpenAI enterprise solutions globally. As far as risk premium expansion goes: imagine asking millennials if they care about risk premiums.

Source: @fundstrat

Now, let’s shift to GLP-1 and how it helps with the wealth gap and consumption.

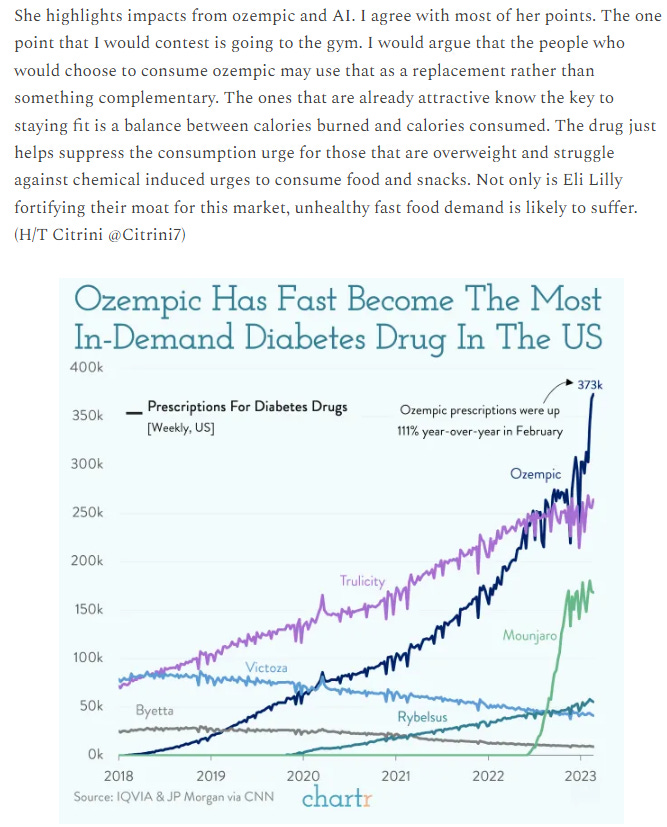

In July, I noted the rise of the drugs that has created major waves recently. I credit Sophie (@netcapgirl) and Citrini (@Citrini7) who collaborated on this piece:

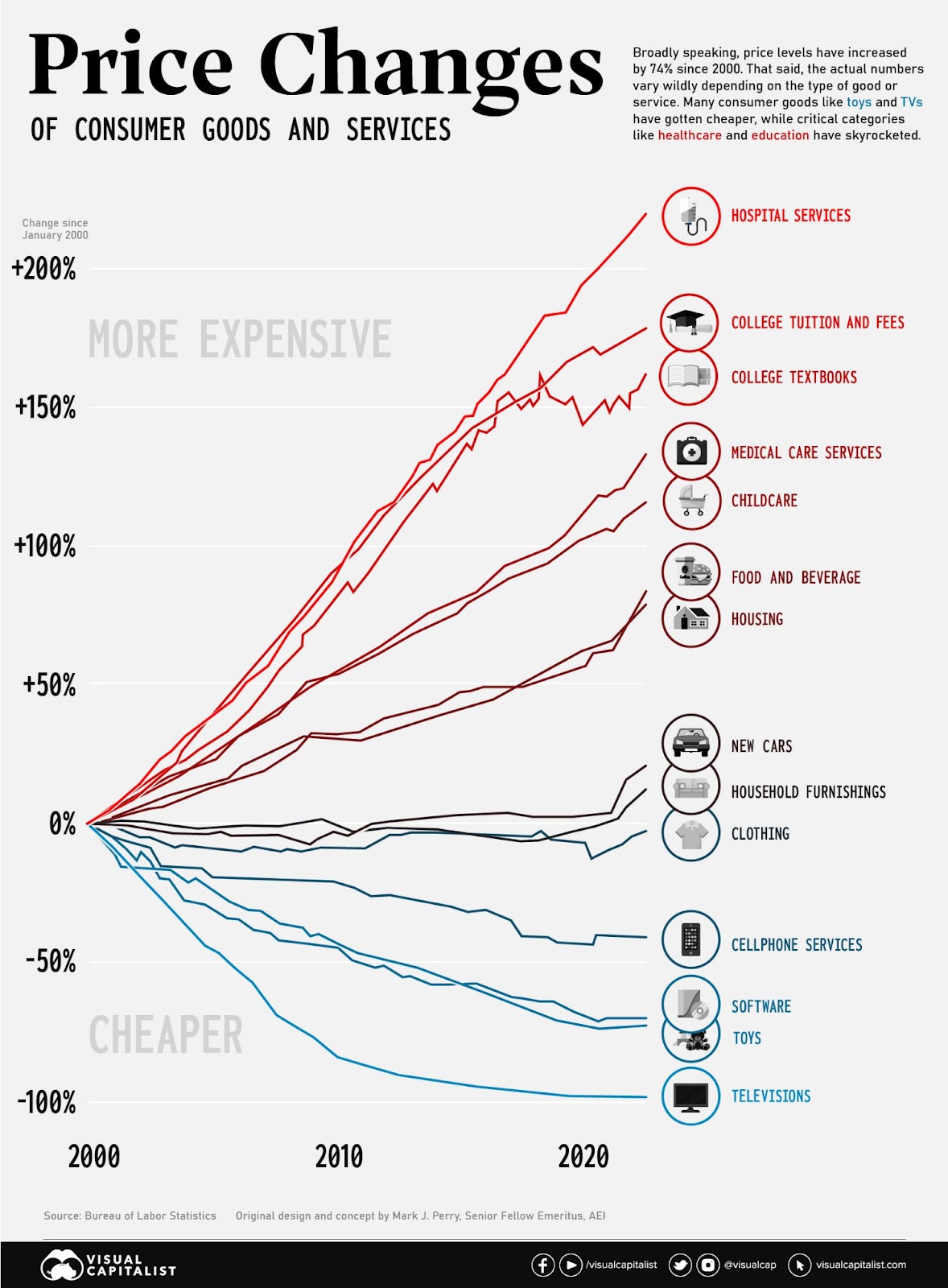

The following chart depicts the price changes of consumer and services over the last couple decades. The top four items on the following price change chart can all be addressed with AI. With the rise of chatbots and personalized/sector-specific large language models (LLMs), hospital services and education are ripe for disruption. Between faster drug discoveries to reduce R&D costs and streamlining insurance overhead, GPT models should help reduce medical costs and improve hospital care.

Source: https://www.visualcapitalist.com/inflation-chart-tracks-price-changes-us-goods-services/

Now GLP-1 is added to the deflationary mix for hospital services, medical care services, food and maybe even clothing. What has been increasingly apparent is there exists a barrier to upward mobility and how to improve the quality of life for all. That barrier has taken the form of inflation. There is one thing that Cathie Wood is correct about: technology is deflationary. The combination of AI and GLP-1 will have their deflationary effects and coupled with lower quartiles gaining wages as overall wage growth moderates, this helps close the wealth gap.

Source: https://twitter.com/LizAnnSonders/status/1712797911380111782

Source: https://twitter.com/JustinWolfers/status/1677106660198830080

Source: https://www.atlantafed.org/chcs/wage-growth-tracker

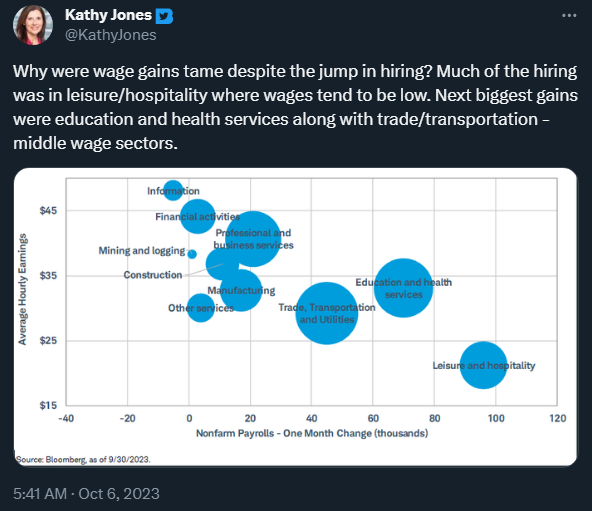

Source: https://twitter.com/KathyJones/status/1710274004869689715

Let’s assume these weight loss drug work and people actively chose them despite longer timeframe adverse effects such as thyroid cancer. Citrini (@Citrini7) provided the following chart recently. This chart somewhat changes my view on how GLP-1 mixes with exercising. While lifestyle changes should produce better weight loss results, I was not sure the majority of GLP-1 users would choose to change their lifestyle. It seems that I was being too pessimistic. Recently, mainstream media is helping facilitate that complementary exercise conversation as Eli Lilly’s Mounjaro nears its FDA approval, with plenty of Oprah headlines who sits on Weight Watchers board.

Source: @Citrini7

So, how does this affect consumption and have deflationary effects? Let’s start with this study to provide some context.

Source: https://twitter.com/nejm/status/1673438484168597504?s=46&t=E8AFkSxBpVxZHPBSZIFkIQ

Source: https://twitter.com/citrini7/status/1673464832626917376?s=46&t=E8AFkSxBpVxZHPBSZIFkIQ

If we could give everyone in America bariatric surgery, we could probably solve the obesity epidemic. This study implies 8-12mg should achieve 15-20% weight reduction, and assuming that it scales, this puts the US national BMI average <24. However, not everyone wants surgery, and it is extremely expensive.

Source: https://www.tfah.org/report-details/state-of-obesity-2023/

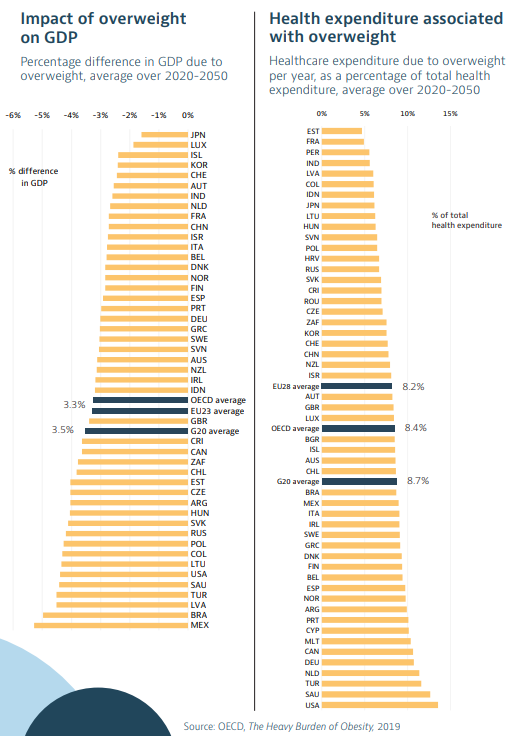

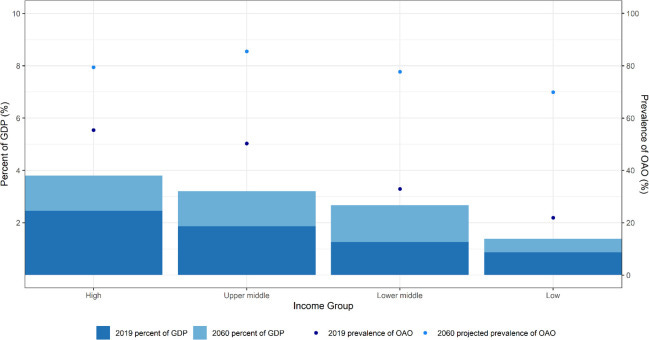

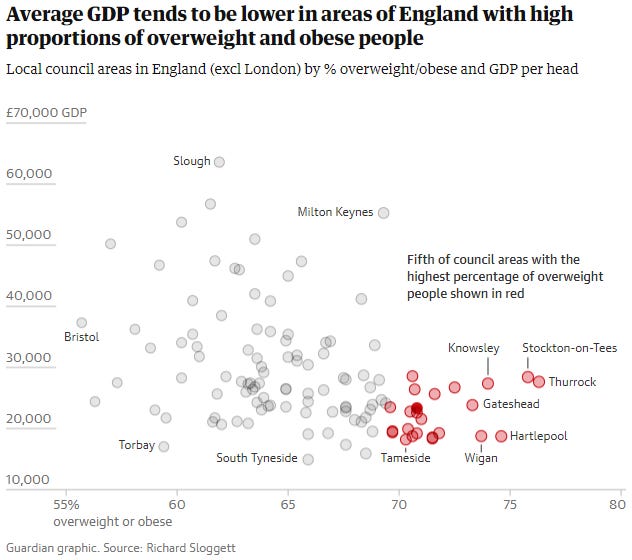

The World Obesity Foundation estimates that obesity could cost the global economy $4 trillion in 2035. Statista breaks it down by region in the following chart, as a percentage of GDP.

Source: https://ourworldindata.org/grapher/obesity-vs-gdp

Source: https://www.oecd.org/health/health-systems/Heavy-burden-of-obesity-Policy-Brief-2019.pdf

Let’s see how it breaks down by income level. According to this RTI study, it illustrates the relationship between income and obesity. They also provided a hypothetical scenario that demonstrates a reduction in overweight and obesity (OAO) prevalence can result in lower economic impacts. A 5% reduction in projected prevalence between 2020 and 2060 will result in about US$429 billion in annual savings on average globally. A scenario that halts the projected rise in OAO prevalence at 2019 levels would result in about US$2.20 trillion in annual savings on average globally. Hence investments and targeted systemic actions to prevent and reduce OAO can have considerable positive implications for improved global health and economies.

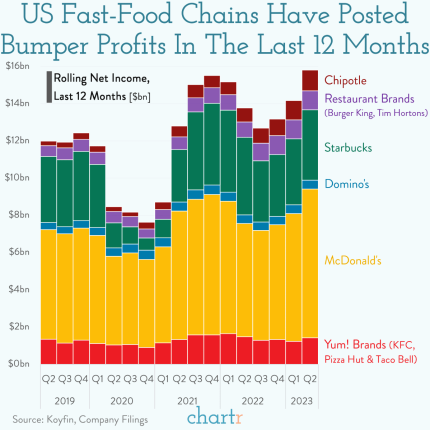

Corry Wang (@corry_wang) illustrates the benefit of using Pareto analysis and asks the important question: “How many American industries have been propped up for the last 50 years by the poor impulse control of a small cohort of people with eating problems, drinking problems, and gambling problems?”

Source: https://twitter.com/corry_wang/status/1711925742869639245?s=20

A reasonable follow up question is where does this money go, if not to food, beverages, and gambling. Now, we have gone full circle back to Sophie’s (@netcapgirl) hyper individualization. The number of earnings transcripts mentioning GLP-1 is likely to increase just like AI mentions has. Good companies will survive with pricing power and maintaining margins.

Sell side analysts have piled in with comments over the last couple months. Here’s some of BoA’s commentary. In my opinion, the biggest immediate effect is how do slimmer Boomers affect consumption for the next 6 months, and it probably fits the luxury services as described by Sophie (@netcapgirl):

Beauty, Cosmetics, Luxury, Travel, Plastic Surgery, House Refurbishing & Upgrades, Tutors & Custom Education, Financial Services, etc. are all industries that should benefit from this trend in one way or another.

Although the weight loss related stocks have priced in a lot of growth and Novo Nordisk just raised guidance again, I think it is still worth highlighting the surge in demand for these drugs. The short term weight reduction have shown up. The demand for it helped Denmark avoid a recession and required a new methodology for tracking GDP.

Source: https://link.springer.com/article/10.1007/s10557-023-07488-3

Source: @JosephPolitano

Similar to AI, the developments of this “miracle drug” require keeping up with: such as alcohol consumption, Type 1 diabetes and chronic kidney disease. This has caused drawdowns for many of the medical device stocks, even to the point where Intuitive Surgical called GLP-1 out as a possible cause for a reduction in number of joint surgeries.

Source: https://twitter.com/EricTopol/status/1699528145593151654

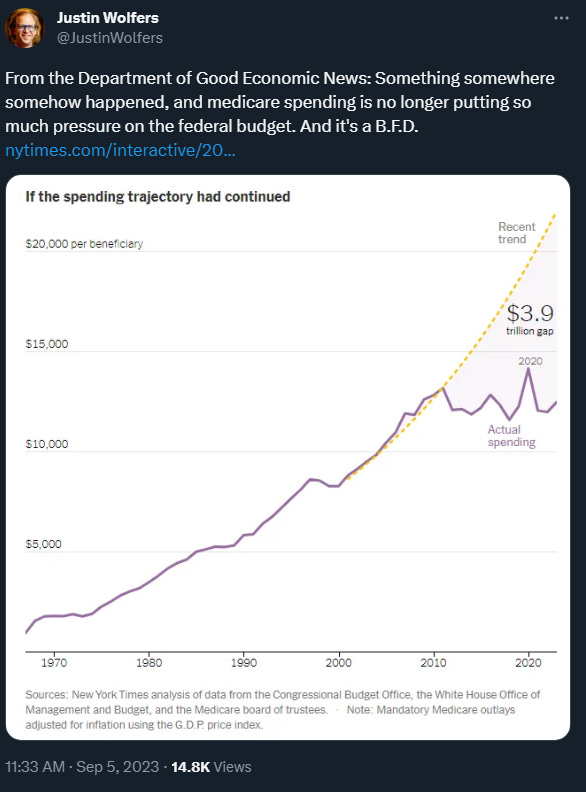

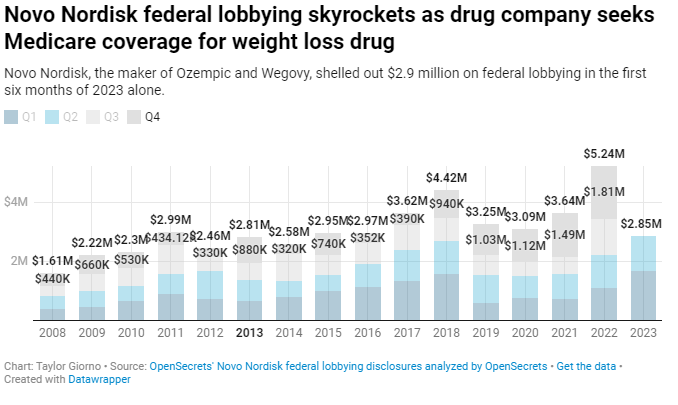

Considering the secondary effects of obesity on health, I do not think it is that far-fetched to consider the eventual coverage of GLP-1 drugs with Medicare, adding another lever for fiscal dominance.

Source: https://twitter.com/JustinWolfers/status/1699128605479964822

A Vanderbilt study makes the assertion it would be too costly, as it is currently around $14,000 per year. Again, let’s continue with Pareto analysis and say roughly 20% of beneficiaries use it. That would put the cost around $50 billion (which is roughly the BoA estimate for 2026 GLP-1 market), keeping in mind that this assumes the treatment does not get cheaper and no accounting for reductions in spending as people lose weight and avoid secondary diseases from being obese. Extrapolating the 5% RTI study number and assuming it was optimistic by +20%, it puts annual savings for 10% weight reduction to around $600 billion in annual savings. The math seems to work when accounting for net spending and savings.

Kaiser Family Foundation starts with similar numbers but highlights how the Inflation Reduction Act (IRA) could fold weight loss drug coverage into Medicare.

Insurance plans are looking at the data and pulling back on coverage as demand as surged. There is a saying: “the best cure for high prices, is high prices.” The duopoly from Eli Lilly and Novo Nordisk is likely to be challenged as the demand creates competition.

If the administration decides that the treatments are not merely products that offer a cosmetic change, but also provide medical benefit when coupled with lifestyle changes, there is real incentive to fold coverage into Medicare to battle the obesity epidemic. Novo Nordisk just started their lobbying campaign and it is just a matter of time until Eli Lilly joins. The lifestyle changes language is key. Employers have been actively considering expanding coverage as more believe GLP-1 coverage would enhance employees' health and perception of healthcare benefits.

Now, does how does obesity affect labor productivity. There are numerous studies showing the productivity loss due to being obese, as there are inability to work implications with being overweight. There are implications as those obese typically restrict themselves into occupations with fewer physical job demands.

Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5770108/

This leads to geography differences as well, outlined by a UK study. Although this Indiana study was supported by Eli Lilly, the numbers do not seem out of line with what has been presented above.

Source: https://www.globaldata.com/health-economics/US/Indiana/Obesity-Impact-on-Indiana.pdf

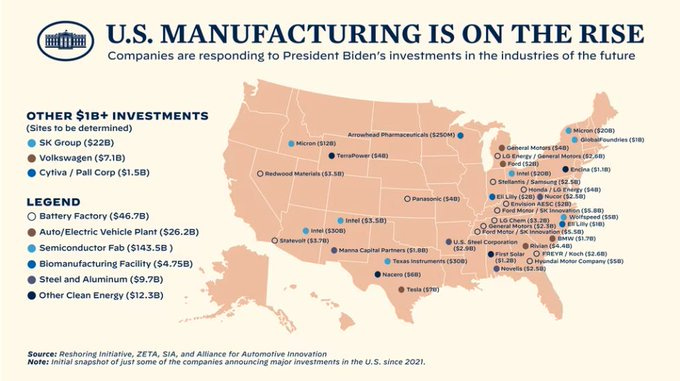

With Indiana numbers in mind, I think it is worth looking at the US obesity map again, but also followed by the IRA/CHIPS map. There seems to be a little overlap. The White House site has more detailed and updated information about the $500 billion that is coming to America. I can’t help but think that GLP-1 will boost productivity as well, with fiscal support sooner than people think.

Source: https://www.tfah.org/report-details/state-of-obesity-2023/

Source: https://twitter.com/ReshoreNow/status/1644352611661873161?s=20

In summary, not only are upper quartile consumers positioned to sustain consumption and growth such that positive stock and bond correlation is sustained as shelter slowly moderates, the biggest immediate effect from GLP-1 is how Boomers change their consumption behavior after reducing some weight. I think it manifests with luxury services benefiting and the market implications is basically a repeat of 2023 1H: technology, luxury, and homebuilders being the beneficiaries. There are likely productivity growth implications from the use of weight loss drugs as well, if the cost is reduced and/or Medicare is expanded.

The market has digested the 10yr trading between 4.3-4.8%. The push and pull between the underlying supply and demand for the long end of the yield curve is something that needs to be monitored on a week to week basis due to headlines and issuance, but I am of the opinion that the market will push higher with the 10yr less than 4.5%.

As productivity growth manifests with margins holding or even growing. It is probable that AI overpowers discount rates. President Biden’s CHIPs act will further enable the US to maintain global competitiveness in this new regime. Those worried about deglobalization may be underestimating how much the internet contributed to globalization. Although reshoring initiatives may be inflationary short term, automation has the chance of balancing out those price pressures. Furthermore, GPT technology has the potential to provide the necessary productivity gains that bring inflation down to the Fed’s target in a timely fashion. On a longer timeframe, Medicare coverage for weight loss drugs is likely to manifest as another lever for productivity growth via fiscal dominance.

In my opinion, LLM’s coupled with code interpreter (renamed “Advanced Data Analysis”) is poised to more than offset deglobalization with respect to contribution to corporate capex and margin improvement, as productivity is increased for every sector. It is probable that the effects will be felt within a 6-9 months and is faster than those treating AI as a Gartner Hype Cycle. The potential of English as a programming language is still underestimated. The transmission and absorption of information is much faster now and Microsoft has deployed OpenAI enterprise solutions globally.

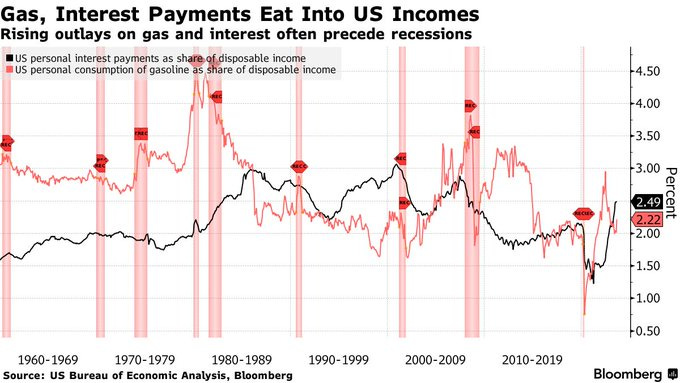

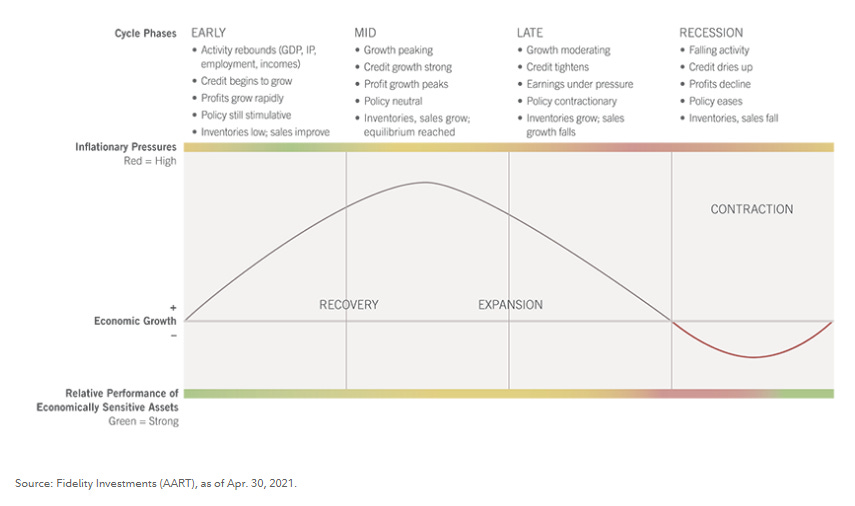

It is important to remember soft is the easy part. It is keeping it soft that is the hard part and containing the spike in unemployment. There are still headwinds to the US consumer and it is taking the form of higher borrowing costs, gasoline prices, depletion of excess savings and student loan payments. The longer the Fed can maintain this rate, the more bullish it is for the US economy as Chair Powell can choose to slowly ease and maintain real rates as NFP rolls over. Meanwhile, the market is trading like the economy is in the early phase of a new business cycle.

Source: https://twitter.com/allstarcharts/status/1713194853348135109