Jackson Hole came and went. A year has passed and not much has changed from the Fed perspective. Market participants are still debating inflation and interest rate paths, despite headline CPI getting halved with unemployment barely budging. People are forecasting recession again within the next 6-9 months. Deja Vu.

I will attempt to break it down in terms of five market drivers that I have focused on in the past.

Let’s start with the Fed and monetary policy being restrictive.

Monetary Policy:

I wrote Boring FOMC in mid July:

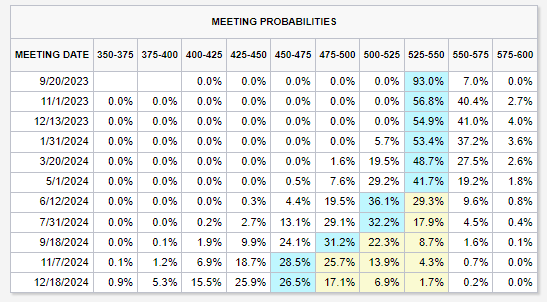

That is pretty much what we’ve gotten so far. I’ll elaborate on my view on price in a follow up post, so let’s focus on the Fed reaction function and interest rates. The Fed Funds pricing is currently depicted below:

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

The market is pricing in a June 2024 cut instead of a March 2024 cut, with 2024 terminal still at 4.5%. I believe the September FOMC itself will likely be relatively boring and get priced in right after the CPI print next week on 9/13. Chair Powell is likely to continue the same rhetoric as the last FOMC, while keeping the door open for another rate hike for risk management purposes.

I continue to believe that Chair Powell will aim for soft landing and the path to do that is maintaining constant “real” rates as I highlighted after the BoJ announcement. It is probably worth noting “real” is more or less the market vibe whether inflation continues its trajectory downwards.

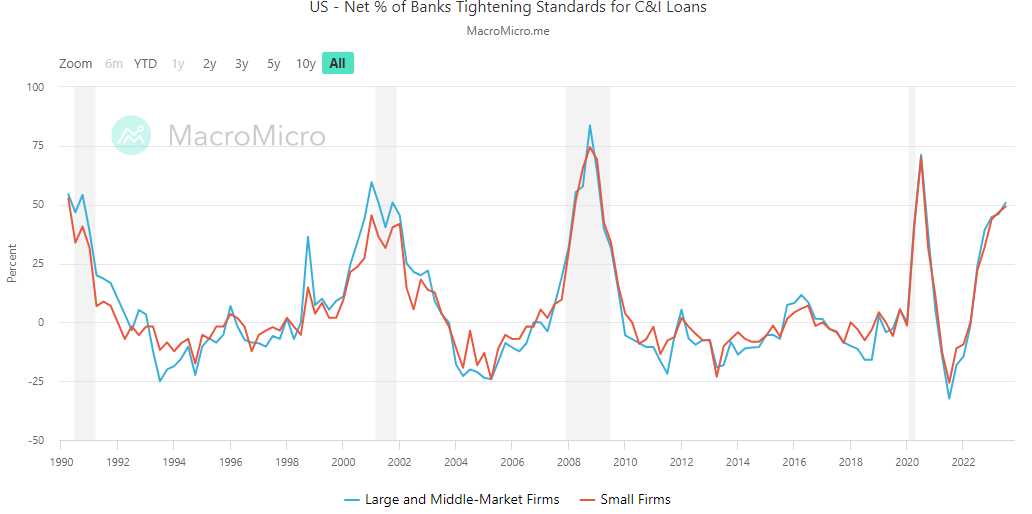

I think monetary policy is sufficiently restrictive. What does the market think Chair Powell think?

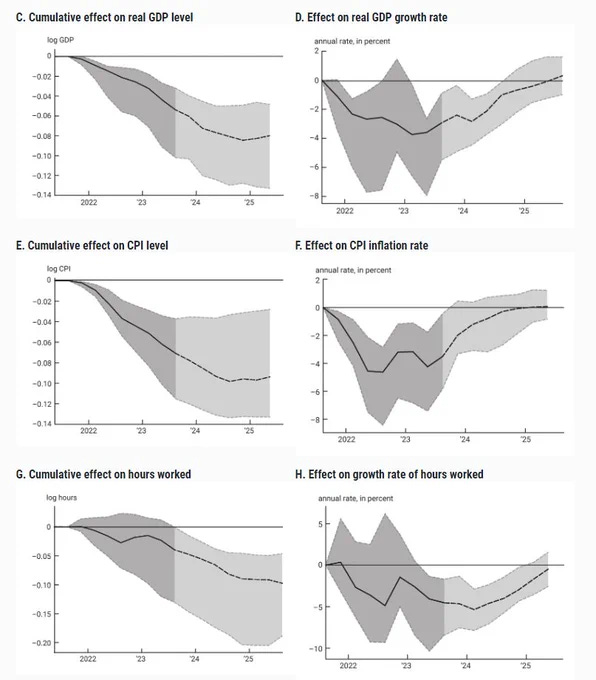

Source: https://www.chicagofed.org/publications/chicago-fed-letter/2023/483

I think the odds are high that the September Summary of Economic Projections (SEP) is likely to be largely unchanged to reflect the soft landing goal. Chair Powell has maintained the 2024/2025 4.5% unemployment rates for a full year now and there is little reason to adjust them even if GDP projections were conservative and require an upward revision. Chair Powell also highlighted the impacts of both shelter drag and wage growth slowing down at Jackson Hole. I have felt the SEP implied soft landing for a full year now and that still remains the case.

Source: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230614.pdf

Source: https://www.federalreserve.gov/newsevents/speech/powell20230825a.htm

Some market participants are looking for changing of the 2024 4.6 terminal rate, but they are also calling for hard landing. Sound familiar? If it does not, it is exactly the stagflation narrative/position that permeated throughout the market around Q1 2023, which was utterly destroyed as inflation rolled off faster than the economy did.

Source: Bank of America Global Fund Manager Survey (March 21 2023)

The path to soft landing has only widened as the Fed becomes solely reactive to labor market data and observe the delicate dance struck by monetary policy and fiscal policy. As long as wage growth continues to slow, the Fed can watch the QT tightening mechanism being transmitted by the long end, dictated by Secretary Yellen’s issuance composition.

You can make the argument that soft landing is fully priced in here, but is AI? Market seems to have digested the 10yr at 4.2% relatively fine. If you think AI is just hype (6 month timeframe), you probably also think the gap between Nasdaq and the long end of the yield curve should be closing soon.

Here’s a gap that didn’t really close. Choose your fighter. I think AI beats oil.

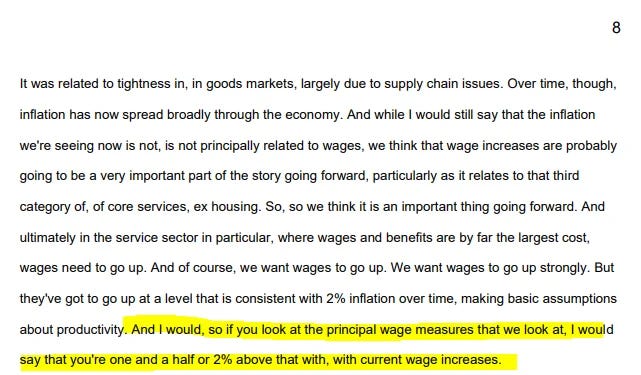

What does Chair Powell think? That is probably the better question. Here’s what he said at Brookings.

Source: https://www.brookings.edu/wp-content/uploads/2022/11/es_20221130_powell_transcript.pdf

This is probably what Treasury Secretary Yellen thinks.

Source: https://www.frbsf.org/economic-research/publications/economic-letter/2005/february/productivity-and-inflation/#subhead2

I still maintain that the current Bidenomics regime is more of a combination of post WW2 and the 90s.

Source: @LynAldenContact

Oil is outside of Chair Powell’s control and his reaction function should no longer be focused on dampening short term demand. Wage growth is slowing and people are returning to the work force. Furthermore, increases in short term rates are probably no longer net restrictive and the Fed probably knows that. The only people saying rates are not restrictive are probably not looking to buy a house. Chair Powell has likely completed his tightening cycle and is ready to observe whether shelter continues its downtrend and offset any commodity price impulses.

Source: https://twitter.com/rhunterh/status/1697393281720602723?s=20

Source: https://twitter.com/LizAnnSonders/status/1699382011629035813?s=20

Source: https://www.financialresearch.gov/money-market-funds/

Source: https://www.ici.org/research/stats/mmf

Source: https://twitter.com/LizAnnSonders/status/1694646176736305169?s=20

In summary, last year’s question was whether inflation rolls over faster than the economy. This year’s question is whether NFP rolls over faster than the economy. The hard landing folks calling for further wage growth inflation pressures are stuck in the 70s where the US was heavily dependent on the whims of OPEC. There is a nonzero chance that the oil pressures manifest as margin contraction and a drag on discretionary spending, rather than another wave of inflation.

I think Chair Powell has substantial justification to pause rate hikes this coming FOMC, albeit with data dependent rhetoric in case inflation inflects upwards again. It is worth emphasizing that what matters to the real economy is the long end of the yield curve, with the 10yr trading between 4.0-4.3%. Over the past 9 months, there has been a weird paradox of forward pricing. Every time the bond market prices recession, it stimulates the real economy with lower yields and holds off the recession. I expect the same to happen in the next 6 months as the recession calls grow louder with monetary policy being restrictive, excess savings depleting, and student loans resuming.

The “higher for longer” narrative that Chair Powell has been pushing since his Jackson Hole “pain” speech last August probably shifts to “for longer”. For Chair Powell to feel comfortable, he most likely needs a string (~6 4) <0.3 MoM prints which is ~3.3-3.7% annualized. The long end of the curve is basically up to Secretary Yellen and how she controls the composition of treasury issuance and whether the market demand meets the duration supply. She probably held the most important lever for QT this year as Chair Powell faced the press, and she exercised it to push the long end higher recently. But I think she pulls it back a little for next QRA, and I will elaborate in a follow up for risk premium.

I think Chair Powell eventually mentions that AI can boost productivity. Technology is the strongest deflationary force in the world and work flows are very much changing real time thanks to the combination of LLMs and coding APIs. The cloud infrastructure already established makes the absorption rate drastically faster than the 90s. Memory will lose its edge and data analysis will be improved in every office in every sector. Buckle up.