Risk Premium

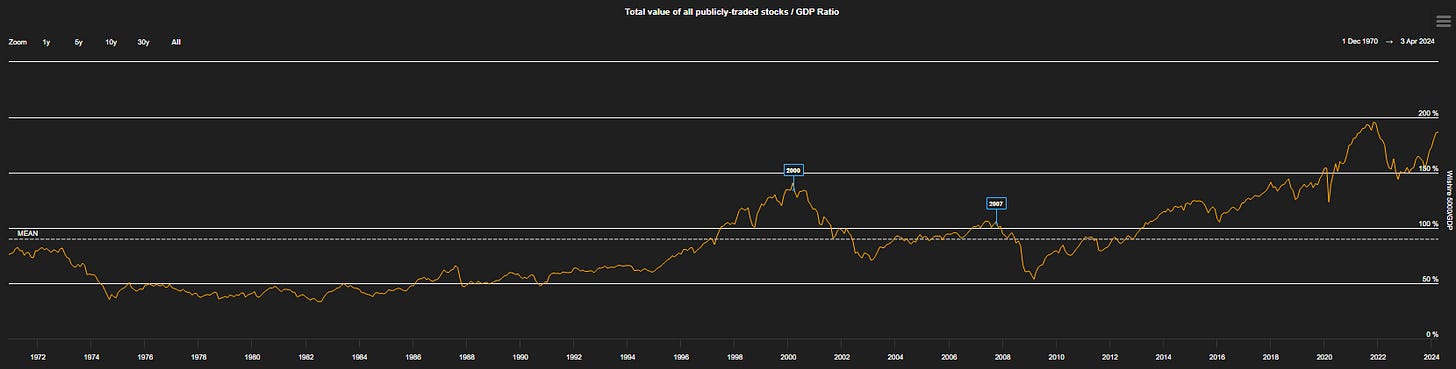

The current 2024 market earnings per share is ~243 and 2025 is ~276, pricing in ~13% growth relative to 2024. Using the expected earnings per share, this translates to ~21.4x P/E and ~18.8x P/E. The 3 month treasury bill (Tbill) yields 5.5% while the 10yr yields 4.3% at the time of writing, translating to ~18.6x P/E and 22.7x P/E.

Oversimplifying yield assessment, an investor can choose to park their cash in the broad market which is (maybe optimistically) based on forward earnings expectations or government Tbills. For the risk averse, it is not a hard decision to park cash in the latter when the yield expectations are equal and there is minimal risk. One can argue longer durations 2yr-10yr are rich relative to Tbills as well.

I would normally reference Buy the Dip Generation, but the housing season might actually end up being net negative for the stock market. There is probably a little upside left with top line revenues and profits trending up. However, I think the stock market is more likely to chop around here, with some rotations underneath before heading down once the Fed finally cuts (with the cuts being perceived in context of slowing growth and inflation). The market is likely to unwind the short volatility strategies while digesting slowing NGDP. Here’s the recent risk premium thread.

In the September post, I argued that the yield curve would remain inverted and that seems to have played out as it’s been largely unchanged since the end of that month. Two cuts would guarantee a disinversion.

I believe that the shape of the yield curve is a policy choice through the effort of both Chair Powell and Treasury Secretary Yellen and that choice has been “soft landing.” That choice was stress tested with the Jan/Feb prints, but will be put to the test with 4/10 CPI print. If the print is hot, then the long end is likely to push out the cut further and pressure the stock market immediately. I am putting 30% on this probability, with base case being inline/soft <0.3 MoM. The ultimate goal is to steepen the curve to disinvert without causing a recession, as productivity growth enables continued growth with disinflation. Thus, if the print is hot, the long end will once again tighten economic conditions and narrow the path for avoiding significant job loss.

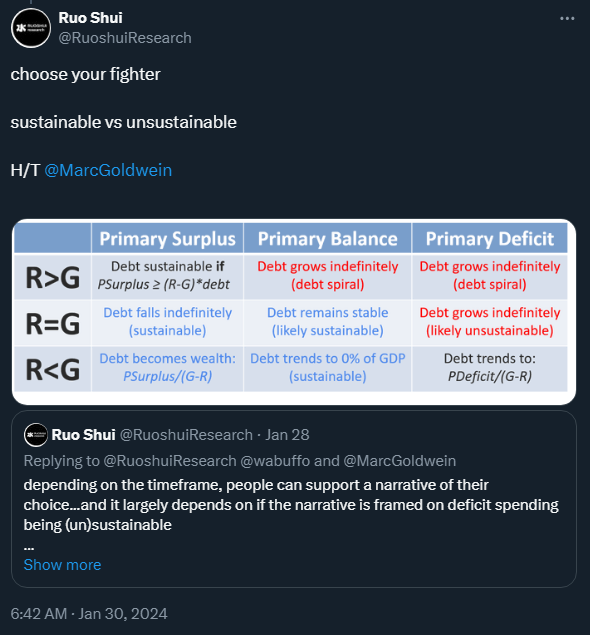

The disinversion trade has largely been front run, and banks/builders are likely to have priced it in. They would likely need earnings to support additional price appreciation. The real economy is still being steered by the market’s whims on the long end: attempting to price in productivity growth, growth and inflation expectations. I continue to believe the QRA issuance is likely to be absorbed, assuming the market treats the deficit spending as sustainable in the near term. I view one candidate is more likely to cause a tantrum than the other and will update (un)sustainable view based on election results.

With how market inflation breakevens and credit spreads have behaved, it is likely that the long end upward pressure would mainly come from reflation and/or supply from Secretary Yellen’s QRA. While I rely on folks like Bill (@wabuffo) and Brad (@Brad_Setser) for plumbing insight- domestic and foreign respectively- but I do not hold a strong view other than duration stays bid (10yr <4.5%). I believe this holds as long as market perceives deficit spending is sustainable, and G (growth) > R (interest rate) in the near term (3-6 months) as described by Marc Goldwein (@MarcGoldwein). Reflation is the primary risk to this view.

I think that Secretary Yellen is likely to take the lead to support the economy if monetary loosening proves insufficient. It is also worth mentioning that mortgage spreads with the 10yr are starting to improve as the Fed policy guidance has incorporated the mention of QT taper. There are some people claiming no one wants to buy duration, but these are the same people that stayed in cash/MMF for 2023. Where does 2T go when Chair Powell cuts?

Conclusion

In summary, the narratives have included the following:

Labor shock was coming

Banks were failing

Credit crunch was coming

AI effects were too early to justify valuations

Debt ceiling/TGA rebuild was going to cause bond market turbulence

Earnings were/are going to disappoint

Duration supply from China/Japan and Treasury Issuance

Reflation and unsustainable deficit spending

I think the stock market has a little upside left, but I think it is going to start digesting slowing nominal growth in Q2 and I do not think cuts will be sufficient to offset the downside move completely. In fact, the first cut is the signal for slowing growth as short vol strategies unwind. The real economy should react favorably though.

It is important to remember soft is the easy part. It is keeping it soft that is the hard part and containing the spike in unemployment. The longer the Fed can maintain this rate, the more bullish it has been for the US economy, but the risks are balanced and Chair Powell can choose to slowly ease and maintain real rates while watching NFP and productivity growth, especially so as payroll growth equilibrium has been shifted due to immigration.

The market has been trading like the economy is in the early phase of a new business cycle. If fiscal policies prove to be productivity enhancing, there’s a chance “business” becomes the norm.