the "p" word and the fiscal/monetary dance

Trends: Soft Landing, Fiscal Dominance, Wealth Gap and Consumption and AI/GLP-1

This post is going to be a long one. It will be the combination of three trends that I wrote about in the past: soft landing, fiscal dominance, and AI/GLP-1. I believe these trends will continue into 2024 and I will talk about risks to each view after a brief 2023 review.

the inverted dive

Trend: Soft Landing

2023 is going to be remembered as the year that transitory goldilocks was transitory.

I believe it is too early to call it, but it certainly does not look as implausible as last year. Chair Powell’s job is to keep watch for employment stabilization while waiting to see if productivity growth maintains trend.

In order to have any chance at guessing what is to come, I think it we should attempt to understand what happened in 2023. I wrote in July about how Chair Powell had always been aiming for a soft landing:

Looking back, this was truly an inverted dive that seemed impossible, unless you believed a significant portion of inflation was caused by supply disruption from Covid and Russia, and that the housing market would hold without Fed intervention.

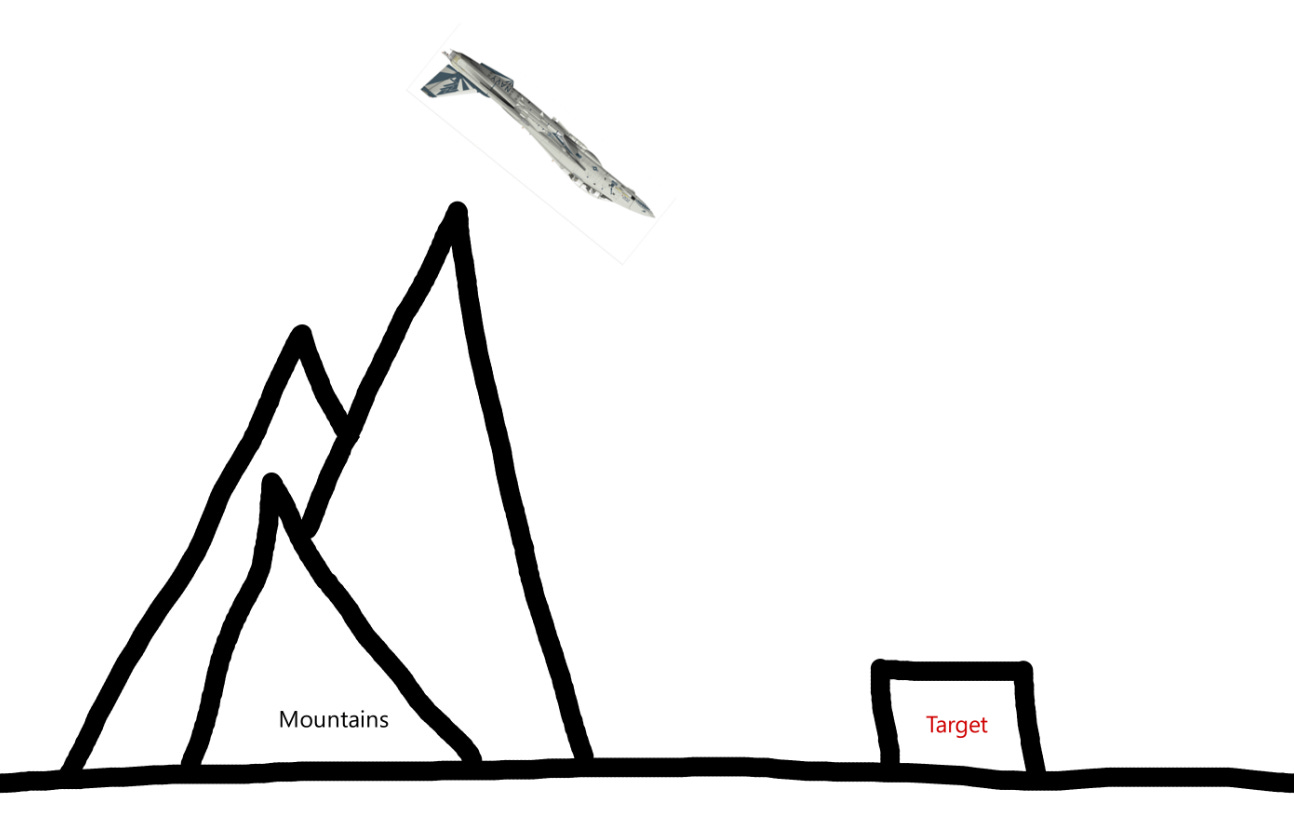

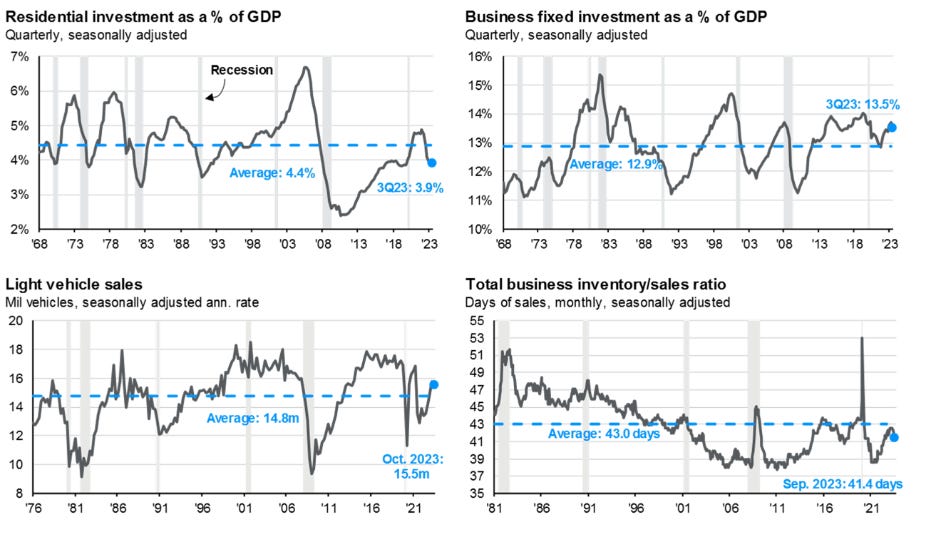

The definition of “pivot” for these housings charts was defined as cuts to the effective Federal funds rate. Just to review, here’s some past cycle charts previously discussed.

Source: JP Morgan

The context of a pivot matters and right now Chair Powell is focused on growth by highlighting maintaining real rates at a restrictive level. Furthermore, by maintain real rates, he is focusing on long term supply while facilitating expansion.

I will admit that I was surprised by the last FOMC reducing the unemployment forecast from 4.5% to 4.1%, but that may have been necessary to put additional breaks on the juggernaut that is the US economy. Regardless, I think both the September SEP and the upcoming December SEP + dot plot will reflect a soft landing. The dots might align more with Goldman Sach’s estimated Q4 cuts, but the market might wave it off as Chair Powell’s press conference focuses on supply and having achieved restrictive policy with real rates. My view on the Fed reaction function and the long end hasn’t really changed much since Sept. This is still Deja Vu.

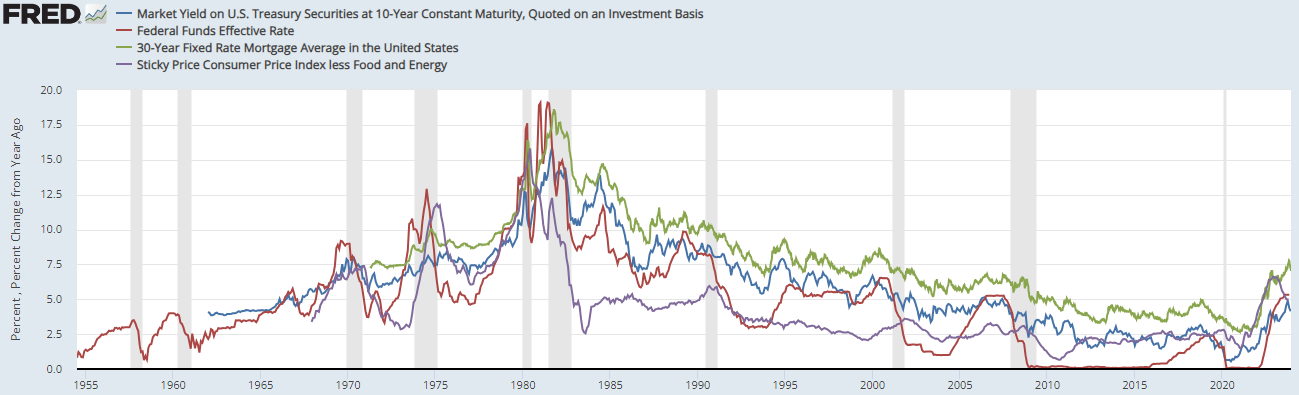

March cuts seem too early and my current lean is for a Q2 (May/June) cut, with just two or three 25 bps cuts in the 2024. The market has once again gone into its forward pricing paradox loop. Every time the bond market prices recession, it stimulates the real economy with lower yields and holds off the recession. After one more tightening from the long end as it reacts to better than expected Growth, this loop is likely to break in 2024.

Some participants are already preparing for the disinversion trade. Companies that utilize borrowing short and lending long end rates is likely to benefit, such as banks and home builders. I think it is worth noting two cuts would cause the bull steepener resulting with the 10yr-2yr disinversion, and that is my base case for 2024. Any “manicure” 25 bps adjustments after that is not likely to have a large impact as the real economy is steered by the market’s whims on the long end: which is attempting to price in productivity growth, growth, and inflation (in my order of importance). Fed is unlikely to say it out loud, but they are seemingly doing more NGDP targeting rather than inflation targeting at the moment also known as the real policy regime.

Source: https://twitter.com/WarrenPies/status/1620542116081590272

Source: https://fred.stlouisfed.org/series/T10Y2Y

It is probably worth pointing out that this same “pivot easing” happened last November going into Brookings 11/30/2022 where the bond market supported the real economy by pricing in recession. For the record, the theme for my September notes was “Deja Vu.” You can ignore the AI part if you are a nonbeliever.

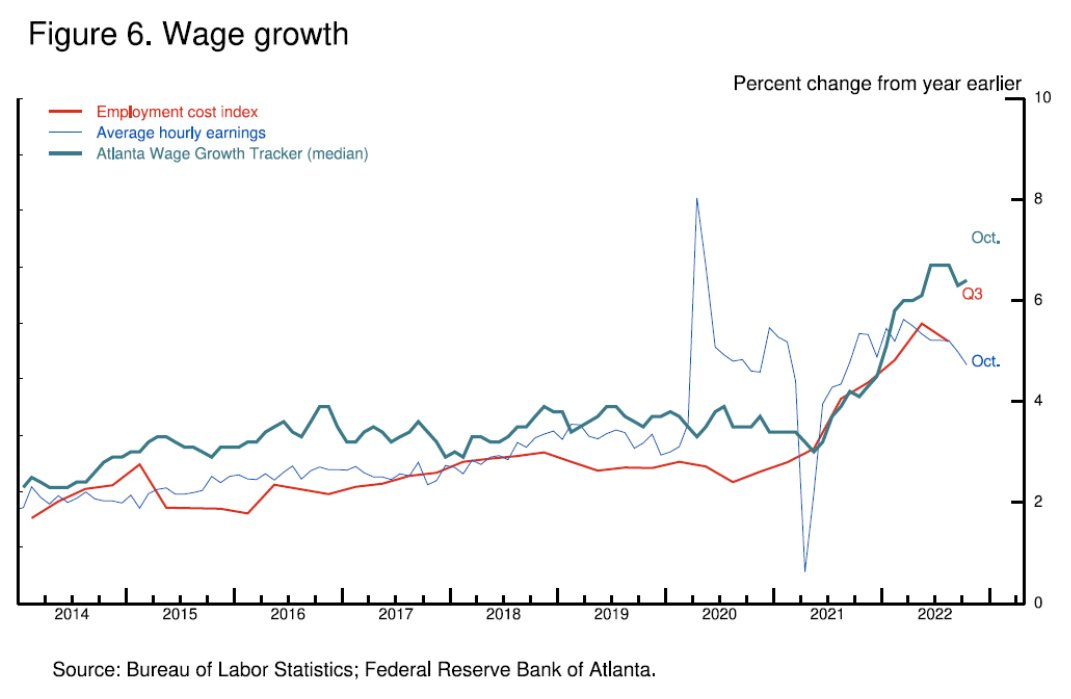

This is your friendly reminder that Chair Powell gave his target for wage growth at Brookings last year, with “basic assumptions about productivity.” I opted to substitute a November entry with a couple Twitter threads as both my Growth/Price and Risk Premium/AI+GLP-1 outlook had not changed and it was basically just checks on maintaining trends.

Source: https://www.brookings.edu/wp-content/uploads/2022/11/es_20221130_powell_transcript.pdf

Having just looked at a bunch of past cycles, I think it is important to accept that the current regime has no analog. It has WW2 deficit spending, 70s Middle East conflict, 90s technology capex, and procyclical fiscal that drove up cash buffers and nonresidential jobs, after a global shutdown from a black swan virus that spread without symptoms. In my opinion, the market is already in “early” cycle. Whether that is correct, will come down to productivity growth in 2024.

Source: https://digital.fidelity.com/prgw/digital/research/market

Regardless of your views on where the US economy is in the business cycle, I think it is incredibly important to admit this cycle really is different. I would not be surprised if Jan Hatzius had his 2023 outlook framed somewhere.

There are some arguing strikes will cause disinflation to stall or even reignite inflation. I think these strikes may just help some people catch up to inflation, rather than ramp aggregate demand. I think it is also worth bringing up again that union membership is not like the 70s. Even so, the closest analog to the 70s is likely labor not oil. However, it has the biggest disinflationary opponent: technology.

I agree with Hatzius’ 2024 view that as NGDP slows, the labor market loosens and wages maintain their downward normalizing trends. With UAW/WGA strikes behind us and record multi-family construction since the 70s, car prices and apartment trends are likely to maintain their disinflationary trends, which nudge core PCE towards the Fed’s target by 2025.

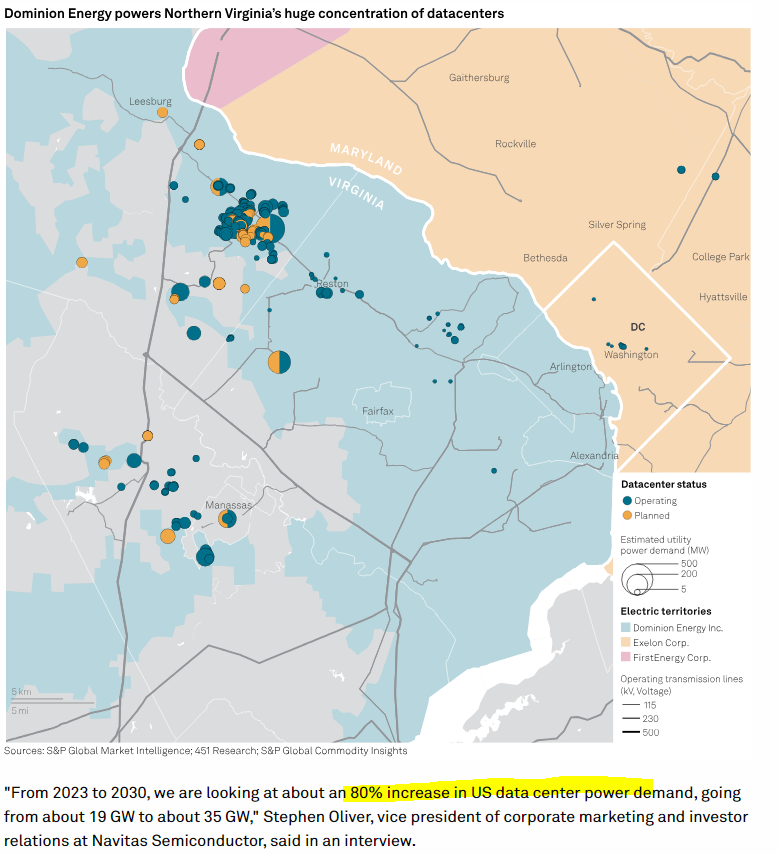

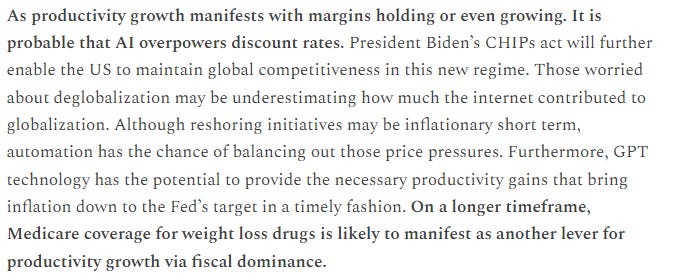

In the Twitter thread above, I updated the case for continuing disinflation coming from supply: from apartments, refineries, electric vehicles, data centers, immigration and disabled employment. It should be noted that soft landing may be fully priced, but sustainable expansion from productivity growth may not be. In the September Price note:

My conclusion remains the same. Chair Powell has done a tremendous job and used his “blunt” tools of Fed Funds rate adjustment and monetary policy guidance to steer the US economy through multiple shocks. Now that shelter lag from rent growth is offsetting commodity impulses, there is not much to do except keep watch on growth and adjust real rates to maintain restrictive policy. Some people are still equating housing price trends to rent growth trends.

Source: https://www.zillow.com/research/november-2023-rent-report-33470/

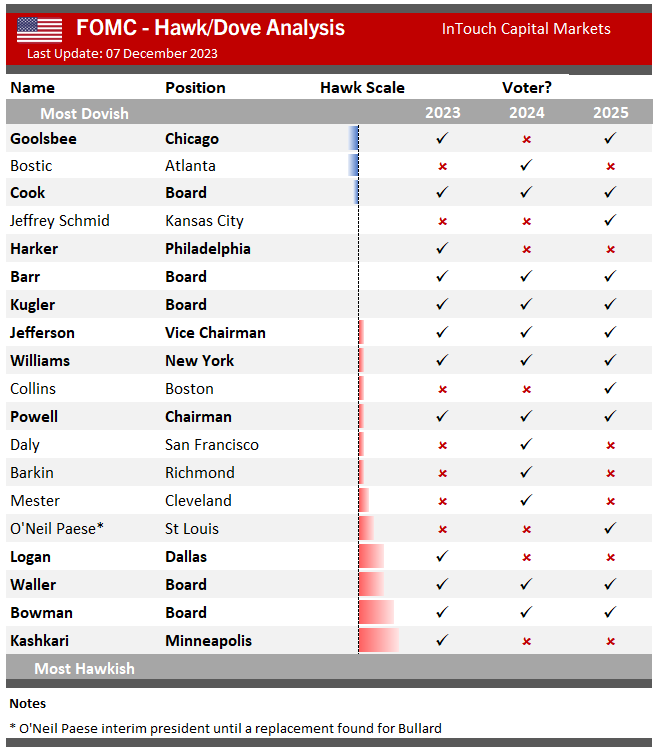

Just in case that you are still glued to the news feed watching for Fed speakers and decrypting every single quote, the actual voters get updated for 2024. In my opinion, only Chair Powell has mattered since his Brookings speech last year and you can forget about lasagna man for the foreseeable future.

Source: https://www.itcmarkets.com/hawk-dove-cheat-sheet-2/#

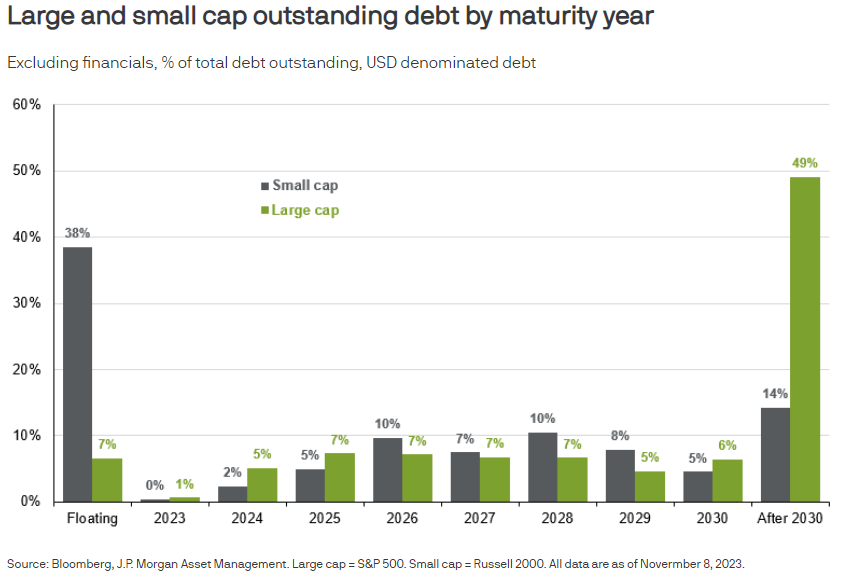

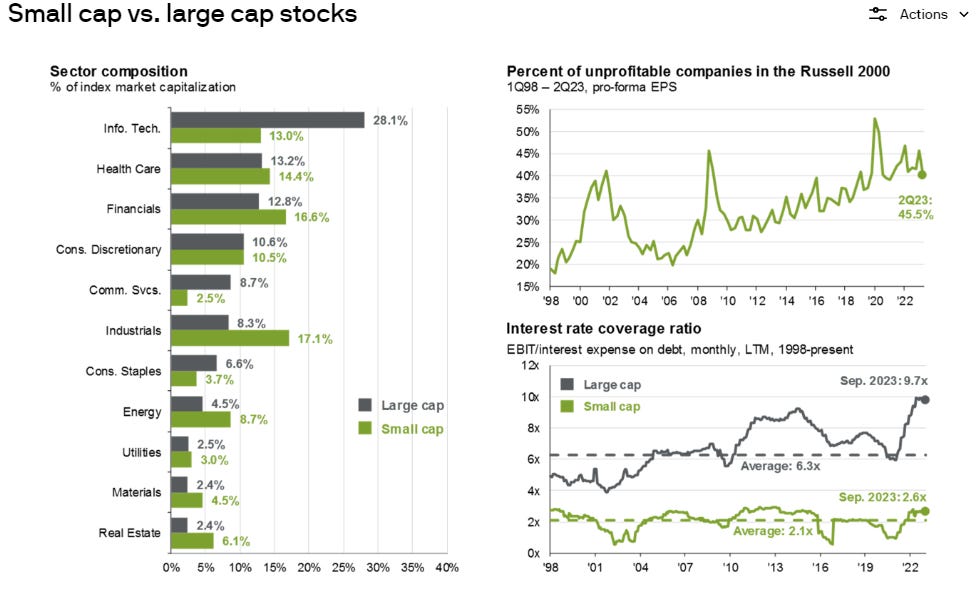

It is important to accept that the US economy is just not that rate sensitive as a whole. The upper quartiles are enjoying 5% on the short end and trying to figure out when to shift to long end. Household balance sheets in aggregate look healthy with effective mortgage rates < 4%, despite headwinds like borrow cost, gasoline and student loan payments. Corporate balance sheets for large cap companies tell a similar story, especially as the majority of companies improved their margins.

Source: https://fred.stlouisfed.org/series/TERMCBCCALLNS

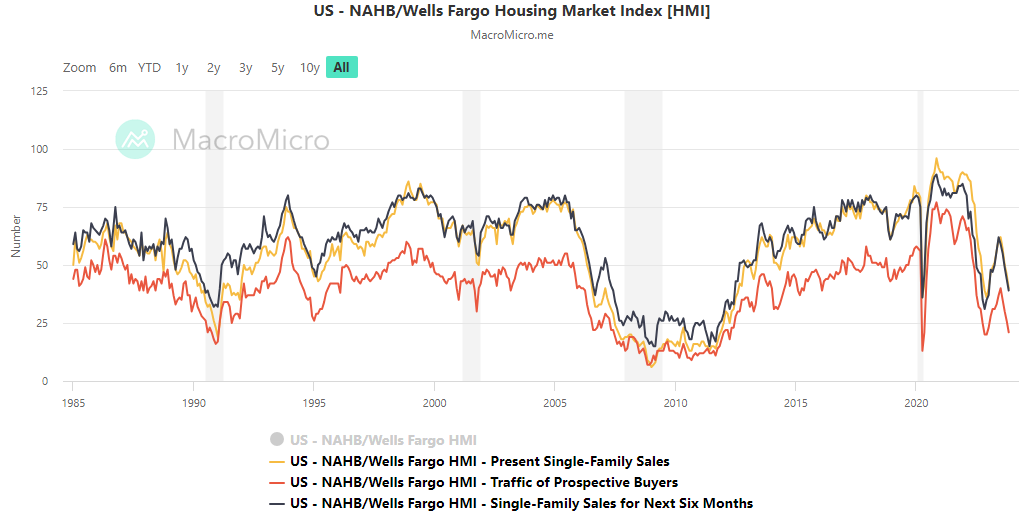

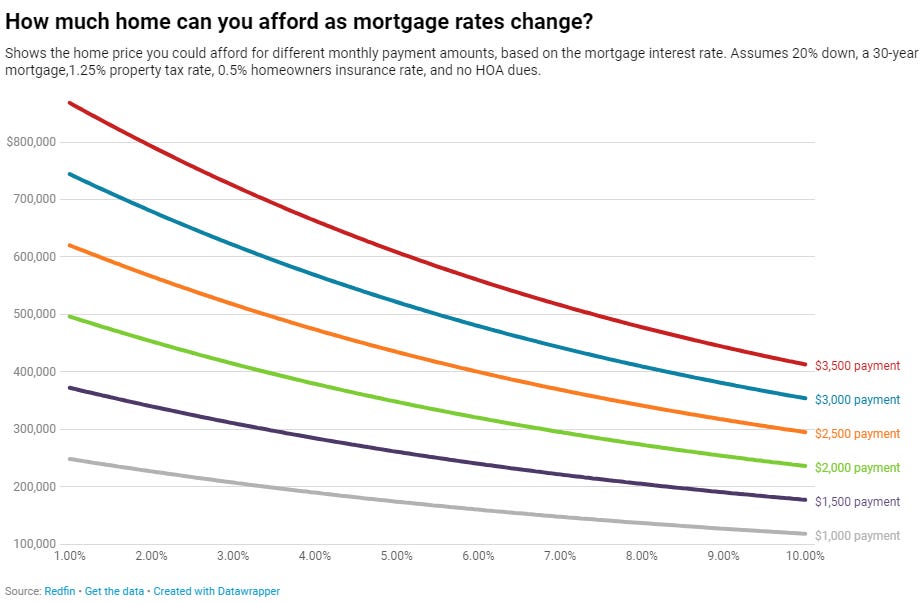

On the other hand, the people saying rates are not restrictive are probably not looking to buy a house, which is the primary mechanism for policy transmission. The affordability part is key as housing price is likely to slow bleed down as rates reprice the frozen existing homes that come to market. The people focusing on demand and wealth effect from assets are ignoring supply. Furthermore, both the proxy funds rate and SLOOS remain in restrictive territory, and I think even Bullard would say monetary policy is restrictive based on his Taylor Rule formula last year.

Source: https://en.macromicro.me/collections/7/us-housing-relative/1858/us-nahb-hmi-plot

Source: https://tradingeconomics.com/united-states/existing-home-sales

Source: https://fred.stlouisfed.org/series/MSACSR

Source: https://www.redfin.com/news/housing-market-update-high-mortgage-rates-buyers-lose-purchasing-power/

Source: https://www.frbsf.org/economic-research/indicators-data/proxy-funds-rate/

Source: https://en.macromicro.me/collections/9/us-market-relative/1241/us-bank-net-percent-tight-loan

Source: https://en.macromicro.me/charts/77820/us-fed-fci-g

Source: Bank of America Global Research

In summary, it is important to remember soft is the easy part. It is keeping it soft that is the hard part and containing a spike in unemployment. The longer the Fed can maintain this rate, the more bullish it is for the US economy. Chair Powell can choose to slowly ease if real rates trend too high or cut fast if NFP rolls over too fast. Unfortunately, if NFP rolls over too fast, cutting rates might not be stimulative enough to prevent a recession. I think this scenario is low probability for 2024, unless real disposable income flips negative and financial conditions overtighten. The opposite would be if real disposable drives more price increases. I also think this scenario unlikely, but will be watching for it from companies that benefited initially from price increases, to only be punished later as price and volume matrix went against top line revenue and margins.

Source: https://www.atlantafed.org/chcs/calculator

The biggest risk that would cause disinflation to stall at higher levels is likely labor, but I am about to dedicate a portion of this entry to discussing productivity growth, possibly from AI and GLP-1. It is also important to note that the biggest beneficiaries from the recent wage growth have been for the lower income quartile. Frankly, this is a good thing for the economy and closing the wealth gap, and it is more some folks catching up to inflation than fueling more price increases. If capitalism does its job and there is competition for demand, then prices should reach an equilibrium with supply at certain points.

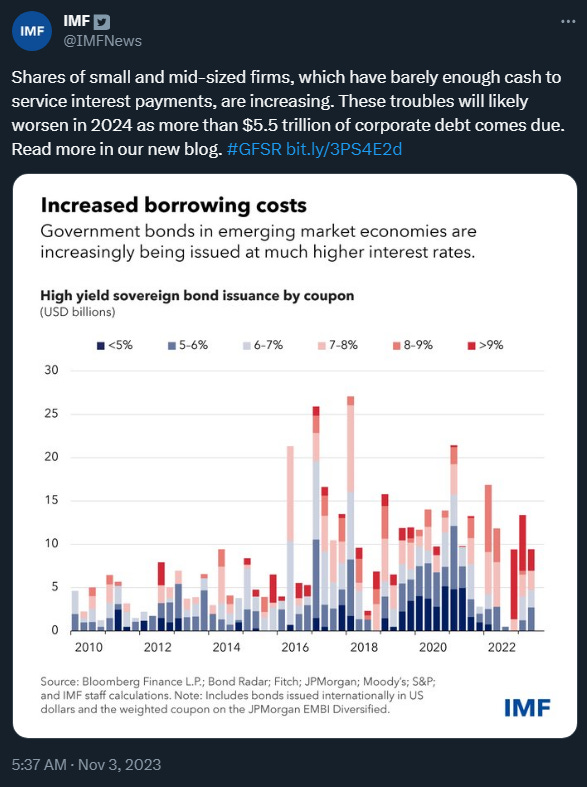

The biggest risk to no recession would be the Fed holds rates “too long.” Chair Powell being “hawkish” is not inherently bearish, as that means he is bullish the economy and if growth really does drop, a couple 25 bps cuts will not really do much to stop the descent. Credit spreads are fairly tight at the moment, but every one knows about the looming 2024 2H maturity rolls, including Powell and Yellen. The way to cause a recession would be for the market to not price any cuts, which was the “pain” message from Jackson Hole 2022 Powell. That message was sent when CPI had a 8 handle though. We’ll see how long Chair Powell is willing to wait for productivity in 2024.

Source: https://www.creditspreadalert.com/

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Source: Bank of America Global Research

uncle sam always pays its debts

Trend: Fiscal Dominance

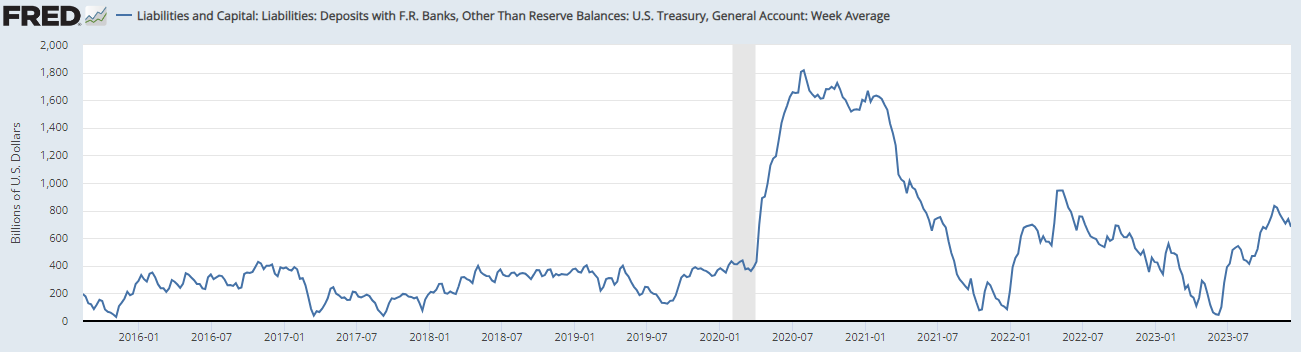

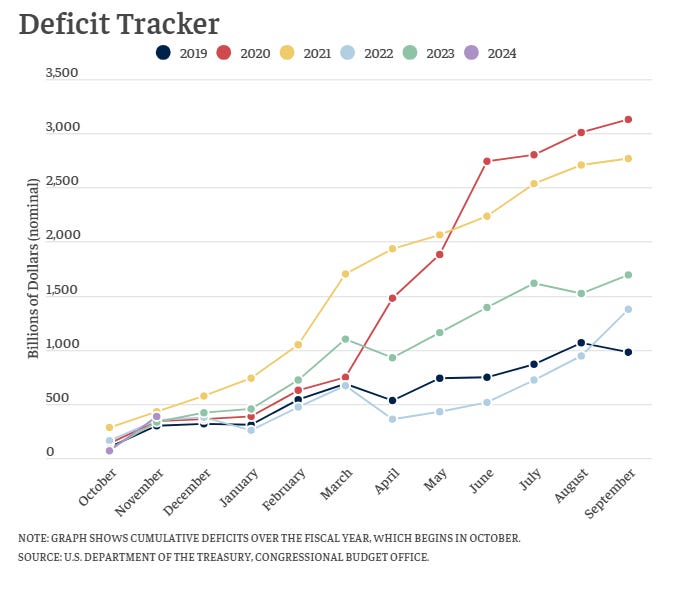

Treasury Secretary Yellen continues to spend down the Treasury General Account (TGA), albeit a little less compared to when debt ceiling was resolved (on paper at least). After California residents filed taxes, the TGA peaked around $840 billion and is currently around $680 billion. Since the Q4 Quarterly Refunding Announcement (QRA) issuance, she has been able to stabilize the TGA level as any spending is resupplied by the large amount of issuance that is happening every month. This deficit spending supports Growth.

Source: https://fred.stlouisfed.org/series/WTREGEN

Source: https://fiscaldata.treasury.gov/datasets/daily-treasury-statement/operating-cash-balance

Source: https://home.treasury.gov/news/press-releases/jy1864

Source: https://tradingeconomics.com/united-states/government-debt-to-gdp

Source: https://bipartisanpolicy.org/report/deficit-tracker/

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

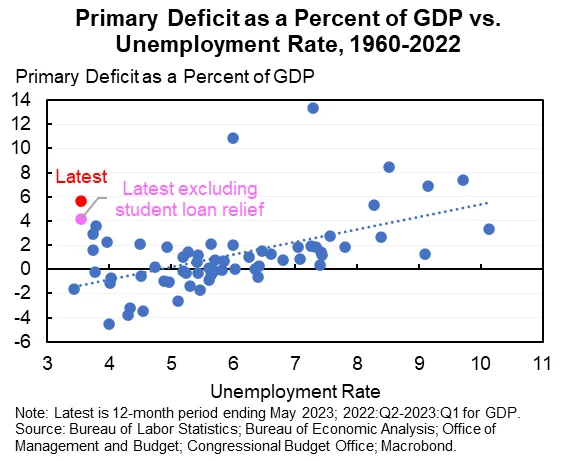

This dance between monetary and fiscal policy continues to be balanced somehow, with high rates dampening the inflationary aspects of fiscal spending and the fiscal stimulus offsetting the deflationary aspects of higher borrowing costs. Secretary Yellen controls the levers for short term demand (TGA and QRA). This transitory equilibrium has resulted with inflation trending down without significant job losses thus far. It is worth noting again this procyclical spending has been a primary driver that pushed the US economy back to trend after a global pandemic.

Source: https://twitter.com/jasonfurman/status/1667153519923675137?s=20

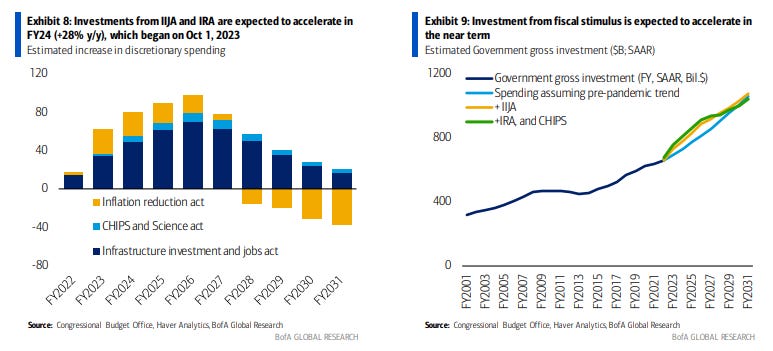

Source: Bank of America Global Research

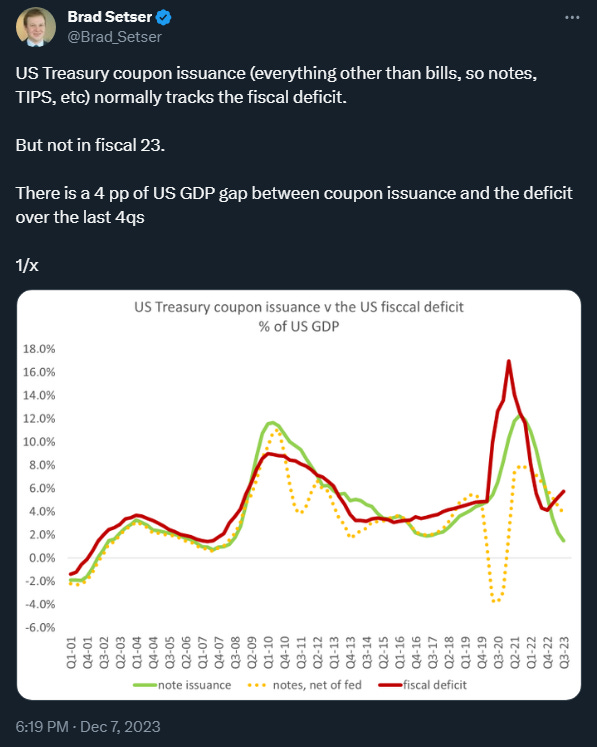

After the Q3 QRA, the treasury auctions did not go that smoothly, especially for the 30 year bond. I walked through my opinion of how the auctions have affected markets in the following Twitter thread. There were plenty of debates about why the long end was rising, but the secondary market has since bid duration back up and then some.

There was a case that deficit spending was not the primary driver of long end yields, even without looking at current yields. The case being that German bunds seemed to disprove that narrative, considering the German government was running a 3% GDP deficit compared to the US government 6%. If deficit spending was truly the cause, US treasuries should have paid more than German issuance on a relative basis. I think the upcoming auctions may have neutral/maybe even poor results again, but there remains enough secondary market duration appetite to offset. I think Secretary Yellen will maintain similar issuance composition in January after seeing the auction results and aim to increase duration issuance after the first rate cut in early summer.

On the other side of the issuance, the current spending resembles the post WW2 era and the ideal scenario would be that there is sufficient demand to absorb the supply established, and the demand can come from emerging markets for this new technology era, especially countries expanding oil refinery capacity. The spending is likely to taper off as TGA levels stabilize further, but this is the lever Treasury Yellen can pull if the US economy starts slipping in an election year. As long as the US retains its geopolitical risk premium and technology lead, the US is likely to find buyers of its debt. At some point, that may become the Fed again, but that requires inflation at an acceptable and sustainable level. There are some noting the end of the excess cash regime.

Source: @LynAldenContact

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

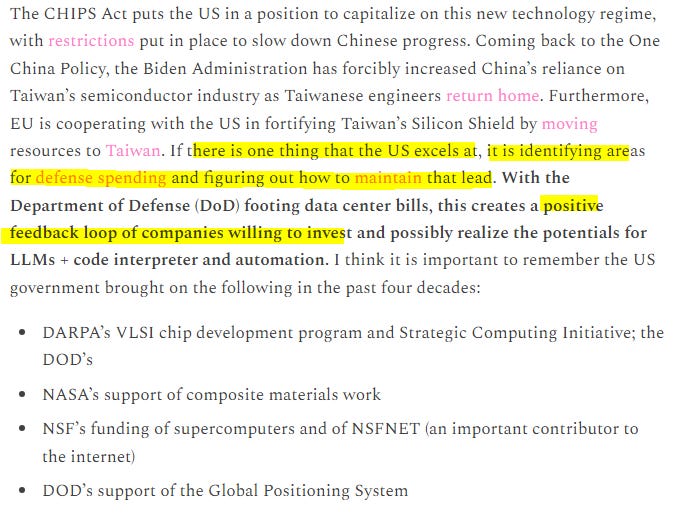

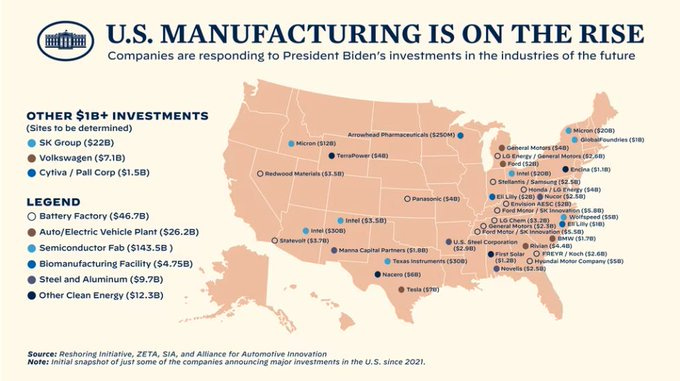

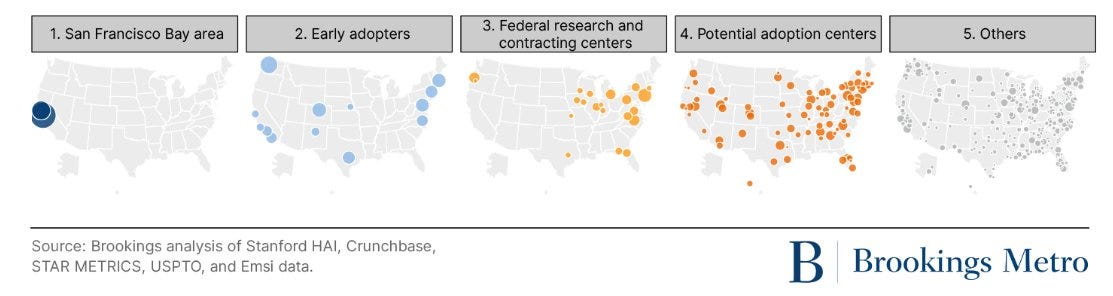

In August, I noted the following about AI becoming the US industrial policy:

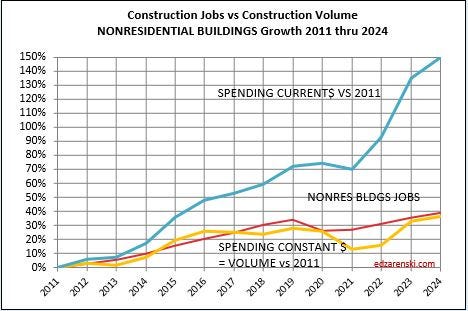

Before diving into AI, let’s go through a general CHIPS/IRA spending check that continues to support nonresidential building.

Source: https://edzarenski.com/category/behind-the-headlines/

Source: Bank of America Global Research

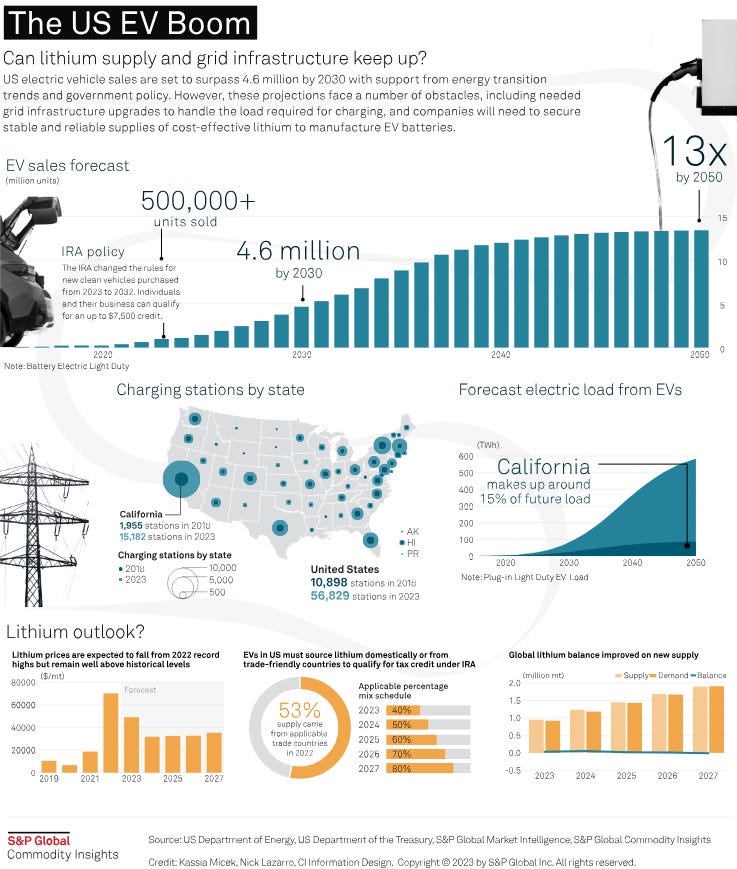

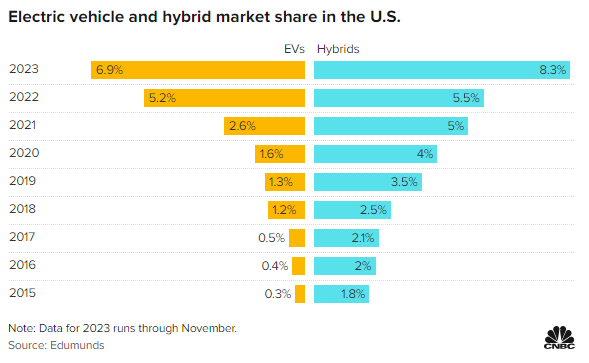

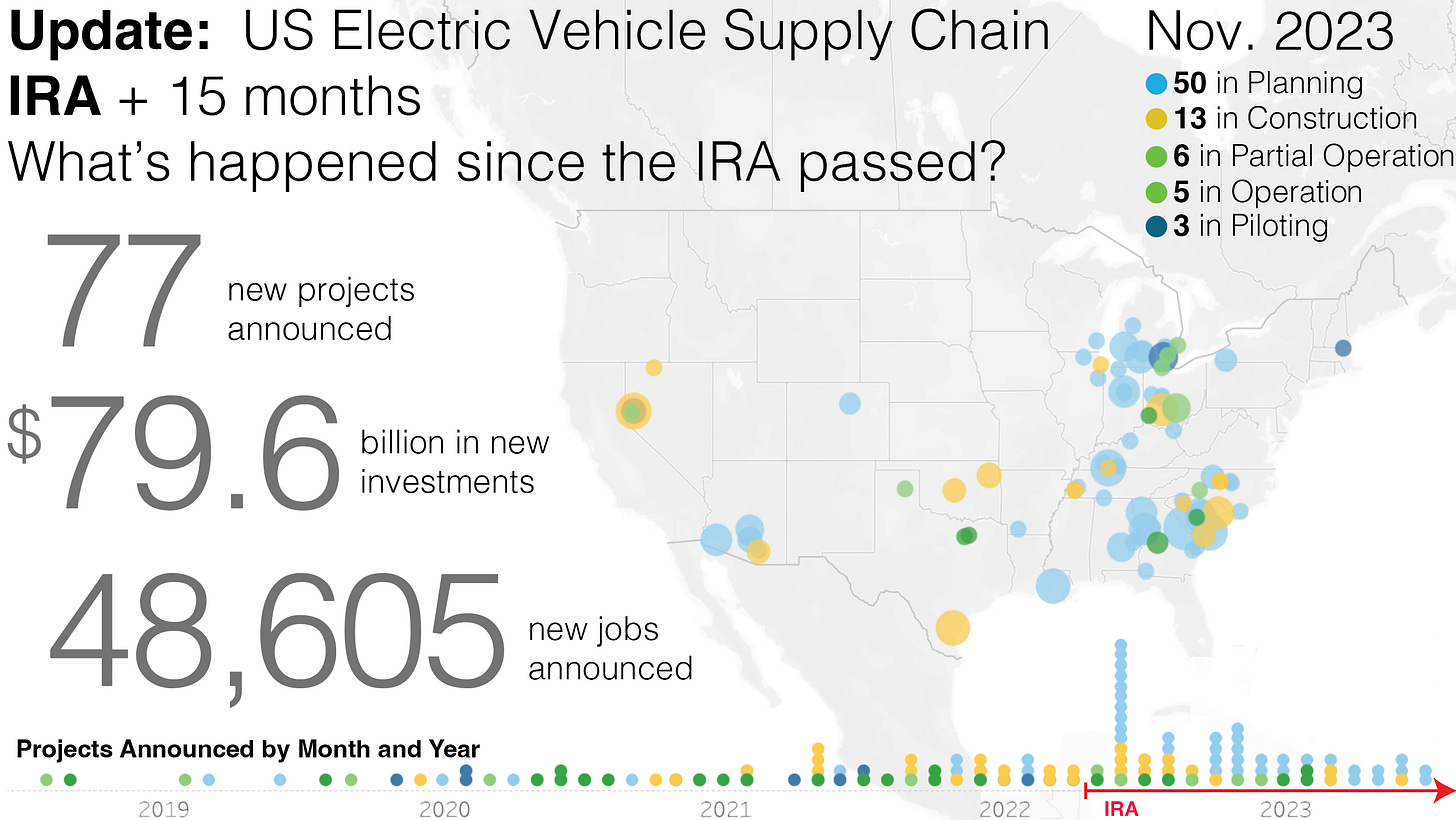

Electric vehicles continue to increase penetration as a percentage of total US new vehicle sales. Most estimates continue to support a sustainable adoption trend, especially as chip shortage and lithium carbonate prices normalize.

Source: https://www.eia.gov/todayinenergy/detail.php?id=61004&src=email

Source: https://tradingeconomics.com/commodity/lithium

As the more factories complete and production ramps up, the electric and hybrid market share should continue to increase, as hybrid producers take advantage of the reduced battery costs as well. This relieves some pressure on oil production, meanwhile both Chevron and Exxon have lifted their production capex guidance.

Source: https://www.charged-the-book.com/na-ev-supply-chain-map

Source: https://www.cnbc.com/2023/12/08/automakers-turn-to-hybrids-ev-transition.html

A key foundation of my perspective is believing in (post)Keynesian Modern Monetary Theory (MMT) and that budget deficits do not lead to inflation. I will reiterate that I believe technology enabled globalization and that is why it took Covid supply shocks for the US to experience inflation, despite years of a zero interest rate environment from the Fed. Technology is fundamentally deflationary and the onset of the new technology regime enables Fiscal Dominance. Once again, it should be emphasized that I think nominal GDP can be sustained by the combination of fiscal policies and the productivity gains brought on by the exponential potential of LLMs + code interpreter. I do not disagree with the notion that the Fed may have to step in with QE to sustain the deficit spending at some point, as it is unlikely that taxes will be raised in the short term to reduce the deficit.

The looming 2025 expiration of the Tax Cuts and Jobs Act (TCJA) is likely to be a topic of debate for the upcoming election. I think it is worth noting that a recent study concluded the tax cuts led to increased investments and makes the case to keep corporate tax rates lower than prior levels. Corporations as a whole have deleveraged compared to the past, but many CIOs have realized the margin tailwinds that come from deficit spending, providing a good opportunity to shift investments.

Source: https://fred.stlouisfed.org/series/TCMDO#0

There is also the case that the deficit spending is sustainable, if revenue is increased through taxes. Though, if corporate taxes increase, it may act as a drag on Growth and slow the capex needed to further sustain US innovation leadership.

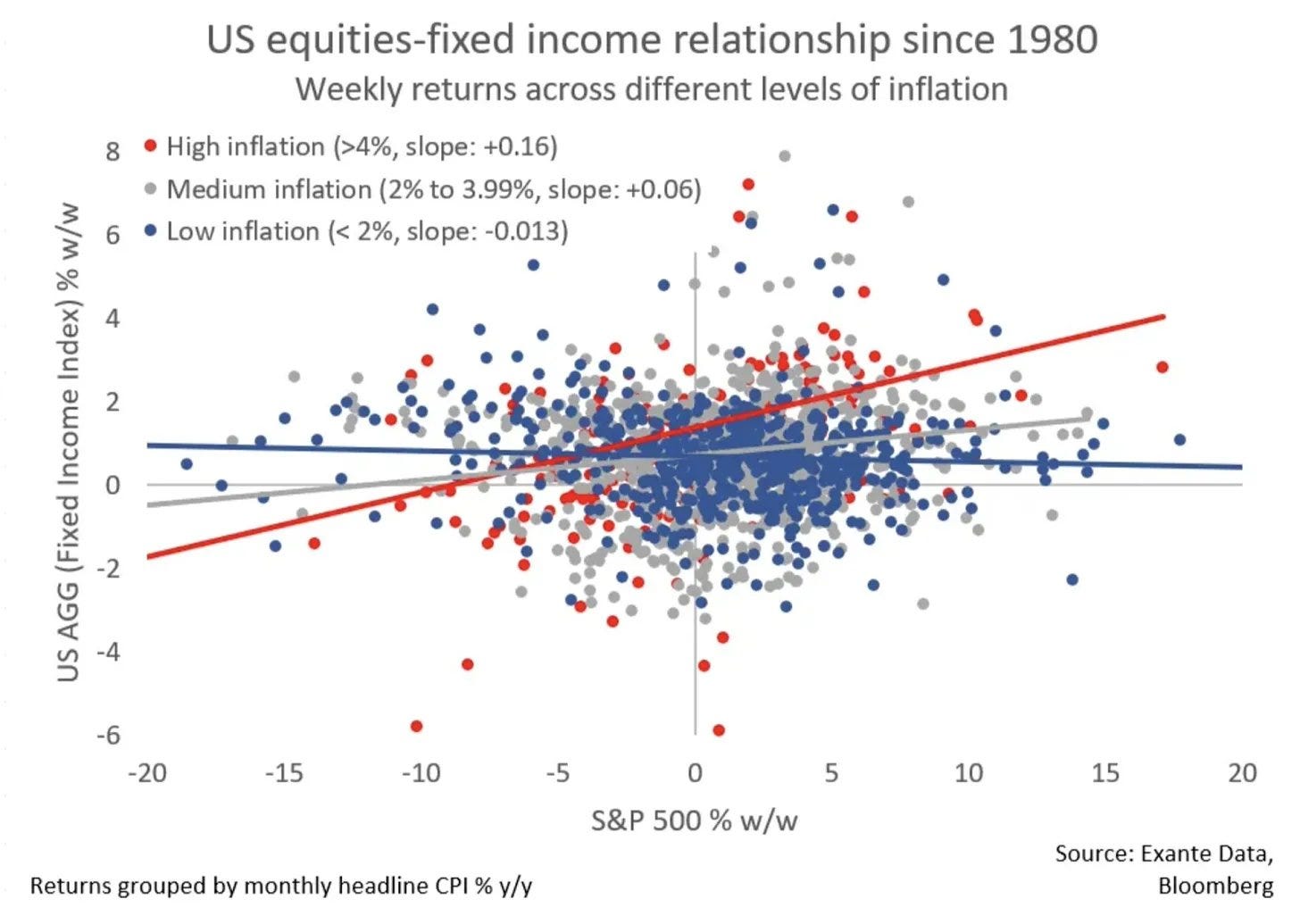

In summary, this delicate dance between fiscal and monetary policy is key to watch, and the lead dancer is Secretary Yellen. The US economy has become less rate sensitive with the current state of household/corporate balance sheets that locked in low interest debts, so monetary policy has become less effective. If fiscal stimulus overpowers the restrictive stance of the Fed’s monetary policy, Secretary Yellen is likely to increase duration issuance to dampen short term demand. However, she and Chair Powell are likely aware of the implications that come with high long end yields when numerous struggling companies need to rollover debt in the back half of 2024. I continue to believe productivity growth is the most important variable and is the key to sustaining the deficit. If nominal growth is sustained with continued disinflation, the equity and fixed income relationship may not stay positive in 2024. There have been a lot of "firsts" the last four years. What's a few more?

productivity growth, everything everywhere all at once

Trend: Wealth Gap and Consumption and AI/GLP-1

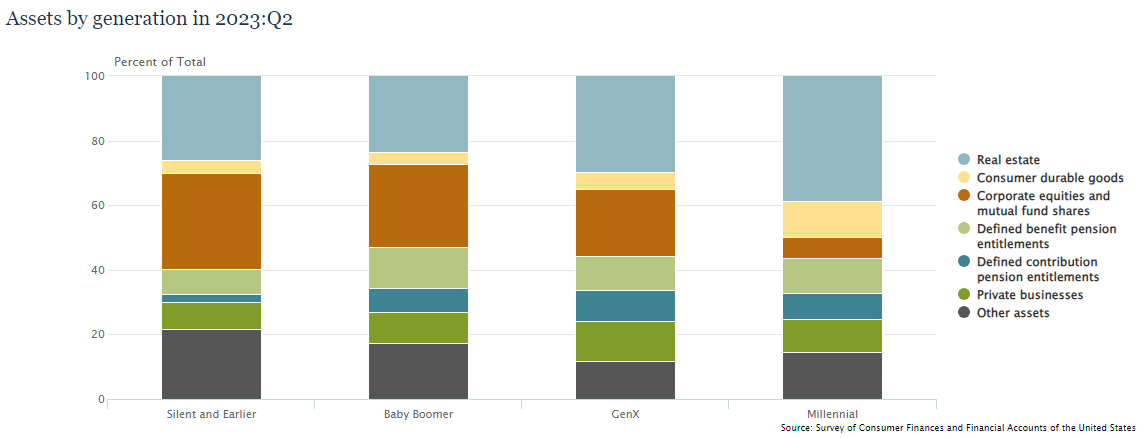

Here’s the wealth distribution:

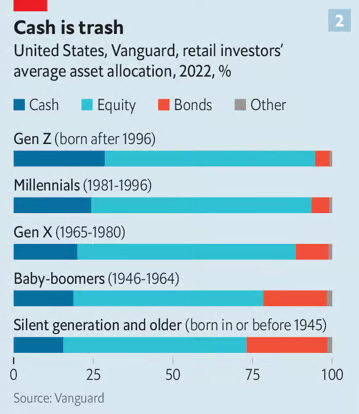

There is a large percentage of wealth that is concentrated in the top quartile. Furthermore, Baby Boomers have amassed generational wealth. Retirees have more time than they know what to do with and that is turning into consumption.

Source: Bank of America

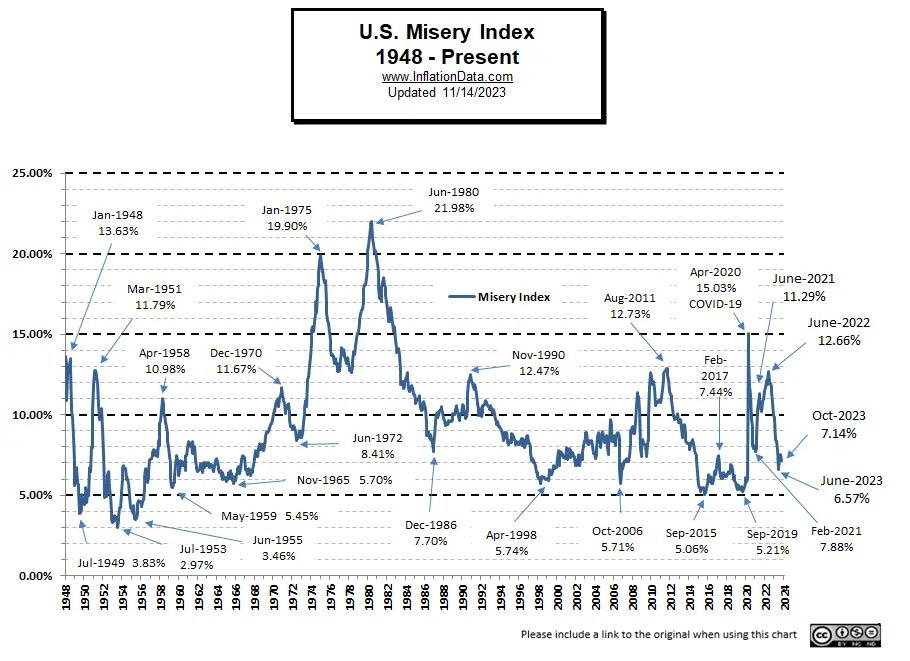

It is pretty clear that real estate takes up a substantial percentage of Millennials’ net worth. Despite the lower quartiles having achieved the highest real disposable income growth, many missed out on purchasing a home during the pandemic and watched others lock down < 4% rates. To make it worse, rate hikes barely affect housing prices. Along with a variety of other reasons, this has contributed to the “vibecession” a word coined by Kyla Scanlon (@kylascan).

Source: https://www.atlantafed.org/chcs/wage-growth-tracker

Source: https://inflationdata.com/articles/misery-index/

Despite the gloomy vibes, Millennials are in their prime leverage years and have taken advantage of rate buy downs offered by home builders, amid shrinking square footage and still high prices.

Source: https://twitter.com/LoganMohtashami/status/1683497268589260801

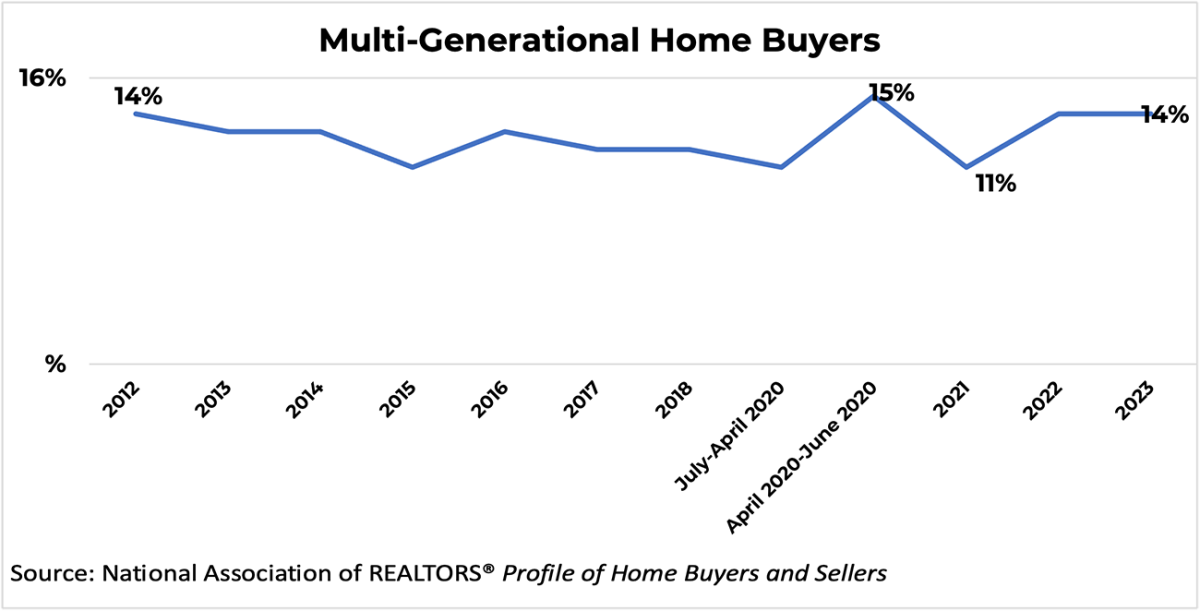

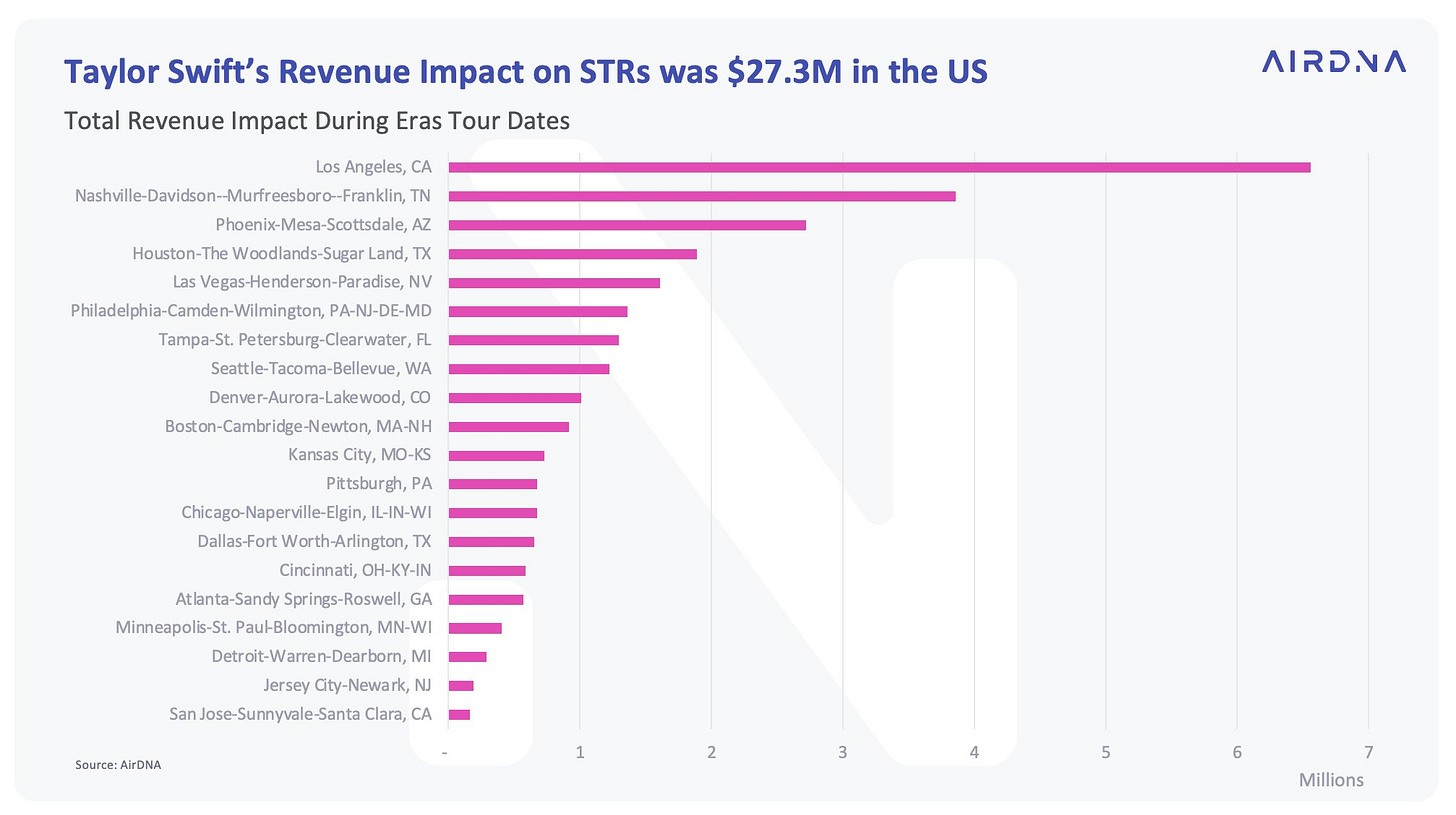

Another demographic demonstrating strong consumption trends are single females, which was highlighted again by the NAR report. It is also noteworthy that multi-generational home buying is a sticking trend. The upper income quartile has demonstrated that they have been able to sustain consumption habits and there is a massive wealth transfer on the way as Millennials accumulate assets. It might be worth noting that Taylor Swift is going to Japan and EU next.

Source: https://www.airdna.co/blog/taylor-swift-transforms-local-economies-str-market

I am going to reiterate my July post:

Wealth being distributed so top heavy is not healthy. Nominal growth being sustained by the upper income quartiles is what gave rise to populism, emerging in the forms of Former President Donald Trump and Bernie Sanders. What has been increasingly apparent is that there exists a barrier to upward mobility and how to improve the quality of life for all. That barrier has taken the form of inflation.

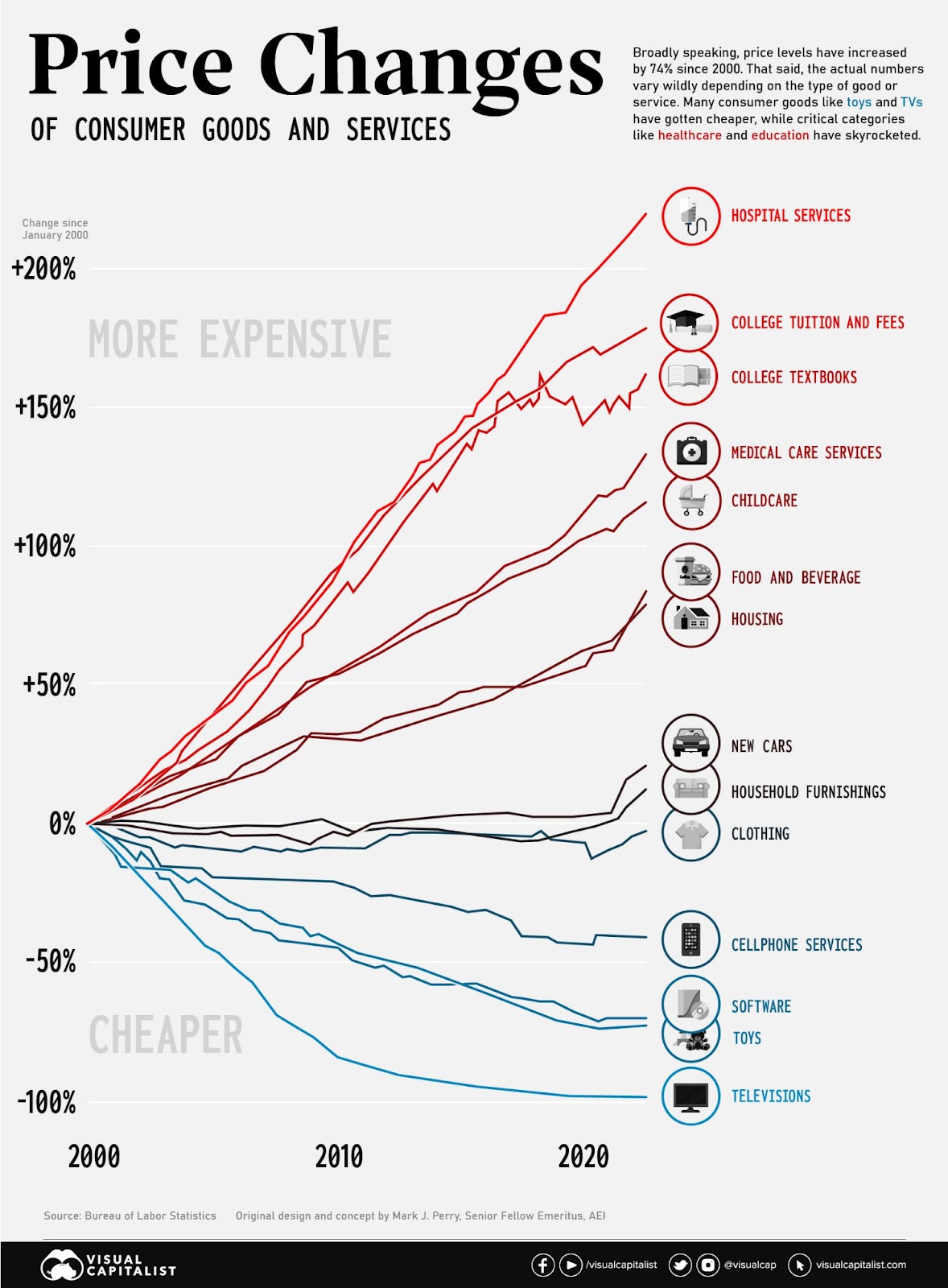

It is not just housing and energy. Reposting following chart which depicts the price changes of consumer and services over the last couple decades. The top four items on the following price change chart can all be addressed with AI (GPT+automation) and GLP-1. Cathie Wood might not have the best timing, but her core themes for innovation are likely correct.

Although AI has become a buzzword lately with every company needing to address it or be seen as left behind, it truly has the potential to change the world. With the rise of chatbots and personalized/sector-specific large language models (LLMs), hospital services and education are ripe for disruption. Between faster drug discoveries to reduce R&D costs and streamlining insurance overhead, generative pretrained transformer (GPT) models should help reduce medical costs and improve hospital care.

Source: https://www.visualcapitalist.com/inflation-chart-tracks-price-changes-us-goods-services/

It wasn’t until the OpenAI drama that I realized there was a massive chasm, much wider than I previously thought.

Source: https://en.wikipedia.org/wiki/Crossing_the_Chasm

The morning after Sam Altman was initially fired, I decided to start my running Twitter thread documenting news that I thought would contribute to improving the inflation situation. The criteria being that the news needs to be at an enterprise level and either 1) already in production or 2) will be in production within the next six to nine months. At some point, people will realize knowledge compression impacts every sector and “time” is a precious commodity.

Source: https://www.morganstanley.com/ideas/generative-ai-future-of-work

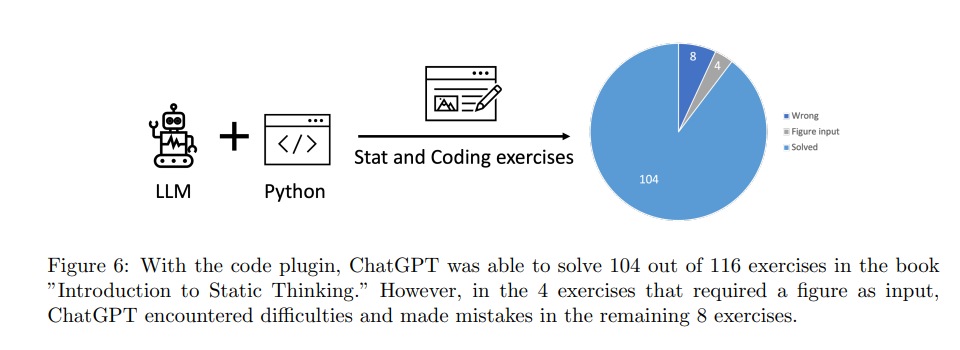

Before I keep going, I think it’s worth reviewing GPT4’s exam results. Some people that have only used the free ChatGPT utilizing GPT3.5 are using a couple prompts to judge LLM’s as a whole. Some people still do not understand what a LLM is supposed to be used for, despite it being available for a year already. Furthermore, some people still do not know what code interpreter is. This chasm will be filled.

Source: https://openai.com/research/gpt-4

Source: https://arxiv.org/pdf/2307.02792v2.pdf

The potential of English as a programming language has massive ramifications for unskilled labor. The combination of LLMs and a coding sandbox is an extremely powerful tool that changes the learning curve for data analysis. Instead of spending time on memorizing equations, future generations will jump straight to learning to learn and how to ask the “right” question and understanding how to approach problem sets from first principles. The consultant industry is preparing to actually do more “implementations” as proposal teams are augmented by their own custom LLMs, such as McKinsey’s Lilli.

To understand my perspective, you need to understand how I view knowledge and how innovation boundaries are pushed. It is key to understand that there is a difference between breadth and depth of knowledge. True innovation happens at the very leading edges of knowledge, often in ways thought improbable.

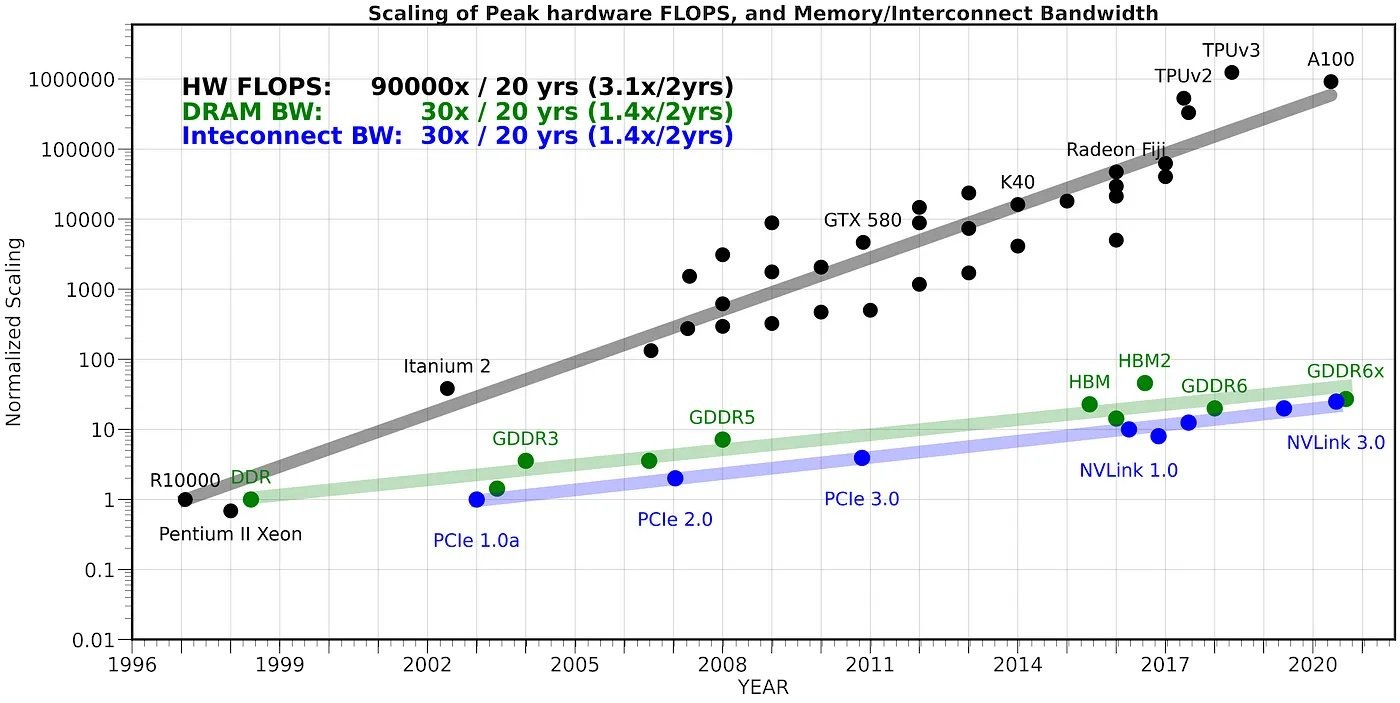

Now, breadth knowledge has been compressed. Jim Fan (@DrJimFan) shared the results of the specialized model trained using Nvidia’s internal design documents and code. I think 30 years of chip design can be considered as depth knowledge and Meta’s LLaMA2 was able to communicate and interact with this knowledge. Many enterprises will soon follow and iterate using DGX cloud platforms and the Foundry Nvidia that has established with Microsoft.

With the promise of efficient knowledge transfer and readily available hyperscalers partnered with their Foundation Model of choice, I think it is unlikely that adoption is going to take years. Specialize models can be trained and tuned in around 6-9 months. Sure, there will be plenty of iterations, but that is the point.

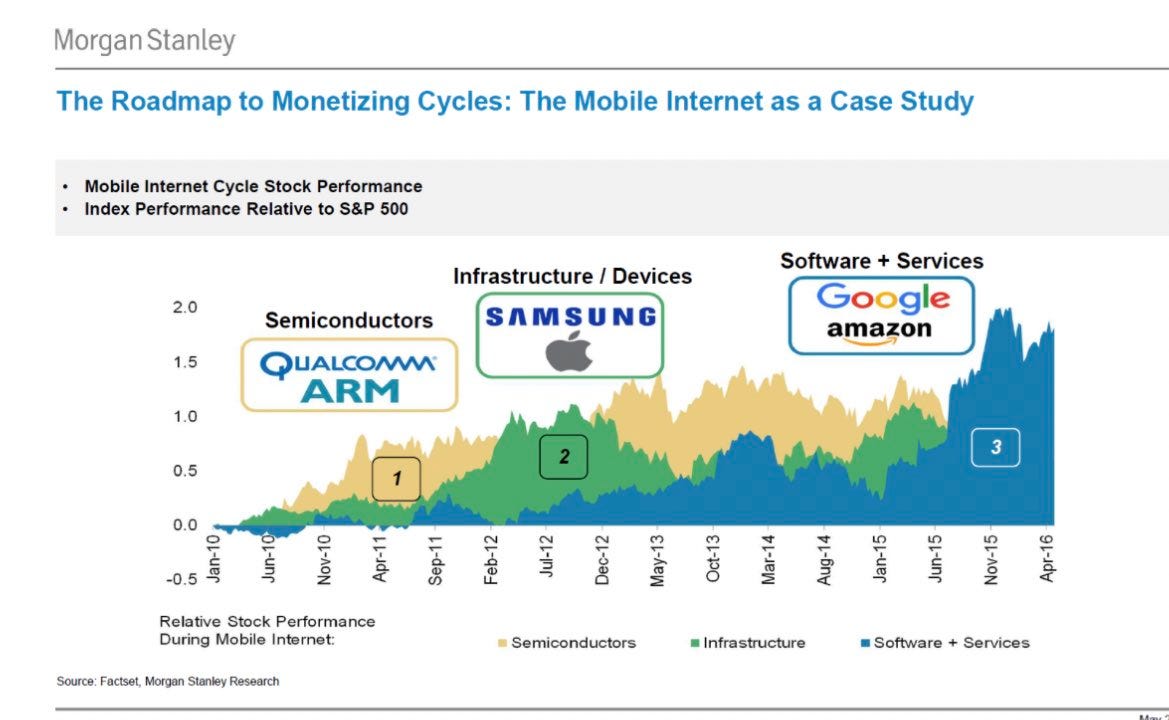

Source: https://www.goldmansachs.com/intelligence/pages/why-ai-stocks-arent-in-a-bubble.html

Steve Jobs talked about petrochemical energy and intellectual energy in 1985. Knowledge and data are a company’s edge. GPTs will likely end up being the commodity. Data is oil. Foundation Models and GPUs/ASICs/FPGAs are the foundries and rigs.

Source: Bank of America Global Research

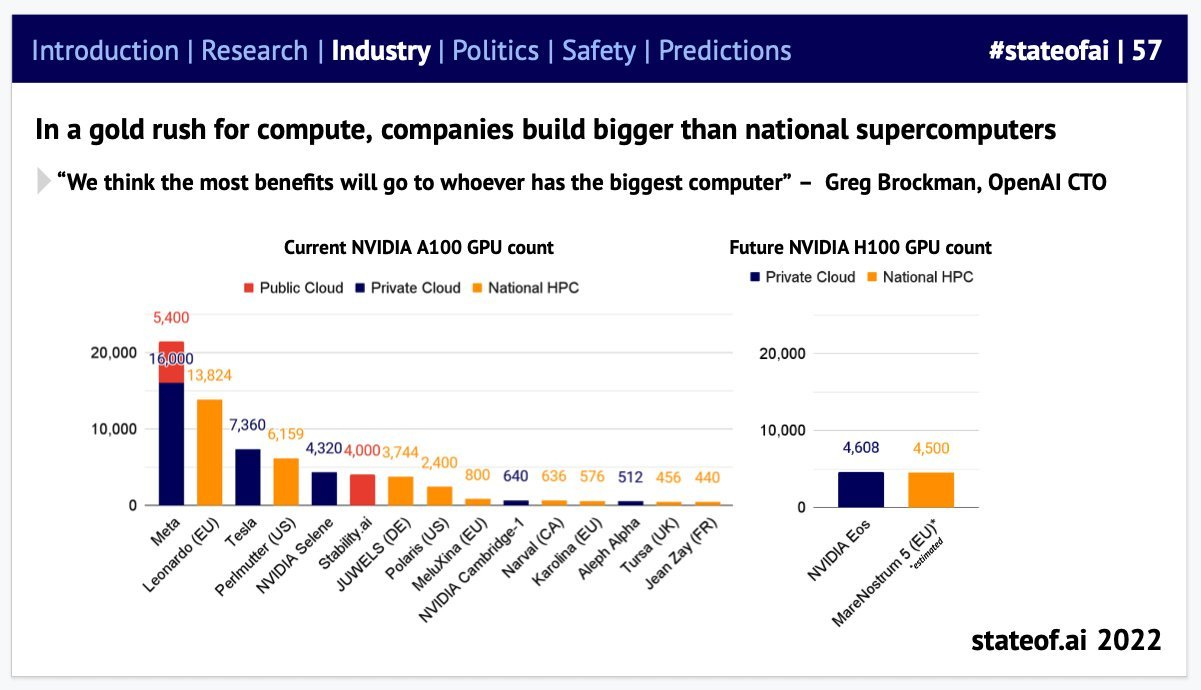

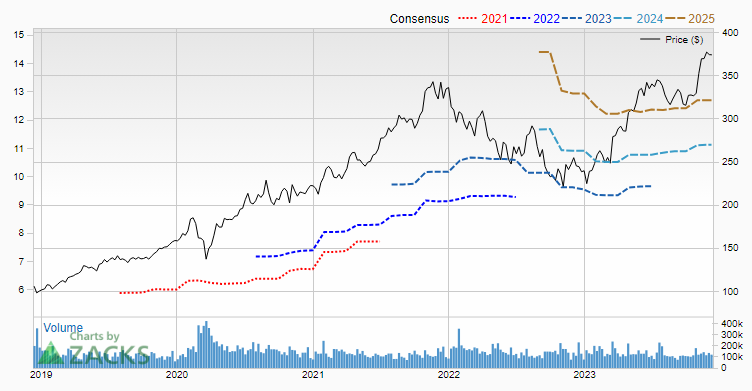

Let’s quickly review Nvidia’s last year. After Etherium moved to Proof of Stake (PoS), Nvidia GPU inventory started to build up. Then, the China restrictions were announced that also put downward pressure on the stock. However, this was signal that the Department of Defense was gearing up for AI, continuing what Former Secretary Jim Mattis had started (2018 National Defense Strategy, Joint Artificial Intelligence Center). Mattis’ Joint Enterprise Defense Infrastructure (JEDI) efforts evolved into Joint Warfighting Cloud Capability (JWCC), where Google, Oracle, Amazon and Microsoft were awarded Pentagon cloud deal.

It is worth noting that Nvidia went up on Meta capex guidance last year, even before the release of ChatGPT on 11/30/2022. Mark Zuckerberg was aiming at “metaverse,” but he was really just building a supercomputer and he already had his own language models that were not as well publicized as his “meta” endeavor.

Then, ChatGPT was released. Microsoft announced their partnership extension with OpenAI and GPT4 was released. There were many estimating the total addressable market (TAM) for generative pretrained transformer technology during/after the regional bank issues and debt ceiling stalemate subsided. For the stock market, March 2023 was the seed for the AI vs rate war.

Source: https://blogs.microsoft.com/blog/2023/01/23/microsoftandopenaiextendpartnership/

Source: Bank of America Global Research

A year since the initial China restrictions, let’s check again. Processing and performance restrictions were updated, but Nvidia will just update their specs for their Chinese customers, while China relies on Taiwan even more for the time being. It is worth going through the memo that Deputy Secretary of Defense Kathleen H. Hicks delivered for 'The State of AI in the Department of Defense'. There is a reason some people have been getting complaining about getting outbid on GPUs by Uncle Sam.

Nvidia continued its ascent as people lost track of the number of collaborations and partnerships that piled up.

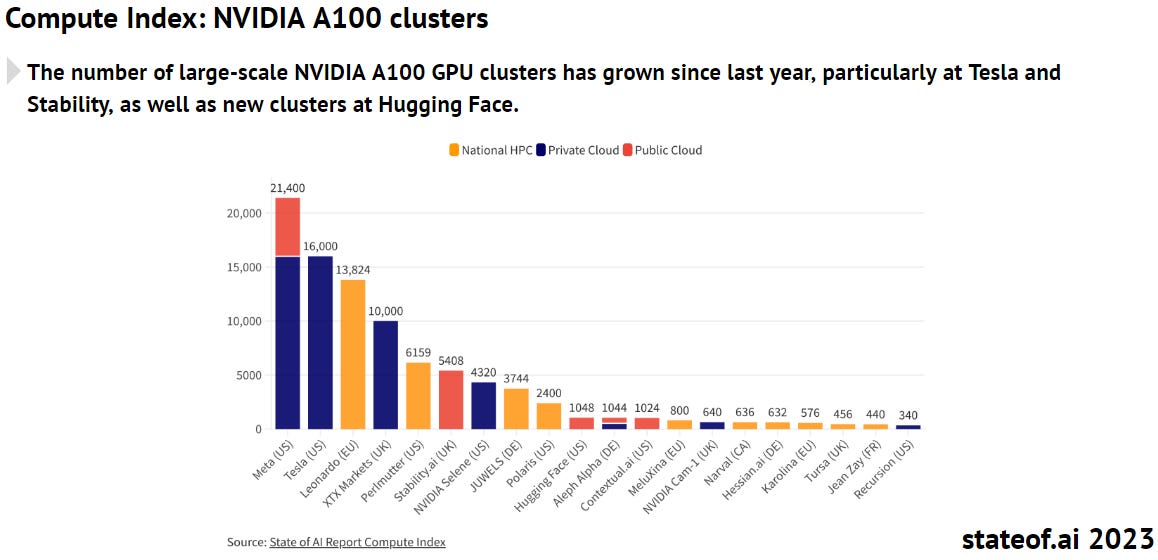

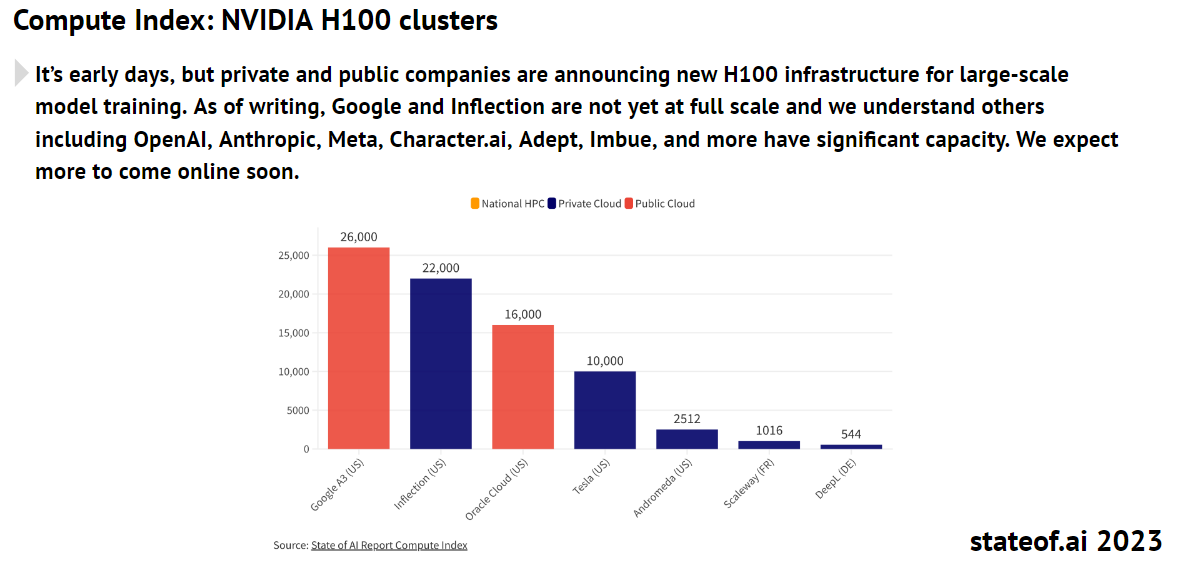

Source: https://www.stateof.ai/compute

The hyperscalers have all went into capex mode and continue to build up their infrastructure. With enterprises signing up to build their own internal LLM’s, this is unlikely to stop anytime soon. Given the host cost and revenue margins, monetizing Nvidia DGX cloud is unlikely to be a worry for shareholders. Nvidia might even start to get treated as a Software as a Service (SaaS) company.

Taiwan Semiconductor Manufacturing (TSM) continues ramp up capex to meet the demands of hyperscalers and every .ai company trying to compete with Uncle Sam. Traditional data centerlines are likely to get upgraded to accommodate chip on wafer on substrate (CoWoS) demand for training chips with sustained utilization that started in Februrary 2023. Morris Chang started with government support and that still has not changed as Taiwan is providing biggest corporate investment related tax deductions ever. The semiconductor equipment billings have troughed and memory prices have more than bottomed since Samsung cut production plans after being satisfied with their increased market share and turned their attention to high bandwidth memory (HBM) chips needed for training and inference.

Source: https://en.macromicro.me/collections/4345/mm-semiconductor/21192/global-semiconductor-billings

These charts are from September, but they are worth reposting.

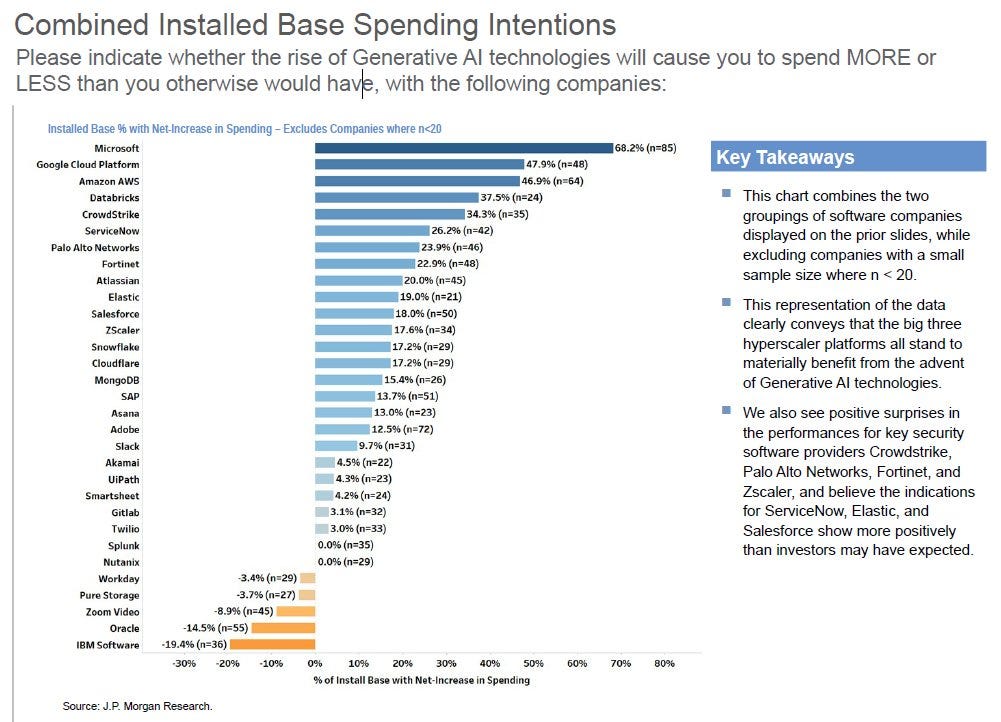

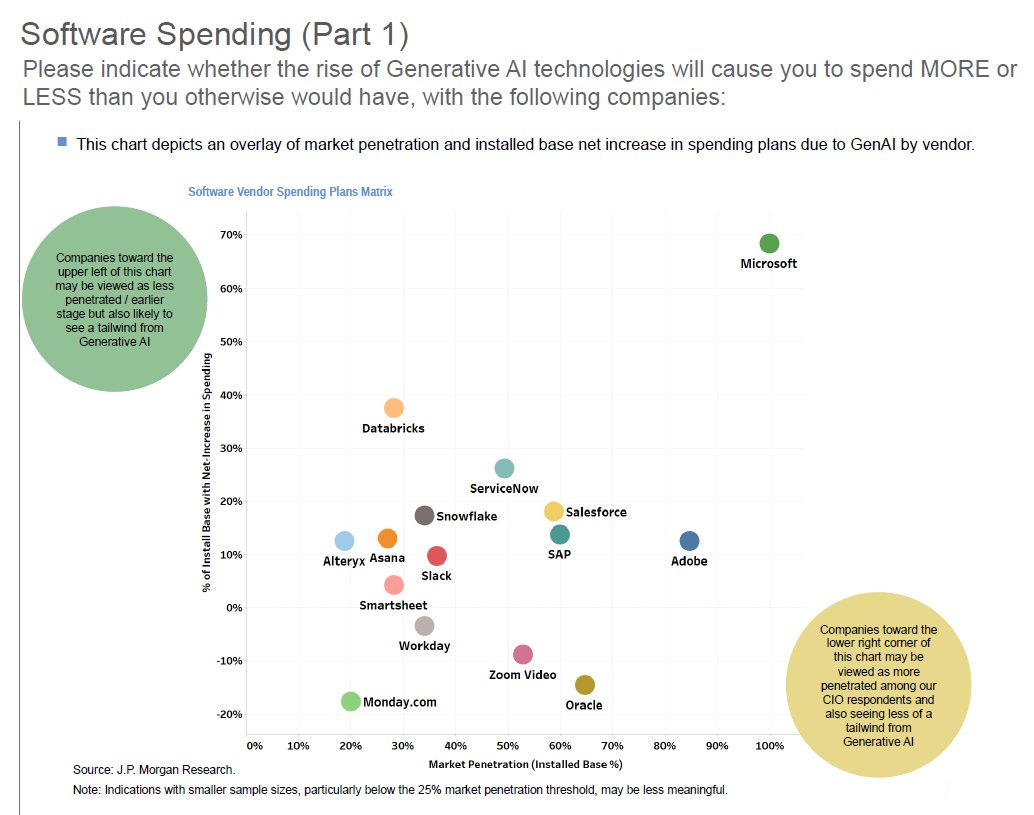

Let’s check on Microsoft. After the January announcement that sparked a GPU arms race and forced Google to declare “Code Red.” Edge/Bing has ticked up in browser market share, possibly due to the incorporation of GPT3.5/GPT4 and Dall-E 3. Microsoft reported additional capex and has since demonstrated increased market share of the hyperscaler platforms. GPT4 continues to lead Foundation Models, but each cloud provider has since partnered with a Foundation Model provider. An October Survey is shown for reference only.

Microsoft Azure OpenAI Studio: OpenAI (GPT4) and Meta (LLaMA2)

Amazon Web Service (Bedrock): Anthropic (Claude 2) and Meta (LLaMA2)

Google Cloud Platform (Vertex AI): Bard (PaLM 2/Gemini) and Anthropic (Claude 2) and Meta (LLaMA2)

Oracle Cloud Infrastructure (OCI) Generative AI: Azure OpenAI, Coral (Cohere) and Meta (LLaMA2)

Source: https://gs.statcounter.com/browser-market-share

Enterprise is the level to look at, as it dictates the adoption rate. Like September, I am just going to focus on the leader, Microsoft :

Microsoft is front and center as they deploy enterprise solutions (Copilot, Excel Python) together with OpenAI’s “Advanced Data Analysis,” formerly Code Interpreter.

and in October:

Disregarding that GPT4-V was just released, some people are still only focusing on chatbots and image generators when the reality is that a lot of people are still using excel at work. Data analysis using GPT + Python API hooks will boost productivity and Copilot (and any alternatives using GPT4 API) code summaries will improve code documentation in every office Microsoft is used.

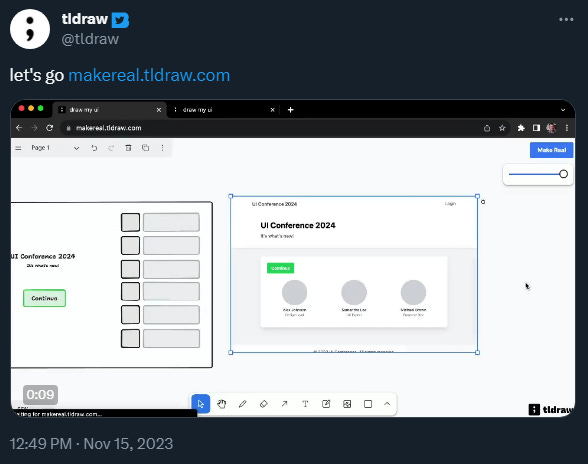

GPT4-V use cases are just starting to get explored and some people still do not know what code interpreter is, which was released in July. That is likely to change. tldraw introduced functionalities that are likely to scare all front end developers and Microsoft is nice enough to incorporate code interpreter into Bing for free. Github Copilot has a few competitors emerging (like Amazon CodeWhisperer), but still leads the version control software market and that is unlikely to change with Hugging Face also using the platform. The demand for Github enterprise is global, as more companies pursue their own custom LLM and setup Retrieval Augmented Generation (RAG).

It is not an exaggeration to say that the updated “Freedom Package” includes Nvidia and Microsoft, as that is exactly what happened with Biden’s Vietnam visit. Singapore drove 15% of Nvidia’s revenue, Japan is leading the charge in government adoption and needs more chip plants, and India is positioned to be a hub with the strongest demographic advantage. Brazil is not far behind as it expands its oil production to try its hand on a bigger stage.

Source: https://github.blog/2023-11-08-the-state-of-open-source-and-ai/

As far as the OpenAI fisaco goes, it was over by Saturday night, less than 24 hours after Ilya Sutskever delivered the firing over Google Meet. Two weeks after the inaugurate dev day for the hottest startup of 2023, Jeremy Howard had some harsh words for the rough draft of the next global network API. If you would like more AGI perspective, Ilya’s mentor Geoffrey Hinton left Google in May, but it was clear employees and Satya Nadella wanted Altman back.

As a side note, Google proposed transformers for natural language in 2017 with “Attention is All You need”, after introducing their first Tensor Processing Unit (TPU). Google squandered their lead that was built on TensorFlow.

Source: https://openai.com/our-structure

So, where are we?

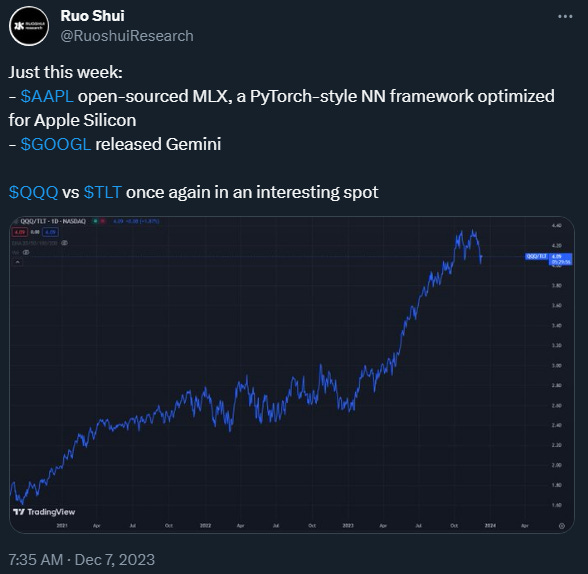

There is undeniable demand. Is it pulling forward too much? Semiconductor equipment billings just started to turn and even memory is troughed as Samsung turned their focus on HBM. I am not as sure as some people who seem certain the economy is “late” cycle. The hyperscalers (Microsoft, Amazon, Google, Oracle) all have continued capex plans for 2024. Mobile chips are preparing for inference already, as Qualcomm Snapdragon 8 demonstrated stable diffusion capabilities.

LLM inference is surprisingly fast on your MacBook as demonstrated by Andrej Karpathy (@karpathy). If all you want to do is batch 1 inference (i.e. a single "stream" of generation), only the memory bandwidth matters and the memory bandwidth gap between chips is a lot smaller, and has been a lot harder to scale compared to flops. It is probable that Apple is cooking up Ajax for their M3 chips. They released their open source MLX PyTorch-style NN framework optimized for Apple Silicon last week.

Source: https://twitter.com/karpathy/status/1691571869051445433

The hyperscalers like Azure OpenAI, Google’s Vertex AI, AWS Bedrock have new functionality updates every few months. It is incredibly hard to keep pace with the development speed. As far as media and content creation goes, it is lightspeed.

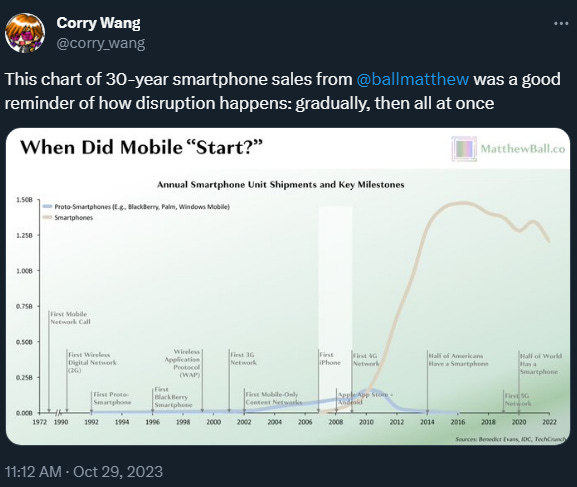

My answer to “where are we?”: Everything Everywhere All at Once. Due to the existing mobile and cloud infrastructures, the adoption cost of generative AI like ChatGPT is low because there’s no hardware required to try out the tech. People already own the smartphones, tablets, and desktops needed to experiment with generative AI. Due to the demand surge, smartphone makers and cloud providers are both shifting capex focus to prepare for the next generation of compute. Furthermore, although the Foundation Models have been established, there is still training to be done for next iterations and custom LLMs. With the models available, inference is already happening at scale.

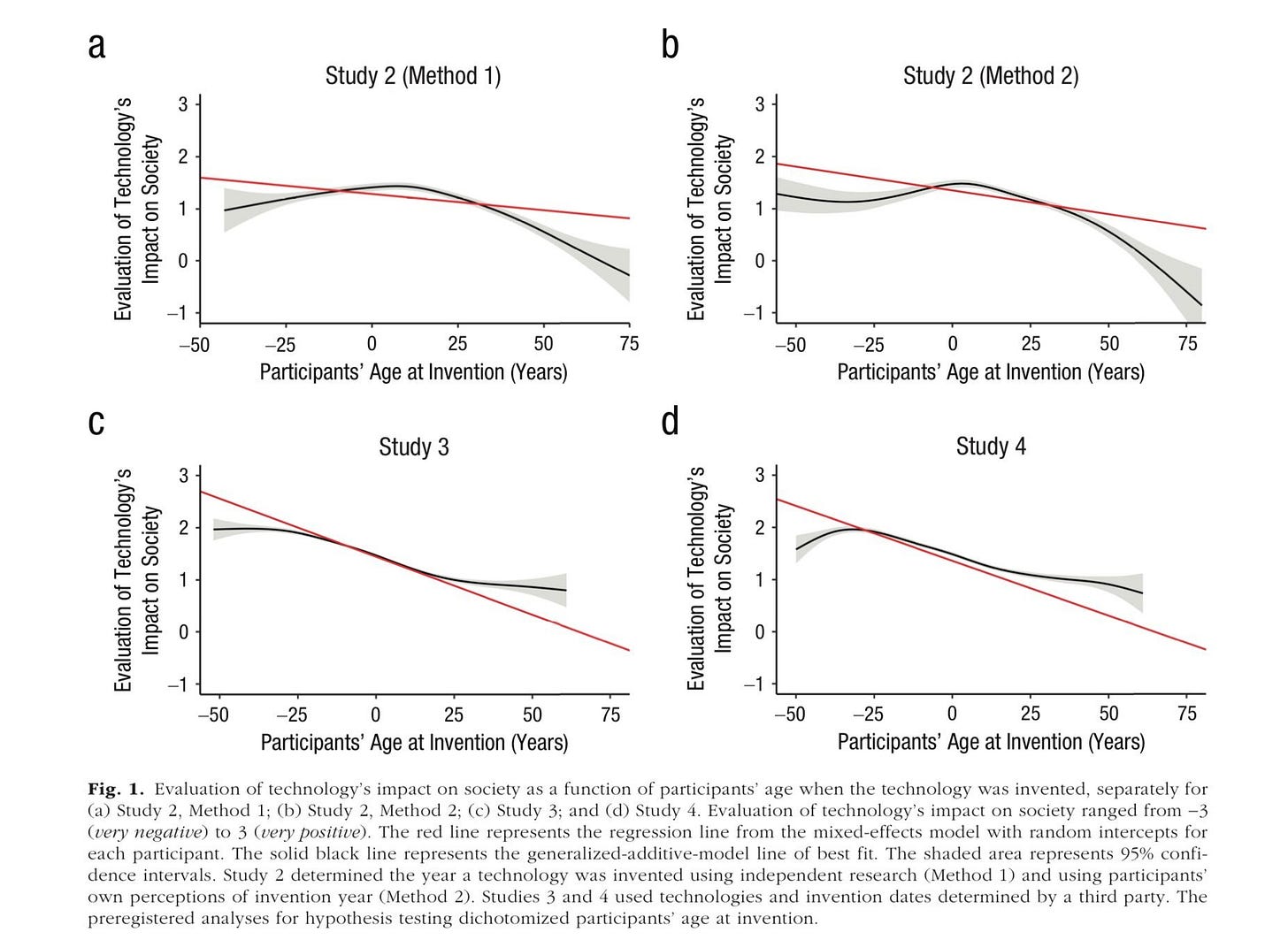

Generative AI is still a novelty to many because it’s so young/weird and there is a skeptics chasm. Some people tried the inferior ChatGPT3.5 a couple times without realizing the leap between GPT3.5 and GPT4. Some people might not know that GPT4 can code if you give it a pep talk. It is likely that younger folks are quicker to adopt, as they are less threatened by innovations changing status quo. At some point, people will choose the path of least resistance. Whether it is by choice is a different story.

Source: https://twitter.com/emollick/status/1720452579933528468

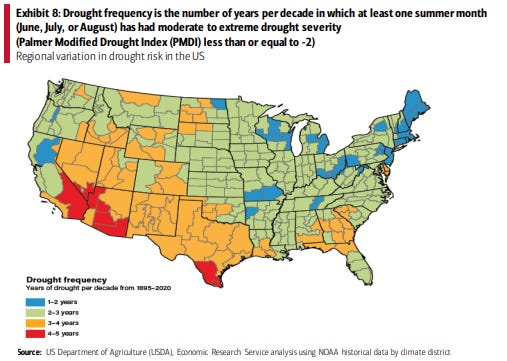

It is worth noting that the data center demand will drive energy and water demand as well. So, there will be second order effects from the expanded data center networks.

Source: Bank of America Global Research

So, again. Where are we? In my opinion, it comes down to productivity growth for the market. It sounds ridiculous to say AI causes a soft landing, but so did “E-mail is going to prevent a hard landing” in 1995. That’s literally what it did. Asset inflation absorbing any excess money supply as new GDP growth is created by the exponential rise of AI. The other side of this argument would be 1999, where productivity growth is not “real” and higher yields are needed to slow down the economy due to deficit spending being too stimulative.

Furthermore, it is worth noting AI is a double-edged sword. The Internet has massively broadened the possible space of careers, but it was not clear at inception and some people still have not figured this out yet. The internet put its fair share of people out of work, like brick and mortar retail Blockbluster employees that did not adapt quick enough. So will GPTs and automation. GPT4 is just a first node in the new network API, as it saves many time.

There is a difference between intelligence and memorization. Specific intelligence is knowledge that you cannot be trained for and not just a memory retrieval. If society can train you, it can train someone else, and replace you. Specific intelligence is found by pursuing your genuine curiosity and passion. Specific intelligence is often highly technical or creative, and is the result from a thought process that is continuously developed over time. It cannot be outsourced or automated.

Code and media are permissionless leverage. They have been the leverage behind the newly rich. People created software and media that works for them while they sleep. An army of robots is now freely available - it's just packed in data centers for heat and space efficiency. Use it. It is only getting easier to produce content, especially if you did not code, write books and blogs, record videos and podcasts.

The linkage between nominal growth and productivity growth is crucial to monitor, as long rates basically follow the Fisher equation of NGDP growth. Real + inflation = NGDP => long rates. NGDP is a function of productivity+population growth, also known as the Cobb-Douglass production function. The key to sustaining the deficit is productivity growth, which provides downward pressure on inflation while maintaining NGDP growth. Population is not really growing except immigration, but there are Gen Z entering the workforce to replace Boomers before they all retire.

Source: https://www.axios.com/2023/11/22/gen-z-boomers-work-census-data

Similar to going through soft landing cycles, here are some productivity charts. If AI does bring productivity growth, it is plausible long rates are higher than pre-Covid. However, it could be for a different reason than stagflation/deglobalization/higher for longer/new normal.

Source: https://www.mckinsey.com/mgi/our-research/rekindling-us-productivity-for-a-new-era#introduction

Source: https://www.brookings.edu/articles/machines-of-mind-the-case-for-an-ai-powered-productivity-boom/

Source: https://www.wellington.com/en/insights/macro-implications-of-the-ai-revolution

Source: https://fred.stlouisfed.org/series/OPHNFB#0

In July, I highlighted the job openings. These openings are likely still there. There just is not enough people that understand reinforced learning (RL). The ones that do have likely already left their post-doc positions.

Companies are actively choosing GPT and automation investments over labor. Just think about how many self checkout Kiosk are showing up even if you are skeptical about LLMs, despite shrinkage risk at retailers. AI could do damage to the absolute number of people employed, even if it ultimately increases the amount of GDP created. But, that might be a longer term problem, in the short term AI may mimic the computing boom while governments try to figure out how to retrain and adapt folks for what is coming. Microsoft has quite the reach.

Just in case productivity growth is not “real”, let’s just make sure productivity is defined properly. I like Gabe Newell’s perspective. While elusive, it is basically a measurement of “meaningful” output vs time to market. Some developers use lines of code as metric, but if you have written software before, you know not all lines are created equal.

Typically “meaningful” is defined by currency value, so let’s just roll with revenue. Time to market can be defined in a variety of ways, but number of employees can be equated to time. Time is money. Thus, time or number of employees necessary to bring a product to market can be interpreted as a metric for efficiency or productivity.

I think it is extremely important to understand the idea of “Network API.” The internet made computation, communication, and data access cheaper. GPTs will compound on what the internet accomplished, with Foundation Models acting as the first node.

A Network API (Application Programming Interface) is a set of rules that allows different software applications to communicate and transfer data. It acts as an intermediary layer that processes data transfers between systems. Network APIs provide entry points to protocols and reusable software libraries. They play a crucial role in network programming, which is a type of software development for applications that connect and communicate over computer networks, including the internet

Every other tool becomes an API for the interface level model to delegate to. LLM is a tool picker that can instantly reconfigure your tech stack. Imagine the price of an API doubles. Well that can just be rerouted to API B. Previously, that would take between 1week-10 years of business and tech debt refactoring. Now it can be done in seconds, dynamically.

To get an idea of the current state, I recommend Simon Willison’s (@simonw) podcast. To get an idea of the future, I recommend Andrej Karpathy (@karpathy)’s podcast.

With all the AI talk, some people have forgot about the year of efficiency at large cap technology companies that Elon Musk and Mark Zuckerberg kicked off last year. Here are some revenue per employee charts, which has margin implications.

If these numbers go up, 2024 margins not only hold, but they go drift up as well. If company margins hold or drift up, severe layoffs that would cause nonlinear rollover of NFP is unlikely. Furthermore, if LLM and automation reach is not only in technology but spreads to other sectors, it will not just be technology margins going up. This is how productivity growth goes up before NFP rolls over.

As far as the markets go, if you zoom out Nasdaq is just catching up to Dow Jones. What happens when gloomy vibes subside? The risk is obviously a dotcom dive, but no one tries to do the overlay despite loving 70s overlays. 11/2/2023 is not just a fluky number. It was p word day.

Investing is literally an expression of optimism. If you are not optimistic, it is unlikely you choose to invest. I am optimistic about where AI is in the Gartner Hype Cycle. If productivity growth turns out to be “fake,” and margins start bleeding because it was not the general purpose technology promised, that would set off alarm bells. There are risks to LLMs as well, as they are “weird:”

Red team and data infiltration

Hallucinations rates

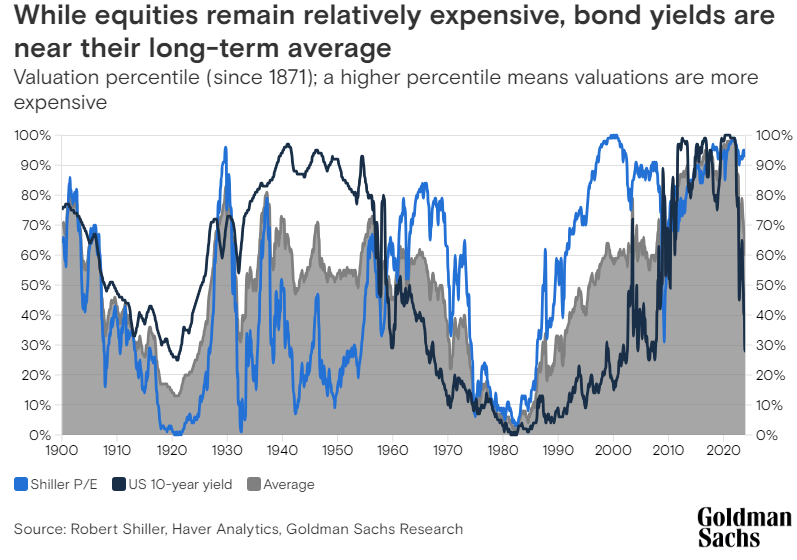

Just to play the other side, let’s check valuations. If Chair Powell goes forward with the real rates policy regime, it is unlikely money markets does not experience outflows. On a relative basis, $SPX is not expensive compared to duration yields, assuming you believe the consensus 2024 245.75 earnings estimate. Analysts expect about +11.3% change with respect to 2023 earnings. 4% is not a bad yield in comparison if you are risk averse.

$SPX (2023): 21x

$SPX (2024): 18.9x

$SGOV: 18.4x

$IEF: 23.8x

$TLT: 23.2x

Source: https://www.yardeni.com/pub/peacockfeval.pdf

Source: https://www.investing.com/rates-bonds/usa-government-bonds

Source: https://www.longtermtrends.net/market-cap-to-gdp-the-buffett-indicator/

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Now, risk premiums might scare Boomers, but do they scare Millennials, the Buy the Dip Generation?

Source: https://www.economist.com/finance-and-economics/2023/11/16/how-the-young-should-invest

Cash is king did not pan out in 2023.

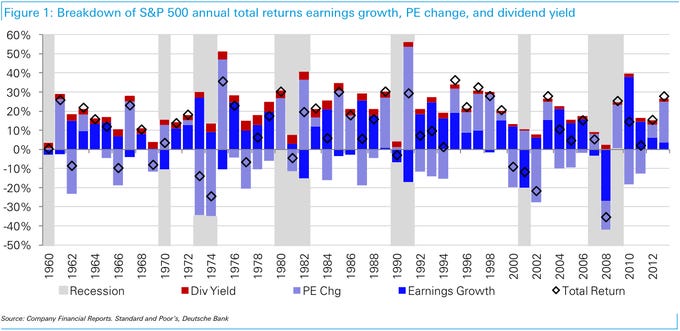

Will it work in 2024? Maybe. In the past multiple expansions were followed by earnings growth and margin expansion in a sustainable economic expansion. There are a few reasons to think this is 1995 instead of 1999.

If AI truly brings productivity growth, 14% margin does not seem that farfetched. That would be the 1995 scenario.

If productivity is “fake,” multiples are likely to come back down to reflect whatever the short end is at, but the earnings part of the P/E is at risk. That would be the 1999 scenario.

Source: https://twitter.com/timmerfidelity/status/1729902150518448447

In my opinion, P/Es are just vibes. When recession was the vibe, staples were bid to 30x. Now look at them at cheaper valuations. Elon Musk turned Tesla vibes into gigafactories. Ryan Cohen turned Gamestop vibes into a poor hedge fund. What will AI vibes bring for 2024?

Maybe the hype needs a wake up call. But, the reality is that the next compute is coming and it is coming fast. Governments and education institutions are already late on preparing for the incoming change coming at future generations and the possible labor displacements already taking place.

Source: https://www.mckinsey.com/mgi/our-research/generative-ai-and-the-future-of-work-in-america

Source: https://www3.weforum.org/docs/WEF_Future_of_Jobs_2023.pdf

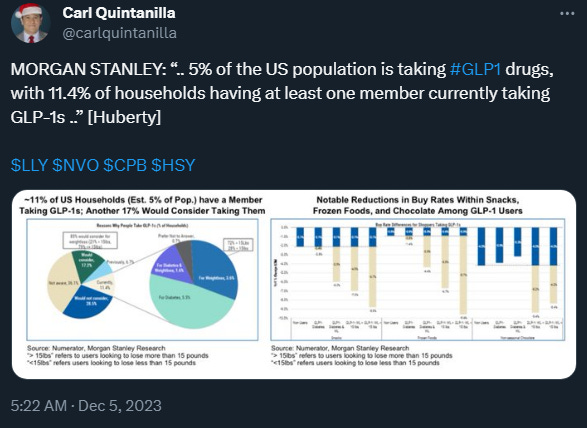

GLP-1 was the focus for the last entry, but it is quietly chugging along.

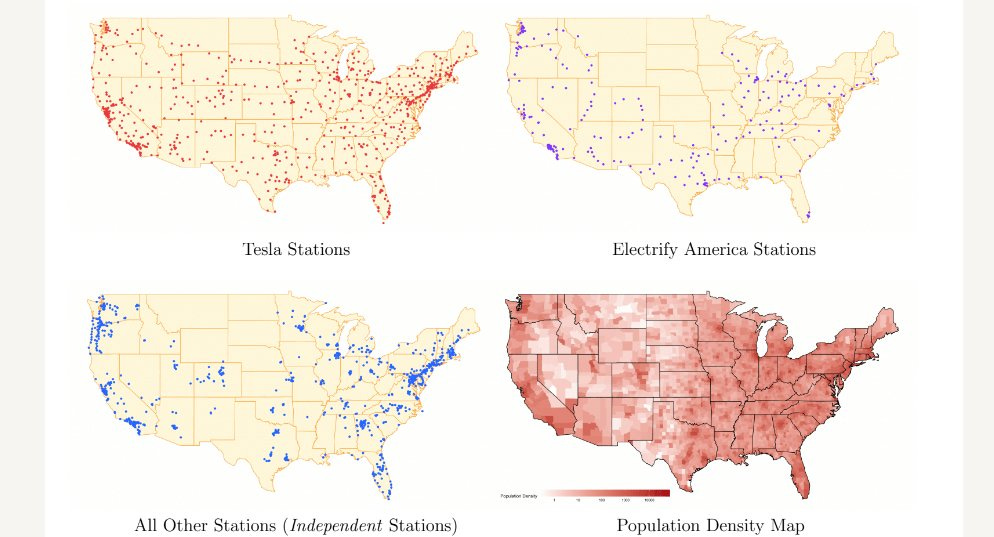

If you have made it this far, I thank you for your time. In the ideal scenario, the US chooses to build more cities. Not many people are talking about it, but Biden is building new cities. Here are some maps.

Source: https://twitter.com/ReshoreNow/status/1644352611661873161?s=20

Source: https://twitter.com/_jay_turner/status/1725528675691409889

Source: https://twitter.com/willwheels/status/1726933142278431193

Source: https://www.tfah.org/report-details/state-of-obesity-2023/

In summary, this market is a mere opportunity to accumulate for millennials. Millennials pulled out a compounding calculator for 30 year horizons and have been unfazed by this market. Funds that were touting cash is king have underperformed the broad market and at some point people are likely to realize they have run out of negative excuses to short or sit out the market. The narratives that have been:

Labor shock was coming

Banks were failing

Credit crunch was coming

AI effects were too early to justify valuations

Debt ceiling/TGA rebuild was going to cause bond market turbulence

Earnings were/are going to disappoint

Duration supply from China/Japan and Treasury Issuance

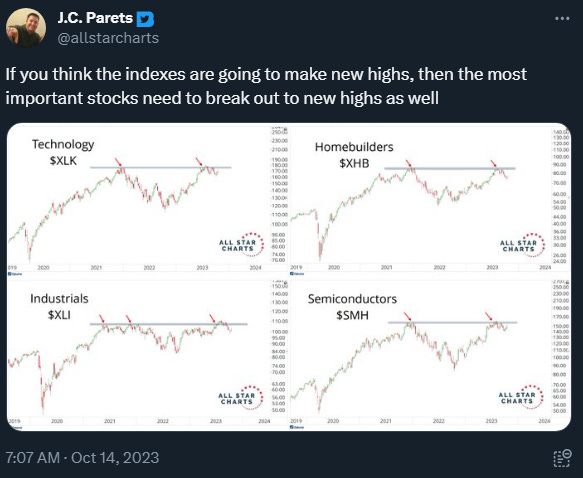

Not only are upper quartile consumers positioned to sustain consumption and growth such that positive stock and bond correlation is sustained as shelter slowly moderates, the biggest immediate effect from GLP-1 is how Boomers change their consumption behavior after reducing some weight. I think it manifests with luxury services benefiting and the market implications is basically a repeat of 2023 1H: technology, luxury, and homebuilders being the beneficiaries. There are likely productivity growth implications from the use of weight loss drugs as well, if the cost is reduced and/or Medicare is expanded. In October:

The market has digested the 10yr trading between 4.1-4.5%. The push and pull between the underlying supply and demand for the long end of the yield curve is something that needs to be monitored on a quarter to quarter basis due to headlines and issuance, but I am of the opinion that the market will push higher with the 10yr less than 4.5%. AI beat rates in Q4 2023. Technology names did not push up just due to rate sensitivity. The QQQ/TLT chart tells you this, so I am not sure why people still ignore that AI disrupted equity and fixed income relationship.

In my opinion, LLM’s coupled with code interpreter (renamed “Advanced Data Analysis”) is poised to more than offset deglobalization with respect to contribution to corporate capex and margin improvement, as productivity is increased for every sector. It is probable that the effects will be felt within a 6-9 months and is faster than those treating AI as a Gartner Hype Cycle. The potential of English as a programming language is still underestimated. The transmission and absorption of information is much faster now and Microsoft has deployed OpenAI enterprise solutions globally. If AI does bring productivity growth, it is plausible long rates are higher than pre-Covid, just for a different reason than the stagflation crowd.

It is important to remember soft is the easy part. It is keeping it soft that is the hard part and containing the spike in unemployment. There are still headwinds to the US consumer and it is taking the form of higher borrowing costs, gasoline prices, depletion of excess savings and student loan payments. The longer the Fed can maintain this rate, the more bullish it is for the US economy as Chair Powell can choose to slowly ease and maintain real rates as NFP rolls over. Meanwhile, the market is trading like the economy is in the early phase of a new business cycle.