wafers and builders

trend: wealth gap and macroprudential fiscal

Introduction

The younger generations are the future. This post is going to focus on the impacts that fiscal policy has had on the younger generations. I believe there is more to be done, especially for housing.

Macropudential fiscal is the new trend that I will be tracking, regardless of election results (may need to adjust the “prudential” part under a Trump second term). As disinflation is baked into 2H, I am focusing on the election and compiling my views further and adjusting my priors for fiscal dominance (updated). The best scenario would be macroprudential fiscal replaces fiscal dominance. I will be including housing into industrial policy, as I view it as the number one priority for the next administration.

For full transparency, I will be voting Democrat in the upcoming elections. I am not an economist. I am not a global trade expert. I am not a geopolitical expert. I am not writing this to change anyone’s mind. I am just documenting my observations and attempting to synthesize market effects based on my opinions. I was not planning on writing about the election this year other than my February thread. However, I have been inspired by Claire Robertson (@CRobertson500) to say more in context of the market reaction for the 6/27/2024 Presidential Debate.

Regardless of election results, the fiscal and monetary dance is going to be documented and studied for decades. I believe the trajectory of the US economy is going to be drastically altered by the election. My optimism for the future drops significantly with a Trump second term as I see the long end rising out of Fed control and eventually causing a recession, which widens the wealth gap further.

Building housing (builders) and maintaining technology leadership (wafers) are critical for America’s future. I believe Trump is likely to fail at both. There is a path such that industrial policy guides the economy to bring about a productivity boom and building more housing is at the center of it.

Fiscal Policy (Fiscal Dominance/Deficit Spending)

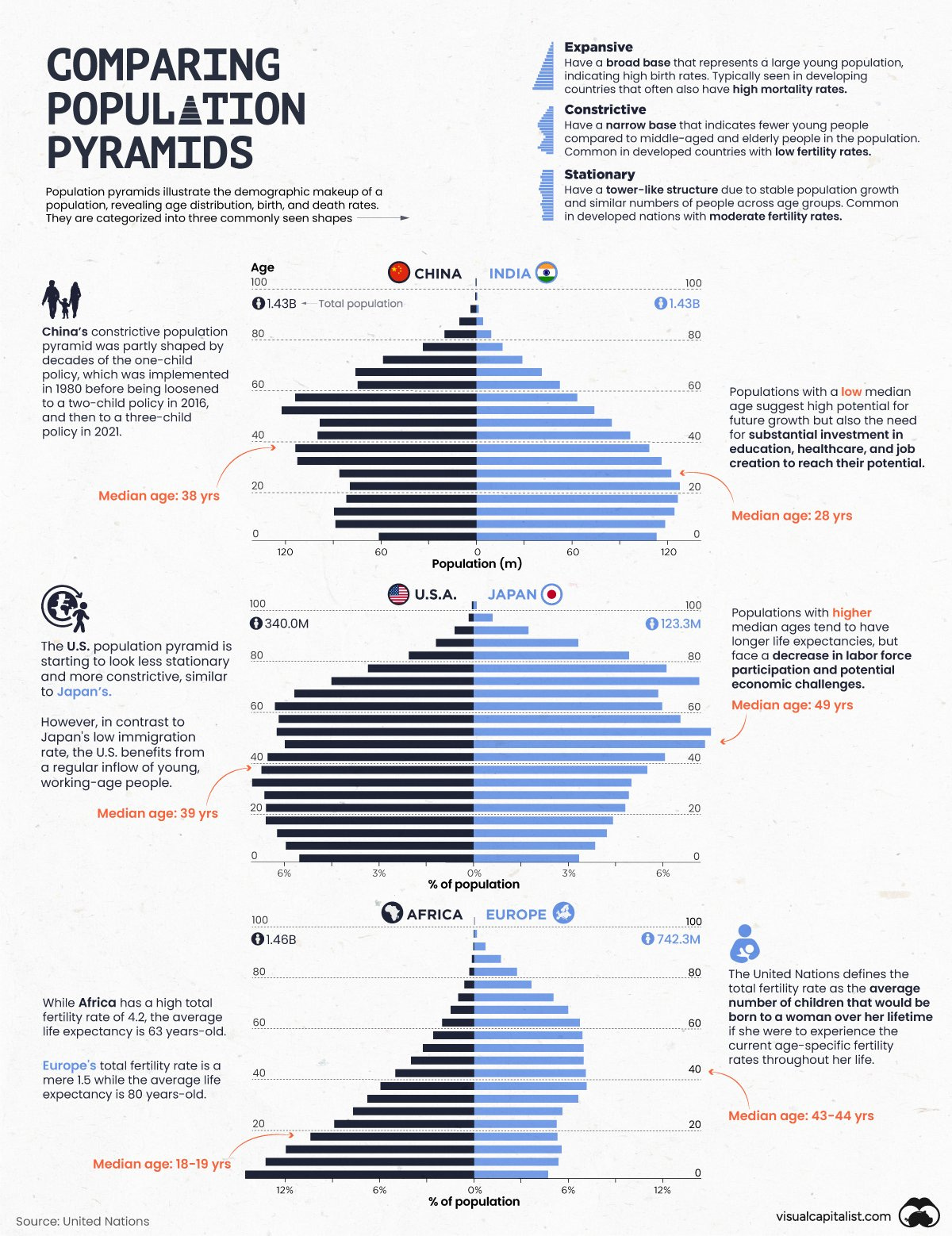

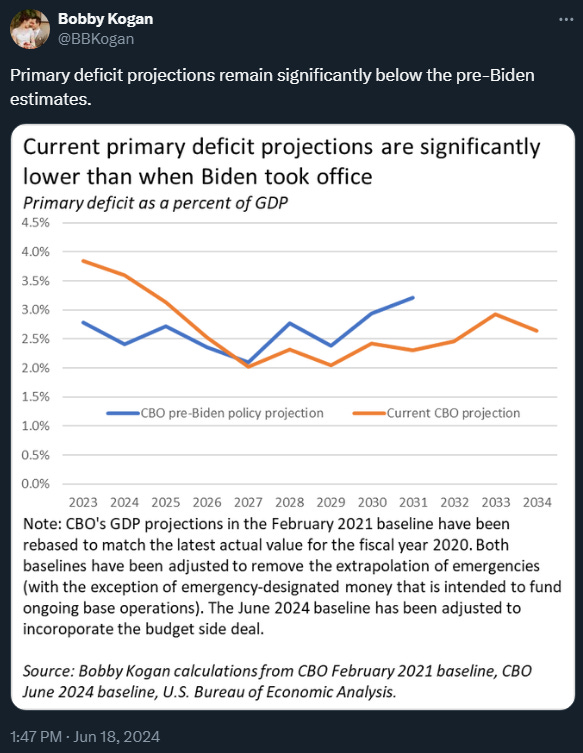

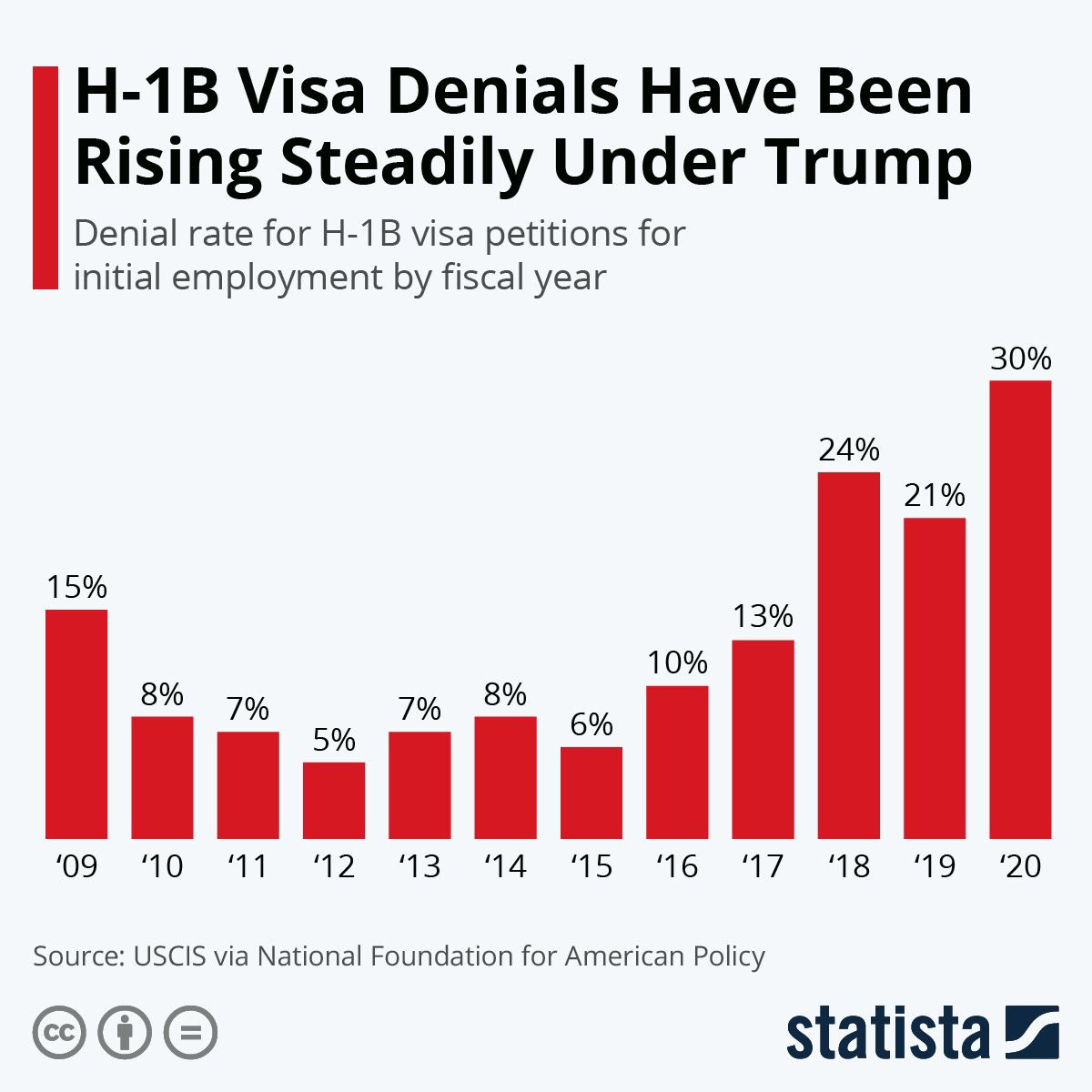

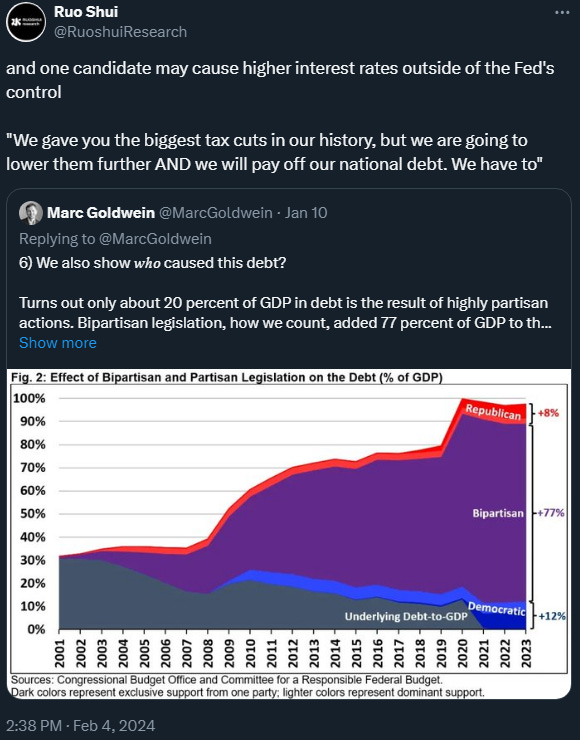

I have been treating fiscal dominance as “procyclical deficit spending which dampened monetary policy.” Marc Goldwein (@MarcGoldwein) and Bobby Kogan (@BBKogan) are two of the best with respect to congressional budget discussions. At the core of deficit spending is how the average interest rate of government debt is balanced by the growth rate of GDP, which is really dictated by population growth (including immigration) and productivity growth in the long run.

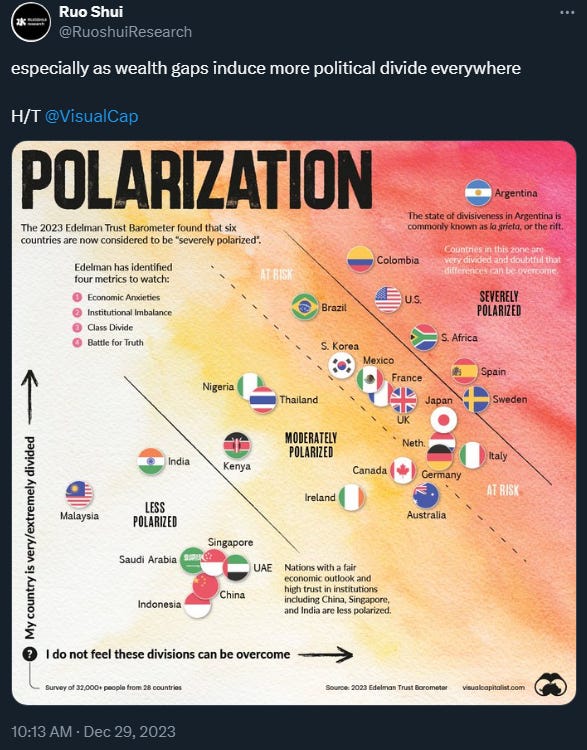

The federal debt to GDP ratio is barely off all time highs, last seen during World War II. Some might say we are not at war. I disagree. Even if one ignores international geopolitics, I believe there is a war with wealth gap domestically.

That being said, here is the divergence between the budget deficit and unemployment rate. The current spending trajectory is unsustainable. That is a mathematical fact.

Keeping current primary deficits in mind, I agree with Mark Dow (@mark_dow)’s more precise fiscal dominance definition here, if one wants to treat “dominance” as losing the long end completely and the central bank having no control over inflation and the yield curve. The short end is currently controlled via Fed Funds Rate and long end is affected via anchoring inflation expectations, while market is attempting to price in productivity growth, growth, and inflation. If inflation expectations become unanchored, not even yield curve control will be able to keep long end contained during a new round of deficit spending rendering the fiscal stimulus unproductive.

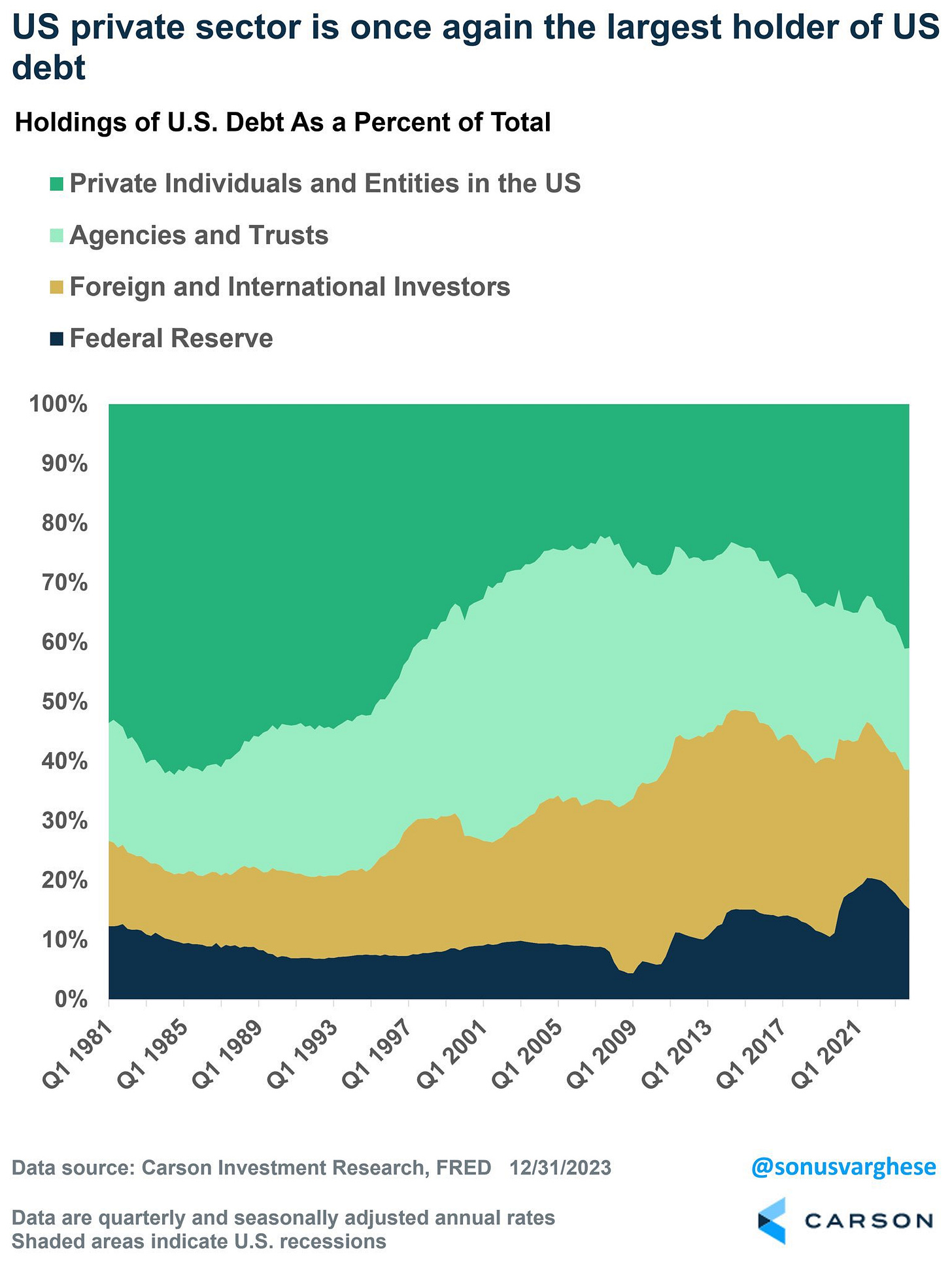

Treasury Financing

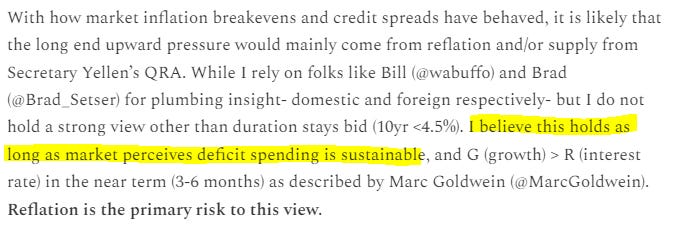

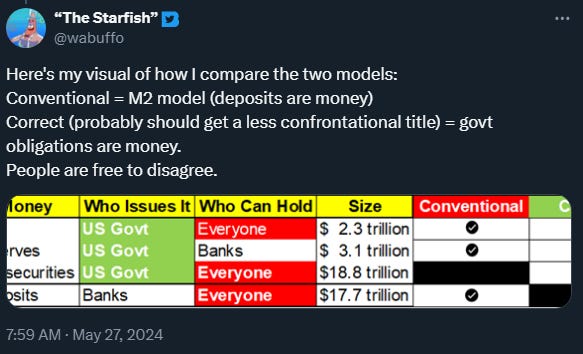

I do not intend on discussing whether “QE is debt monetization.” My primary takeaway for treasury financing was compiled at the beginning of the year. I will reiterate my main thesis that the key to sustaining the deficit is productivity growth, which provides downward pressure on inflation while maintaining nGDP growth.

Modern Monetary Theory (MMT) is likely to only keep coming up as both parties have embraced Keynesian economics. The budget constraint is the economy’s growth potential and stability, which is largely dependent on population growth, immigration and productivity growth in the long run. I think deep down, MMT folks just believe technology is deflationary and America leads innovation.

If interested, I think Bill (aka “The Starfish @wabuffo) provides one of the better explanations for MMT plumbing interpretations. If the market perceives deficit spending as sustainable, the long end rate will attempt to price in productivity growth, growth and inflation expectations. Some people attempt to back out productivity based on the difference between nominal growth and realized inflation. That being said, measured productivity often leads to disagreements, but so does inflation.

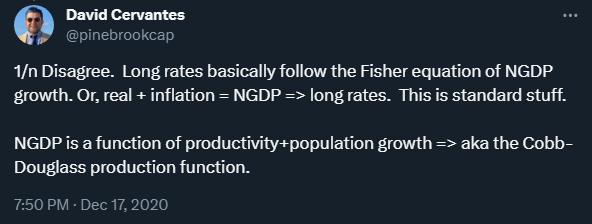

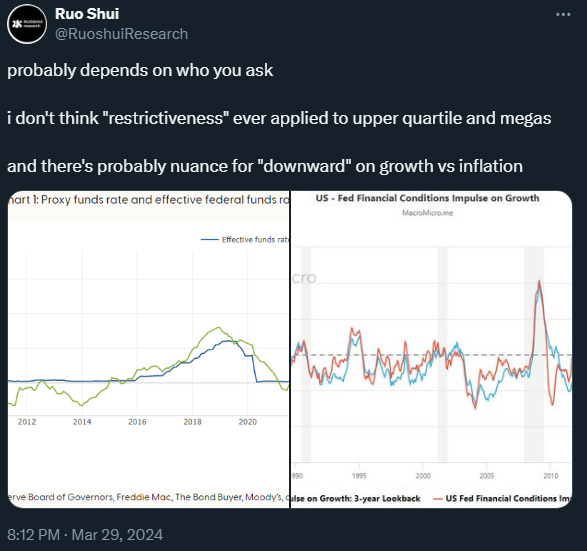

The long end of the yield curve is what dictates the real economy. Some folks frame “restrictiveness” on growth, but growth only equals inflation if productivity is zero. David Cervantes (@EconstratPB) frames the yield curve and the relationship between long rates and nGDP in such a way that it leads to an accurate interpretation for the Fed’s reaction function. Fed has really been targeting nGDP, but only a few people have picked up on it.

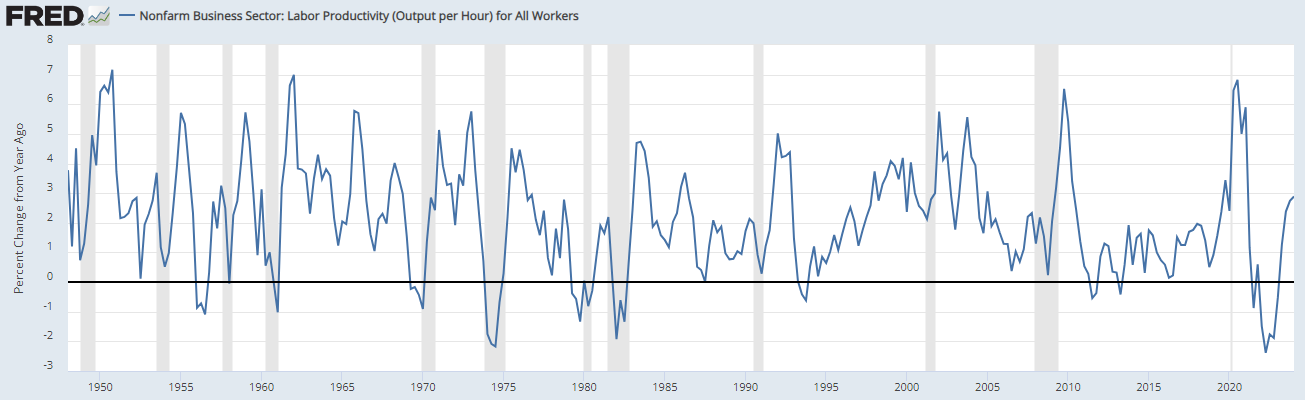

I do not think productivity is zero. In fact, I think quite the opposite. My productivity growth thoughts are compiled in this thread, which was essentially mixing my views with Preston Mui’s (@PrestonMui). My July post was titled “AI to the Rescue.” My October post was title “AI/GLP-1 to the Rescue” and my April post was titled “ Middle Out Compression.”

The worst type of hawks are the ones that think productivity growth isn’t “real” while also saying monetary policy is not “restrictive”. If productivity growth is not “real,” then monetary policy is even tighter as neutral rate is unchanged. If productivity growth is “real”, then monetary policy is less tight as neutral rate is raised, but that means growth is “real” (adjusted for inflation) and it is not inflationary as supply expansion outpaces demand growth.

These hawks are the worst not just because they cannot admit being wrong after losing money, but also because their framework is not self-consistent.

Fed Governor Waller effectively summarized the views of these hawks. They are likely to continue to be wrong as productivity growth is “real” for 2024. Assuming 0.5% population growth and 1.5% productivity growth (90s for reference), long rates end up around 4%.

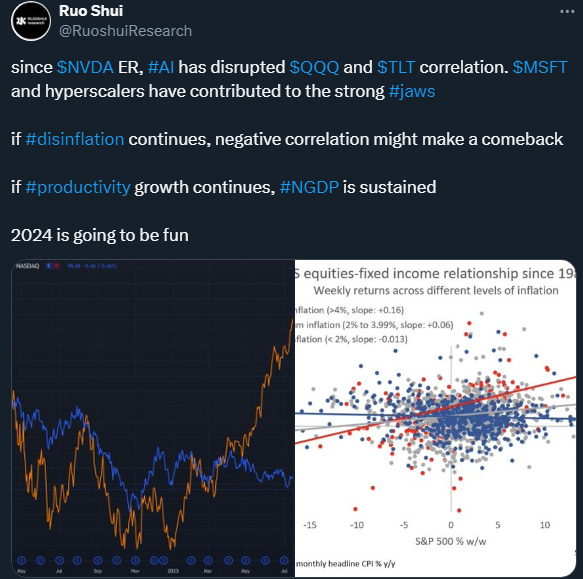

There is quite the significant overlap between hawks and those who think the only real productivity advance in the last two centuries was the use of fossil fuels. And yes, I am specifically referring to those who think the internet did not secularly improve productivity. These hawks are also typically oil bulls. I am not sure if this is a partisan or personality thing at this point. Maybe it’s a bit of both. Bridgewater Ray Dalio ended up being extremely wrong about equity and bond correlation, especially so since 5/24/2023.

With productivity growth in mind, the treasury will likely shift treasury issuance composition to notes/bonds soon, I believe that is likely as Treasury Secretary Janet Yellen knows productivity growth and positive carry (yield curve disinversion) bring levered duration buyers to the market.

The spread between the 10yr note and the 30yr mortgage has improved since the QT taper announcement, alleviating potential homebuyer sensitivity to coupon auction results.

The next TBAC Report is scheduled for 7/31/2024. Up to this point, the issuance supply has been absorbed by the combination of foreign purchases and domestic households. With levered buyers as active market participants, bond market volatility should stabilize as bond market prices for positive carry, especially with growth slowing.

Wealth Gap

Here’s the US population by age.

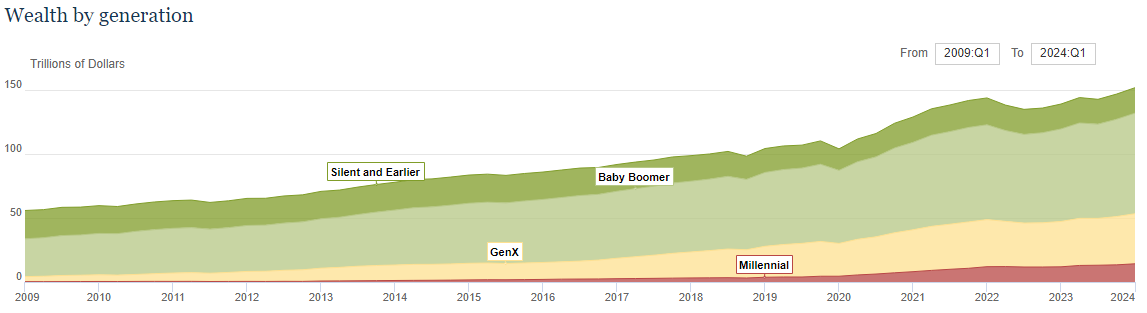

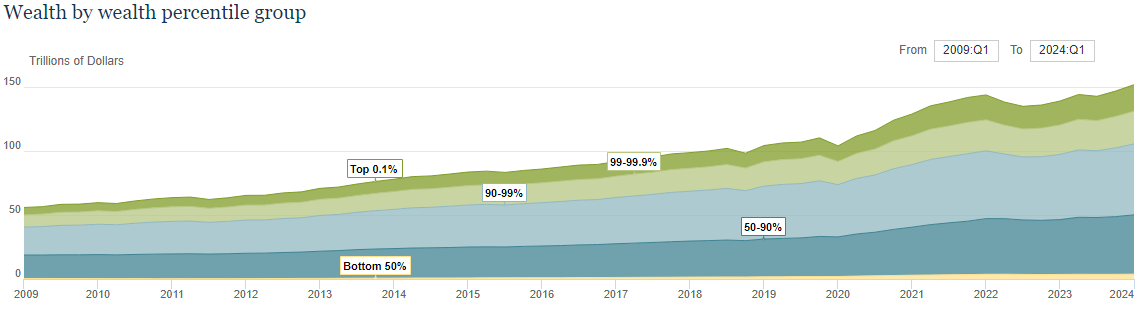

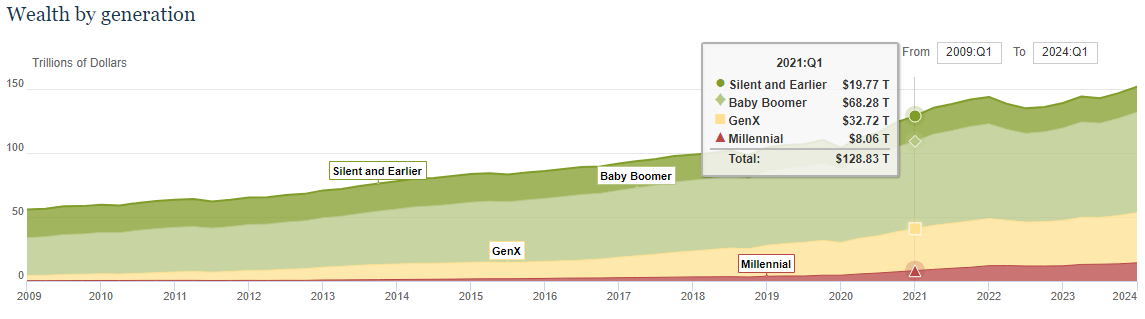

Here are the distributions for wealth, by generation, percentile, and income.

Here’s another view of the current distribution of assets by generation.

I believe wealth gap is the root cause for polarization and political divide everywhere.

Housing and Rate Sensitivity

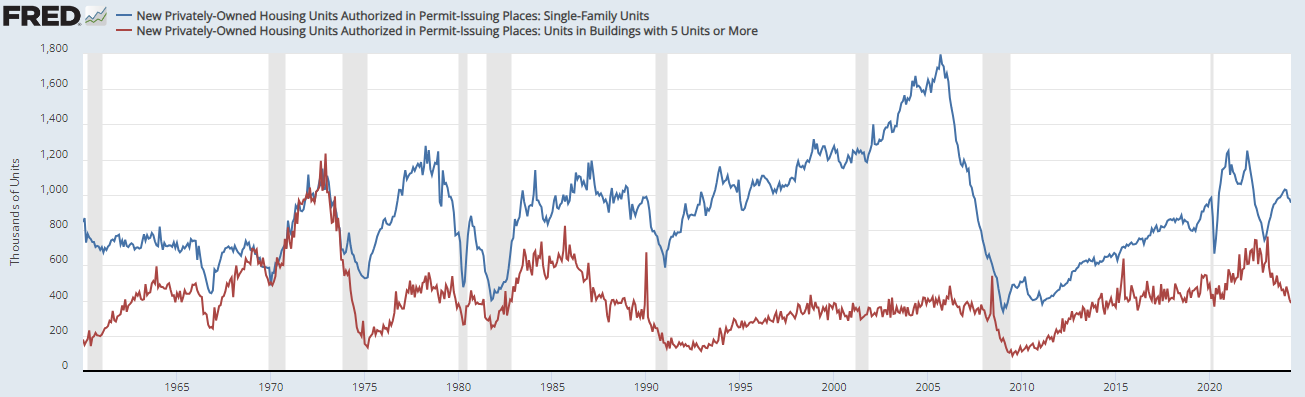

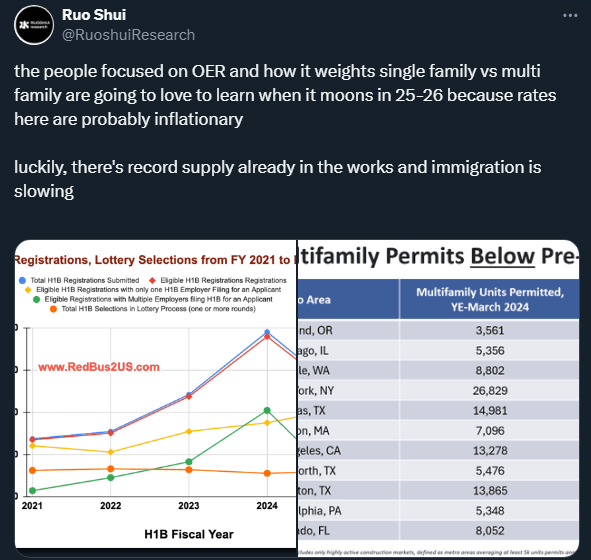

The wealth distribution is skewing consumption and confusing some folks about the rate sensitivity and “restrictiveness” of monetary policy. The confused hawks all seem to like ignoring housing activity data, as housing starts and permits are clearly being restricted. The lack of multifamily permits is likely to become inflationary for 2025-2026. Supply contraction and expansion is a blind spot for these folks.

The housing price data is skewed and even then there are only so many million dollar homes builders can build. Single family builders are starting to feel the burden of providing rate buy down incentives. So, if one wants higher shelter inflation, keeping rates restrictive is a good way to do it.

The view that higher rates reduces the wealth gap is incorrect. Housing being the only component of “inflation” left is probably the only thing people agree on, but people have opposite views on how rates affect its trajectory. The only way to deal with housing inflation is to build. Neither higher rates nor recession solve housing. If one thinks building less somehow alleviates the housing shortage, a review of supply and demand might be necessary. The spread between completions and under construction is just barely making it back to prepandemic levels.

The pandemic lockdowns further distorted supply and demand as remote work upended the definition of “local,” especially in communities where the incoming migrants were from substantially higher cost of living/income areas. These people purchased or refinanced with rates < 3.5%.

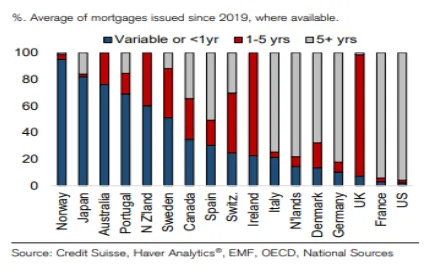

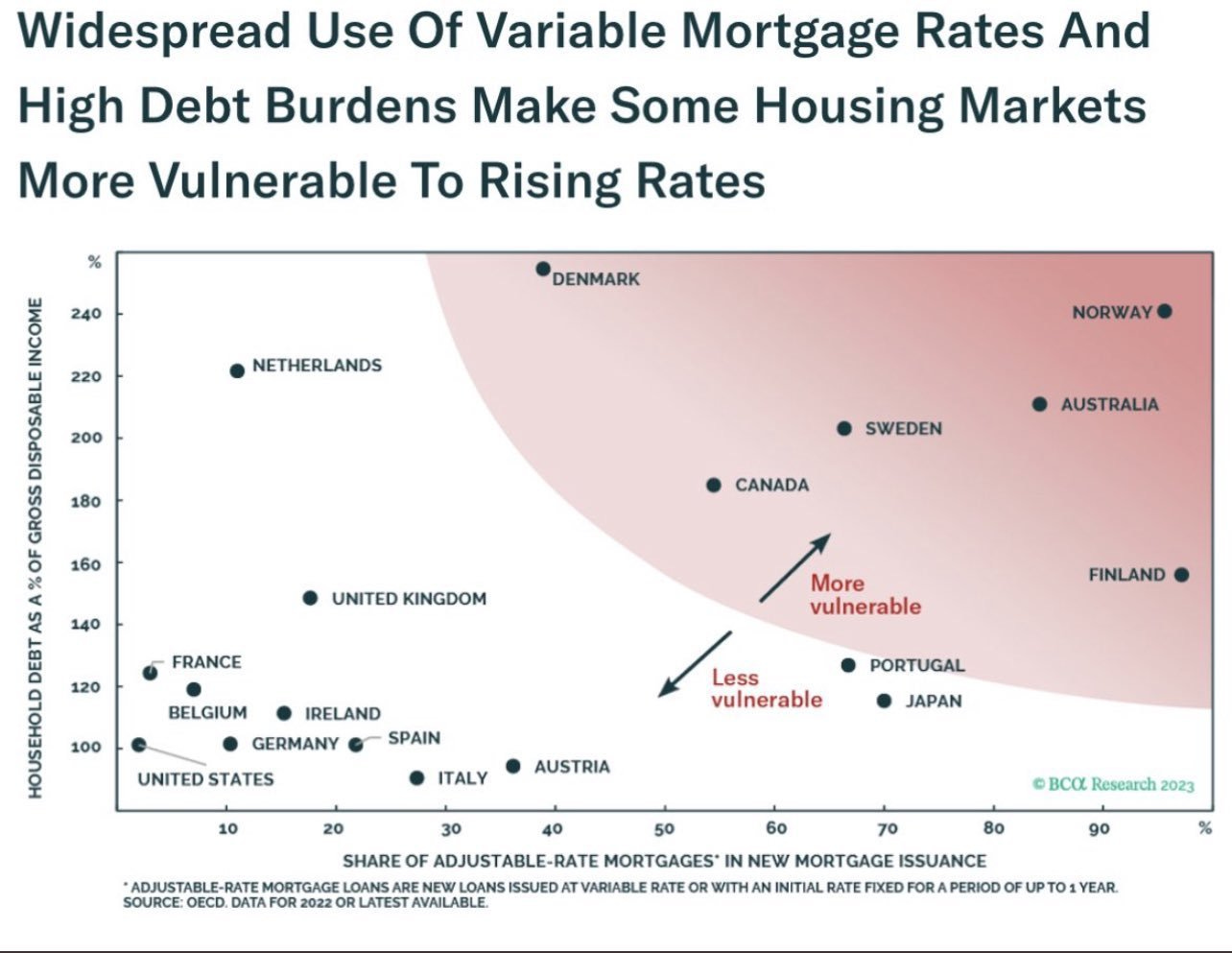

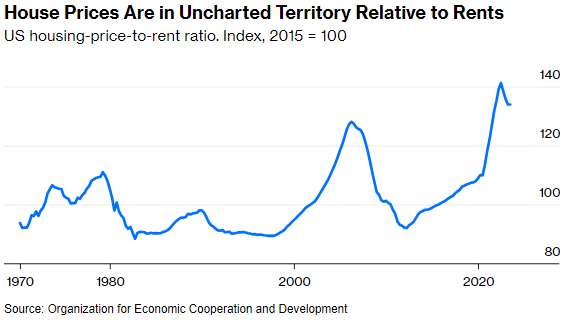

This is a global phenomenon, not just a US one. Relative to income, America is actually not in that bad of a spot. The location and commute may be less than desired though.

The difference in the US is the availability of the 30yr mortgage. When the Fed began the tightening cycle in 2022, the breakdown of variable rate vs fixed rate mortgages was the lowest in the world. It still is.

Most agree that monetary policy distorted the housing market, with QE that overstayed its welcome. However, those proposing outright sells of MBS implicitly want to cause pain to younger generations, who have a larger portion of their net worth tied up in housing.

Boomer Wealth and Consumption

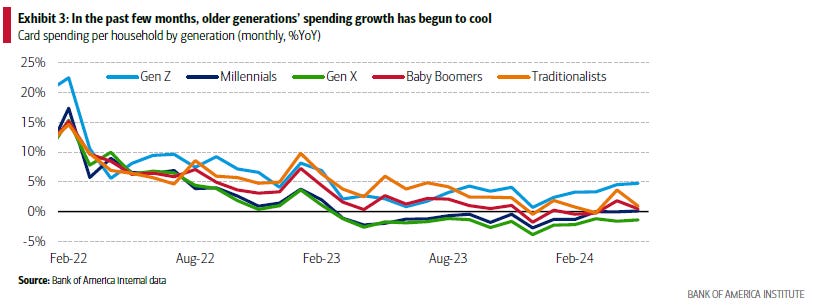

Ironically, it has been boomers making up a significant portion of overall consumption. Boomers retired and did not know what to do with their accumulated wealth and the best risk free dividend in decades. Awkward situation for Fed where higher MMF rates are inflationary as this retired and wealthy cohort is desensitized to borrow costs and employment.

With time and money and empty nests, the next logical step was service spending. After remodeling their houses, luxury, travel and entertainment were the name of the game.

Boomers have finally started to show signs of exhaustion lately and are diverting their funds towards housing for the next generation. Especially as the market is pricing for positive carry and normalization of the yield curve.

Wealth Effect and Consumption

The people that overestimated the rate sensitivity from rate hikes are now overestimating the effect from a few rate cuts. I recommend ignoring the noisy folks talking about wealth effect and financial condition index (FCI) which is just another indicator for assets/stocks. If wealth effect had that causality, consumption should have slowed during the bear market of 2022. It did not really have an effect.

Hurdle rates matter. Those that refinanced < 3.5% are not likely to casually refinance again at > 6%. In fact, some businesses are not going to survive the next year even with a few cuts to the front end.

Asset appreciation does not fully translate to consumption. Risk appetite does. The wealth effect folks lack rigor in their analysis and misinterpret causation. I am fully aware Nvidia employees are probably inflating Bay Area housing prices. However, the more important linkage with growth is through income and labor, especially when corporations have incentive to choose capital expenditure over labor compensation.

The restrictive long end dictates the real economy and provides the hurdle rate for capital expenditure and labor compensation. While positive carry would be stimulative for credit and loan growth, there will be also be disinflationary effects from supply expansion that balances/outpaces demand growth, especially as service spending is diverted back to a healthier housing market with existing home transactions and higher active inventory.

The goods vs service distortion has been caused by skew of wealth distribution and housing affordability. The unfortunate twist is that services spending has been propped up as some young people give up on buying a house and divert down payments to luxury and entertainment due to affordability concerns from the high borrow cost. The root cause is still wealth gap and housing.

Restrictiveness

Here’s a basic “restrictiveness” analogy, treating each generation’s wealth as a spring. If one has four springs, do the four springs experience equal displacement from “compression” caused by (cumulative) inflation and interest rates? Are these springs in series or are they parallel?

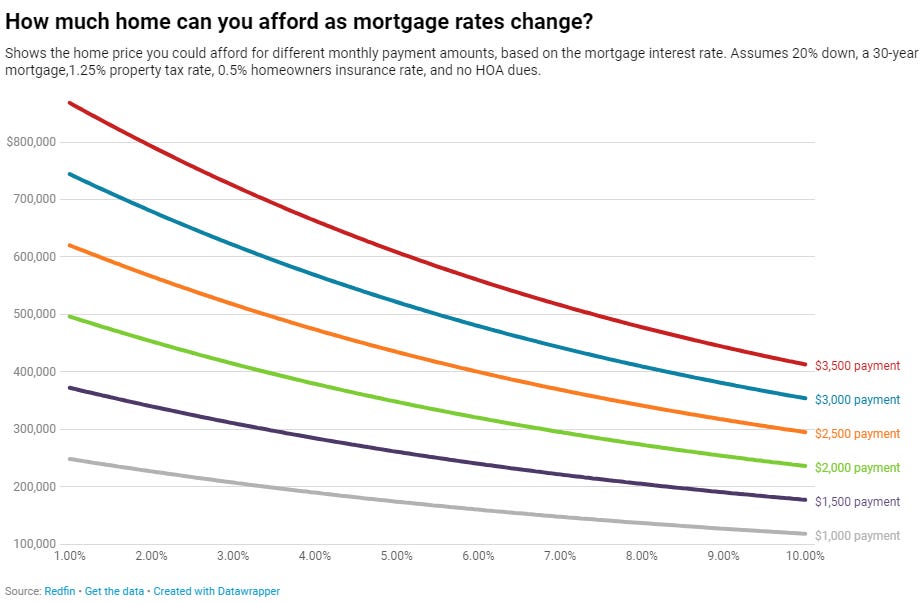

Monetary policy can be approximated via the 10yr yield as it correlates to 30yr mortgage rate through the 10yr note yield. For potential home buyers and Millennials/Gen Z restrictiveness, it combines with home prices to show up as housing affordability.

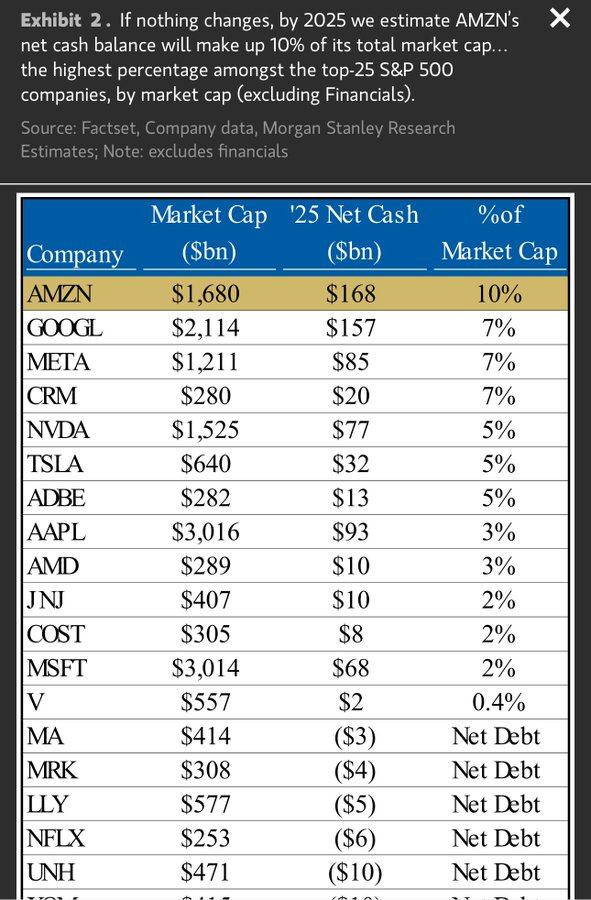

Some folks are assuming that the springs are in parallel and everybody is experiencing the same displacement and equally feeling the same “restrictiveness.” That’s incorrect. People are not experiencing the same displacement. The mega caps termed out their debt and are benefiting from market money fund (MMF) with their cash pile. Big tech companies trimmed their number of employees early in the tightening cycle to maintain cash flow and improve efficiencies that show up as revenue per employee.

The same applies to those that were able to purchase or refinance their mortgage < 3.5% during the pandemic. These folks have not really experienced much tightening.

Let me reiterate: I agree that some folks have not experienced “restrictiveness.” This is the bifurcation and root cause for the k-shaped economy.

For springs in series, the system is weaker than the weakest spring. Springs are not in parallel. The correct way is to model the the four springs in series. Equivalent force from the blunt “restrictiveness” is equal across the springs and each spring experiences compression based on individual spring stiffness, with higher stiffness (higher wealth/income) springs experiencing less displacement while lower stiffness (lower wealth/income) springs experience more displacement. This is physics. Not a partisan statement.

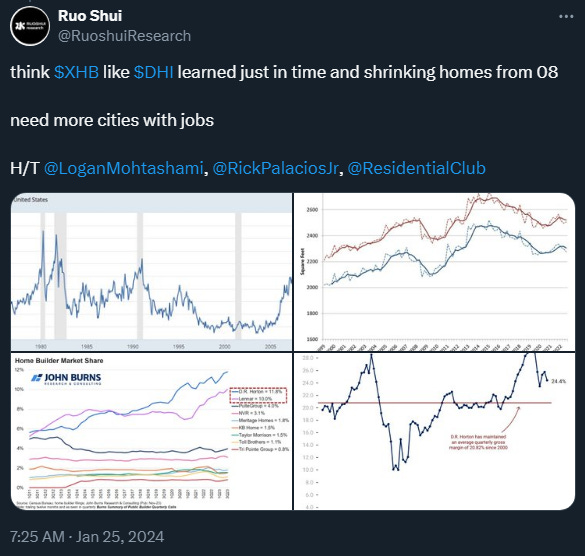

The nonlinearity happens when the weakest spring is broken. There’s an elastic range and then there’s the yield point. That point is when applied stress is removed, the weakest spring still does not return to its original shape. That would be recession, with the Great Financial Crisis (GFC) being the extreme example. Some people still have not recovered, whether it be financially or psychologically. Home builders learned “just in time” to survive.

Consumer cracks have been showing. If the position is that the weakest cohorts, aka younger generations and small businesses, need to break for Personal Consumption Expenditures (PCE) to be < 2.5 in 2024. Just say that. I disagree with it, but that is more reasonable than talking about wealth effects. However, a bear market didn’t change consumption behavior for the upper quartile during a oil/war shock, so I do not see why they would care about 25 bps up or down. The mental gymnastics needed for thinking that a recession would reduce wealth gap is impressive.

Inequity

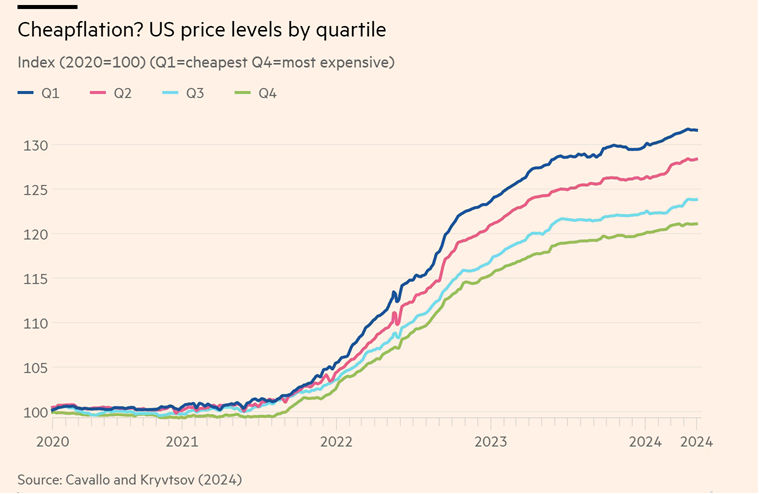

The cumulative inflation and borrow cost is weighing the heaviest on the weakest cohort and is driving sentiment.

Inflation induces a sense of inequity, especially upon those that did not experience asset appreciation whether the stock market or housing. Thus, there is this gloomy view from those that did not experience asset appreciation despite “real” wage gains.

Price Growth

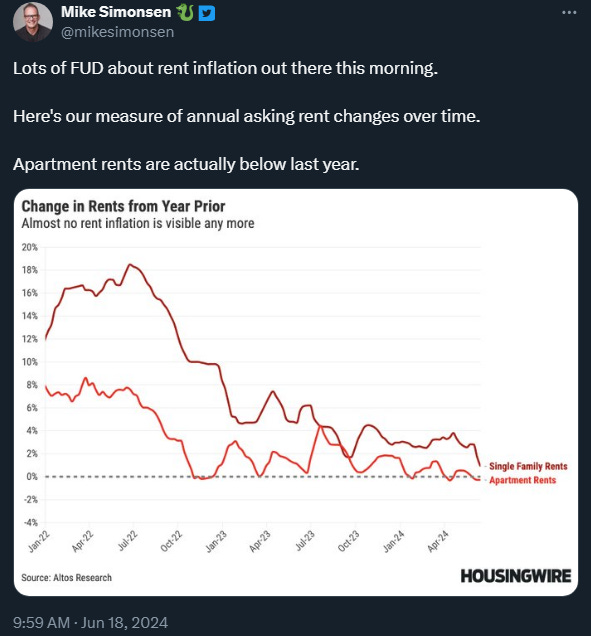

Shelter Inflation

The only component of inflation that is sticky is shelter. Owner’s equivalent rent (OER) easing for 2H of 2024 will prove that existing homes transacting and rerating to 6-7% is disinflationary. The lock-in effect is grossly overexaggerated. As people get used to the new long end ~4%, life happens. The rerating of these < 3.5% homes to > 6% will be disinflationary, as these transactions pressure builder market share.

The Fed should really be more worried about 2025-2026 as permits and starts have cratered. There are many apartments that made it past permitting, but face financing challenges with rent disinflation and high interest rates making hurdle rates difficult. The financing situation is awkwardly demonstrating how higher rates are inflationary.

Some people are confusing “inflation” with borrow cost. Thus, when interest rates are lowered, “inflation” will also be lowered for these people. Going by the Larry Summers chart, reducing interest payments would effectively be lowering “inflation.”

A rate cut is net bearish housing prices for the rest of 2024. I have already talked about existing homes, but there are still loan portfolios at many small banks, which will affect/reduce loan originations and dampen demand growth. For 2025 and beyond, the pace of home building vs affordability/wealth transfer is likely to continue keeping home prices in a seasonal range.

Those single family seasonality headwinds will allow for consecutive core PCE <.2 month over month (MoM) this upcoming quarter. Hopefully, people will eventually discuss the need to update weights for OER, as the Fed makes its impact on new leases which makes inflation prints lagging indicators.

Fed Reaction Function and Market Pricing

If one thinks the Fed won’t cut in September, I disagree. They will likely follow the housing market as it is their primary mechanism for policy transmission. The amusing part is that the “cut” is likely bearish markets and bullish real economy. Many will be confused as the cut is already priced in. The stock market level is irrelevant for the Fed.

It is interesting that some hawks think a cut is bullish equities. These people have not realized the soft landing already happened. Some people are just not in the right arena. Might be in the wrong year too. The economy is k-shaped, as the expansion and growth have been skewed. Only the Fed can normalize this bifurcation.

Many frameworks will be upended as some folks deal with the reality that lower rates lead to lower inflation. Especially so for those that believe productivity growth only happens during recessions. At the end of the day, most hawks just do not believe productivity growth is “real” and can be extrapolated near term. Thus, “inflation” is always a demand growth story and supply never expands.

Fiscal Path: Past, Present, Future

Now, that I have provided my perspective on deficit spending, treasury financing, wealth gap, and price growth, I want to review the fiscal path that brought us to today and assess whether deficit spending has been inflationary. If one thinks that question is easy to answer, then it should be easy to answer whether productivity growth is “real”. Let me reemphasize: the linkage between nominal growth and wage growth is productivity growth. This relationship determines the split between nominal and “real” (inflation adjusted) growth.

In addition, people have been talking about cumulative price levels without mentioning cumulative wage growth. It would be more helpful if people posted receipts and taxable income side by side. If one’s perspective is that deficit spending only fueled asset appreciation, I disagree. Biden’s fiscal policies incentivized expenditures that stimulated wage growth while simultaneously creating assets with productive capacity. At the end of the day, the question should be whether government expenditures were/are productivity enhancing. If the answer is no, then that spending is inflationary.

The counterfactuals are somewhat silly, as disaggregating various policy lag effects is nearly impossible. But since everyone else is yapping, I figured that I might as well provide my perspective and attempt to distill a little bit of signal. I will be breaking policy into three segments, for both the Trump and Biden administrations. Trump and Biden were inaugurated January 20, 2017 and January 20, 2021 respectively:

Industrial and Trade policy

Treasury financing (including Tax Cuts and Jobs Act, aka TCJA)

Foreign policy (including immigration)

I will assess their impact on growth and inflation. As a side note, I have the following core beliefs:

- Freedom of speech is foundational for innovation

- Shelter and education for talent are critical for growth and innovation

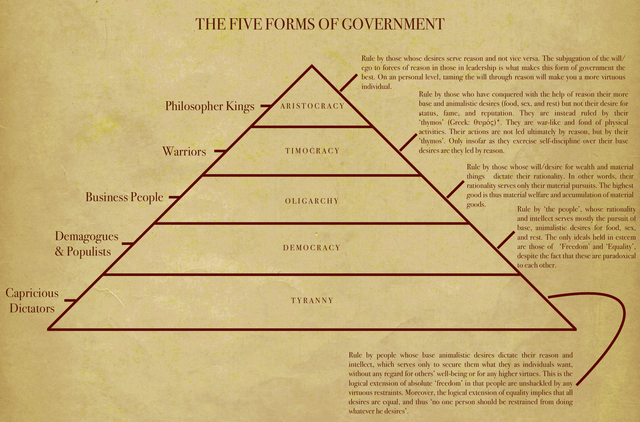

- Current wealth gap is unsustainable for democracy (some might argue it’s already oligarchy with regulatory capture)

These traits are only exhibited by one party at the moment. Some people confuse freedom of speech with freedom to lie. Facts are not relative, even if “truth” is relative.

Before I go on, here’s a podcast with Professor Philip Wong talking about nurturing talent and I believe younger generations are the key to economic growth. In order to nurture talent, shelter and education need to be made available and affordable.

Industrial and Trade Policy

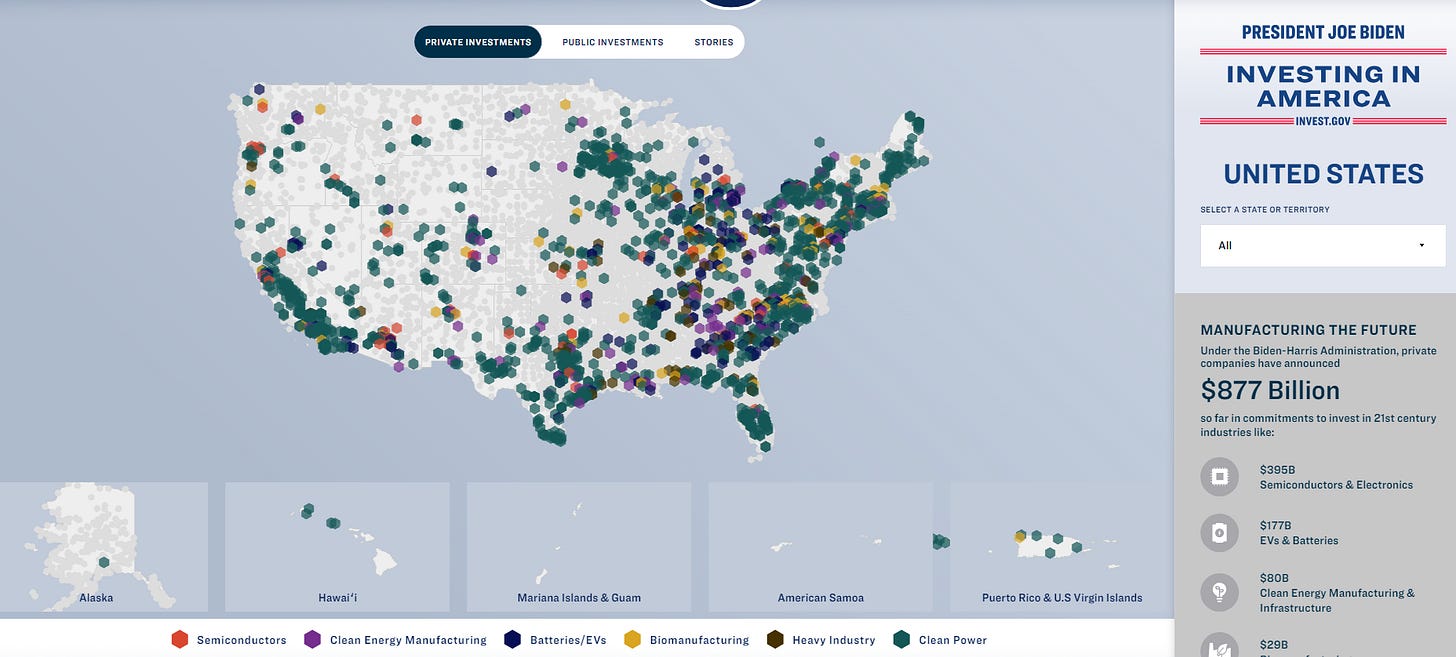

Here’s the list of policies enacted by the two administrations.

Trump Administration

Trans-Pacific Partnership (TPP) Withdrawal

North American Free Trade Agreement (NAFTA) Renegotiation

Tariffs on foreign aluminum, steel, and others

Biden Administration

Covid Transition and Industrial Policy

The transition between the two administrations happened during Covid-19. Former President Trump initiated the Covid vaccine program and somehow wants to defund schools with a vaccine mandate. Tom Brady received $960,855. If there was a way to cause chaos in schools and further widen the wealth gap, these would be decent examples.

While Trump lit the match for industrial policy and fiscal dominance, he failed to execute and follow through on policies to improve the country’s productive capacity and much of it was just fraudulent PPP loans.

The Trump administration disregarded science and education, treating basic knowledge as some sort of elitist brainwashing. When first principles cannot be agreed upon, there is only chaos and disorder.

The Biden administration did what they could with setting up the vaccine distribution network and the Delta variant still swept through the nation. We’re still dealing with repercussions such as loneliness from lockdowns and lost of trust in institutions. A second Trump term would only exacerbate divide and distrust. If one still thinks Trump cares about rural and lower income/wealth communities, the areas that were hit the hardest were those with the least vaccinated.

I believe in logical reasoning and the scientific method. It is how progress has been made and what brings prosperity to people. Understanding why an apple falls from the tree and how fast it falls is how society has improved standard of living for everyone. I am aware the distribution is uneven. I wrote an entire section about wealth gap just above. It is the most important issue for me and Trump poses the biggest threat to reducing the wealth gap. A second Trump term represents the transition to the next regime in Plato’s Republic. Just to be clear, Project 2025 represents chaos and tyranny. Some folks are trying to frame it with the balance of federal vs state control. I disagree. MAGA representatives represent chaos.

If one thinks Trump intends on reducing the wealth gap, I strongly disagree. I understand the “promises.” Those promises turned out to be “lies.” He is not a simple farmer taking on the bad guys that live in shiny space stations. If anything, he is the bad guy doing a con job pretending to be a farmer from the shiny space stations.

One should ask what actual actions did he take that made people’s lives better. The only legislation passed was for Covid and there was no vaccine distribution plan despite vaccines having been FDA approved. No, the PPP loans did not improve people’s lives as it was only a temporary backstop. I will address tax cuts in a separate section, but the benefits were skewed to make the wealthy richer. I believed a second Trump term would be devastating for the country and still do.

I don’t agree with everything Professor Galloway has to say, but he points out the relationship between wealth gap (assets) and the Cobb–Douglas production function. Some folks do have views that essentially translate to protecting boomer wealth with young people’s livelihoods, and it shows up in the polls. Unfortunately, Professor Galloway did not mention unemployment and his wage growth chart stopped at 2021, so his talk only assessed Trump policies. He also missed the opportunity to pose the question whether government expenditures improved productive capacity.

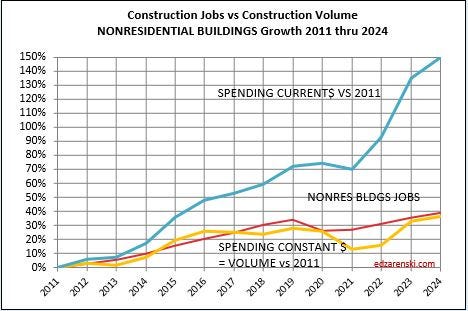

Not only do I believe Biden policies improved American productive capacity, but I also believe a Trump second term will reverse the progress made under Biden to improve the lives of younger generations. The Biden industrial policy laid the path for investments that demanded skilled-trade occupations which the younger generation are taking on. These are not temporary backstops. Whether people agree with pursuing renewable energy and chip manufacturing is a different story.

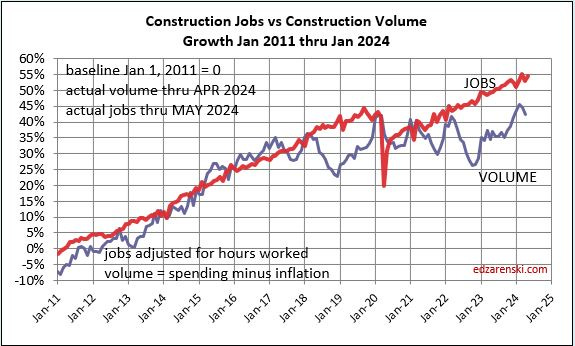

Skilled-trade is trending higher and younger.

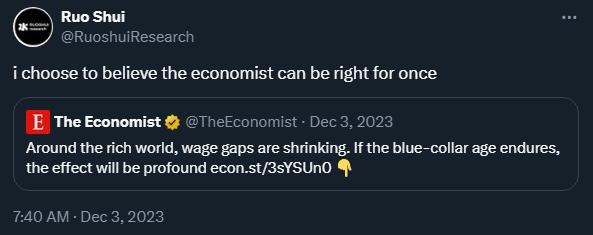

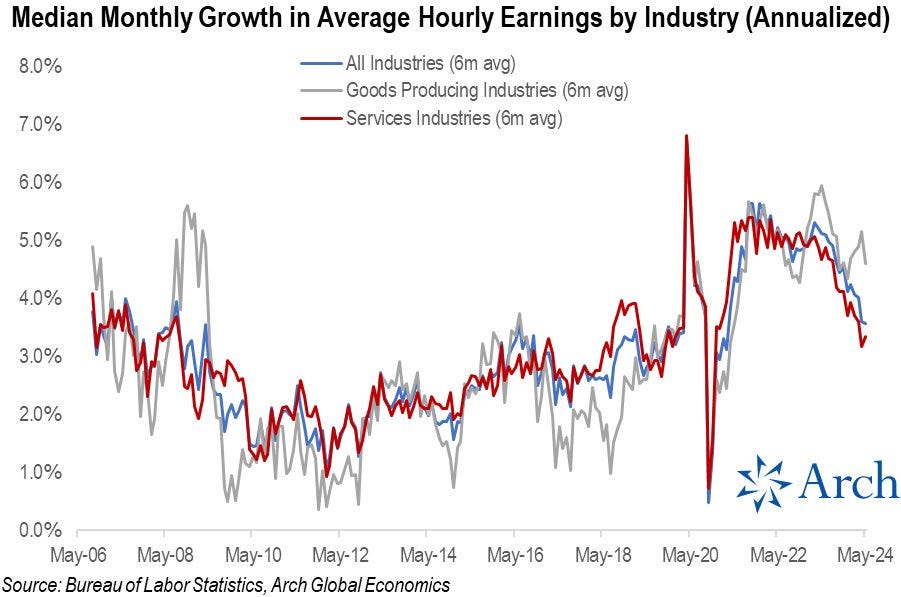

These jobs are not just “government” jobs. Job growth has rotated to sectors with higher productivity and wages, reaching levels last seen during the 90s. Wage gaps are shrinking between blue collar and white collar jobs.

Most media headlines chase cyclical volatility. Sometimes, they do hit secular trends.

Ironically, Biden’s industrial policies have generated the most business investment and economic growth in red states. Whether or not Republicans admit it is a different story. Trump talked a big game about domestic manufacturing infrastructure, but Biden actually delivered.

It is adorable when Republicans smile for the cameras during ribbon cutting season, despite having voted against the legislation that brought about the ribbon. Some Republicans think that a Trump administration would be able to completely roll back the Inflation Reduction Act (IRA), when red states were the primary beneficiaries. I find that unlikely.

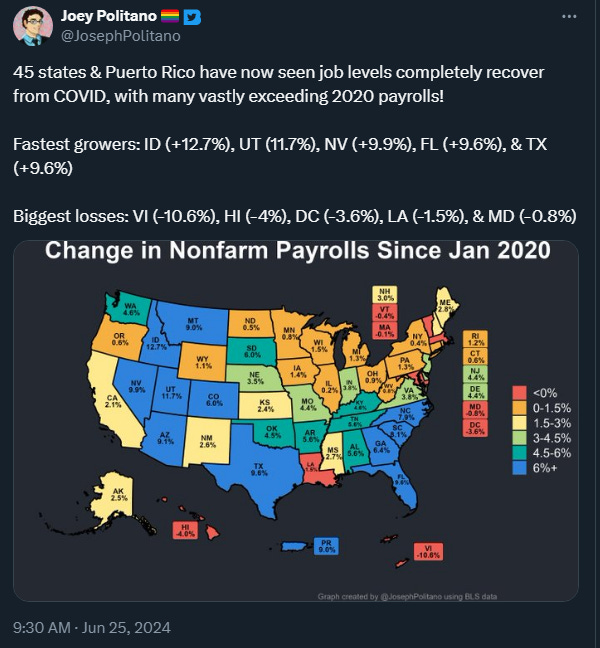

The economic growth directly translated to job recovery and then some. Many of the fastest job growing states were red states.

Trade Policy and Global Trade

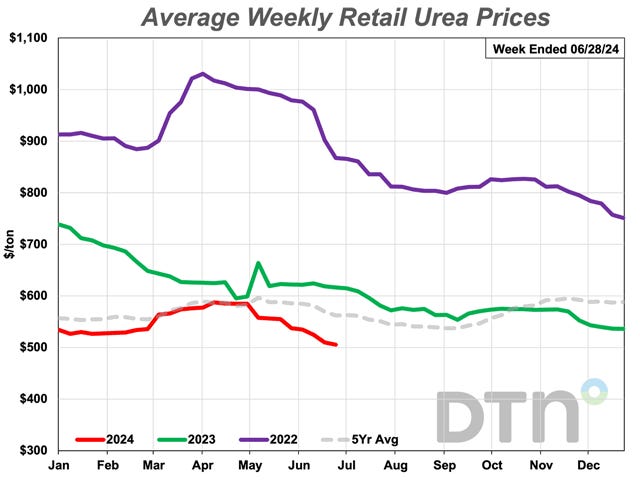

As far as trade policy goes, the 2018-2019 tariffs raised consumer prices, and will likely do so again with a Trump second term. If one thinks Trump’s trade policies will help with inflation, I disagree. Soybean farmers directly felt the tariffs that Trump enacted although Biden kept them place. Another trade war would bring more price instability and more inflation.

It is worth noting the deglobalization narrative has largely been more narrative than actual trade outcome.

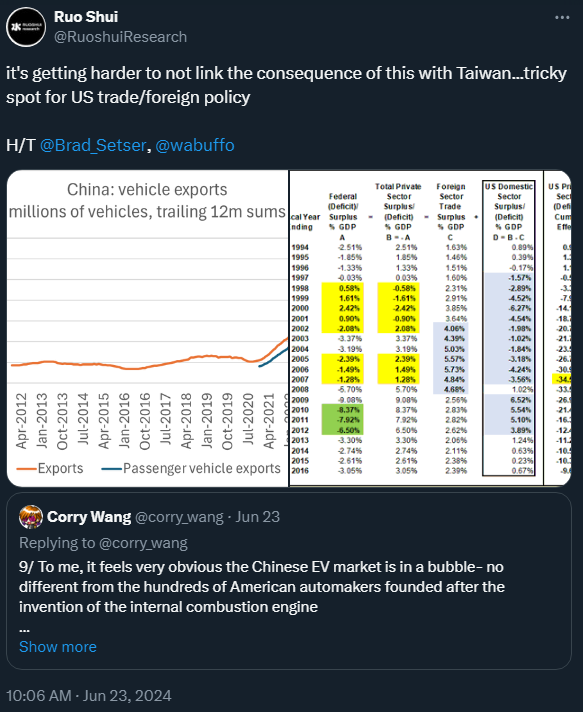

It should be noted that China has become increasingly reliant on their exports and are now the global leader in car exports. The Chinese were able to establish their auto export sector behind a tariff wall and massive government subsidies. They quietly overtook Japanese and German auto manufactures in just four years.

Their solar production also remains very strong. Make no mistake, China has been leading the renewable energy race.

However, Chinese domestic consumption has still been lackluster as their real estate market has yet to trough and this has exposed their reliance on domestic housing activity. The drop in property prices has translated to weak consumer confidence and struggling domestic demand is leading to a surge in exports.

The upcoming Third Plenum is supposedly aimed at Chinese consumers, but I do not have high expectations as the idea of injecting capital directly to consumers is somewhat counter to Xi Jinping’s prioritization of control over economic growth. Perhaps I am wrong.

There is a delicate balance US trade policy requires with respect to China electric vehicle and solar panel exports. If that source of growth stops, there is a risk for Taiwan as Xi Jinping could target the island as an next avenue for “growth.” The Chinese population is only getting older as decades of one-child policy is showing and younger folks stay abroad rather than returning to China. I have serious doubts for a Trump administration’s capability to balance the risks and choose the optimal path for the American people in dealing with Chinese manipulation and aggression. It is worth noting that Mexico (some may say Chinese rerouting) has become a beneficiary of Biden’s friend-shoring policies in the meantime.

The US is going to need to avoid a massive trade surplus like when China just entered WTO in 2001, while building up domestic productive capacity for electric vehicles capable of competing globally. However, it needs to continue to incentivize China to participate in the global order such that there is a path for Chinese economic growth via export. A tricky spot for trade and foreign policy.

Chinese battery technology is top notch and should be welcomed to promote competition and innovation in US battery technology.

Climate Change and Geopolitical Tensions

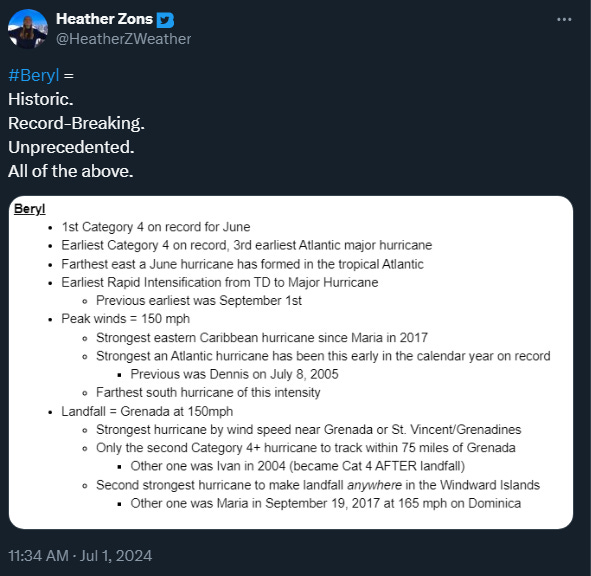

Make no mistake, climate change is already here. It is not some distant thing in 100 years.

It unfortunate that Florida has a large contingent of folks that deny climate change, but are among the first to see the financial repercussions in the form of their insurance bill. Meanwhile, the Caribbean just got hit with one of the biggest hurricanes.

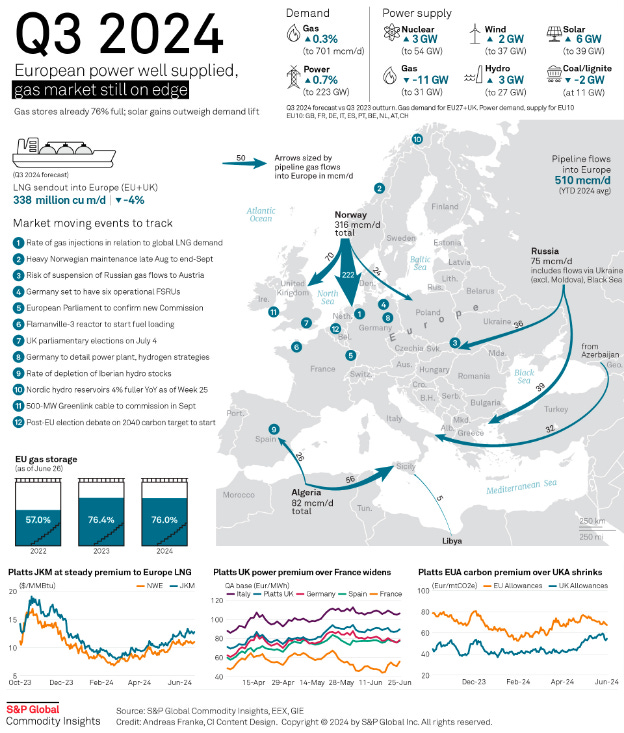

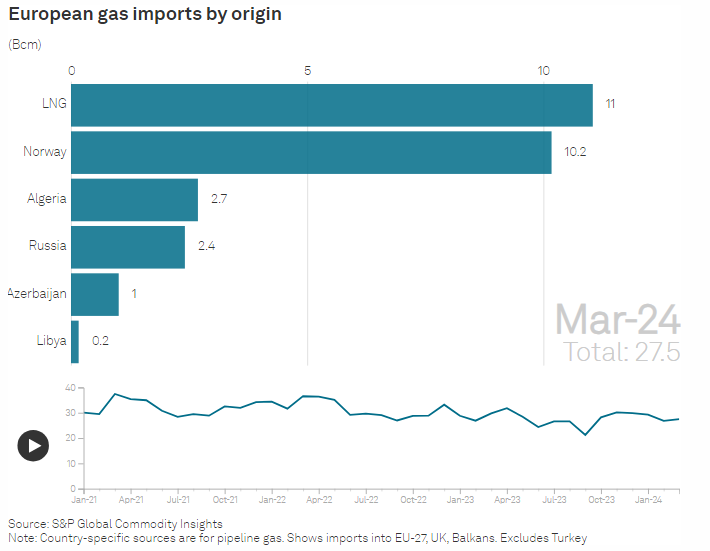

Frankly, climate change is how the European Union (EU) survived cutting off Russian gas as the last couple winters ended up mild. European Central Bank (ECB) was essentially bracing themselves for an energy shock, but then had to tighten policy themselves after gas storage held up. In the meantime, LNG imports from US ramped up and the Baltic pipeline from Norway opened.

The US has become a significant LNG partner for EU. Combined with Norway, Qatar, and Africa, these new supply chains have offset the loss of Russian Nord Stream gas flow into Europe.

Industrial Policy Assessment

Asset Appreciation

While it is key to empathize with those without assets that feel left behind, as equity gains outstripped wage gains, it is important to understand initial conditions and give credit when it is due. The misery index attempts to quantify how the average citizen is doing economically. It is calculated by simply adding the annual inflation rate to the seasonally adjusted unemployment rate.

The stock market already scored Biden’s policies and anyone who holds a 401k is benefiting. Corporate profits are near all time highs and the US market has outperformed the rest of the world with significant margin.

Employment and Energy Dominance

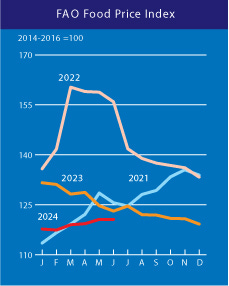

Headlines only focus on inflation, but the US has avoided recession during an energy shock (war). Media chases volatility. Price leads narrative, not the other way around. Many seemed certain about recession 10/17/2022. For the first time ever, the US has avoided a recession during a Fed tightening cycle that coincided with a food and energy shock. Furthermore, the US is energy dominant now. And no, I do not believe people would be better off with higher unemployment. People say that, until they can’t find a job.

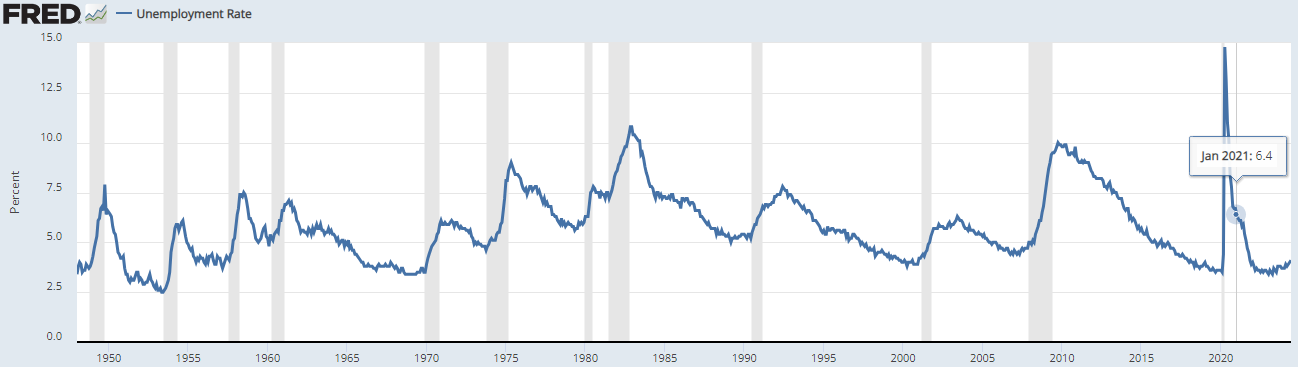

There are many folks blaming the Biden Administration for inflation. On the day of inauguration: CPI was 1.4%, Unemployment was 6.4% and GDP was 4.1%. Well, then they better blame Biden for the following too:

They should be blaming Biden for the fastest job recovery ever.

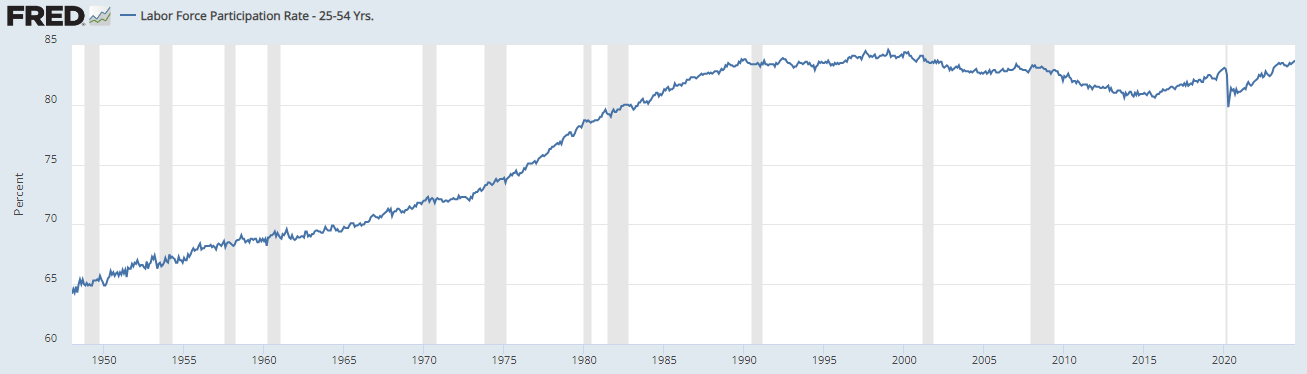

They should be blaming Biden for achieving full employment for prime age workers.

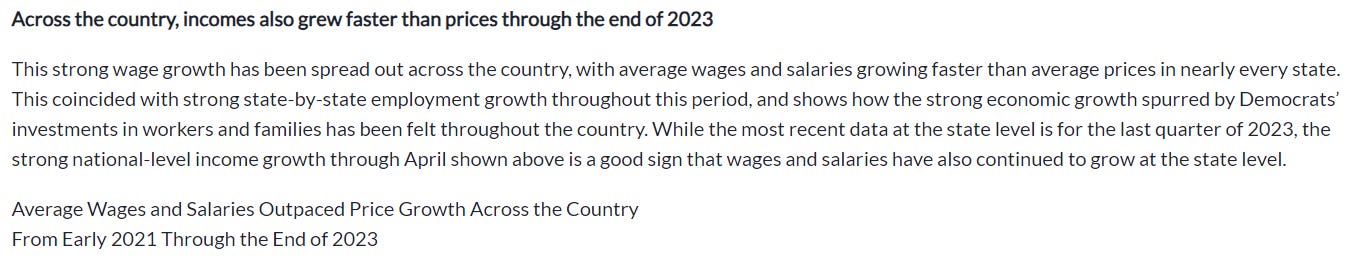

They should be blaming Biden for the highest wage gains for the least wealthy cohort.

They should be blaming Biden for achieving energy dominance.

They should be blaming Biden for the highest GDP in the world.

The should be blaming Biden for avoiding recession while achieving the Fed’s inflation target for 2024 (this is my still my view)

The US achieved the fastest job recovery ever

The US achieved full employment for prime age workers

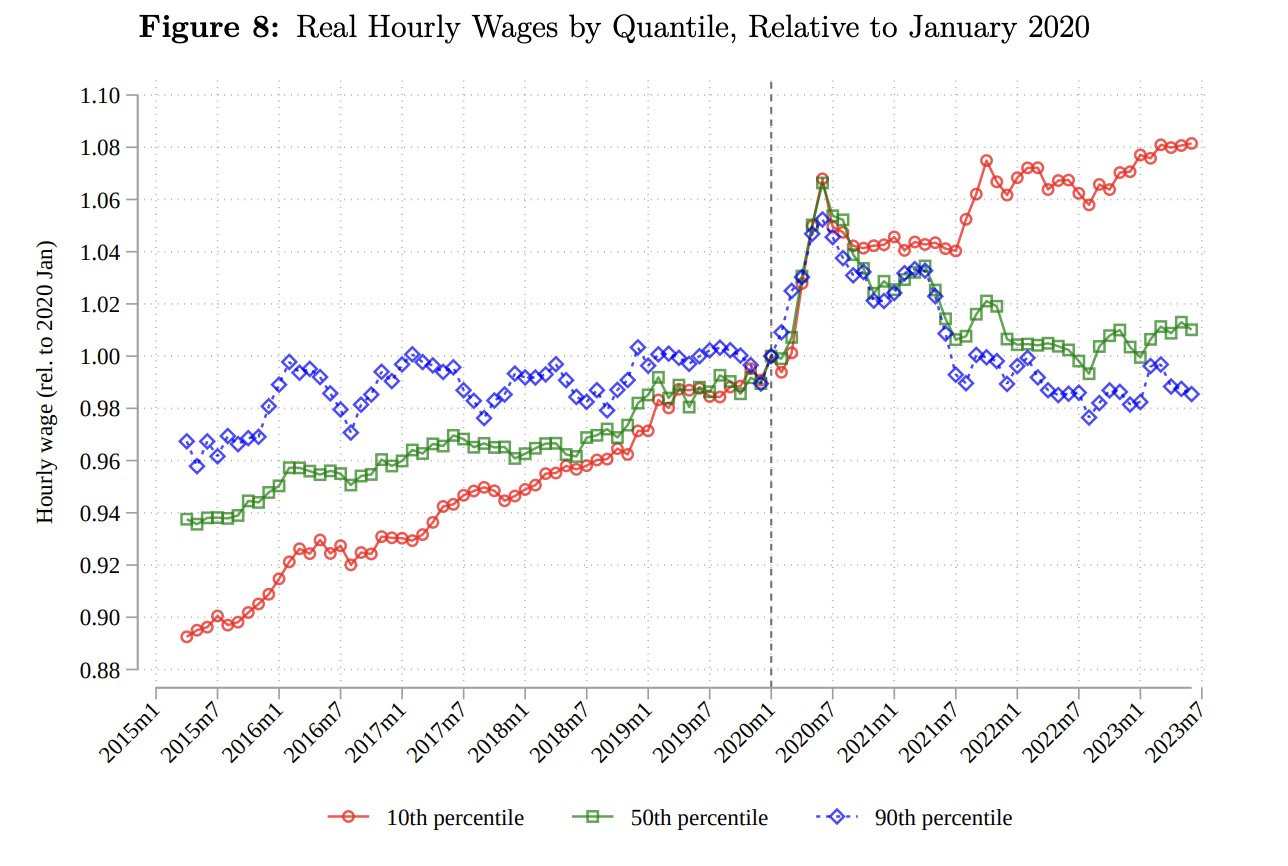

The US achieved the highest wage gains for the least wealthy cohort.

The US now leads the world in oil production and is a major exporter of natural gas.

The US has the highest GDP per capita in the world

The US avoided recession while achieving the Fed’s inflation target for 2024 (PCE < 2.5). This will be apparent by September.

Wage Growth vs Price Growth

The big fiscal spending helped those that needed it the most, the lower income cohorts. The reduction in wage gap is a good thing. Some might argue the deficit spending is/was too big. If expenditures prove to be productivity enhancing, then that debate becomes moot.

Chart of wage growth outpacing rent growth below is based on a Redfin analysis of median U.S. apartment asking rents as of the three months ending May 31, 2024, and estimated median incomes for renter households. The area under the curves are cumulative wage/rent gains.

Some folks are upset at the wage gap reduction and think wage growth is inflationary. I will reiterate this is not correct when productivity growth is “real”. These folks are used to productivity growth only happening during a recession and cannot fathom supply expansion without job loss.

As I have highlighted earlier, the compression and stress varies based on cohort and hawks want the Fed to target the weakest link. The lower quartiles are not the cause of inflation and a recession would mean losing the wage gains for these lower income/wealth cohorts.

The real wage gains for these lower income cohorts is catching up to inflation, not fueling inflation. If it were causing a wage-price spiral, then consumer staple companies would not be mentioning volume issues.

The argument that “inflation outpaced wage gains” is only correct on a couple shorter timeframes. Furthermore, people seem to forget a global lockdown happened and a couple wars are still happening. At some point, it’s better to look at numbers than rely on vibes.

If you want to blame inflation on wage gains caused by fiscal policies, then you need to start with the Trump administration, not the Biden administration. However, if you accept the premise that the wage gains from the Trump administration were not inflationary due to productivity growth, then that logic should also apply to the wages gains under the Biden administration. I am acutely aware of the distortions for hours worked caused by the pandemic lockdowns and work from home (WFH).

I doubt people will ever be fully convinced that wage gains outpaced price increases, but here is a Joint Economic Committee (JEC) note.

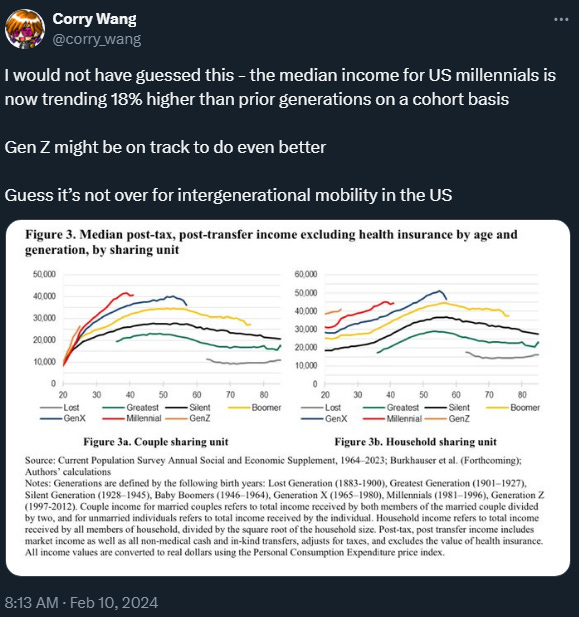

And two separate studies about the younger generations achieving significant wage increases. The hawks are essentially saying these wage gains 1) need to be pulled back and 2) are inflationary. The weakest spring will be the first to yield and buckle. Again, this is not a partisan statement, that is just what has happened in past business cycles and will happen in future business cycles.

Rates affect supply. Supply cannot expand properly under restrictive monetary policy. In aggregate, balance sheets are holding up, especially relative to past business cycles.

Monetary policy is restrictive. The people calling for > 6% 10yr have been wrong and will be wrong, unless Trump gets elected.

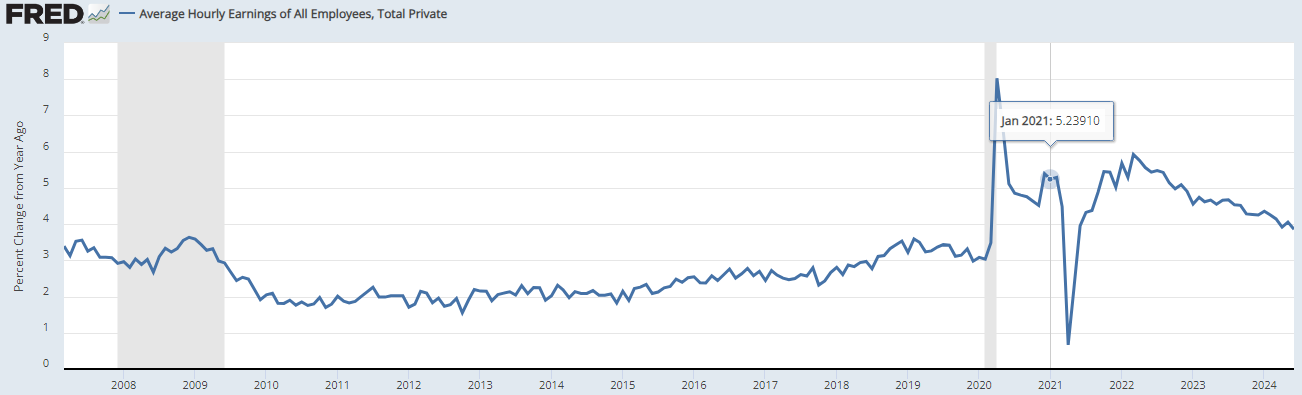

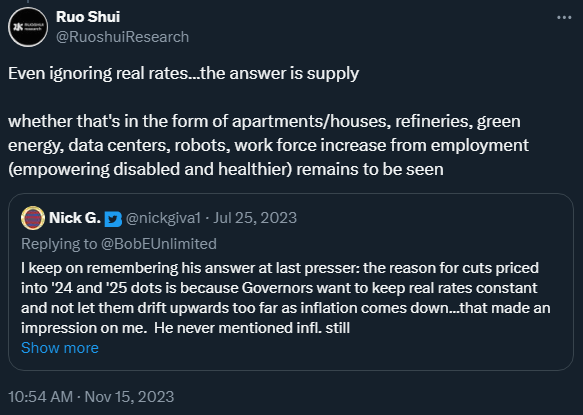

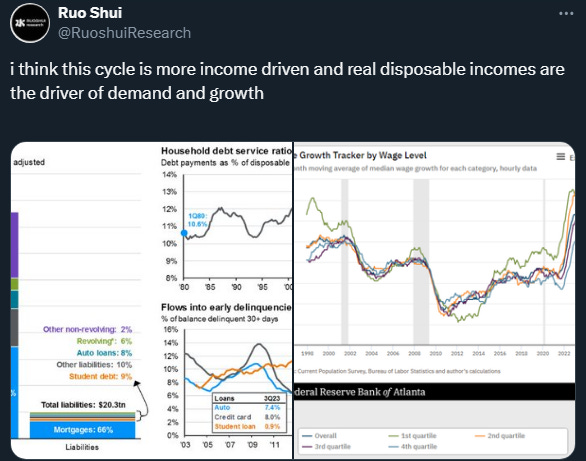

Overall consumption is slowing as seen via nGDP. Average hourly earnings (AHE) is slowing as well. The economy is compressed and just waiting to expand. nGDP and wage growth have both been cooling.

Productivity Growth

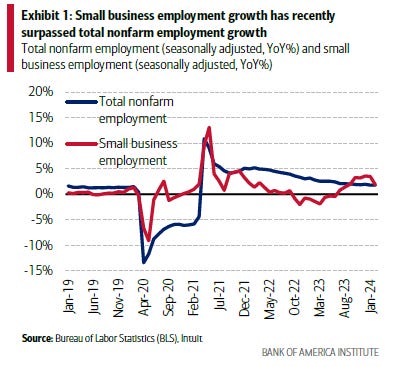

Once again, I will reiterate the linkage between nominal wage growth and inflation is productivity growth. If productivity growth is “real,” then supply expansion outpaces demand growth. The distribution of growth is what people should really care and worry about. The growth distribution mechanism is through labor compensation or new business formation. New business formation has been booming under the Biden administration, much higher than under Trump.

I have serious doubts Trump supports small businesses, as his Covid policies were insufficient for small businesses. Biden policies were targeted at small businesses. The stock market has not started to worry about small businesses yet. Trump’s proposed policies will cause yields to rise and small businesses will be the first to feel the squeeze and some may be forced to declare bankruptcy. Housing affordability will get worse as smaller home builders fold from rates rising. Furthermore, productivity growth from AI will not flow to small businesses as hurdle rates get worse.

Not to mention large corporation interests will likely be put ahead of society. Citizens United continues to favor “regulation is the friend of the incumbent”. Trump embraces Citizens United and uses campaign funds to pay legal bills.

Thus, I believe the trajectory and distribution of the productivity growth to come, will be significantly altered by the election. Not only will productivity growth be significantly lower with a Trump presidency, but the distribution is likely to also only benefit the wealthy, further decreasing labor share of economic growth and widening the wealth gap. Ultimately, this will lead to social unrest and political instability.

Fiscal and Monetary Dance

Federal Reserve Chair Jerome Powell

It is unfortunate to see Chair Powell being criticized by both doves (Democrats) and hawks (Republicans) over wage/productivity growth and shelter inflation, issues that he highlighted on 11/30/2022.

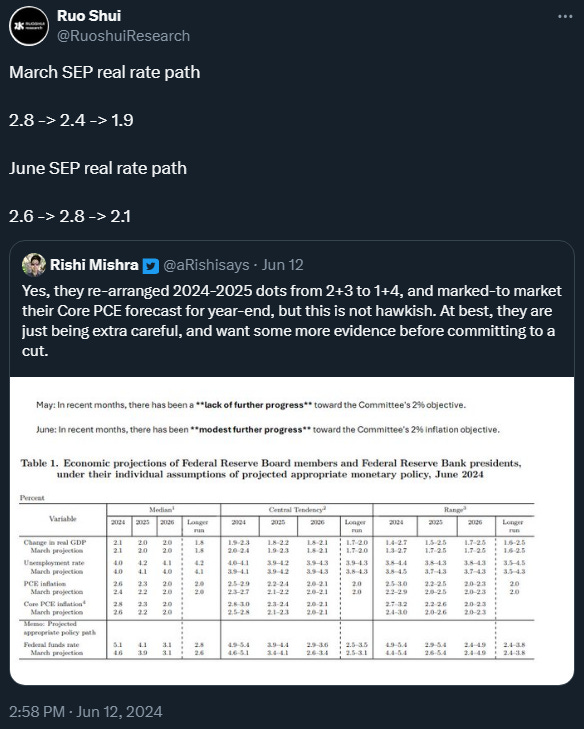

Meanwhile, the doves that predicted a recession have been wrong and the hawks that predicted stagflation/reflation have been wrong. The 2024 Q1 inflation prints were an inflation echo in auto insurance, but the “OER” for pandemic vehicle price spikes has since rolled over.

I think Jerome Powell will be remembered as the best Fed Chair in history and will hand one of the best economies ever to the next administration. He likely regrets holding off rate hikes and buying additional MBS during the Omicron variant which ended up being benign. However, he steered the US economy through a global lockdown, a couple wars, and some regional bank failures. And he did it with just Fed Funds Rate and monetary guidance.

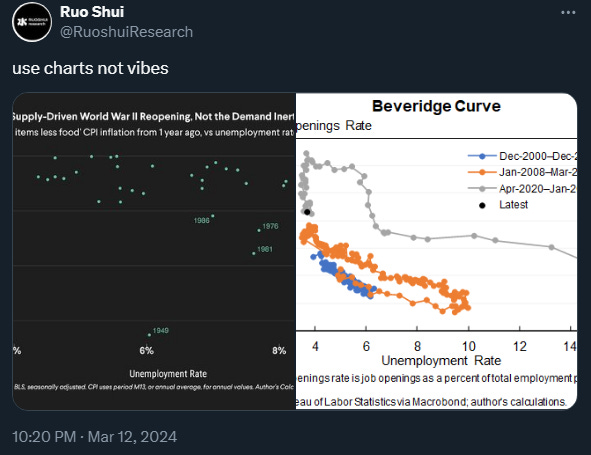

There was some (maybe even a lot) luck involved as the labor market and corporate profits were more resilient than thought, immigration boosted labor supply, and households/corporations terming out debt reduced rate sensitivity. Some say luck is what happens when preparation meets opportunity. Regardless, the labor market made its way back to the prepandemic Beveridge curve without significant job loss during the greatest labor force recomposition since WW2.

The coordination between Powell and Yellen pinned the long end rate for two housing seasons and subdued shelter inflation.

I would have preferred a July cut, but I understand why the Fed did what they did. Plus, they snuck the QT taper announcement into the May 2024 meeting, so they actually did “ease” monetary policy. I fully expect them to signal a September cut at the upcoming July meeting, especially with the market already providing that guidance.

The FOMC have done an admirable job fending off both doves and hawks since their last action and it is time to facilitate a broader economic expansion, especially since the risk of bond market pricing in a Trump second term has increased. Pricing in a Trump win is going to restrict monetary conditions. I believe Powell pivots as priced for 2024. It is unfortunate that the difference between July and September is essentially losing two months of building.

Fiscal Induced Productive Capacity and Energy Dominance

The combination of IIJA, CHIPs, and IRA have been the biggest domestic investments in decades and it provided a much needed positive supply shock to improve America’s productive capacity to reduce inflation. These productivity-enhancing expenditures can only be improved and further streamlined for cost efficiency. One third of those investments are operational and the results are showing up in vehicle and battery prices, providing further disinflation as more production comes online. By definition, this is adding supply and since supply expansion has outpaced demand growth, these expenditures have not been inflationary.

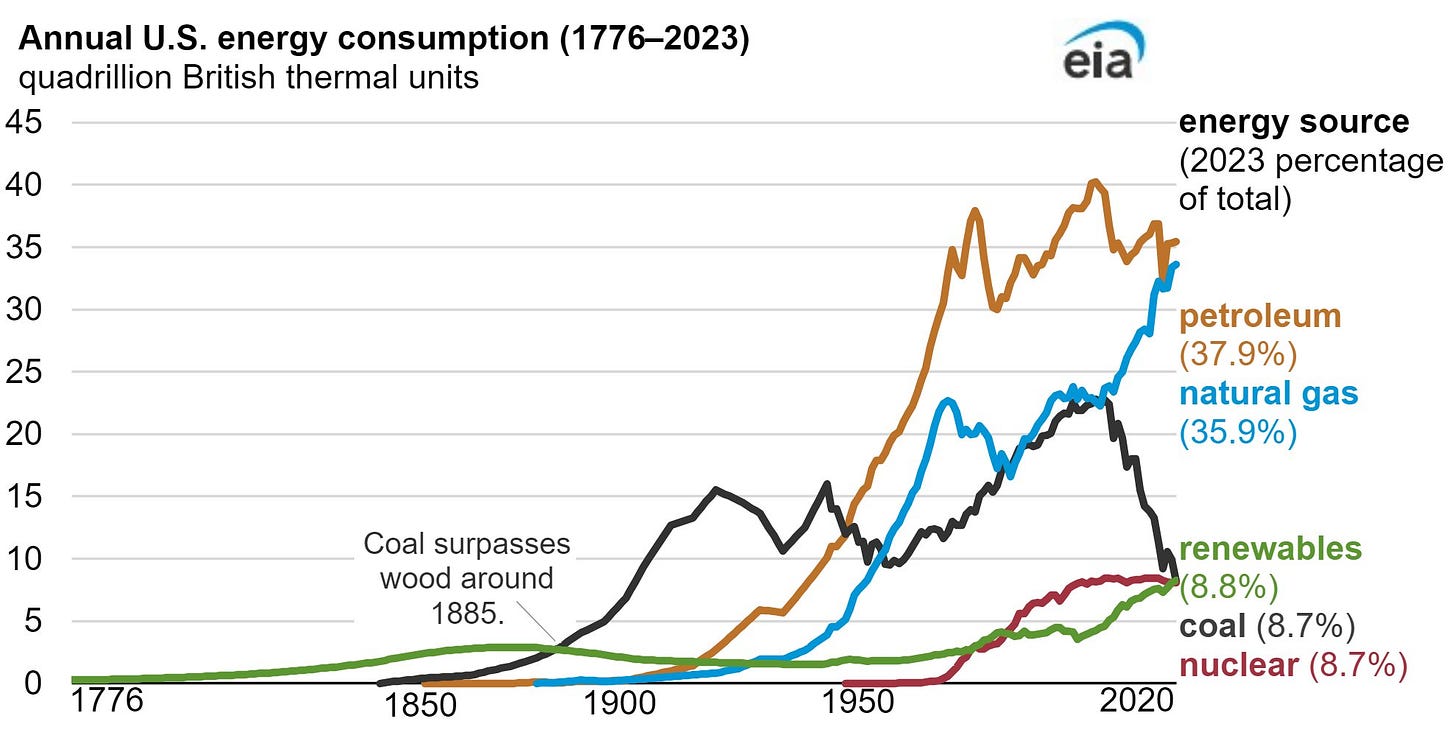

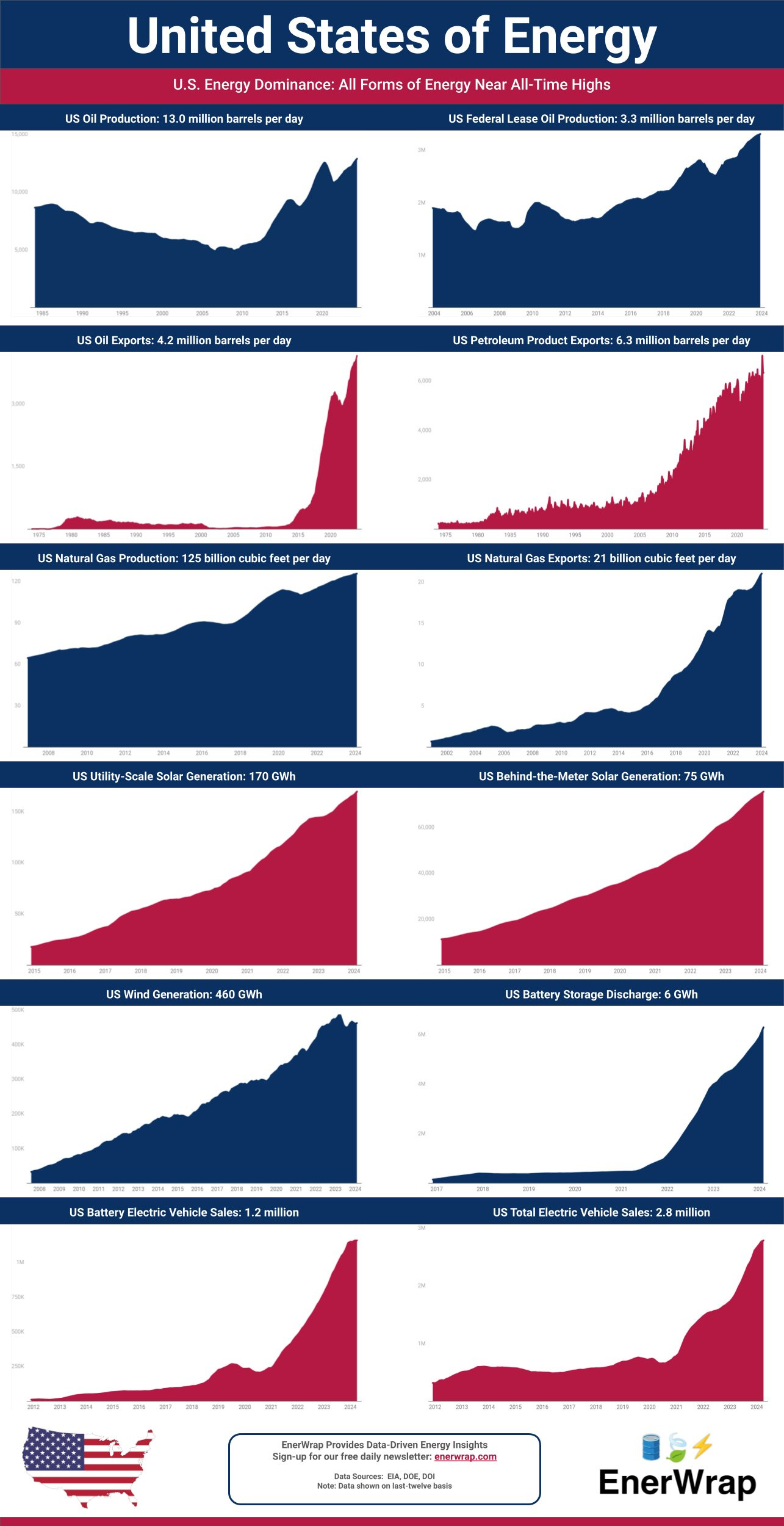

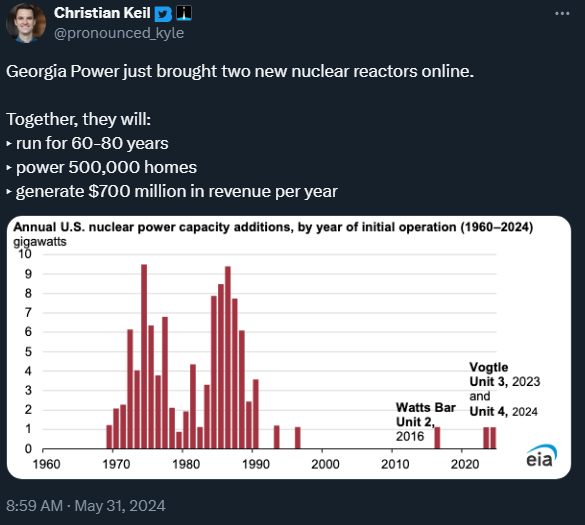

America is energy dominant, producing all forms of energy at all time high levels. Nuclear is better than coal, so the drop in coal is a good thing. I remain optimistic that nuclear will trend up over time.

The Biden administration did not curtail oil and gas production. In fact, the opposite happened and crude production is higher than production levels under Trump administration.

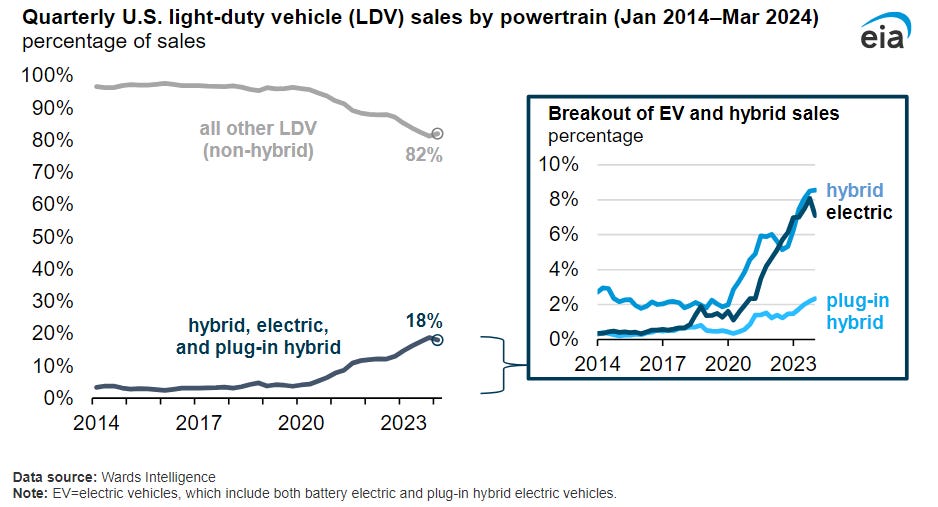

Between electric vehicle (EV) adoption, internal combustion engine (ICE)/hybrid engine efficiency improvements and WFH levels stabilizing around 35-40%, America is consuming less gasoline than prepandemic.

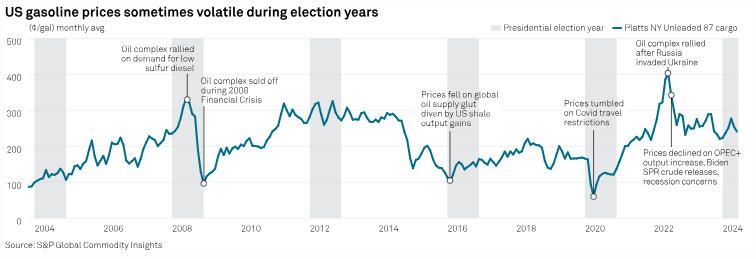

Meanwhile, gasoline price has been stable. Current prices are at the same levels as just before the GFC. As a percentage of overall consumption, they are at the same levels as they were under the Trump administration.

This is with a zero-Covid China and a Russian invasion in 2022, followed by an oil production cut from Saudi Arabia. The Biden administration’s use of SPR gives them the title of “best oil trader of the pandemic.” SPR is now being refilled after shorting the highs during an energy shock, demonstrating how capacitors can be properly used. In addition, one can argue the refill level is up for debate as domestic production is at all time highs and the US is no longer energy reliant on OPEC.

As far as renewables go, one third of projects are now operational and the results are showing up in the economy. I believe this will continue to be the case for the rest of the year.

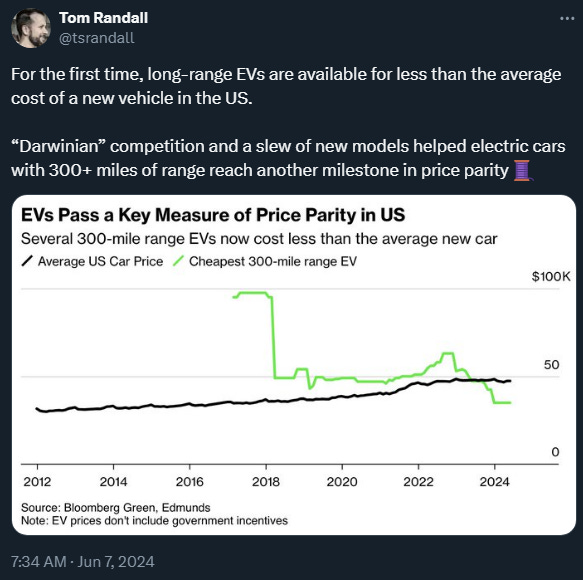

Domestic electric vehicle production has significantly ramped up. They have become affordable relative to ICE and economy of scale is working.

Solar, wind and batteries have begun to be deployed from IRA and are all increasing energy production/storage and diversifying the power supply and improving grid capacity.

Solar leads the way for both California and Texas grid. Batteries have begun to take charge of the California grid and reducing natural gas usage.

Electric Reliability Council of Texas (ERCOT) added significant wind power and added half of US battery storage capacity additions.

Geothermal has started to appear in headlines recently, further diversifying US energy production.

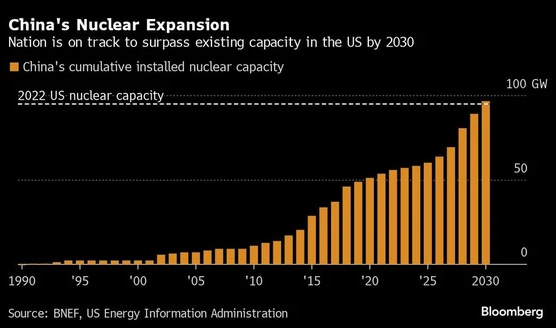

Although the US is just starting to play catch up with China in nuclear power, there is momentum.

Vogtle Units were significantly over budget and schedule, but they will power homes in Georgia for decades.

Nuclear seems to be the only bipartisan agenda and I am all for it.

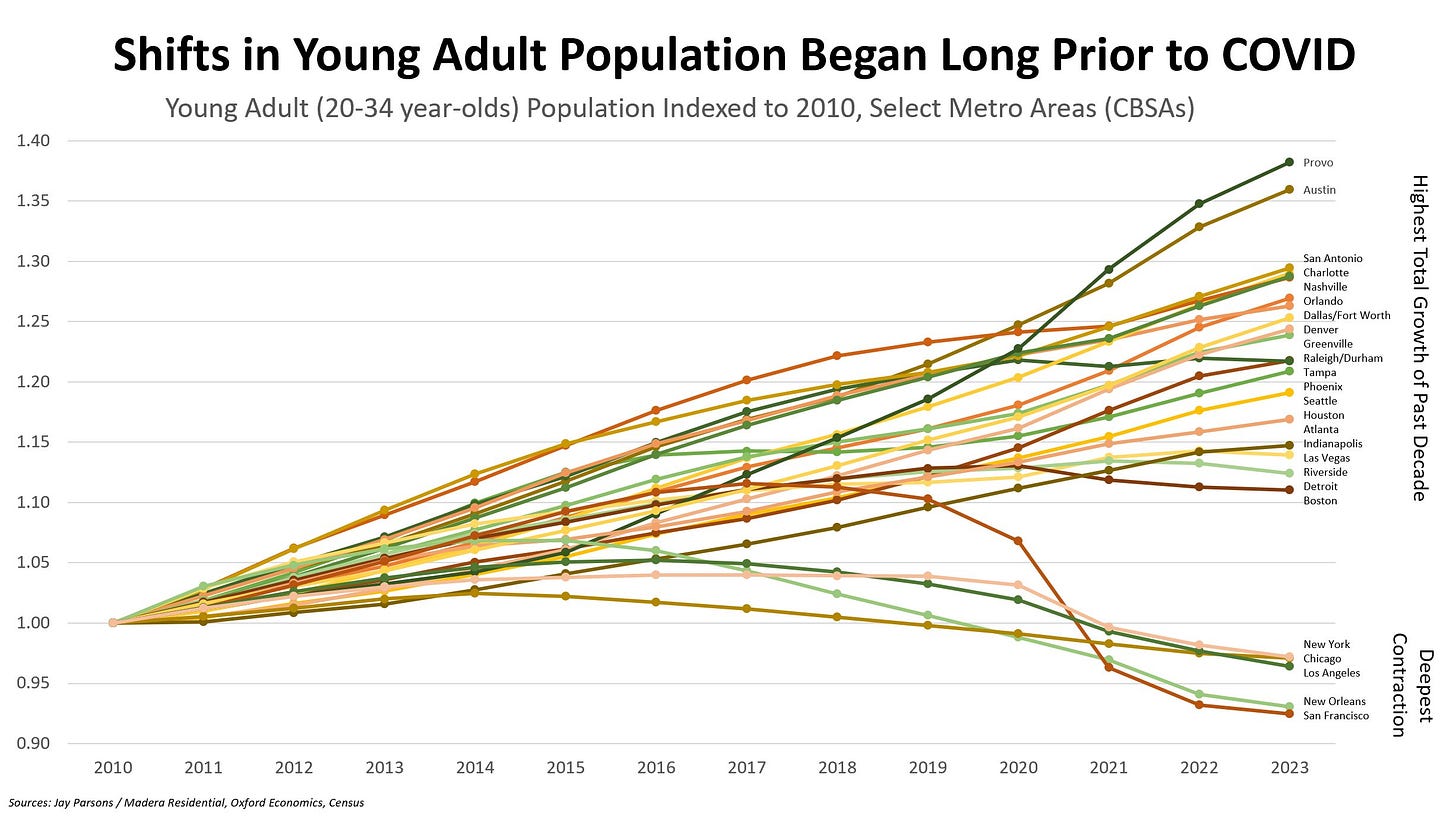

Housing Infrastructure

Housing should be the top priority of the next administration. The best capacitors for growth are people and people need shelter. It should be treated as infrastructure as it is fundamental to improving GDP per capita. The only way to improve the housing situation is to build. A recession does not solve the situation and just delays dealing with the shortage. Demand is inelastic. Millennials are in their prime leverage age and Gen Z is not far behind.

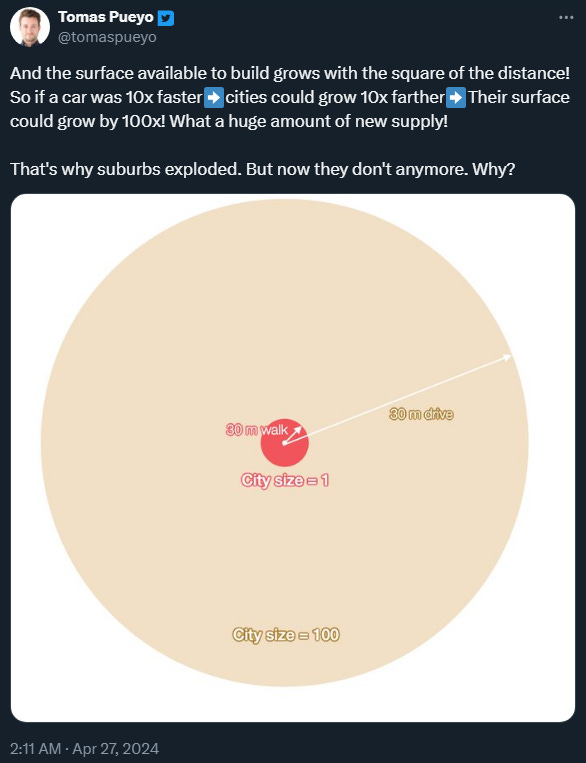

At the heart of the issue is dense cities have saturated and NIMBY/zoning have halted new builds. Not to mention the largest builders do not even operate in the Northeast.

There is a very high correlation with building and migration. Supply is the only viable path. If a city builds, people shall come.

Migration patterns may be noteworthy for the 2024 battleground states.

There is an inverse correlation between housing price and months of inventory and positive correlation for migration, except Louisiana. I am not sure what is happening there. Might need more gumbo.

Building new cities is what is necessary. The next administration should incentivize home builders to partner with technology companies that are building out the data center infrastructure. The key is to have a sustainable job market. Walkable is worth bonus points.

Just to be clear, I am not talking about subsidizing demand, but incentivizing builders to build.

In an ideal world, the data center expansions leads to housing expansion. It almost seems too simple. People are already needed to build out data centers. Why not build some houses at the same time? We have lessons from WW2 on how to ramp building.

The inelastic demand for real estate will not be solved via recession nor higher rates, especially when it is still viewed as the best long term “investment.” While many would dislike it, increasing property taxes would be a good start to “incentivize” mobility in high density cities and improve home ownership transfer.

Treasury Financing

Trump Administration

Tax Cuts and Jobs Act (TCJA)

Biden Administration

Growth (Productivity and Population Growth)

Affordable Care Act (ACA)

IRA

Tax Revenue

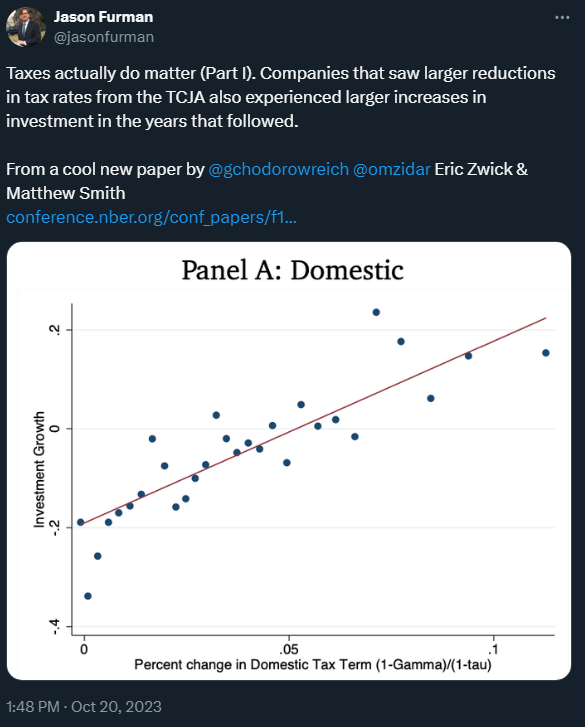

The TCJA moved the corporate tax rate to 21%. I think this played a role in averting recession. For better or worse, this enabled the largest companies with the largest profit margins to use their cash flow for capital expenditure, namely the data center infrastructure expansion. For this reason alone, I think the corporate tax rate should remain unchanged, even under another Democratic administration. Raising the corporate tax rate would be a drag on top line growth and slow down capital expenditure.

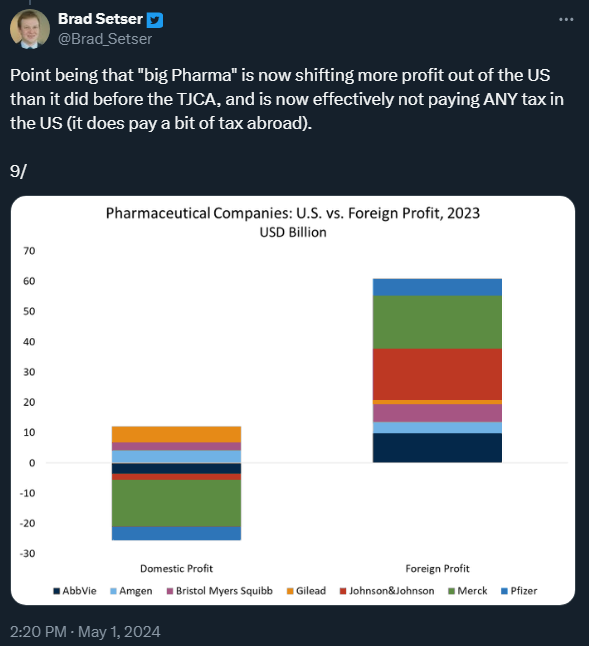

However, the TCJA has many flaws. One being that US pharma companies have essentially evaded tax payments to the US treasury, tied to transfer pricing to move profit on US sales offshore.

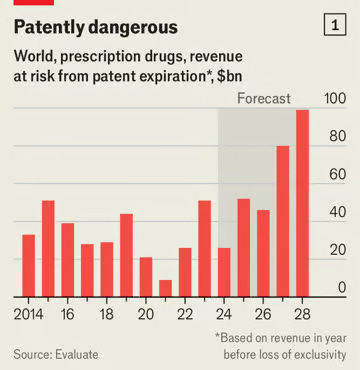

The US pharma companies have shifted focus to marketing and distribution, and outsource much of the innovating to the biotech sector. Some folks believe that more agile biotech firms may have better odds of success in drug development for a specific disease compared with a sprawling big pharma. In the meantime, there are patent expirations are coming and the offshore profit strategy could/should face scrutiny.

The second biggest issue with TCJA is that is has not scaled with economic growth, remaining at just 16.5% of GDP. It is proving to be a tax cut that cannot pay for itself and loses potential revenue for the treasury.

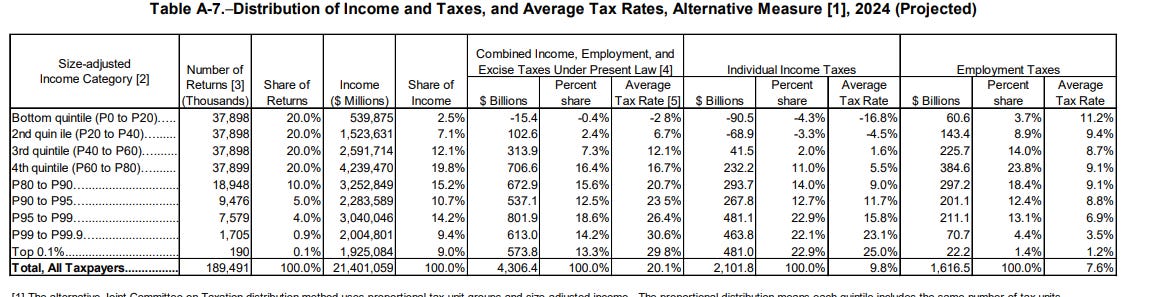

The biggest issue is that its benefits were skewed for the wealthy. Trickle down economics simply does not work as advertised. A full extension would permanently benefit the wealthy and effectively continuously widen the wealth gap.

According to the latest Joint Committee on Taxation (JCT) table, the top 0.1% is 190,000 households who have 9% of national income, pay 13.3% of federal taxes and 22.9% of income taxes.

Growth

Meanwhile, primary deficit projections are significantly lower than when Biden took office. The main reason is that growth has been above CBO estimates. Stronger growth means stronger tax receipts, which reduces the deficit.

Japan is typically used as the example for dynamics between fiscal/monetary policy and an aging population.

Once again, “real” growth has two sources: 1) population growth which includes immigration and 2) productivity growth. Immigration means more labor supply, more consumption, and more tax receipts. The additional 2023 labor supply shifted the equilibrium point for the labor market.

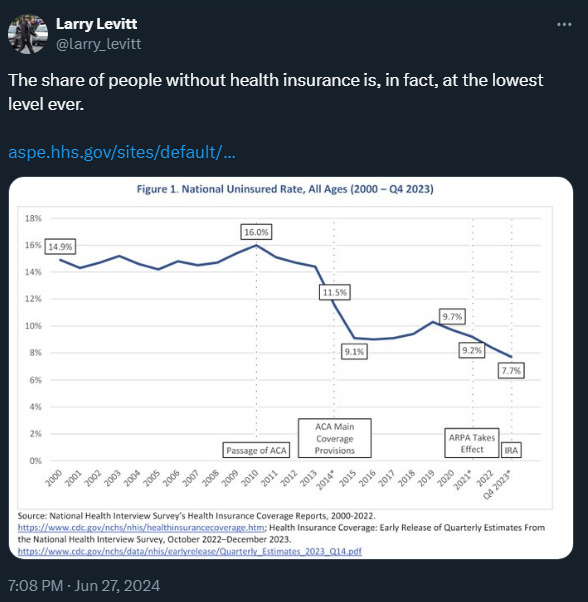

ACA and IRA

Lastly, the ACA disrupted the medicare spending trajectory. Just by halting the upward trend, ACA is helping the deficit situation while the share of people without insurance is at the lowest level ever.

Over the course of the IRA, it is projected to reduce deficits by 2030. While renewable/EV projects come online and improve the country’s energy production, they are also set to pay for themselves over time.

Of course, there are assumptions with projections and they are outlined below. The credits should be amended based on realized ROI with IRS. When the threshold for economies of scale is hit, the credit levels should be updated accordingly.

Foreign Policy (Including Immigration)

Trump Administration

Biden Administration

Global Order

Choosing protectionism and isolationism is equivalent to abandoning the US hegemony as Americans lose the benefits from comparative advantages of international trade and global order. The global order has brought prosperity to everyone, although the distribution has been skewed. Conflict is inflationary and will be equally distributed. Professor Sarah Paine’s interview below is a must watch.

The argument that Putin would not have invaded under a Trump administration is a straw man. Trump would have gifted Ukraine even if the world did not pivot to renewable energy under a Biden administration. The invasion was Putin attempting to prove that Russia wasn’t just a glorified gas station anymore. That failed.

Biden’s Ukraine lend lease seems to be a prelude to a Modern Marshall Plan. Contrary to popular belief, the majority of the “money” is in the form of hardware: arms, munitions and equipment. The $175B spent so far is dwarfed by the annual defense budget of $800B. If one’s problem is with defense spending, Ukraine is not the right target.

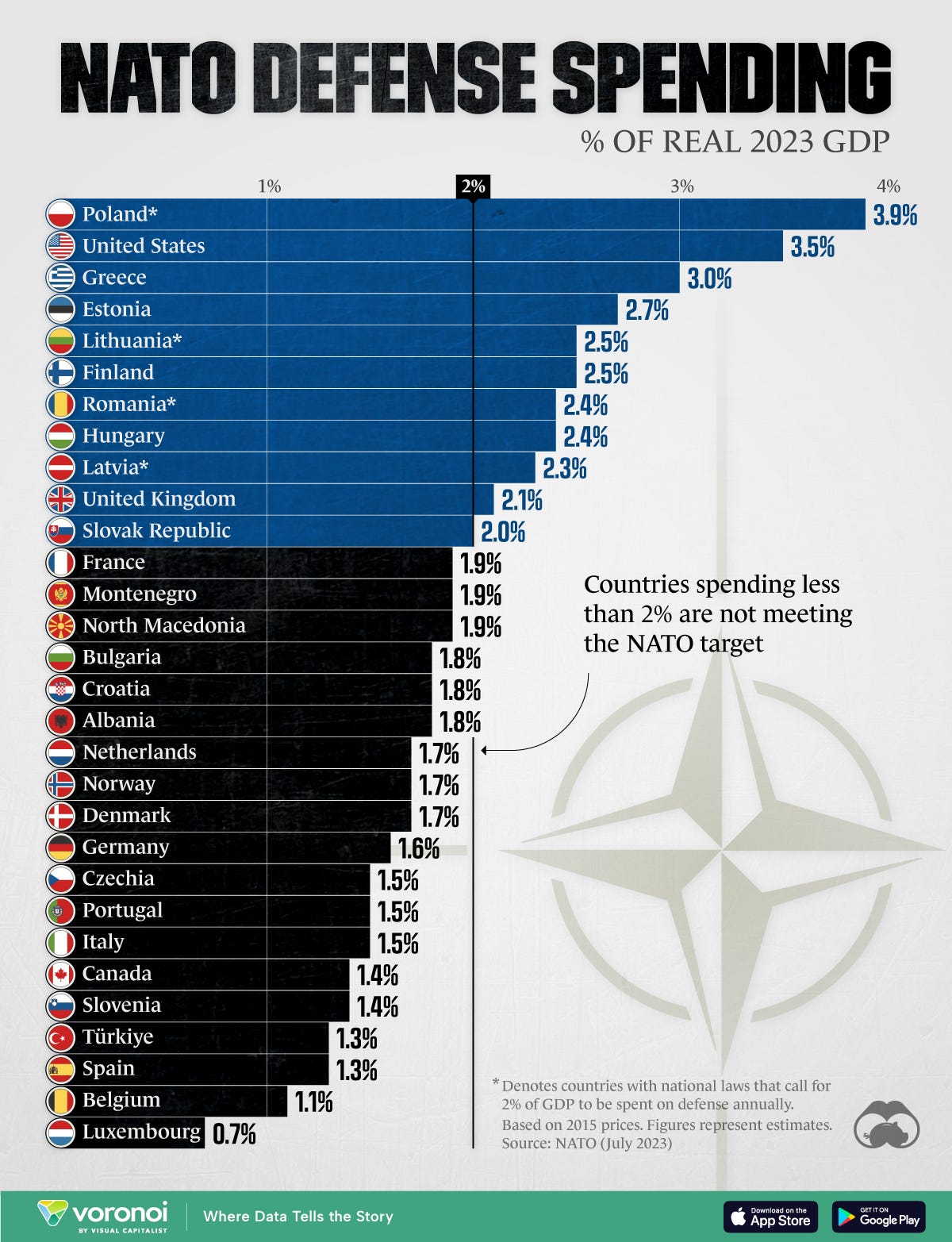

The Russian invasion has increased NATO defense spending.

While Trump talks a big game, he is likely to gift Taiwan to Xi Jinping and hand China the keys to the chip race and technological leadership along with it. He lies and flip flops, and his position on banning TikTok is just one example. Taiwan’s semiconductor supply chain is critical for the prosperity of Americans. This is probably still an understatement. Meanwhile, Biden fortified Taiwan’s silicon shield with the CHIPS Act. Biden did more than stabilize US alliances, as NATO and Island Chain relationships seem stronger than they ever were.

Source:

Former Secretary Jim Mattis knew the importance of artificial intelligence for national defense. The importance of Taiwan’s semiconductor supply chain for Americans is not debatable.

Secretary Mattis also had the following words about the former president:

In 2020, Mattis broke his silence and shredded his former boss in an open letter to The Atlantic, saying Trump “is the first president in my lifetime who does not try to unite the American people — does not even pretend to try.”

“Instead he tries to divide us,” he continued. “We are witnessing the consequences of three years of this deliberate effort. We are witnessing the consequences of three years without mature leadership.”

It seems surreal that almost the entire former Trump cabinet refuses to endorse him. If the President can’t even achieve “one cabinet, indivisible” forget about “one nation, indivisible.”

Immigration

Foreign policy is not just about global order. It also includes immigration. America was once thought to be a melting pot. Although the diverse set of cultures creates conflicts and prejudices due to different backgrounds and cultures, it is also America’s super power. Democracy thrives when issues are debated and free speech is the foundation for innovation.

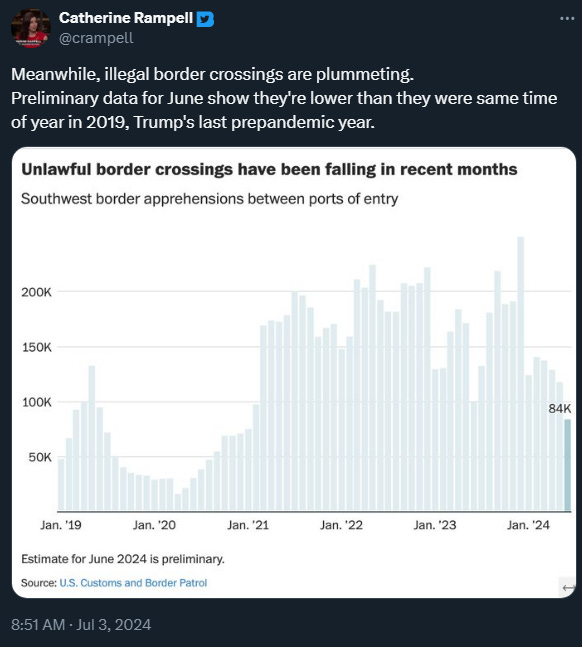

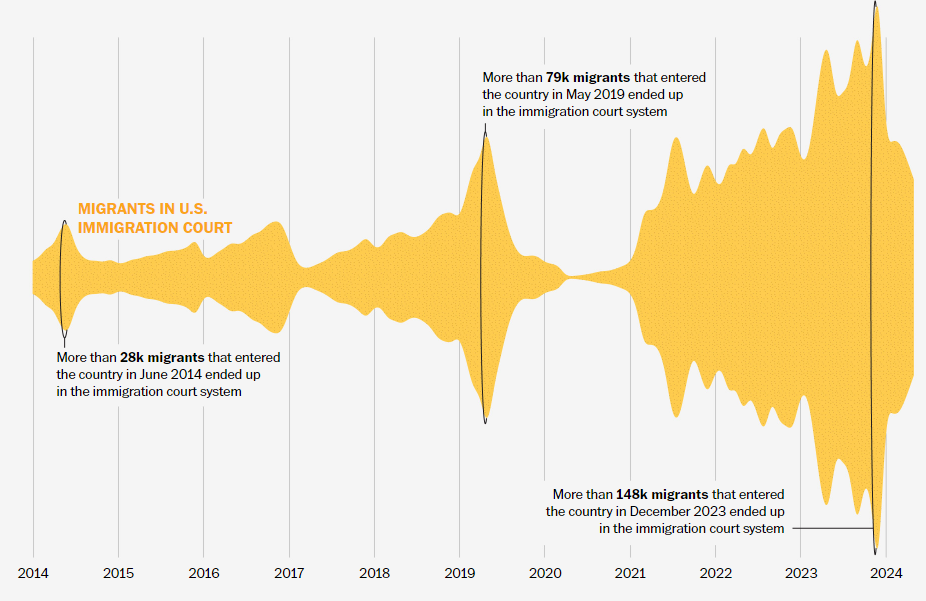

The 2023 immigration wave was likely a confluence of multiple factors as people sought out a better life in America, especially those seeking asylum.

2023 turned out to be a record year for immigration, as some estimates putting net population growth at nearly 4M. The numbers via employment authorization documents of 3M, translate to approximately +1% population growth.

It is worth noting that the backlog for green cards is incredibly long, spanning nearly 11 years in some cases. People can debate the (il)legal story of immigration, but the current legal process is limiting US growth. It is clear that people want to legally come to the best nation in the world.

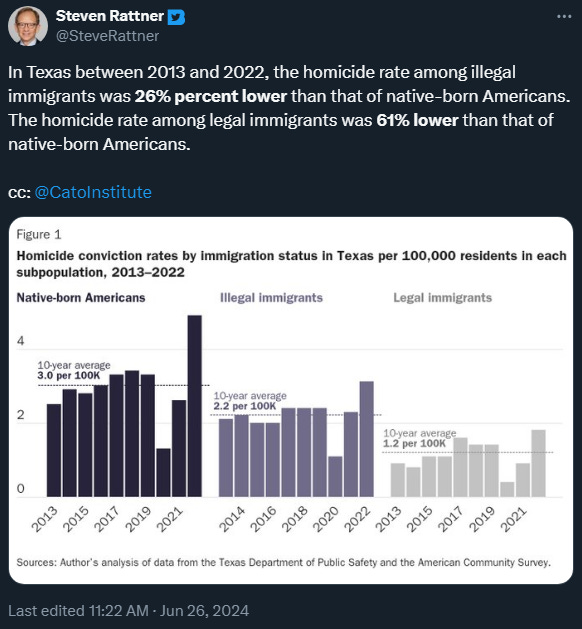

Immigrants did not take native jobs. No native jobs were lost as immigrants filled out vacancies, especially in lower wage sectors.

Immigrants did not cause crime rates to rise.

Homicide rates are at the same levels as when Trump took office and down from levels when he left office.

Motor vehicle theft, carjacking and shoplifting are the outliers, but crime rates have largely been tame since Biden took office.

Immigrants did not cause rents to soar. Correlation does not mean causation.

At the end of the day, shelter inflation is about supply expansion vs demand growth. Places seeing sticky rents have abysmal supply, not mass immigration.

Immigrants do not have the credit score to apply for a mortgage. It has been painfully obvious that the largest builders do not operate in the New England region.

Since Biden’s halt on asylum processing, the number of border crossings has fallen back to levels before he took office.

Supreme Court Rulings:

I am including a couple Supreme Court rulings for completeness, namely the ones that have potential market impacts.

Regulation (Deregulation)

Chevron deference was overruled. I might be wrong, but this seems to tip legislative power back to states vs federal (agencies). Part of me hopes for better legislation to avoid lawsuits. The other part of me is worried that it will be fresh 25 year-old clerks using LLMs with no subject matter knowledge that end up affecting the lives of many. Libertarians likely rejoiced while Progressives were upset that Federal Agencies lost regulatory power over morality vs capitalism.

Roe vs Wade (Reproductive Rights)

Reproductive rights have increasingly become the issue for women. This has effects on population growth and fertility rate. Denying IVF seems like a good way to decrease population growth.

Aside from abortion and IVF, the cost of childcare in the US has not helped fertility rates. Childcare needs to be improved, as this has effects on labor participation rate for woman as well.

Conclusion

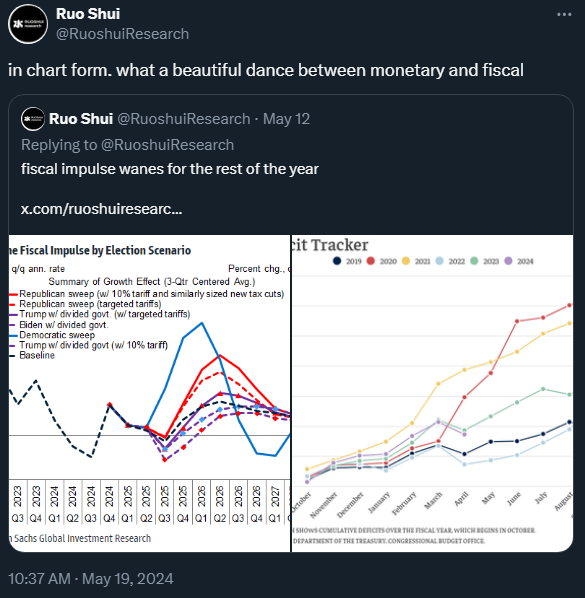

Biden policies enabled the fastest job recovery in history and improved the livelihoods of younger generations. That is missing from headlines. The US becoming energy dominant and improving overall productive capacity are just extra points. I believe recent Democrat legislations have had a better plan for funding, especially when the Republican plan was “no plan.” The candidate that proposed tariffs and tax cuts is likely going to cause yields to rise out of the Fed’s control. Some folks might think a second Trump term is bullish equities. That is likely incorrect on a longer timeframe. Instead, the long end is probably going to cause a recession that invites a round of inflationary fiscal spending. The deficit spending then leads to an unstable inflationary loop. The Fed may attempt QE and resort to yield curve control. Then the US would truly achieve fiscal dominance.

The optimal fiscal path would be a Democratic win with a divided government. In an ideal world the tax code is updated in a way that would bring in additional revenue, while avoiding significant drag on economic growth and corporate capex. Considering the wealth gap, I would support higher taxes for those with >$400k income. However, I would oppose corporate tax increases but rather focus on making sure companies are not evading taxes offshore. One could argue recession has been avoided thanks to technology companies using their profits for capital expenditure. This would imply that the current corporate tax rate played a part in avoiding recession. That being said, Trump administration expenditures were not productivity-enhancing and I do not expect anything different for a second term. I expect the rest of the year to be a choppy battleground for duration as it attempts to include post-election fiscal path into the long end rate. Any significant increase in Trump win probability would cause long end yields to rise.

Post Presidential Debate trading on 6/28/2024:

The so-called bond vigilantes had remained in hibernation until the Presidential Debate. There’s no “debate.” The evidence was overwhelming.

With PCE coming inline with soft expectations that had been known for two weeks, the yield curve bear steepened after the data release. It was the easiest trade and you had some bond bears pounding their chest about their “macro views” when it was just Trump that pumped duration shorts.

December target rate probabilities were unchanged, meaning the short end was fixed. The two day duration sell off brought the 10yr-2yr spread to levels last seen right before the 5/2/2024 Apple earnings report.

The Japan reserves narrative on 7/1/2024 was a cascade effect (not root cause), since the dollar remained tame throughout the miniature tantrum episode. This interpretation looks correct after the 7/5/2024 NFP report, as both high yield corporate bonds (HYG) and treasury bonds (TLT) have recovered much of the selloff. I believe this was just a small glimpse of markets under Trump. Small caps have yet to fully recover at time of writing and will likely perform poorly under a second Trump term.

Here’s a list of tickers for GOP policy beneficiaries over the two days. This is by no means a comprehensive list (could be even wrong over a longer timeframe). The intent of bringing them up is really to refute the claim that trading on this post debate day had anything to do with inflation or growth expectations. There was probably end of quarter rebalancing mixed in as well, but the debate was the biggest factor and it is not close. It is worth noting that people incorrectly predicted TAN and XLE performances for a Biden administration.

Long: JPM, PIPR, PFE, TSLA, BTU, GEO

Short: DIS, LEN, IWM, NEE, TAN (FSLR)

Market Outlook

The risk to the equity market is that two/three Fed cuts are already priced in for this year and nGDP slows more than any movement in long rates can offset. Rate sensitive laggards may try to catch up with positive carry in sight, but the index is likely to drop a bit even with rotations happening to improve market breadth. I do not expect much change in the long end from monetary policy. Instead, markets are likely to experience less volatility from inflation prints and become more sensitive to fiscal policy path speculation driven by the election headlines and results. There is bound to be bullwhips, productivity-enhancing capital expenditures is the way to have a sustainable expansion.

If disinflation flips the stock and bond correlation negative, that will be the confirmation to hedge and prepare for some downside. MMF funds are more likely to shift to bonds during a growth slowdown than equities at 23x forward P/E (2024) and 20x forward P/E (2025). Election uncertainty alone is enough to make me cautious.

I have been bullish equities but the market is trading at a high multiple relative to near term earnings expectation. I will be more than ready to buy a ~8% dip, which would take the S&P 500 to right before the May 2024 Apple earnings report. I will be looking to play the RSP/SPY bounce as rotations happen underneath a market chop down.

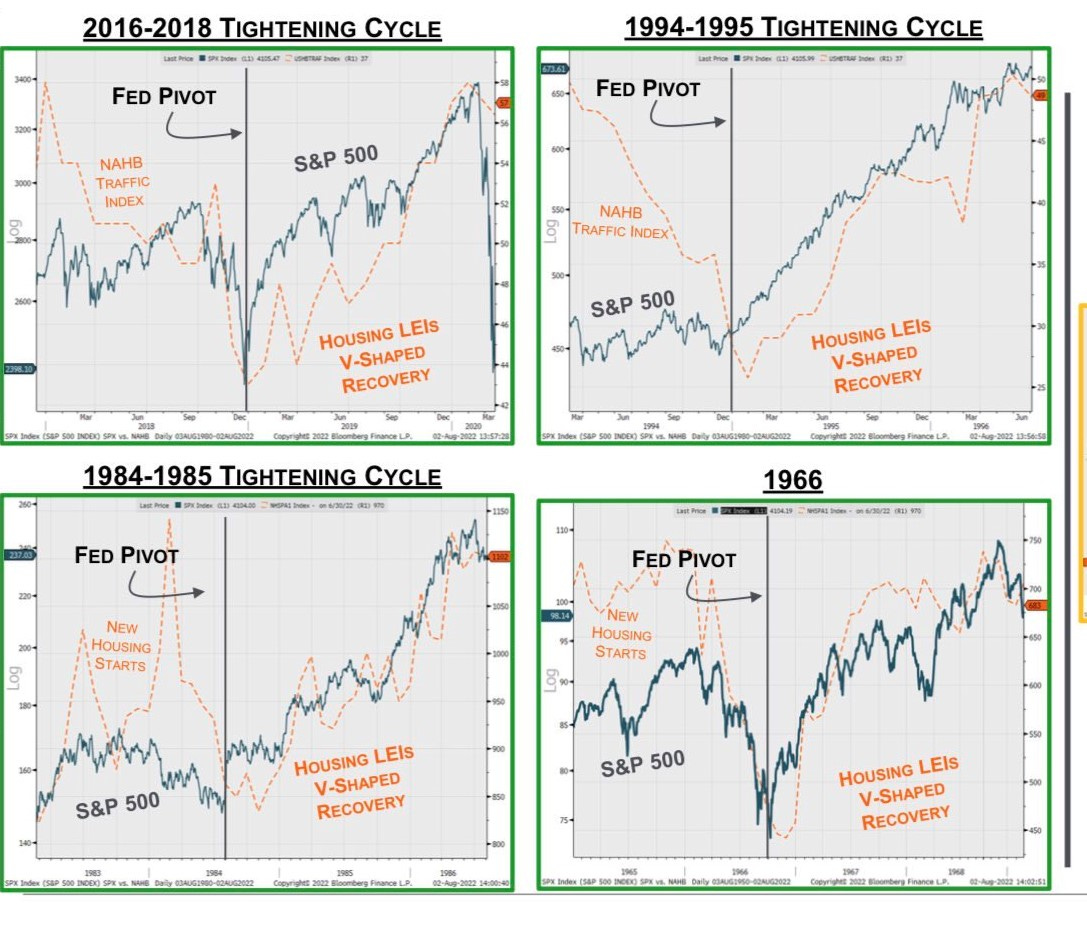

Short volatility strategies have been a high interest rate phenomenon. The unwind is likely to be bullish volatility. I do not think a bear market will happen from a cut, as positive carry is bullish the real economy. I am simply saying the first cut is priced in and some rather crowded strategies are likely to unwind due to a lower MMF rate. The Fed pivot chart is from November 2022. Spot the four soft landings that the arrows missed.

Volmageddon notes from @selling_theta below for reference.

As recession calls get a louder again leading up to the election, remember that lower yields stimulate the economy. It looks like the lag between the yield curve and housing activity is approximately three months now. Fiscal also picks back up in Q4.